Ekso Bionics Holdings, Inc. (Nasdaq: EKSO) (the “Company”), an

industry leader in exoskeleton technology for medical and

industrial use, today reported financial results for the three and

nine months ended September 30, 2024.

Recent Highlights and

Accomplishments

- Reported revenue of $4.1 million in the third quarter of

2024

- Sold a total of 33 EksoHealth devices in the third quarter of

2024

- Announced receipt of initial Centers for Medicare &

Medicaid Services (“CMS”) reimbursement for Ekso Indego

Personal

- Achieved gross margin of 53.5% in the third quarter of

2024

- Completed underwritten offering resulting in net proceeds of

approximately $5.0 million in September 2024

“The receipt of initial CMS reimbursement

through our Durable Medical Equipment Medicare Administrative

Contractors (“DMEs”) for our Ekso Indego Personal was a major

milestone for us and, importantly, spinal cord injury (“SCI”)

patients, allowing those covered by Medicare to access the

transformative mobility benefits of our Ekso Indego Personal at

home and in community settings,” said Scott Davis, the Company’s

Chief Executive Officer. “With a growing number of CMS claim

submissions in our pipeline, we are actively collaborating with our

network of existing neuro-rehabilitation facilities, physicians,

and DMEs to lay the groundwork for future sales. Going forward, we

remain focused on expanding access to our family of EksoHealth

devices across the continuum of care while getting back on pace as

procurement cycles with Integrated Delivery Networks (“IDNs”)

normalize in the near-term.”

Third Quarter 2024 Financial

Results

Revenue was $4.1 million for the quarter ended

September 30, 2024, compared to $4.6 million for the same period in

2023. The Company sold a total of 33 EksoHealth devices in the

third quarter of 2024.

Gross profit for the quarter ended September 30,

2024 was $2.2 million, representing a gross margin of approximately

53.5%, compared to $2.5 million for the same period in 2023,

representing a gross margin of 53.3%. The increase in gross margin

was primarily driven by cost savings in supply chain and a

reduction in service costs, partially offset by lower margin sales

related to increased volume through distribution.

Sales and marketing expenses for the quarter

ended September 30, 2024 were $1.8 million, compared to $2.1

million for the same period in 2023. The 14% decrease was primarily

due to lower headcount, discretionary payroll, and

travel expenses.

Research and development expenses for the

quarter ended September 30, 2024 were $0.8 million, compared to

$1.2 million for the same period in 2023. The 33% decrease was

primarily due to a decrease in the use of product development

consultants.

General and administrative expenses for the

quarter ended September 30, 2024 were $2.3 million, compared to

$2.2 million for the same period in 2023. The increase was

primarily due to higher consulting costs.

Net loss applicable to common stockholders for

the quarter ended September 30, 2024 narrowed to $2.1 million, or

$0.10 per basic and diluted share, from a net loss of $3.4 million,

or $0.24 per basic and diluted share, for the same period in

2023.

Nine Months Ended September 30,

2024

Revenue was $12.8 million for the nine months

ended September 30, 2024, compared to $13.4 million for the same

period in 2023. The Company sold a total of 99 EksoHealth devices

in the first nine months of 2024.

Gross profit for the nine months ended September

30, 2024 was $6.8 million, representing a gross margin of

approximately 53%, compared to gross profit of $6.7 million for the

same period in 2023, representing a gross margin of 50%. The

increase in gross margin was primarily driven by cost savings

in supply chain and a reduction in service costs.

Sales and marketing expenses for the nine months

ended September 30, 2024 were $5.4 million, compared to $6.5

million the same period in 2023. The 16% decrease was primarily due

to lower headcount, discretionary payroll, and consultant

costs.

Research and development expenses for the nine

months ended September 30, 2024 were $3.0 million, compared to $3.7

million for the same period in 2023. The 18% decrease was primarily

due to a decrease in the use of product development

consultants and lower discretionary payroll costs.

General and administrative expenses for the nine

months ended September 30, 2024 were $6.6 million, compared to $8.2

million for the same period in 2023. The 20% decrease was primarily

due to lower discretionary payroll, accounting,

and legal costs.

Net loss applicable to common stockholders for

the nine months ended September 30, 2024 was $7.9 million, or $0.42

per basic and diluted share, compared to net loss of $12.0 million,

or $0.88 per basic and diluted share, for the same period in

2023.

Cash on hand on September 30, 2024 was $8.3

million, compared to $8.6 million at December 31, 2023. In

September 2024, the Company closed a firm commitment underwritten

public offering, resulting in net proceeds to the Company of

approximately $5.0 million. Net cash used in operating activities

in the first nine months of 2024 was $8.4 million, compared to

$10.5 million in the same period of 2023.

Conference CallManagement will

host a conference call today beginning at 1:30 p.m. PT / 4:30 p.m.

ET to discuss the Company’s financial results and recent business

developments.

A live webcast of the event is available in the

“Investors” section of the Company’s website at

www.eksobionics.com, or by clicking here. Investors interested in

listening to the conference call may do so by dialing 877-407-6184

for domestic callers or 201-389-0877 for international callers. The

webcast will also be available on the Company’s website for one

month following the completion of the call.

About Ekso

Bionics®Ekso Bionics® is a leading

developer of exoskeleton solutions that amplify human potential by

supporting or enhancing strength, endurance and mobility across

medical and industrial applications. Founded in 2005, the Company

continues to build upon its industry-leading expertise to design

some of the most cutting-edge, innovative wearable robots available

on the market. Ekso Bionics is the only known exoskeleton company

to offer technologies that range from helping those with paralysis

to stand up and walk, to enhancing human capabilities on job sites

across the globe. The Company is headquartered in the San Francisco

Bay Area and is listed on the Nasdaq Capital Market under the

symbol “EKSO.” For more information, visit: www.eksobionics.com or

follow @EksoBionics on X.

Forward-Looking StatementsAny

statements contained in this press release that do not describe

historical facts may constitute forward-looking statements.

Forward-looking statements may include, without limitation,

statements regarding the plans, objectives and expectations of

management with respect to the Company’s industry, growth and

strategy, including the growing number of CMS claim submissions in

the Company’s pipeline, the Company’s ability to expand access to

EksoHealth devices and the normalization of the procurement cycles

for EksoHealth devices. Such forward-looking statements are not

meant to predict or guarantee actual results, performance, events

or circumstances and may not be realized because they are based

upon the Company's current projections, plans, objectives, beliefs,

expectations, estimates and assumptions and are subject to a number

of risks and uncertainties and other influences, many of which the

Company has no control over. Actual results and the timing of

certain events and circumstances may differ materially from those

described by the forward-looking statements as a result of these

risks and uncertainties. Factors that may influence or contribute

to the inaccuracy of the forward-looking statements or cause actual

results to differ materially from expected or desired results may

include, without limitation, the Company's inability to obtain

adequate financing to fund and grow the Company's operations and

necessary to develop or enhance the Company’s technology, the

Company’s inability to successfully collaborate with its network of

existing neuro-rehabilitation facilities, physicians, and DMEs in

seeking CMS reimbursements, the Company’s inability to obtain

future reimbursements from CMS in a timely manner and at the

expected reimbursement levels, the Company’s inability to obtain

insurance coverage beyond CMS, the Company’s inability to obtain

additional indications of use for its devices, the significant

length of time and resources associated with the development of the

Company’s products, the Company’s failure to achieve broad market

acceptance of the Company’s products, the failure of the Company’s

sales and marketing efforts or of partners to market the Company’s

products effectively, adverse results in future clinical studies of

the Company’s medical device products, the failure of the Company

to obtain or maintain patent protection for the Company’s

technology, the failure of the Company to obtain or maintain

regulatory approval to market the Company’s medical devices, lack

of product diversification, existing or increased competition,

disruptions in the Company’s supply chain, and the Company's

failure to implement the Company's business plans or strategies.

These and other factors are identified and described in more detail

in the Company's filings with the SEC, including the Company’s most

recently filed Annual Report on Form 10-K and its subsequently

filed Quarterly Reports on Form 10-Q. To learn more about Ekso

Bionics please visit the Company’s website at www.eksobionics.com

or refer to the Company’s X page, formerly Twitter, at

@EksoBionics. Any forward-looking statements made in this press

release speak only as of the date of this press release. The

Company does not undertake to update these forward-looking

statements, except as required by law.

Contact: David

Carey212-867-1768investors@eksobionics.com

| Ekso Bionics

Holdings, Inc. |

|

| Condensed

Consolidated Balance Sheets |

|

| (In

thousands) |

|

|

|

|

|

|

|

|

|

| |

|

|

September

30, |

|

December

31, |

|

| |

|

|

2024 |

|

2023 |

|

|

Assets |

|

(unaudited) |

|

|

|

|

Current assets: |

|

|

|

|

|

| |

Cash and restricted cash |

$ |

8,292 |

|

$ |

8,638 |

|

|

| |

Accounts

receivable, net |

|

6,964 |

|

|

5,645 |

|

|

| |

Inventories |

|

5,031 |

|

|

5,050 |

|

|

| |

Prepaid

expenses and other current assets |

|

779 |

|

|

875 |

|

|

|

Total current assets |

|

21,066 |

|

|

20,208 |

|

|

|

Property and equipment, net |

|

1,628 |

|

|

2,018 |

|

|

|

Right-of-use assets |

|

891 |

|

|

977 |

|

|

|

Intangible assets, net |

|

4,662 |

|

|

4,892 |

|

|

|

Goodwill |

|

431 |

|

|

431 |

|

|

|

Other assets |

|

531 |

|

|

392 |

|

|

|

Total assets |

$ |

29,209 |

|

$ |

28,918 |

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

| |

Accounts

payable |

$ |

1,808 |

|

$ |

1,847 |

|

|

| |

Accrued

liabilities |

|

1,975 |

|

|

2,664 |

|

|

| |

Deferred

revenues, current |

|

2,039 |

|

|

1,993 |

|

|

| |

Notes

payable, current |

|

1,250 |

|

|

1,250 |

|

|

| |

Lease

liabilities, current |

|

434 |

|

|

363 |

|

|

|

Total current liabilities |

|

7,506 |

|

|

8,117 |

|

|

|

Deferred revenues |

|

1,971 |

|

|

2,169 |

|

|

|

Notes payable, net |

|

4,106 |

|

|

4,832 |

|

|

|

Lease liabilities |

|

556 |

|

|

723 |

|

|

|

Warrant liabilities |

|

35 |

|

|

366 |

|

|

|

Other non-current liabilities |

|

165 |

|

|

105 |

|

|

|

Total liabilities |

|

14,339 |

|

|

16,312 |

|

|

|

Stockholders' equity: |

|

|

|

|

|

| |

Common

stock |

|

22 |

|

|

15 |

|

|

| |

Additional

paid-in capital |

|

261,898 |

|

|

251,580 |

|

|

| |

Accumulated

other comprehensive income |

|

12 |

|

|

156 |

|

|

| |

Accumulated

deficit |

|

(247,062 |

) |

|

(239,145 |

) |

|

|

Total stockholders' equity |

|

14,870 |

|

|

12,606 |

|

|

|

Total liabilities and stockholders' equity |

$ |

29,209 |

|

$ |

28,918 |

|

|

| |

|

|

|

|

|

|

| Ekso Bionics

Holdings, Inc. |

|

| Condensed

Consolidated Statements of Operations |

|

| (In

thousands, except per share amounts) |

|

|

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

4,129 |

|

$ |

4,607 |

|

$ |

12,835 |

|

$ |

13,432 |

|

|

| Cost of

revenue |

|

1,920 |

|

|

2,151 |

|

|

6,038 |

|

|

6,722 |

|

|

| Gross

profit |

|

2,209 |

|

|

2,456 |

|

|

6,797 |

|

|

6,710 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

1,760 |

|

|

2,052 |

|

|

5,424 |

|

|

6,489 |

|

|

|

Research and development |

|

777 |

|

|

1,159 |

|

|

3,029 |

|

|

3,712 |

|

|

|

General and administrative |

|

2,311 |

|

|

2,176 |

|

|

6,574 |

|

|

8,172 |

|

|

| Total

operating expenses |

|

4,848 |

|

|

5,387 |

|

|

15,027 |

|

|

18,373 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(2,639 |

) |

|

(2,931 |

) |

|

(8,230 |

) |

|

(11,663 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Other income

(expense), net: |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(79 |

) |

|

(64 |

) |

|

(210 |

) |

|

(236 |

) |

|

|

Loss on modification of warrant |

|

|

|

|

|

(109 |

) |

|

- |

|

|

|

Gain on revaluation of warrant liabilities |

|

14 |

|

|

60 |

|

|

440 |

|

|

186 |

|

|

|

Unrealized gain (loss) on foreign exchange |

|

634 |

|

|

(433 |

) |

|

194 |

|

|

(223 |

) |

|

|

Other (expense) income, net |

|

(2 |

) |

|

3 |

|

|

(2 |

) |

|

(48 |

) |

|

| Total other

income (expense), net |

|

567 |

|

|

(434 |

) |

|

313 |

|

|

(321 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Net

loss |

$ |

(2,072 |

) |

$ |

(3,365 |

) |

$ |

(7,917 |

) |

$ |

(11,984 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net loss per

share, basic and diluted |

$ |

(0.10 |

) |

$ |

(0.24 |

) |

$ |

(0.42 |

) |

$ |

(0.88 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Net loss per

share, diluted |

$ |

(0.10 |

) |

$ |

(0.24 |

) |

$ |

(0.42 |

) |

$ |

(0.88 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares of common |

|

|

|

|

|

|

|

|

|

|

stock outstanding, basic and diluted |

|

20,310 |

|

|

14,073 |

|

|

18,657 |

|

|

13,672 |

|

|

| |

|

|

|

|

|

|

|

|

|

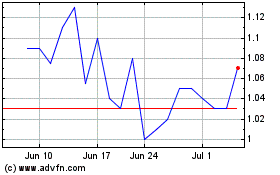

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Dec 2023 to Dec 2024