false

0001682639

0001682639

2024-11-22

2024-11-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): November 22, 2024

EYENOVIA, INC.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

001-38365 |

|

47-1178401 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

295 Madison Avenue, Suite 2400, New York, NY

10017

(Address of Principal Executive Offices, and

Zip Code)

(833) 393-6684

Registrant’s Telephone Number, Including

Area Code

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

| (Title of each class) |

|

(Trading

Symbol) |

|

(Name of each exchange

on which registered) |

| Common stock, par value $0.0001 per share |

|

EYEN |

|

The Nasdaq Stock Market

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. | Entry Into a Material Definitive Agreement. |

First Amendment to Loan and Security Agreement

On November 22, 2024, Eyenovia, Inc. (the “Company”)

entered into the First Amendment (the “First Amendment”) to the Supplement (the “Supplement”) to that certain

Loan and Security Agreement, dated November 22, 2022 (the “Loan and Security Agreement”) with Avenue Capital Management II,

L.P., as administrative agent and collateral agent, Avenue Venture Opportunities Fund, L.P., as a lender (“Avenue 1”) and

Avenue Venture Opportunities Fund II, L.P., as a lender (together with Avenue 1, the “Lenders”).

As previously disclosed, the Loan and Security

Agreement, as supplemented by the Supplement, provides for term loans in an aggregate principal amount of up to $15.0 million to be delivered

in multiple tranches. As of November 19, 2024, the Company owed $10.1 million in principal and accrued interest under the facility. Amounts

outstanding under the facility bear interest at an annual rate equal to the greater of (a) 7.0% and (b) the prime rate as reported in

The Wall Street Journal plus 4.45% (the “Interest Rate”). The maturity date is November 1, 2025.

Pursuant to the First Amendment, the Lenders agreed

to defer principal and interest payments on amounts outstanding until the end of February 2025. Deferred interest will accrue on the outstanding

principal amount at the Interest Rate.

The foregoing descriptions of the Loan and Security

Agreement and the Supplement do not purport to be complete and are qualified in their entirety by reference to the full text of the Loan

and Security Agreement and the Supplement, copies of which were filed as Exhibits 10.30 and 10.31, respectively, to the Annual Report

on Form 10-K filed by the Company on March 31, 2023. The foregoing description of the First Amendment does not purport to be complete

and is qualified in its entirety by reference to the full text of the First Amendment, a copy of which is filed as Exhibit 10.1 to this

Current Report on Form 8-K and incorporated herein by reference.

Subscription Agreement

In connection with the First Amendment, the

Company and the Lenders entered into a Subscription Agreement, dated November 22, 2024 (the “Subscription Agreement”),

under which the Company agreed to issue to the Lenders an aggregate of 1,901,733 shares (the “Shares”) of common stock,

par value $0.0001 per share, of the Company, at a price per share of approximately $0.1052, which was based on the five trading-day

VWAP preceding entry into the Subscription Agreement. The issuance of the Shares will be exempt from registration under the Securities Act

of 1933, as amended, and is expected to occur on or around November 25, 2024.

The foregoing description of the Subscription

Agreement does not purport to be complete and is qualified in its entirety by reference to the Subscription Agreement, a copy of which

is attached as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of

a Registrant. |

The information contained in Item 1.01 of this

Form 8-K under the heading “First Amendment to Loan and Security Agreement” is incorporated into this Item 2.03 by

reference.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information contained in Item 1.01 of this

Form 8-K under the heading “Subscription Agreement” is incorporated into this Item 3.02 by reference.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

As part of the Company’s restructuring process,

effective November 22, 2024 (the “Effective Date”), Andrew D. Jones transitioned out of his position as Chief Financial

Officer, Treasurer and Secretary of the Company and will serve as a part-time consultant of the Company

until December 31, 2024. There were no disagreements between Mr. Jones and the Company, and this transition is not related to the operations,

policies or practices of the Company or any issues regarding accounting policies or practices.

On the Effective Date, Michael Rowe, Chief Executive

Officer of the Company and a member of the board of directors of the Company (the “Board”), was appointed to the roles of

Principal Financial Officer, Treasurer and Secretary. Mr. Rowe has been the Chief Executive Officer and a member of the Board since August

2022. Prior to these roles, he served as the Company’s Corporate Vice President from 2018 to 2021 and the Chief Operating Officer

from 2021 until being named Chief Executive Officer. Previously, Mr. Rowe was the Executive Director of Marketing for Aerie Pharmaceuticals

Inc., where he was pivotal in the commercialization of their glaucoma franchise. Before that, Mr. Rowe spent 12 years at Allergan plc,

where he found the health economics department, led strategic planning and new pharmaceutical and device product commercialization for

the global glaucoma franchise and found the competitive intelligence function across the company. During this time, Mr. Rowe also served

as the Company’s liaison with Senju Pharmaceuticals (a current stockholder and licensee of Eyenovia) and was instrumental in the

successful launch of multiple glaucoma products in the Japanese market.

There are no arrangements or understandings between

Mr. Rowe and any other persons pursuant to which he was appointed as Principal Financial Officer, Treasurer and Secretary of the Company,

and there is no family relationship between Mr. Rowe and any director or executive officer of the Company. There are no transactions between

the Company and Mr. Rowe that are disclosable pursuant to Item 404(a) of Regulation S-K.

Mr. Jones will receive $20,000 for his consulting

services to the Company over the next five weeks.

| |

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

Exhibit

Number |

|

Description |

| 10.1 |

|

First Amendment to Supplement to Loan and Security Agreement, dated as of November 22, 2024, by and among Eyenovia, Inc., Avenue Capital Management II, L.P., Avenue Venture Opportunities Fund, L.P. and Avenue Venture Opportunities Fund II, L.P. |

| 10.2 |

|

Subscription Agreement, dated as of November 22, 2024, by and among Eyenovia, Inc., Avenue Venture Opportunities Fund, L.P. and Avenue Venture Opportunities Fund II, L.P. |

| 104 |

|

Cover Page Interactive Data File (embedded within the inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EYENOVIA, INC. |

| |

|

|

| Dated: November 25, 2024 |

By: |

/s/ Michael Rowe |

| |

|

Michael Rowe |

| |

|

Chief Executive Officer |

Exhibit 10.1

FIRST AMENDMENT TO SUPPLEMENT TO

LOAN AND SECURITY AGREEMENT

This

First Amendment to Supplement to Loan and Security Agreement (this “Amendment”) is entered into as of November 22,

2024, by and among AVENUE CAPITAL MANAGEMENT II, L.P., a Delaware limited partnership (as administrative and collateral agent (in such

capacity, “Agent”)), AVENUE VENTURE OPPORTUNITIES FUND, L.P., a Delaware limited partnership (“Avenue”),

AVENUE VENTURE OPPORTUNITIES FUND II, L.P., a Delaware limited partnership (“Avenue 2”; and, collectively with Avenue,

“Lenders” and each, individually, a “Lender”), and EYENOVIA, INC., a Delaware corporation (“Borrower”).

RECITALS

Borrower and Lender are parties to that certain

Loan and Security Agreement dated as of November 22, 2022 (as may be amended, restated, amended and restated, modified or supplemented

from time to time, the “Agreement”) and that certain Supplement to Loan and Security Agreement dated as of November

22, 2022 (as may be amended, restated, amended and restated, modified or supplemented from time to time, the “Supplement”).

The parties desire to amend the Supplement in accordance with the terms of this Amendment.

NOW, THEREFORE, the parties agree as follows:

1. The following defined term contained in Part 1 of the Supplement is hereby amended and restated in its entirety to read as follows:

“Amortization

Period” means each of (i) the period commencing on the first day of the first full calendar month following the Interest-only

Period and continuing until November 30, 2024 and (ii) the period commencing on March 1, 2025 and continuing until the Maturity Date.

2. The following defined term is hereby added to Part 1 of the Supplement:

“Payment Deferral Period”

means the period from December 1, 2024 through and including February 28, 2025.

3. Section 1(c) of Part 2 of the Supplement hereby is amended and restated in its entirety to read as follows:

“Repayment of Growth Capital

Loans. Principal of, and interest on, each Growth Capital Loan shall be payable as set forth in a Note evidencing such Growth Capital

Loan (substantially in the form attached hereto as Exhibit “A”), which Note shall provide substantially as follows:

principal shall be fully amortized over the applicable Amortization Period in equal, monthly principal installments plus, in each case,

unpaid interest thereon at the Designated Rate (such unpaid interest, “Cash Interest”), commencing after the Interest-only

Period of interest-only installments of Cash Interest at the Designated Rate. In particular, on the Borrowing Date applicable to such

Growth Capital Loan, Borrower shall pay to Agent (i) if the Borrowing Date is earlier than the Loan Commencement Date, Cash Interest

only at the Designated Rate, in advance, on the outstanding principal balance of the Growth Capital Loan for the period from the Borrowing

Date through the last day of the calendar month in which such Borrowing Date occurs (it being understood that this clause (i) shall not

apply in the case the Borrowing Date is on the same date as the Loan Commencement Date), and (ii) the first (1st) interest-only installment

of Cash Interest at the Designated Rate, in advance, on the outstanding principal balance of the Note evidencing such Loan for the ensuing

month. Commencing on the first day of the second full month after the Borrowing Date and continuing on the first day of each month during

the Interest-only Period thereafter, Borrower shall pay to Agent Cash Interest only at the Designated Rate, in advance, on the outstanding

principal balance of the Loan evidenced by such Note for the ensuing month. Commencing on the first day of the first full month after

the end of the Interest-only Period, and continuing on the first day of each consecutive calendar month thereafter, Borrower shall pay

to Agent equal consecutive monthly principal installments in advance in an amount sufficient to fully amortize the Loan evidenced by

such Note over the Amortization Period, plus Cash Interest at the Designated Rate for such month.

Notwithstanding anything in the foregoing

to the contrary, during the Payment Deferral Period, (i) Borrower shall not be required to pay monthly principal installments in respect

of the Growth Capital Loans and (ii) Borrower shall not pay Cash Interest but, instead, each Growth Capital Loan shall accrue deferred

interest in arrears at a rate equal to the Designated Rate and such interest shall not be paid in cash but shall instead be added to

the outstanding principal balance so as to increase the outstanding principal balance of the Growth Capital Loans on each payment date

during the Payment Deferral Period (such interest, “Deferred Interest”), which principal balance shall amortize in

accordance with the terms hereof. Commencing on March 1, 2025, and continuing on the first day of each consecutive calendar month thereafter,

Borrower shall pay to Agent equal consecutive monthly principal installments in advance in an amount sufficient to fully amortize the

Growth Capital Loans over the applicable Amortization Period, plus Cash Interest at the Designated Rate for such month. On the Maturity

Date, all principal (including any Deferred Interest which has been added to principal) and accrued interest then remaining unpaid and

the Final Payment shall be due and payable.”

4. No course of dealing on the part of Agent or any Lender, nor any failure or delay in the exercise of any right by Agent or any

Lender, shall operate as a waiver thereof, and any single or partial exercise of any such right shall not preclude any later exercise

of any such right. Agent or any Lender’s failure at any time to require strict performance by Borrower of any provision shall not

affect any right of Agent or Lender thereafter to demand strict compliance and performance. Any suspension or waiver of a right must

be in writing signed by an officer of Agent.

5. Unless otherwise defined, all initially capitalized terms in this Amendment shall be as defined in the Loan Documents (as defined

in the Agreement). The Loan Documents, as amended hereby, shall be and remain in full force and effect in accordance with their respective

terms and hereby are ratified and confirmed in all respects. Except as expressly set forth herein, the execution, delivery, and performance

of this Amendment shall not operate as a waiver of, or as an amendment of, any right, power, or remedy of Agent or any Lender under the

Loan Documents, as in effect prior to the date hereof.

6. Borrower represents and warrants that the representations and warranties contained in the Agreement are true and correct as of

the date of this Amendment, and that no Event of Default has occurred and is continuing, other than with respect to representations and

warranties pertaining to financial condition or ongoing clinical trials.

7. As a condition to the effectiveness of this Amendment, Agent shall have received, in form and substance satisfactory to Lender,

the following:

(a) this Amendment, duly executed by Borrower;

(b) subscription agreement documentation issued by Borrower to the Lenders effectuating a grant of an

aggregate number of shares of Borrower’s common stock, par value $0.0001 per share, purchasable by dividing (A) Two Hundred Thousand

Dollars ($200,000) by (b) the five (5) trading -day VWAP, as calculated on the date of issuance,

which shares shall be issued in a transaction exempt from the registration requirements of the Securities Act of 1933, as amended, to

be allocated to the Lenders in accordance with the pro rata Commitment of each Lender; and

(c) all reasonable Lender expenses incurred through the date of this Amendment and noted in Annex A hereto, which Borrower shall remit

via wire transfer on the date of execution of this Amendment per the instructions set forth on Annex A hereto.

8. This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together

shall constitute one instrument.

[Balance of Page Intentionally Left Blank]

IN WITNESS WHEREOF, the undersigned have executed

this Amendment as of the first date above written.

| |

BORROWER: |

| |

|

| |

EYENOVIA, INC. |

| |

|

| |

By: |

/s/ Andrew D. Jones |

| |

Name: Andrew D. Jones |

| |

Title: Chief Financial Officer |

[Signature Page to First Amendment to Supplement]

AGENT:

| |

AVENUE VENTURE OPPORTUNITIES FUND, L.P. |

| |

|

|

| |

By: |

Avenue Venture Opportunities Partners, LLC |

| |

Its: |

General Partner |

| |

|

|

| |

By: |

/s/ Sonia Gardner |

| |

Name: |

Sonia Gardner |

| |

Title: |

Authorized Signatory |

| Address for Notices: |

11 West 42nd Street, 9th Floor

New York, New York 10036

Attn: Todd Greenbarg, Senior Managing Director

Email: [***]

Phone # [***] |

LENDERS:

| |

AVENUE VENTURE OPPORTUNITIES FUND, L.P. |

| |

|

|

| |

By: |

Avenue Venture Opportunities Partners, LLC |

| |

Its: |

General Partner |

| |

|

|

| |

By: |

/s/ Sonia Gardner |

| |

Name: |

Sonia Gardner |

| |

Title: |

Authorized Signatory |

| Address for Notices: |

11 West 42nd Street, 9th Floor

New York, New York 10036

Attn: Todd Greenbarg, Senior Managing Director

Email: [***]

Phone # [***] |

| |

AVENUE VENTURE OPPORTUNITIES FUND II, L.P. |

| |

|

|

| |

By: |

Avenue Venture Opportunities Partners, LLC |

| |

Its: |

General Partner |

| |

|

|

| |

By: |

/s/ Sonia Gardner |

| |

Name: |

Sonia Gardner |

| |

Title: |

Authorized Signatory |

| Address for Notices: |

11 West 42nd Street, 9th Floor

New York, New York 10036

Attn: Todd Greenbarg, Senior Managing Director

Email: [***]

Phone # [***] |

[Signature Page to First Amendment to Supplement]

Exhibit 10.2

SUBSCRIPTION AGREEMENT

Eyenovia, Inc.

295 Madison Avenue, Suite 2400

New York, NY 10017

Ladies and Gentlemen:

This Subscription Agreement

(this “Subscription Agreement”) is being entered into as of the date set forth on the signature page hereto, by and

among Eyenovia, Inc., a Delaware corporation (the “Company”), Avenue Venture Opportunities Fund, L.P. (“Avenue”)

and Avenue Venture Opportunities Fund II, L.P. (“Avenue 2,” and together with Avenue, each an “Investor”

and collectively, the “Investors”).

This Subscription Agreement is entered into in

connection with that certain First Amendment to Supplement to Loan and Security Agreement by and among the Company, Avenue Capital Management

II, L.P. (the “Agent”) and the Investors, dated as of even date herewith (the “Amendment”).

In connection therewith, and in consideration of

the foregoing and the mutual representations, warranties and covenants, and subject to the conditions, set forth herein, and intending

to be legally bound hereby, each of the Investors and the Company acknowledges and agrees as follows:

1. Subscription.

Investors hereby irrevocably subscribe for the number of shares of common stock, par value $0.0001 per share, of the Company set forth

on the signature page of this Subscription Agreement (the “Shares”) on the terms and subject to the conditions provided

for herein.

2. Closing.

The closing of the issuance of the Shares (the “Closing”) shall occur substantially concurrently with and conditioned

upon the execution of the Amendment (the “Closing Date”). On the Closing Date, the Company shall issue the number of

Shares to Investors set forth on the signature page to this Subscription Agreement, and shall subsequently cause such Shares to be registered

in book entry form in the name of Investor on the Company’s share register. For purposes of this Subscription Agreement, “business

day” shall mean a day, other than a Saturday or Sunday, on which commercial banks in New York, New York are open for the general

transaction of business.

3. Closing

Conditions.

(a) The

obligation of the parties hereto to consummate the issuance of the Shares pursuant to this Subscription Agreement is subject to the following

conditions:

(i) the

execution of the Amendment; and

(ii) no

applicable governmental authority shall have enacted, issued, promulgated, enforced or entered any judgment, order, law, rule or regulation

(whether temporary, preliminary or permanent) which is then in effect and has the effect of making consummation of the transactions contemplated

hereby illegal or otherwise restraining or prohibiting consummation of the transactions contemplated hereby.

(b) The

obligation of the Company to consummate the issuance and sale of the Shares pursuant to this Subscription Agreement shall be subject to

the condition that all representations and warranties of Investors contained in this Subscription Agreement are true and correct in all

material respects (other than representations and warranties that are qualified as to materiality or Material Adverse Effect, which representations

and warranties shall be true in all respects) at and as of the Closing Date, and consummation of the Closing shall constitute a reaffirmation

by Investors of each of the representations and warranties of Investor contained in this Subscription Agreement as of the Closing Date.

(c) The

obligation of Investors to consummate the purchase of the Shares pursuant to this Subscription Agreement shall be subject to the condition

that all representations and warranties of the Company contained in this Subscription Agreement shall be true and correct in all material

respects (other than representations and warranties that are qualified as to materiality or Material Adverse Effect (as defined herein),

which representations and warranties shall be true in all respects) at and as of the Closing Date, and consummation of the Closing shall

constitute a reaffirmation by the Company of each of the representations and warranties of the Company contained in this Subscription

Agreement as of the Closing Date.

4. Registration

Rights. Following the Closing, the Company and Investors shall promptly (and in any event within 30 calendar days) enter into a registration

rights agreement, pursuant to which the Company will provide the Investors demand registration rights and piggyback registration rights

on terms satisfactory to the Investors, including, without limitation, that the Company will bear all expenses related to such registration

and will agree to use best efforts to register the Shares as described therein.

5. Further

Assurances. The parties hereto shall execute and deliver such additional documents and take such additional actions as the parties

reasonably may deem to be practical and necessary in order to consummate the subscription as contemplated by this Subscription Agreement.

6. Company

Representations and Warranties. The Company represents and warrants to Investors that:

(a) The

Company is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Delaware. The Company

has all corporate power and authority to own, lease and operate its properties and conduct its business as presently conducted and to

enter into, deliver and perform its obligations under this Subscription Agreement.

(b) As of

the Closing Date, the Shares will be duly authorized and, when issued and delivered to Investors in accordance with the terms of this

Subscription Agreement and the Amendment, the Shares will be validly issued, fully paid and non-assessable and will not have been issued

in violation of or subject to any preemptive or similar rights created under the Company’s certificate of incorporation (as amended

to the Closing Date) or under the General Corporation Law of the State of Delaware.

(c) This

Subscription Agreement has been duly authorized, executed and delivered by the Company and, assuming that this Subscription Agreement

constitutes the valid and binding agreement of Investors, this Subscription Agreement is enforceable against the Company in accordance

with its terms, except as may be limited or otherwise affected by (i) bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium

or other laws relating to or affecting the rights of creditors generally, or (ii) principles of equity, whether considered at law or equity.

(d) The

issuance and sale of the Shares and the compliance by the Company with all of the provisions of this Subscription Agreement and the consummation

of the transactions contemplated herein will not conflict with or result in a breach or violation of any of the terms or provisions of,

or constitute a default under, or result in the creation or imposition of any lien, charge or encumbrance upon any of the property or

assets of the Company pursuant to the terms of (i) any indenture, mortgage, deed of trust, loan agreement, lease, license or other agreement

or instrument to which the Company is a party or by which the Company is bound or to which any of the property or assets of the Company

is subject that would reasonably be expected to have a material adverse effect on the business, financial condition or results of operations

of the Company, taken as a whole (a “Material Adverse Effect”) or materially affect the validity of the Shares or the

legal authority of the Company to comply in all material respects with the terms of this Subscription Agreement; (ii) result in any violation

of the provisions of the organizational documents of the Company; or (iii) result in any violation of any statute or any judgment, order,

rule or regulation of any court or governmental agency or body, domestic or foreign, having jurisdiction over the Company or any of their

properties that would reasonably be expected to have a Material Adverse Effect or materially affect the validity of the Shares or the

legal authority of the Company to comply in all material respects with this Subscription Agreement.

7. Investor

Representations and Warranties. Each Investor represents and warrants to the Company that:

(a) Such

Investor (i) is a “qualified institutional buyer” (as defined in Rule 144A under the Securities Act of 1933, as amended (the

“Securities Act”)) or an institutional “accredited investor” (within the meaning of Rule 501(a) under the

Securities Act), in each case, satisfying the applicable requirements set forth on Schedule A, (ii) is acquiring the Shares only

for its own account and not for the account of others, and (iii) is not acquiring the Shares with a view to, or for offer or sale in connection

with, any distribution thereof in violation of the Securities Act (and shall provide the requested information set forth on Schedule

A). Such Investor is not an entity formed for the specific purpose of acquiring the Shares and is an “institutional account”

as defined by FINRA Rule 4512(c).

(b) Such

Investor acknowledges and agrees that the Shares are being offered in a transaction not involving any public offering within the meaning

of the Securities Act and that the Shares have not been registered under the Securities Act. Such Investor acknowledges and agrees that

the Shares may not be offered, resold, transferred, pledged or otherwise disposed of by such Investor absent an effective registration

statement under the Securities Act except (i) to the Company or a subsidiary thereof, (ii) to non-U.S. persons pursuant to offers and

sales that occur outside the United States within the meaning of Regulation S under the Securities Act or (iii) pursuant to another applicable

exemption from the registration requirements of the Securities Act, and in each case in accordance with any applicable securities laws

of the states of the United States and other jurisdictions, and that any certificates representing the Shares shall contain a restrictive

legend to such effect. Such Investor acknowledges and agrees that the Shares will be subject to transfer restrictions and, as a result

of these transfer restrictions, such Investor may not be able to readily offer, resell, transfer, pledge or otherwise dispose of the Shares

and may be required to bear the financial risk of an investment in the Shares for an indefinite period of time. Such Investor acknowledges

and agrees that the Shares will not be eligible for offer, resale, transfer, pledge or disposition pursuant to Rule 144 promulgated under

the Securities Act until at least six months from the Closing Date. Such Investor acknowledges and agrees that it has been advised to

consult legal counsel prior to making any offer, resale, transfer, pledge or disposition of any of the Shares.

(c) Such

Investor acknowledges that there have been no representations, warranties, covenants and agreements made to such Investor by or on behalf

of the Company, any of its affiliates or any control persons, officers, directors, employees, partners, agents or representatives of any

of the foregoing or any other person or entity, expressly or by implication, other than those representations, warranties, covenants and

agreements of the Company expressly set forth in Section 6 of this Subscription Agreement.

(d) Such

Investor’s acquisition and holding of the Shares will not constitute or result in a non-exempt prohibited transaction under Section

406 of the Employee Retirement Income Security Act of 1974, as amended, Section 4975 of the Internal Revenue Code of 1986, as amended,

or any applicable similar law.

(e) Such

Investor acknowledges and agrees that such Investor has received such information as such Investor deems necessary in order to make an

investment decision with respect to the Shares, including with respect to the Company and its subsidiaries. Without limiting the generality

of the foregoing, such Investor acknowledges that it has reviewed the Company’s filings with the U.S. Securities and Exchange Commission

(the “SEC”). Such Investor acknowledges and agrees that such Investor and such Investor’s professional advisor(s),

if any, have had the full opportunity to ask such questions, receive such answers and obtain such information as such Investor and such

Investor’s professional advisor(s), if any, have deemed necessary to make an investment decision with respect to the Shares.

(f) Such

Investor became aware of this offering of the Shares solely by means of direct contact between such Investor and the Company or a representative

of the Company, and the Shares were offered to Investor solely by direct contact between such Investor and the Company or a representative

of the Company. Such Investor acknowledges that the Shares (i) were not offered by any form of general solicitation or general advertising

and (ii) are not being offered in a manner involving a public offering under, or in a distribution in violation of, the Securities Act,

or any state securities laws. Such Investor acknowledges that it is not relying upon, and has not relied upon, any statement, representation

or warranty made by any person, firm or corporation (including, without limitation, the Company, any of its affiliates or any control

persons, officers, directors, employees, partners, agents or representatives of any of the foregoing), other than the representations

and warranties of the Company contained in Section 6 of this Subscription Agreement, in making its investment or decision to invest in

the Company.

(g) Such

Investor acknowledges that it is aware that there are substantial risks incident to the purchase and ownership of the Shares, including

those set forth in the Company’s filings with the SEC. Such Investor has such knowledge and experience in financial and business

matters as to be capable of evaluating the merits and risks of an investment in the Shares, and such Investor has sought such accounting,

legal and tax advice as such Investor has considered necessary to make an informed investment decision. Such Investor is able to sustain

a complete loss on its investment in the Shares, has no need for liquidity with respect to its investment in the Shares and has no reason

to anticipate any change in circumstances, financial or otherwise, which may cause or require any sale or distribution of all or any part

of the Shares.

(h) Alone,

or together with any professional advisor(s), such Investor has adequately analyzed and fully considered the risks of an investment in

the Shares and determined that the Shares are a suitable investment for such Investor and that such Investor is able at this time and

in the foreseeable future to bear the economic risk of a total loss of such Investor’s investment in the Company. Such Investor

acknowledges specifically that a possibility of total loss exists.

(i) In making

its decision to purchase the Shares, such Investor has relied solely upon independent investigation made by such Investor.

(j) Such

Investor acknowledges and agrees that no federal or state agency has passed upon or endorsed the merits of the offering of the Shares

or made any findings or determination as to the fairness of this investment.

(k) Such

Investor has been duly formed or incorporated and is validly existing and is in good standing under the laws of its jurisdiction of formation

or incorporation, with power and authority to enter into, deliver and perform its obligations under this Subscription Agreement.

(l) The

execution, delivery and performance by such Investor of this Subscription Agreement are within the powers of such Investor, have been

duly authorized and will not constitute or result in a breach or default under or conflict with any order, ruling or regulation of any

court or other tribunal or of any governmental commission or agency, or any agreement or other undertaking, to which such Investor is

a party or by which such Investor is bound, and will not violate any provisions of such Investor’s organizational documents, including,

without limitation, its incorporation or formation papers, bylaws, indenture of trust or partnership or operating agreement, as may be

applicable. The signature on this Subscription Agreement is genuine, and the signatory has legal competence and capacity to execute the

same or the signatory has been duly authorized to execute the same, and this Subscription Agreement constitutes a legal, valid and binding

obligation of such Investor, enforceable against Investor in accordance with its terms except as may be limited or otherwise affected

by (i) bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other laws relating to or affecting the rights of

creditors generally, and (ii) principles of equity, whether considered at law or equity.

(m) Such

Investor is not (i) a person or entity named on the List of Specially Designated Nationals and Blocked Persons administered by the U.S.

Treasury Department’s Office of Foreign Assets Control (“OFAC”) or in any Executive Order issued by the President

of the United States and administered by OFAC (“OFAC List”), or a person or entity prohibited by any OFAC sanctions

program, (ii) a Designated National as defined in the Cuban Assets Control Regulations, 31 C.F.R. Part 515, or (iii) a non-U.S. shell

bank or providing banking services indirectly to a non-U.S. shell bank (each, a “Prohibited Investor”). Such Investor

agrees to provide law enforcement agencies, if requested thereby, such records as required by applicable law, provided that such Investor

is permitted to do so under applicable law. If such Investor is a financial institution subject to the Bank Secrecy Act (31 U.S.C. Section

5311 et seq.) (the “BSA”), as amended by the USA PATRIOT Act of 2001 (the “PATRIOT Act”), and its

implementing regulations (collectively, the “BSA/PATRIOT Act”), such Investor maintains policies and procedures reasonably

designed to comply with applicable obligations under the BSA/PATRIOT Act. To the extent required, it maintains policies and procedures

reasonably designed for the screening of its investors against the OFAC sanctions programs, including the OFAC List. To the extent required

by applicable law, such Investor maintains policies and procedures reasonably designed to ensure that the funds held by such Investor

and used to purchase the Shares were legally derived and were not obtained, directly or indirectly, from a Prohibited Investor.

(n) In connection

with the issue and purchase of the Shares, no person, firm or corporation has acted as such Investor’s financial advisor or fiduciary.

8. Termination.

This Subscription Agreement shall terminate and be void and of no further force and effect, and all rights and obligations of the parties

hereunder shall terminate if any of the conditions to Closing set forth in Section 3 of this Subscription Agreement are (i) not satisfied

or waived prior to the Closing (and if the failure to so satisfy such condition is capable of being cured prior to the Closing, such failure

shall not have been cured by the thirtieth calendar day following receipt of written notice from the party claiming such condition has

not been satisfied) or (ii) not capable of being satisfied on the Closing and, in each case of (i) and (ii), as a result thereof, the

transactions contemplated by this Subscription Agreement will not be and are not consummated at the Closing (collectively, the “Termination

Events”); provided that nothing herein will relieve any party from liability for any willful breach hereof prior to the

time of termination, and each party will be entitled to any remedies at law or in equity to recover losses, liabilities or damages arising

from any such willful breach. Upon the occurrence of any Termination Event, this Subscription Agreement shall be void and of no further

effect and any monies paid by Investors to the Company in connection herewith shall promptly (and in any event within one business day)

following the Termination Event be returned to Investors, which obligation to return such monies and remedies for losses, liabilities

and damages arising from willful breach shall survive termination of this Subscription Agreement.

9. Miscellaneous.

(a) Neither this Subscription Agreement nor any rights

that may accrue to Investors hereunder (other than the Shares acquired hereunder, if any) may be transferred or assigned.

(b) Investors

acknowledge that the Company may file a copy of this Subscription Agreement with the SEC as an exhibit to a periodic report or a registration

statement of the Company.

(c) Investors

acknowledge that the Company and others will rely on the acknowledgments, understandings, agreements, representations and warranties contained

in this Subscription Agreement. Prior to the Closing, each Investor agrees to promptly notify the Company if any of the acknowledgments,

understandings, agreements, representations and warranties set forth in Section 7 above are no longer accurate. Each Investor acknowledges

and agrees that each purchase by such Investor of Shares from the Company will constitute a reaffirmation of the acknowledgments, understandings,

agreements, representations and warranties herein (as modified by any such notice) by such Investor as of the time of such purchase.

(d) The

Company is entitled to rely upon this Subscription Agreement and is irrevocably authorized to produce this Subscription Agreement or a

copy hereof to any interested party in any administrative or legal proceeding or official inquiry with respect to the matters covered

hereby.

(e) All

of the agreements, representations and warranties made by each party hereto in this Subscription Agreement shall survive the Closing.

(f) This

Subscription Agreement may not be modified, waived or terminated (other than pursuant to the terms of Section 8 above) except by an instrument

in writing, signed by each of the parties hereto. No failure or delay of either party in exercising any right or remedy hereunder shall

operate as a waiver thereof, nor shall any single or partial exercise of any such right or power, or any abandonment or discontinuance

of steps to enforce such right or power, or any course of conduct, preclude any other or further exercise thereof or the exercise of any

other right or power. The rights and remedies of the parties hereunder are cumulative and are not exclusive of any rights or remedies

that they would otherwise have hereunder.

(g) This

Subscription Agreement (including the schedule hereto) constitutes the entire agreement, and supersedes all other prior agreements, understandings,

representations and warranties, both written and oral, among the parties, with respect to the subject matter hereof. This Subscription

Agreement shall not confer any rights or remedies upon any person other than the parties hereto, and their respective successors and assigns,

and the parties hereto acknowledge that such persons so referenced are third party beneficiaries of this Subscription Agreement for the

purposes of, and to the extent of, the rights granted to them, if any, pursuant to the applicable provisions.

(h) Except

as otherwise provided herein, this Subscription Agreement shall be binding upon, and inure to the benefit of the parties hereto and their

heirs, executors, administrators, successors, legal representatives, and permitted assigns, and the agreements, representations, warranties,

covenants and acknowledgments contained herein shall be deemed to be made by, and be binding upon, such heirs, executors, administrators,

successors, legal representatives and permitted assigns.

(i) If any

provision of this Subscription Agreement shall be adjudicated by a court of competent jurisdiction to be invalid, illegal or unenforceable,

the validity, legality or enforceability of the remaining provisions of this Subscription Agreement shall not in any way be affected or

impaired thereby and shall continue in full force and effect.

(j) This

Subscription Agreement may be executed in one or more counterparts (including by facsimile or electronic mail or in .pdf) and by different

parties in separate counterparts, with the same effect as if all parties hereto had signed the same document. All counterparts so executed

and delivered shall be construed together and shall constitute one and the same agreement.

(k) The

parties hereto acknowledge and agree that irreparable damage would occur in the event that any of the provisions of this Subscription

Agreement were not performed in accordance with their specific terms or were otherwise breached. It is accordingly agreed that the parties

shall be entitled to an injunction or injunctions to prevent breaches of this Subscription Agreement, without posting a bond or undertaking

and without proof of damages, to enforce specifically the terms and provisions of this Subscription Agreement, this being in addition

to any other remedy to which such party is entitled at law, in equity, in contract, in tort or otherwise.

(l) This

Subscription Agreement shall be governed by and construed in accordance with the laws of the State of Delaware (regardless of the laws

that might otherwise govern under applicable principles of conflicts of laws thereof) as to all matters (including any action, suit, litigation,

arbitration, mediation, claim, charge, complaint, inquiry, proceeding, hearing, audit, investigation or reviews by or before any governmental

entity related hereto), including matters of validity, construction, effect, performance and remedies.

(m) Any

action, suit or proceeding between or among the parties hereto, whether arising in contract, tort or otherwise, arising in connection

with any disagreement, dispute, controversy or claim arising out of or relating to this Subscription Agreement or any related document

or any of the transactions contemplated hereby or thereby (“Legal Dispute”) shall be brought only to the exclusive

jurisdiction of the courts of the State of Delaware or the federal courts located in the State of Delaware, and each party hereto hereby

consents to the jurisdiction of such courts (and of the appropriate appellate courts therefrom) in any such suit, action or proceeding

and irrevocably waives, to the fullest extent permitted by law, any objection that it may now or hereafter have to the laying of the venue

of any such suit, action or proceeding in any such court or that any such suit, action or proceeding that is brought in any such court

has been brought in an inconvenient forum. During the period a Legal Dispute that is filed in accordance with this Section 9(m) is pending

before a court, all actions, suits or proceedings with respect to such Legal Dispute or any other Legal Dispute, including any counterclaim,

cross-claim or interpleader, shall be subject to the exclusive jurisdiction of such court. A final judgment in any action, suit or proceeding

described in this Section 9(m) following the expiration of any period permitted for appeal and subject to any stay during appeal shall

be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by applicable laws. EACH

OF THE PARTIES HERETO IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT TO TRIAL BY JURY ON ANY CLAIMS OR COUNTERCLAIMS ASSERTED IN ANY

LEGAL DISPUTE RELATING TO THIS SUBSCRIPTION AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY AND FOR ANY COUNTERCLAIM RELATING THERETO.

IF THE SUBJECT MATTER OF ANY SUCH LEGAL DISPUTE IS ONE IN WHICH THE WAIVER OF JURY TRIAL IS PROHIBITED, NO PARTY HERETO NOR ANY PERSON

ASSERTING RIGHTS AS A THIRD PARTY BENEFICIARY SHALL ASSERT IN SUCH LEGAL DISPUTE A NONCOMPULSORY COUNTERCLAIM ARISING OUT OF OR RELATING

TO THIS SUBSCRIPTION AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY. FURTHERMORE, NO PARTY HERETO NOR ANY PERSON ASSERTING RIGHTS AS

A THIRD PARTY BENEFICIARY SHALL SEEK TO CONSOLIDATE ANY SUCH LEGAL DISPUTE WITH A SEPARATE ACTION OR OTHER LEGAL PROCEEDING IN WHICH A

JURY TRIAL CANNOT BE WAIVED.

[SIGNATURE PAGES FOLLOW]

IN

WITNESS WHEREOF, the Investor named below has executed or caused this Subscription Agreement to be executed by its duly authorized

representative as of the date set forth below.

| Name of Investor: |

State/Country of Formation or Domicile: |

| |

|

| AVENUE VENTURE OPPORTUNITIES FUND, L.P. |

Delaware |

| By: |

Avenue Venture Opportunities Partners, LLC |

|

| Its: |

General Partner |

|

| |

|

|

| By: |

/s/ Sonia Gardner |

|

| Name: |

Sonia Gardner |

|

| Title: |

Authorized Signatory |

|

| Date: |

November 22, 2024 |

|

Name in which Shares are to be registered

(if different):

Investor’s EIN: [***]

Business

Address-Street: 11 West 42nd Street, 9th Floor

City, State, Zip: New York, New York 10036

Attn: Todd Greenbarg, Senior Managing Director

Telephone No.: [***]

Email: [***]

For

notices, with copy For notices, with copy to (which shall not constitute notice):

Manatt, Phelps & Phillips, LLP

12730 High Bluff Dr., Suite 300

San Diego, CA 92130

Attn: Troy Zander

Email: [***]

Number of Shares: 760,693

Signature Page to Subscription Agreement

IN

WITNESS WHEREOF, the Investor named below has executed or caused this Subscription Agreement to be executed by its duly authorized

representative as of the date set forth below.

| Name of Investor: |

State/Country of Formation or Domicile: |

| |

|

| AVENUE VENTURE OPPORTUNITIES FUND II, L.P. |

Delaware |

| By: |

Avenue Venture Opportunities Partners, LLC |

|

| Its: |

General Partner |

|

| |

|

|

| By: |

/s/ Sonia Gardner |

|

| Name: |

Sonia Gardner |

|

| Title: |

Authorized Signatory |

|

| Date: |

November 22, 2024 |

|

Name in which Shares are to be registered

(if different):

Investor’s EIN: [***]

Business

Address-Street: 11 West 42nd Street, 9th Floor

City, State, Zip: New York, New York 10036

Attn: Todd Greenbarg, Senior Managing Director

Telephone No.: [***]

Email: [***]

For notices, with copy to (which shall not constitute notice):

Manatt, Phelps & Phillips, LLP

12730 High Bluff Dr., Suite 300

San Diego, CA 92130

Attn: Troy Zander

Email: [***]

Number of Shares: 1,141,040

Signature Page to Subscription Agreement

IN

WITNESS WHEREOF, the Company has accepted this Subscription Agreement as of the date set forth below.

| |

EYENOVIA, INC. |

| |

|

| |

By: |

/s/ Michael Rowe |

| |

Name: Michal Rowe |

| |

Title: Chief Executive Officer |

Date: November 22, 2024

Signature Page to Subscription Agreement

v3.24.3

Cover

|

Nov. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 22, 2024

|

| Entity File Number |

001-38365

|

| Entity Registrant Name |

EYENOVIA, INC.

|

| Entity Central Index Key |

0001682639

|

| Entity Tax Identification Number |

47-1178401

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

295 Madison Avenue

|

| Entity Address, Address Line Two |

Suite 2400

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

833

|

| Local Phone Number |

393-6684

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

EYEN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

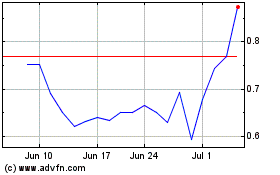

Eyenovia (NASDAQ:EYEN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Eyenovia (NASDAQ:EYEN)

Historical Stock Chart

From Dec 2023 to Dec 2024