Elys Game Technology, Corp. (“Elys” or the “Company”)

(Nasdaq:ELYS), an interactive gaming and sports betting technology

company, today reported that growth continued in our licensed

Italian facing B2C market as our Euro based turnover increased by

2.7% for the fiscal year ended December 31, 2022, to €730.5 million

from €711.4 million for the fiscal year ended December 31, 2021.

The average U.S. Dollar exchange rate strengthened by over 10% from

$1.1834 in 2021 to an average rate of $1.0543 in 2022, which

resulted in the Company reporting a net decrease in reported

turnover of $71.7 million from $841.9 million to $770.2 million, a

net currency impact of approximately $94.2 million.

Management expects Gross Gaming revenues (“GGR”)

from Euro based operations to increase by approximately 3.7% to

approximately €50.1 million from €48.3 million for the fiscal year

ended December 31, 2022 and 2021, respectively, subject to final

audit verification. The strengthening of the U.S. Dollar against

the Euro resulted in the Company reporting GGR of $52.9 million a

decrease of $4.3 million compared to $57.2 million in the prior

year report, a net adverse foreign currency swing of approximately

$6.4 million, subject to final audit verification.

The streamlining of our European operations

towards our Multigioco subsidiary resulted in gaming taxes

increasing by €1.4 million or 13.1% to €12.1 million from €10.7

million for the years ended December 31, 2022 and 2021,

respectively, which fell in line with our expectations after

shutting down our Ulisse operations in the prior year. Multigioco

activated 53 acquired location rights during the second half of

2022 and expects to activate the remaining 47 locations over the

first half of 2023, that we expect will continue to positively

impact operating results over the next 12 – 18 months. Gaming taxes

as a percentage of revenue increased from 22.1% to 24.2%. The

strengthening of the U.S. Dollar against the Euro resulted in

reported gaming taxes of $12.8 million compared to $12.7 million

for the years ended December 31, 2022 and 2021, respectively,

subject to final audit verification.

Our go-to-market strategy for our first full

year of U.S. facing operations reflected remarkable service-based

revenue growth of 150.2% or $1.6 million to $2.6 million, subject

to final audit verification. During the fiscal year ended December

31, 2022, the Company continued to invest in U.S. expansion through

technology and licensing strategies, and as a result we expect to

launch our U.S. ready mobile solution in multiple states and Canada

in the near future.

The Company took prompt action to address

disappointing cost control performance in the recently acquired US

Bookmaking (“USB”) division which led to a dispute and legal

proceedings with the former management of USB. The swift decisions

of Company management led to immediate improvements in Q4-2022 and

put the group back onto to the pathway-to-profitability that we

mandated in Q1-2022. These actions are expected to provide

year-over-year comparisons beginning in Q1-23. Salient points about

operating expenses, before impairment charges, which includes

selling and general and administrative expenses are anticipated to

be as follows:

- Selling expenses, which consists primarily of commissions paid

to third party agents on our B2C operations in Europe and

calculated as a percentage of turnover reported in U.S. dollars, of

approximately $32.7 million decreased by approximately 9.9% for the

fiscal year ended December 31, 2022, compared to approximately

$36.3 million in the prior year. Selling expenses were primarily

Euro denominated and also affected by the strengthening of the

exchange rate over the prior year, increased by €0.1 million from

€30.7 million to €30.8 million, or 0.3%, based on an increase in

Euro based turnover of 2.7%, in line with our strategy to reduce

operating expenses.

- General and administrative expenses reported in U.S. dollars,

and are aggregated group-wide, increased by approximately $2.5

million or 14.3% from approximately $17.5 million in 2021 to

approximately $20.0 million in 2022, subject to final audit

verification. The increase fell in line with our 2022 roadmap

expectations and is primarily related to an increase in non-cash

stock based compensation expense of $2.3 million, and a one-time

severance cost of $1.2 million, offset by a reduction in platform

related fees linked to the closure of our Ulisse operations in the

prior year.

Impairment charges, which are non-cash, are

preliminarily estimated to be $20.6 million for 2022, subject to

final audit verification. The impairment charges are related to our

US Bookmaking operation’s goodwill of $14.5 million and an

additional impairment charge of $6.1 million related to non-compete

agreements and customer relationships, this is offset by the

reduction of the remaining contingent purchase consideration due to

the selling shareholders of $12.9 million. In the prior year we had

impaired goodwill relating to US Bookmaking of approximately $12.5

million, offset by a reduction in contingent purchase consideration

of $11.9 million, and an impairment of Ulisse licenses of

approximately $4.8 million. We are currently in dispute with the

selling shareholders of US Bookmaking and are pursuing legal

remedies against them.

About Elys Game Technology, Corp.

Elys Game Technology, Corp., is a global gaming

technology company operating in multiple countries worldwide. Elys

offers its clients a full suite of omnichannel leisure gaming

products and services, such as sports betting, e-sports, virtual

sports, online casino, poker, bingo, interactive games and slots on

a B2C basis in Italy and has B2B operations in five states as well

as the District of Columbia in the U.S. market. Elys' vision is to

become a global leader in the gaming industry through the

development of pioneering and innovative technology.

The Company provides wagering solutions,

services online operators, casinos, retail betting establishments

and franchise distribution networks. Additional information is

available on our corporate website at www.elysgame.com.

Investors may also find us on Twitter

@ELYS_gaming.

Forward-Looking Statements

This press release contains certain

forward-looking statements within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These statements are identified by the use of the words “could,”

“believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,”

“continue,” “predict,” “potential,” “project” and similar

expressions that are intended to identify forward-looking

statements and include statements regarding the estimated increase

in GGR, the estimated increase in non-GAAP measured turnover, the

estimated increase in gaming tax in Italy, the estimated decrease

in selling expenses, the estimated increase in general and

administrative expenses, the expected positive impact from

activating additional locations in Italy, the expected growth in

service-revenue, the expected expenses related to the Company’s

investment and the expected launch of mobile product in the U.S.

Market, the expected growth in the Italian B2C market, the results

expected from the pathway to profitability plan, and the expected

increase in impairment charges. These forward-looking statements

are based on management’s expectations and assumptions as of the

date of this press release and are subject to a number of risks and

uncertainties, many of which are difficult to predict that could

cause actual results to differ materially from current expectations

and assumptions from those set forth or implied by any

forward-looking statements. Important factors that could cause

actual results to differ materially from current expectations

include, among others, the Company’s ability to continue growing

the licensed Italian facing B2C market, to streamline European

operations, to activate the remaining 47 locations and to

positively impact operating results over the next 12 – 18 months,

to launch our U.S. ready mobile solution in multiple states and

Canada in the near future, to put the group back onto to the

pathway to profitability mandate initiated in Q1-2022, to

demonstrate year-over-year results beginning in Q1-23, to continue

cost reduction efforts and to keep general expenses in line with

roadmap expectations, and to resolve the dispute with USB selling

shareholders and obtaining legal remedies against them, the

duration and scope of the COVID-19 outbreak worldwide, including

the impact to the state and local economies, and the risk factors

described in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2021 and its subsequent filings with the U.S.

Securities and Exchange Commission, including subsequent periodic

reports on Form 10-Q and current reports on Form 8-K. The

information in this release is provided only as of the date of this

release, and the Company undertakes no obligation to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise, after the date on

which the statements are made or to reflect the occurrence of

unanticipated events, except as required by law.

The preliminary, estimated financial results for

the fiscal year 2022 contained in this press release contain

forward-looking statements and are subject to the completion of

management’s and the audit committee’s final reviews and our other

financial closing procedures and are therefore subject to change.

You should not place undue reliance on such preliminary information

and estimates because they may prove to be materially inaccurate.

The preliminary information and estimates have not been compiled or

examined by our independent auditors and they are subject to

revision as we prepare our financial statements as of and for the

fiscal year ended December 31, 2022 including all disclosures

required by U.S. generally accepted accounting principles, and as

our auditors conduct their audit of these financial statements.

While we believe that such preliminary information and estimates

are based on reasonable assumptions, actual results may vary, and

such variations may be material.

Company ContactsElys Game Technology,

Corp.Investor RelationsTel.: 1-561-838-3325Email:

i.relations@elysgame.com

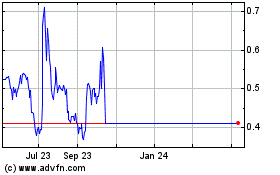

Elys Game Technology (NASDAQ:ELYS)

Historical Stock Chart

From Apr 2024 to May 2024

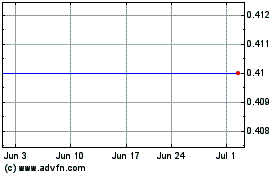

Elys Game Technology (NASDAQ:ELYS)

Historical Stock Chart

From May 2023 to May 2024