Lockheed Returns Shareholder Wealth - Analyst Blog

September 27 2013 - 5:00PM

Zacks

Lockheed Martin Corp. (LMT) has increased its

quarterly dividend to $1.33 per share and has authorized the

purchase of up to an additional $3 billion of its common stock

under the share repurchase program. This move reflects the

company’s strong performance and program execution capability.

Lockheed Martin has increased the quarterly dividend by 18 cents

from the current payout of approximately $1.15 per share. The

proposed hike would bring the annual dividend to $5.32, up

approximately 15.7% from the previous payout. The increased

quarterly dividend will be paid on Dec 27, 2013 to shareholders of

record at the close of business on Dec 2, 2013.

With the current annual dividend rate of $5.32 and the current

price of $92.46 (as of Sep 26, 2013), the company has a dividend

yield of approximately 4.1%.

This is the eleventh consecutive annual double-digit increase in

the company’s dividend. In Sep 2012, the company had increased its

quarterly dividend by 15% or 15 cents per share from $1.00 per

share to approximately $1.15 per share.

As per the new share repurchase program, the company is permitted

to repurchase up to an additional $3.0 billion of the company’s

common stock. The program does not have an expiration date. In Sep

2011, the company had last increased its share buyback

authorization. The company was then authorized to purchase up to an

additional $2.5 billion of its common stock under the share

repurchase program.

Lockheed continues to be a strong cash generator with its operating

cash flow reaching approximately $2.7 billion during the second

quarter. The company ended the second quarter with cash and cash

equivalents of $2.8 billion and total long-term debt of

approximately $6.1 billion (including current portion of the

long-term debt), which fell from $6.2 billion at year-end 2012.

This helps Lockheed to return a substantial portion of free cash

flow to its shareholders through share repurchases and incremental

dividends.

In the second quarter of 2013, the company repurchased 4.5 million

shares at a cost of $465 million and disbursed $371 million as

dividends. As of Jun 30, 2013, the company had repurchased 63.8

million shares for a total cost of $5.1 billion. The company has

another $1.4 billion remaining under the current repurchase

program.

Going forward, shareholder return will continue to be shored up by

the company’s focus on debt repayment, its ongoing share repurchase

program and the incremental dividend, which would keep the stock

attractive for shareholders. Meanwhile, the steady flow of

contracts for Lockheed would add to the top line of the company.

The company presently retains a short-term Zacks Rank #2 (Buy).

Other stocks worth considering in the space are Northrop

Grumman Corp. (NOC), Elbit Systems Ltd.

(ESLT) and Alliant Techsystems Inc. (ATK). While

Alliant Techsystems carries a Zacks Rank #1 (Strong Buy), Northrop

Grumman and Elbit Systems hold a Zacks Rank #2 (Buy).

ALLIANT TECHSYS (ATK): Free Stock Analysis Report

ELBIT SYSTEMS (ESLT): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

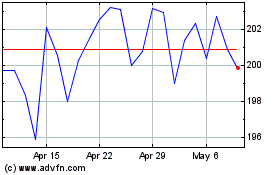

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jun 2024 to Jul 2024

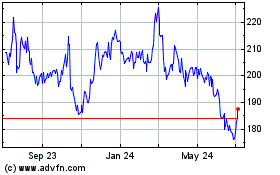

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jul 2023 to Jul 2024