Amended Current Report Filing (8-k/a)

October 13 2022 - 6:02AM

Edgar (US Regulatory)

0001847986

false

0001847986

2022-10-07

2022-10-07

0001847986

dei:FormerAddressMember

2022-10-07

2022-10-07

0001847986

us-gaap:CommonStockMember

2022-10-07

2022-10-07

0001847986

DFLI:RedeemableWarrantsExercisableForCommonStockAtExercisePriceOf11.50PerShareSubjectToAdjustmentMember

2022-10-07

2022-10-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 12, 2022 (October 7, 2022)

DRAGONFLY ENERGY HOLDINGS CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40730 |

|

85-1873463 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

| 1190 Trademark Drive #108 |

| Reno, Nevada 89521 |

| (Address of principal executive offices, including zip code) |

Registrant’s telephone number, including area code: (775) 622-3448

Chardan NexTech Acquisition 2 Corp.

17 State Street, 21st Floor

New York, New York 10004

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered: |

| Common stock, par value $0.0001 per share |

|

DFLI |

|

The Nasdaq Global Market |

| Redeemable warrants, exercisable for common stock at an exercise price of $11.50 per share, subject to adjustment |

|

DFLIW |

|

The Nasdaq Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

EXPLANATORY NOTE

This Amendment No. 1 to

the Current Report on Form 8-K amends Item 2.01 of the Current Report on Form 8-K filed on October 7, 2022 (the

“Original Form 8-K”) solely to correct the number of shares and related disclosures in the Beneficial Ownership

Table. The Beneficial Ownership Table in Item 2.01 of the Original Form 8-K is corrected as follows:

The beneficial ownership of

Common Stock is based on 44,848,686 shares of Common Stock issued and outstanding immediately following consummation of the Transactions,

including the redemption of public shares of Common Stock as described above.

Beneficial Ownership Table

| Name and Address of Beneficial Owners | |

Number of Shares of Common Stock Beneficially Owned | | |

% | |

| 5% Holders: | |

| | | |

| | |

| Dynavolt Technology (HK) Ltd. | |

| 11,820,900 | | |

| 26.4 | % |

| Jonas Grossman(1)(2)(3) | |

| 3,530,500 | | |

| 7.9 | % |

| Chardan

NexTech Investments 2 LLC(1)(3) | |

| 3,030,500 | | |

| 6.8 | % |

| David Gong | |

| 2,364,180 | | |

| 5.3 | % |

| | |

| | | |

| | |

| Executive Officers and Directors: | |

| | | |

| | |

| Dr. Denis Phares(4)(5) | |

| 15,899,110 | | |

| 35.5 | % |

| Sean Nichols(4)(6) | |

| 3,558,683 | | |

| 7.9 | % |

| Nicole Harvey | |

| 11,821 | | |

| * | |

| John Marchetti | |

| — | | |

| — | |

| Luisa Ingargiola | |

| — | | |

| — | |

| Brian Nelson | |

| — | | |

| — | |

| Perry Boyle | |

| 22,000 | | |

| * | |

| Jonathan Bellows | |

| — | | |

| — | |

| Rick Parod | |

| — | | |

| — | |

| Karina Edmonds | |

| — | | |

| — | |

* Less than one percent.

| (1) |

Jonas Grossman is the managing member of Sponsor. As such,

Mr. Grossman may be deemed to have beneficial ownership of the common stock held directly by Sponsor. Mr. Grossman

disclaims any beneficial ownership of the reported shares other than to the extent of any pecuniary interest he may have therein,

directly or indirectly. Certain other employees of Chardan Capital Markets LLC or its affiliates, have direct or indirect membership

interests in Sponsor, and thus have pecuniary interests in certain of the reported shares. The business address of Sponsor and Mr.

Grossman is 17 State Street, 21st Floor, New York, NY 10004. |

| (2) | Includes 485,000 shares purchased by Chardan Capital Markets LLC, a

New York limited liability company (“CCM LLC”), in the open market in satisfaction of a portion of its purchase commitment

under the Subscription Agreement and 15,000 shares issued pursuant to the Subscription Agreement. CCM LLC is a broker-dealer and a member

of the Financial Industry Regulatory Authority, Inc. Mr. Kerry Popper, Mr. Steven Urbach and Mr. Jonas Grossman, are CCM LLC’s Chairman,

Chief Executive Officer and President, respectively, and are each Members and Managers of Chardan Securities LLC, which holds a controlling

interest in CCM LLC. The foregoing should not be construed in and of itself as an admission by any of Mr. Popper, Mr. Urbach or Mr. Grossman

as to beneficial ownership of the securities beneficially owned by CCM LLC. The business address of CCM LLC is 17 State Street, Suite 2130, New York, NY 10004.

|

| (3) | Excludes 4,627,858 Chardan private warrants, which Warrant Holdings has agreed not to exercise to

the extent that Warrant Holdings and its affiliates would be deemed to beneficially own, more than 7.5% of the shares of Common

Stock outstanding immediately after giving effect to such exercise. The business address of Warrant Holdings is 17 State Street, 21st Floor, New York, NY 10004. |

| (4) | Excludes 40,000,000 Earnout Shares

of Common Stock as the earnout contingencies have not yet been met. |

| (5) | Includes 1,217,906 shares held

on behalf of the Phares 2021 GRAT dated July 9, 2021, of which Dr. Phares is trustee. |

| (6) | Includes 54,393 shares held on behalf of the Nichols GRAT I dated June 14, 2021, and 3,383,142 held

on behalf of the Nichols Living Trust 2015, each of which Mr. Nichols is trustee. |

This Amendment No. 1 makes

no other changes to the Original Form 8-K as filed with the SEC on October 7, 2022, and no attempt has been made in this Amendment No.

1 to modify or update the other disclosures presented in the Original Form 8-K. This Amendment No. 1 does not reflect subsequent events

occurring after the original filing of the Original Form 8-K (i.e., those events occurring after October 7, 2022) or modify or update

in any way those disclosures that may be affected by subsequent events. Accordingly, this Amendment No. 1 should be read in conjunction

with the Original Form 8-K and our other filings with the SEC.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| 104 | |

Cover Page Interactive Data

File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

DRAGONFLY ENERGY HOLDINGS CORP. |

| |

|

|

| Date: October 12, 2022 |

By: |

/s/ Denis Phares |

| |

Name: |

Denis Phares |

| |

Title: |

President and Chief Executive Officer |

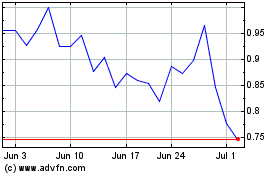

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dragonfly Energy (NASDAQ:DFLI)

Historical Stock Chart

From Apr 2023 to Apr 2024