Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-272401

PROSPECTUS

11,131,900 Shares of Common Stock Issuable Upon Exercise

of Previously Issued Warrants

This

prospectus relates to the issuance by us of up to 11,131,900 shares of our common stock, $0.0001 par value per share (the “Common

Stock”), that may be issued from time to time upon the exercise of warrants (the “Warrants”) previously issued by the

Company to investors in our public offering that closed on June 22, 2023, including pursuant to the partial exercise of the underwriters’

overallotment option (the “Offering”), the issuance of which was previously registered on a Registration Statement on Form

S-1 (File No. 333-272401).

Each

Warrant is exercisable for one share of our Common Stock at an exercise price of $2.00 per share. The Warrants were immediately exercisable

upon issuance and expire on June 22, 2028. We will receive all of the proceeds from the exercise for cash of the Warrants.

Our

Common Stock is currently listed on the Nasdaq Capital Market under the symbol “DFLI,” and our public warrants are currently

listed on the Nasdaq Capital Market under the symbol “DFLIW.” As of June 20, 2024, the closing price of our common

stock was $0.855. As of June 20, 2024, the closing price of our public warrants was $0.039.

We

are an “emerging growth company” under applicable federal securities laws and are subject to reduced public company reporting

requirements.

Investing

in our Common Stock involves a high degree of risk. Before making an investment decision. See “Risk Factors” in our most

recent Annual Report on Form 10-K as such risk factors may be updated in our subsequent reports filed with the Securities and Exchange

Commission, which are incorporated by reference herein, and as may be amended, supplemented or superseded from time to time by other

reports we file with the Securities and Exchange Commission.

Neither

the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the

accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is July 8, 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 we filed with the Securities and Exchange Commission (the “SEC”)

using the “shelf” registration process. This prospectus relates to the issuance by us of the shares of Common Stock issuable

upon the exercise of the Warrants. We will receive the exercise price per share for each Warrant exercised for cash.

We

are responsible for the information contained in this prospectus and in any free-writing prospectus we prepare or authorize. We have

not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give

you. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not

assume that the information contained in this prospectus is accurate as of any date other than the date on the cover of this prospectus.

Persons

who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are

required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any

such free writing prospectus applicable to that jurisdiction. relating to, the offering of our securities and the distribution of this

prospectus outside the United States.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Additional

Information” and “Incorporation Of Certain Information By Reference.”

We

may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or

change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective

amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus

entitled “Additional Information” and “Incorporation Of Certain Information By Reference.”

Solely

for convenience, trademarks and tradenames referred to in this prospectus may appear without the ® or ™ symbols, but such references

are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights, or that the

applicable owner will not assert its rights, to these trademarks and tradenames.

Unless

the context otherwise requires, references in this prospectus to “Dragonfly,” the “Company,” “us,”

“we,” “our” and any related terms are intended to mean Dragonfly Energy Holdings Corp. and its consolidated subsidiaries.

PROSPECTUS

SUMMARY

The

following summary highlights some information from this prospectus. It is not complete and does not contain all of the information that

you should consider before making an investment decision. You should read this entire prospectus, including the “Risk Factors”

section on page 4 and the disclosures to which that section refers you, the financial statements and related notes and the other more

detailed information appearing elsewhere or incorporated by reference into this prospectus before investing in any of the securities

described in this prospectus.

The

Company

We

are a manufacturer of non-toxic deep cycle lithium-ion batteries that caters to customers in the consumer industry (including the recreational

vehicle (“RV”), marine vessel, solar, oil and gas, and off-grid residence industries), and industrial and energy storage

markets, with proprietary, patented and disruptive battery cell manufacturing and non-flammable solid-state cell technology currently

under development. Our goal is to develop technology to deliver environmentally impactful solutions for energy storage to everyone globally.

We believe that the innovative design of our lithium-ion batteries is ideally suited for the demands of modern customers who rely on

consumer electronics, connected devices and smart appliances that require continuous, reliable electricity, regardless of location.

We have a dual-brand strategy for battery products,

Dragonfly Energy (“Dragonfly Energy”) and Battle Born Batteries (“Battle Born”). Battle Born branded products

are primarily sold direct-to-consumers (“DTC”), while the Dragonfly Energy brand is primarily sold to original equipment

manufacturers (“OEMs”). However, with the growing popularity and brand recognition of Battle Born, these batteries have become

increasingly popular with our OEM customers. Based on the extensive research and optimization undertaken by our team, we have developed

a line of products with features including a proprietary battery management system and an internal battery heating feature for cold temperatures,

and we have recently launched our unique battery communication system. We currently source the lithium iron phosphate (“LFP”)

cells incorporated into our batteries from a limited number of carefully selected suppliers that can meet our demanding quality standards

and with whom we have developed long-term relationships.

We

currently offer several lines of batteries across our two brands, each differentiated by size, power and capacity, consisting of seven

different models, four of which come with a heated option. To supplement our battery offerings, we are also a reseller of accessories

for battery systems. These include chargers, inverters, monitors, controllers and other system accessories from brands such as Victron

Energy, Progressive Dynamics, Magnum Energy and Sterling Power. Pursuant to the Asset Purchase Agreement dated April 22, 2022 by and

among us and Thomason Jones Company, LLC (“Thomason Jones”) and the other parties thereto, we also acquired the assets, including

the Wakespeed Offshore brand (“Wakespeed”) of Thomason Jones, allowing us to include our own alternator regulator in systems

that we sell.

In

addition, we have successfully developed innovative manufacturing processes for dry-electrode manufacturing of lithium-ion cells, and

we are continuing development efforts relating to next-generation solid-state technology. Since our inception, we have built a comprehensive

patent portfolio around our proprietary dry-electrode battery manufacturing process, which eliminates the use of harmful solvents and

energy-intensive drying ovens compared to traditional methods. This translates to significant environmental and cost benefits, including

reduced energy consumption, smaller space requirements, and a lower carbon footprint.

The

mailing address of our principal executive office is 1190 Trademark Dr. #108, Reno, Nevada 89521, and our telephone number is (775) 622-3448.

Emerging

Growth Company

We

are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities

Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to

take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging

growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section

404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation

in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive

compensation and stockholder approval of any golden parachute payments not previously approved. If some investors find our securities

less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more

volatile.

We

will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) ending December 31, 2026, (b) in

which we have total annual gross revenue of at least $1.235 billion, or (c) in which we are deemed to be a large accelerated filer, which

means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s

second fiscal quarter; and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year

period. References herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

Smaller

Reporting Company

Additionally,

we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take

advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements.

We will remain a smaller reporting company until the last day of the fiscal year in which (i) the market value of our common stock held

by non-affiliates exceeds $250 million as of the prior June 30, or (ii) our annual revenues exceeded $100 million during such completed

fiscal year and the market value of our common stock held by non-affiliates exceeds $700 million as of the prior June 30.

THE

OFFERING

The

following summary of the offering contains basic information about the offering and our securities and is not intended to be complete.

It does not contain all the information that may be important to you. For a more complete understanding of our securities, please refer

to the section titled “Description of Securities.”

We

are registering the issuance by us of 11,131,900 shares of Common Stock that may be issued from time to time upon the exercise

of the Warrants.

Issuance

of Common Stock

Underlying the Warrants |

11,131,900

shares of Common Stock |

| |

|

| Common

Stock Outstanding |

61,148,917

shares of Common Stock as of June 20, 2024 |

| |

|

| Description

of the Warrants |

The

Warrants have an exercise price of $2.00 per share of Common Stock, were immediately exercisable upon issuance and expire on June

22, 2028. Each Warrant is exercisable one share of our Common Stock, subject to adjustment in the event of stock dividends, stock

splits, stock combinations, reclassifications, reorganizations or similar events affecting our Common Stock.

This

prospectus relates to the issuance of Common Stock upon exercise of the Warrants. To better understand the terms of the Warrants,

you should carefully read the “Description of Securities” section of this prospectus. You should also read the

form of Warrant, which is filed as an exhibit to the registration statement that includes this prospectus. |

| |

|

| Use

of Proceeds |

We

will receive the exercise price per share for each Warrant exercised for cash; however, we are unable to predict the timing or amount

of potential Warrant exercises. As such, we have not allocated any proceeds of such exercises to any particular purpose. Accordingly,

all such proceeds will be used for working capital and other general corporate purposes. It is possible that some, or all, of the

Warrants may expire and never be exercised. |

| |

|

| Risk

Factors |

See

“Risk Factors” in our most recent Annual Report on Form 10-K and in our subsequent reports filed with the SEC,

which are incorporated by reference herein, and other information in this prospectus for a discussion of the factors you should consider

before you decide to invest in our securities. |

| |

|

| Trading

Market and Ticker Symbol |

Our

common stock is currently listed on the Nasdaq Capital Market under the symbol “DFLI.” |

Unless

we specifically state otherwise or the context otherwise requires, the information above is as of June 20, 2024, does not give effect

to issuances of our Common Stock, Warrants, options to purchase shares of our Common Stock, or the exercise of Warrants or options after

such date, and excludes:

| |

● |

25,000,000

shares of Common Stock reserved for issuance in the event of certain financial achievements per our $75,000,000 term loan (the “Term

Loan”); |

| |

● |

1,501,386

shares of Common Stock issuable upon exercise of the private placement warrants that were originally issued in a private placement

at the time of the Chardan NexTech Acquisition 2 Corp. initial public offering (the “CNTQ IPO”); |

| |

● |

9,422,519

shares of Common Stock issuable upon exercise of the public warrants sold as part of the CNTQ IPO; |

| |

● |

4,440,720

shares of Common Stock currently issuable upon the exercise of the certain penny warrants issued to the lenders of our Term Loan;

|

| |

● |

11,131,900

shares of Common Stock issuable upon the exercise of the Warrants issued as part of the Offering; |

| |

● |

570,250

shares of Common Stock issuable upon the exercise of the underwriters’ warrants issued as part of the Offering; |

| |

● |

1,996,374

shares of Common Stock underlying outstanding options; and |

| |

● |

2,421,002

shares of Common Stock underlying outstanding restricted stock units. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before purchasing any of the securities you should carefully consider the risk factors

incorporated by reference in this prospectus from our most recent Annual Report on Form 10-K and any subsequent updates described in

our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. For a description of these reports and information about where you

can find them, see “Additional Information” and “Incorporation of Certain Information By Reference.”

Additional risks not presently known or that we presently consider to be immaterial could subsequently materially and adversely affect

our financial condition, results of operations, business and prospects.

FORWARD-LOOKING

STATEMENTS

This

prospectus and the documents incorporated by reference in this prospectus contain, and our officers and representatives may from time

to time make, forward-looking statements that involve substantial risks and uncertainties. In some cases, you can identify forward-looking

statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,”

“could,” “intend,” “target,” “project,” “estimate,” “believe,”

“estimate,” “predict,” “potential” or “continue” or the negative of these terms or other

similar expressions intended to identify statements about the future. These statements speak only as of the date of this prospectus and

involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements include,

without limitation, statements about the following:

| ● |

our

ability to successfully increase market penetration into target markets; |

| ● |

the

addressable markets that we intend to target do not grow as expected; |

| ● |

the

potential for events or circumstances that result in our failure to timely achieve the anticipated benefits of our customer arrangements

with THOR Industries and its affiliate brands (including Keystone RV Company (“Keystone”)), including Keystone’s

decision in July 2023, that, due to weaker demand for its products and its subsequent focus on reducing costs, it would no longer

install our storage solutions as standard equipment, but rather return to offering those solutions as an option to dealers and consumers; |

| ● |

our

ability to generate revenue from future product sales and our ability to achieve and maintain profitability; |

| ● |

the

loss of any members of our senior management team or other key personnel; |

| ● |

the

loss of any relationships with key suppliers, including suppliers in China; |

| ● |

the

loss of any relationships with key customers; |

| ● |

our

ability to protect our patents and other intellectual property; |

| ● |

the

failure to successfully optimize solid-state cells or to produce commercially viable solid-state cells in a timely manner or at all,

or to scale to mass production; |

| ● |

changes

in applicable laws or regulations, including changes in the rates of tariffs or any adjustments to the amounts payable by us to customs

as a result of improperly identifying the applicable tariff rate payable on our products; |

| ● |

our

ability to maintain the listing of our Common Stock and public warrants on the Nasdaq Capital Market; |

| ● |

the

possibility that we may be adversely affected by other economic, business and/or competitive factors (including an economic slowdown

or inflationary pressures); |

| ● |

our

ability to sell the desired amounts of shares of Common Stock at desired prices under our equity facility; |

| ● |

our

ability to raise additional capital to fund our operations; |

| ● |

the

accuracy of our projections and estimates regarding our expenses, capital requirements, cash utilization, and need for additional

financing; |

| ● |

developments

relating to our competitors and our industry; |

| ● |

our

ability to engage target customers and successfully retain these customers for future orders; |

| ● |

the

reliance on two suppliers for our lithium iron phosphate cells and a single supplier for the manufacture of our battery management

system; |

| ● |

the

potential impact of geopolitical events, including the Russia-Ukraine conflict and Hamas’ attack on Israel, and their effects

on our operations; and |

| ● |

our

current dependence on two manufacturing facilities. |

The

foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein and

in the documents incorporated by reference herein or risk factors that we are faced with that may cause our actual results to differ

from those anticipate in our forward-looking statements. Factors that may affect our results include, but are not limited to, the risks

and uncertainties discussed in the “Risk Factors” section on page 4 of this prospectus, in our Annual Report on

Form 10-K or in other reports we file with the SEC.

Moreover,

new risks regularly emerge, and it is not possible for our management to predict or articulate all risks we face, nor can we assess the

impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from

those contained in any forward-looking statements. The Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities

Act, do not protect any forward-looking statements that we make in connection with this offering. All forward-looking statements included

in this prospectus and in the documents incorporated by reference in this prospectus are based on information available to us on the

date of this prospectus or the date of the applicable document incorporated by reference. Except to the extent required by applicable

laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether written or oral, that may

be made from time to time, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking

statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained above and throughout this prospectus and in the documents incorporated by reference in this prospectus. We qualify all of our

forward-looking statements by these cautionary statements.

USE

OF PROCEEDS

We

will receive the exercise price per share for each Warrant exercised for cash; however, we are unable to predict the timing or amount

of potential Warrant exercises. As such, we have not allocated any proceeds of such exercises to any particular purpose. Accordingly,

all such proceeds will be used for working capital and other general corporate purposes. It is possible that some, or all, of the Warrants

may expire and never be exercised.

DESCRIPTION

OF SECURITIES

The

following summary of the material terms of our securities is not intended to be a complete summary of the rights and preferences of such

securities. You are encouraged to read the applicable provisions of the means the Nevada Revised Statutes (the “NRS”), our

Articles of Incorporation and our Bylaws in their entirety for a complete description of the rights and preferences of our securities.

Authorized

Capitalization

We

have 255,000,000 shares of capital stock authorized under our Charter, which consists of 250,000,000 shares of Common Stock with a par

value of $0.0001 per share and 5,000,000 shares of preferred stock with par value $0.0001 per share.

As

of June 20, 2024 there were 61,148,917 shares of Common Stock outstanding and no shares of preferred stock outstanding.

Common

Stock

Holders

of our Common Stock are entitled to such dividends as may be declared by our board of directors out of funds legally available for such

purposes. Holders of our Common Stock are entitled to receive proportionately any dividends as may be declared by our board, subject

to any preferential dividend rights of any series of preferred stock that we may designate and issue in the future. The shares of Common

Stock are neither redeemable nor convertible. Holders of Common Stock have no preemptive or subscription rights to purchase any of our

securities. The rights, preferences and privileges of holders of our Common Stock are subject to and may be adversely affected by the

rights of the holders of shares of any series of preferred stock that we may designate and issue in the future. Each holder of our Common

Stock is entitled to one vote for each such share outstanding in the holder’s name. No holder of Common Stock is entitled to cumulate

votes in voting for directors.

In

the event of our liquidation, dissolution or winding up, the holders of our Common Stock are entitled to receive a pro rata share of

our assets, which are legally available for distribution, after payments of all debts and other liabilities. All of the outstanding shares

of our Common Stock are fully paid and non-assessable.

Warrants

The

following is a summary of the material terms and provisions of the Warrants. This summary is subject to and qualified in its entirety

by the form of Warrant which is filed as an exhibit to the registration statement of which this prospectus forms a part.

Duration

and Exercise Price

Each

Warrant has an exercise price of $2.00 per share. The Warrants were exercisable upon issuance and may be exercised until five years from

the date of issuance. The exercise price and number of shares of Common Stock issuable upon exercise of the Warrants is subject to appropriate

adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting our Common Stock and the exercise

price. The Warrants were issued in certificated form only.

Exercisability

The

Warrants are exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied

by payment in full for the number of shares of our Common Stock purchased upon such exercise (except in the case of a cashless exercise

as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s Warrants to the extent

that the holder would own more than 4.99% of the outstanding Common Stock immediately after exercise, except that upon at least 61 days’

prior notice from the holder to us, the holder may increase the amount of ownership of outstanding stock after exercising the holder’s

warrants up to 9.99% of the number of shares of our Common Stock outstanding immediately after giving effect to the exercise, as such

percentage ownership is determined in accordance with the terms of the Warrants.

Cashless

Exercise

If,

at the time a holder exercises its Warrants, a registration statement registering the issuance or resale of the shares of Common Stock

underlying the Warrants under the Securities Act is not then effective or available for the issuance of such shares, then in lieu of

making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder

may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of Common Stock determined according

to a formula set forth in the Warrant.

Fundamental

Transactions

If,

at any time while the Warrants are outstanding and there is a fundamental transaction as described in the Warrant where, we, directly

or indirectly, (1) effect any merger or consolidation with or into another person, (2) effect any sale, lease, exclusive license, assignment,

transfer, conveyance or other disposition of all or substantially all of our assets in one or a series of related transactions, (3) complete

any direct or indirect purchase offer, tender offer or exchange offer (whether by us or another person) pursuant to which holders of

our Common Stock are permitted to sell, tender or exchange their shares for other securities, cash or property and which has been accepted

by the holders of 50% or more of the outstanding Common Stock, (4) effect any reclassification, reorganization or recapitalization of

the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other

securities, cash or property, or (5) in one or more related transactions consummate a stock or share purchase agreement or other business

combination (including a reorganization, recapitalization, spin-off or scheme of arrangement) with another person or group of persons

whereby such other person or group acquires more than 50% of the outstanding shares of Common Stock, or each, a Fundamental Transaction,

then the holder shall have the right thereafter to receive, upon exercise of the Warrant, the same amount and kind of securities, cash

or property as it would have been entitled to receive upon the occurrence of such Fundamental Transaction if it had been, immediately

prior to such Fundamental Transaction, the holder of the number of Warrant shares then issuable upon exercise of the Warrant. Any successor

to us or surviving entity shall assume the obligations under the Warrant. Notwithstanding the foregoing, in the event of a Fundamental

Transaction approved by our board of directors, the holders of the Warrants have the right to require us or a successor entity to redeem

the Warrants for cash in the amount of the Black Scholes Value (as defined in each Warrant) of the unexercised portion of the Warrants

on the date of the consummation of the Fundamental Transaction, concurrently with or within 30 days following the consummation of a Fundamental

Transaction. In the event of a Fundamental Transaction that is not within our control, including any Fundamental Transaction which is

not approved by our board of directors, the holders of the Warrants have the right to receive the same type or form of consideration

paid to holders of Common Stock in the Fundamental Transaction in the amount of the Black Scholes Value of the unexercised portion of

the Warrants on the date of the consummation of the Fundamental Transaction.

Transferability

Subject

to applicable laws, an Warrant may be transferred at the option of the holder upon surrender of the Warrant to us together with the appropriate

instruments of transfer.

Fractional

Shares

No

fractional shares of Common Stock will be issued upon the exercise of the Warrants. Rather, the number of shares of Common Stock to be

issued will, at our election, either be rounded up to the next whole share or we will pay a cash adjustment in respect of such final

fraction in an amount equal to such fraction multiplied by the exercise price.

Trading

Market

There

is no established trading market for the Warrants, and we do not expect such a market to develop. We do not intend to apply to list the

Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of

the Warrants is extremely limited.

Right

as a Stockholder

Except

as otherwise provided in the Warrants or by virtue of the holder’s ownership of shares of our Common Stock, such holder of Warrants

does not have the rights or privileges of a holder of our Common Stock, including any voting rights, until such holder exercises such

holder’s Warrants. The Warrants will provide that the holders of the Warrants have the right to participate in distributions or

dividends paid on our shares of Common Stock.

Waivers

and Amendments

The

Warrants may be modified or amended or the provisions of such warrants waived with our consent and the consent of the holders of at least

a majority of the outstanding warrants.

Our

Transfer Agent

The

transfer agent for our shares of Common Stock is Equiniti Trust Company, LLC.

Preferred

Stock

Our

Articles of Incorporation authorizes a total of 5,000,000 shares of preferred stock, par value $0.0001 per share.

Under

the terms of our Articles of Incorporation, our board of directors is authorized to issue shares of preferred stock in one or more series

without stockholder approval. Our board of directors has the discretion to determine the terms, rights, preferences, privileges and restrictions,

including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, of each series of preferred

stock.

The

issuance of preferred stock, while providing flexibility in connection with possible acquisitions, future financings and other corporate

purposes, could have the effect of making it more difficult for a third party to acquire, or could discourage a third party from seeking

to acquire, a majority of our outstanding voting stock. We have no present plans to issue any shares of preferred stock.

Choice

of Forum Provisions

Our

Articles of Incorporation, in Article XI, includes a mandatory forum provision that, to the fullest extent permitted by law, and unless

we consent in writing, the Second Judicial District Court, in and for the State of Nevada, located in Washoe County, shall be the sole

and exclusive forum for (a) any derivative action or proceeding brought in the name or right of the Company or on our behalf, (b) any

action asserting a claim for breach of any fiduciary duty owed by any of our current or former directors, officers, employees or stockholders

to the Company or our stockholders, (c) any action arising or asserting a claim arising pursuant to any provision of NRS Chapters 78

or 92A or any provision of the Articles of Incorporation or Bylaws, (d) any action to interpret, apply, enforce or determine the validity

of the Articles of Incorporation or Bylaws or (e) any action asserting a claim governed by the internal affairs doctrine.

These

provisions would not apply to suits brought to enforce a duty or liability created by the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or any other claim for which the federal courts have exclusive jurisdiction. Any person or entity purchasing

or otherwise acquiring or holding any interest in our securities shall be deemed to have notice of and consented to these provisions.

Our exclusive forum provision will not relieve us of our duties to comply with the federal securities laws and the rules and regulations

thereunder, and our shareholders will not be deemed to have waived our compliance with these laws, rules and regulations.

Anti-Takeover

Effects of the Charter, the Bylaws and Nevada Law

We

are a Nevada corporation and are generally governed by the NRS. The following is a brief description of the provisions in our Articles

of Incorporation, Bylaws and the NRS that could have an effect of delaying, deferring, or preventing a change in control of the Company.

The

provisions of the NRS, our Articles of Incorporation, and Bylaws could have the effect of discouraging others from attempting hostile

takeovers and, as a consequence, they may also inhibit temporary fluctuations in the price of our Common Stock that often result from

actual or rumored hostile takeover attempts. These provisions may also have the effect of preventing changes in our management. It is

possible that these provisions could make it more difficult to accomplish transactions that stockholders may otherwise deem to be in

their best interests.

Combinations

with Interested Stockholders

The

“combinations with interested stockholders” provisions of Sections 78.411 to 78.444, inclusive, prohibit a Nevada corporation

with at least 200 stockholders of record from engaging in various business “combinations” with any person deemed to be an

“interested stockholder” for a period of two years after the date that the person first become an interested stockholder,

unless the business combination or the transaction by which the person first became an interested stockholder is approved by the corporation’s

board of directors before the person first became an interested stockholder, or the business combination is approved by the board of

directors and thereafter is approved at a meeting of the corporation’s stockholders by the affirmative vote of at least 60% of

the outstanding voting power of the corporation not beneficially owned by the interested stockholder, its affiliates, and associates.

Following

the expiration of the two-year period, the corporation is prohibited from engaging in business “combinations” with the interested

stockholder, unless: (i) the business combination or the transaction by which the person first became an interested stockholder is approved

by the corporation’s board of directors before the person first became an interested stockholder; (ii) the business combination

is approved by a majority of the outstanding voting power of the corporation held by disinterested stockholders; or (iii) the aggregate

amount of the consideration to be received in the business combination by all of the holders of outstanding common shares of the corporation

not beneficially owned by the interested stockholder is at least equal to the higher of: (a) the highest price per share paid by the

interested stockholder, at a time when the interested stockholder was the beneficial owner, directly or indirectly, of 5 percent or more

of the outstanding voting shares of the corporation, for any common shares of the same class or series acquired by the interested stockholder

within two years immediately before the date of announcement with respect to the combination or within two years immediately before,

or in, the transaction in which the person became an interested stockholder, whichever is higher, plus, in either case, interest compounded

annually from the earliest date on which the highest price per share was paid through the date of consummation at the rate for one-year

obligations of the United States Treasury in effect on that earliest date, less the aggregate amount of any dividends paid in cash and

the market value of any dividends paid other than in cash, per common share since that earliest date, and (b) the market value per common

share on the date of the announcement of the business combination or on the date that the person first became an interested stockholder,

whichever is higher, plus interest compounded annually from that date through the date of consummation at the rate for one-year obligations

of the United States Treasury in effect on that date, less the aggregate amount of any dividends paid in cash and the market value of

any dividends paid other than in cash, per common share since that date.

In

general, an “interested stockholder” is any person who is (i) the direct or indirect beneficial owner of 10% or more of the

voting power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time

within two years immediately before the date in question was the direct or indirect beneficial owner of 10% or more of the voting power

of the then outstanding shares of the corporation.

Companies

are entitled to opt out of the business combination provisions of the NRS. In our Articles of Incorporation, we have not opted out of

the business combination provisions of NRS 78.411 to 78.444, inclusive.

Acquisition

of Controlling Interests

Nevada

law also protects the corporation and its stockholders from persons acquiring a “controlling interest” in a corporation.

The provisions can be found in NRS 78.378 to 78.3793, inclusive.

The

restriction on acquisition of a controlling interest applies to corporations which have 200 or more stockholders of record (at least

100 of whom have had addresses in Nevada at all times during the 90 days immediately preceding the date of the acquisition) and conducts

business in Nevada, unless the charter or bylaws of the corporation in effect on the tenth day after the acquisition of a controlling

interest provide otherwise. NRS 78.3785 provides that a “controlling interest” means the ownership of outstanding voting

shares of an issuing corporation sufficient to enable the acquiring person, individually or in association with others, directly or indirectly,

to exercise (i) one fifth or more but less than one third, (ii) one third or more but less than a majority, or (iii) a majority or more

of the voting power of the issuing corporation in the election of directors. Once an acquirer crosses one of these thresholds by acquiring

a controlling interest in the corporation, the shares which the acquirer acquired in the transaction taking it over the threshold and

within the 90 days immediately preceding the date when the acquiring person acquired or offered to acquire a controlling interest in

the corporation become “control shares.” Pursuant to NRS 78.379, any person who acquires a controlling interest in a corporation

may not exercise voting rights on any control shares unless such voting rights are conferred by a majority vote of the disinterested

stockholders of the issuing corporation at an annual meeting or a special meeting of such stockholders held upon the request and at the

expense of the acquiring person, or, if the acquisition would adversely alter or change any preference or any relative or other right

given to any other class or series of outstanding shares, the holders of a majority of each class or series affected. In the event that

the control shares are accorded full voting rights and the acquiring person acquires control shares with a majority or more of all the

voting power, any stockholder, other than the acquiring person, who does not vote in favor of authorizing voting rights for the control

shares is entitled to demand payment for the fair value of such person’s shares, and, provided that the proper procedure is adhered

to, the corporation must comply with the demand.

NRS

78.378(1) provides that the control share statutes of the NRS do not apply to any acquisition of a controlling interest in an issuing

corporation if the charter or bylaws of the corporation in effect on the 10th day following the acquisition of a controlling interest

by the acquiring person provide that the provisions of those sections do not apply to the corporation or to an acquisition of a controlling

interest specifically by types of existing or future stockholders, whether or not identified. NRS 78.378(2) provides that the corporation

may impose stricter requirements if it so desires. We have not opted out of the control share statutes and will be subject to these statutes

if we are an “issuing corporation” as defined in such statutes.

The

effect of the Nevada control share statutes is that the acquiring person, and those acting in association with the acquiring person,

will obtain only such voting rights in the control shares as are conferred by a resolution of the stockholders at an annual or special

meeting. The Nevada control share law, if applicable, could have the effect of discouraging takeovers of our Company.

Authorized

Shares

Section

78.207 of the NRS provides that without any action by our shareholders, we may increase or decrease the number of authorized shares in

a class or series of our shares and correspondingly effect a forward or reverse split of any class or series of the our shares (and change

the par value thereof), so long as the action taken does not adversely change or alter any right or preference of our shareholders and

does not include any provision or provisions pursuant to which only money will be paid or scrip issued to stockholders who hold 10% or

more of the outstanding shares of the affected class and series, and who would otherwise be entitled to receive fractions of shares in

exchange for the cancellation of all of their outstanding shares. Common stock and Series A Preferred Stock have been established, and

our board has authority to establish more than one series of preferred stock, and the different series shall have such relative rights

and preferences, with such designations, as our board may by resolution provide. Issuance of such a new series could, depending upon

the terms of the series, delay, defer, or prevent a change of control of our Company.

Stockholder

Action by Written Consent

Pursuant

to Section 78.320 of the NRS, any action required to be taken at any annual or special meeting of the stockholders may be taken without

a meeting, without prior notice and without a vote if a consent or consents in writing, setting forth the action so taken, is signed

by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such

action at a meeting at which all shares of our stock entitled to vote thereon were present and voted, unless the charter provides otherwise.

Our Articles of Incorporation preclude stockholder action by written consent.

Number

of Directors; Vacancies; Removal

Our

Bylaws provide that our board may fix the number of directors at no less than one. Any vacancy on our board may be filled by the affirmative

vote of a majority of the remaining directors though less than a quorum of our board. A director elected to fill a vacancy shall be elected

for the unexpired term of his predecessor in office, and shall hold such office until his successor is duly elected and qualified. Any

directorship to be filled by reason of an increase in the number of directors shall be filled by the affirmative vote of a majority of

the directors then in office, even if less than a quorum. A director chosen to fill a position resulting from an increase in the number

of directors shall hold office for a term that coincides with the remaining term of that class of director.

The

NRS requires the vote of the holders of at least two-thirds of the shares or class or series of shares of the issued and outstanding

stock entitled to vote at an election of directors in order to remove a director or all of the directors. Furthermore, the NRS does not

make a distinction between removals for cause and removals without cause. The articles of incorporation may provide for a higher voting

threshold but not a lower one.

Our

Bylaws provide that any director or directors of the corporation, except those elected by the holders of any series or class of preferred

stock provided for or fixed pursuant to the provisions of Article V of the Articles of Incorporation, may be removed from office at any

time, but only for cause, by the vote or written consent of stockholders representing not less than 66 2/3% of the voting power of all

of the then outstanding shares of stock entitled to vote in the election of directors, voting together as a single class.

Advance

Notice Requirements for Stockholder Proposals and Director Nominations

Our

Bylaws contain advance notice provisions that a stockholder must follow if it intends to bring business proposals or director nominations,

as applicable, before a meeting of stockholders. These provisions may preclude our stockholders from bringing matters before the annual

meeting of stockholders or from making nominations at the annual meeting of stockholders.

Approval

for Amendment of Certificate of Incorporation and Bylaws

Our

Articles of Incorporation further provides that the affirmative vote of holders of at least 66 2∕3% of the voting power of all

of the then outstanding shares of stock entitled to vote in the election of directors, voting as a single class, is required to amend

or repeal certain provisions of our Articles of Incorporation, including provisions relating to the size of the board, removal of directors,

special meetings and actions by written consent. The affirmative vote of holders of at least 66 2/3% of the voting power of all of the

then outstanding shares of stock entitled to vote in the election of directors, voting as a single class, is required to adopt, amend,

alter or repeal our Bylaws, although our Bylaws may be adopted, amended, altered or repealed by a majority vote of the board of directors,

assuming no vacancies.

Stock

Exchange Listing

Our

Common Stock is currently listed on The Nasdaq Capital Market under the symbol “DFLI” and our public warrants are currently

listed on The Nasdaq Capital Market under the symbol “DFLIW.”

PLAN

OF DISTRIBUTION AND DETERMINATION OF OFFERING PRICE

We

will deliver shares of our Common Stock offered hereby upon exercise of the Warrants we issued in connection with the Offering. The form

of Warrant contains instructions for exercise. In order to exercise the Warrants, the holder must deliver to us the information required

in the form of Warrant, along with payment for the exercise price of the shares to be purchased. We will then deliver shares of our Common

Stock in the manner described in the applicable form of Warrant, a copy of which is filed as an exhibit to the registration statement

of which this prospectus is a part.

Each

Warrant is exercisable into one share of our Common Stock, with an exercise price of $2.00 per share.

Upon

compliance by any holder with the instructions for exercise contained in the form of Warrant, we will, within the time allotted by the

form of Warrant, issue to the holder shares of Common Stock, free of a restrictive legend. Shares of Common Stock that are held by affiliates

will be issued free of legend but will be deemed control securities.

LEGAL

MATTERS

The

validity of the securities offered hereby will be passed upon for us by Parsons Behle & Latimer, Reno, Nevada and Lowenstein Sandler

LLP, New York, New York.

EXPERTS

The

consolidated financial statements of Dragonfly Energy Holdings Corp. as of and for the year ended December 31, 2023 incorporated

by reference into this prospectus and Registration Statement, have been so incorporated in reliance on the report of Marcum LLP, an independent

registered public accounting firm given on the authority of said firm as experts in auditing and accounting. The report on the consolidated

financial statements contains an explanatory paragraph regarding the Company’s ability to continue as a going concern. The report

also contains an explanatory paragraph regarding adjustments described in Note 15 of such report that were applied to revise the

2022 financial statements to correct an error. They were not engaged to audit, review or apply any procedures to the 2022 financial statements

other than with respect to the adjustments.

The

consolidated financial statements of Dragonfly Energy Holdings Corp. (the Company) as of December 31, 2022 and for the year then

ended before the effects of the adjustments for the correction of the error described in Note 15 (not separately included or incorporated

by reference in the Prospectus), have been audited by BDO USA, LLP (n/k/a BDO USA, P.C.), an independent registered public accounting

firm. The adjustments to those consolidated financial statements to correct the error described in Note 15 have been audited by Marcum

LLP, an independent registered public accounting firm. The consolidated financial statements as of December 31, 2022 and for the year

then ended incorporated by reference in this Prospectus and in the Registration Statement, have been so incorporated

in reliance on (i) the report (which contains an explanatory paragraph regarding the Company’s ability to continue as

a going concern) of BDO USA, LLP (n/k/a BDO USA, P.C.) solely with respect to those consolidated financial statements before the

effects of the adjustments to correct the error described in Note 15, and (ii) the report of Marcum LLP solely with respect to the adjustments

to those financial statements to correct the error described in Note 15, given on the authority of said firms as experts in

auditing and accounting.

ADDITIONAL

INFORMATION

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities offered by this

prospectus. This prospectus, which is part of the registration statement, omits certain information, exhibits, schedules and undertakings

set forth in the registration statement. For further information pertaining to us and our securities, reference is made to our SEC filings

and the registration statement and the exhibits and schedules to the registration statement. Statements contained in this prospectus

as to the contents or provisions of any documents referred to in this prospectus are not necessarily complete, and in each instance where

a copy of the document has been filed as an exhibit to the registration statement, reference is made to the exhibit for a more complete

description of the matters involved.

In

addition, registration statements and certain other filings made with the SEC electronically are publicly available through the SEC’s

web site at http://www.sec.gov. The registration statement, including all exhibits and amendments to the registration statement, has

been filed electronically with the SEC.

We

are subject to the information and periodic reporting requirements of the Securities Exchange Act of 1934, as amended, and, in accordance

with such requirements, will file periodic reports, proxy statements, and other information with the SEC. These periodic reports, proxy

statements, and other information will be available for inspection and copying at the web site of the SEC referred to above. We also

maintain a website at https://www.dragonflyenergy.com/, at which you may access these materials free of charge as soon as reasonably

practicable after they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed

through, our website is not part of, and is not incorporated into, this prospectus. We have included our website address in this prospectus

solely as an inactive textual reference.

You

should rely only on the information in this prospectus and the additional information described above and under the heading “Incorporation

of Certain Information by Reference” below. We have not authorized any other person to provide you with different information.

If anyone provides you with different or inconsistent information, you should not rely upon it. We are not making an offer to sell these

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus was

accurate on the date of the front cover of this prospectus only. Our business, financial condition, results of operations and prospects

may have changed since that date.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information that we file with it into this prospectus, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is an important

part of this prospectus. The information incorporated by reference is considered to be a part of this prospectus, and information that

we file later with the SEC will automatically update and supersede information contained in this prospectus and any accompanying prospectus

supplement.

We

incorporate by reference the documents listed below that we have previously filed with the SEC:

| ● |

our

Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”) filed with the SEC on April 16, 2024, as

amended on April 29, 2024; |

| |

|

| ● |

our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 filed with the SEC on May 15, 2024; |

| |

|

| ● |

our

Current Reports on Form 8-K filed with the SEC on March 4, 2024, March 4, 2024, April 22, 2024, May 20, 2024, and June 11, 2024 (in

each case, excluding any information deemed furnished under Items 2.02 or 7.01 of Form 8-K, including the related exhibits, which

information is not incorporated by reference herein); and |

| |

|

| ● |

the

description of the Common Stock of the Company contained in our Registration Statement on Form 8-A, filed on August 10, 2021 under

Section 12(b) of the Exchange Act including any amendments or reports filed for the purpose of updating such description, including

Exhibit 4.10 to the Form 10-K. |

All

reports and other documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of

this prospectus but prior to the termination of the offering of the securities hereunder will also be considered to be incorporated by

reference into this prospectus from the date of the filing of these reports and documents, and will supersede the information herein;

provided, however, that all reports, exhibits and other information that we “furnish” to the SEC will not be considered

incorporated by reference into this prospectus. Any statement contained in a document incorporated by reference in this prospectus or

any prospectus supplement shall be deemed to be modified or superseded to the extent that a statement contained herein, therein or in

any other subsequently filed document that also is incorporated by reference herein or therein modifies or supersedes such statement.

Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus

or any prospectus supplement.

We

will provide you without charge, upon your oral or written request, with a copy of any or all reports, proxy statements and other documents

we file with the SEC, as well as any or all of the documents incorporated by reference in this prospectus or the registration statement

(other than exhibits to such documents unless such exhibits are specifically incorporated by reference into such documents). Requests

for such copies should be directed to Dragonfly Energy Holdings Corp., Attn: Chief Executive Officer, 1190 Trademark Dr. #108,

Reno, Nevada 89521. You may also direct any requests for documents to us by telephone at (775) 622-3448.

11,131,900 Shares

of Common Stock Issuable Upon Exercise of Previously Issued Warrants

PROSPECTUS

July

8, 2024

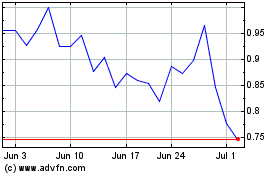

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From Jul 2023 to Jul 2024