Energous Corporation d/b/a Energous Wireless Power Solutions

(NASDAQ: WATT), a pioneer in scalable, over-the-air (OTA) wireless

power networks, today announced financial results for the three

months ended September 30, 2024, and provided an update on recent

partnerships and company highlights.

Third Quarter 2024 Financial Results

- Revenue for the three months ended September 30, 2024 of $230

thousand versus approximately $169 thousand in the same 2023

period, representing a 36% increase year over year.

- Costs and expenses for the three months ended September 30,

2024 totaled $3.8 million versus $5.3 million in the same 2023

period. Total third quarter 2024 GAAP costs and expenses consisted

of approximately $0.3 million in cost of revenue, $1.7 million in

research and development (R&D) expenses, $1.7 million in sales,

marketing, general and administrative (SG&A) expenses, and

approximately $0.1 million in severance expenses.

- Non-GAAP costs and expenses for the three months ended

September 30, 2024 were $3.5 million, decreasing from $4.6 million

for the same 2023 period, representing a reduction of approximately

$1.0 million, or 22%, year over year.

- Continued operational cost reductions and increased commercial

revenue yielded improved year over year net loss and loss per share

of approximately $(3.4) million, or $(0.50) per basic and diluted

share for the three months ended September 30, 2024, versus a net

loss of approximately $(4.1) million, or $(0.86) per basic and

diluted share, for the same 2023 period.

- Non-GAAP net loss of approximately $(3.3) million for the three

months ended September 30, 2024 versus non-GAAP net loss of

approximately ($4.2) million for the same 2023 period, representing

a 22% improvement year over year.

- Approximately $1.5 million in cash and cash equivalents as of

September 30, 2024.

See “Non-GAAP Financial Measures” below for additional

information.

Company Highlights

- As of November 8, 2024, the Company had $0.2 million in

backlog, representing confirmed new and follow-on PowerBridge

transmitter system orders from large retail customers, as well as

engineering services. This backlog signifies growing market

adoption of Energous wireless power solutions.

- The third quarter of 2024 represented the highest quarter for

commercial PowerBridge transmitter system shipments since

introducing the product to the market in the fourth quarter of

2021.

- In addition to transitioning a portion of active Proof of

Concept (POCs) trials as of the end of the second quarter of 2024

to commercial deployments, the Company increased its active POCs

from 47 to 56 as of October 31, 2024, representing a 19% increase

and demonstrating increased interest in deploying the technology

across a myriad of use cases.

- The Company received multiple orders for its PowerBridge

transmitters from a Fortune 10 multinational retail organization.

The retailer will use 2W PowerBridge transmitters for improved

grocery and store supply chain visibility and control and will use

1W PowerBridge transmitters to help improve transportation

efficiency.

- The 2W PowerBridge transmitter received full Federal

Communications Commission (FCC) certification, making it the

industry’s first certified transmitter available at this power

level.

- Energous shipped the first orders of its 2W PowerBridge

transmitters to a Fortune 100 technology company. The transmitters

will be used for reverse logistics processes at the company’s

distribution centers.

- The 2W PowerBridge transmitter system won a Mobile Breakthrough

Award for “IoT Innovation of the Year.”

- Energous was engaged by a global leader in RFID-based

source-to-shopper solutions to develop a battery-free smart tag

designed to enhance visibility and asset tracking for retail IoT

applications.

“As we push the boundaries of wireless power to create a world

where battery-free devices are always connected and real-time data

is always accessible, we continue to focus on three key

initiatives: gaining traction with significant commercial accounts,

demonstrating the value of our wireless power network solutions to

businesses, and optimizing our operations,” said Mallorie Burak,

CEO and CFO, Energous Wireless Power Solutions. “Progress is being

made on all fronts, as we carefully balance continued reductions in

infrastructure costs with strategic investments in scalable growth.

The third quarter sales momentum and increased interest in our WPN

technology represents a solid step forward for the Company as we

chart the path to profitability.”

About Energous Wireless Power Solutions

Energous Corporation d/b/a Energous Wireless Power Solutions

(NASDAQ: WATT) is pioneering scalable, over-the-air (OTA) wireless

power networks that enable unprecedented levels of visibility,

control, and intelligent business automation. The Company’s

wireless power transmitter and receiver technologies deliver

continuous access to wireless power, helping drive a new generation

of battery-free devices for asset and inventory tracking and

management—from retail sensors, electronic shelf labels, and asset

trackers, to air quality monitors, motion detectors, and more. For

more information, visit http://www.energous.com/ or follow on

LinkedIn.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Securities Act of 1933, as amended, the

Securities Exchange Act of 1934, as amended, and the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

All statements other than statements of historical fact included in

this press release are forward-looking statements. Forward-looking

statements may describe our future plans and expectations and are

based on the current beliefs, expectations and assumptions of

Energous. These statements generally use terms such as “believe,”

“expect,” “may,” “will,” “should,” “could,” “seek,” “intend,”

“plan,” “estimate,” “anticipate” or similar terms. Examples of

forward-looking statements in this release include but are not

limited to statements about our financial results and projections,

statements about the success of our collaborations with our

partners, statements about any governmental approvals we may need

to operate our business, statements about our technology and its

expected functionality, and statements with respect to expected

company growth. Factors that could cause actual results to differ

from current expectations include: uncertain timing of necessary

regulatory approvals; timing of customer product development and

market success of customer products; our dependence on distribution

partners; and intense industry competition. We urge you to consider

those factors, and the other risks and uncertainties described in

our most recent annual report on Form 10-K as filed with the

Securities and Exchange Commission (SEC), any subsequently filed

quarterly reports on Form 10-Q as well as in other documents that

may have been subsequently filed by Energous, from time to time,

with the SEC, in evaluating our forward-looking statements. In

addition, any forward-looking statements represent Energous’ views

only as of the date of this release and should not be relied upon

as representing its views as of any subsequent date. Energous does

not assume any obligation to update any forward-looking statements

unless required by law.

Non-GAAP Financial Measures

We have provided in this release financial information that has

not been prepared in accordance with accounting standards generally

accepted in the United States of America (GAAP). We use non-GAAP

financial measures internally in analyzing our financial results

and believe they are useful to investors, as a supplement to GAAP

measures, in evaluating our ongoing operational performance. We

believe that the use of these non-GAAP financial measures provides

an additional tool for investors to use in evaluating ongoing

operating results and trends, and in comparing our financial

results with other companies in our industry, many of which present

similar non-GAAP financial measures to investors.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. Investors are encouraged to

review the reconciliation of these non-GAAP financial measures to

their most directly comparable GAAP financial measures below.

Our reported results include certain non-GAAP financial

measures, including non-GAAP net loss, non-GAAP costs and expenses,

non-GAAP sales, marketing, general and administrative expenses

(SG&A) and non-GAAP research and development expenses

(R&D). Non-GAAP net loss excludes depreciation and

amortization, stock-based compensation expense, severance expense,

offering costs related to warrant liability and change in fair

value of warrant liability. Non-GAAP costs and expenses excludes

depreciation and amortization, stock-based compensation expense and

severance expense. Non-GAAP SG&A excludes depreciation and

amortization and stock-based compensation expense. Non-GAAP R&D

excludes depreciation and amortization and stock-based compensation

expense. A reconciliation of our non-GAAP financial measures to

their most directly comparable GAAP measures has been provided in

the financial statement tables included below in this press

release.

Energous Corporation BALANCE SHEETS

(Unaudited) (in thousands) As of September 30, 2024

December 31, 2023

ASSETS Current assets: Cash and cash

equivalents

$

1,451

$

13,876

Restricted cash

-

60

Accounts receivable, net

152

102

Inventory

737

430

Prepaid expenses and other current assets

511

539

Total current assets

2,851

15,007

Property and equipment, net

404

429

Right-of-use lease asset

695

1,240

Total assets

$

3,950

$

16,676

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Accounts payable

$

1,538

$

1,879

Accrued expenses

956

1,254

Accrued severance

37

134

Warrant liability

207

620

Operating lease liabilities, current portion

767

707

Deferred revenue

11

27

Total current liabilities

3,516

4,621

Operating lease liabilities, long-term portion

-

557

Total liabilities

3,516

5,178

Stockholders’ equity: Preferred stock

-

-

Common stock

1

1

Additional paid-in capital

396,744

393,539

Accumulated deficit

(396,311

)

(382,042

)

Total stockholders’ equity

434

11,498

Total liabilities and stockholders’ equity

$

3,950

$

16,676

Energous Corporation STATEMENTS OF OPERATIONS

(Unaudited) (in thousands, except share and per share

amounts) For the Three Months Ended September 30, For

the Nine Months Ended September 30,

2024

2023

2024

2023

Revenue

$

230

$

169

$

340

$

383

Costs and expenses: Cost of revenue

306

48

537

270

Research and development

1,701

2,460

6,489

8,419

Sales and marketing

699

774

2,391

3,074

General and administrative

1,022

1,699

4,443

5,764

Severance expense

83

269

1,377

359

Total costs and expenses

3,811

5,250

15,237

17,886

Loss from operations

(3,581

)

(5,081

)

(14,897

)

(17,503

)

Other income (expense), net: Offering costs related to

warrant liability

-

-

-

(592

)

Change in fair value of warrant liability

159

788

413

2,685

Interest income

10

179

215

648

Total other income (expense), net

169

967

628

2,741

Net loss

$

(3,412

)

$

(4,114

)

$

(14,269

)

$

(14,762

)

Basic and diluted net loss per common share

$

(0.50

)

$

(0.86

)

$

(2.21

)

$

(3.30

)

Weighted average shares outstanding, basic and diluted

6,834,170

4,762,187

6,446,274

4,467,436

Energous Corporation Reconciliation of Non-GAAP

Information (Unaudited) (in thousands) For

the Three Months Ended September 30, For the Nine Months Ended

September 30,

2024

2023

2024

2023

Net loss (GAAP)

$

(3,412

)

$

(4,114

)

$

(14,269

)

$

(14,762

)

Add (subtract) the following items: Depreciation and amortization

50

47

148

138

Stock-based compensation expense *

129

369

676

1,395

Severance expense

83

269

1,377

359

Offering costs related to warrant liability

-

-

-

592

Change in fair value of warrant liability

(159

)

(788

)

(413

)

(2,685

)

Non-GAAP net loss

$

(3,309

)

$

(4,217

)

$

(12,481

)

$

(14,963

)

* Stock-based compensation expense excludes $130 which is

included in severance expense for the nine months ended September

30, 2024. Total costs and expenses (GAAP)

$

3,811

$

5,250

$

15,237

$

17,886

Subtract the following items: Depreciation and amortization

(50

)

(47

)

(148

)

(138

)

Stock-based compensation expense *

(129

)

(369

)

(676

)

(1,395

)

Severance expense

(83

)

(269

)

(1,377

)

(359

)

Non-GAAP costs and expenses

$

3,549

$

4,565

$

13,036

$

15,994

* Stock-based compensation expense excludes $130 which is

included in severance expense for the nine months ended September

30, 2024. Total research and development expenses (GAAP)

$

1,701

$

2,460

$

6,489

$

8,419

Subtract the following items: Depreciation and amortization

(46

)

(43

)

(129

)

(127

)

Stock-based compensation expense

(35

)

(139

)

(194

)

(558

)

Non-GAAP research and development expenses

$

1,620

$

2,278

$

6,166

$

7,734

Total sales, marketing, general and administrative

expenses (GAAP)

$

1,721

$

2,473

$

6,834

$

8,838

Subtract the following items: Depreciation and amortization

(4

)

(3

)

(19

)

(11

)

Stock-based compensation expense

(94

)

(230

)

(352

)

(837

)

Non-GAAP sales, marketing, general and administrative expenses

$

1,623

$

2,240

$

6,463

$

7,990

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112058055/en/

Investor Relations IR@energous.com

Media Relations pr@energous.com

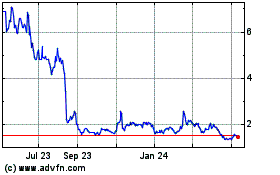

Energous (NASDAQ:WATT)

Historical Stock Chart

From Nov 2024 to Dec 2024

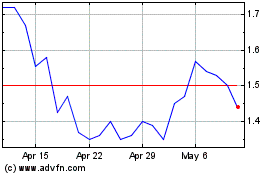

Energous (NASDAQ:WATT)

Historical Stock Chart

From Dec 2023 to Dec 2024