0001822359FALSE00018223592024-09-252024-09-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): September 25, 2024

___________________________________

DOCGO INC.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | | | | | | | |

Delaware | | 001-39618 | | 85-2515483 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

35 West 35th Street, Floor 6, New York, New York | | 10001 |

(Address of principal executive offices) | | (Zip Code) |

| | | | |

(844) 443-6246 |

(Registrant's telephone number, including area code) |

| | | | |

| N/A |

| (Former name or former address, if changed since last report) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

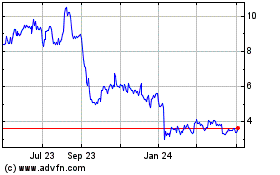

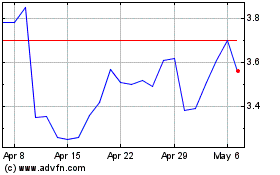

| Common stock, par value $0.0001 per share | | DCGO | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 26, 2024, the Board of Directors (the “Board”) of DocGo Inc. (the “Company”) appointed Stephen K. Klasko, MD as a Class III director and independent Chair of the Board, effective as of October 1, 2024 (the “Effective Date”). Mr. Klasko fills the vacancy created by the departure of Steven Katz, who served as a Class III director and independent Chair of the Board until October 1, 2024, the effective date of his resignation from the Board. Dr. Klasko will hold such positions until his successor shall have been duly elected and qualified or his earlier resignation, disqualification, death or removal. Also on September 26, 2024, the Board appointed (i) Dr. Klasko as a member of the Board’s Audit and Compliance Committee (the “Audit Committee”) and a member of the Board’s Nominating and Corporate Governance Committee and (ii) Michael Burdiek, a current member of the Audit Committee, as Chair of the Audit Committee, in each case effective as of the Effective Date.

Dr. Klasko has served on the Board of Directors of Teleflex Incorporated (NYSE:TFX), a global provider of medical technology products, since 2008, where he also currently serves as independent Lead Director and chair of the nominating and governance committee. Since March 2021, he has served as Chief Medical Officer at Abundant Venture Partners, and since February 2022, he has also served as an advisor to General Catalyst, a venture capital firm focused on early stage and growth investments. He previously served as President and CEO of Thomas Jefferson University and Jefferson Health, a multi-state non-profit health system, from September 2013 until his retirement in December 2021. From 2004 to 2013, Dr. Klasko served as the Dean of the Morsani College of Medicine at the University of South Florida. From 2009 to 2013, he also served as the Chief Executive Officer of USF Health, which encompasses the University of South Florida’s colleges of medicine, nursing, pharmacy and public health as well as USF Physicians Group. Prior to that, from 2000 to 2004, Dr. Klasko served as Dean of the Drexel University College of Medicine and CEO of Drexel University Physicians. Dr. Klasko received his undergraduate degree from Lehigh University, his MD from Hahnemann University College of Medicine and his MBA from the Wharton School of the University of Pennsylvania.

In connection with Dr. Klasko’s appointment to the Board, the Board approved the following compensation:

•In lieu of the Company’s standard compensation program for non-employee directors as disclosed in the Company’s 2024 proxy statement, on the first day of the Company’s first open trading window following the Effective Date (the “Grant Date”), an initial one-time grant of $500,000 of stock options to Dr. Klasko under the DocGo Inc. 2021 Stock Incentive Plan (the “2021 Plan”), which will vest on the first anniversary of the Grant Date, subject to the terms of the 2021 Plan and the applicable award agreement.

•Cash compensation in the amount of $300,000 for Dr. Klasko’s first year of service as Chair of the Board, payable quarterly in arrears.

Dr. Klasko has also entered into a standard indemnification agreement with the Company, the form of which is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Report”) and incorporated herein by reference.

There are no transactions involving Dr. Klasko and the Company that require disclosure under Item 404(a) of Regulation S-K. In addition, there are no arrangements or understandings between Dr. Klasko and any other person pursuant to which he was selected to serve as a director.

On September 25, 2024, Mr. Katz notified the Board that he intends to step down as a director and Chair of the Board, effective as of the Effective Date. Mr. Katz’s decision to step down as a director and Chair of the Board was not the result of any disagreement with the Company on any matter relating to the Company’s operations, disclosures, policies or practices.

Following the Effective Date, Mr. Katz will continue to serve as a consultant to the Company until December 31, 2024 (such period, the “Consulting Period”) pursuant to a consulting agreement that was approved by the Board and entered into by and between the Company and Mr. Katz on September 27, 2024 (the “Consulting Agreement”). During the Consulting Period, Mr. Katz will provide transition advisory services relating to the Board and its committees as may be requested from time to time by the Company’s executive officers or the Board, and as consideration for his services, Mr. Katz will receive consulting fees in the amount of (i) $2,500 per month plus (ii) $400 for each hour of services rendered in excess of five hours during each month. During the Consulting Period, Mr. Katz’s equity awards will also continue to vest under the 2021 Plan. The foregoing description of the Consulting Agreement does not purport to be complete and is qualified in its entirety by the full text of the Consulting Agreement, a copy of which is filed as Exhibit 10.2 to this Report and incorporated herein by reference.

On September 30, 2024, the Company issued a press release announcing Dr. Klasko’s appointment as a director and Chair of the Board and Mr. Katz’s departure from the Board, a copy of which is furnished as Exhibit 99.1 to this Report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | |

| 10.2 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| DOCGO INC. |

| |

By: | /s/ Ely D. Tendler |

Name: | Ely D. Tendler |

Title: | General Counsel and Secretary |

Date: September 30, 2024

Exhibit 10.1

AMENDED AND RESTATED INDEMNIFICATION AGREEMENT

This Amended and Restated Indemnification Agreement (this “Agreement”) is entered into as of the date last signed below (the “Effective Date”) by and between DocGo Inc., a Delaware corporation (the “Company”), and the undersigned (the “Indemnitee”).

RECITALS

WHEREAS, the Board of Directors has determined that the inability to attract and retain qualified persons as directors and officers is detrimental to the best interests of the Company’s stockholders and that the Company should act to assure such persons that there shall be adequate certainty of protection through insurance and indemnification against risks of claims and actions against them arising out of their service to and activities on behalf of the Company;

WHEREAS, the Company has adopted provisions in its Second Amended and Restated Certificate of Incorporation (as amended and/or restated from time to time, the “Certificate of Incorporation”) and its Amended and Restated Bylaws (as amended and/or restated from time to time, the “Bylaws”) providing for indemnification and advancement of expenses of its directors and officers to the fullest extent authorized by the General Corporation Law of the State of Delaware (the “DGCL”), and the Company wishes to clarify and enhance the rights and obligations of the Company and the Indemnitee with respect to indemnification and advancement of expenses;

WHEREAS, in order to induce and encourage highly experienced and capable persons such as the Indemnitee to serve and continue to serve as directors and officers of the Company and in any other capacity with respect to the Company as the Company may request, and to otherwise promote the desirable end that such persons shall resist what they consider unjustified lawsuits and claims made against them in connection with the good faith performance of their duties to the Company, with the knowledge that certain costs, judgments, penalties, fines, liabilities, and expenses incurred by them in their defense of such litigation are to be borne by the Company and they shall receive appropriate protection against such risks and liabilities, the Board of Directors of the Company has determined that the following Agreement is reasonable and prudent to promote and ensure the best interests of the Company and its stockholders; and

WHEREAS, the Company desires to have the Indemnitee continue to serve as a director or officer of the Company and in any other capacity with respect to the Company as the Company may request, as the case may be, free from undue concern for unpredictable, inappropriate, or unreasonable legal risks and personal liabilities by reason of the Indemnitee acting in good faith in the performance of the Indemnitee’s duty to the Company; and the Indemnitee desires to continue so to serve the Company, provided, and on the express condition, that he or she is furnished with the protections set forth hereinafter.

AGREEMENT

NOW, THEREFORE, in consideration of the Indemnitee’s continued service as a director or officer of the Company, the parties hereto agree as follows:

1. Definitions. For purposes of this Agreement:

(a) A “Change in Control” will be deemed to have occurred if, with respect to any particular 24-month period, the individuals who, at the beginning of such 24-month period, constituted the Board of Directors of the Company (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board of Directors; provided, however, that any individual becoming a director subsequent to the beginning of such 24-month period whose election, or nomination for election by the stockholders of the Company, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a person other than the Board of Directors.

(b) “Disinterested Director” means a director of the Company who is not or was not a party to the Proceeding in respect of which indemnification is being sought by the Indemnitee.

(c) “Expenses” includes, without limitation, expenses incurred in connection with the defense or settlement of, or participation in, any action, suit, arbitration, alternative dispute resolution mechanism, investigation, inquiry, judicial, administrative, or legislative hearing, or any other threatened, pending, or completed proceeding, whether brought by or in the right of the Company or otherwise, including any and all appeals thereof, whether of a civil, criminal, administrative, legislative, investigative, or other nature, including all reasonable and documented attorneys’ fees, court costs, transcript costs, fees of experts, witness fees and expenses, travel expenses, duplicating costs, printing and binding costs, telephone charges, postage, delivery service fees, fees and expenses of accountants and other advisors, retainers and disbursements and advances thereon, the premium, security for, and other costs relating to any bond (including cost bonds, appraisal bonds, supersedes bond, other appeal bond or their equivalents), any federal, state, local or foreign taxes imposed on the Indemnitee as a result of the actual or deemed receipt of any payments under this Agreement, and any expenses of establishing a right to indemnification or advancement under Sections 9, 11, 13, and 16 hereof, but shall not include the amount of judgments, fines, ERISA excise taxes, or penalties actually levied against the Indemnitee, or any amounts paid in settlement by or on behalf of the Indemnitee.

(d) “Independent Counsel” means a law firm or a partner or member of a law firm, as applicable, that is experienced in matters of Delaware corporation law and neither is presently nor in the past five years has been retained to represent (i) the Company or the Indemnitee in any matter material to either such party or (other than with respect to matters concerning Indemnitee under this Agreement, or of other indemnitees under similar indemnification agreements) (ii) any other party to the Proceeding giving rise to a request for indemnification hereunder. Notwithstanding the foregoing, the term “Independent Counsel” shall not include any person who, under the applicable standards of professional conduct then prevailing, would have a conflict of interest in representing either the Company or the Indemnitee in an action to determine the Indemnitee’s right to indemnification under this Agreement. The Company agrees to pay the reasonable fees and expenses of the Independent Counsel and to fully indemnify such counsel against any and all expenses, claims, liabilities and damages arising out of or relating to this Agreement or its engagement pursuant hereto.

(e) “Proceeding” means any action, suit, arbitration, alternative dispute resolution mechanism, investigation, inquiry, judicial, administrative, or legislative hearing, or any other threatened, pending, or completed proceeding, whether brought by or in the right of the Company or otherwise, including any and all appeals, whether of a civil, criminal, administrative, legislative, investigative, or other nature, to which the Indemnitee was or is a party or is threatened to be made a party or is otherwise involved in by reason of the fact that the Indemnitee is or was a director, officer, employee, agent, or trustee of the Company or while a director, officer, employee, agent, or trustee of the Company is or was serving at the request of the Company as a director, officer, employee, agent, or trustee of another corporation or of a partnership, joint venture, trust, or other enterprise, including service with respect to an employee benefit plan, or by reason of anything done or not done by the Indemnitee in any such capacity, whether or not the Indemnitee is serving in such capacity at the time any expense, liability, or loss is incurred for which indemnification or advancement can be provided under this Agreement.

2. Service by the Indemnitee. The Indemnitee shall serve and/or continue to serve as a director or officer of the Company faithfully and to the best of the Indemnitee’s ability so long as the Indemnitee is duly elected or appointed and until such time as the Indemnitee’s successor is elected and qualified or the Indemnitee is removed as permitted by applicable law or tenders a resignation in writing.

3. Indemnification and Advancement of Expenses. The Company shall indemnify and hold harmless the Indemnitee, and shall pay to the Indemnitee in advance of the final disposition of any Proceeding all Expenses incurred by the Indemnitee in defending any such Proceeding, to the fullest extent authorized by the DGCL, as the same exists or may hereafter be amended, all on the terms and conditions set forth in this Agreement. Without diminishing the scope of the rights provided by this Section, the rights of the Indemnitee to indemnification and advancement of Expenses provided hereunder shall include but shall not be limited to those rights hereinafter set forth, except that no indemnification or advancement of Expenses shall be paid to the Indemnitee:

(a) to the extent expressly prohibited by applicable law;

(b) for and to the extent that payment is actually made to the Indemnitee under any insurance policy, contract, agreement or otherwise (and the Indemnitee shall reimburse the Company for any amounts paid by the Company and subsequently so recovered by the Indemnitee); or

(c) in connection with an action, suit, or proceeding, or part thereof voluntarily initiated by the Indemnitee (including claims and counterclaims, whether such counterclaims are asserted by (i) the Indemnitee, or (ii) the Company in an action, suit, or proceeding initiated by the Indemnitee), except a judicial proceeding or arbitration pursuant to Section 11 to enforce rights under this Agreement, unless the action, suit, or proceeding, or part thereof, was authorized or ratified by the Board of Directors of the Company or the Board of Directors otherwise determines that indemnification or advancement of Expenses is appropriate.

4. Action or Proceedings Other than an Action by or in the Right of the Company. Except as limited by Section 3 above, the Indemnitee shall be entitled to the indemnification rights provided in this Section if the Indemnitee was or is a party or is threatened to be made a party to, or was or is otherwise involved in, any Proceeding (other than a Proceeding by or in the right of the Company to procure a judgment in its favor). Pursuant to this Section, the Indemnitee shall be indemnified against all expense, liability, and loss (including judgments, fines, ERISA excise taxes, penalties, amounts paid in settlement by or on behalf of the Indemnitee, and Expenses) actually and reasonably incurred by the Indemnitee in connection with such Proceeding, if the Indemnitee acted in good faith and in a manner the Indemnitee reasonably believed to be in or not opposed to the interests of the Company, and with respect to any criminal Proceeding, had no reasonable cause to believe his or her conduct was unlawful.

5. Indemnity in Proceedings by or in the Right of the Company. Except as limited by Section 3 above, the Indemnitee shall be entitled to the indemnification rights provided in this Section if the Indemnitee was or is a party or is threatened to be made a party to, or was or is otherwise involved in, any Proceeding brought by or in the right of the Company to procure a judgment in its favor. Pursuant to this Section, the Indemnitee shall be indemnified against all Expenses actually and reasonably incurred by the Indemnitee in connection with such Proceeding or any claim, issue or matter therein, if the Indemnitee acted in good faith and in a manner the Indemnitee reasonably believed to be in or not opposed to the interests of the Company; provided, however, that no such indemnification shall be made in respect of any claim, issue, or matter as to which the DGCL expressly prohibits such indemnification by reason of any adjudication of liability of the Indemnitee to the Company, unless and only to the extent that the Court of Chancery of the State of Delaware or the court in which such Proceeding was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, the Indemnitee is fairly and reasonably entitled to indemnification for such Expenses as such court shall deem proper.

6. Indemnification for Costs, Charges, and Expenses of Successful Party. Notwithstanding any limitations of any other provision of this Agreement, including Sections 3(c), 4 and 5 above, to the extent that the Indemnitee has been successful, on the merits or otherwise, in whole or in part, in defense of any Proceeding, or in defense of any claim, issue, or matter therein, including, without limitation, the dismissal of any action without prejudice, or if it is ultimately determined, by final judicial decision of a court of competent jurisdiction from which there is no further right to appeal, that the Indemnitee is otherwise entitled to be indemnified against Expenses, the Indemnitee shall be indemnified against all Expenses actually and reasonably incurred by the Indemnitee in connection therewith.

7. Partial Indemnification. If the Indemnitee is entitled under any provision of this Agreement to indemnification by the Company for some or a portion of the expense, liability, and loss (including judgments, fines, ERISA excise taxes, penalties, amounts paid in settlement by or on behalf of the Indemnitee, and Expenses) actually and reasonably incurred in connection with any Proceeding, or in connection with any judicial proceeding or arbitration pursuant to Section 11 to enforce rights under this Agreement, but not, however, for all of the total amount thereof, the Company shall nevertheless indemnify the Indemnitee for the portion of such expense, liability, and loss actually and reasonably incurred to which the Indemnitee is entitled. Indemnification under this Section 7 shall not be subject to satisfaction of any standard of conduct, and the Company may not assert the failure to satisfy a standard of conduct as a basis to deny indemnification or recover Expenses advanced, including in a suit brought pursuant to Section 11 hereof).

8. Indemnification for Expenses as a Witness. Notwithstanding any other provision of this Agreement, to the maximum extent permitted by the DGCL, the Indemnitee shall be entitled to indemnification against all

Expenses actually and reasonably incurred by the Indemnitee or on the Indemnitee’s behalf if the Indemnitee appears as a witness or otherwise incurs legal expenses as a result of or related to the Indemnitee’s official capacity, in any Proceeding to which the Indemnitee neither is, nor is threatened to be made, a party.

9. Determination of Entitlement to Indemnification. To receive indemnification under this Agreement, the Indemnitee shall submit a written request to the Secretary of the Company. Such request shall include documentation or information that is reasonably necessary for such determination and is reasonably available to the Indemnitee, but in no case shall Indemnitee be required to convey any information that would cause Indemnitee to waive any privilege accorded by applicable law. Upon receipt by the Secretary of the Company of a written request by the Indemnitee for indemnification, the entitlement of the Indemnitee to indemnification, to the extent not required pursuant to the terms of Section 6 or Section 8 of this Agreement, shall be determined by the following person or persons who shall be empowered to make such determination (as selected by the Board of Directors, except with respect to Section 9(e) below): (a) the Board of Directors of the Company by a majority vote of Disinterested Directors, whether or not such majority constitutes a quorum; (b) a committee of Disinterested Directors designated by a majority vote of such directors, whether or not such majority constitutes a quorum; (c) if there are no Disinterested Directors, or if the Disinterested Directors so direct, by Independent Counsel in a written opinion to the Board of Directors, a copy of which shall be delivered to the Indemnitee; (d) the stockholders of the Company; or (e) in the event that a Change in Control has occurred, by Independent Counsel in a written opinion to the Board of Directors, a copy of which shall be delivered to the Indemnitee. Such Independent Counsel shall be selected by the Board of Directors and approved by the Indemnitee, except that in the event that a Change in Control has occurred, Independent Counsel shall be selected by the Indemnitee. Upon failure of the Board of Directors so to select such Independent Counsel or upon failure of the Indemnitee so to approve (or so to select, in the event a Change in Control has occurred), such Independent Counsel shall be selected upon application to a court of competent jurisdiction. The determination of entitlement to indemnification shall be made and, unless a contrary determination is made, such indemnification shall be paid in full by the Company not later than 60 calendar days after receipt by the Secretary of the Company of a written request for indemnification. If the person making such determination shall determine that the Indemnitee is entitled to indemnification as to part (but not all) of the application for indemnification, such person shall reasonably prorate such partial indemnification among the claims, issues, or matters at issue at the time of the determination. Indemnitee shall cooperate with the determination with respect to Indemnitee’s entitlement to indemnification, including providing, upon reasonable advance request, any documentation or information which is not privileged or otherwise protected from disclosure and which is reasonably available to Indemnitee and reasonably necessary to such determination. Any costs or expenses (including attorneys’ fees and disbursements) incurred by Indemnitee in so cooperating shall, to the fullest extent permitted by applicable law, be borne by the Company (irrespective of the determination as to Indemnitee’s entitlement to indemnification) and the Company hereby indemnifies and agrees to hold Indemnitee harmless therefrom.

10. Presumptions and Effect of Certain Proceedings. The Secretary of the Company shall, promptly upon receipt of the Indemnitee’s written request for indemnification, advise in writing the Board of Directors or such other person or persons empowered to make the determination as provided in Section 9 that the Indemnitee has made such request for indemnification. Upon making such request for indemnification, the Indemnitee shall be presumed to be entitled to indemnification hereunder and the Company shall have the burden of proof in making any determination contrary to such presumption by clear and convincing evidence. To the extent not prohibited by applicable law, if the person or persons so empowered to make such determination shall have failed to make the requested determination with respect to indemnification within 60 calendar days after receipt by the Secretary of the Company of such request, a requisite determination of entitlement to indemnification shall be deemed to have been made and the Indemnitee shall be absolutely entitled to such indemnification, absent actual fraud in the request for indemnification. The termination of any Proceeding or of any claim, issue or matter therein, by judgment, order, settlement, or conviction, or upon a plea of guilty, nolo contendere or its equivalent, shall not, of itself (a) create a presumption that the Indemnitee did not act in good faith and in a manner the Indemnitee reasonably believed to be in or not opposed to the best interests of the Company, and with respect to any criminal Proceeding, had reasonable cause to believe his or her conduct was unlawful or (b) otherwise adversely affect the rights of the Indemnitee to indemnification, in each case, except as may be provided herein.

11. Remedies of the Indemnitee in Cases of Determination Not to Indemnify or to Advance Expenses; Right to Bring Suit. In the event that a determination is made that the Indemnitee is not entitled to indemnification or, if the Indemnitee is not a director of the Corporation, advancement of Expenses hereunder or if payment is not timely made following a determination of entitlement to indemnification pursuant to Sections 9 and 10, or if an

advancement of Expenses is not timely made pursuant to Section 16, the Indemnitee may at any time thereafter bring suit against the Company seeking an adjudication of entitlement to such indemnification or advancement of Expenses. Alternatively, the Indemnitee at the Indemnitee’s option may seek an award in an arbitration to be conducted by a single arbitrator in the State of Delaware pursuant to the Commercial Arbitration Rules of the American Arbitration Association, such award to be made within 60 calendar days following the filing of the demand for arbitration. The Company shall not oppose the Indemnitee’s right to seek any such adjudication or award in arbitration. In any suit or arbitration brought by the Indemnitee to enforce a right to indemnification hereunder (but not in a suit or arbitration brought by the Indemnitee to enforce a right to an advancement of Expenses), it shall be a defense that the Indemnitee has not met any applicable standard of conduct for indemnification set forth in the DGCL, including the standard described in Section 4 or 5, as applicable (the “Standard of Conduct”). If the Indemnitee is not a director of the Corporation, in any suit or arbitration brought by the Indemnitee to enforce a right to an advancement of Expenses, it shall be a defense that the advancement of Expenses was properly denied pursuant to the terms of Section 16. Further, in any suit brought by the Company to recover an advancement of Expenses pursuant to the terms of an undertaking, the Company shall be entitled to recover such Expenses upon a final judicial decision of a court of competent jurisdiction from which there is no further right to appeal that the Indemnitee has not met the Standard of Conduct. Neither the failure of the Company (including the Disinterested Directors, a committee of Disinterested Directors, Independent Counsel, or its stockholders) to have made a determination prior to the commencement of such suit or arbitration that indemnification of the Indemnitee is proper in the circumstances because the Indemnitee has met the Standard of Conduct, nor an actual determination by the Company (including the Disinterested Directors, a committee of Disinterested Directors, Independent Counsel, or its stockholders) that the Indemnitee has not met the Standard of Conduct shall create a presumption that the Indemnitee has not met the Standard of Conduct, or, in the case of such a suit brought by the Indemnitee, be a defense to such suit. In any suit brought by the Indemnitee to enforce a right to indemnification or to an advancement of Expenses hereunder, or brought by the Company to recover an advancement of Expenses pursuant to the terms of an undertaking, the burden of proving that the Indemnitee is not entitled to be indemnified, or to such advancement of expenses, under this Section 11 or otherwise shall be on the Company by clear and convincing evidence. Absent a misstatement by Indemnitee of a material fact, or an omission of a material fact necessary to make Indemnitee’s statement not materially misleading, in connection with the request for indemnification, if a determination is made or deemed to have been made pursuant to the terms of Section 9 or 10 that the Indemnitee is entitled to indemnification, the Company shall be bound by such determination and is precluded from asserting that such determination has not been made or that the procedure by which such determination was made is not valid, binding, and enforceable. The Company further agrees to stipulate in any court or before any arbitrator pursuant to this Section 11 that the Company is bound by all the provisions of this Agreement and is precluded from making any assertions to the contrary. If the court or arbitrator shall determine that the Indemnitee is entitled to any indemnification or advancement of Expenses hereunder, the Company shall indemnify Indemnitee against all Expenses actually and reasonably incurred by the Indemnitee in connection with such adjudication or award in arbitration (including, but not limited to, any appellate proceedings) to the fullest extent permitted by law, and in any suit brought by the Company to recover an advancement of Expenses pursuant to the terms of an undertaking, the Company shall indemnify Indemnitee against all Expenses actually and reasonably incurred by the Indemnitee in connection with such suit to the extent the Indemnitee has been successful, on the merits or otherwise, in whole or in part, in defense of such suit, to the fullest extent permitted by law. Indemnitee shall be entitled to the advancement of All expenses incurred by Indemnitee to enforce Indemnitee’s rights pursuant to this Section 11. Indemnitee hereby undertakes to repay any and all of the amount of Expenses advanced to Indemnitee pursuant to this Section 11 if it is finally determined by a court of competent jurisdiction that Indemnitee is not entitled under this Agreement to indemnification with respect to such Expenses. No other form of undertaking shall be required other than the execution of this Agreement.

12. Non-Exclusivity of Rights. The rights to indemnification and to the advancement of Expenses provided by this Agreement shall not be deemed exclusive of any other right that the Indemnitee may now or hereafter acquire under any applicable law, agreement, vote of stockholders or Disinterested Directors, provisions of a charter or bylaws (including the Certificate of Incorporation or Bylaws of the Company), or otherwise.

13. Expenses for Disputes Relating Agreement. In the event that the Indemnitee is subject to or intervenes in any action, suit, or proceeding in which the validity or enforceability of this Agreement is at issue, or to recover damages for breach of, this Agreement, the Indemnitee, if the Indemnitee prevails in whole or in part in such action, suit, or proceeding, shall be entitled to recover from the Company and shall be indemnified by the Company against any Expenses actually and reasonably incurred by the Indemnitee in connection therewith.

14. Continuation of Indemnity. All agreements and obligations of the Company contained herein shall continue during the period the Indemnitee is a director, officer, employee, agent, or trustee of the Company or while a director, officer, employee, agent, or trustee is serving at the request of the Company as a director, officer, employee, agent, or trustee of another corporation or of a partnership, joint venture, trust, or other enterprise, including service with respect to an employee benefit plan, and shall continue thereafter with respect to any possible claims based on the fact that the Indemnitee was a director, officer, employee, agent, or trustee of the Company or, while a director, officer, employee, agent or trustee of the Company, was serving at the request of the Company as a director, officer, employee, agent or trustee of another corporation or of a partnership, joint venture, trust, or other enterprise, including service with respect to an employee benefit plan. This Agreement shall be binding upon all successors and assigns of the Company (including any transferee of all or substantially all of its assets and any successor by merger or operation of law) and shall inure to the benefit of the Indemnitee’s heirs, executors, and administrators. The Company shall require and cause any successor (whether direct or indirect by purchase, merger, consolidation, or otherwise) to all, substantially all, or a substantial part, of the business and/or assets of the Company, by written agreement in form and substance satisfactory to Indemnitee, expressly to assume and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform if no such succession had taken place.

15. Notification and Defense of Proceeding. Promptly after receipt by the Indemnitee of any summons, citation, subpoena, complaint, indictment, information or other document relating to any Proceeding or matter which may be subject to indemnification or advancement as provided hereunder, the Indemnitee shall, if a request for indemnification or an advancement of Expenses in respect thereof is to be made against the Company under this Agreement, notify the Company in writing of the commencement thereof; but the omission so to notify the Company shall not relieve it from any liability that it may have to the Indemnitee. Notwithstanding any other provision of this Agreement, with respect to any such Proceeding of which the Indemnitee notifies the Company:

(a) The Company shall be entitled to participate therein at its own expense;

(b) Except as otherwise provided in this Section 15(b), to the extent that it may wish, the Company, jointly with any other indemnifying party similarly notified, shall be entitled to assume the defense thereof, with counsel satisfactory to the Indemnitee. After notice from the Company to the Indemnitee of its election so to assume the defense thereof, the Company shall not be liable to the Indemnitee under this Agreement for any expenses of counsel subsequently incurred by the Indemnitee in connection with the defense thereof except as otherwise provided below. The Indemnitee shall have the right to employ the Indemnitee’s own counsel in such Proceeding, but the fees and expenses of such counsel incurred after notice from the Company of its assumption of the defense thereof shall be at the expense of the Indemnitee unless (i) the employment of counsel by the Indemnitee has been authorized by the Company, (ii) the Indemnitee shall have reasonably concluded that there may be a conflict of interest between the Company and the Indemnitee in the conduct of the defense of such Proceeding, or (iii) the Company shall not within 60 calendar days of receipt of notice from the Indemnitee in fact have employed counsel to assume the defense of the Proceeding, in each of which cases the Indemnitee shall be entitled to advancement of all fees and expenses of the Indemnitee’s counsel in accordance with Section 16 hereof and indemnification against such fees and expenses in accordance with the applicable provisions of this Agreement. The Company shall not be entitled to assume the defense of any Proceeding brought by or on behalf of the Company or as to which the Indemnitee shall have made the conclusion provided for in (ii) above; and

(c) Notwithstanding any other provision of this Agreement, the Company shall not be liable to indemnify the Indemnitee under this Agreement for any amounts paid in settlement of any Proceeding effected without the Company’s written consent, or for any judicial or other award, if the Company was not given an opportunity, in accordance with this Section 15, to participate in the defense of such Proceeding. The Company shall not settle any Proceeding in any manner that would impose any penalty or limitation on or disclosure obligation with respect to the Indemnitee, or that would directly or indirectly constitute or impose any admission or acknowledgment of fault or culpability with respect to the Indemnitee, without the Indemnitee’s written consent. Neither the Company nor the Indemnitee shall unreasonably withhold any consent required under this Section 15(c).

16. Advancement of Expenses. All Expenses incurred by the Indemnitee in defending any Proceeding described in Section 4 or 5 shall be paid by the Company in advance of the final disposition of such Proceeding at the request of the Indemnitee. Notwithstanding the foregoing, if the Indemnitee is not a director of the Company, the Company shall not advance or continue to advance Expenses to the Indemnitee if a determination is reasonably made that the facts known at the time such determination is made demonstrate clearly and convincingly that the

Indemnitee acted in bad faith or in a manner that the Indemnitee did not reasonably believe to be in or not opposed to the best interests of the Company, or, with respect to any criminal Proceeding, that the Indemnitee had reasonable cause to believe his or her conduct was unlawful. Such determination shall be made: (i) by the Board of Directors by a majority vote of directors who are not parties to such proceeding, whether or not such majority constitutes a quorum; (ii) by a committee of such directors designated by a majority vote of such directors, whether or not such majority constitutes a quorum; (iii) if there are no such directors, or if such directors so direct, by independent legal counsel in a written opinion to the Board of Directors, a copy of which shall be delivered to the Indemnitee. To receive an advancement of Expenses under this Agreement, the Indemnitee shall submit a written request to the Secretary of the Company. Such request shall reasonably evidence the Expenses incurred by the Indemnitee and shall include or be accompanied by an undertaking, by or on behalf of the Indemnitee, to repay all amounts so advanced if it shall ultimately be determined, by final judicial decision of a court of competent jurisdiction from which there is no further right to appeal, that the Indemnitee is not entitled to be indemnified for such Expenses by the Company as provided by this Agreement or otherwise. The Indemnitee’s undertaking to repay any such amounts is not required to be secured. Each such advancement of Expenses shall be made within 20 calendar days after the receipt by the Secretary of the Company of such written request.

17. D&O Insurance.

(a)To the extent that the Company maintains an insurance policy or policies providing liability insurance for directors, officers, employees or agents of the Company or of any other Enterprise, Indemnitee shall be covered by such policy or policies in accordance with its or their terms to the maximum extent of the coverage available for any such director, officer, employee or agent under such policy or policies. If, at the time of the receipt of a notice of a claim pursuant to the terms hereof, the Company has director and officer liability insurance in effect, the Company shall give prompt notice of the commencement of such proceeding to the insurers in accordance with the procedures set forth in the respective policies. The Company shall thereafter take all necessary or desirable action to cause such insurers to pay, on behalf of Indemnitee, all amounts payable as a result of such proceeding in accordance with the terms of such policies.

(b) In the event of a Change of Control or the Company’s becoming insolvent, the Company shall maintain in force any and all insurance policies then maintained by the Company in providing insurance--directors’ and officers’ liability, fiduciary, employment practices or otherwise--in respect of the individual directors and officers of the Company, for a fixed period of six years thereafter (a “Tail Policy”). Such coverage shall be non-cancellable and shall be placed and serviced for the duration of its term by the Company’s incumbent insurance broker. Such broker shall place the Tail policy with the incumbent insurance carriers using the policies that were in place at the time of the change of control event (unless the incumbent carriers will not offer such policies, in which case the Tail Policy placed by the Company’s insurance broker shall be substantially comparable in scope and amount as the expiring policies, and the insurance carriers for the Tail Policy shall have an AM Best rating that is the same or better than the AM Best ratings of the expiring policies).

18. Monetary Damages Insufficient/Specific Performance. The Company and Indemnitee agree that a monetary remedy for breach of this Agreement may be inadequate, impracticable and difficult of proof, and further agree that such breach may cause Indemnitee irreparable harm. Accordingly, the parties hereto agree that Indemnitee may enforce this Agreement by seeking injunctive relief and/or specific performance hereof, without any necessity of showing actual damage or irreparable harm (having agreed that actual and irreparable harm will result in not forcing the Company to specifically perform its obligations pursuant to this Agreement) and that by seeking injunctive relief and/or specific performance, Indemnitee shall not be precluded from seeking or obtaining any other relief to which he may be entitled. The Company and Indemnitee further agree that Indemnitee shall be entitled to such specific performance and injunctive relief, including temporary restraining orders, preliminary injunctions and permanent injunctions, without the necessity of posting bonds or other undertaking in connection therewith. The Company acknowledges that in the absence of a waiver, a bond or undertaking may be required of Indemnitee by the Court, and the Company hereby waives any such requirement of a bond or undertaking. If Indemnitee seeks mandatory injunctive relief, it shall not be a defense to enforcement of the Company’s obligations set forth in this Agreement that Indemnitee has an adequate remedy at law for damages.

19. Notice by Company. If the Indemnitee is the subject of, or is, to the knowledge of the Company, implicated in any way during an investigation (other than investigation conducted by or on behalf of the Company), whether formal or informal, that is related to Indemnitee’s official capacity and that reasonably could lead to a Proceeding for which indemnification can be provided under this Agreement, the Company shall notify the

Indemnitee of such investigation and shall, to the extent not prohibited by applicable law, share with Indemnitee any information it has provided to any third parties concerning the investigation (“Shared Information”). By executing this Agreement, Indemnitee agrees that such Shared Information is material non-public information that Indemnitee is obligated to hold in confidence and may not disclose publicly; provided, however, that Indemnitee may use the Shared Information and disclose such Shared Information to Indemnitee’s legal counsel and third parties, in each case solely in connection with defending Indemnitee from legal liability.

20. Severability; Prior Indemnification Agreements. If any provision or provisions of this Agreement shall be held to be invalid, illegal, or unenforceable as applied to any person or entity or circumstance for any reason whatsoever, then, to the fullest extent permitted by law (a) the validity, legality, and enforceability of such provision in any other circumstance and of the remaining provisions of this Agreement (including, without limitation, all portions of any paragraphs of this Agreement containing any such provision held to be invalid, illegal, or unenforceable, that are not by themselves invalid, illegal, or unenforceable) and the application of such provision to other persons or entities or circumstances shall not in any way be affected or impaired thereby, and (b) to the fullest extent possible, the provisions of this Agreement (including, without limitation, all portions of any paragraph of this Agreement containing any such provision held to be invalid, illegal, or unenforceable, that are not themselves invalid, illegal, or unenforceable) shall be construed so as to give effect to the intent of the parties that the Company provide protection to the Indemnitee to the fullest extent set forth in this Agreement. This Agreement shall supersede and replace any prior indemnification agreements entered into by and between the Company and the Indemnitee and any such prior agreements shall be terminated upon execution of this Agreement.

21. Headings; References; Pronouns. The headings of the sections of this Agreement are inserted for convenience only and shall not be deemed to constitute part of this Agreement or to affect the construction thereof. References herein to section numbers are to sections of this Agreement. All pronouns and any variations thereof shall be deemed to refer to the singular or plural as appropriate.

22. Other Provisions.

(a) This Agreement and all disputes or controversies arising out of or related to this Agreement shall be governed by, and construed in accordance with, the internal laws of the State of Delaware, without regard to the laws of any other jurisdiction that might be applied because of conflicts of laws principles of the State of Delaware, unless otherwise required by the law of the state in which the Indemnitee primarily resides and works. Except with respect to any arbitration commenced by Indemnitee pursuant to Section 11 of this Agreement, the Company and Indemnitee hereby irrevocably and unconditionally (i) agree that any action or proceeding arising out of or in connection with this Agreement shall be brought only in the Delaware Court of Chancery, and not in any other state or federal court in the United States of America or any court in any other country, (ii) consent to submit to the exclusive jurisdiction of the Delaware Court of Chancery for purposes of any action or proceeding arising out of or in connection with this Agreement, (iii) consent to service of process at the address set forth in Section 22(g) of this Agreement with the same legal force and validity as if served upon such party personally within the State of Delaware, (iv) waive any objection to the laying of venue of any such action or proceeding in the Delaware Court of Chancery and (v) waive, and agree not to plead or to make, any claim that any such action or proceeding brought in the Delaware Court of Chancery has been brought in an improper or inconvenient forum.

(b) This Agreement may be executed in one or more counterparts, each of which shall be considered one and the same instrument and shall become effective when one or more counterparts have been signed by each of the parties and delivered to the other party.

(c) This Agreement shall not be deemed an employment contract between the Company and Indemnitee, and, if the Indemnitee is an officer of the Company, the Indemnitee specifically acknowledges that the Indemnitee may be discharged at any time for any reason, with or without cause, and with or without severance compensation, except as may be otherwise provided in a separate written contract between the Indemnitee and the Company.

(d) In the event of payment under this Agreement, the Company shall be subrogated to the extent of such payment to all of the rights of recovery of the Indemnitee (excluding insurance obtained on the Indemnitee’s own behalf), and the Indemnitee shall execute all papers required and shall do everything that may be necessary to secure such rights, including the execution of such documents necessary to enable the Company effectively to bring suit to enforce such rights.

(e) This Agreement may not be amended, modified, or supplemented in any manner, whether by course of conduct or otherwise, except by an instrument in writing specifically designated as an amendment hereto, signed on behalf of each party; provided, however, that no amendment, modification, or repeal of this Agreement or any provision hereof shall limit or restrict any right of Indemnitee under this Agreement in respect of any action taken or omitted by such Indemnitee in his or her official capacity. No failure or delay of either party in exercising any right or remedy hereunder shall operate as a waiver thereof, and no single or partial exercise of any such right or power, or any abandonment or discontinuance of steps to enforce such right or power, or any course of conduct, shall preclude any other or further exercise thereof or the exercise of any other right or power.

(f) All notices, requests, demands and other communications under this Agreement shall be in writing and shall be deemed to have been duly given if (1) delivered by hand and receipted for by the party to whom said notice or other communication shall have been directed, (2) mailed by certified or registered mail with postage prepaid, on the third business day after the date on which it is so mailed, (3) mailed by reputable overnight courier and receipted for by the party to whom said notice or other communication shall have been directed or (4) sent by facsimile transmission, with receipt of oral confirmation that such transmission has been received:

(i)If to Indemnitee, at such address as Indemnitee shall provide to the Company.

(ii)If to the Company to:

DocGo Inc.

35 West 35th Street, Floor 6

New York, New York 10001

Attention: General Counsel

or to any other address as may have been furnished to Indemnitee by the Company.

(g) To the fullest extent permitted by applicable law, if the indemnification provided for in this Agreement is unavailable to Indemnitee for any reason whatsoever, the Company, in lieu of indemnifying Indemnitee, shall contribute to the amount incurred by Indemnitee, whether for judgments, fines, penalties, excise taxes, amounts paid or to be paid in settlement and/or for Expenses, in connection with any Proceeding in such proportion as is deemed fair and reasonable in light of all of the circumstances in order to reflect (1) the relative benefits received by the Company and Indemnitee in connection with the event(s) and/or transaction(s) giving rise to such Proceeding; and/or (2) the relative fault of the Company (and its directors, officers, employees and agents) and Indemnitee in connection with such event(s) and/or transactions.

(h) This Agreement shall continue until and terminate upon the later of: (1) 10 years after the date that Indemnitee shall have ceased to serve as a director or officer of the Company or (2) one year after the final termination of any Proceeding, including any appeal, then pending in respect of which Indemnitee is granted rights of indemnification or advancement hereunder and of any proceeding, including any appeal, commenced by Indemnitee pursuant to Section 11 of this Agreement relating thereto.

[The remainder of this page is intentionally left blank.]

IN WITNESS WHEREOF, the Company and the Indemnitee have caused this Agreement to be executed as of the date last signed below.

| | | | | | | | | | | |

| DocGo Inc.

|

| |

| By: |

| | Name: | |

| | Title: | |

| | | |

| Date: |

| | | |

|

| | |

| |

| [Name] |

| | | |

| Date: |

Exhibit 10.2

TRANSITION CONSULTING AGREEMENT

This TRANSITION CONSULTING AGREEMENT (this “Agreement”) is entered into by and between DocGo Inc., a Delaware corporation (the “Company”), and Steven Katz (“Consultant”). Consultant and the Company are each referred to herein as a “Party” and collectively as the “Parties.”

WHEREAS, Consultant has resigned as a member of the Board of Directors (the “Board”) of the Company, non-executive Chair of the Board, Chair and member of the Audit and Compliance Committee of the Board, and a member of the Nominating and Corporate Governance Committee of the Board (together, the “Board Roles”), effective as September 30, 2024 (the “Resignation Date”); and

WHEREAS, the Parties wish to enter into a consulting arrangement following the Resignation Date upon the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the promises set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by Consultant and the Company, the Parties hereby agree as follows:

1.Resignation.

(a) Consultant’s service pursuant to the Board Roles will end as of the Resignation Date.

(b) The Company and Consultant acknowledge and agree that, for the avoidance of doubt, that certain indemnification agreement, dated November 5, 2021, by and between the Parties, remains in full force and effect in accordance with its terms.

2.Consulting Services.

(a) Beginning on the Resignation Date and through December 31, 2024 (such period, as may be extended or earlier terminated as provided in Section 2(d), the “Consulting Period”), the Company and Consultant agree that Consultant shall serve as a consultant to the Company providing the Services (as defined below) on an as-needed basis during normal business hours. During the Consulting Period, Consultant agrees to provide information and other transition advisory services relating to the Board and its committees, as may be requested from time to time by the Company’s executive officers or the Board (the “Services”).

(b) As compensation for the Services, Consultant shall be entitled to consulting fees in the amount of (i) two thousand five hundred dollars ($2,500) per month, plus (ii) four hundred dollars ($400) for each hour of Services rendered in excess of five (5) hours during each month. Promptly after the conclusion of each month of the Consulting Period, Consultant shall submit to the Company a written report recording in reasonable detail the dates on which Services were performed, the number of hours spent on such dates and a brief description of the Services rendered. As an independent contractor, no income or other taxes shall be withheld from the amounts paid to Consultant pursuant to this Section 2(b). In addition, during the Consulting Period, Consultant shall continue to vest in Consultant’s outstanding stock options and restricted stock units under the Company’s 2021 Stock Incentive Plan (the “2021 Plan”).

(c) During the Consulting Period, Consultant’s relationship with the Company shall be that of an independent contractor. Consultant shall control and determine how the Services are to be accomplished; provided, however, that in all events Consultant shall perform the Services in a quality, workmanlike manner and within reasonable deadlines established by the Company and consistent with the professional talent of Consultant that Consultant applied during Consultant’s prior service with the Company. As an independent contractor, Consultant shall not participate as an active employee in any employee benefit plan of the Company or of an affiliate.

(d) During the Consulting Period, Consultant shall indemnify, defend and hold the Company harmless from against any and all claims (including claims for personal injury, death or damage to property), liabilities, fines, penalties or amounts, losses, damages (including reasonable attorneys’ fees), and obligations asserted against the Company by any third party to the extent directly and proximately caused by (i) gross negligence or willful misconduct by Consultant or (ii) breach of any applicable law, rule or regulation by Consultant, in each case, in his capacity as an independent contractor during the Consulting Period. During the Consulting Period, the Company shall indemnify, defend and hold Consultant harmless from against any and all claims (including claims for personal injury, death or damage to property), liabilities, fines, penalties or amounts, losses, damages (including reasonable attorneys’ fees), and obligations asserted against Consultant by any third party to the extent arising out of Consultant performing the Services during the Consulting Period, unless resulting from Consultant’s gross negligence, willful misconduct or breach of any applicable law, rule or regulation as set forth above.

(e) Notwithstanding any other provision of this Section 2, the Consulting Period may be terminated (i) by the Company for Cause (as defined in the 2021 Plan), (ii) as a result of Consultant’s death or Disability (as defined in the 2021 Plan) and (iii) by mutual agreement of the Parties. The Consulting Period may be extended by mutual agreement of the Parties.

3.Covenant to Cooperate in Legal Proceedings. Consultant agrees to fully cooperate with the Company and its affiliates (the “DocGo Affiliated Entities”) in any internal investigation, any administrative, regulatory, or judicial proceeding or any dispute with a third party at a rate of four hundred dollars ($400) per hour for time spent on such matters. Consultant understands and agrees that Consultant’s cooperation may include, but not be limited to, making Consultant available to the DocGo Affiliated Entities upon reasonable notice for interviews and factual investigations; appearing at the request of any DocGo Affiliated Entity to give testimony without requiring service of a subpoena or other legal process; volunteering to the DocGo Affiliated Entities pertinent information received by Consultant in Consultant’s capacity as a director or consultant of the Company; and turning over to the DocGo Affiliated Entities all relevant documents which are or may come into Consultant’s possession in Consultant’s capacity as a director or consultant of the Company, or otherwise, promptly at all at times and on schedules that are reasonable.

4.Governing Law. This Agreement and its performance will be construed and interpreted in accordance with the laws of the State of Delaware, without regard to principles of conflicts of law that would apply the substantive law of any other jurisdiction.

5.Counterparts. This Agreement may be executed in several counterparts, including by .PDF or .GIF attachment to email or by facsimile, each of which is deemed to be an original, and all of which taken together constitute one and the same agreement.

6.Amendment; Entire Agreement. This Agreement may not be changed orally but only by an agreement in writing agreed to and signed by the Party to be charged. This Agreement constitutes the entire agreement of the Parties with regard to the subject matter hereof and supersedes any and all prior and contemporaneous agreements and understandings, oral or written, between Consultant and the Company with regard to the subject matter hereof.

7. Confidentiality. During the Consulting Period, Consultant may be provided with, and may have access to, Confidential Information (as defined in Section 7(d) below). In consideration of Consultant’s receipt and access to such Confidential Information, and as a condition of Consultant’s engagement hereunder, Consultant shall comply with this Section 7.

(a)Both during the Consulting Period and thereafter, except as expressly permitted by this Agreement, Consultant shall not disclose any Confidential Information to any person or entity and shall not use any Confidential Information except for the benefit of the Company or its affiliates. Consultant shall follow all Company policies and protocols regarding the security of all documents and other materials containing Confidential Information (regardless of the medium on which Confidential Information is stored). Except to the extent required for the performance of Consultant’s duties pursuant to this Agreement, Consultant shall not remove from facilities of the Company or any of its affiliates any information, property, equipment, drawings, notes, reports, manuals, invention records, computer software, customer information, or other data or materials that relate in any way to the Confidential Information, whether paper or electronic and whether produced by Consultant or obtained by the Company or any of its affiliates. The covenants of this Section 7(a) shall apply to all Confidential Information, whether now known or later to become known to Consultant during the period that Consultant is engaged by or affiliated with the Company or any of its affiliates.

(b)Notwithstanding any provision of Section 7(a) to the contrary, Consultant may make the following disclosures and uses of Confidential Information:

(i)disclosures to employees, officers or directors of the Company or any of its affiliates who have a need to know the information in connection with the businesses of the Company or any of its affiliates;

(ii)disclosures and uses that are approved in writing by the Board or an executive officer of the Company; or

(iii)disclosures to a person or entity that has (x) been retained by the Company or any of its affiliates to provide services to the Company and/or its affiliates and (y) agreed in writing to abide by the terms of a confidentiality agreement.

(c)At the request of the Company, Consultant shall (a) promptly and permanently surrender and deliver to the Company all documents (including electronically stored information) and all copies thereof and all other materials of any nature containing or pertaining to all Confidential Information and any other Company property (including any Company-issued computer, mobile device or other equipment) in Consultant’s possession, custody or control, and Consultant shall not retain any such documents or other materials or property of the Company or any of its affiliates, and (b) confirm to the Company in writing that all such documents, materials and property have been returned to the Company or otherwise destroyed.

(d)“Confidential Information” means all confidential, competitively valuable, non-public or proprietary information that is conceived, made, developed or acquired by or disclosed to Consultant (whether conveyed orally or in writing), individually or in conjunction with others, during the period that Consultant is engaged by the Company or any of its affiliates (whether during business hours or otherwise and whether on the Company’s premises or otherwise) including: (i) technical information of the Company, its affiliates, its investors, customers, vendors, suppliers or other third parties, including computer programs, software, databases, data, ideas, know-how, formulae, compositions, processes, discoveries, machines, inventions (whether patentable or not), designs, developmental or experimental work, techniques, improvements, work in process, research or test results, original works of authorship, training programs and procedures, diagrams, charts, business and product development plans, and similar items; (ii) information relating to the Company or any of its affiliates’ businesses or properties, products or services (including all such information relating to corporate opportunities, operations, future plans, methods of doing business, business plans, strategies for developing business and market share, research, financial and sales data, pricing terms, evaluations, opinions, interpretations, acquisition prospects, the identity of customers or acquisition targets or their requirements, the identity of key contacts within customers’ organizations or within the organization of acquisition prospects, or marketing and merchandising techniques, prospective names and marks) or pursuant to which the Company or any of its affiliates owes a confidentiality obligation; and (iii) other valuable, confidential information and trade secrets of the Company, its affiliates, its customers or other third parties. Moreover, all documents, videotapes, written presentations, brochures, drawings, memoranda, notes, records, files, correspondence, manuals, models, specifications, computer programs, e-mail, voice mail, electronic databases, maps, drawings, architectural renditions, models and all other writings or materials of any type including or embodying any of such information, ideas, concepts, improvements, discoveries, inventions and other similar forms of expression are and shall be the sole and exclusive property of the Company or its other applicable affiliates and be subject to the same restrictions on disclosure applicable to all Confidential Information pursuant to this Agreement. For purposes of this Agreement, Confidential Information shall not include any information that (A) is or becomes generally available to the public other than as a result of a disclosure or wrongful act of Consultant or any of Consultant’s agents; (B) was available to Consultant on a non-confidential basis before its disclosure by the Company or any of its affiliates; (C) becomes available to Consultant on a non-confidential basis from a source other than the Company or any of its affiliates; provided, however, that such source is not bound by a confidentiality agreement with, or other obligation with respect to confidentiality to, the Company or any of its affiliates; or (D) is required to be disclosed by applicable law.

(e)Notwithstanding the foregoing, nothing in this Agreement shall prohibit or restrict Consultant from lawfully: (i) initiating communications directly with, cooperating with, providing information to, causing information to be provided to, or otherwise assisting in an investigation by, any governmental authority regarding a possible violation of any law; (ii) responding to any inquiry or legal process directed to Consultant from any such governmental authority; (iii) testifying, participating or otherwise assisting in any action or proceeding by any such governmental authority relating to a possible violation of law; or (iv) making any other disclosures that are protected under the whistleblower provisions of any applicable law. Additionally, pursuant to the federal Defend Trade Secrets Act of 2016, an individual shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of

a trade secret that: (A) is made (1) in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney and (2) solely for the purpose of reporting or investigating a suspected violation of law; (B) is made to the individual’s attorney in relation to a lawsuit for retaliation against the individual for reporting a suspected violation of law; or (C) is made in a complaint or other document filed in a lawsuit or proceeding, if such filing is made under seal. Nothing in this Agreement requires Consultant to obtain prior authorization before engaging in any conduct described in this paragraph, or to notify the Company that Consultant has engaged in any such conduct.

8.Severability. Any term or provision of this Agreement (or part thereof) that renders such term or provision (or part thereof) or any other term or provision (or part thereof) hereof invalid or unenforceable in any respect shall be severable and shall be modified or severed to the extent necessary to avoid rendering such term or provision (or part thereof) invalid or unenforceable, and such modification or severance shall be accomplished in the manner that most nearly preserves the benefit of the Parties’ bargain hereunder.

9.Interpretation. The Section headings have been inserted for purposes of convenience and shall not be used for interpretive purposes. The words “hereof,” “herein” and “hereunder” and other compounds of the word “here” shall refer to the entire Agreement and not to any particular provision hereof. The use herein of the word “including” following any general statement, term or matter shall not be construed to limit such statement, term or matter to the specific items or matters set forth immediately following such word or to similar items or matters, whether or not non-limiting language (such as “without limitation”, “but not limited to”, or words of similar import) is used with reference thereto, but rather shall be deemed to refer to all other items or matters that could reasonably fall within the broadest possible scope of such general statement, term or matter. The word “or” as used herein is not exclusive and is deemed to have the meaning “and/or.” Unless the context requires otherwise, all references herein to a law, agreement, instrument or other document shall be deemed to refer to such law, agreement, instrument or other document as amended, supplemented, modified and restated from time to time to the extent permitted by the provisions thereof. Neither this Agreement nor any uncertainty or ambiguity herein shall be construed against any Party, whether under any rule of construction or otherwise. This Agreement has been reviewed by each of the Parties and shall be construed and interpreted according to the ordinary meaning of the words used so as to fairly accomplish the purposes and intentions of the Parties.

10.No Assignment. No right to receive payments and benefits under this Agreement shall be subject to set off, offset, anticipation, commutation, alienation, assignment, encumbrance, charge, pledge or hypothecation or to execution, attachment, levy, or similar process or assignment by operation of law.

11.Section 409A. This Agreement and the benefits provided hereunder are intended be exempt from, or compliant with, the requirements of Code and the Treasury regulations and other guidance issued thereunder (collectively, “Section 409A”) and shall be construed and administered in accordance with such intent. Each installment payment under this Agreement shall be deemed and treated as a separate payment for purposes of Section 409A. Notwithstanding the foregoing, the Company makes no representations that the benefits provided under this Agreement are exempt from the requirements of Section 409A and in no event shall

the Company be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by Consultant on account of non-compliance with Section 409A.

[Signatures Follow]

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the dates set forth beneath their names below, effective for all purposes as provided above.

CONSULTANT

| | |

| /s/ Steven Katz |

| Steven Katz |

Date: 09/27/2024

DOCGO INC.

| | | | | | | | |

| By: | /s/ Norman Rosenberg | | | |

| Name: | Norman Rosenberg | | | |

| Title: | Chief Financial Officer and Treasurer | | | |

Date: 09/26/2024

Exhibit 99.1

DocGo Appoints Healthcare Visionary Dr. Stephen K. Klasko as Chair of the Board

NEW YORK, September 30, 2024 – DocGo Inc. (Nasdaq: DCGO) (“DocGo” or the “Company”), a leading provider of technology-enabled mobile health services, today announced the appointment of Stephen K. Klasko, M.D., M.B.A as the new independent, non-executive Chair of its Board of Directors, effective October 1, 2024.

Dr. Klasko has an extensive background in leadership roles within healthcare, higher education and medical industry innovation, including an eight-year tenure as the President of Thomas Jefferson University and the CEO of Jefferson Health where he oversaw its expansion to 18 hospitals and over 35,000 employees. Prior to that, he was CEO of USF Health and Dean of the Morsani College of Medicine at the University of South Florida, and he also served as Dean of Drexel University College of Medicine. Dr. Klasko will fill the board vacancy created by the resignation of DocGo’s outgoing Chair of the Board, Steven Katz.

Dr. Klasko currently serves as a Special Advisor at leading venture capital firm General Catalyst, and as Chief Medical Officer of Abundant Venture Partners. He has sat on the board of directors of Teleflex Incorporated since 2008 where he served on the audit committee and is currently chair of the governance committee and independent Lead Director. His track record of success has earned him accolades over the past several years including Modern Healthcare’s #2 “Most Influential Person in Healthcare” in 2018, one of Fast Company’s “100 Most Creative People in Business 2018”; Ernst & Young’s “Greater Philadelphia Entrepreneur of the Year 2018”; and Becker's Healthcare Review's “Great Leaders in Healthcare” in 2022, 2023 and 2024.

Dr. Klasko has authored several books including UnHealthcare: A Manifesto for Health Assurance with Hemant Taneja, CEO of General Catalyst, which outlines his passion for “healthcare at any address” and actualizing population health. Dr. Klasko was first introduced to DocGo when Jefferson Health formed a joint venture with DocGo’s Ambulnz division, which grew to provide medical transportation services to Jefferson’s eleven hospital locations and is now the largest provider of medical transportation in the Philadelphia market.

"It is imperative that we transform population health, personalized medicine and social determinants from philosophy to the mainstream of clinical care and payment models," said Dr. Klasko. "I’ve been impressed with DocGo’s vision for mobile health, excited by CEO Lee Bienstock’s entrepreneurial spirit and his vision for DocGo’s leadership in the proactive healthcare revolution. I look forward to partnering with Lee and the DocGo Board to oversee creation of solutions that help improve patient outcomes, make healthcare more affordable and accessible, and deliver on the promise of healthcare at any address."

As non-executive Chair of the Board, Dr. Klasko will assist Mr. Bienstock and the rest of the DocGo Board in steering the company’s efforts to transform healthcare delivery through its mobile health initiatives and value-based care strategies.

"Dr. Klasko’s appointment comes at an exciting time for DocGo as we are well-positioned to accelerate our growth and expand our impact in the healthcare space," said Lee Bienstock, CEO of DocGo. "His strategic insight and proven track record in delivering innovation at scale will be

invaluable to the Board as we continue to launch new programs and optimize our value-based care model. I look forward to partnering closely with him and all of our dedicated Board members to drive long-term value for our stakeholders."