Triumph Group Beats Earnings - Analyst Blog

May 02 2013 - 6:20AM

Zacks

Triumph Group Inc.

(TGI) reported fourth quarter of fiscal 2013 results that ended Mar

31, 2013. Adjusted earnings from continuing operations of $1.68 per

share surpassed the Zacks Consensus Estimate of $1.59 by 5.7% and

also increased 7.0% from the year-earlier adjusted profit of

$1.57.

Adjusted income from continuing operations came in at $6.21 per

share in fiscal year 2013, which climbed nearly 24% from $5.01

posted in fiscal year 2012.

During the quarter as well as full year, the company registered

strong results across all its business segments. Apart from

completing two important acquisitions – Embee Inc. and Triumph

Engine Control Systems (previously known as Goodrich Pump &

Engine Control Systems) from United Technologies

Corp. (UTX) – Triumph offloaded two of its Aftermarket

Services’ Instruments Companies. These acquisitions are expected to

contribute significantly to revenue going forward.

Revenue

In the reported quarter, net sales inched up 4.2% year over year to

$986.3 million, of which organic growth accounted for 2%. The

reported figure also beat the Zacks Consensus Estimate of $950.0

million.

Segment-wise, sales from Aerostructures surged to $720.7 million

from $714.2 million in the prior-year comparable quarter, the

growth being entirely organic. Aerospace Systems revenue grew 21.4%

year over year to $184.1 million, while Aftermarket Services

increased marginally to $83.9 million from $83.1 million in the

year-ago quarter.

Full year fiscal 2013 top line grew 8.6% year over year to $3,702.7

million, of which organic growth was 8%.

Margins

Operating income in the fiscal fourth quarter plummeted 38.4% to

$134.4 million from $183.2 million in the year-ago quarter.

Operating margin decreased to 11.5% in the reported quarter from

19.4% in the fiscal fourth quarter of 2012.

On a segmental basis, Aerostructures reported a 6.8% decline in

operating income, to settle at $110.9 million. However, Aerospace

Systems’ operating income grew 26.5% to $33.4 million. Also,

Aftermarket Services displayed a rise of 18.2% to reach $13.0

million.

For fiscal 2013, the company’s operating income climbed 3.2% year

over year to $531.2 million. All three business segments at Triumph

Group executed well and delivered year-over-year operating margin

expansion.

Balance Sheet

Exiting the fiscal fourth quarter, Triumph’s cash and cash

equivalents were $32.0 million compared with $29.7 million at the

end of the prior-year quarter. Long-term debt (including the

current portion) was up 14.8% to $1,329.9 million from $1,158.9

million in the prior year. The debt-to-capitalization ratio in the

reported quarter stood at 39.4%.

Cash Flow

Cash from operations, before pension contributions, was $453.2

million in fiscal 2013; up from $349.1 million in the year-ago

period. Capital expenditures climbed to $142.8 million during the

year from $94.0 million in the year-ago quarter.

Guidance

For fiscal year 2014, the company expects sales in the range of

$3.8 billion to $4.0 billion and earnings per share from continuing

operations of $5.65 to $5.75 per diluted share. Adjusted earnings

per share from continuing operations for fiscal year 2014 are

expected in a band of $6.30 to $6.40 per diluted share.

Zacks Rank

Triumph carries a Zacks Rank #2 (Buy). Other aviation companies

like B/E Aerospace Inc. (BEAV) with a Zacks Rank

#2 (Buy) and Elbit Systems Ltd. (ESLT) with a

Zacks Rank #1 (Strong Buy) are also worth considering.

B/E AEROSPACE (BEAV): Free Stock Analysis Report

ELBIT SYSTEMS (ESLT): Free Stock Analysis Report

TRIUMPH GRP INC (TGI): Free Stock Analysis Report

UTD TECHS CORP (UTX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

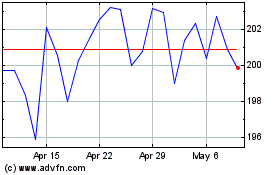

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jun 2024 to Jul 2024

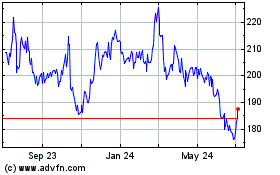

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jul 2023 to Jul 2024