- Loan guarantee to support nationwide deployment of

approximately 7,500 high-power fast charging stalls

- EVgo to host investor conference call at 5 p.m. ET today

EVgo Inc. (NASDAQ: EVGO) (“EVgo” or the “Company”) today

announced the closing of its $1.25 billion guaranteed loan facility

from the U.S. Department of Energy (“DOE”) Loan Programs Office

(“LPO”) under its Title 17 Clean Energy Financing Program to

support EVgo’s forthcoming efforts to build convenient, reliable

public charging infrastructure for electric vehicles (EVs) with the

construction of 7,500 new fast charging stalls nationwide. This

buildout will bring EVgo’s total owned and operated network to at

least 10,000 fast charging stalls, allowing the Company to more

than triple its network footprint by 2029.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241212262441/en/

EVgo fast charging network to further

expand across the United States. (Photo: Business Wire)

“As one of the nation’s leading public fast charging providers,

we are well-positioned to deploy the infrastructure needed to

support both current and future domestic investments in

transportation electrification,” said EVgo CEO, Badar Khan. “This

public-private partnership will help us continue to scale our

operations to serve the influx of vehicle options that will be

available to American consumers in the coming years.”

Building high-power public charging at scale bolsters range

confidence for Americans as they consider the choice to drive an

EV. Expanding fast charging infrastructure not only contributes to

job creation and local economic benefits, but it is also critical

to protecting the investments made by the automotive industry,

which is expected to release over 30 new affordable EV models by

the end of 2025,1 in addition to the more than 70 vehicle models

already available to American consumers today.2 EVs now account for

roughly 9% of new vehicle sales3 and increasing consumer confidence

in the availability of public charging is key to the success of

these investments.

EVgo estimates this project buildout will create more than 1,000

jobs in the U.S., over 700 of which will be contracted resources

engaged by the Company encompassing roles in construction,

engineering, development, and operations and maintenance.

Terms of the $1.25 Billion Guaranteed Loan Facility

Total Guaranteed Loan Facility Amount

- $1.25 billion • Principal: $1.05 billion • Capitalized

interest: Up to $193 million

Interest Rate

- Interest rates fixed from the date of each quarterly advance

for the term of the loan at the applicable long-dated U.S. Treasury

rate with an aggregate risk-based charge and liquidity margin of

approximately 1.2%

Collateral

- EVgo has contributed 1,594 charging stalls from its existing

public network to the project as project collateral

Equity Contribution

- Project cashflows are expected to provide the additional cash

equity from EVgo over the course of the loan

Tenor

- 17 years from date of first drawdown

Deployment Period

- 5-year deployment period starting 2025, ramping annually to

reach approximately 7,500 fast charging stalls

Principal & Interest Grace Period

- Scheduled principal repayments do not begin until after end of

deployment period

- Interest during the deployment period is capitalized, instead

of being paid in cash

Loan Structure

- Limited recourse project financing, secured by project

assets

First Drawdown

- Subject to satisfaction of all conditions precedent, the first

drawdown of approximately $75 million is expected in January

2025

Additional Key Terms

- Customary covenants and events of defaults for a limited

recourse project finance loan facility

- Customary conditions precedent to advances for a limited

recourse project finance loan facility

The closing of this DOE guaranteed loan facility follows receipt

of a conditional commitment on October 3, 2024, and marks the

conclusion of a thorough 18-month process.

Innovative Charging Solutions

Through the EVgo Innovation Lab, the Company is fostering

American innovation to advance the broader transportation

electrification ecosystem, including its extensive interoperability

testing and ongoing technical collaboration with leading automakers

and technology partners to support a superior customer experience

for drivers.

This technical innovation extends to the joint development of

next-generation charging architecture, for which EVgo will soon

secure domestic intellectual property rights. This architecture

will leverage EVgo’s learnings from serving over a million

customers nationwide to provide EVgo with more control over the

full customer experience, streamlining the charging process while

driving energy efficiency and cost savings. The Company plans to

deploy this new architecture beginning in the second half of

2026.

For more information about the EVgo network, visit

www.evgo.com.

Conference Call Information

A live audio webcast and conference call for EVgo’s DOE Loan

Facility will be held today at 5 p.m. ET / 2 p.m. PT. The webcast

will be available at investors.evgo.com, and the dial-in

information for those wishing to access via phone is:

Toll Free: (800) 715-9871 (for U.S. callers)

Toll/International: (646) 307-1963 (for callers outside the

U.S.) Conference ID: 9312273

This press release, along with other investor materials that

will be used or referred to during the webcast and conference call,

including a slide presentation will also be available on that

site.

Transaction Advisors Goldman Sachs acted as the financial

advisor to EVgo.

About EVgo

EVgo (Nasdaq: EVGO) is one of the nation’s leading public fast

charging providers. With more than 1,000 fast charging stations

across 40 states, EVgo strategically deploys localized and

accessible charging infrastructure by partnering with leading

businesses across the U.S., including retailers, grocery stores,

restaurants, shopping centers, gas stations, rideshare operators,

and autonomous vehicle companies. At its dedicated Innovation Lab,

EVgo performs extensive interoperability testing and has ongoing

technical collaborations with leading automakers and industry

partners to advance the EV charging industry and deliver a seamless

charging experience.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Exchange Act, as amended.

Forward-looking statements generally relate to future events or the

Company’s future financial or operating performance. In some cases,

you can identify forward-looking statements because they contain

words such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “going to,” “could,” “intends,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,”

“potential” or “continue” or the negative of these words or other

similar terms or expressions that concern the Company’s

expectations, strategy, priorities, plans or intentions.

Forward-looking statements in this press release include, but are

not limited to, statements regarding the terms of the DOE loan

facility; the anticipated benefits and growth from the DOE loan

facility, including project build out plan, use of proceeds,

issuance, timing and availability of advances, satisfaction of

covenants and the absence of events of default; growth in the

demand for EV vehicles and charging infrastructure; the anticipated

release of new affordable EV models; anticipated job creation in

the US from the project buildout; the Company’s ability to scale;

the joint development and deployment of the Company’s

next-generation charging infrastructure, and the anticipated IP

rights, efficiencies, cost savings and launch plans. These

statements are based on various assumptions and on the current

expectations of EVgo’s management, and are not predictions of

actual performance. The Company’s expectations and beliefs

regarding these matters may not materialize. There are a

significant number of factors that could cause actual results to

differ materially from the statements made in this press release,

including changes or developments in the broader general market;

EVgo’s dependence on the widespread adoption of EVs and growth of

the EV and EV charging markets; EVgo's reliance on the DOE loan

facility, its ability to fully draw on the DOE loan facility and

its ability to comply with the covenants and other terms of the DOE

loan facility; competition from existing and new competitors;

EVgo’s ability to expand into new service markets, grow its

customer base and manage its operations; the risks associated with

cyclical demand for EVgo’s services and vulnerability to industry

downturns and regional or national downturns; fluctuations in

EVgo’s revenue and operating results; EVgo’s ability to satisfy the

required conditions, enter into definitive agreements and receive

loan funding in connection with, and to realize any anticipated

benefits and growth from, the DOE loan facility; unfavorable

conditions or disruptions in the capital and credit markets and

EVgo’s ability to obtain additional financing on commercially

reasonable terms; EVgo’s ability to generate cash, service

indebtedness and incur additional indebtedness; any current,

pending or future legislation, regulations or policies that could

impact EVgo’s business, results of operations and financial

condition, including regulations impacting the EV charging market

and government programs designed to drive broader adoption of EVs

and any reduction, modification or elimination of such programs due

to the results of the 2024 Presidential and Congressional

elections; EVgo’s ability to adapt its assets and infrastructure to

changes in industry and regulatory standards and market demands

related to EV charging; impediments to EVgo’s expansion plans,

including permitting and utility-related delays; EVgo’s ability to

integrate any businesses it acquires; EVgo’s ability to recruit and

retain experienced personnel; risks related to legal proceedings or

claims, including liability claims; EVgo’s dependence on third

parties, including hardware and software vendors and service

providers, utilities and permit-granting entities; supply chain

disruptions, inflation and other increases in expenses; safety and

environmental requirements or regulations that may subject EVgo to

unanticipated liabilities or costs; EVgo’s ability to enter into

and maintain valuable partnerships with commercial or public-entity

property owners, landlords and/or tenants (collectively “Site

Hosts”), original equipment manufacturers (“OEMs”), fleet operators

and suppliers; EVgo’s ability to maintain, protect and enhance

EVgo’s intellectual property; and general economic or political

conditions, including the conflicts in Ukraine, Israel and the

broader Middle East region, and elevated rates of inflation and

associated changes in monetary policy. The forward-looking

statements contained in this report are also subject to other risks

and uncertainties, including those more fully described herein and

in the Company’s filings with the Securities and Exchange

Commission, including the Company’s annual report on Form 10-K for

the fiscal year ended December 31, 2023, the Company’s quarterly

reports on Form 10-Q for the quarterly periods ended March 31,

2024, June 30, 2024 and September 30, 2024 and current reports on

Form 8-K. The forward-looking statements in this report are based

on information available to the Company as of the date hereof, and

the Company disclaims any obligation to update any forward-looking

statements, except as required by law.

1 Source: JD Power’s Future Vehicle Calendar (April 2024) 2

Source: EV Volumes, 2024 US EV sales 3

https://www.coxautoinc.com/market-insights/q3-2024-ev-sales/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212262441/en/

EVgo Contacts For Investors:

investors@evgo.com

For Media: press@evgo.com

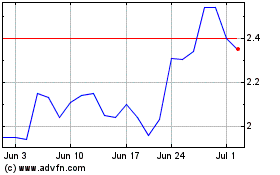

EVgo (NASDAQ:EVGO)

Historical Stock Chart

From Dec 2024 to Jan 2025

EVgo (NASDAQ:EVGO)

Historical Stock Chart

From Jan 2024 to Jan 2025