false

0001575793

0001575793

2024-11-12

2024-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 12, 2024

ENERGOUS CORPORATION

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36379 |

|

46-1318953 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

3590

North First Street, Suite

210

San Jose, California 95134

(Address, including zip code, of principal executive

offices)

Registrant’s telephone number, including

area code: (408) 963-0200

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each

class registered |

|

Trading symbol(s) |

|

Name of each

exchange on which registered |

| Common Stock, par value $0.00001 per share |

|

WATT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. |

Results of Operations and Financial Condition. |

On November 12, 2024, Energous Corporation (d/b/a Energous Wireless

Power Solutions) issued a press release announcing its financial results for the three months ended September 30, 2024. A copy of the

press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and Exhibit 99.1 attached hereto

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ENERGOUS CORPORATION |

| |

|

|

| Date: November 12, 2024 |

By: |

/s/ Mallorie Burak |

| |

Name: |

Mallorie Burak |

| |

Title: |

Chief Executive Officer and Chief Financial Officer (Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer) |

Exhibit 99.1

Energous Wireless Power Solutions Reports

2024 Third Quarter Results

SAN JOSE, Calif. – November 12, 2024 – Energous

Corporation d/b/a Energous Wireless Power Solutions (NASDAQ: WATT), a pioneer in scalable, over-the-air (OTA) wireless power networks,

today announced financial results for the three months ended September 30, 2024, and provided an update on recent partnerships and company

highlights.

Third Quarter 2024 Financial Results

| |

· |

Revenue for the three months ended September 30, 2024 of $230 thousand versus approximately $169 thousand in the same 2023 period, representing a 36% increase year over year. |

| · | Costs and expenses for the three months ended September 30, 2024 totaled

$3.8 million versus $5.3 million in the same 2023 period. Total third quarter 2024 GAAP costs and expenses consisted of approximately

$0.3 million in cost of revenue, $1.7 million in research and development (R&D) expenses, $1.7 million in sales, marketing, general

and administrative (SG&A) expenses, and approximately $0.1 million in severance expenses. |

| |

· |

Non-GAAP costs and expenses for the three months ended September 30, 2024 were $3.5 million, decreasing from $4.6 million for the same 2023 period, representing a reduction of approximately $1.0 million, or 22%, year over year. |

| · | Continued operational cost reductions and increased commercial revenue yielded

improved year over year net loss and loss per share of approximately $(3.4) million, or $(0.50) per basic and diluted share for the three

months ended September 30, 2024, versus a net loss of approximately $(4.1) million, or $(0.86) per basic and diluted share, for the same

2023 period. |

| · | Non-GAAP net loss of approximately $(3.3) million for the three months ended

September 30, 2024 versus non-GAAP net loss of approximately ($4.2) million for the same 2023 period, representing a 22% improvement year

over year. |

| |

· |

Approximately $1.5 million in cash and cash equivalents as of September 30, 2024. |

See “Non-GAAP Financial Measures” below for additional

information.

Company Highlights

| · | As

of November 8, 2024, the Company had $0.2 million in backlog, representing confirmed new and

follow-on PowerBridge transmitter system orders from large retail customers, as well as engineering

services. This backlog signifies growing market adoption of Energous wireless power solutions.

|

| · | The third quarter of 2024 represented the highest quarter for commercial

PowerBridge transmitter system shipments since introducing the product to the market in the fourth quarter of 2021. |

| · | In addition to transitioning a portion of active Proof of Concept (POCs)

trials as of the end of the second quarter of 2024 to commercial deployments, the Company increased its active POCs from 47 to 56 as of

October 31, 2024, representing a 19% increase and demonstrating increased interest in deploying the technology across a myriad of use

cases. |

| · | The Company received multiple orders for its PowerBridge transmitters from

a Fortune 10 multinational retail organization. The retailer will use 2W PowerBridge transmitters for improved grocery and store supply

chain visibility and control and will use 1W PowerBridge transmitters to help improve transportation efficiency. |

| o | https://energous.com/company/newsroom/news/energous-receives-multiple-orders-from-multinational-retailer-for-grocery-distribution |

| o | https://energous.com/company/newsroom/news/energous-powerbridge-transmitters-to-help-improve-transportation-efficiency-for-multinational-retailer/ |

| · | The 2W PowerBridge transmitter received full Federal Communications Commission

(FCC) certification, making it the industry’s first certified transmitter available at this power level. |

o https://energous.com/company/newsroom/news/energous-2w-powerbridge-transmitter-receives-full-fcc-certification/

| · | Energous shipped the first orders of its 2W PowerBridge transmitters to a

Fortune 100 technology company. The transmitters will be used for reverse logistics processes at the company’s distribution centers.

|

o https://energous.com/company/newsroom/news/energous-ships-first-orders-to-multinational-technology-company-for-reverse-logistics/

| · | The 2W PowerBridge transmitter system won a Mobile Breakthrough Award for

“IoT Innovation of the Year”. |

| o | https://energous.com/company/newsroom/news/energous-wins-mobile-breakthrough-award-for-iot-innovation/ |

| | · | Energous was engaged by a global leader in RFID-based source-to-shopper

solutions to develop a battery-free smart tag designed to enhance visibility and asset tracking for retail IoT applications. |

| | o | https://energous.com/company/newsroom/news/energous-to-develop-battery-free-smart-tag-for-global-rfid-leader

|

“As we

push the boundaries of wireless power to create a world where battery-free devices are always connected and real-time data is always accessible,

we continue to focus on three key initiatives: gaining traction with significant commercial accounts, demonstrating the value of our wireless

power network solutions to businesses, and optimizing our operations,” said Mallorie Burak, CEO and CFO, Energous Wireless Power

Solutions. “Progress is being made on all fronts, as we carefully balance continued reductions in infrastructure costs with strategic

investments in scalable growth. The third quarter sales momentum and increased interest in our WPN technology represents a solid step

forward for the Company as we chart the path to profitability.”

About Energous Wireless Power Solutions

Energous

Corporation d/b/a Energous Wireless Power Solutions (NASDAQ: WATT) is pioneering scalable, over-the-air

(OTA) wireless power networks that enable unprecedented levels of visibility, control, and intelligent business automation. The Company’s

wireless power transmitter and receiver technologies deliver continuous access to wireless power, helping drive a new generation of battery-free

devices for asset and inventory tracking and management—from retail sensors, electronic shelf labels, and asset trackers, to air

quality monitors, motion detectors, and more. For more information, visit http://www.energous.com/

or follow on LinkedIn.

Forward-Looking Statements

This press release contains “forward-looking statements”

within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this press

release are forward-looking statements. Forward-looking statements may describe our future plans and expectations and are based on the

current beliefs, expectations and assumptions of Energous. These statements generally use terms such as “believe,” “expect,”

“may,” “will,” “should,” “could,” “seek,” “intend,” “plan,”

“estimate,” “anticipate” or similar terms. Examples of forward-looking statements in this release include but

are not limited to statements about our financial results and projections, statements about the success of our collaborations with our

partners, statements about any governmental approvals we may need to operate our business, statements about our technology and its expected

functionality, and statements with respect to expected company growth. Factors that could cause actual results to differ from current

expectations include: uncertain timing of necessary regulatory approvals; timing of customer product development and market success of

customer products; our dependence on distribution partners; and intense industry competition. We urge you to consider those factors, and

the other risks and uncertainties described in our most recent annual report on Form 10-K as filed with the Securities and Exchange Commission

(SEC), any subsequently filed quarterly reports on Form 10-Q as well as in other documents that may have been subsequently filed by Energous,

from time to time, with the SEC, in evaluating our forward-looking statements. In addition, any forward-looking statements represent Energous’

views only as of the date of this release and should not be relied upon as representing its views as of any subsequent date. Energous

does not assume any obligation to update any forward-looking statements unless required by law.

Non-GAAP Financial Measures

We have provided in this release financial information that has not

been prepared in accordance with accounting standards generally accepted in the United States of America (GAAP). We use non-GAAP financial

measures internally in analyzing our financial results and believe they are useful to investors, as a supplement to GAAP measures, in

evaluating our ongoing operational performance. We believe that the use of these non-GAAP financial measures provides an additional tool

for investors to use in evaluating ongoing operating results and trends, and in comparing our financial results with other companies in

our industry, many of which present similar non-GAAP financial measures to investors.

Non-GAAP financial measures should not be considered in isolation from,

or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation

of these non-GAAP financial measures to their most directly comparable GAAP financial measures below.

Our reported results include certain non-GAAP financial measures, including

non-GAAP net loss, non-GAAP costs and expenses, non-GAAP sales, marketing, general and administrative expenses (SG&A) and non-GAAP

research and development expenses (R&D). Non-GAAP net loss excludes depreciation and amortization, stock-based compensation expense,

severance expense, offering costs related to warrant liability and change in fair value of warrant liability. Non-GAAP costs and expenses

excludes depreciation and amortization, stock-based compensation expense and severance expense. Non-GAAP SG&A excludes depreciation

and amortization and stock-based compensation expense. Non-GAAP R&D excludes depreciation and amortization and stock-based compensation

expense. A reconciliation of our non-GAAP financial measures to their most directly comparable GAAP measures has been provided in the

financial statement tables included below in this press release.

Energous Corporation

BALANCE SHEETS

(Unaudited)

(in thousands)

| | |

As of | |

| | |

September 30, 2024 | | |

December 31, 2023 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,451 | | |

$ | 13,876 | |

| Restricted cash | |

| - | | |

| 60 | |

| Accounts receivable, net | |

| 152 | | |

| 102 | |

| Inventory | |

| 737 | | |

| 430 | |

| Prepaid expenses and other current assets | |

| 511 | | |

| 539 | |

| Total current assets | |

| 2,851 | | |

| 15,007 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 404 | | |

| 429 | |

| Right-of-use lease asset | |

| 695 | | |

| 1,240 | |

| Total assets | |

$ | 3,950 | | |

$ | 16,676 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,538 | | |

$ | 1,879 | |

| Accrued expenses | |

| 956 | | |

| 1,254 | |

| Accrued severance | |

| 37 | | |

| 134 | |

| Warrant liability | |

| 207 | | |

| 620 | |

| Operating lease liabilities, current portion | |

| 767 | | |

| 707 | |

| Deferred revenue | |

| 11 | | |

| 27 | |

| Total current liabilities | |

| 3,516 | | |

| 4,621 | |

| | |

| | | |

| | |

| Operating lease liabilities, long-term portion | |

| - | | |

| 557 | |

| Total liabilities | |

| 3,516 | | |

| 5,178 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock | |

| - | | |

| - | |

| Common stock | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 396,744 | | |

| 393,539 | |

| Accumulated deficit | |

| (396,311 | ) | |

| (382,042 | ) |

| Total stockholders’ equity | |

| 434 | | |

| 11,498 | |

| Total liabilities and stockholders’ equity | |

$ | 3,950 | | |

$ | 16,676 | |

Energous Corporation

STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except share and per share amounts)

| | |

For the Three Months Ended September 30, | | |

For the Nine Months Ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 230 | | |

$ | 169 | | |

$ | 340 | | |

$ | 383 | |

| | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 306 | | |

| 48 | | |

| 537 | | |

| 270 | |

| Research and development | |

| 1,701 | | |

| 2,460 | | |

| 6,489 | | |

| 8,419 | |

| Sales and marketing | |

| 699 | | |

| 774 | | |

| 2,391 | | |

| 3,074 | |

| General and administrative | |

| 1,022 | | |

| 1,699 | | |

| 4,443 | | |

| 5,764 | |

| Severance expense | |

| 83 | | |

| 269 | | |

| 1,377 | | |

| 359 | |

| Total costs and expenses | |

| 3,811 | | |

| 5,250 | | |

| 15,237 | | |

| 17,886 | |

| Loss from operations | |

| (3,581 | ) | |

| (5,081 | ) | |

| (14,897 | ) | |

| (17,503 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense), net: | |

| | | |

| | | |

| | | |

| | |

| Offering costs related to warrant liability | |

| - | | |

| - | | |

| - | | |

| (592 | ) |

| Change in fair value of warrant liability | |

| 159 | | |

| 788 | | |

| 413 | | |

| 2,685 | |

| Interest income | |

| 10 | | |

| 179 | | |

| 215 | | |

| 648 | |

| Total other income (expense), net | |

| 169 | | |

| 967 | | |

| 628 | | |

| 2,741 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (3,412 | ) | |

$ | (4,114 | ) | |

$ | (14,269 | ) | |

$ | (14,762 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss per common share | |

$ | (0.50 | ) | |

$ | (0.86 | ) | |

$ | (2.21 | ) | |

$ | (3.30 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding, basic and diluted | |

| 6,834,170 | | |

| 4,762,187 | | |

| 6,446,274 | | |

| 4,467,436 | |

Energous Corporation

Reconciliation of Non-GAAP Information

(Unaudited)

(in thousands)

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss (GAAP) |

|

$ |

(3,412 |

) |

|

$ |

(4,114 |

) |

|

$ |

(14,269 |

) |

|

$ |

(14,762 |

) |

| Add (subtract) the following items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

50 |

|

|

|

47 |

|

|

|

148 |

|

|

|

138 |

|

| Stock-based compensation expense * |

|

|

129 |

|

|

|

369 |

|

|

|

676 |

|

|

|

1,395 |

|

| Severance expense |

|

|

83 |

|

|

|

269 |

|

|

|

1,377 |

|

|

|

359 |

|

| Offering costs related to warrant liability |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

592 |

|

| Change in fair value of warrant liability |

|

|

(159 |

) |

|

|

(788 |

) |

|

|

(413 |

) |

|

|

(2,685 |

) |

| Non-GAAP net loss |

|

$ |

(3,309 |

) |

|

$ |

(4,217 |

) |

|

$ |

(12,481 |

) |

|

$ |

(14,963 |

) |

* Stock-based compensation expense excludes $130 which is included

in severance expense for the nine months ended September 30, 2024.

| Total costs and expenses (GAAP) | |

$ | 3,811 | | |

$ | 5,250 | | |

$ | 15,237 | | |

$ | 17,886 | |

| Subtract the following items: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| (50 | ) | |

| (47 | ) | |

| (148 | ) | |

| (138 | ) |

| Stock-based compensation expense * | |

| (129 | ) | |

| (369 | ) | |

| (676 | ) | |

| (1,395 | ) |

| Severance expense | |

| (83 | ) | |

| (269 | ) | |

| (1,377 | ) | |

| (359 | ) |

| Non-GAAP costs and expenses | |

$ | 3,549 | | |

$ | 4,565 | | |

$ | 13,036 | | |

$ | 15,994 | |

* Stock-based compensation expense excludes $130 which is included

in severance expense for the nine months ended September 30, 2024.

| Total research and development expenses (GAAP) |

|

$ |

1,701 |

|

|

$ |

2,460 |

|

|

$ |

6,489 |

|

|

$ |

8,419 |

|

| Subtract the following items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

(46 |

) |

|

|

(43 |

) |

|

|

(129 |

) |

|

|

(127 |

) |

| Stock-based compensation expense |

|

|

(35 |

) |

|

|

(139 |

) |

|

|

(194 |

) |

|

|

(558 |

) |

| Non-GAAP research and development expenses |

|

$ |

1,620 |

|

|

$ |

2,278 |

|

|

$ |

6,166 |

|

|

$ |

7,734 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total sales, marketing, general and administrative expenses (GAAP) |

|

$ |

1,721 |

|

|

$ |

2,473 |

|

|

$ |

6,834 |

|

|

$ |

8,838 |

|

| Subtract the following items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

(19 |

) |

|

|

(11 |

) |

| Stock-based compensation expense |

|

|

(94 |

) |

|

|

(230 |

) |

|

|

(352 |

) |

|

|

(837 |

) |

| Non-GAAP sales, marketing, general and administrative expenses |

|

$ |

1,623 |

|

|

$ |

2,239 |

|

|

$ |

6,463 |

|

|

$ |

7,990 |

|

Contacts:

Investor Relations

IR@energous.com

Media Relations

pr@energous.com

###

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

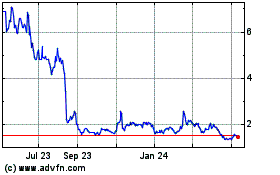

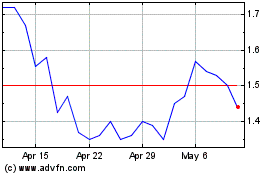

Energous (NASDAQ:WATT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Energous (NASDAQ:WATT)

Historical Stock Chart

From Dec 2023 to Dec 2024