0000922621false00009226212024-07-232024-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of Earliest Event Reported): | July 23, 2024 |

| | | | | | | | |

| ERIE INDEMNITY COMPANY | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | | | | | | | | | | | | | | |

| Pennsylvania | | 0-24000 | | 25-0466020 | |

| (State or other jurisdiction | | (Commission | | (IRS Employer | |

| of incorporation) | | File Number) | | Identification No.) | |

| | | | | | | | | | | | | | | | | | | | |

| 100 Erie Insurance Place, | Erie, | Pennsylvania | | 16530 | |

| (Address of principal executive offices) | | (Zip Code) | |

| | | | | | | | | | | | | | |

| Registrant’s telephone number, including area code: | 814 | 870-2000 | |

| | | | | | | | |

| Not applicable | |

| Former name or former address, if changed since last report | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Class A common stock, | stated value $0.0292 per share | | ERIE | | NASDAQ Stock Market, LLC |

| (Title of each class) | | (Trading Symbol) | | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 25, 2024, Erie Indemnity Company (the “Company”) issued a press release announcing financial results for the quarter and six months ended June 30, 2024. Copies of the press release and financial information are attached hereto and are incorporated herein by reference as Exhibit 99.1 and Exhibit 99.2, respectively.

On July 26, 2024 at 10:00 a.m. the Company will provide a pre-recorded Webcast that is complementary to the press release announcing financial results for the quarter and six months ended June 30, 2024.

Item 8.01 Other Events.

At its meeting on July 23, 2024, the Company's Board of Directors approved the following quarterly dividend on shares of Erie Indemnity Company Class A common stock:

Dividend Number: 377

Class A Rate Per Share: $1.275

Declaration Date: July 23, 2024

Ex-Dividend Date: October 7, 2024

Record Date: October 7, 2024

Payable Date: October 22, 2024

Item 9.01 Financial Statements and Exhibits.

Exhibit 99.1 Press Release

Exhibit 99.2 Financial Information

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

Exhibit Index

| | | | | | | | |

| | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | |

| | | Erie Indemnity Company |

| | | | | |

| July 25, 2024 | | By: | | /s/ Julie M. Pelkowski |

| | | | |

| | | | | Name: Julie M. Pelkowski |

| | | | | Title: Executive Vice President & CFO |

Erie Indemnity Reports Second Quarter 2024 Results

Net Income per Diluted Share was $3.13 for the Quarter and $5.52 for the Six Months of 2024

Erie, Pa., July 25, 2024 - Erie Indemnity Company (NASDAQ: ERIE) today announced financial results for the quarter and six months ending June 30, 2024. Net income was $163.9 million, or $3.13 per diluted share, in the second quarter of 2024, compared to $117.9 million, or $2.25 per diluted share, in the second quarter of 2023. Net income was $288.5 million, or $5.52 per diluted share, in the first six months of 2024, compared to $204.1 million, or $3.90 per diluted share, in the first six months of 2023.

| | | | | | | | | | | | | | | | | | | | |

| | |

| 2Q and First Half 2024 | | | | |

| | | | | | | | | |

| | | | | | | | |

| (in thousands) | 2Q'24 | 2Q'23 | | 1H'24 | 1H'23 | | | |

| Operating income | $ | 190,208 | | $ | 134,158 | | | | $ | 329,020 | | $ | 244,701 | | | | | |

| Investment income | 13,827 | | 11,627 | | | | 28,906 | | 6,895 | | | | | |

| Other income | 3,292 | | 3,305 | | | | 6,703 | | 6,642 | | | | | |

| Income before income taxes | 207,327 | | 149,090 | | | | 364,629 | | 258,238 | | | | | |

| Income tax expense | 43,424 | | 31,238 | | | | 76,174 | | 54,145 | | | | | |

| Net income | $ | 163,903 | | $ | 117,852 | | | | $ | 288,455 | | $ | 204,093 | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Operating income before taxes increased $56.1 million, or 41.8 percent, in the second quarter of 2024 compared to the second quarter of 2023.

•Management fee revenue - policy issuance and renewal services increased $127.5 million, or 20.1 percent, in the second quarter of 2024 compared to the second quarter of 2023.

•Management fee revenue - administrative services increased $1.4 million, or 9.0 percent, in the second quarter of 2024 compared to the second quarter of 2023.

•Cost of operations - policy issuance and renewal services

◦Commissions increased $68.8 million in the second quarter of 2024 compared to the second quarter of 2023, primarily driven by the growth in direct and affiliated assumed written premium and, to a lesser extent, an increase in agent incentive compensation related to profitable growth.

◦Non-commission expense increased $4.1 million in the second quarter of 2024 compared to the second quarter of 2023. Underwriting and policy processing expense increased $4.2 million primarily due to increased underwriting report and personnel costs. Information technology costs decreased $3.8 million primarily due to a decrease in professional fees and personnel costs. Customer service costs increased $2.0 million primarily due to increased personnel costs and credit card processing fees.

Income from investments before taxes totaled $13.8 million in the second quarter of 2024 compared to $11.6 million in the second quarter of 2023. Net investment income was $16.0 million in the second quarter of 2024 compared to $13.5 million in the second quarter of 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Half 2024 Highlights |

Operating income before taxes increased $84.3 million, or 34.5 percent, in the first six months of 2024 compared to the first six months of 2023.

•Management fee revenue - policy issuance and renewal services increased $235.1 million, or 19.7 percent, in the first six months of 2024 compared to the first six months of 2023.

•Management fee revenue - administrative services increased $3.2 million, or 10.3 percent, in the first six months of 2024 compared to the first six months of 2023.

•Cost of operations - policy issuance and renewal services

◦Commissions increased $135.8 million in the first six months of 2024 compared to the first six months of 2023, primarily driven by the growth in direct and affiliated assumed written premium and, to a lesser extent, an increase in agent incentive compensation related to profitable growth.

◦Non-commission expense increased $18.4 million in the first six months of 2024 compared to the first six months of 2023. Underwriting and policy processing expense increased $8.7 million primarily due to increased underwriting report and personnel costs. Information technology costs decreased $7.5 million primarily due to a decrease in professional fees and personnel costs largely driven by an increase in capitalized labor costs related to technology initiatives. Sales and advertising expense increased $5.2 million primarily due to increased agent-related and advertising costs. Customer service costs increased $4.0 million primarily due to increased personnel costs and credit card processing fees. Administrative and other costs increased $8.0 million primarily due to increased personnel costs, charitable contributions and professional fees.

Income from investments before taxes totaled $28.9 million in the first six months of 2024 compared to $6.9 million in the first six months of 2023. Net investment income was $31.9 million in the first six months of 2024 compared to $15.7 million in the first six months of 2023. Net investment income included $0.3 million of limited partnership earnings in the first six months of 2024 compared to losses of $10.7 million in the first six months of 2023. Net realized and unrealized gains were $0.1 million in the first six months of 2024 compared to losses of $7.0 million in the first six months of 2023.

Webcast Information

Indemnity has scheduled a pre-recorded audio broadcast on the Web for 10:00 AM ET on July 26, 2024. Investors may access the pre-recorded audio broadcast by logging on to www.erieinsurance.com.

Erie Insurance Group

According to A.M. Best Company, Erie Insurance Group, based in Erie, Pennsylvania, is the 12th largest homeowners insurer, 13th largest automobile insurer and 13th largest commercial lines insurer in the United States based on direct premiums written. Founded in 1925, Erie Insurance is a Fortune 500 company and the 17th largest property/casualty insurer in the United States based on total lines net premium written. Rated A+ (Superior) by A.M. Best, ERIE has more than 7 million policies in force and operates in 12 states and the District of Columbia.

News releases and more information are available on ERIE's website at www.erieinsurance.com.

***

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

Statements contained herein that are not historical fact are forward-looking statements and, as such, are subject to risks and uncertainties that could cause actual events and results to differ, perhaps materially, from those discussed herein. Forward-looking statements relate to future trends, events or results and include, without limitation, statements and assumptions on which such statements are based that are related to our plans, strategies, objectives, expectations, intentions, and adequacy of resources. Examples of forward-looking statements are discussions relating to premium and investment income, expenses, operating results, and compliance with contractual and regulatory requirements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Among the risks and uncertainties, in addition to those set forth in our filings with the Securities and Exchange Commission, that could cause actual results and future events to differ from those set forth or contemplated in the forward-looking statements include the following:

•dependence upon our relationship with the Erie Insurance Exchange ("Exchange") and the management fee under the agreement with the subscribers at the Exchange;

•dependence upon our relationship with the Exchange and the growth of the Exchange, including:

◦general business and economic conditions;

◦factors affecting insurance industry competition, including technological innovations;

◦dependence upon the independent agency system; and

◦ability to maintain our brand, including our reputation for customer service;

•dependence upon our relationship with the Exchange and the financial condition of the Exchange, including:

◦the Exchange's ability to maintain acceptable financial strength ratings;

◦factors affecting the quality and liquidity of the Exchange's investment portfolio;

◦changes in government regulation of the insurance industry;

◦litigation and regulatory actions;

◦emergence of significant unexpected events, including pandemics and economic or social inflation;

◦emerging claims and coverage issues in the industry; and

◦severe weather conditions or other catastrophic losses, including terrorism;

•costs of providing policy issuance and renewal services to the subscribers at the Exchange under the subscriber's agreement;

•ability to attract and retain talented management and employees;

•ability to ensure system availability and effectively manage technology initiatives;

•difficulties with technology or data security breaches, including cyber attacks;

•ability to maintain uninterrupted business operations;

•compliance with complex and evolving laws and regulations and outcome of pending and potential litigation;

•factors affecting the quality and liquidity of our investment portfolio; and

•ability to meet liquidity needs and access capital.

A forward-looking statement speaks only as of the date on which it is made and reflects our analysis only as of that date. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changes in assumptions, or otherwise.

Exhibit 99.2

Erie Indemnity Company

Statements of Operations

(dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (Unaudited) | | (Unaudited) |

| Operating revenue | | | | | | | | |

| Management fee revenue - policy issuance and renewal services | | $ | 760,886 | | | $ | 633,339 | | | $ | 1,426,572 | | | $ | 1,191,429 | |

| Management fee revenue - administrative services | | 17,051 | | | 15,636 | | | 33,985 | | | 30,825 | |

| Administrative services reimbursement revenue | | 206,028 | | | 184,466 | | | 397,595 | | | 357,293 | |

| Service agreement revenue | | 6,473 | | | 6,429 | | | 12,987 | | | 12,788 | |

| Total operating revenue | | 990,438 | | | 839,870 | | | 1,871,139 | | | 1,592,335 | |

| | | | | | | | |

| Operating expenses | | | | | | | | |

| Cost of operations - policy issuance and renewal services | | 594,202 | | | 521,246 | | | 1,144,524 | | | 990,341 | |

| Cost of operations - administrative services | | 206,028 | | | 184,466 | | | 397,595 | | | 357,293 | |

| | | | | | | | |

| Total operating expenses | | 800,230 | | | 705,712 | | | 1,542,119 | | | 1,347,634 | |

| Operating income | | 190,208 | | | 134,158 | | | 329,020 | | | 244,701 | |

| | | | | | | | |

| Investment income | | | | | | | | |

| Net investment income | | 16,010 | | | 13,535 | | | 31,913 | | | 15,718 | |

| Net realized and unrealized investment (losses) gains | | (1,795) | | | (1,737) | | | 58 | | | (7,019) | |

| Net impairment losses recognized in earnings | | (388) | | | (171) | | | (3,065) | | | (1,804) | |

| | | | | | | | |

| Total investment income | | 13,827 | | | 11,627 | | | 28,906 | | | 6,895 | |

| | | | | | | | |

| | | | | | | | |

| Other income | | 3,292 | | | 3,305 | | | 6,703 | | | 6,642 | |

| Income before income taxes | | 207,327 | | | 149,090 | | | 364,629 | | | 258,238 | |

| Income tax expense | | 43,424 | | | 31,238 | | | 76,174 | | | 54,145 | |

| Net income | | $ | 163,903 | | | $ | 117,852 | | | $ | 288,455 | | | $ | 204,093 | |

| | | | | | | | |

| | | | | | | | |

| Net income per share | | | | | | | | |

| Class A common stock – basic | | $ | 3.52 | | | $ | 2.53 | | | $ | 6.19 | | | $ | 4.38 | |

| Class A common stock – diluted | | $ | 3.13 | | | $ | 2.25 | | | $ | 5.52 | | | $ | 3.90 | |

| Class B common stock – basic and diluted | | $ | 528 | | | $ | 380 | | | $ | 929 | | | $ | 657 | |

| | | | | | | | |

| | | | | | | | |

| Weighted average shares outstanding – Basic | | | | | | | | |

| Class A common stock | | 46,189,042 | | | 46,189,026 | | | 46,189,028 | | | 46,188,923 | |

| Class B common stock | | 2,542 | | | 2,542 | | | 2,542 | | | 2,542 | |

| | | | | | | | |

| Weighted average shares outstanding – Diluted | | | | | | | | |

| Class A common stock | | 52,305,299 | | | 52,299,974 | | | 52,303,551 | | | 52,298,298 | |

| Class B common stock | | 2,542 | | | 2,542 | | | 2,542 | | | 2,542 | |

| | | | | | | | |

| Dividends declared per share | | | | | | | | |

| Class A common stock | | $ | 1.275 | | | $ | 1.19 | | | $ | 2.55 | | | $ | 2.38 | |

| Class B common stock | | $ | 191.25 | | | $ | 178.50 | | | $ | 382.50 | | | $ | 357.00 | |

Erie Indemnity Company

Statements of Financial Position

(in thousands)

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31, 2023 |

| | (Unaudited) | | |

| Assets | | | | |

| Current assets: | | | | |

Cash and cash equivalents (includes restricted cash of $14,027 and $12,542, respectively) | | $ | 170,634 | | | $ | 144,055 | |

| Available-for-sale securities | | 47,734 | | | 82,017 | |

| | | | |

| Receivables from Erie Insurance Exchange and affiliates, net | | 708,171 | | | 625,338 | |

| Prepaid expenses and other current assets | | 83,529 | | | 69,321 | |

| | | | |

| Accrued investment income | | 10,204 | | | 9,458 | |

| Total current assets | | 1,020,272 | | | 930,189 | |

| | | | |

| Available-for-sale securities, net | | 946,525 | | | 879,224 | |

| Available-for-sale securities lent | | 6,125 | | | 0 | |

| Equity securities | | 80,128 | | | 84,253 | |

| | | | |

| Fixed assets, net | | 469,145 | | | 442,610 | |

| Agent loans, net | | 56,813 | | | 58,434 | |

| | | | |

| Defined benefit pension plan | | 65,221 | | | 34,320 | |

| Other assets, net | | 47,731 | | | 42,934 | |

| Total assets | | $ | 2,691,960 | | | $ | 2,471,964 | |

| | | | |

| Liabilities and shareholders' equity | | | | |

| Current liabilities: | | | | |

| Commissions payable | | $ | 413,205 | | | $ | 353,709 | |

| Agent incentive compensation | | 44,870 | | | 68,077 | |

| Accounts payable and accrued liabilities | | 198,689 | | | 175,622 | |

| Dividends payable | | 59,377 | | | 59,377 | |

| Contract liability | | 41,570 | | | 41,210 | |

| Deferred executive compensation | | 8,216 | | | 10,982 | |

| | | | |

| | | | |

| | | | |

| Securities lending payable | | 6,345 | | | 0 | |

| Total current liabilities | | 772,272 | | | 708,977 | |

| | | | |

| Defined benefit pension plan | | 26,591 | | | 26,260 | |

| | | | |

| Contract liability | | 20,645 | | | 19,910 | |

| Deferred executive compensation | | 16,341 | | | 20,936 | |

| Deferred income taxes, net | | 5,192 | | | 11,481 | |

| Other long-term liabilities | | 22,106 | | | 21,565 | |

| Total liabilities | | 863,147 | | | 809,129 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Shareholders’ equity | | 1,828,813 | | | 1,662,835 | |

| Total liabilities and shareholders’ equity | | $ | 2,691,960 | | | $ | 2,471,964 | |

Document and Entity Information

|

Jul. 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 23, 2024

|

| Entity Registrant Name |

ERIE INDEMNITY COMPANY

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity File Number |

0-24000

|

| Entity Tax Identification Number |

25-0466020

|

| Entity Address, Address Line One |

100 Erie Insurance Place,

|

| Entity Address, City or Town |

Erie,

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

16530

|

| City Area Code |

814

|

| Local Phone Number |

870-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock,

|

| Trading Symbol |

ERIE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000922621

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

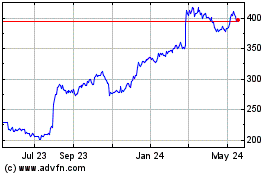

Erie Indemnity (NASDAQ:ERIE)

Historical Stock Chart

From Oct 2024 to Nov 2024

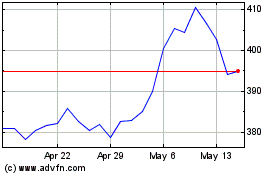

Erie Indemnity (NASDAQ:ERIE)

Historical Stock Chart

From Nov 2023 to Nov 2024