Form SCHEDULE 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

February 07 2025 - 4:12PM

Edgar (US Regulatory)

February 6, 2025

Mr. Christopher Shoemaker

BofA Securities

711 5th Ave.

New York, NY 10022

Email: Christopher.shoemaker@bofa.com

Via Email

Re: DMC Global Non-Binding Indication of Interest

Dear Mr. Shoemaker:

Steel Connect LLC (together with its affiliates, “Steel”,

“we” or “our”) is pleased to present this non-binding proposal to acquire all the outstanding shares of common

stock of DMC Global Inc. (“DMC” or the “Company”) that we do not already own at a price equal to $10.18 per share

in cash (the “Transaction”). For stockholders, our proposal represents a 28.7% premium over today’s closing price of

$7.91 per share and a 29.4% premium over the average last 30-day closing price of $7.86 per share.

We are submitting this proposal in response to your

process letter provided to us on January 17, 2025. We have addressed the following items that you requested:

Valuation. Our valuation is based on 20,026,491

shares of DMC outstanding as of October 31, 2024 and is subject to (i) the satisfactory completion of our due diligence described below,

(ii) the delivery of audited financial statements for 2024 consistent with the forecasts we have been provided by the Company, and (iii)

the reaffirmation by the Company’s management and board of directors of their 2025-2027 projections that were previously shared

with us.

Description of Acquiring Entity. Steel Connect

LLC is a wholly owned subsidiary of Steel Partners Holdings L.P. Steel Partners is a New York Stock Exchange-listed, diversified global

holding company which owns and operates businesses in various segments, including diversified industrial products, energy, defense, supply

chain management and logistic, banking and youth sports. We would expect that the Transaction would be accomplished through the merger

of a newly formed, wholly owned acquisition subsidiary of Steel Connect LLC with and into DMC, with DMC continuing as the surviving corporation.

Sources of Financing. This all-cash proposal

is not contingent on financing. Steel would use cash on hand and availability under its current revolving credit facility to acquire the

Company.

Internal/External Approvals. We are fully authorized

to pursue the Transaction on the terms outlined herein; any definitive agreement would require the approval of Steel’s Board of

Directors. We would expect that the only third-party approvals necessary would be customary regulatory competition filings, which we would

expect to be submitted promptly following the execution of a definitive agreement. We would anticipate being able to obtain these regulatory

approvals in the ordinary course and without additional requests for information.

590 Madison Avenue, 32nd Floor, New York, NY 10022

Due Diligence. In order to complete our due

diligence, we will require access to Arcadia’s management team as well as follow up access to the other segments’ management

teams. Although we have performed significant due diligence to date on the Company and its businesses, we have not received all requested

access and information that we would have expected to receive in this context. Accordingly, we require customary confirmatory diligence

information, including information on the Company’s operational, legal, tax, environmental/safety/health and administrative functions.

Given our experience in completing acquisitions and our dedicated in-house professionals, we believe we can be efficient in completing

this work, provided we receive the requisite cooperation from the Company, its management and board of directors. We are prepared to proceed

immediately. A list of anticipated team members and third-party advisors for this Transaction will be provided as appropriate.

Management and Employee Matters. We believe

that keeping the operational management team intact is very important. In this case, we would expect to keep the operations management

team and current employees in place to execute the Company’s strategy.

Our team is committed to allocating the requisite

resources to complete this Transaction in an expeditious manner. We are confident, assuming reasonable and customary access to the Company,

its management and certain other discrete information we have requested, that we would have the ability to complete our confirmatory diligence,

concomitantly negotiate and execute definitive agreements and consummate the Transaction swiftly and with certainty.

Steel stands ready to meet with the Company’s

board of directors and its representatives as soon as possible. We request a response to this proposal by February 11, 2025.

We believe that our proposal represents the best opportunity

for stockholders to achieve immediate liquidity and full and fair value for their shares. Please be aware that this letter constitutes

an expression of interest only and does not create and shall not be deemed to constitute or create any legally binding or enforceable

obligations on the part of either of us until a definitive transaction agreement is executed. We reserve the right to withdraw or modify

any proposal at any time and for any reason.

We look forward to working towards a mutually agreeable

outcome that we believe will be in the best interests of all stockholders.

Respectfully,

/s/ Warren Lichtenstein

Warren Lichtenstein

590 Madison Avenue, 32nd Floor, New York, NY 10022

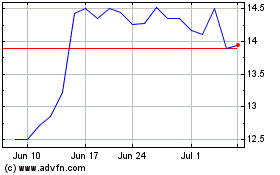

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jan 2025 to Feb 2025

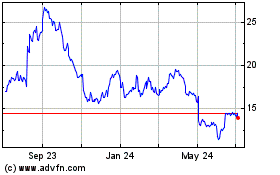

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Feb 2024 to Feb 2025