Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 06 2019 - 6:03AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-219841

June 5, 2019

Final Term Sheet

$35,000,000

6.0% Fixed-to-Floating Rate Subordinated Notes due 2029

|

Issuer:

|

First Internet Bancorp (the “Company”), an Indiana corporation

|

|

|

|

|

Securities Offered:

|

6.0% Fixed-to-Floating Rate Subordinated Notes due 2029 (the “Notes”)

|

|

|

|

|

Aggregate Principal Amount:

|

$35,000,000

|

|

|

|

|

Expected Security Rating:

|

Kroll Bond Rating Agency: BBB-(Negative)

A rating reflects only the view of a rating agency, and it is not a recommendation to buy, sell or hold the Notes. Any rating can be revised upward or downward or withdrawn at any time by a rating agency if such rating agency decides that circumstances warrant that change. Each rating should be evaluated independently of any other rating.

|

|

|

|

|

Trade Date:

|

June 5, 2019

|

|

|

|

|

Settlement Date:

|

June 12, 2019 (T+5)*

|

|

|

|

|

Final Maturity (if not previously redeemed):

|

June 30, 2029

|

|

Issuer:

|

First Internet Bancorp (the “Company”), an Indiana corporation

|

|

|

|

|

Interest Rate:

|

From and including the original issue date to, but excluding June 30, 2024, a fixed per annum rate of 6.0%.

From and including June 30, 2024, through maturity or earlier redemption, a floating per annum rate equal to the then-current Benchmark Rate plus the applicable margin. If a Benchmark Rate Replacement Event has not occurred before the time at which interest is determined for the first floating rate interest payment date, the initial interest rate will be three-month LIBOR plus 4.114%. For more information on the manner of setting the floating rate, the Benchmark Rate and the Benchmark Rate Replacement Event, see ‘‘Description of the Notes—Interest” in the preliminary prospectus supplement dated June 5, 2019.

|

|

|

|

|

Issue Price to Investors:

|

100%

|

|

|

|

|

Interest Payment Dates:

|

Interest on the Notes will be payable quarterly in arrears on March 30, June 30, September 30 and December 30 of each year. The first interest payment will be made on September 30, 2019.

|

|

|

|

|

Day Count Convention:

|

30/360 to but excluding September 30, 2024, and, thereafter, a 360-day year and the number of days actually elapsed.

|

|

|

|

|

Optional Redemption:

|

The Company may, at its option, beginning with the Interest Payment Date of June 30, 2024 and on any scheduled Interest Payment Date thereafter, redeem the Notes, in whole or in part, at a redemption price equal to 100% of the principal amount of the Notes to be redeemed plus accrued and unpaid interest to, but excluding, the date of redemption.

|

2

|

Issuer:

|

First Internet Bancorp (the “Company”), an Indiana corporation

|

|

|

|

|

Special Event Redemption:

|

The Notes may not be redeemed prior to June 30, 2024, except that the Company may redeem the Notes at any time, at its option, in whole or in part, subject to obtaining any required regulatory approvals, if (i) a change or prospective change in law occurs that could prevent the Company from deducting interest payable on the Notes for U.S. federal income tax purposes, (ii) a subsequent event occurs that precludes the Notes from being recognized as Tier 2 capital for regulatory capital purposes, or (iii) the Company is required to register as an investment company under the Investment Company Act of 1940, as amended, in each case, at a redemption price equal to 100% of the principal amount of the Notes plus any accrued and unpaid interest through, but excluding, the redemption date. For more information, see ‘‘Description of the Notes—Redemption’’ in the preliminary prospectus supplement dated June 5, 2019.

|

|

|

|

|

Ranking:

|

The Securities will be general unsecured subordinated obligations of the Issuer and will rank equally with all of the Issuer’s other unsecured subordinated obligations from time to time outstanding.

|

|

|

|

|

Denomination:

|

$25 denominations and integral multiples of $25

|

|

|

|

|

Listing and Trading Markets:

|

Application has been made to list the Notes on the Nasdaq Global Select Market

|

|

|

|

|

Purchase Option:

|

The Company has granted the underwriters the right to purchase up to an additional $2,000,000 of the aggregate principal amount of Notes at the public offering price, less the underwriting discount, within 30 days from the date of the final prospectus supplement.

|

|

|

|

|

Underwriters’ Discount:

|

3.15%

|

|

|

|

|

Proceeds to the Company (before expenses):

|

$33,897,500

|

|

|

|

|

Use of Proceeds:

|

The Company intends to use the net proceeds to support its growth organically or through strategic acquisitions, repayment of indebtedness, repurchases of issued and outstanding shares of common stock, financing investments and capital expenditures, and for investments in the Bank as regulatory capital.

|

|

|

|

|

CUSIP / ISIN:

|

320557 309 / US3205573096

|

3

|

Issuer:

|

First Internet Bancorp (the “Company”), an Indiana corporation

|

|

|

|

|

Sole Book Running Manager:

|

Keefe, Bruyette & Woods,

A Stifel Company

|

|

|

|

|

Co-Managers:

|

Janney Montgomery Scott, BB&T Capital Markets, a division of BB&T Securities, a division of BB&T Securities, LLC, Boenning & Scattergood, Inc., and William Blair

|

*We expect that delivery of the Notes will be made against payment therefor on or about June 12, 2019, which will be the five business day following the date hereof (such settlement referred to as “T+5”). Under Rule 15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade Notes prior to delivery of the Notes hereunder will be required, by virtue of the fact the Notes will initially settle T+5, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to their date of delivery hereunder should consult their advisors.

The Company has filed a shelf registration statement (File No. 333-219841) (including a base prospectus) and a related preliminary prospectus supplement dated June 5, 2019 with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, and the related preliminary prospectus supplement and any other documents that the Company has filed with the SEC for more information about the Company and the offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company, the Underwriters or any dealer participating in the offering will arrange to send you the prospectus and the related preliminary prospectus supplement if you request it by calling Keefe, Bruyette & Woods toll-free at (800) 966-1559.

4

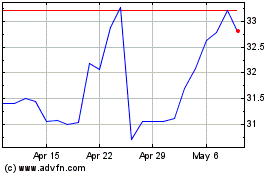

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Sep 2024 to Oct 2024

First Internet Bancorp (NASDAQ:INBK)

Historical Stock Chart

From Oct 2023 to Oct 2024