Form DFAN14A - Additional definitive proxy soliciting materials filed by non-management and Rule 14(a)(12) material

August 30 2023 - 4:28PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

DIVERSIFIED HEALTHCARE TRUST

|

(Name of Registrant as Specified In Its Charter)

|

| |

FLAT FOOTED, LLC

MARC ANDERSEN

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Flat Footed LLC, a Delaware

limited liability company (“Flat Footed”), together with the other participant named herein, has filed a definitive proxy

statement and accompanying GOLD proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit

votes in connection with its opposition to proposals to be presented at the special meeting of shareholders (the “Special Meeting”)

of Diversified Healthcare Trust, a Maryland corporation (the “Company”).

Item 1: On August 30, 2023,

Flat Footed issued the following press release:

Flat Footed LLC Comments on Diversified Healthcare

Trust’s Adjournment of Special Meeting of Shareholders

WILSON, Wyo.--(BUSINESS WIRE)--Flat Footed LLC (together

with its affiliates, “FFL” or “we”), a top shareholder of Diversified Healthcare Trust (Nasdaq: DHC) (“DHC”

or the “Company”) and the owner of approximately 9.8% of the Company’s outstanding common shares, today commented on

DHC’s adjournment of its Special Meeting of Shareholders (the “Special Meeting”) to September 6, at 10:00 a.m. Eastern

Time, where shareholders are scheduled to vote on the proposed merger with Office Properties Income Trust (Nasdaq: OPI) (“OPI”).

Marc Andersen, Managing Member of FFL, commented:

“We continue to believe that it is in the best

interest of DHC shareholders to vote AGAINST the proposed merger with OPI at the adjourned Special Meeting.”

***

Visit www.SaveDHC.com to Obtain Information

on How to Vote on the GOLD Proxy Card AGAINST the DHC-OPI Merger.

***

About Flat Footed

Flat Footed LLC is a special situation, value-oriented

investment management firm focused on leveraged, asset-heavy companies with complex capital structures. The Flat Footed LLC team has cumulatively

managed $2.8 billion since founding their first fund together in 1999. For more information, visit www.flatfootedllc.com.

Contacts

Flat Footed LLC

ir@flatfootedllc.com

Okapi Partners LLC

Mark Harnett, 212-297-0720

mharnett@okapipartners.com

or

Longacre Square Partners

Greg Marose / Charlotte Kiaie, 646-386-0091

FFL@longacresquare.com

Item 2: Also on August

30, 2023, Flat Footed posted the following materials to www.SaveDHC.com:

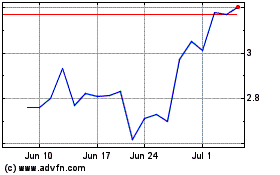

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Apr 2024 to May 2024

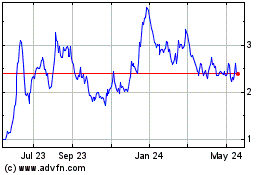

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From May 2023 to May 2024