DENTSPLY SIRONA Inc. (“Dentsply Sirona” or “the Company”) (Nasdaq:

XRAY) today announced the completion of the previously

disclosed internal investigation into certain financial reporting

matters. The investigation was undertaken by the Audit and Finance

Committee of the Dentsply Sirona Board of Directors (the “Audit and

Finance Committee”). Its findings and the actions the Company is

taking to address these findings and certain related financial

reporting matters are discussed in a Current Report on Form 8-K

(the “8-K”) filed by the Company today.

“The Audit and Finance Committee’s thorough process conducted

along with independent counsel and advisors resulted in findings

and conclusions which have the full support of the Board,” said

Eric Brandt, Chairman of the Dentsply Sirona Board of Directors.

“The Company has already taken decisive and meaningful steps to

address the findings and is now implementing enhancements and

remedial measures to ensure these issues are thoroughly resolved.

With a management team that is committed to accountability,

operational rigor and integrity, coupled with the remedial

measures, the entire Dentsply Sirona organization can move forward

focused on delivering long-term growth and value creation.”

Restatements of Third Quarter 2021 and Full Year

2021

As noted in the 8-K filed today, on October 29, 2022, the

Company, in consultation with the Audit and Finance Committee,

reached a determination that the Company’s consolidated financial

statements and related disclosures for the three and nine months

ended September 30, 2021, and for the fiscal year ended December

31, 2021, should no longer be relied upon because of certain

misstatements contained in those financial statements. The Company

has determined that it is appropriate to correct the misstatements

in the Company’s previously issued financial statements by amending

its Quarterly Report on Form 10-Q for the fiscal quarter ended

September 30, 2021 (the “Third Quarter 2021 Form 10-Q/A”), and its

Annual Report on Form 10-K for the fiscal year ended December 31,

2021 (the “2021 Form 10-K/A”). The Audit and Finance Committee and

management also discussed this conclusion with the Company’s

independent registered public accounting firm,

PricewaterhouseCoopers LLP.

Controls and Procedures

In connection with the restatement of the financial statements

and related disclosures in the Third Quarter 2021 Form 10-Q/A and

the 2021 Form 10-K/A, management re-evaluated the effectiveness of

the Company’s internal control over financial reporting and its

disclosure controls and procedures and identified one or more

material weaknesses in the Company’s internal control over

financial reporting as of September 30, 2021. The material

weaknesses remained in place as of December 31, 2021 and as of the

date of the 8-K.

The Company’s management has started to implement certain

enhancements and remedial measures to its internal control over

financial reporting and disclosure controls and procedures.

Management will continue to evaluate the processes, procedures and

controls and will make any further changes as appropriate.

Goodwill Impairment

In the nine months ended September 30, 2022, the Company expects

to record a pre-tax non-cash charge for the impairment of goodwill

and intangible assets in the range of $1.0 billion - $1.3 billion,

due primarily to macroeconomic factors such as higher cost of

capital, cost inflation, unfavorable foreign currency impacts, and

increased supply chain costs, which are contributing to reduced

forecasted revenues, lower operating margins, and reduced

expectations for future cash flows.

Select Preliminary Third Quarter 2022 Results and Fourth

Quarter 2022 Revenue Outlook

On a preliminary basis, the Company expects that third quarter

2022 Net sales will be approximately $947 million (representing a

slight decline in organic sales versus the prior year). Relative to

the prior year period, these results reflect foreign exchange

headwinds, global supply chain challenges, and softer volumes in

the U.S. and China.

Based on expected demand trends and foreign exchange impacts,

the Company expects sequential Net sales to decline low-single

digits in the fourth quarter 2022. On a constant currency basis,

the Company expects sequential Net sales to be flat or up

low-single digits in the fourth quarter 2022.The Company will

provide further information about its results and 2022 outlook

assumptions on its third quarter earnings conference call.

The amounts set forth above are preliminary estimates. The

Company is currently finalizing its results of operations for the

third quarter ended September 30, 2022. These preliminary estimates

are based solely on information available to management as of the

date of this press release. The Company’s actual results may differ

from these estimates due to the completion of its quarter-end

closing procedures, final adjustments and developments that may

arise or information that may become available between now and the

time the Company’s financial results are finalized and included in

its Form 10-Q for the three and nine month periods ended September

30, 2022.

The Company expects to announce its full third quarter 2022

financial results on or around November 9, 2022, and will host an

earnings conference call to discuss these results at that time.

About Dentsply Sirona

Dentsply Sirona is the world’s largest manufacturer of

professional dental products and technologies, with over a century

of innovation and service to the dental industry and patients

worldwide. Dentsply Sirona develops, manufactures, and markets a

comprehensive solutions offering including dental and oral health

products as well as other consumable medical devices under a strong

portfolio of world class brands. Dentsply Sirona’s products provide

innovative, high-quality and effective solutions to advance patient

care and deliver better and safer dental care. Dentsply Sirona’s

headquarters is located in Charlotte, North Carolina. The Company’s

shares are listed in the United States on Nasdaq under the symbol

XRAY. Visit www.dentsplysirona.com for more information about

Dentsply Sirona and its products.

Forward-Looking Statements

All statements in this press release that do not directly and

exclusively relate to historical facts constitute “forward-looking

statements.” These statements represent current expectations and

beliefs and no assurance can be given that the results described in

such statements will be achieved. Such statements are subject to

numerous assumptions, risks, uncertainties and other factors,

including those described in the section titled “Risk Factors” in

Dentsply Sirona’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2021 and any amendment. No assurance can be

given that any expectation, belief, goal or plan set forth in any

forward-looking statement can or will be achieved, and readers are

cautioned not to place undue reliance on such statements which

speak only as of the date they are made. The Company does not

undertake any obligation to update or release any revisions to any

forward-looking statement or to report any events or circumstances

after the date of this press release or to reflect the occurrence

of unanticipated events.

Non-GAAP Financial Measures

The Company has provided certain measures in this press release

that are not calculated in accordance with US GAAP and therefore

represent Non-GAAP measures. These Non-GAAP measures may differ

from those used by other companies and should not be considered in

isolation from, or as a substitute for, measures of financial

performance prepared in accordance with US GAAP. These Non-GAAP

measures are used by the Company to measure its performance and may

differ from those used by other companies.

Management believes that these Non-GAAP measures are helpful as

they provide another measure of the results of operations, and are

frequently used by investors and analysts to evaluate the Company’s

performance exclusive of certain items that impact the

comparability of results from period to period, and which may not

be indicative of past or future performance of the Company.

Organic SalesThe Company defines "organic sales" as the reported

net sales adjusted for: (1) net sales from acquired businesses

recorded prior to the first anniversary of the acquisition, (2) net

sales attributable to disposed businesses or discontinued product

lines in both the current and prior year periods, and (3) the

impact of foreign currency changes, which is calculated by

translating current period net sales using the comparable prior

period's currency exchange rates.

Contact Information

Investors:Andrea DaleyVP, Investor

Relations+1-704-805-1293InvestorRelations@dentsplysirona.com

Press:Marion Par-WeixlbergerVP, Corporate Communications and

PR+43 676 848414588marion.par-weixlberger@dentsplysirona.com

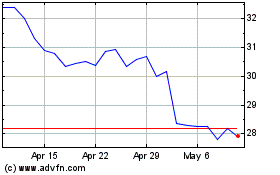

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

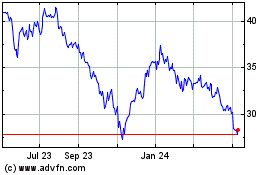

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

From Apr 2023 to Apr 2024