Everbridge, Inc. (Nasdaq: EVBG), the global leader in critical

event management (CEM) and national public warning solutions, today

announced its financial results for the first quarter ended March

31, 2024. Revenue for the first quarter was up 3% year-over-year to

$111.4 million, and GAAP net loss was $(20.1) million, compared to

$(14.6) million for the first quarter of 2023.

First Quarter 2024 Financial Highlights

- Total revenue was $111.4 million, an increase of 3% compared to

$108.3 million for the first quarter of 2023. Revenue from

subscription services was $105.3 million, an increase of 7%

compared to $98.8 million for the first quarter of 2023. Revenue

from professional services, software licenses and other was $6.1

million, a decrease of 36% compared to $9.5 million for the first

quarter of 2023.

- GAAP operating loss was $(14.9) million, compared to $(15.4)

million for the first quarter of 2023.

- Non-GAAP operating income was $8.2 million, compared to $10.1

million for the first quarter of 2023.

- GAAP net loss was $(20.1) million, compared to $(14.6) million

for the first quarter of 2023. GAAP diluted net loss per share was

$(0.49) based on 41.3 million diluted weighted average common

shares outstanding, compared to $(0.36) for the first quarter of

2023, based on 40.3 million diluted weighted average common shares

outstanding.

- Non-GAAP net income was $8.0 million, compared to $10.8 million

for the first quarter of 2023. Non-GAAP diluted net income per

share was $0.18, based on 43.8 million diluted weighted average

common shares outstanding, compared to $0.25 for the first quarter

of 2023, based on 43.8 million diluted weighted average common

shares outstanding.

- Adjusted EBITDA was $13.7 million, compared to $15.9 million

for the first quarter of 2023.

- Cash flow from operations was an inflow of $2.1 million,

compared to $20.6 million for the first quarter of 2023.

- Adjusted for one-time cash payments related to our 2022

Strategic Realignment program, adjusted free cash flow was an

inflow of $1.9 million, compared to $20.0 million for the first

quarter of 2023.

- Annualized Recurring Revenue (ARR) was $416 million, and 26 CEM

customers were added during the quarter.

- Deal metrics: 37 deals over $100,000; 6 deals over

$500,000.

About Everbridge

Everbridge (Nasdaq: EVBG) empowers enterprises and government

organizations to anticipate, mitigate, respond to, and recover

stronger from critical events. In today’s unpredictable world,

resilient organizations minimize impact to people and operations,

absorb stress, and return to productivity faster when deploying

critical event management (CEM) technology. Everbridge digitizes

organizational resilience by combining intelligent automation with

the industry’s most comprehensive risk data to Keep People Safe and

Organizations Running™. For more information, visit

https://www.everbridge.com/, read the company blog, and follow on

LinkedIn. Everbridge… Empowering Resilience.

Key Performance Metric

Annualized Recurring Revenue (ARR) is defined as the expected

recurring revenue in the next twelve months from active customer

contracts, assuming no increases or reductions in the subscriptions

from that cohort of customers. Investors should not place undue

reliance on ARR as an indicator of future or expected results. Our

presentation of this metric may differ from similarly titled

metrics presented by other companies and therefore comparability

may be limited.

Non-GAAP Financial Measures

This press release contains the following non-GAAP financial

measures: non-GAAP gross profit, non-GAAP gross margin, non-GAAP

operating income/(loss), non-GAAP net income/(loss), non-GAAP net

income/(loss) per share, EBITDA, adjusted EBITDA, free cash flow,

adjusted free cash flow and adjusted EBITDA margin.

Non-GAAP operating income excludes amortization of acquired

intangible assets, stock-based compensation and costs related to

the 2022 Strategic Realignment. Non-GAAP net income excludes

amortization of acquired intangible assets, stock-based

compensation, costs related to the 2022 Strategic Realignment,

accretion of interest on convertible senior notes and the tax

impact of such adjustments. EBITDA represents net loss before

interest income and interest expense, income tax expense and

benefit and depreciation and amortization expense. Adjusted EBITDA

represents EBITDA as further adjusted for stock-based compensation

expense and costs related to the 2022 Strategic Realignment. Free

cash flow represents cash provided by operating activities minus

cash used for capital expenditures and capitalized software

development costs. Adjusted free cash flow represents free cash

flow as further adjusted for cash payments for the 2022 Strategic

Realignment.

We believe that these non-GAAP measures of financial results

provide useful information to management and investors regarding

certain financial and business trends relating to Everbridge's

financial condition and results of operations. We use these

non-GAAP measures for financial, operational and budgetary

decision-making purposes, to understand and evaluate our core

operating performance and trends, and to generate future operating

plans. We believe that these non-GAAP financial measures provide

useful information regarding past financial performance and future

prospects, and permit us to more thoroughly analyze key financial

metrics used to make operational decisions. We believe that the use

of these non-GAAP financial measures provides an additional tool

for investors to use in evaluating ongoing operating results and

trends and in comparing our financial measures with other software

companies, many of which present similar non-GAAP financial

measures to investors.

We do not consider these non-GAAP measures in isolation or as an

alternative to financial measures determined in accordance with

GAAP. The principal limitation of these non-GAAP financial measures

is that they exclude significant expenses and income that are

required by GAAP to be recorded in the Company's financial

statements. In addition, they are subject to inherent limitations

as they reflect the exercise of judgment by management about which

expenses and income are excluded or included in determining these

non-GAAP financial measures. In order to compensate for these

limitations, management presents non-GAAP financial measures in

connection with GAAP results. We urge investors to review the

reconciliation of our non-GAAP financial measures to the comparable

GAAP financial measures, which are included in this press release,

and not to rely on any single financial measure to evaluate our

business.

Cautionary Language Concerning Forward-Looking

Statements

This press release may contain “forward-looking statements”

within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are made as of the date of this press release and were

based on current expectations, estimates, forecasts and projections

as well as the beliefs and assumptions of management. Words such as

“expect,” “anticipate,” “should,” “believe,” “target,” “project,”

“goals,” “estimate,” “potential,” “predict,” “may,” “will,”

“could,” “intend,” variations of these terms or the negative of

these terms and similar expressions are intended to identify these

forward-looking statements. Forward-looking statements are subject

to a number of risks and uncertainties, many of which involve

factors or circumstances that are beyond our control. Our actual

results could differ materially from those stated or implied in

forward-looking statements due to a number of factors, including

but not limited to: our proposed acquisition by entities affiliated

with Thoma Bravo, L.P. (“Thoma Bravo”); our expectation regarding

the timing and completion of the proposed acquisition by entities

affiliated with Thoma Bravo; the effect of recent changes in our

senior management team on our business; our ability to maintain

effective internal control over financial reporting and disclosure

controls and procedures, including our ability to remediate the

material weakness in internal control over financial reporting in

the anticipated timeframe, if at all; the ability of our products

and services to perform as intended and meet our customers’

expectations; our ability to successfully integrate businesses and

assets that we may acquire; our ability to attract new customers

and retain and increase sales to existing customers; our ability to

increase sales of our Mass Notification application and/or ability

to increase sales of our other applications; developments in the

market for targeted and contextually relevant critical

communications or the associated regulatory environment; our

estimates of market opportunity and forecasts of market growth may

prove to be inaccurate; we have not been profitable on a consistent

basis historically and may not achieve or maintain profitability in

the future; the lengthy and unpredictable sales cycles for new

customers; nature of our business exposes us to inherent liability

risks; our ability to attract, integrate and retain qualified

personnel; our ability to maintain successful relationships with

our channel partners and technology partners; our ability to manage

our growth effectively; our ability to respond to competitive

pressures; potential liability related to privacy and security of

personally identifiable information; our ability to protect our

intellectual property rights, and the other risks detailed in our

risk factors discussed in filings with the U.S. Securities and

Exchange Commission (SEC), including but not limited to, our Annual

Report on Form 10-K for the year ended December 31, 2023, which we

filed with the SEC on February 27, 2024 and other subsequent

filings with the SEC. The forward-looking statements included in

this press release represent our views as of the date of this press

release. We undertake no intention or obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. These forward-looking

statements should not be relied upon as representing our views as

of any date subsequent to the date of this press release.

All Everbridge products are trademarks of Everbridge, Inc. in

the USA and other countries. All other product or company names

mentioned are the property of their respective owners.

Consolidated Balance Sheets (in

thousands) (unaudited)

March 31,

December 31,

2024

2023

Current assets:

Cash and cash equivalents

$

121,432

$

122,440

Restricted cash

2,097

2,120

Accounts receivable, net

101,720

119,389

Prepaid expenses

13,826

12,880

Deferred costs and other current

assets

31,365

36,604

Total current assets

270,440

293,433

Property and equipment, net

7,369

8,305

Capitalized software development costs,

net

31,334

31,630

Goodwill

512,545

517,184

Intangible assets, net

120,809

130,264

Restricted cash

790

811

Prepaid expenses

1,053

902

Deferred costs and other assets

44,123

43,356

Total assets

$

988,463

$

1,025,885

Current liabilities:

Accounts payable

$

8,113

$

15,013

Accrued payroll and employee related

liabilities

30,987

32,824

Accrued expenses

18,003

36,346

Deferred revenue

248,511

242,789

Convertible senior notes, current

63,201

63,110

Other current liabilities

7,687

8,918

Total current liabilities

376,502

399,000

Long-term liabilities:

Deferred revenue, noncurrent

5,627

6,429

Convertible senior notes, noncurrent

296,989

296,561

Deferred tax liabilities

4,882

4,318

Other long-term liabilities

16,307

17,268

Total liabilities

700,307

723,576

Stockholders' equity:

Common stock

42

41

Additional paid-in capital

783,732

771,779

Accumulated deficit

(469,497

)

(449,429

)

Accumulated other comprehensive loss

(26,121

)

(20,082

)

Total stockholders' equity

288,156

302,309

Total liabilities and stockholders'

equity

$

988,463

$

1,025,885

Consolidated Statements of Operations

and Comprehensive Loss (in thousands, except share and per

share data) (unaudited)

Three Months Ended

March 31,

2024

2023

Revenue

$

111,429

$

108,268

Cost of revenue

32,444

31,981

Gross profit

78,985

76,287

Gross margin

70.88

%

70.46

%

Operating expenses:

Sales and marketing

37,118

42,188

Research and development

22,848

25,004

General and administrative

31,541

24,466

Restructuring

2,344

21

Total operating expenses

93,851

91,679

Operating loss

(14,866

)

(15,392

)

Other income, net

Interest and investment income

1,084

1,737

Interest expense

(539

)

(769

)

Other income (expense), net

(396

)

618

Total other income, net

149

1,586

Loss before income taxes

(14,717

)

(13,806

)

Provision for income taxes

(5,351

)

(842

)

Net loss

$

(20,068

)

$

(14,648

)

Net loss per share attributable to common

stockholders:

Basic

$

(0.49

)

$

(0.36

)

Diluted

$

(0.49

)

$

(0.36

)

Weighted-average common shares

outstanding:

Basic

41,330,475

40,274,069

Diluted

41,330,475

40,274,069

Other comprehensive income (loss):

Foreign currency translation

adjustment

(6,039

)

2,426

Total comprehensive loss

$

(26,107

)

$

(12,222

)

Stock-based compensation expense included

in the above:

(in thousands)

Three Months Ended

March 31,

2024

2023

Cost of revenue

$

1,287

$

1,655

Sales and marketing

4,067

4,747

Research and development

2,639

3,726

General and administrative

3,419

3,321

Total stock-based compensation

$

11,412

$

13,449

Consolidated Statements of Cash

Flows (in thousands) (unaudited)

Three Months Ended

March 31,

2024

2023

Cash flows from operating activities:

Net loss

$

(20,068

)

$

(14,648

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

14,447

14,774

Amortization of deferred costs

4,860

4,514

Deferred income taxes

(35

)

(501

)

Accretion of interest on convertible

senior notes

519

715

(Gain) loss on disposal of assets

1

(352

)

Provision for credit losses and sales

reserve

441

1,635

Stock-based compensation

11,412

13,449

Changes in operating assets and

liabilities:

Accounts receivable

17,853

11,994

Prepaid expenses

(1,097

)

(2,465

)

Deferred costs

(4,621

)

(5,909

)

Other assets

3,000

(597

)

Accounts payable

(6,539

)

(1,732

)

Accrued payroll and employee related

liabilities

(1,837

)

(1,652

)

Accrued expenses

(18,343

)

(797

)

Deferred revenue

4,316

3,589

Other liabilities

(2,167

)

(1,442

)

Net cash provided by operating

activities

2,142

20,575

Cash flows from investing activities:

Capital expenditures

(247

)

(575

)

Proceeds from landlord reimbursement

2,006

—

Proceeds from sale of assets

13

4,289

Additions to capitalized software

development costs

(3,958

)

(4,112

)

Net cash used in investing activities

(2,186

)

(398

)

Cash flows from financing activities:

Payments associated with shares withheld

to settle employee tax withholding liability

(2,164

)

(1,866

)

Proceeds from employee stock purchase

plan

1,853

2,546

Proceeds from stock option exercises

53

1,263

Other

(18

)

(19

)

Net cash provided by (used in) financing

activities

(276

)

1,924

Effect of exchange rates on cash, cash

equivalents and restricted cash

(732

)

63

Net increase (decrease) in cash, cash

equivalents and restricted cash

(1,052

)

22,164

Cash, cash equivalents and restricted

cash—beginning of period

125,371

201,594

Cash, cash equivalents and restricted

cash—end of period

$

124,319

$

223,758

Reconciliation of GAAP measures to

non-GAAP measures (unaudited)

The following table reconciles our GAAP

gross profit to non-GAAP gross profit (in thousands):

Three Months Ended

March 31,

2024

2023

Gross profit

$

78,985

$

76,287

Amortization of acquired intangibles

1,521

2,385

Stock-based compensation

1,287

1,655

2022 Strategic Realignment

65

341

Non-GAAP gross profit

$

81,858

$

80,668

The following table reconciles our GAAP

gross margin to non-GAAP gross margin(1):

Three Months Ended

March 31,

2024

2023

Gross margin

70.9

%

70.5

%

Amortization of acquired intangibles

margin

1.4

%

2.2

%

Stock-based compensation margin

1.2

%

1.5

%

2022 Strategic Realignment margin

0.1

%

0.3

%

Non-GAAP gross margin

73.5

%

74.5

%

(1) Columns may not add up due to

rounding.

The following table reconciles our GAAP

operating loss to non-GAAP operating income (in thousands):

Three Months Ended

March 31,

2024

2023

Operating loss

$

(14,866

)

$

(15,392

)

Amortization of acquired intangibles

8,583

9,648

Stock-based compensation

11,412

13,449

2022 Strategic Realignment

3,083

2,405

Non-GAAP operating income

$

8,212

$

10,110

The following table reconciles our GAAP

net loss to non-GAAP net income:

Three Months Ended

March 31,

2024

2023

Net loss

$

(20,068

)

$

(14,648

)

Amortization of acquired intangibles

8,583

9,648

Stock-based compensation

11,412

13,449

2022 Strategic Realignment

3,083

2,404

Accretion of interest on convertible

senior notes

519

715

Income tax adjustments

4,444

(737

)

Non-GAAP net income

$

7,973

$

10,831

Reconciliation of GAAP measures to

non-GAAP measures (Continued) (unaudited) The following table

reconciles our GAAP net loss per basic share to non-GAAP net income

per basic share(1):

Three Months Ended

March 31,

2024

2023

Net loss per basic share⁽ᵃ⁾

$

(0.49

)

$

(0.36

)

Amortization of acquired intangibles per

basic share⁽ᵇ⁾

0.21

0.24

Stock-based compensation per basic

share⁽ᵇ⁾

0.28

0.33

2022 Strategic Realignment per basic

share⁽ᵇ⁾

0.07

0.06

Accretion of interest on convertible

senior notes per basic share⁽ᵇ⁾

0.01

0.02

Income tax adjustments per basic

share⁽ᵇ⁾

0.11

(0.02

)

Non-GAAP net income per basic share⁽ᵇ⁾

$

0.19

$

0.27

(1) Amounts may not add up due to

rounding.

The following table reconciles our GAAP

net loss per diluted share to non-GAAP net income per diluted

share(1):

Three Months Ended

March 31,

2024

2023

Net loss per diluted share⁽ᵃ⁾

$

(0.49

)

$

(0.36

)

Amortization of acquired intangibles per

diluted share⁽ᵇ⁾

0.20

0.22

Stock-based compensation per diluted

share⁽ᵇ⁾

0.26

0.31

2022 Strategic Realignment per diluted

share⁽ᵇ⁾

0.07

0.05

Accretion of interest on convertible

senior notes per diluted share⁽ᵇ⁾

0.01

0.02

Income tax adjustments per diluted

share⁽ᵇ⁾

0.10

(0.02

)

Non-GAAP net income per diluted

share⁽ᵇ⁾

$

0.18

$

0.25

(1) Amounts may not add up due to

differences in GAAP and non-GAAP net income (loss) and diluted

shares.

(a) GAAP weighted-average common shares

outstanding:

Basic

41,330,475

40,274,069

Diluted

41,330,475

40,274,069

(b) Non-GAAP weighted-average common

shares outstanding:

Basic

41,330,475

40,274,069

Diluted

43,792,612

43,767,021

GAAP diluted weighted-average shares

include dilutive potential common shares related to stock-based

compensation grants. Non-GAAP diluted weighted-average shares

include dilutive potential common shares related to convertible

notes and stock-based compensation grants.

Reconciliation of GAAP measures to

non-GAAP measures (Continued) (unaudited) The following tables

reconcile our GAAP net loss to EBITDA and adjusted EBITDA, net cash

provided by operating activities to free cash flow and adjusted

free cash flow and net loss margin to EBITDA margin and adjusted

EBITDA margin (dollars in thousands):

Three Months Ended

March 31,

2024

2023

Net loss

$

(20,068

)

$

(14,648

)

Interest and investment expense, net

(545

)

(968

)

Provision for income taxes

5,351

842

Depreciation and amortization

14,447

14,774

EBITDA

(815

)

—

Stock-based compensation

11,412

13,449

2022 Strategic Realignment

3,083

2,404

Adjusted EBITDA

$

13,680

$

15,853

Net cash provided by operating

activities

$

2,142

$

20,575

Capital expenditures

(247

)

(575

)

Capitalized software development costs

(3,958

)

(4,112

)

Free cash flow

(2,063

)

15,888

Cash payments for 2022 Strategic

Realignment

3,923

4,121

Adjusted free cash flow

$

1,860

$

20,009

Net loss margin

(18.0

)%

(13.5

)%

Interest and investment expense, net

margin

(0.5

)%

(0.9

)%

Provision for income taxes margin

4.8

%

0.8

%

Depreciation and amortization margin

13.0

%

13.6

%

EBITDA margin

(0.7

)%

—

Stock-based compensation margin

10.2

%

12.4

%

2022 Strategic Realignment margin

2.8

%

2.2

%

Adjusted EBITDA margin

12.3

%

14.6

%

(margin % columns may not add up due to

rounding)

Remaining Performance Obligations as of

March 31, 2024 (in millions)

Remaining Performance

Obligations

Remaining Performance

Obligations Next Twelve Months

Subscription and other contracts

$

488

$

302

Professional services contracts

10

9

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509270317/en/

Everbridge Contacts: Investors: Nandan Amladi

Investor Relations nandan.amladi@everbridge.com 617-665-7197

Media: Jeff Young Media Relations jeff.young@everbridge.com

781-859-4116

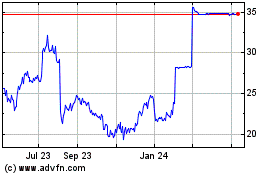

Everbridge (NASDAQ:EVBG)

Historical Stock Chart

From Oct 2024 to Nov 2024

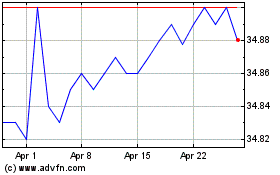

Everbridge (NASDAQ:EVBG)

Historical Stock Chart

From Nov 2023 to Nov 2024