Form 424B3 - Prospectus [Rule 424(b)(3)]

August 01 2023 - 4:16PM

Edgar (US Regulatory)

Filed

Pursuant to Rule 424(b)(3)

File

No.: 333-268185

Prospectus

Supplement No. 3 Dated August 1, 2023

(To

Prospectus Dated May 4, 2023)

DRAGONFLY

ENERGY HOLDINGS CORP.

35,161,573

Shares of Common Stock

12,266,971

Warrants to Purchase Shares of Common Stock

12,266,971

Shares of Common Stock Underlying Warrants

This

Prospectus Supplement No. 3 supplements the prospectus of Dragonfly Energy Holdings Corp. (the “Company”, “we”,

“us”, or “our”) dated May 4, 2023 (as supplemented to date, the “Prospectus”) with the following

information. This Prospectus Supplement No. 3 should be read in conjunction with the Prospectus, which is required to be delivered with

this Prospectus Supplement No. 3. This Prospectus Supplement No. 3 updates, amends and supplements the information included in the Prospectus.

If there is any inconsistency between the information in the Prospectus and this Prospectus Supplement, you should rely on the information

in this Prospectus Supplement No. 3.

This

Prospectus Supplement No. 3 is not complete without, and may not be delivered or utilized except in connection with, the Prospectus,

including any amendments or supplements to it.

Investing

in our common stock involves a high degree of risk. Before making any investment in our common stock, you should carefully consider the

risk factors for our common stock, which are described in the Prospectus, as amended or supplemented.

You

should rely only on the information contained in the Prospectus, as supplemented or amended by this Prospectus Supplement No. 3 and any

other prospectus supplement or amendment thereto. We have not authorized anyone to provide you with different information.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this Prospectus Supplement No. 3 is August 1, 2023

SELLING

SECURITYHOLDERS

As

a result of the transfer of an aggregate of 2,026,895 shares of our common stock by Chardan NexTech Investments 2 LLC, which shares

of common stock underlying such warrants were originally included in the Prospectus, the information contained in the chart in the section

entitled “Selling Securityholders” commencing on page 98 of the Prospectus is hereby supplemented as follows:

The

following selling securityholder’s information shall be added to the Selling Securityholders chart, as follows:

| | |

Securities Beneficially Owned Prior to the Offering | | |

Securities Being Offered in the Offering | | |

Securities Beneficially Owned After the Offered Securities are Sold | |

| Name | |

Shares of Common Stock | | |

Warrants | | |

Shares of Common Stock | | |

% | |

Warrants | | |

% | |

Shares of Common Stock | | |

Warrants | |

| Alex Weil (1) | |

| 142,479 | | |

| 73,676 | | |

| 142,479 | | |

* | |

| — | | |

* | |

| — | | |

| 73,676 | |

| Camilo Rico Restrepo | |

| 5,155 | | |

| 7,009 | | |

| 5,155 | | |

* | |

| — | | |

* | |

| — | | |

| 7,009 | |

| CAPTrading LLC (2) | |

| 177,835 | | |

| 324,173 | | |

| 177,835 | | |

* | |

| — | | |

* | |

| — | | |

| 324,173 | |

| Chardan 2021 Vintage LLC

(3) | |

| 77,614 | | |

| — | | |

| 77,614 | | |

* | |

| — | | |

* | |

| — | | |

| — | |

| Chardan Securities LLC

(4) | |

| 1,417 | | |

| — | | |

| 1,417 | | |

* | |

| — | | |

* | |

| — | | |

| — | |

| Connor Breisacher | |

| 3,060 | | |

| 1,752 | | |

| 3,060 | | |

* | |

| — | | |

* | |

| — | | |

| 1,752 | |

| David Lederman (5) | |

| 5,670 | | |

| — | | |

| 5,670 | | |

* | |

| — | | |

* | |

| — | | |

| — | |

| Emily Levine (6) | |

| 25,002 | | |

| 26,284 | | |

| 25,002 | | |

* | |

| — | | |

* | |

| — | | |

| 26,284 | |

| George Kaufman (7) | |

| 216,470 | | |

| 138,061 | | |

| 216,470 | | |

* | |

| — | | |

* | |

| — | | |

| 138,061 | |

| Gbolahan Amusa (8) | |

| 71,239 | | |

| 36,838 | | |

| 71,239 | | |

* | |

| — | | |

* | |

| — | | |

| 36,838 | |

| Guy Barudin (9) | |

| 5,671 | | |

| — | | |

| 5,671 | | |

* | |

| — | | |

* | |

| — | | |

| — | |

| Harrison Garfinkle | |

| 9,022 | | |

| 12,266 | | |

| 9,002 | | |

* | |

| — | | |

* | |

| — | | |

| 12,266 | |

| Headwaters Capital LLC (10) | |

| 12,887 | | |

| 17,522 | | |

| 12,887 | | |

* | |

| — | | |

* | |

| — | | |

| 17,522 | |

| Perry Boyle (11) | |

| 42,887 | | |

| 17,522 | | |

| 12,887 | | |

* | |

| — | | |

* | |

| 30,000 | | |

| — | |

| Illya E. Gnedy (12) | |

| 7,410 | | |

| 5,257 | | |

| 7,410 | | |

* | |

| — | | |

* | |

| — | | |

| 5,257 | |

| James O’Day (13) | |

| 5,670 | | |

| — | | |

| 5,670 | | |

* | |

| — | | |

* | |

| — | | |

| — | |

| John Klipchirchir Bitok (14) | |

| 1,772 | | |

| — | | |

| 1,772 | | |

* | |

| — | | |

* | |

| — | | |

| — | |

| John Zuschnitt (15) | |

| 5,864 | | |

| 7,009 | | |

| 5,864 | | |

* | |

| — | | |

* | |

| — | | |

| 7,009 | |

| Jonas Grossman (16) | |

| 603,735 | | |

| 423,472 | | |

| 603,735 | | |

* | |

| — | | |

* | |

| — | | |

| 423,472 | |

| Jonathan Biele | |

| 22,000 | | |

| 17,522 | | |

| 12,887 | | |

* | |

| — | | |

* | |

| 9,113 | | |

| 17,522 | |

| Matthew T. Mroznski (17) | |

| 14,248 | | |

| 7,368 | | |

| 14,248 | | |

* | |

| — | | |

* | |

| — | | |

| 7,368 | |

| Maxwell Pierce Hewes (18) | |

| 1,772 | | |

| — | | |

| 1,772 | | |

* | |

| — | | |

* | |

| — | | |

| — | |

| Michael Marrus (19) | |

| 7,153 | | |

| 8,761 | | |

| 7,153 | | |

* | |

| — | | |

* | |

| — | | |

| 8,761 | |

| Murat Omur (20) | |

| 12,114 | | |

| 8,761 | | |

| 12,114 | | |

* | |

| — | | |

* | |

| — | | |

| 8,761 | |

| Omar Khalil (21) | |

| 11,276 | | |

| 10,514 | | |

| 11,276 | | |

* | |

| — | | |

* | |

| — | | |

| 10,514 | |

| Richard Korhammer (22) | |

| 5,670 | | |

| — | | |

| 5,670 | | |

* | |

| — | | |

* | |

| — | | |

| — | |

| Ronald Glickman (23) | |

| 5,670 | | |

| — | | |

| 5,670 | | |

* | |

| — | | |

* | |

| — | | |

| — | |

| Scott Blakeman (24) | |

| 99,735 | | |

| 51,573 | | |

| 99,735 | | |

* | |

| — | | |

* | |

| — | | |

| 51,573 | |

| Sean McGann (25) | |

| 31,446 | | |

| 35,045 | | |

| 31,446 | | |

* | |

| — | | |

* | |

| — | | |

| 35,045 | |

| Shai Gerson (26) | |

| 119,212 | | |

| 110,023 | | |

| 119,212 | | |

* | |

| — | | |

* | |

| — | | |

| 110,023 | |

| Steven Urbach (27) | |

| 311,309 | | |

| 160,978 | | |

| 311,309 | | |

* | |

| — | | |

* | |

| — | | |

| 160,978 | |

| Yingjie Weng (28) | |

| 3,544 | | |

| — | | |

| 3,544 | | |

* | |

| — | | |

* | |

| — | | |

| — | |

*

Each of the above securityholders owns less than 1% of our total outstanding shares as of the date of this Prospectus Supplement No.

3.

| 1. |

Mr.

Weil previously served as the Chief Financial Officer and a director of CNTQ from August 2022 until he resigned in connection with

the Business Combination effective as of October 7, 2022, the closing date of the Business Combination. Mr. Weil is a Managing Director

and Co-Head of FinTech Investment Banking at CCM. CCM, an affiliate of the Sponsor, is a registered broker-dealer and a member organization

of FINRA. |

| 2. |

Kerry

Propper, the Co-Founder and Executive Chairman of CCM, is the manager of CAPTrading LLC. Due to Mr. Propper’s ownership

of CAPTrading LLC, he may be deemed to have sole voting and dispositive control over the shares of our common stock held by

CAPTrading LLC. As a result, Mr. Propper may be deemed to beneficially own the shares of our common stock held by CAPTrading

LLC. Mr. Propper previously served as the Chairman and a member of the Board of Directors of CNTQ. |

| 3. |

Steven

Urbach is the managing member of Chardan 2021 Vintage LLC. As such, Mr. Urbach may be deemed to have beneficial ownership of the

common stock held directly by Chardan 2021 Vintage LLC. Mr. Urbach disclaims any beneficial ownership of the reported shares other

than to the extent of any pecuniary interest he may have therein, directly or indirectly. Mr. Urbach is a Co-Founder and the CEO of

CCM. Certain other employees of CCM or its affiliates have direct or indirect membership interests in Chardan 2021 Vintage LLC, and

thus have pecuniary interests in certain of the reported shares. The business address of Chardan 2021 Vintage LLC and Mr. Urbach is

17 State Street, 21st Floor, New York, NY 10004. |

| 4. |

Kerry

Propper, Steven Urbach and Jonas Grossman are managing members of Chardan Securities LLC. As such, each of them may be deemed to

have beneficial ownership of the common stock held directly by Chardan Securities LLC. Each of them disclaims any beneficial ownership

of the reported shares other than to the extent of any pecuniary interest each may have therein, directly or indirectly. Chardan

Securities LLC has beneficial ownership of any shares held by CCM. |

| 5. |

Mr.

Lederman is an employee of CCM. |

| 6. |

Ms.

Levine is an employee of CCM |

| 7. |

Mr.

Kaufman is a partner and Head of Investment Banking at CCM. |

| 8. |

Mr.

Amusa is a partner and Chief Scientific Officer of CCM. |

| 9. |

Mr.

Barudin is an employee of CCM. |

| 10. |

Todd

Thompson is a managing member of Headwaters Capital LLC. As such, Mr. Thompson may be deemed to have beneficial ownership interest

of Headwaters Capital LLC. Mr. Thompson disclaims any beneficial ownership interest of Headwaters Capital LLC other than to the extent

at any pecuniary interest he may have therein, directly or indirectly. Mr. Thompson previously served as a Director of CNTQ. |

| 11. |

Mr. Boyle is

a current director of the Company. Mr. Boyle previously served as a director of CNTQ from August 2021 until the consummation of the

Business Combination. |

| 12. |

Mr.

Gnedy is an employee of CCM. |

| 13. |

Mr.

O’Day is an employee of CCM. |

| 14. |

Mr.

Bitok is an employee of CCM. |

| 15. |

Mr.

Zuschnitt is an employee of CCM. |

| 16. |

Mr. Grossman

served as the Chief Executive Officer, President, Secretary, Treasurer and Director of CNTQ from August 2022 until he resigned in

connection with the Business Combination effective as of October 7, 2022, the closing date of the Business Combination. He currently

is a managing member of the Sponsor and is the President of CCM. |

| 17. |

Mr.

Mrozinski is an employee of CCM. |

| 18. |

Mr.

Hewes is an employee of CCM. |

| 19. |

Mr.

Marrus is an employee of CCM. |

| 20. |

Mr.

Omur is an employee of CCM. |

| 21. |

Mr.

Khalil is an employee of CCM. |

| 22. |

Mr.

Korhammer is an employee of CCM. |

| 23. |

Mr.

Glickman is an employee of CCM. |

| 24. |

Mr.

Blakeman is a partner and Head of Trading at CCM. |

| 25. |

Mr.

McGann is an employee of CCM. |

| 26. |

Mr.

Gerson is a partner and Head of Equity Capital Markets at CCM. |

| 27. |

Mr.

Urbach is the Chief Executive Officer of CCM. |

| 28. |

Ms.

Weng is an employee of CCM. |

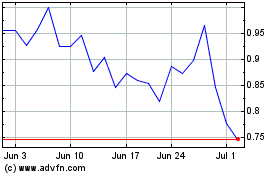

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From Apr 2024 to May 2024

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From May 2023 to May 2024