As filed with the Securities and Exchange Commission on August 2, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FARO TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| | |

| Florida | | 59-3157093 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

250 Technology Park

Lake Mary, Florida 32746

(Address of principal executive offices, including zip code)

2022 Equity Incentive Plan

Inducement Restricted Stock Unit Awards (August 2, 2023)

(Full title of the plan)

Yuval Wasserman

Executive Chairman

Faro Technologies, Inc.

250 Technology Park

Lake Mary, Florida 32746

(407) 333-9911

(Name, address and telephone number, including area code, of agent for service)

Copies to:

Tony Jeffries

Christina L. Poulsen

Wilson Sonsini Goodrich & Rosati, P.C.

650 Page Mill Road

Palo Alto, California 94304

(650) 493-9300

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☒ |

| | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

EXPLANATORY NOTE

This Registration Statement on Form S-8 (this “Registration Statement”) is filed by FARO Technologies, Inc. (the

“Registrant”) for the purpose of registering (i) 1,250,000 shares of common stock of the Registrant reserved for issuance under

the 2022 Equity Incentive Plan, as amended (the “2022 Plan”) and (ii) 434,837 shares of common stock of the Registrant

issuable under the inducement awards to Peter J. Lau, the Registrant’s Chief Executive Officer and Director (the “Inducement

Awards”). The Inducement Awards were approved by the Talent, Development and Compensation Committee of the Board of

Directors of the Registrant in compliance with and in reliance on Nasdaq Listing Rule 5635(c)(4). The Inducement Awards was

granted through separate inducement restricted stock unit grants with terms generally consistent with the terms of the 2022

Plan.

INFORMATION REQUIRED IN THE SECTION 10(A) PROSPECTUS

The information specified in Item 1 and Item 2 of Part I of Form S-8 is omitted from this Registration Statement in accordance with the provisions of Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”) and the introductory note to Part I of Form S-8. The documents containing the information specified in Part I of Form S-8 will be delivered to the participants in the equity benefit plans covered by this Registration Statement as specified by Rule 428(b)(1) under the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of Form S-8, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| | | | | |

| Item 3. | Incorporation of Documents by Reference. |

The Registrant hereby incorporates by reference into this Registration Statement the following documents previously filed with the Securities and Exchange Commission (the “Commission”):

(a) the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Commission on February 15, 2023;

(b) the section of the Registrant’s Definitive Proxy Statement for the 2023 annual meeting of shareholders, filed with the Commission on April 24, 2023, that are incorporated by reference in the Registrant's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as supplemented by the Proxy Supplement, filed with the SEC on May 17, 2023;

(c) all other reports filed with the Commission pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), since the end of the fiscal year covered by the Registrant’s Annual Report on Form 10-K referred to in (a) above; and

(d) the description of the Registrant’s common stock contained in the Registrant’s Registration Statement on Form 8-A (File No. 000-23081) filed with the Commission on September 15, 1997, pursuant to Section 12(b) of Exchange Act, including any amendment or report filed for the purpose of updating such description.

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on or after the date

of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement that indicates

that all securities offered have been sold or that deregisters all securities then remaining unsold shall be deemed to be

incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents;

provided, however, that documents or information deemed to have been furnished and not filed in accordance with the rules of

the Commission shall not be deemed incorporated by reference into this Registration Statement. Any statement contained in a

document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for

purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document which also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so

modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration

Statement

| | | | | |

| Item 4. | Description of Securities. |

Not applicable.

| | | | | |

| Item 5. | Interests of Named Experts and Counsel. |

Not applicable.

| | | | | |

| Item 6. | Indemnification of Directors and Officers. |

The Registrant is a Florida corporation subject to the Florida Business Corporation Act (the “Florida Act”). Under Section

607.0831 of the Florida Act, a director is not personally liable for monetary damages to the corporation or any other person for

any statement, vote, decision, or failure to act regarding corporate management or policy unless (1) the director breached or

failed to perform his or her duties as a director and (2) the director’s breach of, or failure to perform, those duties constitutes:

(a) a violation of the criminal law, unless the director had reasonable cause to believe his or her conduct was lawful or had no

reasonable cause to believe his or her conduct was unlawful; (b) a transaction from which the director derived an improper

personal benefit, either directly or indirectly; (c) a circumstance under which the liability provisions of Section 607.0834 of the

Florida Act are applicable (relating to liability for unlawful distributions); (d) in a proceeding by or in the right of the

corporation to procure a judgment in its favor or by or in the right of a shareholder, conscious disregard for the best interest of

the corporation, or willful misconduct; or (e) in a proceeding by or in the right of someone other than the corporation or a

shareholder, recklessness or an act or omission which was committed in bad faith or with malicious purpose or in a manner

exhibiting wanton and willful disregard of human rights, safety, or property. A judgment or other final adjudication against a

director in any criminal proceeding for a violation of the criminal law stops that director from contesting the fact that his or her

breach, or failure to perform, constitutes a violation of the criminal law; but does not stop the director from establishing that he

or she had reasonable cause to believe that his or her conduct was lawful or had no reasonable cause to believe that his or her

conduct was unlawful.

Under Section 607.0851 of the Florida Act, a corporation generally has the power to indemnify any person who was or is a

party to any proceeding because the individual is or was a director or officer of the corporation if (a) the director or officer

acted in good faith; (b) the director or officer acted in a manner he or she reasonably believed to be in, or not opposed to, the

best interests of the corporation; and (c) in the case of any criminal proceeding, the director or officer had no reasonable cause

to believe his or her conduct was unlawful. The termination of a proceeding by judgment, order, settlement, or conviction, or

upon a plea of nolo contendere or its equivalent, does not, of itself, create a presumption that the director or officer did not

meet the relevant standard of conduct described in this section of the Florida Act. Unless ordered by a court, a corporation may

not indemnify a director or an officer in connection with a proceeding by or in the right of the corporation except for expenses

and amounts paid in settlement not exceeding, in the judgment of the board of directors, the estimated expense of litigating the

proceeding to conclusion, actually and reasonably incurred in connection with the defense or settlement of such proceeding,

where such person acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best

interests of the corporation.

For purposes of the indemnification provisions of the Florida Act, “director” or “officer” means an individual who is or was a

director or officer, respectively, of a corporation or who, while a director or officer of the corporation, is or was serving at the

corporation’s request as a director or officer, manager, partner, trustee, employee, or agent of another domestic or foreign

corporation, limited liability company, partnership, joint venture, trust, employee benefit plan, or another enterprise or entity

and the terms include, unless the context otherwise requires, the estate, heirs, executors, administrators, and personal

representatives of a director or officer.

Section 607.0852 of the Florida Act provides that a corporation must indemnify an individual who is or was a director or

officer who was wholly successful, on the merits or otherwise, in the defense of any proceeding to which the individual was a

party because he or she is or was a director or officer of the corporation against expenses incurred by the individual in

connection with the proceeding.

Section 607.0853 of the Florida Act provides that a corporation may, before final disposition of a proceeding, advance funds to

pay for or reimburse expenses incurred in connection with the proceeding by an individual who is a party to the proceeding

because that individual is or was a director or an officer if the director or officer delivers to the corporation a signed written

undertaking of the director or officer to repay any funds advanced if (a) the director or officer is not entitled to mandatory

indemnification under Section 607.0852; and (b) it is ultimately determined under Section 607.0854 or Section 607.0855 (as

described below) that the director or officer has not met the relevant standard of conduct described in Section 607.0851 or the

director or officer is not entitled to indemnification under Section 607.0859 (as described below).

Section 607.0854 of the Florida Act provides that, unless the corporation’s articles of incorporation provide otherwise,

notwithstanding the failure of a corporation to provide indemnification, and despite any contrary determination of the board of

directors or of the shareholders in the specific case, a director or officer of the corporation who is a party to a proceeding

because he or she is or was a director or officer may apply for indemnification or an advance for expenses, or both, to a court

having jurisdiction over the corporation which is conducting the proceeding, or to a circuit court of competent jurisdiction. The

Registrant’s Articles of Incorporation do not provide any such exclusion. After receipt of an application and after giving any

notice it considers necessary, the court may order indemnification or advancement of expenses upon certain determinations of

the court.

Section 607.0855 of the Florida Act provides that, unless ordered by a court under Section 607.0854, a corporation may not

indemnify a director or officer under Section 607.0851 unless authorized for a specific proceeding after a determination has

been made that indemnification is permissible because the director or officer has met the relevant standard of conduct set forth

in Section 607.0851.

Section 607.0857 of the Florida Act provides that a corporation has the power to purchase and maintain insurance on behalf of

and for the benefit of an individual who is entitled to indemnification as set forth therein, and Section 607.0858 of the Florida

Act provides that the indemnification provided pursuant to Section 607.0851 and Section 607.0852, and the advancement of

expenses provided pursuant to Section 607.0853 are not exclusive. A corporation may, by a provision in its articles of

incorporation, bylaws or any agreement, or by vote of shareholders or disinterested directors, or otherwise, obligate itself in

advance of the act or omission giving rise to a proceeding to provide any other or further indemnification or advancement of

expenses to any of its directors or officers.

Section 607.0859 of the Florida Act provides that, unless ordered by a court under provisions of Section 607.0854 of the

Florida Act, a corporation may not indemnify a director or officer under Section 607.0851 or Section 607.0858 or advance

expenses to a director or officer under Section 607.0853 or Section 607.0858 if a judgment or other final adjudication

establishes that his or her actions, or omissions to act, were material to the cause of action so adjudicated and constitute: (a)

willful or intentional misconduct or a conscious disregard for the best interests of the corporation in a proceeding by or in the

right of the corporation to procure a judgment in its favor or in a proceeding by or in the right of a shareholder; (b) a

transaction in which a director or officer derived an improper personal benefit; (c) a violation of the criminal law, unless the

director or officer had reasonable cause to believe his or her conduct was lawful or had no reasonable cause to believe his or

her conduct was unlawful; or (d) in the case of a director, a circumstance under which the liability provisions of Section

607.0834 are applicable (relating to unlawful distributions).

The Registrant’s Amended and Restated Articles of Incorporation (the “Articles of Incorporation”) and Amended and Restated

Bylaws (the “Bylaws”) provide that the Registrant shall indemnify directors and executive officers to the fullest extent now or

hereafter permitted by the Florida Act and shall advance any and all reasonable expenses incurred in any proceeding to which

any director or executive officer is a party or in which such director or executive officer is deposed or called to testify as a

witness because he or she is or was a director or executive officer of the Registrant. In addition, the Registrant may enter into

indemnification agreements with its directors and executive officers in which the Registrant has agreed to indemnify such

persons to the fullest extent now or hereafter permitted by the Florida Act. The indemnification provided by the Florida Act and in the Articles of Incorporation and Bylaws is not exclusive of any other rights to which indemnification to a director or officer may be entitled.

As permitted by the Florida Act, the Registrant has entered into separate indemnification agreements with each of the

Registrant’s directors and executive officers which would require the Registrant, among other things, to indemnify them against certain liabilities which may arise by reason of their status as directors or executive officers.

In addition, the Florida Act permits, and the Articles of Incorporation and Bylaws authorize, us to purchase insurance on behalf

of the Registrant's directors and executive officers, insuring them against certain risks whether or not the Registrant would be

obligated to indemnify or advance expenses to such directors or executive officers under the Articles of Incorporation and

Bylaws. The Registrant maintains such insurance coverage for the Registrant's officers and directors as well as insurance

coverage to reimburse the Registrant for potential costs of the Registrant's corporate indemnification of officers and directors.

The general effect of the foregoing provisions may be to reduce the circumstances in which an officer or director of the

Registrant may be required to bear the economic burden of the foregoing liabilities and expense. These indemnification

provisions and the indemnification agreements entered into between the Registrant and the Registrant’s officers and directors

may be sufficiently broad to permit indemnification of the Registrant’s officers and directors for liabilities (including

reimbursement of expenses incurred) arising under the Securities Act.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to the Registrant’s directors, officers

and controlling persons pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion

of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable.

See also the undertakings set out in response to Item 9 herein.

| | | | | |

| Item 7. | Exemption from Registration Claimed. |

Not applicable.

| | | | | | | | | | | | | | | | | |

Exhibit

No. | Description | Incorporated by Reference |

| Form | File Number | Exhibit Number | Filing Date |

| 4.1 | | S-1/A | 333-32983 | 4.1 | September 10, 1997 |

| 4.2 | | 10-Q | 000-23081 | 10.1 | August 2, 2023 |

| 5.1 | | | | | |

| 23.1* | | | | | |

| 23.2 | | | | | |

| 24.1* | | | | | |

| 99.1* | | | | | |

| 99.2* | | | | | |

| 107* | | | | | |

1.The undersigned Registrant hereby undertakes:

(a)To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the

estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (A)(1)(i) and (A)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

(b)That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

2.The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3.Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer, or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Lake Mary, Florida on August 2, 2023.

| | | | | | | | | | | | | | |

| | | | |

| FARO TECHNOLOGIES, INC. |

| By: | | /s/ Yuval Wasserman |

| | Name: | | Yuval Wasserman |

| | Title: | | Executive Chairman |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Yuval Wasserman and Allen Muhich, and each of them, as his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign this Registration Statement and any and all amendments thereto, including post-effective amendments, and to file the same, with all exhibits thereto, and all other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith and about the premises, as fully for all intents and purposes as they, he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent or any of them, or their, his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | |

/s/ Yuval Wasserman | | Executive Chairman (Principal Executive Officer) | | August 2, 2023 |

| Yuval Wasserman | | | | |

| | |

/s/ Allen Muhich | | Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) | | August 2, 2023 |

| Allen Muhich | | |

| | | | |

/s/ Peter J. Lau | | Chief Executive Officer and Director | | August 2, 2023 |

| Peter J. Lau | | | | |

| | | | |

/s/ Jawad Ahsan | | Director | | August 2, 2023 |

| Jawad Ahsan | | | | |

| | |

/s/ Lynn Brubaker | | Director | | August 2, 2023 |

| Lynn Brubaker | | | | |

| | |

/s/ Moonhie Chin | | Director | | August 2, 2023 |

Moonhie Chin | | | | |

| | |

/s/ Alex Davern | | Director | | August 2, 2023 |

| Alex Davern | | | | |

| | |

/s/ John Donofrio | | Director | | August 2, 2023 |

| John Donofrio | | | | |

| | |

/s/ Jeroen van Rotterdam | | Director | | August 2, 2023 |

| Jeroen van Rotterdam | | | | |

| | |

| /s/ Rajani Ramanathan | | Director | | August 2, 2023 |

| Rajani Ramanathan | | | | |

Calculation of Filing Fee Tables

Form S-8

(Form Type)

FARO Technologies, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| Table 1 – Newly Registered Securities |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered(1) | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

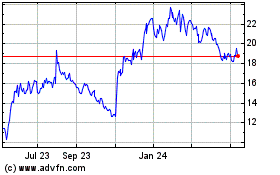

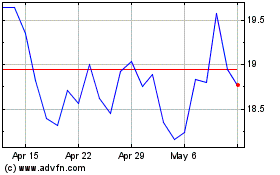

| Equity | Common stock, $0.001 par value per share | Rule 457(c) and Rule 457(h) | 1,250,000 (2) | $16.03(1)(3) | $20,037,500 | $110.20 per $1,000,000 | $2,208.14 |

| Equity | Common stock, $0.001 par value per share | Rule 457(c) and Rule 457(h) | 434,837 (4) | $16.03(3) | $6,970,437.11 | $110.20 per $1,000,000 | $768.15 |

| Total Offering Amounts | | $27,007,937.11 | | $2,976.29 |

| Total Fee Offsets | | | | — |

| Net Fee Due | | | | $2,976.29 |

(1)Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this registration statement on Form S-8 shall also cover any additional shares of the registrant’s common stock, par value $0.001 per share, that become issuable with respect to (i) the securities identified in the above table under the registrant’s 2022 Equity Incentive Plan (the “2022 Plan”) and (ii) the inducement awards granted to Peter J. Lau, the registrant’s Chief Executive Officer and Director, pursuant to Rule 5635(c)(4) of the Nasdaq Listing Rules (the “Inducement Awards”) by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the registrant’s receipt of consideration which results in an increase in the number of outstanding shares of common stock.

(2)Represents shares of common stock available for future issuance under the 2022 Plan.

(3)Estimated in accordance with Rules 457(c) and 457(h) of the Securities Act solely for the purpose of calculating the registration fee on the basis of $16.03 per share, which is the average of the high and low prices of the registrant’s common stock on July 27, 2023 as reported on The Nasdaq Global Select Market.

(4)Represents shares of common stock issuable under the new hire inducement restricted stock unit awards granted on August 2, 2023 in accordance with Nasdaq Listing Rule 5635(c)(4).

| | | | | | | | |

| |

NELSON MULLINS RILEY & SCARBOROUGH LLP ATTORNEYS AND COUNSELORS AT LAW |

| Daniel B. Nunn, Jr. T 904.665.3601 F 904.665.3699 daniel.nunn@nelsonmullins.com |

50 N. Laura Street, 41st Floor Jacksonville, FL 32202 T 904.665.3600 F 904.665.3699 nelsonmullins.com |

Exhibit 5.1

August 2, 2023

FARO Technologies, Inc.

250 Technology Park

Lake Mary, Florida 32746

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as special counsel to FARO Technologies, Inc., a Florida corporation (the “Company”) in connection with the Registration Statement on Form S-8 filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Act”). The Registration Statement relates to the offer and sale by certain selling shareholders named in the Registration Statement (the “Selling Shareholders”) of up to 1,250,000 shares of common stock, par value $0.001 per share, of the Company (the “Shares”) as well as the grant of restricted stock units to Peter J. Lau as an inducement grant.

The opinions contained in this letter (herein called “our opinions”) are based exclusively upon the Florida Business Corporation Act, as now constituted. We express no opinion as to the applicability of, compliance with, or effect of any other law or governmental requirement with respect to the Company.

For purposes of this opinion, we have assumed the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as copies and the authenticity of the originals of all documents submitted to us as copies. We have also assumed the legal capacity of all natural persons, the genuineness of the signatures of persons signing all documents in connection with which this opinion is rendered, the authority of such persons signing on behalf of the parties thereto and the due authorization, execution and delivery of all documents by the parties thereto. We have not independently established or verified any facts relevant to the opinion expressed herein but have relied upon (i) statements and representations of officers and other representatives of the Company, including its general counsel and others, and (ii) factual information we have obtained from such other sources as we have deemed reasonable. We have assumed that the Shares have not been sold prior to the effectiveness of the Registration Statement.

For purposes of this opinion, we have relied without any independent verification upon factual information supplied to us by the Company and the accuracy of the factual information contained in the Company’s filings with the Commission. We have assumed without investigation that there has been no relevant change or development between the dates as of which the information cited in the preceding sentences was given and the date of this letter and that the information upon which we have relied is accurate and does not omit disclosure necessary to prevent such information from being misleading.

Based upon and subject to the foregoing, we are of the opinion that the Shares are validly issued, fully paid and non-assessable.

California | Colorado | District of Columbia | Florida | Georgia | Maryland | Massachusetts | New York

North Carolina | South Carolina | Tennessee | West Virginia

Our opinion expressed above is subject to the qualifications that we express no opinion as to the applicability of, compliance with, or effect of (i) any bankruptcy, insolvency, reorganization, fraudulent transfer, fraudulent conveyance, moratorium or other similar law affecting the enforcement of creditors’ rights generally; (ii) general principles of equity (regardless of whether enforcement is considered in a proceeding in equity or at law); (iii) public policy considerations which may limit the rights of parties to obtain certain remedies; or (iv) any laws except the Florida Business Corporation Act. Our advice on any legal issue addressed in this letter represents our opinion as to how that issue would be resolved were it to be considered by the highest court in the jurisdiction which enacted such law. The manner in which any particular issue would be treated in any actual court case would depend in part on facts and circumstances particular to the case, and this letter is not intended to guarantee the outcome of any legal dispute which may arise in the future.

This opinion is being rendered to be effective as of the effective date of the Registration Statement, and we hereby consent to the filing of this opinion with the Commission as Exhibit 5.1 to the Registration Statement. In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission.

We do not find it necessary for the purposes of this opinion, and accordingly we do not purport to cover herein, the application of the securities or “Blue Sky” laws of the various states to the issuance and sale of the shares of Common Stock registered under the Registration Statement.

This opinion is limited to the specific issues addressed herein, and no opinion may be inferred or implied beyond that expressly stated herein. We assume no obligation to revise or supplement this opinion should the present Florida Business Corporation Act be changed by legislative action, judicial decision or otherwise, should there be factual developments which might affect any matters or opinions set forth herein or for any other reason. This opinion is furnished to you in connection with the filing of the Registration Statement and is not to be used, circulated, quoted or otherwise relied upon for any other purpose.

Very truly yours,

/s/ Nelson Mullins Riley & Scarborough LLP

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our reports dated February 15, 2023 with respect to the consolidated financial statements and internal control over financial reporting of FARO Technologies, Inc. included in the Annual Report on Form 10-K for the year ended December 31, 2022, which are incorporated by reference in this Registration Statement. We consent to the incorporation by reference of the aforementioned reports in this Registration Statement.

/s/ GRANT THORNTON LLP

Orlando, Florida

August 2, 2023

Exhibit 99.1

FARO Technologies, Inc.

Restricted Stock Unit Award Agreement (Inducement – Performance-Based)

1.NOTICE OF GRANT OF RESTRICTED STOCK UNIT AWARD (PERFORMANCE-BASED)

Grantee’s Name: Peter J. Lau

Address: [Intentionally Omitted]

You have been granted the right to receive an award of performance-based restricted stock units (“Restricted Stock Units”), subject to the terms and conditions of this Restricted Stock Unit Award Agreement, including Exhibit A and Exhibit B attached hereto (the “Agreement”), as follows:

Grant Number

Date of Grant July 24, 2023

Vesting Commencement Date July 24, 2023

Target Number of Restricted Stock Units 163,064

Vesting Schedule:

Subject to Sections 3 and 6 of Exhibit A and any acceleration provisions set forth below, the Restricted Stock Units will be scheduled to vest as set forth in Exhibit B. Except as otherwise set forth in the Severance Plan or Exhibit A, in the event you cease to be in a Service Relationship for any or no reason before you vest in the Restricted Stock Units, the Restricted Stock Units and your right to acquire any Stock hereunder will immediately be forfeited and terminated.

You agree and acknowledge that you have reviewed this Agreement in its entirety, have had an opportunity to obtain the advice of counsel, and fully understand all provisions of this Agreement. By accepting this Award, you hereby agree (i) to accept as binding, conclusive, and final all decisions or interpretations of the Administrator upon any questions relating to the Agreement, (ii) to notify the Company upon any change in the residence address indicated above, and (iii) to the extent provided for in Section 6 of Exhibit A, the sale of Stock to cover the Tax-Related Items (and any associated broker or other fees) and agree and acknowledge that you may not satisfy them by any means other than such sale of Stock, unless required to do so by the Administrator or pursuant to the Administrator’s express written consent.

EXHIBIT A

TERMS AND CONDITIONS OF RESTRICTED STOCK UNIT AWARD

1.Definitions. As used herein, the following definitions will apply:

“Act” means the Securities Act of 1933, as amended, and the rules and regulations thereunder.

“Administrator” means either the Board or the compensation committee of the Board or a similar committee performing the functions of the compensation committee and which is comprised of not less than two Non-Employee Directors who are independent.

“Affiliate” means, at the time of determination, any “parent” or “subsidiary” of the Company as such terms are defined in Rule 405 of the Act. The Administrator will have the authority to determine the time or times at which “parent” or “subsidiary” status is determined within the foregoing definition.

“Award” means this award of Restricted Stock Units.

“Board” means the Board of Directors of the Company.

“Code” means the Internal Revenue Code of 1986, as amended, and any successor Code, and related rules, regulations and interpretations. Reference to a specific section of the Code or regulation thereunder will include such section or regulation, any valid regulation promulgated under such section, and any comparable provision of any future legislation or regulation amending, supplementing or superseding such section or regulation.

“Company” means Faro Technologies, Inc., a Florida corporation, or any successor thereto.

“Consultant” means a consultant or adviser who provides bona fide services to the Company or an Affiliate as an independent contractor and who qualifies as a consultant or advisor under Instruction A.1.(a)(1) of Form S-8 under the Act.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder.

“Fair Market Value” of the Stock on any given date means the fair market value of the Stock determined in good faith by the Administrator; provided, however, that if the Stock is listed on the National Association of Securities Dealers Automated Quotation System (“NASDAQ”), NASDAQ Global Market, The New York Stock Exchange or another national securities exchange or traded on any established market, the determination will be made by reference to market quotations. If there are no market quotations for such date, the determination will be made by reference to the last date preceding such date for which there are market quotations.

“Non-Employee Director” means a member of the Board who is not also an employee of the Company or any Subsidiary.

“Sale Event” will mean (i) the sale of all or substantially all of the assets of the Company on a consolidated basis to an unrelated person or entity, (ii) a merger, reorganization or consolidation pursuant to which the holders of the Company’s outstanding voting power and outstanding stock immediately prior to such transaction do not own a majority of the outstanding voting power and outstanding stock or other equity interests of the resulting or successor entity (or its ultimate parent, if applicable) immediately upon completion of such transaction, (iii) the sale of all of the Stock of the Company to an unrelated person, entity or group thereof acting in concert, (iv) any other transaction in which the owners of the Company’s outstanding voting power immediately prior to such transaction do not own at least a majority of the outstanding voting power of the Company or

any successor entity immediately upon completion of the transaction other than as a result of the acquisition of securities directly from the Company; or (v) individuals who, as of the Effective Date, constitute the Board (the “Incumbent Directors”) cease for any reason to constitute at least a majority of the Board or other governing body or entity of the Company, its successor or survivor, provided that any person becoming a director subsequent to the Grant Date but prior to any Sale Event, whose election or nomination for election was approved or recommended by a vote of a majority of the Incumbent Directors then on the Board (either by a specific vote or by approval of the proxy statement of the Company in which such person is named as a nominee for director, without written objection to such nomination), will be an Incumbent Director; provided, however, that no individual initially elected or nominated as a director of the Company as a result of an actual or threatened election contest with respect to directors or as a result of any other actual or threatened solicitation of proxies or consents by or on behalf of any person other than the Board will be deemed to be an Incumbent Director.

“Sale Price” means the value as determined by the Administrator of the consideration payable, or otherwise to be received by shareholders, per share of Stock pursuant to a Sale Event.

“Section 409A” means Section 409A of the Code.

“Service Relationship” means any relationship as an employee, director or Consultant of the Company or any Affiliate (e.g., a Service Relationship will be deemed to continue without interruption in the event an individual’s status changes from full-time employee to part-time employee or Consultant). For purposes of this Agreement, the following events will not be deemed a termination of a Service Relationship: (i) a transfer to the employment of the Company from an Affiliate or from the Company to an Affiliate, or from one Affiliate to another; or (ii) an approved leave of absence for military service or sickness, or for any other purpose approved by the Company, if the your right to re-employment is guaranteed either by a statute or by contract or under the policy pursuant to which the leave of absence was granted or if the Administrator otherwise so provides in writing.

“Severance Plan” means the Company’s Key Executive Change in Control and Severance Plan.

“Stock” means the Common Stock, par value $0.001 per share, of the Company, subject to adjustments pursuant to Section 7.

“Subsidiary” means any corporation or other entity (other than the Company) in which the Company has at least a 50 percent interest, either directly or indirectly.

2.Award of Restricted Stock Units. The Company hereby confirms the grant to you, as of the Grant Date and subject to the terms and conditions of this Agreement, of an award of Restricted Stock Units in an amount initially equal to the Target Number of Restricted Stock Units specified above. The number of Restricted Stock Units that may actually be earned and become eligible to vest pursuant to this Award can be between 0% and 200% of the Target Number of Restricted Stock Units. Each Restricted Stock Unit that is earned as a result of the performance goals specified in Exhibit A to this Agreement having been satisfied and which thereafter vests represents the right to receive one share of Stock (or, in the Administrator’s or its authorized delegates’ discretion, the Fair Market Value as of the Restricted Stock Unit vesting date of one share of Stock). Prior to their settlement or forfeiture in accordance with the terms of this Agreement, the Restricted Stock Units granted to you will be credited to an account in your name maintained by the Company. This account will be

unfunded and maintained for book-keeping purposes only, with the Restricted Stock Units simply representing an unfunded and unsecured contingent obligation of the Company.

3.Vesting of Restricted Stock Units; Forfeiture. Except as otherwise provided in Exhibit B, the number of Restricted Stock Units determined to have been earned in accordance with Exhibit B attached hereto as of the end of the Performance Period specified in Exhibit B will vest on the date the Administrator certifies such performance results (assuming your Service Relationship through such date), which will be no later than the Scheduled Vesting Date specified in Exhibit B. Except as may be provided for in the Severance Plan and Exhibit B, if your Service Relationship is terminated prior to the date the Restricted Stock Units vest, the Restricted Stock Units that have not yet vested as of the date of such termination will be immediately forfeited without further consideration or any act or action by you; provided, however, if, prior to the date the Restricted Stock Units have vested, your Service Relationship terminates as a result of death or Disability, the Administrator, in its sole discretion, will have the right to immediately vest all or any portion of such Restricted Stock Units, subject to such terms as the Administrator, in its sole discretion, deems appropriate.

4.Settlement of Restricted Stock Units. Subject to Section 6 of this Agreement, each vested Restricted Stock Unit will be settled in one share of Stock (or, as provided in Section 2, the Fair Market Value thereof as of the Restricted Stock Unit’s vesting date), as soon as reasonably practicable following the vesting date (but in no event later than the 15th day of the third calendar month following the calendar year during which the vesting date occurs). If settled in cash, you will receive a cash amount in payment and settlement of the vested Restricted Stock Units equal to the product of the Fair Market Value of a share of Stock on the applicable vesting date, multiplied by the number of vested Restricted Stock Units. If settled in shares of Stock, you will receive one share of Stock in payment and settlement of each vested Restricted Stock Unit, and such shares will be registered in the your name on the books of the Company as of the vesting date.

To the extent certificated, stock certificates to you will be deemed delivered for all purposes when the Company or a stock transfer agent of the Company has mailed such certificates in the United States mail, addressed to you, at your last known address on file with the Company. Uncertificated Stock will be deemed delivered for all purposes when the Company or a Stock transfer agent of the Company will have given to you by electronic mail (with proof of receipt) or by United States mail, addressed to you, at your last known address on file with the Company, notice of issuance and recorded the issuance in its records (which may include electronic “book entry” records). Notwithstanding anything herein to the contrary, the Company will not be required to issue or deliver any evidence of book entry or certificates evidencing shares of Stock pursuant to the settlement of this Award, unless and until the Administrator has determined, with advice of counsel (to the extent the Administrator deems such advice necessary or advisable), that the issuance and delivery is in compliance with all applicable laws, regulations of governmental authorities and, if applicable, the requirements of any exchange on which the shares of Stock are listed, quoted or traded. Any Stock issued pursuant to this Agreement will be subject to any stop-transfer orders and other restrictions as the Administrator deems necessary or advisable to comply with federal, state or foreign jurisdiction, securities or other laws, rules and quotation system on which the Stock is listed, quoted or traded. The Administrator may place legends on any Stock certificate or notations on any book entry to reference restrictions applicable to the Stock. In addition to the terms and conditions provided herein, the Administrator may require that an individual make such reasonable covenants, agreements, and representations as the Administrator, in its discretion, deems necessary or advisable in order to comply with any such laws, regulations, or requirements. The Administrator will have the right to require any individual to comply with any timing or other restrictions with respect to the settlement of this Award, including a window-period limitation, as may be imposed in the discretion of the Administrator.

Until Stock is deemed delivered in accordance with this Section 4, no right to vote or receive dividends or any other rights of a shareholder will exist with respect to shares of Stock to be issued in connection with this Award, notwithstanding the any action by you with respect to this Award.

This Award and any shares of Stock issued pursuant to this Award is subject to the Company’s insider trading policies and procedures, as in effect from time to time. Further, this Award and any shares of Stock issued pursuant to this Award is subject to the Company’s clawback policy, as in effect from time to time.

5.Nontransferability of the Award. This Award will not be transferable by you otherwise than by will or the laws of descent and distribution or as otherwise expressly permitted pursuant to this Agreement.

6.Tax Withholding. When the Restricted Stock Units become taxable income to you, the Company may deduct and withhold from any cash otherwise payable to you (whether payable with respect to the Restricted Stock Units or as salary, bonus or other compensation) such amount as may be required for the purpose of satisfying the Company’s obligation to withhold Federal, state or local taxes or foreign taxes or other social insurance amounts. Further, in the event the amount actually withheld is insufficient for this purpose, the Company may require that you, upon its demand or otherwise, make arrangements satisfactory to the Company for payment of the amount as may be requested by the Company in order to satisfy its obligation to withhold any such taxes. In any case where a tax is required to be withheld in connection with the delivery of shares of Stock under this Agreement, you will be permitted to satisfy the Company’s tax withholding requirements by making a written election (in accordance with such rules and regulations and in such form as the Administrator may determine) to have the Company withhold shares of Stock otherwise issuable to you pursuant to the vesting of the Restricted Stock Units (the “Withholding Election”) having a Fair Market Value on the date income is recognized (the “Tax Date”) equal to the minimum amount required to be withheld. If the number of shares of Stock withheld to satisfy withholding tax requirements will include a fractional share, the number of shares of Stock withheld will be reduced to the next lower whole number and you will deliver cash in lieu of such fractional share, or otherwise make arrangements satisfactory to the Company for payment of such amount. A Withholding Election must be received by the Corporate Secretary of the Company on or prior to the Tax Date.

7.Changes in Stock. Subject to Section 8 hereof, if, as a result of any reorganization, recapitalization, reclassification, stock dividend, stock split, reverse stock split or other similar change in the Company’s capital stock, the outstanding shares of Stock are increased or decreased or are exchanged for a different number or kind of shares or other securities of the Company, or additional shares or new or different shares or other securities of the Company or other non-cash assets are distributed with respect to such shares of Stock or other securities, or, if, as a result of any merger or consolidation, sale of all or substantially all of the assets of the Company, the outstanding shares of Stock are converted into or exchanged for securities of the Company or any successor entity (or a parent or subsidiary thereof), the Administrator will make equitable or proportionate adjustments in the number of shares subject to this Award and the terms of this Award to take any such event. Further, the Administrator will make equitable and proportionate adjustments in the number of shares subject to this Award and the terms of this Award to take into consideration cash dividends paid other than in the ordinary course or any other extraordinary corporate event. The adjustment by the Administrator will be final, binding and conclusive. No fractional shares of Stock will be issued

under this Award resulting from any such adjustment, but the Administrator in its discretion may make a cash payment in lieu of fractional shares.

8.Mergers and Other Transactions. In the case of and subject to the consummation of a Sale Event, the parties thereto may cause the assumption or continuation of this Award, or the substitution of this Award with a new award of the successor entity or parent thereof, with appropriate adjustment as to the number and kind of shares, as such parties will agree. To the extent the parties to the Sale Event do not provide for the assumption, continuation or substitution of this Award, upon the effective time of the Sale Event, this Award, to the extent outstanding, will terminate. In such case, to the extent this Award became eligible to vest in connection with a Sale Event as set forth in Exhibit B, it will become fully vested and nonforfeitable as of the effective time of the Sale Event, and there will be a payout to you within sixty (60) days following the Sale Event (unless a later date is required by Section 409A). In the event this Award is terminated, (i) the Company will have the option (in its sole discretion) to make or provide for a payment, in cash or in kind, to you, in exchange for the cancellation of this Award, an amount equal to the Sale Price multiplied by the number of shares of Stock then subject to this Award.

If this Award is assumed by the successor entity or otherwise equitably continued or substituted in connection with a Sale Event, then if within one year after the effective date of the Sale Event, your employment with the Company or its successor is terminated in a manner that would entitle you to severance benefits under the Severance Plan, then this Award will fully vest as of the date of such termination, subject to executing and not revoking a separation agreement as contemplated by, and subject to the terms and conditions of, the Severance Plan.

9.Status of Grantee. You will not be deemed for any purposes to be a shareholder of the Company with respect to any of the Restricted Stock Units unless and until they are settled in shares of Stock and registered in your name on the books of the Company, in accordance with Section 4 above, upon vesting of the Restricted Stock Units. This Agreement does not confer upon you any right to continue in the employ of the Company or any of its Affiliates (or to continue in any Service Relationship), nor does it interfere in any way with the right of the Company (or its Affiliates, if applicable) to terminate your employment with the Company (or any of its Affiliates, if applicable) at any time. In no event will the value, at any time, of this Award, the shares of Stock underlying this Award or any other benefit provided by this Agreement be included as compensation or earnings for purposes of any other compensation, retirement or benefit plan offered to employees of the Company or its subsidiaries unless otherwise specifically provided for in such plan or arrangement.

10.Powers of the Company Not Affected. The existence of this Award will not affect in any way the right or power of the Company or its shareholders to make or authorize any or all adjustments, recapitalizations, reorganizations or other changes in the Company’s capital structure or its business, or any merger or consolidation of the Company, or any issuance of bonds, debentures, preferred or prior preference stock senior to or affecting the shares of Stock or the rights thereof, or dissolution or liquidation of the Company, or any sale or transfer of all or any part of the Company’s assets or business or any other corporate act or proceeding, whether of a similar character or otherwise.

11.Determinations by Administrator. As a condition of the granting of the Restricted Stock Units, you agree, for yourself and your legal representatives or guardians, that this Agreement will be interpreted by the Administrator and that any interpretation by the Administrator of the terms of this Agreement and any determination made by the Administrator pursuant to this Agreement will

be final, binding and conclusive. The Administrator (a) may at any time to adopt, alter and repeal such rules, guidelines and practices for administration of this Award and for its own acts and proceedings as it will deem advisable (b) will be able to make all determinations it deems advisable for the administration of this Award, (c) will decide all disputes arising in connection with this Award; and (d) will otherwise supervise the administration of this Award.

12.Indemnification. Neither the Board nor the Administrator, nor any member of either or any delegate thereof, will be liable for any act, omission, interpretation, construction or determination made in good faith in connection with this Award, and the members of the Board and the Administrator (and any delegate thereof) will be entitled in all cases to indemnification and reimbursement by the Company in respect of any claim, loss, damage or expense (including, without limitation, reasonable attorneys’ fees) arising or resulting therefrom to the fullest extent permitted by law and/or under the Company’s articles or bylaws or any directors’ and officers’ liability insurance coverage which may be in effect from time to time and/or any indemnification agreement between such individual and the Company.

13.Nature of the Award. You acknowledge and agree that you understand that the value that may be realized, if any, from this Award is contingent, and depends on the future market price of shares of Stock, among other factors. You further confirm your understanding that this Award is intended to promote employee retention and stock ownership and to align employees’ interests with those of shareholders, is subject to vesting conditions and will be forfeited if vesting conditions are not satisfied.

You also acknowledge and agree that you understand that (a) the grant of this Award is voluntary and occasional and does not create any contractual or other right to receive future awards, or benefits in lieu of awards even if other awards have been granted repeatedly in the past; (b) all decisions with respect to any future award will be at the sole discretion of the Company; (c) the value of this Award is an extraordinary item of compensation which is outside the scope of your employment contract with your actual employer, if any; (d) this Award and past or future awards are not part of normal or expected compensation or salary for any purposes, including, but not limited to, calculating any severance, resignation, redundancy, end of service payments, bonuses, long-service awards, pension or retirement benefits or similar payments; and (e) no claim or entitlement to compensation or damages arises from termination of this Award or diminution in value of this Award, and you irrevocably release the Company and its Affiliates from any such claim that may arise.

14.Administration. You acknowledge and agree that you understand that the Company and its Affiliates hold certain personal information about you, including, but not limited to, information such as your name, home address, telephone number, date of birth, salary, nationality, job title, social security number, social insurance number or other such tax identity number and details of this Award or other entitlement to shares of Stock awarded, cancelled, exercised, vested, unvested or outstanding in the your favor (“Personal Data”).

You acknowledge and agree that you understand that in order for the Company to process this Award, the Company will collect, use, transfer and disclose Personal Data within the Company and among its Affiliates electronically or otherwise, as necessary for the implementation and administration of the Plan, including, in the case of a social insurance number, for income reporting purposes as required by law. You further understand that the Company may transfer Personal Data, electronically or otherwise, to third parties, including but not limited to such third parties as outside tax, accounting, technical and legal consultants when such third parties are assisting the Company or its Affiliates in the implementation and administration of this Award. You understand that such recipients may be located within the jurisdiction of your residence, or within the United States or elsewhere and are subject to the legal requirements in those jurisdictions. You understand

that the employees of the Company, its Affiliates and third parties performing work related to the implementation and administration of this Award will have access to the Personal Data as is necessary to fulfill their duties related to the implementation and administration of this Award. By accepting this Award, you consent, to the fullest extent permitted by law, to the collection, use, transfer and disclosure, electronically or otherwise, of your Personal Data by or to such entities for such purposes and accepts that this may involve the transfer of Personal Data to a country which may not have the same level of data protection law as the country in which this Agreement is executed. You confirm that if you have provided or, in the future, will provide Personal Data concerning third parties including beneficiaries, you have the consent of such third party to provide their Personal Data to the Company for the same purposes.

You understand that you may, at any time, request to review the Personal Data and require any necessary amendments to it by contacting the Company in writing. As well, you may always elect to for-go this Award.

15.Miscellaneous.

(a)This Agreement and your rights hereunder are subject to all the terms and conditions of this Agreement, as the same may be amended from time to time, as well as to such rules and regulations as the Administrator may adopt for administration of this Award. The Administrator will have the right to impose such restrictions on any shares of Stock acquired pursuant to this Award, as it may deem advisable, including, without limitation, restrictions under applicable federal securities laws, under applicable federal and state tax law, under the requirements of any stock exchange or market upon which such shares of Stock are then listed and/or traded, and under any blue sky or state securities laws applicable to such shares of Stock.

(b)It is expressly understood that the Administrator is authorized to administer, construe, and make all determinations necessary or appropriate to the administration of this Agreement, all of which will be binding upon you.

(c)You agree to take all steps necessary to comply with all applicable provisions of federal and state securities and tax laws in exercising your rights under this Agreement.

(d)This Agreement will be subject to all applicable laws, rules, and regulations, and to such approvals by any governmental agencies or national securities exchanges as may be required.

(e)All obligations of the Company under this Agreement will be binding on any successor to the Company, whether the existence of such successor is the result of a direct or indirect purchase of all or substantially all of the business and/or assets of the Company, or the result of a merger, consolidation or otherwise.

(f)The award of Restricted Stock Units as provided in this Agreement and any issuance of shares of Stock or payment pursuant to this Agreement are intended to be exempt from Section 409A under the short-term deferral exception specified in Treas. Reg. § 1.409A-l(b)(4).

(g)The Company may, in its sole discretion, decide to deliver any documents related to this Award by electronic means. You hereby consent to receive such documents by

electronic delivery and agree to use an on-line or electronic system established and maintained by the Company or a third party designated by the Company for purposes of administering this Award.

(h)To the extent not preempted by federal law, this Agreement will be governed by, and construed in accordance with, the laws of the State of Florida.

*****

IN WITNESS WHEREOF, the parties have caused this Agreement to be executed as of the Date of Grant

FARO TECHNOLOGIES, INC.

By:

Name: Yuval Wasserman

Title: Executive Chairman

GRANTEE

Signed Electronically

Name

EXHIBIT B

RESTRICTED STOCK UNIT AWARD (PERFORMANCE-BASED) TERMS AND CONDITIONS

PERFORMANCE METRICS

Performance Period: July 24, 2023 through July 23, 2026

Scheduled Vesting Date: The date, not to exceed 30 calendar days following the conclusion of the above performance period, on which the Committee certifies (i) the degree to which the applicable performance objectives for the Performance Period have been satisfied, and (ii) the number of Restricted Stock Units that have been earned during the Performance Period and will vest, as determined in accordance with this Exhibit B.

1.Units Earned; Vesting. Subject to the terms of the Restricted Stock Unit Award Agreement (Inducement– Performance-Based) (“Agreement”) of which this Exhibit B is a part, the number of Restricted Stock Units that will be earned during the Performance Period and will vest as of the Scheduled Vesting Date as set forth in the Notice of Grant of Restricted Stock Unit Award (Performance-Based) (the “Notice of Grant”) will be determined as provided below. Any capitalized term used in this Exhibit B that is not defined herein will have the meaning given to it in the Agreement.

2.Performance Objectives. The Restricted Stock Units subject to this Award may be earned based on the Company’s Relative TSR Performance as described in Section 3 below, subject to the limitation described in Section 4 below, if applicable.

3.Relative TSR Performance. The number of Restricted Stock Units that will be considered earned based on the Relative TSR Performance of the Company will be determined using the following formula:

(Target Number of Units) x (Relative TSR Percentage)

For purposes of determining the Company’s Relative TSR Performance, the following terms will have the meanings indicated:

a)“Relative TSR” means the percentile ranking of the Company’s TSR relative to the TSR of the other companies included in the Russell 2000 Index for the entirety of the Performance Period (the “Peer Companies”). Relative TSR will be determined by ranking the Company and the Peer Companies from highest to lowest according to their respective TSRs. After this ranking, the percentile performance of the Company relative to the Peer Companies will be determined as follows:

P = N ‐ R

N ‐ 1

where:

“P” represents the percentile performance which will be rounded, if necessary, to the nearest whole percentile by application of regular rounding.

“N” represents the remaining number of Peer Companies, plus the Company.

“R” represents the Company’s ranking among the Peer Companies.

Example: If there are 239 Peer Companies, and the Company ranked 67th, the performance would be at the 72nd percentile: .72 = (240 - 67)/(240 - 1)

b)“TSR” means, with respect to any company, the percentage growth in total shareholder return, determined by dividing (A) the appreciation in price of a share of the company’s common stock from the Opening Value to the Closing Value, plus any dividends paid during the Performance Period (which will be deemed reinvested in the company’s common stock on the ex-dividend date), by (B) the Opening Value.

c)“Opening Value” means, with respect to any company, the average of the closing prices per share of the company’s common stock for all trading days in the 90 calendar day period beginning on and including the first day of the Performance Period, assuming any dividends paid during the 90 calendar day period are reinvested in the company’s common stock on the ex-dividend date.

d)“Closing Value” means, with respect to any company, the average of the closing prices per share of the company’s common stock for all trading days in the 90 calendar day period ending on and including the last day of the Performance Period, assuming any dividends paid during the 90 calendar day period are reinvested in the company’s common stock on the ex-dividend date.

e)“Relative TSR Percentage” means the percentage specified in the following table that corresponds to the Relative TSR ranking achieved by the Company during the Performance Period. If the Relative TSR is between performance levels specified in the table, the corresponding Relative TSR Percentage will be determined by linear interpolation. For the avoidance of doubt, in no event will the Relative TSR Percentage exceed 200%.

| | | | | | | | |

Payout Level |

Relative TSR | Relative TSR Percentage |

Max | 80th percentile or above | 200% |

Target | 55th percentile | 100% |

Threshold | 25th percentile | 25% |

None | Less than 25th percentile | 0% |

4.Negative TSR. If the Company’s TSR for the Performance Period is negative, then the maximum Relative TSR Percentage that may be achieved is 100%.

5.Sale Event.

a)In the event of a Sale Event: (i) the Performance Period will be deemed to have ended as of the date of the consummation of the Sale Event (the “CIC Date,” and such Performance Period, the “Abbreviated Performance Period”), (ii) the TSR for the Company and each of the Peer Companies will be calculated by using the Closing Value of each company’s common stock as of the CIC Date, and (iii) the number of earned Restricted Stock Units for such Abbreviated Performance Period (the “CIC Earned Units”) will be determined in accordance with Section 3 above, provided that any reference to “Performance Period” in Section 3 above will be deemed to be a reference to the Abbreviated Performance Period for purposes of this calculation.

b)If this Restricted Stock Unit Award is not continued or assumed in connection with a Sale Event or otherwise equitably converted or substituted for in connection with a Sale Event, the number of CIC Earned Units, as determined in accordance with section 5(a) above, will vest immediately upon the CIC Date and settle in accordance with Section 3 and 8 of Exhibit A (unless a later date is required by the Agreement).

c)If this Award is continued or assumed in connection with a Sale Event or otherwise equitably converted or substituted for in connection with a Sale Event, the CIC Earned Units will be determined in accordance with section 5(a) above. The Pro Rata Portion of the CIC Earned Units will vest immediately upon the CIC Date and settle in accordance with Section 3 of Exhibit A (unless a later date is required under the Agreement), and the balance of the CIC Earned Units (the “Continued Units”) will convert immediately upon the CIC Date into a time-based vesting award for the remaining duration of the original Performance Period and, assuming your continued Service Relationship, will vest on the last day of the original Performance Period, subject to any vesting acceleration provided for in Section 8 of Exhibit A.

d)The “Pro Rata Portion” means that number of Restricted Stock Units equal to the product obtained by multiplying (x) the total number of CIC Earned Units (as determined in accordance with section 5(a) above) by (y) a fraction, the numerator of which is the number of days elapsed from the first day of the original Performance Period through the CIC Date and the denominator of which is the number of days in the original Performance Period.

6.Treatment Upon Death of Grantee. In the event of termination of your Service Relationship resulting from your death, any then unvested portion of this Award will not be forfeited, but instead will remain outstanding, and to the extent the performance objectives for the Performance Period are met, your estate will be entitled to a pro rata portion of the Award relating to that portion of the Performance Period that you served as the Company’s President & Chief Executive Officer.

Exhibit 99.2

FARO Technologies, Inc.

Restricted Stock Unit Award Agreement (Inducement – Service Based)

1.NOTICE OF GRANT OF RESTRICTED STOCK UNIT AWARD

Grantee’s Name: Peter J. Lau

Address: [Intentionally Omitted]

You have been granted the right to receive an award of restricted stock units (“Restricted Stock Units”, subject to the terms and conditions of this Restricted Stock Unit Award Agreement, including Exhibit A attached hereto (the “Agreement”), as follows:

Grant Number

Date of Grant July 24, 2023

Vesting Commencement Date July 24, 2023

Number of Restricted Stock Units 108,709

Vesting Schedule:

Subject to Sections 3 and 6 of Exhibit A and any acceleration provisions set forth below, the Restricted Stock Units will be scheduled to vest in accordance with the following schedule:

One-third (1/3rd) of the Restricted Stock Units will vest on each yearly anniversary of the Vesting Commencement Date (each, a “Vesting Date”), in each case subject to you continuing in a Service Relationship through the applicable Vesting Date.

In the event you cease to be in a Service Relationship for any or no reason before you vest in the Restricted Stock Units, the Restricted Stock Units and your right to acquire any Stock hereunder will immediately be forfeited and terminated.

You agree and acknowledge that you have reviewed this Agreement in its entirety, have had an opportunity to obtain the advice of counsel, and fully understand all provisions of this Agreement. By accepting this Award, you hereby agree (i) to accept as binding, conclusive, and final all decisions or interpretations of the Administrator upon any questions relating to the Agreement, (ii) to notify the Company upon any change in the residence address indicated above, and (iii) to the extent provided for in Section 6 of Exhibit A, the sale of Stock to cover the Tax-Related Items (and any associated broker or other fees) and agree and acknowledge that you may not satisfy them by any means other than such sale of Stock, unless required to do so by the Administrator or pursuant to the Administrator’s express written consent.

EXHIBIT A

TERMS AND CONDITIONS OF RESTRICTED STOCK UNIT AWARD

1.Definitions. As used herein, the following definitions will apply:

“Act” means the Securities Act of 1933, as amended, and the rules and regulations thereunder.

“Administrator” means either the Board or the compensation committee of the Board or a similar committee performing the functions of the compensation committee and which is comprised of not less than two Non-Employee Directors who are independent.

“Affiliate” means, at the time of determination, any “parent” or “subsidiary” of the Company as such terms are defined in Rule 405 of the Act. The Administrator will have the authority to determine the time or times at which “parent” or “subsidiary” status is determined within the foregoing definition.

“Award” means this award of Restricted Stock Units.

“Board” means the Board of Directors of the Company.

“Code” means the Internal Revenue Code of 1986, as amended, and any successor Code, and related rules, regulations and interpretations. Reference to a specific section of the Code or regulation thereunder will include such section or regulation, any valid regulation promulgated under such section, and any comparable provision of any future legislation or regulation amending, supplementing or superseding such section or regulation.

“Company” means Faro Technologies, Inc., a Florida corporation, or any successor thereto.

“Consultant” means a consultant or adviser who provides bona fide services to the Company or an Affiliate as an independent contractor and who qualifies as a consultant or advisor under Instruction A.1.(a)(1) of Form S-8 under the Act.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder.

“Fair Market Value” of the Stock on any given date means the fair market value of the Stock determined in good faith by the Administrator; provided, however, that if the Stock is listed on the National Association of Securities Dealers Automated Quotation System (“NASDAQ”), NASDAQ Global Market, The New York Stock Exchange or another national securities exchange or traded on any established market, the determination will be made by reference to market quotations. If there are no market quotations for such date, the determination will be made by reference to the last date preceding such date for which there are market quotations.

“Non-Employee Director” means a member of the Board who is not also an employee of the Company or any Subsidiary.

“Sale Event” will mean (i) the sale of all or substantially all of the assets of the Company on a consolidated basis to an unrelated person or entity, (ii) a merger, reorganization or consolidation pursuant to which the holders of the Company’s outstanding voting power and outstanding stock immediately prior to such transaction do not own a majority of the outstanding voting power and outstanding stock or other equity interests of the resulting or successor entity (or its ultimate parent, if applicable) immediately upon completion of such transaction, (iii) the sale of all of the Stock of the Company to an unrelated person, entity or group thereof acting in concert, (iv) any other transaction in which the owners of the Company’s outstanding voting power immediately prior to such transaction do not own at least a majority of the outstanding voting power of the Company or