Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

May 29 2024 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

| |

Criteo S.A. |

|

| |

(Name of Issuer) |

|

| |

|

|

| |

American Depositary Shares, each representing one

Ordinary Share, nominal value €0.025 per share |

|

| |

(Title of Class of Securities) |

|

| |

|

|

| |

226718104 |

|

| |

(CUSIP Number) |

|

| |

|

|

| |

Connie Neumann

Office and compliance manager

Petrus Advisers Ltd

Eighth Floor, 6 New Street Square, New Fetter Lane

London EC4A 3AQ, United Kingdom

+44 20 7933 8831 |

|

| |

(Name, Address and Telephone Number of Person Authorized to |

|

| |

Receive Notices and Communications) |

|

| |

|

|

| |

May 24, 2024 |

|

| |

(Date of Event which Requires Filing of this Statement) |

|

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Sections 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☒

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Section 240.13d-7 for other parties to whom copies

are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 226718104 |

13D |

Page 2 of 8 pages |

| 1 |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Petrus Advisers Ltd. |

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(see instructions) |

(a) |

☐ |

| |

|

(b) |

☐ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS* (see instructions) |

|

|

| |

OO |

|

|

| |

|

|

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED |

|

|

| |

PURSUANT TO ITEMS 2(d) OR 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

United Kingdom |

|

|

| |

7 |

SOLE VOTING POWER |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH: |

|

0 |

| |

|

| 8 |

SHARED VOTING POWER |

| |

4,581,581 |

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

| |

0 |

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

| |

5,008,418 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

5,008,418 |

|

| |

|

|

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

| |

(see instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

8.84%1 |

|

|

| |

|

|

|

| 14 |

TYPE OF REPORTING PERSON* (see instructions) |

|

|

| |

FI |

|

|

| |

|

|

|

| 1 | Based on 56,687,497 Shares (as defined herein) outstanding as

of April 30, 2024, as disclosed in the Issuer’s quarterly report on Form 10-Q filed on May 2, 2024. |

| CUSIP No. 226718104 |

13D |

Page 3 of 8 pages |

| 1 |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Klaus Umek |

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(see instructions) |

(a) |

☐ |

| |

|

(b) |

☐ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS* (see instructions) |

|

|

| |

OO, PF |

|

|

| |

|

|

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED |

|

|

| |

PURSUANT TO ITEMS 2(d) OR 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

Austrian |

|

|

| |

7 |

SOLE VOTING POWER |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH: |

|

85,132 |

| |

|

| 8 |

SHARED VOTING POWER |

| |

4,581,581 |

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

| |

85,132 |

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

| |

5,008,418 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

5,093,550 |

|

| |

|

|

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

| |

(see instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

8.99%2 |

|

|

| |

|

|

|

| 14 |

TYPE OF REPORTING PERSON* (see instructions) |

|

|

| |

IN, HC |

|

|

| |

|

|

|

| 2 | Based on 56,687,497 Shares outstanding as of April 30, 2024,

as disclosed in the Issuer’s quarterly report on Form 10-Q filed on May 2, 2024. |

| CUSIP No. 226718104 |

13D |

Page 4 of 8 pages |

| 1 |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Till Hufnagel |

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(see instructions) |

(a) |

☐ |

| |

|

(b) |

☐ |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS* (see instructions) |

|

|

| |

OO, PF |

|

|

| |

|

|

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED |

|

|

| |

PURSUANT TO ITEMS 2(d) OR 2(e) |

|

☐ |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

German |

|

|

| |

7 |

SOLE VOTING POWER |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH: |

|

185,561 |

| |

|

| 8 |

SHARED VOTING POWER |

| |

4,581,581 |

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

| |

185,561 |

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

| |

5,008,418 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

5,193,979 |

|

| |

|

|

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

| |

(see instructions) |

|

☐ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

9.16%3 |

|

|

| |

|

|

|

| 14 |

TYPE OF REPORTING PERSON* (see instructions) |

|

|

| |

IN, HC |

|

|

| |

|

|

|

| 3 | Based on 56,687,497 Shares outstanding as of April 30, 2024,

as disclosed in the Issuer’s quarterly report on Form 10-Q filed on May 2, 2024. |

| CUSIP No. 226718104 |

13D |

Page 5 of 8 pages |

EXPLANATORY NOTE

Pursuant to Rule 13d-2 under the Act, this Amendment No. 4 to the Schedule

13D (“Amendment No. 4”) amends certain items of the Schedule 13D filed by the Reporting Persons with the Securities and Exchange

Commission (the “Commission”) on February 27, 2024, as amended by Amendment No. 1 filed with the Commission on April 18, 2024,

Amendment No. 2 filed with the Commission on April 24, 2024, and Amendment No. 3 filed with the Commission on May 15, 2024 (collectively,

the “Schedule 13D”), relating to the American Depository Shares (the “ADS”), each representing one ordinary share,

nominal value €0.025 per share (the “Shares”) of Criteo S.A., a French société anonyme whose headquarters

are located at 32 rue Blanche, 75009 Paris, France (the “Issuer”). All capitalized terms contained herein but not otherwise

defined shall have the meanings ascribed to such terms in the Schedule 13D.

| CUSIP No. 226718104 |

13D |

Page 6 of 8 pages |

Item 3. Source and Amount of Funds or Other

Consideration.

Item 3 of the Schedule 13D is hereby amended and supplemented as follows:

Because the Reporting Persons have generated more proceeds from sales

of ADS than they have spent on acquiring ADS and options to acquire ADS since the filing of Amendment No. 3 on May 15, 2024, the Reporting

Persons have not had to source additional funds to acquire the ADS and options to acquire ADS purchased since the filing of Amendment

No. 3 on May 15, 2024.

Item 5. Interest in Securities of the Issuer

Item 5(a)-(c) of the Schedule 13D is hereby

amended and supplemented as follows:

| (a) | See rows (11) and (13) of pages 2, 3 and 4 of

this Amendment No. 4 for the aggregate number of ADS and percentage of ADS beneficially owned by the Reporting Persons. These amounts

include (i) an aggregate 3,795,000 ADS that the Reporting Persons have the right to acquire within 60 days upon exercise of long standardized

call options, and (ii) 310,000 ADS that the Reporting Persons have the right to recall at any time at a price of $29.7930, and 200,000

ADS that the Reporting Persons have the right to recall at any time at a price of $29.036, both pursuant to a repurchase agreement with

RBC Bank that terminates on July 11, 2024. The aggregate percentage of ADS reported beneficially owned by the Reporting Persons is based

upon 56,687,497 Shares outstanding as of April 30, 2024, as disclosed in the Issuer’s quarterly report on Form 10-Q filed by the

Issuer with the Commission on May 2, 2024.

|

| (b) | See rows (7) through (10) of pages 2, 3 and 4 of this Amendment No.

4 for the ADS as to which the Reporting Persons have the sole or shared power to vote or direct the vote and sole or shared power to dispose

or direct the disposition. Each of Petrus, Mr. Hufnagel and Mr. Umek may be deemed to share voting power and share dispositive power over

the ADS and options to acquire ADS held directly by the investment vehicles and managed accounts for which Petrus serves as investment

manager or portfolio adviser and the private individuals who have signed powers of attorney in favor of Petrus. |

| (c) | The transactions in the ADS effected by the Reporting Persons since

the filing of Amendment No. 3 on May 15, 2024 are set forth on Schedule 5 attached hereto. |

| CUSIP No. 226718104 |

13D |

Page 7 of 8 pages |

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

|

Petrus Advisers Ltd. |

| |

|

|

|

By: |

/s/ Suraj Shah |

| |

|

Suraj Shah |

| |

|

(Name) |

| |

|

|

| |

|

Director |

| |

|

(Title) |

| |

|

|

| |

|

May 29, 2024 |

| |

|

(Date) |

|

By: |

/s/ Klaus Umek |

| |

|

Klaus Umek |

| |

|

(Name) |

| |

|

|

| |

|

May 29, 2024 |

| |

|

(Date) |

|

By: |

/s/ Till Hufnagel |

| |

|

Till Hufnagel |

| |

|

(Name) |

| |

|

|

| |

|

May 29, 2024 |

| |

|

(Date) |

| CUSIP No. 226718104 |

13D |

Page 8 of 8 pages |

SCHEDULE 5

Transactions in the ADS of the Issuer by the

Reporting Persons since the filing of Amendment No. 3

The following table sets forth all transactions in the ADS effected

since the filing of Amendment No. 3 on May 15, 2024 by the Reporting Persons. Except as noted below, all such transactions were effected

in the open market through brokers and the price per share excludes commissions.

| Reporting Person |

|

Type |

|

Quantity4 |

|

Name of Security |

|

Price5 |

|

Trade Date6 |

| Petrus Advisers LTD |

|

Sell |

|

-13,900 |

|

CRTO US Equity |

|

37.745000 |

|

20240514 |

| Petrus Advisers LTD |

|

Buy |

|

6,000 |

|

CRTO US Equity |

|

37.667442 |

|

20240514 |

| Petrus Advisers LTD |

|

Sell |

|

-200 |

|

CRTO US Equity |

|

37.800000 |

|

20240514 |

| Petrus Advisers LTD |

|

Sell |

|

-1,305 |

|

CRTO US Equity |

|

37.812720 |

|

20240514 |

| Petrus Advisers LTD |

|

Sell |

|

-1,205 |

|

CRTO US Equity |

|

37.479270 |

|

20240515 |

| Petrus Advisers LTD |

|

Sell |

|

-550 |

|

CRTO US 05/17/24 C35 Equity |

|

1.750000 |

|

20240516 |

| Petrus Advisers LTD |

|

Sell |

|

-1,540 |

|

CRTO US Equity |

|

37.072078 |

|

20240516 |

| Petrus Advisers LTD |

|

Sell |

|

-72,000 |

|

CRTO US Equity |

|

36.297805 |

|

20240517 |

| Petrus Advisers LTD |

|

Sell |

|

-20,000 |

|

CRTO US Equity |

|

36.400000 |

|

20240517 |

| Petrus Advisers LTD |

|

Sell |

|

-85,000 |

|

CRTO US Equity |

|

36.400000 |

|

20240517 |

| Petrus Advisers LTD |

|

Sell |

|

-4,450 |

|

CRTO US 05/17/24 C35 Equity |

|

1.400000 |

|

20240517 |

| Petrus Advisers LTD |

|

Buy |

|

2,500 |

|

CRTO US 06/21/24 C40 Equity |

|

0.600000 |

|

20240517 |

| Petrus Advisers LTD |

|

Buy |

|

2,500 |

|

CRTO US 06/21/24 C42.5 Equity |

|

0.400000 |

|

20240517 |

| Petrus Advisers LTD |

|

Buy |

|

2,500 |

|

CRTO US 07/19/24 C35 Equity |

|

3.200000 |

|

20240517 |

| Petrus Advisers LTD |

|

Buy |

|

4,450 |

|

CRTO US 07/19/24 C35 Equity |

|

3.200000 |

|

20240517 |

| Petrus Advisers LTD |

|

Sell |

|

-3,000 |

|

CRTO US 10/18/24 C30 Equity |

|

7.700000 |

|

20240517 |

| Petrus Advisers LTD |

|

Buy |

|

3,000 |

|

CRTO US 10/18/24 C35 Equity |

|

4.600000 |

|

20240517 |

| Petrus Advisers LTD |

|

Buy |

|

3,000 |

|

CRTO US 10/18/24 C35 Equity |

|

4.600000 |

|

20240517 |

| Petrus Advisers LTD |

|

Sell |

|

-3,000 |

|

CRTO US 10/18/24 C40 Equity |

|

2.250000 |

|

20240517 |

| Petrus Advisers LTD |

|

Sell |

|

-12,000 |

|

CRTO US Equity |

|

36.780000 |

|

20240517 |

| Petrus Advisers LTD |

|

Sell |

|

-20,000 |

|

CRTO US Equity |

|

37.202739 |

|

20240520 |

| Petrus Advisers LTD |

|

Sell |

|

-43,015 |

|

CRTO US Equity |

|

37.306298 |

|

20240520 |

| Petrus Advisers LTD |

|

Sell |

|

-4,945 |

|

CRTO US Equity |

|

37.253764 |

|

20240521 |

| Petrus Advisers LTD |

|

Buy |

|

1,000 |

|

CRTO US Equity |

|

37.141000 |

|

20240521 |

| Petrus Advisers LTD |

|

Buy |

|

69,000 |

|

CRTO US Equity |

|

36.870757 |

|

20240521 |

| Petrus Advisers LTD |

|

Sell |

|

-50,000 |

|

CRTO US Equity |

|

37.165663 |

|

20240522 |

| Petrus Advisers LTD |

|

Sell |

|

-50,000 |

|

CRTO US Equity |

|

37.055000 |

|

20240522 |

| Petrus Advisers LTD |

|

Sell |

|

-50,000 |

|

CRTO US Equity |

|

37.135000 |

|

20240522 |

| Petrus Advisers LTD |

|

Sell |

|

-16,493 |

|

CRTO US Equity |

|

37.522552 |

|

20240523 |

| Petrus Advisers LTD |

|

Sell |

|

-250 |

|

CRTO US Equity |

|

39.000000 |

|

20240524 |

| Petrus Advisers LTD |

|

Sell |

|

-29,343 |

|

CRTO US Equity |

|

38.931082 |

|

20240524 |

| Petrus Advisers LTD |

|

Sell |

|

-24,908 |

|

CRTO US Equity |

|

39.005271 |

|

20240524 |

| Petrus Advisers LTD |

|

Sell |

|

-20,657 |

|

CRTO US Equity |

|

39.014589 |

|

20240524 |

| Petrus Advisers LTD |

|

Sell |

|

-2,200 |

|

CRTO US Equity |

|

39.000227 |

|

20240524 |

| Petrus Advisers LTD |

|

Sell |

|

-39,605 |

|

CRTO US Equity |

|

39.024861 |

|

20240524 |

| Petrus Advisers LTD |

|

Sell |

|

-26,249 |

|

CRTO US Equity |

|

39.023589 |

|

20240524 |

| Petrus Advisers LTD |

|

Sell |

|

-24,100 |

|

CRTO US Equity |

|

39.017523 |

|

20240524 |

| Petrus Advisers LTD |

|

Sell |

|

-25,092 |

|

CRTO US Equity |

|

39.011361 |

|

20240524 |

| 4 | Quantity of options reflects number of contracts, with each

contract representing 100 ADS. |

| 5 | Price per share in US dollars. |

| 6 | Trade dates are following the format YYYYMMDD. |

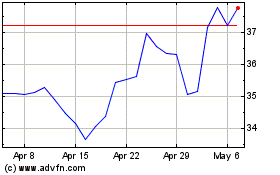

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Oct 2024 to Nov 2024

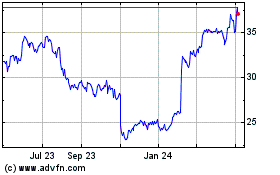

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Nov 2023 to Nov 2024