WASHINGTON, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant x Filed by a Party other than the Registrant o Check the appropriate box: o Preliminary Proxy Statement o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) o Definitive Proxy Statement x Definitive Additional Materials o Soliciting Material Pursuant to §240.14a-12 ELECTRONIC ARTS INC. (Name of Registrant as Specified in its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): x No fee required. o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: o Fee paid previously with preliminary materials. o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. 1) Amount Previously Paid: 2) Form, Schedule or Registration Statement No.: 3) Filing Party: 4) Date Filed: UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Commencing on July 8, 2021, Electronic Arts Inc. will use the following supplemental information in communicating with certain stockholders. Dear Stockholder: Electronic Arts Inc. (“we”, the “Company” or “EA”) is holding its 2021 annual meeting of stockholders (the “Annual Meeting”) on August 12, 2021. On June 25, 2021, we filed a definitive proxy statement (the “Proxy Statement”) with the Securities and Exchange Commission in connection with our Annual Meeting, which is available, along with our 2021 annual report to stockholders, at https://materials.proxyvote.com/ or on our investor relations website at https://ir.ea.com/financial-information/annual-reports-and-proxy-information/default.aspx and we have posted a supplemental Stockholder Outreach Presentation on our Investor Relations website at https://ir.ea.com that we have included with this filing. EA’s Say-On-Pay Responsiveness In response to the 2020 say-on-pay vote, we conducted extensive outreach with our stockholders from the summer of 2020, throughout 2020 and 2021. Following the 2020 annual meeting, we invited 34 of our top institutional stockholders collectively holding approximately 56% of our common stock to have additional calls with our engagement team and members of the Compensation Committee and Nominating and Governance Committee. We had calls with stockholders collectively holding approximately 46% of our common stock, with members of the Board of Directors participating in calls with our largest institutional stockholders collectively holding 35% of our common stock. In response to the stockholder feedback, the Compensation Committee took decisive steps: • Confirmed we have no plans or intentions to utilize special equity awards. Consistent with this approach, no special equity awards were granted in fiscal year 2021 following our 2020 annual meeting, and we have no plans or intentions to grant any special equity awards to any of our named executive officers (“NEOs”). We deem special equity awards to be extraordinary occurrences that should be highly targeted and used only in the unique and rare circumstance to address significant competitive pressures to retain our top critical executive talent. • Strengthened the long-term performance incentive by adding two additional performance metrics (net bookings and operating income) to our fiscal year 2022 performance restricted stock unit (“PRSU”) program to align with our broader business strategy. • Increased alignment of executive’s interests with long-term stockholders by increasing the vesting period for PRSU awards to three-year cliff vesting, beginning fiscal year 2022 and thereafter. • Eliminated the lookback feature from the relative total shareholder return (“TSR”) component of our fiscal year 2022 PRSU program. • Increased threshold and adjusted the relative TSR payout scale to better align with market and peer practices for the relative TSR component of our fiscal year 2022 PRSU program. • Enhanced disclosure of our annual bonus program structure, non-financial goals, and how payouts are determined. • Amended our Executive Bonus Plan, effective for fiscal year 2022, to cap NEO bonuses at 2x their target bonus percentage. • Increased our stock ownership guidelines from 5x base salary to 10x for our CEO, and from 2x base salary to 3x for our other NEOs. • Expanded our Clawback Policy to cover cash incentives, as well as equity incentives.

Other Perspectives We also participated in conversations with organizations that are not EA stockholders, such as proxy advisory firms and SOC Investment Group (formerly known as CtW Investment Group), to hear their perspectives on our compensation programs. A member of our Compensation Committee participated in a conversation with SOC Investment Group. Based upon our extensive outreach, we believe SOC Investment Group’s positions are not aligned with the views of the majority of our stockholders. Acting in the Best Interest of EA’s Stockholders EA’s Board of Directors, the Compensation Committee and our management are committed to acting in the best interest of EA’s long-term stockholders. We operate in a highly competitive market and industry, and in a geographic region, Silicon Valley, that is exceptionally competitive for executive talent. Attracting and retaining innovative, highly-talented and high-performing executives in this competitive and rapidly evolving market is critical to both our short-term and long-term success. In a year like no other, EA delivered a record fiscal year 2021, increasing net bookings over 15% from the prior fiscal year (more than $600 million above original expectations), delivered 13 major games and had more than 42 million new players join our network. In addition, we completed significant acquisitions to grow the company and achieved record employee satisfaction scores across the organization, all against the backdrop of stay-at-home orders and a fully distributed workforce. We look forward to continuing to execute well through fiscal year 2022 with player excitement for the Company’s upcoming titles. The Board of Directors and the Compensation Committee believe that the NEOs’ exceptional leadership managing the Company and our global employees was critical in driving the Company’s many successes this year despite the extreme challenges of the COVID-19 pandemic. Throughout fiscal year 2021, our NEOs executed strategies to address employee health, safety and wellbeing, business continuity, risk mitigation, security, and information technology to respond to the rapidly evolving situation of the pandemic, while at the same time delivering on our title plan, growing our live services business, and generating strong financial performance. We were able to retain this exceptional team together, aligning their interests with those of long-term stockholders in large part due to the compensation program designed and implemented by the Compensation Committee and the Board. We also made the wellbeing of our workforce our top priority with COVID-19 support payments, enhanced paid sick time and mental health support, paid time off for caregiving reasons, among other benefits. Because we are a global leader in digital interactive entertainment and a pioneer in the gaming industry, our executives, seasoned leaders with deep industry experience and expertise, are prime targets for recruiting from large technology companies that are headquartered in the San Francisco Bay Area, including companies like Alphabet, Apple and Facebook that are striving to expand their interactive entertainment capabilities, as well as emerging growth companies and mature technology companies. We also understand compensation is only one factor in the ability to successfully recruit and retain our executive talent. Our Board is actively engaged in succession planning for our executive team and in building a deep bench of talent within our leadership team. However, the Board and the Compensation Committee believe it is critically important that they have the ability to maintain flexibility in this competitive talent market. For the foregoing reasons, we firmly believe support for our say-on-pay proposal is warranted and we ask that you vote FOR the advisory vote to approve NEO compensation.

1 Stockholder Outreach June 2021

● Business Overview ● Compensation Program Highlights ● Corporate Governance ● Corporate Responsibility / Response to COVID-19 Pandemic Contents 2

3 Business Overview

1. Deliver amazing games and content ● Global presence with key franchises that include: FIFA; Battlefield; Madden NFL; Apex Legends; The Sims; Dragon Age; Mass Effect; Need for Speed 2. Offer live services that extend and enhance the experience ● FIFA Ultimate Team pioneered live services on console, now $1B+ business, played annually by over 30 million players ● Apex Legends launched Feb 2019, delivered over $1 billion net bookings life to date as of FY2021 ● Sims 4 enjoying sixth consecutive year of growth 3. Connect more players, across more platforms, and more ways to play ● Leveraging global IP across multiple platforms ● Expanding FIFA worldwide through PC, console and mobile launches ● Apex Legends and Battlefield coming to mobile ● The Sims now on PC, console, and mobile ● Our subscription service now available on PC, Xbox, PlayStation; also through Steam and Microsoft Game Pass Ultimate ● Bringing cross-play to more games ● Debuted cross-progression between Madden on console and Madden Mobile Business Strategy 4

Growth: Topline to Cash 5 (in $ millions) 3,157 3,650 4,016 1,793 1,887 1,613 4,950 5,537 5,629 FY19 FY20 FY21 Full Game Live Services & Other Net Revenue 3,292 3,592 4,592 1,840 1,780 1,598 5,132 5,372 6,190 FY19 FY20 FY21 Net Bookings Full Game Live Services & Other 1,547 1,797 1,934 FY19 FY20 FY21 Operating Cash Flow

Financial and Operational Highlights • FY21 Financial Highlights ○ Fiscal 2021 resulted in record net revenue, net bookings and annual operating cash flow ○ Returned over $800 million to shareholders through our two-year, $2.6 billion stock repurchase program and quarterly dividend • Strong execution with no major delays in launch schedule even as we prioritize health of employees during pandemic ○ Delivered 13 new games during the fiscal year and over 200 live service updates ○ Recently acquired Codemasters, Glu Mobile and Metalhead Software, increasing our reach in sports and on mobile 6

7 Compensation Program Highlights

8 Our Compensation Program Promotes Pay-For-Performance ● Pay-for-Performance ○ Our compensation programs are designed to attract and retain high-performing executives ○ FY21, 96% of our CEO pay and 91% of our NEO pay is at-risk compensation ○ Regularly benchmark against market practice and peers ● Long-term Focus ○ 85% of our executives’ total compensation opportunity is in the form of long-term incentives ○ CEO annual equity award is 60% performance-based; other NEOs at least 50% performance-based ● Linked with Stockholder Success ○ Incentive programs are designed to reward executives when they create stockholder value ○ Utilize STI metrics (non-GAAP net revenue and EPS) that drive stock price performance ○ LTI metric (relative TSR) rewards executives when our stock price outperforms peers; vesting capped when TSR is negative on absolute basis ● Downside Risk ○ Amounts earned are aligned with company performance ○ Example: No cash bonuses were paid and 0% performance-based LTI payout, based on FY19 underperformance

9 ✔ Structure executive compensation to link pay and performance ✔ Provide a high percentage of variable, at-risk pay; approximately 94% of NEO compensation is variable and at- risk ✔ Cap performance-based annual bonus awards ✔ Require our executives to satisfy robust stock holding requirements ✔ Conduct an annual risk assessment of our executive compensation program ✔ Maintain a clawback policy covering cash and equity incentives ✔ Evaluate our compensation peer group at least annually ✔ Engage an independent compensation consultant to advise the Compensation Committee ✔ Conduct regular stockholder outreach ✘ No “single-trigger” change in control arrangements ✘ No excise tax gross-ups upon a change in control ✘ No executive employment contracts (other than as required by local jurisdictions) ✘ No repricing of options without stockholder approval ✘ No hedging or pledging of EA stock ✘ No excessive perquisites ✘ No payment of dividends or dividend equivalents on unearned or unvested equity awards What We Do What We Don’t Do Compensation Best Practices

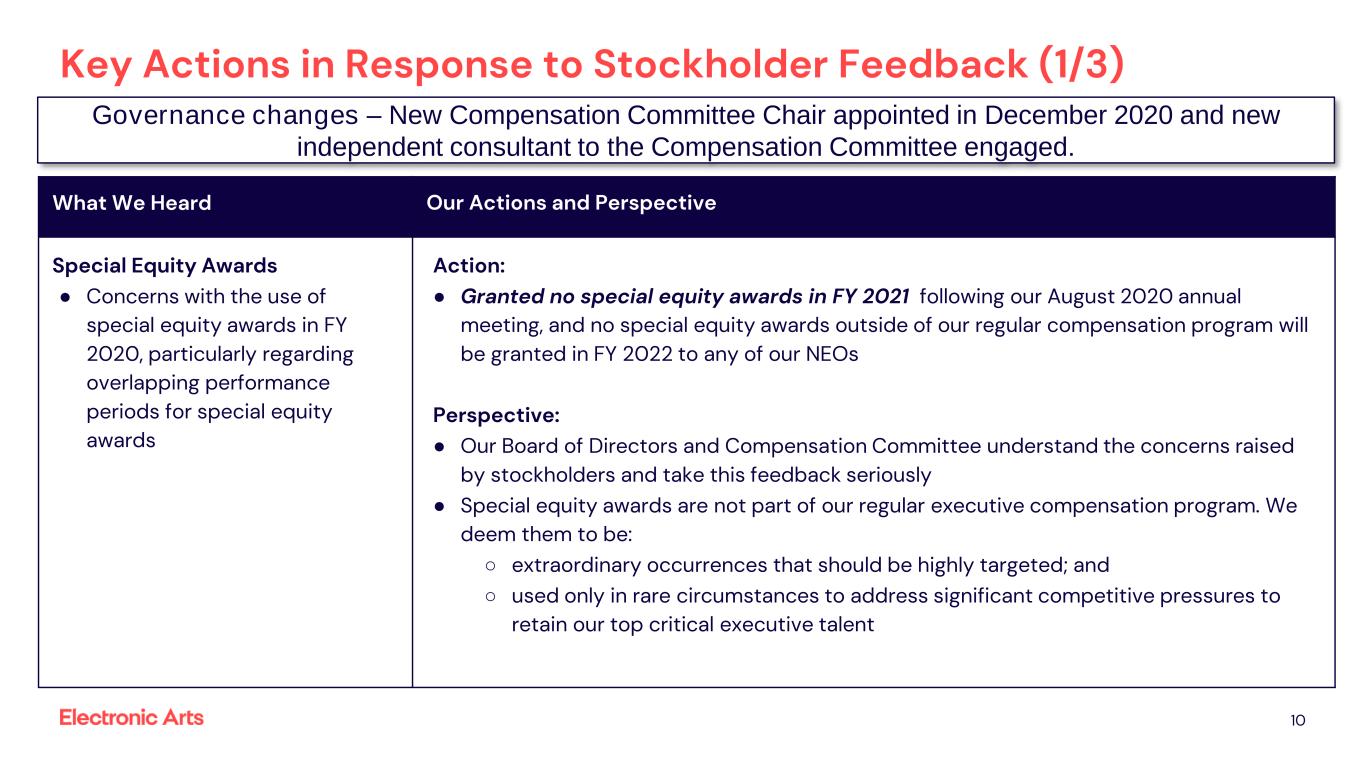

Key Actions in Response to Stockholder Feedback (1/3) 10 Governance changes – New Compensation Committee Chair appointed in December 2020 and new independent consultant to the Compensation Committee engaged. What We Heard Our Actions and Perspective Special Equity Awards ● Concerns with the use of special equity awards in FY 2020, particularly regarding overlapping performance periods for special equity awards Action: ● Granted no special equity awards in FY 2021 following our August 2020 annual meeting, and no special equity awards outside of our regular compensation program will be granted in FY 2022 to any of our NEOs Perspective: ● Our Board of Directors and Compensation Committee understand the concerns raised by stockholders and take this feedback seriously ● Special equity awards are not part of our regular executive compensation program. We deem them to be: ○ extraordinary occurrences that should be highly targeted; and ○ used only in rare circumstances to address significant competitive pressures to retain our top critical executive talent

Key Actions in Response to Stockholder Feedback (2/3) 11 What We Heard Our Actions and Perspective PRSU Program Features ● Program should incorporate financial and operating metrics in addition to relative TSR ● Annual vesting is contrary to long-term nature of program Action: ● Added two additional performance metrics—net bookings and operating income—to our FY 2022 PRSU program ● Split PRSU awards beginning with FY 2022 into three equal tranches: 1/3 relative TSR, 1/3 net bookings, 1/3 operating income ● Increased vesting for annual PRSU awards, beginning FY 2022 and thereafter, to three- year cliff vesting, to better align the interests of executives with long term-stockholders ● Lookback feature is a non- standard design element ● Eliminated the lookback feature from the relative TSR component of FY 2022 PRSU program ● 11th percentile for threshold payout on relative TSR PRSUs is too low ● Increased threshold and adjusted the relative TSR payout scale to better align with market and peer practices. No PRSUs will be earned if relative TSR is below the 25th percentile; continue to require above-market performance to earn target PRSUs ● Would like to see increased use of performance-based awards ● CEO’s annual equity award for FY 2022 and beyond to be at least 60% performance- based

Key Actions in Response to Stockholder Feedback (3/3) 12 What We Heard Our Actions and Perspective Annual Bonus Program ● Would like to better understand our financial and non-financial goals and annual bonus payout determinations ● Enhanced disclosure of our annual bonus program structure, non- financial goals, and how payouts are determined, in our FY2021 proxy statement ● Amended our Executive Bonus Plan, effective for FY2022, to cap NEO bonuses at 2x their target bonus percentage (instead of our legacy Internal Revenue Code Section 162(m) bonus cap of the lesser of 6x annual base salary and $5 million) Stock Ownership ● Would like to see higher stock ownership among executives ● Increased our Stock Ownership Guidelines for our CEO and other NEOs, including doubling the ownership multiple for our CEO from 5x base salary to 10x (CEO) and from 2x base salary to 3x (other NEOs) Clawback ● Clawback should cover cash incentives, as well as equity incentives ● Expanded our Clawback Policy to cover cash incentives, as well as equity incentives

New Entrants to the Interactive Entertainment Space Have Increased the Competition for Experienced Executive Games Industry Talent 13 *Note: King was acquired by Activision Blizzard in 2016; Bethesda (ZeniMax) was acquired by Microsoft in 2020. Competitors are based on a Western view only.

The Board Approved an Enhanced Fiscal 2021 Annual Equity Award for Mr. Wilson in May 2020 for the Following Key Reasons 14 ● To drive transformational growth and long-term success ○ Mr. Wilson has the strategic vision necessary to transform EA into a digital interactive platform ○ The Board is committed to retaining Mr. Wilson for his exceptional leadership, strategic vision and ability to execute on our long-term strategy and objectives ● To recognize his outstanding track-record during his seven-year tenure as CEO* ○ Market cap has grown over 360%, generating ~$31B in market value ○ Total stockholder return is 392%, a CAGR of 20%, compared to a 7% CAGR (S&P 500) and 18% CAGR (Nasdaq- 100) over the same period* ○ EA’s stock price when Mr. Wilson assumed the CEO role was $27.60 ● To address the intensely competitive landscape and significant recruiting pressures ○ Due to the intensely competitive landscape for executives of Mr. Wilson’s caliber, and the significant recruiting efforts made for him as a result, the Board of Directors determined to take definitive action to retain him *Source: FactSet; measurement period is 9/17/2013 – 3/31/2021 June 16, 2020 Grant date of Mr. Wilson’s 2021 annual equity award June 19, 2020 Filed 2020 Proxy Statement with SEC May 14, 2020 Board of Directors approved Mr. Wilson’s fiscal 2021 annual equity award August 6, 2020 Our 2020 Annual Meeting of Stockholders

15 Corporate Governance

● 25% Special Meeting Right ● Proxy Access. 3% / 3 years / greater of 2 directors or 20% of the Board ● Highly Engaged Lead Independent Director. Robust and well-defined duties ● Seven of Eight Board Nomineees are Independent ● Luis Ubinas elected Chair of Compensation Committee in light of need to actively engage stockholders and implement changes reflected in feedback ● Annual Board Self-Evaluations ● Diverse Board. Board reflects diversity in experience, skills, race, ethnicity, age and gender; 62% of Board nominees identify as female or a member of an underrepresented community ● Annual Elections of All Directors and Majority Voting Standard ● Single Class of Common Stock with Equal Voting Rights ● No Supermajority Provisions in Charter/Bylaws ● No Stockholder Rights Plan Corporate Governance Highlights 16

Board Nomineees Reflect and Support Oversight of Long-term Strategy and Evolving Needs Larry Probst and Jay Hoag have announced they will be stepping down from the Board effective at the 2021 Annual Meeting; the Board is actively engaged in succession planning. Range of Tenure 0-5 6-10 > 10 45-54 55-64 65+ Balanced Mix of Ages Independent Oversight • 7 of 8 (88%) independent directors • All 3 Board Committees are 100% independent Diversity of Skills Board reflects diversity in experience, skills, race, ethnicity, age and gender: ● Executive Leadership ● Gaming, Sports & Entertainment ● Digital Commerce ● Financial Expertise ● Global/International ● Technology 5 directors (62%) female and/or from underrepresented communities 62% Two Female Nominees (Ms. Roche & Ms. Ueberroth); Two African American Nominees (Mr. Bruce & Mr. Coleman); One Hispanic/Latino Nominee (Mr. Ubiñas)

18 Corporate Responsibility

Actions and Highlights ● Published inaugural Impact Report in November 2020. Aligned with SASB standards ● Publicly disclosed race/ethnicity/gender representation ● Leveraged Inclusion Framework to help studios develop more inclusive characters and stories across our games and services ● Launched Positive Play Project to promote Online Safety, Healthy Play and Fair Play ● Actioned additional support for the fight for social and racial justice, including $1 million contribution to organizations fighting for racial justice and against discrimination, doubling the employee match to charities addressing racism and discrimination, and holding a series of employee-wide community conversations Response to COVID-19 Pandemic ● Supported Our People: Health and safety prioritized and tangible support offered, including payments to assist with work from home costs and care needs, a pandemic care leave program, and additional services for mental and physical health; invested in resources to support distributed workforce; vast majority of our workforce will be working from home at least through September 2021 ● Executed Our Strategy: Execution against our strategic pillars and increased engagement with our products and services led to growth in our business, aided by consumers spending more time at home; longer-term trends that benefit our business accelerated, including substantial increase in live services net revenue and the percentage of our games purchased digitally Corporate Responsibility 19

Thank You! 20