Revenues Increased by 33% to $2.64 Billion in 2008 With Net Profit

of $204 Million and EPS of $4.78 HAIFA, Israel, March 11

/PRNewswire-FirstCall/ -- Elbit Systems Ltd. (the "Company")

(NASDAQ:ESLTNASDAQ:TASE:NASDAQ:ESLT), the international defense

electronics company, today reported its consolidated results for

the fourth quarter and full year ended December 31, 2008. (Logo:

http://www.newscom.com/cgi-bin/prnh/20080408/300441 ) Fourth

quarter 2008 results Consolidated revenues for the fourth quarter

of 2008 increased by 18.1% to $697.9 million, from $591.1 million

in the fourth quarter of 2007. Gross profit for the fourth quarter

of 2008 increased by 30.2% to $203.4 million (29.1% of revenues),

as compared with gross profit of $156.2 million (26.4% of revenues)

in the fourth quarter of 2007. During the fourth quarter the

Company had a $1 million IPR&D expense due to the acquisition

of Innovative Concepts, Inc., a wireless communications technology

firm in the U.S. Operating income for the fourth quarter of 2008

increased 62.7% to $62.2 million (8.9% of revenues), as compared

with operating income of $38.2 million (6.5% of revenues) in the

fourth quarter of 2007. During the fourth quarter, Mediguide Inc.,

a non-core subsidiary in which the Company owned a 41.3% interest

on a fully diluted basis, was purchased by St. Jude Medical. The

Company recorded net income of $74.4 million from this sale in the

fourth quarter of 2008. In addition, there was a one-time

impairment charge of $10.5 million relating to Sandel Avionics,

Inc., a U.S. company in which the Company invested $12.4 million in

2007. Thus the aggregate contribution to the quarter's results from

these one-time effects was an additional $63.9 million to the net

profit. Financial expenses for the fourth quarter of 2008 were $3.8

million, which included a write-off of Auction Rate Securities

amounting to $9.6 million. The total amount of Auction Rate

Securities remaining on the balance sheet is $3 million.

Consolidated net income for the fourth quarter was $105.3 million

(15.1% of revenues) compared with net income of $31.9 million (5.4%

of revenues) in the fourth quarter of 2007. Diluted earnings per

share for the fourth quarter were $2.48, compared with $0.75 for

the fourth quarter of 2007. Excluding the above-mentioned one-time

effects, namely the IPR&D expense, the proceeds from the sale

of Mediguide and the impairment charge in Sandel, consolidated net

income for the fourth quarter of 2008 increased by 32.6% over the

fourth quarter of 2007 to $42.3 million (6.1% of revenues). This

translates to fourth quarter diluted earnings per share of $1.00.

Full year 2008 results Consolidated revenues for the year ended

December 31, 2008 increased by 33.1% to $2,638 million, as compared

to $1,982 million in 2007. Gross profit for the year ended December

31, 2008 grew 48.6% to $767.4 million (29.1% of revenues), as

compared to gross profit of $516.4 million (26.1% of revenues) in

2007. Operating income for the year ended December 31, 2008 grew

131% to $249 million (9.4% of revenues), from $108 million (5.4% or

revenues) in 2007. It is noted that the 2007 annual results were

negatively affected by one-time charges related to the completion

of the Company's acquisition of the remaining shares of Tadiran

Communications Ltd. in April 2007. The Company recorded $27.1

million in expenses in relation to the acquisition. Financial

expenses for the year were $36.8 million, which included a

write-off of Auction Rate Securities totaling to $18.7 million,

compared to financial expenses of $19.3 million in 2007, which

included a $10 million write-off. Consolidated net income for 2008

were $204.2 million (7.7% of revenues), compared with $76.7 million

(3.9% of revenues) in 2007. Diluted earnings per share, for 2008

was $4.78, compared with $1.81 in 2007. Excluding the one-time

effects, namely the IPR&D expense, the proceeds from the sale

of Mediguide and the impairment charge in Sandel, consolidated net

earnings for the year ended December 31, 2008, were $141.3 million

compared with net earnings of $101.2 million achieved in 2007,

excluding the one-time charges related to the acquisition of

Tadiran Communications. Diluted earnings per share, excluding the

one-time effects, for the year ended December 31, 2008 were $3.34,

as compared with $2.39 for 2007. The growth in earnings and EPS

year over year was approximately 40% Operating cash flow produced

by the Company in 2008 was $209 million, as compared to $263

million in 2007. The Company's backlog of orders as of December 31,

2008 totaled $5,030 million, as compared with $4,872 million as of

September 30, 2008 and $4,624 million as of December 31, 2007.

Approximately 72% of the backlog relates to orders outside of

Israel. Approximately 75% of the Company's backlog as of December

31, 2008 is scheduled to be performed during 2009 and 2010. The

President and CEO of Elbit Systems, Joseph Ackerman, commented,

"Our final quarter in 2008, represents another quarter of continued

progress, with stronger profitability as well as growth across all

areas of operation and geographies. 2008 was a year in which we

successfully integrated our acquisitions from prior years and began

reaping the fruits of these activities. We have proven that our

analysis of the direction of the global defense industry during the

past few years was well founded, and we invested in areas which

have become very relevant for our customers. Consequently, we now

hold a substantial competitive and technological position in all

these areas. We end 2008 in a very strong position as a global

company and a well-known leader by our partners and customers.

Looking ahead, we have primed our business for continued growth,

well into the future. The sale of our holdings in Mediguide,

strengthened our Balance Sheet and underscored that defense

technology can be used in commercial applications." Mr. Ackerman

continued, "While the global economic situation is challenging for

all, we continue to ensure our expense footprint is minimized, as

well as closely manage our risks. At the same time, we are

examining ways to exploit the current environment in order to

upgrade our platform for continued future technological growth and

the nurture of our excellent human resources. This is to ensure we

are well prepared for all eventualities and that we are able to

maintain and build our profitability, momentum and technological

leadership, in the coming quarters and years ahead." The Board of

Directors declared a dividend of $0.80 per share for the fourth

quarter of 2008. The dividend's record date is March 24, 2009, and

the dividend will be paid on April 6, 2009, net of taxes and

levies, at the rate of 16.82%. Conference Call The Company will

also be hosting a conference call today, Wednesday, March 11 at

11am ET. On the call, management will review and discuss the

results and will be available to answer questions. To participate,

please call one of the teleconferencing numbers that follow. Please

begin placing your calls at least 10 minutes before the conference

call commences. If you are unable to connect using the toll-free

numbers, please try the international dial-in number. US Dial-in

Numbers: 1-888-723-3164 UK Dial-in Number: 0-808-101-2717 ISRAEL

Dial-in Number: 03-918-0650 INTERNATIONAL Dial-in Number:

+972-3-918-0650 At: 11:00am Eastern Day-light Time; 8:00am Pacific

Day-light Time; 3:00pm UK Time; 5:00pm Israel Time This call will

be broadcast live on Elbit Systems' web-site at

http://www.elbitsystems.com/. An online replay will be available

from 24 hours after the call ends. Alternatively, for two days

following the end of the call, investors will be able to dial a

replay number to listen to the call. The dial-in numbers:

1-888-269-0005 (US) or +972-03-925-5951 (Israel and International).

About Elbit Systems Ltd. Elbit Systems Ltd. is an international

defense electronics company engaged in a wide range of

defense-related programs throughout the world. The Company, which

includes Elbit Systems and its subsidiaries, operates in the areas

of aerospace, land and naval systems, command, control,

communications, computers, intelligence surveillance and

reconnaissance ("C4ISR"), unmanned air vehicle (UAV) systems,

advanced electro-optics, electro-optic space systems, EW suites,

airborne warning systems, ELINT systems, data links and military

communications systems and radios. The Company also focuses on the

upgrading of existing military platforms and developing new

technologies for defense, homeland security and commercial aviation

applications. This press release contains forward-looking

statements (within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended) regarding Elbit Systems Ltd. and/or its

subsidiaries (collectively the Company), to the extent such

statements do not relate to historical or current fact. Forward

Looking Statements are based on management's expectations,

estimates, projections and assumptions. Forward-looking statements

are made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, as amended. These

statements are not guarantees of future performance and involve

certain risks and uncertainties, which are difficult to predict.

Therefore, actual future results, performance and trends may differ

materially from these forward-looking statements due to a variety

of factors, including, without limitation: scope and length of

customer contracts;governmental regulations and approvals; changes

in governmental budgeting priorities; general market, political and

economic conditions in the countries in which the Company operates

or sells, including Israel and the United States among others;

differences in anticipated and actual program performance,

including the ability to perform under long-term fixed-price

contracts; and the outcome of legal and/or regulatory proceedings.

The factors listed above are not all-inclusive, and further

information is contained in Elbit Systems Ltd.'s latest annual

report on Form 20-F, which is on file with the U.S. Securities and

Exchange Commission. All forward-looking statements speak only as

of the date of this release. The Company does not undertake to

update its forward-looking statements. (FINANCIAL TABLES TO FOLLOW)

ELBIT SYSTEMS LTD. CONSOLIDATED BALANCE SHEETS (In thousand of US

Dollars) December 31 December 31 2008 2007 Audited Audited Assets

Current Assets: Cash and short term deposits 278,043 375,700 Trade

receivable and others 681,000 562,828 Inventories, net of advances

647,561 480,603 Total current assets 1,606,604 1,419,131 Affiliated

Companies & other Investments 62,300 66,161 Long-term

receivables & others 286,874 314,568 Fixed Assets, net 384,086

352,702 Other assets, net 594,283 636,255 2,934,147 2,788,817

Liabilities and Shareholder's Equity Current liabilities 1,316,598

1,242,012 Long-term liabilities 817,241 990,458 Minority Interest

76,475 20,085 Shareholder's equity 723,833 536,262 2,934,147

2,788,817 ELBIT SYSTEMS LTD. CONSOLIDATED STATEMENTS OF INCOME (In

thousand of US Dollars, except for per share amounts) For the Year

Ended Three Months Ended December 31 December 31 2008 2007 2008

2007 Audited Unaudited Revenues 2,638,271 1,981,761 697,854 591,056

Cost of revenues 1,870,830 1,454,913 494,496 434,891 Restructuirng

expenses - 10,482 - - Gross Profit 767,441 516,366 203,358 156,165

Research and development (R&D) 63,875 39,401 expenses, net

184,984 126,995 Marketing and selling epenses 198,274 157,411

45,520 44,277 General and administrative 30,783 34,265 expenses

134,182 107,447 Acquired In Process R&D write-off 1,000 16,560

1,000 - 518,440 408,413 141,178 117,943 Operating income 249,001

107,953 62,180 38,222 Financial expenses, net (36,815) (19,329)

(3,759) (10,632) Other income, net 94,294 368 90,064 286 Income

before taxes on income 306,480 88,992 148,485 27,876 Taxes on

income (54,367) (13,810) (26,278) 7,501 252,113 75,182 122,207

35,377 Equity in net earnings of affiliated companies and

partnership 14,435 14,565 6,364 4,544 Minority interest in earnings

of subsidiaries (62,372) (13,038) (23,299) (7,995) Net income

204,176 76,709 105,272 31,926 Earnings per share Basic net earnings

per share 4.85 1.82 2.50 0.75 Diluted net earnings per share 4.78

1.81 2.48 0.75 Company Contact: Joseph Gaspar, Executive VP &

CFO Dalia Rosen, Head of Corporate Communications Elbit Systems

Ltd. Tel: +972-4-831-6663 Fax: +972-4-831-6944 E-mail: IR Contact:

Ehud Helft / Kenny Green GK Investor Relations Tel: +1-646-201-9246

E-mail:

http://www.newscom.com/cgi-bin/prnh/20080408/300441DATASOURCE:

Elbit Systems Ltd CONTACT: Company Contact: Joseph Gaspar,

Executive VP & CFO, Dalia Rosen, Head of Corporate

Communications, Elbit Systems Ltd., Tel: +972-4-831-6663, Fax:

+972-4-831-6944, E-mail: , ; IR Contact: Ehud Helft / Kenny Green,

GK Investor Relations, Tel: +1-646-201-9246, E-mail:

Copyright

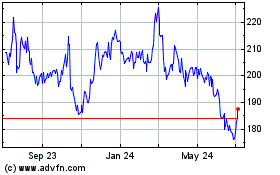

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jun 2024 to Jul 2024

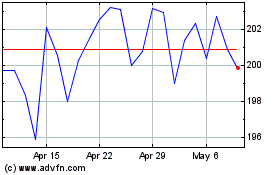

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jul 2023 to Jul 2024