0001274737FALSE00012747372023-07-242023-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2023

EXAGEN INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

|

|

|

|

|

| Delaware |

| 001-39049 |

| 20-0434866 |

(State or other jurisdiction of incorporation) |

| (Commission File Number) |

| (IRS Employer Identification No.) |

1261 Liberty Way

Vista, CA 92081

(Address of principal executive offices) (Zip Code)

(760) 560-1501

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | | | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | | | |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

|

|

|

|

|

| Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

| XGN |

| The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 24, 2023, upon recommendation of the Nominating and Corporate Governance Committee of the Board of Directors (the “Board”) of Exagen Inc. (the “Company”), and pursuant to the bylaws of the Company, the Board appointed Paul Kim to serve as a Class II director, with an initial term expiring at the Company’s 2024 annual meeting of stockholders, filling the vacancy on the Board. In connection with his appointment to the Board, Mr. Kim was also appointed to the Audit Committee of the Board (the “Audit Committee”) and the Compensation Committee of the Board (the “Compensation Committee”), effective as of July 24, 2023. Following Mr. Kim’s appointment, the Audit Committee consists of Frank Stokes (Chair), Wendy Johnson, Ana Hooker and Paul Kim, and the Compensation Committee consists of Bruce C. Robertson, Ph.D. (Chair), Ana Hooker and Paul Kim.

Paul Kim has served as Fulgent Genetic, Inc.’s (“Fulgent”) Chief Financial Officer since January 2016. Prior to his service for Fulgent, Mr. Kim was retired from 2011 until 2015 and served as Chief Financial Officer of Cogent, Inc., a publicly traded biometric identification services and product company, from 2004 until 2011. Mr. Kim’s past experience also includes service as the Chief Financial Officer of JNI Corporation, a publicly traded storage area network technology company, from 2002 until 2003, as Vice President, Finance and Corporate Controller at JNI from October 1999 to August 2002 and as Vice President of Finance and Administration for Datafusion Inc., a privately held software development company, from 1998 until 1999. From April 1996 to January 1998, Mr. Kim was the Corporate Controller for Interlink Computer Sciences, Inc., a publicly traded enterprise software company. From 1990 to 1996, Mr. Kim worked for Coopers and Lybrand L.L.P., leaving as an audit manager. Mr. Kim received a B.A. in Economics from the University of California at Berkeley in 1989 and is a Certified Public Accountant.

Pursuant to the Company’s non-employee director compensation program, on the effective date of Mr. Kim’s appointment to the Board, he was granted an option to purchase 15,000 shares of the Company’s common stock with an exercise price equal to the fair market value of the common stock on the date of grant, which will vest over three years in equal installments on each monthly anniversary of the grant date, subject to his continuing service on the Board through the applicable vesting date. Mr. Kim will also receive cash compensation for his service on the Board, the Audit Committee and the Compensation Committee in accordance with the non-employee director compensation program, which is filed as Exhibit 10.52 to the Company’s Annual Report on Form 10-K, filed with the SEC on March 20, 2023 and is incorporated herein by reference. Mr. Kim will enter into the Company’s standard indemnification agreement for directors, the form of which was filed as Exhibit 10.48 to the Company’s Annual Report on Form 10-K, filed with the SEC on March 20, 2023 and is incorporated herein by reference. There is no arrangement or understanding between Mr. Kim and any other person pursuant to which Mr. Kim was appointed as a director. Mr. Kim is not a party to any transaction that would require disclosure under Item 404(a) of Regulation S-K promulgated under the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. The Board has determined that Mr. Kim is an independent director in accordance with the listing requirements of the Nasdaq Global Market and the standards promulgated by the Securities and Exchange Commission, including enhanced independence criteria applicable to members of the Audit Committee and the Compensation Committee.

Item 8.01. Other Events.

On July 24, 2023, the Company issued a press release announcing the appointment of Mr. Kim as a director, a copy of which is attached hereto as Exhibit 99.1, and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data file (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

| EXAGEN INC. |

|

| |

| |

| |

Date: July 24, 2023 |

|

|

| By: |

| /s/ Kamal Adawi |

|

|

|

|

|

| Name: Kamal Adawi |

|

|

|

|

|

| Title: Chief Financial Officer |

Exhibit 99.1

Exagen Inc. Appoints Paul Kim to Board of Directors

July 24, 2023 at 9:00 AM EDT

SAN DIEGO, July 24, 2023 (GLOBE NEWSWIRE) -- Exagen Inc. (Nasdaq: XGN), a leading provider of autoimmune testing solutions, announced today that Paul Kim has been appointed as a member of the Exagen Board of Directors, effective July 24, 2023.

Mr. Kim currently serves as Chief Financial Officer of Fulgent Genetics (Nasdaq: FLGT), a full-service genomic testing company built around a foundational technology platform. He has held that position since February 2016 and led growth initiatives increasing revenues from $10M in 2015 to $990M in 2021, during the COVID-19 era. Mr. Kim has over 30 years working in accounting and finance, and over 15 years as a Chief Financial Officer of several publicly traded companies. Mr. Kim is a Certified Public Accountant and a graduate of the University of California at Berkeley.

“We are thrilled to welcome Paul to our Board of Directors at Exagen. His leadership experience and background in operating profitable, sound businesses is invaluable,” said John Aballi, President and CEO of Exagen. “I look forward to learning from his 30 plus years of leadership in business.”

“I am delighted to join the Board of Directors at Exagen,” said Paul Kim. “The Company has accomplished an enormous amount over the past few years, cementing its foothold in the large and underserved autoimmune disease market. What has impressed me most is its IP-protected technology and proven utility of products. Those with John’s leadership and overall strategy, which include business and operational goals, is a recipe for success.”

About Exagen Inc.

Exagen is a leading provider of autoimmune diagnostic, prognostic, and monitoring testing solutions. Exagen is a patient focused, discovery driven organization built on the success of AVISE® testing and is investing in its product pipeline to support patients throughout their autoimmune diagnosis and treatment journeys. The goal at Exagen is to assist patients, physicians, and payors by enabling precision medicine. Exagen is located in San Diego County.

For more information, please visit Exagen.com and follow @ExagenInc on Twitter.

Forward-Looking Statements

Exagen cautions you that statements contained in this press release regarding matters that are not historical facts are forward-looking statements. These statements are based on Exagen's current beliefs and expectations. Such forward-looking statements include, but are not limited

to, statements regarding: Exagen's goals and strategies; the potential utility and effectiveness of Exagen's services and testing solutions that are currently available or in its development pipeline; the expected benefits of Mr. Kim’s position with Exagen; the size of and Exagen’s competitive advantage within the autoimmune disease market; and Exagen's potential growth and success and its ability to continue to grow and succeed. The inclusion of forward-looking statements should not be regarded as a representation by Exagen that any of its plans will be achieved. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in Exagen’s business, including, without limitation: delays in reimbursement and coverage decisions from Medicare and third-party payors and in interactions with regulatory authorities, and delays in ongoing and planned clinical trials involving its tests; Exagen’s commercial success depends upon attaining and maintaining significant market acceptance of its testing products among rheumatologists, patients, third-party payors and others in the medical community; Exagen’s ability to successfully execute on its business strategies; third party payors not providing coverage and adequate reimbursement for Exagen’s testing products, including Exagen’s ability to collect on funds due; Exagen’s ability to obtain and maintain intellectual property protection for its testing products; regulatory developments affecting Exagen’s business; and other risks described in Exagen’s prior press releases and Exagen’s filings with the Securities and Exchange Commission (“SEC”), including under the heading “Risk Factors” in Exagen’s Annual Report on Form 10-K for the year ended December 31, 2022 and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Exagen undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Contacts:

Investors Relations

Exagen Inc.

Ryan Douglas

rdouglas@exagen.com

760.560.1525

Company

Exagen Inc.

Kamal Adawi, Chief Financial Officer

kadawi@exagen.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

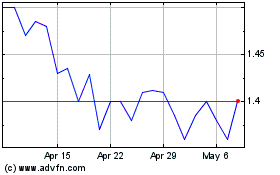

Exagen (NASDAQ:XGN)

Historical Stock Chart

From Oct 2024 to Nov 2024

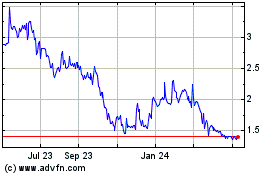

Exagen (NASDAQ:XGN)

Historical Stock Chart

From Nov 2023 to Nov 2024