CNinsure Inc., (Nasdaq:CISG), (the "Company" or "CNinsure"), a

leading independent insurance intermediary company operating in

China, today announced its unaudited financial results for the

second quarter and first half ended June 30, 20131.

Financial Highlights for

Second Quarter

of 2013

- Total net revenues: RMB421.3 million (US$68.6

million), representing an increase of 2.8% from the corresponding

period in 2012.

- Operating income: RMB0.2

million (US$31,882) representing a decrease of 98.9% from the

corresponding period in 2012.

- Non-GAAP

operating

income: RMB10.4 million (US$1.7

million), which excludes share-based compensation expenses,

representing a decrease of 80.9% from the corresponding period in

2012.

- Net income attributable to the Company's

shareholders: RMB20.9 million (US$3.4 million),

representing a decrease of 36.3% from the corresponding period in

2012.

- Non-GAAP net income attributable to the Company's

shareholders: RMB31.1 million (US$5.1 million), which

excludes share-based compensation expenses, representing a decrease

of 55.2% from the corresponding period in 2012.

- Basic and diluted net income per ADS: RMB0.42

(US$0.07) and RMB0.42 (US$0.07), respectively, representing

decreases of 36.0% and 36.2%, respectively, from the corresponding

period in 2012.

- Non-GAAP basic and

diluted net income per ADS: RMB0.62 (US$0.10) and RMB0.62

(US$0.10), respectively, representing decreases of 55.1% and 55.2%,

respectively, from the corresponding period in 2012.

Financial Highlights for First Half of

2013

- Total net revenues: RMB822.6 million (US$134.0

million), representing an increase of 10.1% from the corresponding

period in 2012.

- Operating income: RMB1.8

million (US$0.3 million) representing a decrease of 96.8% from the

corresponding period in 2012.

- Non-GAAP

operating

income: RMB24.8 million (US$4.0

million), which excludes share-based compensation expenses,

representing a decrease of 74.5% from the corresponding period in

2012.

- Net income attributable to the Company's

shareholders: RMB42.0 million (US$6.8 million),

representing a decrease of 52.0% from the corresponding period in

2012.

- Non-GAAP net income attributable to the Company's

shareholders: RMB64.9 million (US$10.6 million), which

excludes share-based compensation expenses, representing a decrease

of 49.4% from the corresponding period in 2012.

- Basic and diluted net income per ADS: RMB0.84

(US$0.14) and RMB0.84 (US$0.14), respectively, representing

decreases of 52.1% and 51.8%, respectively, from the corresponding

period in 2012.

- Non-GAAP basic and

diluted net income per ADS: RMB1.30 (US$0.21) and RMB1.30

(US$0.21), respectively, representing decreases of 49.2% and 49.0%,

respectively, from the corresponding period in 2012.

Commenting on the second quarter financial results, Mr. Chunlin

Wang, CNinsure's chief executive officer, stated, "Amid the

industry trend towards the protection business, we adjusted our

life insurance product strategy during the second quarter of 2013

by shifting our sales focus from participating policies to

traditional protection policies which generally generates lower per

policy premiums but have a higher imbedded value. This shift was

one of the major reasons for the drastic decline of our first year

life insurance premiums and the lower-than-expected growth of our

total net revenues, although the number of new life insurance

policies during the period remained flat year-over-year. Despite

the negative impact on life insurance business volume in the

near-term, we believe this move is conducive to enhancing the

long-term sustainability of our life insurance business and

prepares us well for capitalizing on the growth opportunities

arising from the deregulation of prices for traditional life

insurance products.

"While margins remained under pressure during the second quarter

of 2013, largely as a result of rising labor costs and increased

competition in the property and casualty (the "P&C") insurance

market, we were excited to see the progress in the promotion and

use of CNpad, which aims to enhance efficiency and reduce operating

expenses for sales agents and the Company. During the second

quarter of 2013, CNpad sparked growing enthusiasm with our sales

agents, sales channel partners and underwriters looking for more

cost-effective ways to conduct business. Pilot operations or

internal testing of CNpad has been extended to a total of five

provinces, and auto insurance products from 12 P&C insurance

companies are now available through the system. The aggregate

number of CNpad units sold exceeded 480 as of June 30, 2013, and

those units contributed over RMB30 million in premiums during the

second quarter of 2013.

The roll out of our comprehensive financial services strategy is

also progressing well. We sold RMB240 million worth of wealth

management products during the quarter, and the total number of

customers who purchased wealth management products through us

increased by 460 from the previous quarter."

Mr. Wang concluded, "While there remains a lot of work to do, we

are optimistic that CNpad and comprehensive financial services

strategy will create value for our sales agents and clients, and

position us well for long-term sustainable growth."

Financial Results for the Second

Quarter of

2013

Total net revenues were RMB421.3 million

(US$68.6 million) for the second quarter of 2013, representing an

increase of 2.8% from RMB409.9 million for the corresponding period

in 2012, primarily due to increases in net revenues from our

P&C insurance and claims adjusting business segments. The

increase in the P&C business segment was mainly driven by

slight increases in commission rates received from insurance

underwriters, while the growth of the claims adjusting segment was

mainly attributable to growth in the auto insurance-related claims

adjusting business. Net revenues from commissions and fees derived

from the P&C insurance, life insurance and claims adjusting

businesses for the second quarter of 2013 contributed 71.4%, 14.2%,

and 14.4% of the Company's total net revenues, respectively,

compared to 66.1%, 21.0% and 12.9%, respectively, for the

corresponding period in 2012.

Total operating costs and expenses were

RMB421.1 million (US$68.6 million) for the second quarter of 2013,

representing an increase of 7.4% from RMB392.1 million for the

corresponding period in 2012.

Commissions and fees expenses were RMB313.0

million (US$51.0 million) for the second quarter of 2013,

representing an increase of 17.6% from RMB266.3 million for the

corresponding period in 2012. The increase was primarily due to

further increases in commissions paid to our P&C sales agents

driven by (1) increased competition in the auto insurance market,

and (2) nationwide rising labor costs.

Selling expenses were RMB24.4 million (US$4.0

million) for the second quarter of 2013, representing an increase

of 16.1% from RMB21.0 million for the corresponding period in 2012,

primarily due to increases in travel, gasoline and office expenses

mostly incurred by the claims adjusting business segment.

General and administrative expenses were

RMB83.7 million (US$13.6 million) for the second quarter of 2013,

representing a decrease of 20.2% from RMB104.8 million for the

corresponding period in 2012. The decrease was primarily due to the

net effect of the following factors:

(1) a decrease of 72.2% in share-based compensation expenses,

from RMB36.7 million for the second quarter of 2012 to RMB10.2

million (US$1.7 million) for the second quarter of 2013.

Share-based compensation expenses for the second quarter of 2013

were mainly associated with stock options granted to certain

employees in March 2012, which were recognized on an accelerated

basis and such expenses are expected to decrease each year after

the grant; offset by

(2) an increase of 39.2% in depreciation expense from RMB4.4

million for the second quarter of 2012 to RMB6.1 million (US$1.0

million) for the second quarter of 2013 due to the purchase of more

fixed assets for our e-commerce operations during 2012.

As a result of the foregoing factors, operating

income was RMB0.2 million (US$31,882) for the second

quarter of 2013, representing a decrease of 98.9% from RMB17.8

million for the corresponding period in 2012.

Non-GAAP operating income, which excludes

share-based compensation expenses was RMB10.4 million (US$1.7

million) for the second quarter of 2013, representing a decrease of

80.9% from RMB54.5 million for the corresponding period in

2012.

Operating margin was 0.05% for the second

quarter of 2013, compared with 4.4% for the corresponding period in

2012. Non-GAAP operating margin was 2.4% for the second quarter of

2013, compared with 13.4% for the corresponding period in 2012.

Interest income was RMB20.3 million (US$3.3

million) for the second quarter of 2013, representing a decrease of

9.5% from RMB22.5 million for the corresponding period in 2012. The

decrease in interest income was primarily due to (1) a decrease in

the bank deposits as we increased short-term investments and (2) a

decrease in interest rates from the corresponding period in

2012.

Income tax expense was RMB5.8 million (US$0.9

million) for the second quarter of 2013, representing a decrease of

59.7% from RMB14.4 million for the corresponding period in 2012 due

to the decrease in operating income. The effective tax rate for the

second quarter of 2013 was 24.8% compared with 33.8% for the

corresponding period in 2012. The decrease in effective tax rate

was mainly due to the decrease in share-based compensation expenses

which are non tax-deductible.

Net income attributable to the Company's

shareholders was RMB20.9 million (US$3.4 million) for the

second quarter of 2013, representing a decrease of 36.3% from

RMB32.8 million for the corresponding period in 2012.

Non-GAAP net income attributable to the Company's

shareholders, which excludes share-based compensation

expenses was RMB31.1 million (US$5.1 million) for the second

quarter of 2013, representing a decrease of 55.2% from RMB69.5

million for the corresponding period in 2012.

Net margin was 5.0% for the second quarter of

2013 compared with 8.0% for the corresponding period in 2012.

Non-GAAP net margin was 7.4% for the second

quarter of 2013 compared with 17.0% for the corresponding period in

2012.

Basic and diluted net

income per ADS were RMB0.42 (US$0.07) and RMB0.42

(US$0.07) for the second quarter of 2013, respectively,

representing decreases of 36.0% and 36.2% from RMB0.66 and RMB0.65

for the corresponding period in 2012, respectively.

Non-GAAP basic and diluted

net income per ADS were RMB0.62 (US$0.10) and

RMB0.62 (US$0.10) for the second quarter of 2013, respectively,

representing decreases of 55.1% and 55.2% from RMB1.39 and RMB1.38

for the corresponding period in 2012, respectively.

Financial Results for the First

Half of 2013

Total net revenues were RMB822.6 million

(US$134.0 million) for the first half of 2013, representing an

increase of 10.1% from RMB747.3 million for the corresponding

period in 2012, primarily due to increases in net revenues from our

P&C insurance and claims adjusting business segments. The

increase in the P&C business segment was mainly driven by

slight increases in commission rates received from insurance

underwriters and sales volume growth. The growth of the claims

adjusting segment was mainly attributable to growth in the auto

insurance-related claims adjusting business. Net revenues from

commissions and fees derived from the P&C insurance, life

insurance and claims adjusting businesses for the first half of

2013 contributed 71.0%, 15.3%, and 13.7% of the Company's total net

revenues, respectively, compared to 66.8%, 20.3% and 12.9%,

respectively, for the corresponding period in 2012.

Total operating costs and expenses were

RMB820.7 million (US$133.7 million) for the first half of 2013,

representing an increase of 18.8% from RMB690.8 million for the

corresponding period in 2012.

Commissions and fees expenses were RMB610.2

million (US$99.4 million) for the first half of 2013, representing

an increase of 27.2% from RMB479.7 million for the corresponding

period in 2012. The increase was primarily due to further increases

in commissions paid to our P&C sales agents driven by (1)

increased competition in the auto insurance market, and (2)

nationwide rising labor costs.

Selling expenses were RMB44.5 million (US$7.2

million) for the first half of 2013, representing an increase of

12.1% from RMB39.7 million for the corresponding period in 2012,

primarily due to growth in sales volume.

General and administrative expenses were

RMB166.1 million (US$27.1 million) for the first half of 2013,

representing a decrease of 3.1% from RMB171.4 million for the

corresponding period in 2012. The decrease was primarily due to the

net effect of the following factors:

(1) a decrease of 43.7% in share-based compensation expenses,

from RMB40.8 million for the first half of 2012 to RMB23.0 million

(US$3.7 million) for the first half of 2013. Share-based

compensation expenses for the first half of 2013 were mainly

associated with the grant of stock options in March, 2012 which

were recognized on an accelerated basis and such expenses are

expected to decrease each year after the grant; offset by

(2) an increase of 6.1% in payroll and social insurance expenses

from RMB63.3 million for the first half of 2012 to RMB67.1 million

(US$10.9 million) for the first half of 2013 primarily due to pay

raises for our administrative staff; and

(3) an increase of 40.4% in depreciation expenses, from RMB8.8

million for the first half of 2012 to RMB12.3 million (US$2.0

million) for the first half of 2013, due to the purchase of more

fixed assets for our e-commerce operations during 2012.

As a result of the foregoing factors, operating

income was RMB1.8 million (US$0.3 million) for the first

half of 2013, representing a decrease of 96.8% from RMB56.5 million

for the corresponding period in 2012.

Non-GAAP operating income, which excludes

share-based compensation expenses was RMB24.8 million (US$4.0

million) for the first half of 2013, representing a decrease of

74.5% from RMB97.3 million for the corresponding period in

2012.

Operating margin was 0.2% for the first half of

2013, compared with 7.6% for the corresponding period in 2012.

Non-GAAP operating margin was 3.0% for the first half of 2013,

compared with13.1% for the corresponding period in 2012.

Interest income was RMB41.9 million (US$6.8

million) for the first half of 2013, representing a decrease of

6.8% from RMB44.9 million for the corresponding period in 2012. The

slight decrease in interest income was primarily due to (1) a

decrease in the bank interest rate from the corresponding period in

2012 and (2) a decrease in the bank deposits as we increased

short-term investments.

Income tax expense was RMB12.0 million (US$2.0

million) for the first half of 2013, representing a decrease of

57.2% from RMB28.1 million for the corresponding period in 2012 due

to the significant decrease in operating income. The effective tax

rate for the first half of 2013 was 25.8% compared with 26.9% for

the corresponding period in 2012.The decrease in effective tax rate

was mainly due to the decrease in share-based compensation

expenses, which are non tax-deductible.

Net income attributable to the Company's

shareholders was RMB42.0 million (US$6.9 million) for the

first half of 2013, representing a decrease of 52.0% from RMB87.5

million for the corresponding period in 2012.

Non-GAAP net income attributable to the Company's

shareholders, which excludes share-based compensation

expenses, was RMB64.9 million (US$10.6 million) for the first half

of 2013, representing a decrease of 49.4% from RMB128.3 million for

the corresponding period in 2012.

Net margin was 5.1% for the first half of 2013

compared with 11.7% for the corresponding period in 2012.

Non-GAAP net margin was 7.9% for the first half of

2013, compared with 17.2% for the corresponding period in 2012.

Basic and diluted net

income per ADS were RMB0.84 (US$0.14) and RMB0.84

(US$0.14) for the first half of 2013, respectively, representing

decreases of 52.1% and 51.8% from RMB1.75 and RMB1.74 for the

corresponding period in 2012, respectively.

Non-GAAP basic and diluted

net income per ADS were RMB1.30 (US$0.21) and

RMB1.30 (US$0.21) for the first half of 2013, respectively,

representing decreases of 49.2% and 49.0% from RMB2.56 and RMB2.55

for the corresponding period in 2012, respectively.

As of June 30, 2013, the Company had RMB2.3 billion (US$377.3

million) in cash and cash

equivalents.

Business Highlights:

- As of June 30, 2013, CNinsure's distribution and service

network consisted of 479 sales and services outlets operating in 27

provinces, compared with 508 sales and service outlets operating in

23 provinces as of June 30, 2012. CNinsure had 47,554 sales agents

and representatives and 1,344 professional claims adjustors as of

June 30, 2013, compared with 47,162 sales agents and

representatives, and 1,341 professional claims adjustors as of June

30, 2012. The increase in the number of sales agents and

professional claims adjustors was primarily a result of enhanced

recruitment efforts during the second quarter of 2013 while the

decrease in the number of sales outlets was primarily because we

closed sales outlets that were less productive during the second

and third quarters of 2012.

Business Outlook

CNinsure expects its total net revenues to grow by approximately

5% for the third quarter of 2013 compared with the corresponding

period in 2012. This forecast reflects CNinsure's current view,

which is subject to change.

Conference Call

The Company will host a conference call to discuss the second

quarter and first half 2013 results at

Time: 9:00 PM Eastern

Daylight Time on August 20, 2013

or 9:00 AM Beijing/Hong Kong Time on August 21, 2013

The dial-in numbers:

| United States |

1-845-675-0438 |

| United Kingdom |

0800-015-9724 |

| Canada |

1-855-757-1565 |

| Taiwan |

0080-665-1951 |

| Hong Kong |

852-3051-2745 |

| China (Mainland) |

400-120-0654 |

| Singapore & Other

Areas |

+65-6723-9385 |

A replay of the call will be available for three days by dialing

the following number: + 61 2 8199 0299

Conference ID #: 27587592

Additionally, a live and archived web cast of this call will be

available at: http://ir.cninsure.net/events.cfm

About CNinsure Inc.

CNinsure is a leading independent intermediary company operating

in China. CNinsure's distribution network reaches many of China's

most economically developed regions and affluent cities. The

Company distributes a wide variety of property and casualty and

life insurance products underwritten by domestic and foreign

insurance companies operating in China, and provides insurance

claims adjusting as well as other insurance-related services.

Forward-looking Statements

This press release contains statements of a forward-looking

nature. These statements, including the statements relating to the

Company's future financial and operating results, are made under

the "safe harbor" provisions of the U.S. Private Securities

Litigation Reform Act of 1995. You can identify these forward-

looking statements by terminology such as "will," "expects,"

"believes," "anticipates," "intends," "estimates" and similar

statements. Among other things, the management's quotations and the

Business Outlook section contain forward-looking statements. These

forward-looking statements involve known and unknown risks and

uncertainties and are based on current expectations, assumptions,

estimates and projections about CNinsure and the industry.

Potential risks and uncertainties include, but are not limited to,

those relating to CNinsure's limited operating history, especially

its limited experience in selling life insurance products, its

ability to attract and retain productive agents, especially

entrepreneurial agents, its ability to maintain existing and

develop new business relationships with insurance companies, its

ability to execute its growth strategy, its ability to adapt to the

evolving regulatory environment in the Chinese insurance industry,

its ability to compete effectively against its competitors,

quarterly variations in its operating results caused by factors

beyond its control and macroeconomic conditions in China and their

potential impact on the sales of insurance products. All

information provided in this press release is as of August 20,

2013, and CNinsure undertakes no obligation to update any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although CNinsure believes that the expectations

expressed in these forward-looking statements are reasonable, it

cannot assure you that its expectations will turn out to be

correct, and investors are cautioned that actual results may differ

materially from the anticipated results. Further information

regarding risks and uncertainties faced by CNinsure is included in

CNinsure's filings with the U.S. Securities and Exchange

Commission, including its annual report on Form 20-F.

About Non-GAAP Financial Measures

In addition to the Company's consolidated financial results

under GAAP, the Company also provides non-GAAP financial measures,

which are adjusted to exclude share-based compensation expenses.

The Company believes that both management and investors benefit

from referring to these non-GAAP financial measures in assessing

the Company's performance and when planning and forecasting future

periods. One limitation of using these non-GAAP financial measures

is that these non-GAAP measures exclude the item that was

significant in the second quarter of 2013 and the corresponding

period of 2012. Another is that items such as share-based

compensation expenses have been, and will continue to be, a

significant recurring factor in our business.

In light of the limitations, the presentation of these non-GAAP

financial measures is not intended to be considered in isolation or

as a substitute for the financial information prepared and

presented in accordance with GAAP. We encourage investors and other

interested persons to review our financial information in its

entirety and not rely on a single financial measure. For more

information on these non-GAAP financial measures, please see the

tables captioned "Reconciliations of GAAP Financial Measures to

Non-GAAP Financial Measures" set forth at the end of this

release.

1 This announcement contains translations of certain

Renminbi (RMB) amounts into U.S. dollars (US$) at specified rates

solely for the convenience of the reader. Unless otherwise noted,

all translations from RMB to U.S. dollars are made at a rate of

RMB6.1374 to US$1.00, the effective noon buying rate as of June 28,

2013 in The City of New York for cable transfers of RMB as set

forth in H.10 weekly statistical release of the Federal Reserve

Board.

| CNINSURE

INC. |

| Unaudited Condensed

Consolidated Balance Sheets |

| (In

thousands) |

| |

|

|

|

| |

As of Dec. 31,

2012 |

As of June 30,

2013 |

As of June 30,

2013 |

| |

RMB |

RMB |

US$ |

| ASSETS: |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

2,525,618 |

2,315,545 |

377,284 |

| Restricted cash |

10,871 |

12,050 |

1,963 |

| Short term investments |

600 |

233,900 |

38,111 |

| Accounts receivable, net |

196,244 |

218,844 |

35,658 |

| Insurance premium receivables |

10 |

749 |

122 |

| Other receivables |

86,565 |

62,272 |

10,146 |

| Deferred tax assets |

4,942 |

4,996 |

814 |

| Amounts due from related parties |

151,785 |

136,644 |

22,264 |

| Other current assets |

17,265 |

20,242 |

3,298 |

| Total current assets |

2,993,900 |

3,005,242 |

489,660 |

| |

|

|

|

| Non-current assets: |

|

|

|

| Property, plant, and equipment,

net |

94,921 |

81,732 |

13,317 |

| Goodwill and intangible assets,

net |

121,333 |

114,500 |

18,656 |

| Deferred tax assets |

3,967 |

6,349 |

1,034 |

| Investment in affiliates |

168,620 |

179,264 |

29,209 |

| Other non-current assets |

18,048 |

16,648 |

2,713 |

| Total non-current

assets |

406,889 |

398,493 |

64,929 |

| Total assets |

3,400,789 |

3,403,735 |

554,589 |

| |

|

|

|

| LIABILITIES AND EQUITY: |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable (including accounts payable

of the consolidated variable interest entities ("VIEs") without

recourse to CNinsure Inc. of RMB30,689 and RMB24,384

(US$3,973) as of December 31, 2012 and June 30, 2013,

respectively) |

98,124 |

81,078 |

13,210 |

| Insurance premium payables (including

insurance premium payables of the consolidated VIEs without

recourse to CNinsure Inc. of RMB202 and RMB502 (US$82) as of

December 31, 2012 and June 30, 2013, respectively) |

2,941 |

4,160 |

678 |

| Other payables and accrued expenses

(including other payables and accrued expense of the consolidated

VIEs without recourse to CNinsure Inc. of RMB35,000 and RMB20,850

(US$3,397) as of December 31, 2012 and June 30, 2013,

respectively) |

116,124 |

75,275 |

12,265 |

| Accrued payroll (including accrued payroll of

the consolidated VIEs without recourse to CNinsure Inc. of RMB4,382

and RMB3,758 (US$612) as of December 31, 2012 and June 30, 2013,

respectively) |

42,317 |

35,508 |

5,785 |

| Income tax payable (including income tax

payable of the consolidated of VIEs without recourse to CNinsure

Inc. of RMB2,037 and RMB2,042 (US$333) as of December 31, 2012 and

June 30, 2013, respectively) |

56,003 |

54,449 |

8,872 |

| Amounts due to related parties (including

amounts due to related parties of the consolidated of VIEs without

recourse to CNinsure Inc. of RMB3,030 and RMB3,030 (US$494) as of

December 31, 2012 and June 30, 2013, respectively) |

3,030 |

3,030 |

494 |

| Total current

liabilities |

318,539 |

253,500 |

41,304 |

| |

|

|

|

| Non-current

liabilities: |

|

|

|

| Other tax liabilities |

47,589 |

50,060 |

8,157 |

| Deferred tax liabilities |

26,754 |

25,281 |

4,119 |

| Total non-current

liabilities |

74,343 |

75,341 |

12,276 |

| Total liabilities |

392,882 |

328,841 |

53,580 |

| |

|

|

|

| Ordinary shares |

7,624 |

7,624 |

1,242 |

| Additional paid-in capital |

2,284,906 |

2,307,888 |

376,037 |

| Statutory reserves |

178,440 |

178,440 |

29,074 |

| Retained earnings |

527,542 |

569,495 |

92,791 |

| Accumulated other comprehensive

loss |

(104,132) |

(107,819) |

(17,568) |

| Total CNinsure Inc. shareholders'

equity |

2,894,380 |

2,955,628 |

481,576 |

| Noncontrolling interests |

113,527 |

119,266 |

19,433 |

| Total equity |

3,007,907 |

3,074,894 |

501,009 |

| Total liabilities and

equity |

3,400,789 |

3,403,735 |

554,589 |

| |

| |

| CNINSURE

INC. |

| Unaudited Condensed

Consolidated Statements of Income and Comprehensive

Income |

| (In thousands, except

for shares and per share data) |

| |

| |

For The Three

Months Ended June 30, |

For The Six

Months Ended June 30, |

| |

2012 |

2013 |

2013 |

2012 |

2013 |

2013 |

| |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

| Net revenues: |

|

|

|

|

|

|

| Commissions and fees |

409,827 |

421,282 |

68,642 |

747,108 |

822,537 |

134,020 |

| Other service fees |

104 |

7 |

1 |

165 |

14 |

2 |

| Total net revenues |

409,931 |

421,289 |

68,643 |

747,273 |

822,551 |

134,022 |

| Operating costs and

expenses: |

|

|

|

|

|

|

| Commissions and fees |

(266,256) |

(313,044) |

(51,006) |

(479,734) |

(610,213) |

(99,425) |

| Selling expenses |

(20,995) |

(24,364) |

(3,970) |

(39,675) |

(44,467) |

(7,245) |

| General and administrative expenses |

(104,841) |

(83,686) |

(13,635) |

(171,363) |

(166,067) |

(27,058) |

| Total operating costs and

expenses |

(392,092) |

(421,094) |

(68,611) |

(690,772) |

(820,747) |

(133,728) |

| Income from operations |

17,839 |

195 |

32 |

56,501 |

1,804 |

294 |

| Other income, net: |

|

|

|

|

|

|

| Investment income |

— |

1,320 |

215 |

— |

1,320 |

215 |

| Interest income |

22,467 |

20,323 |

3,311 |

44,922 |

41,868 |

6,822 |

| Others, net |

2,234 |

1,533 |

250 |

3,131 |

1,642 |

268 |

| Income before income taxes and income

of affiliates |

42,540 |

23,371 |

3,808 |

104,554 |

46,634 |

7,599 |

| Income tax expense |

(14,392) |

(5,802) |

(945) |

(28,097) |

(12,035) |

(1,961) |

| Share of income of affiliates |

4,894 |

5,310 |

865 |

9,419 |

10,644 |

1,734 |

| |

|

|

|

|

|

|

| Net income |

33,042 |

22,879 |

3,728 |

85,876 |

45,243 |

7,372 |

| Less: net gain (loss) attributable to

noncontrolling interests |

199 |

1,953 |

318 |

(1,578) |

3,289 |

536 |

| Net income attributable to the

Company's shareholders |

32,843 |

20,926 |

3,410 |

87,454 |

41,954 |

6,836 |

| |

|

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

| Basic |

0.03 |

0.02 |

— |

0.09 |

0.04 |

0.01 |

| Diluted |

0.03 |

0.02 |

— |

0.09 |

0.04 |

0.01 |

| |

|

|

|

|

|

|

| Net income per ADS: |

|

|

|

|

|

|

| Basic |

0.66 |

0.42 |

0.07 |

1.75 |

0.84 |

0.14 |

| Diluted |

0.65 |

0.42 |

0.07 |

1.74 |

0.84 |

0.14 |

| |

|

|

|

|

|

|

| Shares used in calculating net income

per share: |

|

|

|

|

|

|

| Basic |

1,002,564,246 |

998,861,526 |

998,861,526 |

1,002,557,732 |

998,861,526 |

998,861,526 |

| Diluted |

1,004,316,034 |

1,002,321,530 |

1,002,321,530 |

1,006,123,724 |

1,002,278,510 |

1,002,278,510 |

| |

|

|

|

|

|

|

| Net income |

33,042 |

22,879 |

3,728 |

85,876 |

45,243 |

7,372 |

| Other comprehensive income (loss), net of

tax: Foreign currency translation adjustments |

1,874 |

(2,931) |

(478) |

2,093 |

(3,686) |

(601) |

| Comprehensive

income |

34,916 |

19,948 |

3,250 |

87,969 |

41,557 |

6,771 |

| Less: Comprehensive income (loss)

attributable to the noncontrolling interests |

199 |

1,953 |

318 |

(1,578) |

3,289 |

536 |

| Comprehensive income attributable to

the CNinsure Inc's shareholders |

34,717 |

17,995 |

2,932 |

89,547 |

38,268 |

6,235 |

| |

| |

| CNINSURE

INC. |

| Unaudited Condensed

Consolidated Statements of Cash Flow |

| (In

thousands) |

| |

|

|

|

|

|

|

| |

For The Three

Months Ended June 30, |

For The Six

Months Ended June 30, |

| |

2012 |

2013 |

2013 |

2012 |

2013 |

2013 |

| |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

| OPERATING ACTIVITIES |

|

|

|

|

|

|

| Net income |

33,042 |

22,879 |

3,728 |

85,876 |

45,243 |

7,372 |

| Adjustments to reconcile net income

to net cash generated from operating activities: |

|

|

|

|

|

|

| Depreciation |

6,587 |

8,073 |

1,315 |

13,337 |

16,009 |

2,608 |

| Amortization of intangible assets |

3,806 |

3,416 |

557 |

7,834 |

6,832 |

1,113 |

| Allowance for doubtful receivables |

1,497 |

447 |

73 |

2,513 |

1,196 |

195 |

| Compensation expenses associated with stock

option |

36,702 |

10,202 |

1,662 |

40,799 |

22,982 |

3,745 |

| Gain on disposal of property, plant and

equipment |

(36) |

(16) |

(3) |

(36) |

(16) |

(3) |

| Share of income of affiliates |

(4,894) |

(5,310) |

(865) |

(9,419) |

(10,644) |

(1,734) |

| Changes in operating assets and

liabilities |

(4,868) |

11,900 |

1,939 |

(66,940) |

(38,411) |

(6,258) |

| Net cash generated from operating

activities |

71,836 |

51,591 |

8,406 |

73,964 |

43,191 |

7,038 |

| |

|

|

|

|

|

|

| Cash flows used in investing

activities: |

|

|

|

|

|

|

| Purchase of property, plant and

equipment |

(4,472) |

(27,221) |

(4,435) |

(6,195) |

(32,719) |

(5,331) |

| Proceeds from disposal of property and

equipment |

390 |

16 |

3 |

577 |

30 |

5 |

| Proceeds from disposal of short term

investments |

57,450 |

600 |

97 |

71,080 |

600 |

97 |

| Purchase of short term investments |

(40,600) |

(138,900) |

(22,632) |

(40,600) |

(233,900) |

(38,111) |

| Disposal of subsidiaries, net of

cash |

(80) |

— |

— |

(33) |

— |

— |

| Increase in restricted cash |

(2,577) |

(1,013) |

(165) |

(1,923) |

(1,179) |

(192) |

| Increase in other receivables |

(3,400) |

— |

— |

(3,400) |

— |

— |

| Addition in investment in non-current

assets |

— |

— |

— |

(1,948) |

— |

— |

| Return of investment in non-current

assets |

300 |

— |

— |

1,300 |

— |

— |

| Refund of contingent consideration |

— |

4,500 |

733 |

12,500 |

4,500 |

733 |

| Decrease (increase) in amounts due from

related parties |

70,677 |

(29,431) |

(4,795) |

163,368 |

10,640 |

1,734 |

| Net cash generated from (used in)

investing activities |

77,688 |

(191,449) |

(31,194) |

194,726 |

(252,028) |

(41,065) |

| |

|

|

|

|

|

|

| Cash flows (used in ) generated from

financing activities: |

|

|

|

|

|

|

| Acquisition of additional interest in

subsidiaries |

(20,455) |

— |

— |

(20,455) |

— |

— |

| Capital injection by noncontrolling

interests |

4,830 |

— |

— |

11,360 |

2,450 |

399 |

| Proceeds on exercise of stock options

res |

— |

— |

— |

48 |

— |

— |

| Net cash (used in) generated from

financing activities |

(15,625) |

— |

— |

(9,047) |

2,450 |

399 |

| |

|

|

|

|

|

|

| Net increase (decrease) in cash and

cash equivalents |

133,899 |

(139,858) |

(22,788) |

259,643 |

(206,387) |

(33,628) |

| Cash and cash equivalents at

beginning of period |

2,348,123 |

2,458,334 |

400,550 |

2,222,160 |

2,525,618 |

411,513 |

| Effect of exchange rate changes on cash and

cash equivalents |

1,874 |

(2,931) |

(478) |

2,093 |

(3,686) |

(601) |

| Cash and cash equivalents at end of

period |

2,483,896 |

2,315,545 |

377,284 |

2,483,896 |

2,315,545 |

377,284 |

| |

|

|

|

|

|

|

| Interest paid |

— |

— |

— |

— |

— |

— |

| Income taxes paid |

15,603 |

5,275 |

859 |

44,885 |

14,772 |

2,407 |

| |

| |

| CNINSURE

INC. |

| Reconciliations of GAAP

Financial Measures to Non-GAAP Financial Measures |

| (In RMB in thousands,

except shares and per share data) |

| |

|

|

|

| |

For The Three

Months Ended June 30, 2012 |

| |

GAAP |

<1> |

Non-GAAP |

| Operating income |

17,839 |

36,702 |

54,541 |

| Operating margin |

4.4% |

9.0% |

13.4% |

| |

|

|

|

| Net income attributable to the Company's

shareholders |

32,843 |

36,702 |

69,545 |

| Net margin |

8.0% |

9.0% |

17.0% |

| |

|

|

|

| Shares used in calculating basic net income

per share |

1,002,564,246 |

— |

1,002,564,246 |

| |

|

|

|

| Basic net income per ADS |

0.66 |

0.73 |

1.39 |

| Shares used in calculating diluted net income

per share |

1,004,316,034 |

— |

1,004,316,034 |

| |

|

|

|

| Diluted net income per ADS |

0.65 |

0.73 |

1.38 |

| |

|

|

|

| |

For The Three

Months Ended June 30, 2013 |

| |

GAAP |

<1> |

Non-GAAP |

| Operating income |

195 |

10,202 |

10,397 |

| Operating margin |

0.0% |

2.4% |

2.4% |

| |

|

|

|

| Net income attributable to the Company's

shareholders |

20,926 |

10,202 |

31,128 |

| Net margin |

5.0% |

2.4% |

7.4% |

| |

|

|

|

| Shares used in calculating basic net income

per share |

998,861,526 |

— |

998,861,526 |

| |

|

|

|

| Basic net income per ADS |

0.42 |

0.20 |

0.62 |

| Shares used in calculating diluted net income

per share |

1,002,321,530 |

— |

1,002,321,530 |

| |

|

|

|

| Diluted net income per ADS |

0.42 |

0.20 |

0.62 |

| |

|

|

|

| <1> share-based

compensation expenses. |

| |

|

|

|

| |

|

|

|

| |

For The Six

Months Ended June 30, 2012 |

| |

GAAP |

<1> |

Non-GAAP |

| Operating income |

56,501 |

40,799 |

97,300 |

| Operating margin |

7.6% |

5.5% |

13.1% |

| |

|

|

|

| Net income attributable to the Company's

shareholders |

87,454 |

40,799 |

128,253 |

| Net margin |

11.7% |

5.5% |

17.2% |

| |

|

|

|

| Shares used in calculating basic net income

per share |

1,002,557,732 |

— |

1,002,557,732 |

| |

|

|

|

| Basic net income per ADS |

1.75 |

0.81 |

2.56 |

| Shares used in calculating diluted net income

per share |

1,006,123,724 |

— |

1,006,123,724 |

| |

|

|

|

| Diluted net income per ADS |

1.74 |

0.81 |

2.55 |

| |

|

|

|

| |

For The Six

Months Ended June 30, 2013 |

| |

GAAP |

<1> |

Non-GAAP |

| Operating income |

1,804 |

22,982 |

24,786 |

| Operating margin |

0.2% |

2.8% |

3.0% |

| |

|

|

|

| Net income attributable to the Company's

shareholders |

41,954 |

22,982 |

64,936 |

| Net margin |

5.1% |

2.8% |

7.9% |

| |

|

|

|

| Shares used in calculating basic net income

per share |

998,861,526 |

— |

998,861,526 |

| |

|

|

|

| Basic net income per ADS |

0.84 |

0.46 |

1.30 |

| Shares used in calculating diluted net income

per share |

1,002,278,510 |

— |

1,002,278,510 |

| |

|

|

|

| Diluted net income per ADS |

0.84 |

0.46 |

1.30 |

| |

|

|

|

| <1> share-based

compensation expenses. |

CONTACT: Oasis Qiu

Investor Relations Manager

Tel: +86 (20) 6122-2731

Email: qiusr@cninsure.net

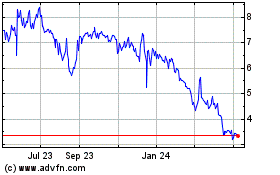

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Oct 2024 to Nov 2024

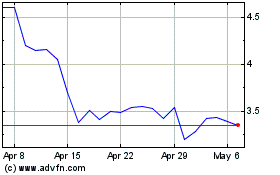

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Nov 2023 to Nov 2024