UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-2 |

| CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. |

| (Name of Registrant as Specified in Its Charter) |

___________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | 5) | Total fee paid: |

| | | |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | 1) | Amount previously paid: |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | 3) | Filing Party: |

| | | |

| | 4) | Date Filed: |

| | | |

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on December 19, 2022

Dear Stockholders of Creative Medical Technology Holdings, Inc.:

We are pleased to invite you to attend our 2022 Annual Meeting of Stockholders to be held on December 19, 2022, at 9:30 a.m. Pacific Standard Time at the Town & Country Resort located at 500 Hotel Cir N, San Diego, CA 92108 (the “Annual Meeting”). The Annual Meeting is being held for the following purposes:

| | 1. | To elect five directors to our Board of Directors to serve until the next Annual Meeting of Stockholders or until their successors have been duly elected or appointed and qualified; |

| | | |

| | 2. | To approve, on a nonbinding advisory basis, the compensation of our named executive officers; |

| | | |

| | 3. | To vote, on a nonbinding advisory basis, on the preferred frequency of holding an advisory vote on executive compensation; |

| | | |

| | 4. | To ratify the appointment of Haynie & Company, as our independent registered public accountants for the fiscal year ending December 31, 2022; and |

| | | |

| | 5. | To transact such other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Our Board of Directors has fixed the close of business on October 21, 2022 as the record date for the Annual Meeting. Only stockholders of record as of October 21, 2022 may vote at the Annual Meeting or any postponements or adjournments of the meeting. This notice of annual meeting, proxy statement, and form of proxy are being made available on or about October 25, 2022.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we would like for your shares to be represented. Please vote as soon as possible via the Internet, telephone, or mail.

| | Sincerely, | |

| | Timothy Warbington Chief Executive Officer | |

October 25, 2022

| Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholder Meeting To Be Held on December 19, 2022: This Proxy Statement, along with the Annual Report on Form 10-K for the fiscal year ended December 31, 2021, is available at the following website: www.proxyvote.com. |

PROXY STATEMENT

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC.

2022 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On December 19, 2022

TABLE OF CONTENTS

PROXY STATEMENT

FOR 2022 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 9:30 a.m. Pacific Standard Time on December 19, 2022

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our Board of Directors (the “Board” or “Board of Directors”) for use at the 2022 annual meeting of stockholders of Creative Medical Technology Holdings, Inc., a Nevada corporation, and any postponements, adjournments or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held on December 19, 2022 at 9:30 a.m. Pacific Standard Time at the Town & Country Resort located at 500 Hotel Cir N, San Diego, CA 92108. References in this Proxy Statement to “we,” “us,” “our,” the “Company” or “Creative Medical Technology Holdings” refer to Creative Medical Technology Holdings, Inc.

The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report is first being mailed on or about October 25, 2022 to all stockholders entitled to vote at the Annual Meeting.

THE INFORMATION PROVIDED IN THE “QUESTION AND ANSWER” FORMAT BELOW IS FOR YOUR CONVENIENCE ONLY AND IS MERELY A SUMMARY OF THE INFORMATION CONTAINED IN THIS PROXY STATEMENT. YOU SHOULD READ THIS ENTIRE PROXY STATEMENT CAREFULLY.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING

| Q: | What is included in the proxy materials? |

| | |

| A: | The proxy materials include this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the SEC on March 30, 2022 (the “Annual Report”). These materials were first made available to you via the Internet on or about October 25, 2022. |

| | |

| Q: | Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials? |

| | |

| A: | In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this Proxy Statement and the Annual Report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about October 25, 2022 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials via the Internet to help reduce the environmental impact of our annual meetings of stockholders. |

| | |

| Q: | What items will be voted on at the Annual Meeting? |

| | |

| A: | Stockholders will vote on the following items at the Annual Meeting: |

| | · | Election of five director nominees named in this proxy statement; |

| | | |

| | · | Advisory approval of the compensation of our named executive officers, as disclosed in this Proxy Statement in accordance with the rules of the SEC; |

| | | |

| | · | Advisory indication of the preferred frequency of holding a stockholder advisory vote on the compensation of our named executive officers; |

| | | |

| | · | Ratification of the selection of Haynie & Company as our independent registered public accounting firm for the year ended December 31, 2022; and |

| | | |

| | · | Such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

| Q: | How does the Board of Directors recommend I vote on these proposals? |

| | |

| A: | The Board of Directors unanimously recommends that the stockholders vote: |

| | · | FOR the election of the five nominated directors; |

| | | |

| | · | FOR the proposal to approve the compensation of our named executive officers; |

| | | |

| | · | FOR the recommendation to approve a one-year frequency for holding an advisory vote on the compensation of our named executive officers; and |

| | | |

| | · | FOR the ratification of the selection of Haynie & Company as our independent registered public accounting firm for the year ending December 31, 2022. |

| | With respect to any other matter that properly comes before the Meeting, the proxies will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion. |

| | |

| Q: | Who may vote at the Annual Meeting? |

| | |

| A: | Stockholders of record as of the close of business on October 21, 2022 (the “Record Date”) are entitled to receive notice of, to attend, and to vote at the Annual Meeting. As of the Record Date, there were 14,070,279 shares of our Common Stock issued and outstanding, held by 75 holders of record. Each share of our Common Stock is entitled to one (1) vote on each matter. |

| | |

| Q: | What is the voting requirement to approve each of the proposals? |

| | |

| A: | The affirmative vote of a plurality of the votes cast at the Annual Meeting by stockholders entitled to vote thereon is required for the election of directors; only votes “FOR” or “WITHHELD” will affect the outcome. A plurality vote means that the directors who receive the most votes in an election, though not necessarily a majority, will be elected. |

| | |

| | For Proposal 2 concerning executive compensation and Proposal 4 to ratify the selection of Haynie & Company, and any proposal to adjourn the Meeting or other matters that may properly come before the Meeting, the affirmative vote from holders of a majority of the shares present and entitled to vote thereon either in person or represented by proxy at the Annual Meeting will be required. |

| | |

| | For Proposal 3 concerning the preferred frequency of an advisory vote concerning executive compensation, the frequency receiving the highest number of affirmative votes cast by stockholders entitled to vote thereon and who are present in person or represented by proxy at the Annual Meeting will be considered the frequency preferred by the stockholders. |

| | |

| | For Proposals 2, 3 and 4, a properly marked “ABSTAIN” with respect to any such matter will not be voted, although it will be counted for purposes of determining the number of shares represented and entitled to vote in person or by proxy at the Meeting for purposes of determining the presence of a quorum. |

| | |

| Q: | How many shares must be present or represented to conduct business at the Annual Meeting? |

| | |

| A: | At the Annual Meeting, the presence in person or by proxy of a majority of the aggregate voting power of the stock issued and outstanding and entitled to vote at the Annual Meeting is required for the Annual Meeting to proceed. If you have returned valid proxy instructions or attend the Annual Meeting, your shares of Common Stock will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the meeting. |

| | |

| Q: | If I am a stockholder of record, how do I vote? |

| | |

| A: | If you are a stockholder of record, there are four ways to vote: |

| | · | At the Annual Meeting. You may vote in person at the Annual Meeting if you are the record owner of the shares to be voted. You can also vote in person at the Annual Meeting if you present a properly signed proxy that authorizes you to vote shares on behalf of the record owner. |

| | | |

| | · | Via the Internet. You may vote by proxy via the Internet by following the instructions found on the proxy card. |

| | | |

| | · | By Telephone. You may vote by proxy by calling the toll-free number found on the proxy card. |

| | | |

| | · | By Mail. You may vote by proxy by filling out the proxy card and returning it in the envelope provided. If you vote by mail, your proxy card must be received by December 18, 2022. |

Please note that the Internet and telephone voting facilities will close at 11:59 p.m. Eastern Time (8:59 p.m. Pacific Standard Time) on December 18, 2022.

| Q: | If I am a beneficial owner of shares held in street name, how do I vote? |

| | |

| A: | If you are a beneficial owner of shares held in street name, you should have received from your broker, bank, trustee or other nominee instructions on how to vote or instruct the broker to vote your shares, which are generally contained in a “vote instruction form” sent by the broker, bank, trustee or other nominee. Please follow their instructions carefully. Street name stockholders generally may vote by one of the following methods: |

| | · | At the Annual Meeting. If you wish to vote at the Annual Meeting, you must obtain a legal proxy from the organization that holds your shares. Please contact that organization for instructions regarding obtaining a legal proxy to you by your broker, bank, trustee, or other nominee. |

| | | |

| | · | Via the Internet. You may vote by proxy via the Internet by following the instruction form provided to you by your broker, bank, trustee, or other nominee. |

| | | |

| | · | By Telephone. You may vote by proxy by calling the toll-free number found on the vote instruction form provided to you by your broker, bank, trustee, or other nominee. |

| | | |

| | · | By Mail. You may vote by proxy by filling out the vote instruction form and returning it in the envelope provided to you by your broker, bank, trustee, or other nominee. |

| Q: | What is the difference between a stockholder of record and a beneficial owner of shares held in street name? |

| | |

| A: | Stockholder of Record. If your shares are registered directly in your name with our transfer agent, vStock Transfer, LLC, you are considered the stockholder of record with respect to those shares, and the Notice or these proxy materials were sent directly to you by us. |

| | |

| | Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and the Notice or these proxy materials were forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. |

| | |

| Q: | How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions? |

| | |

| A: | Brokerage firms and other intermediaries holding shares of our Common Stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on Proposal 4, the proposal to ratify the appointment of Haynie & Company, as our independent registered public accounting firm. Your broker will not have discretion to vote on our other proposals, all of which are “non-routine” matters, absent direction from you, resulting in broker non-votes. |

| Q: | Can I change my vote or revoke my proxy? |

| | |

| A: | You may change your vote or revoke your proxy at any time prior to the taking of the vote at the Annual Meeting. |

| | |

| | If you are the stockholder of record, you may change your vote by (1) granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method), (2) providing a written notice of revocation to our Corporate Secretary at Creative Medical Technology Holdings, Inc., 211 E Osborn Road, Phoenix, AZ 85012 prior to your shares being voted, or (3) attending the Annual Meeting and voting at the Annual Meeting. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote in person at the Annual Meeting. |

| | |

| | For shares you hold beneficially in street name, you generally may change your vote by submitting new voting instructions to your broker, bank, trustee, or nominee following the instructions they provided, or, if you have obtained a legal proxy from your broker, bank, trustee, or nominee giving you the right to vote your shares, by attending the Annual Meeting and voting during the meeting. |

| | |

| Q: | If I submit a proxy, how will it be voted? |

| | |

| A: | When proxies are properly dated, executed, and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted in accordance with the recommendations of our Board of Directors as described above. If any matters not described in the Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described below under “Can I change my vote or revoke my proxy?” |

| | |

| Q: | How are proxies solicited for the Annual Meeting? |

| | |

| A: | Our Board of Directors is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by us. We may, on request, reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker, bank, or other nominee holds shares of our Common Stock on your behalf. In addition, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies. |

| | |

| Q: | What should I do if I get more than one proxy or voting instruction card? |

| | |

| A: | Stockholders may receive more than one set of voting materials, including multiple copies of the proxy materials and multiple Notices, proxy cards, or voting instruction cards. For example, stockholders who hold shares in more than one brokerage account may receive separate sets of proxy materials for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one set of proxy materials or one Notice. You should vote in accordance with all of the proxy cards and voting instruction cards you receive relating to our Annual Meeting to ensure that all of your shares are counted. |

| | |

| Q: | I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? |

| | |

| A: | The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process is commonly referred to as “householding.” |

| | A single set of proxy materials may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you notify your broker or us that you no longer wish to participate in householding. |

| | |

| | If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, you may (1) notify your broker, or (2) direct your written request to: Corporate Secretary, Creative Medical Technology Holdings, Inc., 211 E Osborn Road, Phoenix, AZ 85012. Stockholders who receive multiple copies of the proxy statement or annual report at their address and would like to request householding of their communications should contact their broker. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the Annual Report and Proxy Statement to a stockholder at a shared address to which a single copy of the documents was delivered. |

| | |

| Q: | Where can I find the voting results of the Annual Meeting? |

| | |

| A: | We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. |

| | |

| Q: | What is the deadline to propose actions for consideration at next year’s Annual Meeting of Stockholders or to nominate individuals to serve as directors? |

| | |

| A: | Stockholder Proposals: Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at our next annual meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 2023 Annual Meeting of Stockholders, our Corporate Secretary must receive the written proposal at our principal executive offices no later than June 27, 2023. If we hold our 2022 Annual Meeting of Stockholders more than 30 days before or after December 19, 2023 (the one-year anniversary date of the 2022 Annual Meeting of Stockholders), we will disclose the new deadline by which stockholders proposals must be received in a press release or under Item 5 of Part II of our earliest possible Quarterly Report on Form 10-Q or a Current Report on Form 8-K. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and related SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. |

| Proposals should be addressed to: | Creative Medical Technology Holdings, Inc. Attn: Corporate Secretary 211 E Osborn Road Phoenix, AZ 85012 | |

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Executive Officers and Directors

The following table sets forth the names, ages and positions of our executive officers, directors, and director nominees:

| Name | | Position | | Age |

| Timothy Warbington | | President, Chief Executive Officer and Director | | 61 |

| Donald Dickerson | | Chief Financial Officer & Senior Vice-President and Director | | 57 |

| Michael H. Finger (1)(2)(3) | | Director | | 75 |

| Susan Snow (1)(2)(3) | | Director | | 64 |

| Bruce S. Urdang (1)(2)(3) | | Director | | 64 |

(1) Member of the audit committee.

(2) Member of the corporate governance and nominating committee.

(3) Member of the compensation committee.

Biographies of Directors and Officers

Timothy Warbington. Mr. Warbington has served as our director and as Chief Executive Officer since February 2016 and has served as a director, Chief Executive Officer and President of an affiliate of our predecessor, Creative Medical Health, Inc. (“CMH”), since October 2011. He has over 25 years of executive level management experience. Mr. Warbington received a Bachelor’s Degree in Accounting from Arizona State University in 1984. From 1993 through 2007 he owned and operated a multi-million dollar national agricultural (produce) and finance company with annual revenues of $5,000,000 to $12,000,000. Prior to that, he served as Chief Operating Officer of the U.S. subsidiary of a British firm engaged in the international food trade. For eight years, Mr. Warbington has invested in the biotechnology industry and has provided strategic and tactical advice as a consultant to a publicly traded bio-tech firm. In connection with this experience, he has built a network of scientists, physicians and executives to participate as executive officers and directors of CMH.

Mr. Warbington’s experience as an executive, and in particular with respect to biotechnology companies, qualify him to serve as one of our directors.

Donald Dickerson. Mr. Dickerson has served as our director and as Chief Financial Officer and Senior Vice-President since February 2016, and has served as a director and as Vice President and Chief Operating Officer of CMH since June 2014. He received his Masters of Business Administration in Finance from the University of Southern California in May 1992. Mr. Dickerson has worked in a number of management and accounting positions and has experience with companies in the technology, manufacturing and health sciences area. From October 2003 until February 2009 he was employed as a vice-president for JP Morgan Chase in finance; from March 2009 until May 2014 he served as a director for GMT Ventures in finance and operations; and from June 2011 until May 2014 he also served as CFO for Medistem, Inc.

Michael H. Finger. Mr. Finger has served as a director of ours since December 2, 2021, and is the manager and principal member of Alternative Sales Source, LLC, a real estate consulting firm that he founded in 2017. Prior to founding Alternative Sales Source, LLC, Mr. Finger was active as the founder and principal shareholder of the related companies, Hyland Bay Systems, of which he was Chief Financial Officer, and Hyland Bay Realty, both of which he sold in 2016. Mr. Finger also founded Cardinal Financial Services, Inc., a national commercial real estate mortgage brokerage firm that he operated for over 20 years until its sale in 2007. Mr. Finger received his MBA in finance from Colombia University and holds a B.A. in biology from Boston University.

Mr. Finger’s business and financial experience and expertise qualify him to serve as one of our directors.

Susan Snow. Ms. Snow has served as a director of ours since December 2, 2021. From January 2018 until January 2022, Ms. Snow served as Senior VP, Operations at Redhorse, a consulting firm specializing in contacts and relationships with U.S. governmental agencies. Previously, from May 2009 until January 2018, she was a principal at Transitional Finance Partners. Ms. Snow has also served as a director of NeoVolta Inc. since July 2022. She began her professional career and earned her CPA at KPMG, where she spent 4 years before leaving for a Chief Financial Officer role in private industry.

Ms. Snow’s financial and corporate experience and expertise qualify her to serve as one of our directors.

Bruce S. Urdang, Esq. Mr. Urdang has served as a director of ours since December 2, 2021, and is an attorney in private practice, having represented clients in real estate and business transactions, and commercial litigation, at the Law Offices of Bruce S. Urdang, J.D. since 1989. Mr. Urdang has also been a professor at Northern Arizona University’s School of Hotel and Restaurant Management since 1989. Mr. Urdang received his J.D. from St. John’s School of Law and holds a B.A. in political science from the State University of New York, Oneonta.

Mr. Urdang’s legal and business experience and expertise qualify him to serve as one of our directors.

Each executive officer serves at the discretion of our Board of Directors and holds office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal. Except as set forth above, there are no family relationships among any of our directors or executive officers.

Director Independence

Our Board of Directors currently consists of five directors, three of whom are “independent” as defined under the rules of the Nasdaq Capital Market because they are not employees or executive officers of ours, and have not been paid more than $120,000 of compensation by us in any consecutive 12-month period during the past three years. Timothy Warbington, our Chief Executive Officer, and Donald Dickerson, our Chief Financial Officer, are not independent directors due to their employment by us as executive officers.

Board Leadership Structure and Role in Risk Oversight

Our Board of Directors focuses on the most significant risks facing us and our general risk management strategy, and also ensuring that risks undertaken by us are consistent with the Board’s appetite for risk. While the Board oversees our company’s risk management, management is responsible for day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing us and that our Board leadership structure supports this approach.

Our Board of Directors does not currently have a policy as to whether the roles of Chairman of the Board of Directors and Chief Executive Officer should be separate or combined. Currently, Mr. Warbington serves as both our Chief Executive Officer and Chairman of the Board of Directors, and we do not currently have a Lead Director. Given the current size of our Board of Directors and our company, as well as Mr. Warbington’s history and intimacy with our company, and the effective oversight role played by our independent directors, we believe our current board structure is appropriate for us and our shareholders. Our Board of Directors may in the future reassess our board structure to ensure the interests of our stockholders are best served.

Board Committees

Our Board of Directors currently has an audit committee, a compensation committee, and a corporate governance and nominating committee. The composition and responsibilities of each of the committees of our Board of Directors are described below. Members serve on these committees until their resignation or until otherwise determined by our Board of Directors.

Audit Committee. Our audit committee is comprised of Susan Snow, Bruce Urdang and Michael Finger. Susan Snow serves as the chairperson of our audit committee. Our Board has determined that each member of our audit committee meets the requirements for independence and financial literacy under the applicable rules and regulations of the SEC and the listing standards of the Nasdaq. Our Board has also determined that Susan Snow is an “audit committee financial expert” as defined in the rules of the SEC and has the requisite financial sophistication as defined under the listing standards of the Nasdaq. The responsibilities of our audit committee include, among other things:

| | · | selecting and hiring the independent registered public accounting firm to audit our financial statements; |

| | · | overseeing the performance of the independent registered public accounting firm and taking those actions as it deems necessary to satisfy itself that the accountants are independent of management; |

| | · | reviewing financial statements and discussing with management and the independent registered public accounting firm our annual audited and quarterly financial statements, the results of the independent audit and the quarterly reviews, and the reports and certifications regarding internal control over financial reporting and disclosure controls; |

| | · | preparing the audit committee report that the SEC requires to be included in our annual proxy statement; |

| | · | reviewing the adequacy and effectiveness of our internal controls and disclosure controls and procedures; |

| | · | overseeing our policies on risk assessment and risk management; |

| | · | reviewing related party transactions; and |

| | · | approving or, as required, pre-approving, all audit and all permissible non-audit services and fees to be performed by the independent registered public accounting firm. |

Our audit committee operates under a written charter which satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq, and is available on our website at www.creativemedicaltechnology.com.

Compensation Committee. Our compensation committee is comprised of Susan Snow, Bruce Urdang and Michael Finger. Bruce Urdang serves as the chairman of our compensation committee. Our Board has determined that each member of our compensation committee meets the requirements for independence under the applicable rules and regulations of the SEC and listing standards of Nasdaq. Each member of the compensation committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Exchange Act. The purpose of our compensation committee is to oversee our compensation policies, plans and benefit programs and to discharge the responsibilities of our Board relating to compensation of our executive officers. The responsibilities of our compensation committee include, among other things:

| | · | reviewing and approving or recommending to the Board for approval compensation of our executive officers and directors; |

| | · | overseeing our overall compensation philosophy and compensation policies, plans and benefit programs for service providers, including our executive officers; |

| | · | reviewing, approving and making recommendations to our Board regarding incentive compensation and equity plans; and |

| | · | administering our equity compensation plans. |

Our compensation committee operates under a written charter which satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq, and is available on our website at www.creativemedicaltechnology.com.

Corporate Governance and Nominating Committee. Our corporate governance and nominating committee is comprised of Susan Snow, Bruce Urdang and Michael Finger. Susan Snow serves as chairperson of our corporate governance and nominating committee. Our Board has determined that all members of our corporate governance and nominating committee meet the requirements for independence under the applicable rules and regulations of the SEC and listing standards of Nasdaq. The responsibilities of our corporate governance and nominating committee include, among other things:

| | · | identifying, evaluating and selecting, or making recommendations to our Board regarding, nominees for election to our Board and its committees; |

| | · | evaluating the performance of our Board and of individual directors; |

| | · | considering and making recommendations to our Board regarding the composition of our Board and its committees; and |

| | · | developing and making recommendations to our Board regarding corporate governance guidelines and matters. |

Our corporate governance and nominating committee operates under a written charter which satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq, and is available on our website at www.creativemedicaltechnology.com.

Board Meetings and Director Communications

In 2021, the Board of Directors held three meetings and each director attended at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of the Board of Directors on which he or she served during the periods that he or she served. The Board also acted by unanimous written consent thirteen times during 2021. We have no formal policy regarding director attendance at annual meetings.

Stockholders and other interested parties may communicate with the non-management members of the Board of Directors by mail sent to the Company’s Corporate Secretary, addressed to the intended recipient and care of the Corporate Secretary. The Corporate Secretary will review all incoming stockholder communications (except for mass mailings, job inquiries, business solicitations and patently offensive or otherwise inappropriate material) and route such communications as appropriate to member(s) of the Board of Directors. For a more detailed description of stockholder communications, see “Communications with Our Board of Directors.”

Considerations in Evaluating Director Nominees

Our corporate governance and nominating committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, our corporate governance and nominating committee will consider the current size and composition of our Board of Directors and the needs of our Board of Directors and the respective committees of our Board of Directors. Some of the qualifications that our corporate governance and nominating committee considers include, without limitation: issues of character, integrity, and judgment; independence; diversity, including diversity of experience; experience in corporate management, operations, finance, business development, and mergers and acquisitions; experience relevant to the Company’s industry; experience as a board member or executive officer of another publicly held company; length of service; and any other relevant qualifications, attributes, or skills. Nominees also must have the ability to offer advice and guidance to our Chief Executive Officer based on past experience. Director candidates must have sufficient time available in the judgment of our corporate governance and nominating committee to perform all Board of Directors responsibilities and responsibilities of those committees on which they serve.

Members of our Board of Directors are expected to prepare for, attend, and participate in all Board of Directors and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although our corporate governance and nominating committee may also consider such other factors as it may deem, from time to time, are in the best interests of the Company and its stockholders.

The policy of our corporate governance and nominating committee is to consider properly submitted stockholder recommendations for candidates for membership on the Board. In evaluating such recommendations, the corporate governance and nominating committee will address the membership criteria set forth above.

Although our Board of Directors does not maintain a specific policy with respect to board diversity, our Board of Directors believes that it should be a diverse body, and our corporate governance and nominating committee considers a broad range of backgrounds and experiences. In making determinations regarding nominations of directors, our corporate governance and nominating committee may take into account the benefits of diverse viewpoints. Our corporate governance and nominating committee also considers these and other factors as it oversees the annual Board of Directors and committee evaluations. After completing its review and evaluation of director candidates, our corporate governance and nominating committee recommends to our full Board of Directors the director nominees for selection.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and agents and representatives, including consultants. A copy of the code of ethics and conduct is available on our website at www.creativemedicaltechnology.com.

EXECUTIVE COMPENSATION

The following table contains information concerning the compensation paid during our fiscal years ended December 31, 2021 and 2020 to Timothy Warbington, our Chief Executive Officer, and Donald Dickerson, our Chief Financial Officer, who served as our only executive officers during 2021 and 2020 (collectively, our “Named Executive Officers”). Prior to September 16, 2021 when we entered into direct employment relationships with them, our Named Executive Officers were employed by Creative Medical Health, Inc. (“CMH”), an affiliate of ours, and received their salary from CMH for services performed for us. In turn, we reimbursed CMH for these services at the rate of $35,000 per month.

SUMMARY COMPENSATION TABLE

| Name & Principal Position | | Year | | Salary ($) | | | Option Awards ($) (1) | | | All Other Compensation ($) | | Total ($) | |

| | | | | | | | | | | | | | |

| Timothy Warbington | | 2021 | | | 98,680 | | | -0- | | | -0- | | | 98,680 | |

| Chief Executive Officer | | 2020 | | -0- | | | -0- | | | -0- | | -0- | |

| | | | | | | | | | | | | | | | |

| Donald Dickerson | | 2021 | | | 87,500 | | | | 127,871 | | | -0- | | | 215,371 | |

| Chief Financial Officer | | 2020 | | -0- | | | | 34,027 | | | -0- | | | 34,027 | |

| (1) | Reflects the award of fully vested warrants to Mr. Dickerson to purchase (i) 10,000 shares of common stock at an exercise price of $15.00, awarded in 2021, and (i) 20,000 shares of common stock at an exercise price of $2.00, awarded in 2020. The dollar figures represent the value of the awards at grant date as calculated under FASB ASC Topic 718. Mr. Dickerson will not realize the estimated value of these awards in cash until these awards are exercised and sold. See Note 7 to our audited financial statements for the year ended December 31, 2021 for the assumptions we made in the valuation of these warrants. |

Outstanding Equity Awards at Fiscal Year End

As of December 31, 2021, our Named Executive Officers had outstanding unexercised options as set forth below. Our named Executive Officers did not have any unvested stock awards outstanding at December 31, 2021.

| Name | | Number of securities underlying unexercised options (#) exercisable | | | Number of securities underlying unexercised options (#) unexercisable | | Option Exercise Price ($) | | | Option Expiration Date ($) | |

| | | | | | | | | | | | |

| Timothy Warbington | | -0- | | | -0- | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | |

| Donald Dickerson (1) | | | 10,000 | | | -0- | | | 15.00 | | | July 15, 2031 | |

| | | | 20,000 | | | -0- | | | 2.00 | | | December 28, 2030 | |

| | (1) | These are warrants that were fully vested upon issuance. |

Employment Agreements

On February 9, 2022, we entered into written Employments Agreements with our Named Executive Officer, Timothy Warbington and Donald Dickerson, the Company’s Chief Financial Officer. The Employment Agreements are identical in all material respects other than with respect to base salary, which is $330,000 per annum for Mr. Warbington, and $300,000 per annum for Mr. Dickerson.

Additional terms of the Employment Agreements include the following:

| | · | Each Employment Agreement is for a three year term, subject to automatic renewal for successive three-year periods unless either party provides notice of non-renewal prior to the then end of the term. |

| | | |

| | · | Each executive is entitled to an annual cash bonus targeted at 30% of his base salary. |

| | | |

| | · | Each executive is entitled to an annual grant of an option to purchase a number of shares of our common stock with a value as of the date of grant of 30% of the executive’s base salary, vesting over a three year period. The initial stock option grant under each Employment Agreement was made on February 9, 2022. |

In the event of the termination of the executive’s employment by the Company other than for Cause, or by the Executive for Good Reason (as such terms are defined in the Employment Agreements), the executive will be entitled to continued payment of base salary and annual bonuses for two years.

Compensation of Directors

The following table shows certain information with respect to the compensation of all of our non-employee directors during our year ended December 31, 2021. Prior to September, 2021, our non-employee directors were compensated CMH for their service to us, and turn, we reimbursed CMH for these services at the rate of $10,000 per month.

| Name | | Fees Earned or Paid in Cash ($) | | | Option Awards (2) ($) | | | All other compensation ($) | | Total ($) | |

| Thomas Ichim (1) | | | 47,500 | | | | 127,871 | | | -0- | | | 175,371 | |

| Amit Patel (1) | | | 47,500 | | | | 127,871 | | | -0- | | | 175,371 | |

| Michael Finger | | | 22,000 | | | -0- | | | -0- | | | 22,000 | |

| Susan Snow | | | 33,000 | | | -0- | | | -0- | | | 33,000 | |

| Bruce Urdang | | | 27,500 | | | -0- | | | -0- | | | 27,500 | |

| (1) | Resigned as a director on December 2, 2021 in connection with our public offering and the listing of our common stock on The Nasdaq Stock Market. |

| | |

| (2) | Reflects the award to each of Amit Patel and Thomas Ichim of a fully vested warrant to purchase 10,000 shares of common stock at an exercise price of $15.00. The dollar figures represent the value of the awards at grant date as calculated under FASB ASC Topic 718. The estimated value of these awards will not be realized in cash until these awards are exercised and sold. See Note 7 to our audited financial statements for the year ended December 31, 2021 for the assumptions we made in the valuation of these warrants. |

In connection with our December 2021 public offering and listing of our common stock on the Nasdaq Stock Market, we adopted a compensation program for non-employee directors under which each such director is paid an annual retainer of $80,000, plus $20,000 for each committee they chair. We may pay such amounts in a combination of cash and stock.

Equity Compensation Plan of Information

The following table summarizes the number of outstanding options and rights granted to our employees, consultants and directors, as well as the number of shares of Common Stock remaining available for future issuance, under our equity compensation plans as of December 31, 2021:

| Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for issuance under equity compensation plans (excluding securities reflected in column (a) | |

| Equity compensation plans approved by security holders | | | 0 | | | $ | -- | | | | 600,000 | (1) |

| | | | | | | | | | | | | |

| Equity compensation plans not approved by security holders | | | 100,102 | (2) | | | 10.71 | | | | 27 | (3) |

| | | | | | | | | | | | | |

| Total: | | | 100,102 | | | $ | 10.71 | | | | 600,027 | |

| (1) | Represents shares available for issuance under the Company’s 2021 Equity Incentive Plan. |

| (2) | Represents (i) 20,000 shares of common stock issuable to Donald Dickerson, the Company’s Chief Financial Officer, under a ten-year warrant issued on December 28, 2020 with an exercise price of $2.00 per share, (ii) 10,000 shares of common stock issuable to Donald Dickerson under a ten-year warrant issued on July 15, 2021 with an exercise price of $15.00 per share, (iii) 20,000 shares of common stock issuable to Amit Patel, a former director of the Company, under a ten-year warrant issued on December 28, 2020 with an exercise price of $2.00 per share, (iv) 10,000 shares of common stock issuable to Amit Patel under a ten-year warrant issued on July 15, 2021 with an exercise price of $15.00 per share, (v) 10,000 shares of common stock issuable to Thomas Ichim, a former director of the Company, under a ten-year warrant issued on July 15, 2021 with an exercise price of $15.00 per share, (vi) 30,000 shares of common stock issuable to various consultants of the Company under three-year warrant issued in April and May 2021 with an exercise price of $15.00 per share; (vii) 95 shares of common stock issuable to a consultant of the Company under three-year warrant issued September 2020 with an exercise price of $1.45 per share, and (viii) 7 shares of common stock issuable under options granted under the Company’s 2016 Stock Incentive Plan. |

| (3) | Represents 27 shares available under the Company’s 2016 Stock Incentive Plan. |

Delinquent Section 16(a) Reports

We are required to identify each person who was an officer, director or beneficial owner of more than 10% of our registered equity securities during our most recent fiscal year and who failed to file on a timely basis reports required by Section 16(a) of the Securities Exchange Act of 1934. Based solely upon a review of Forms 3 and 4 and amendments thereto filed with the SEC during the year ended December 31, 2021, no person who, at any time during the year ended December 31, 2021 was a director, officer or beneficial owner of more than 10 percent of our Common Stock, failed to timely file the reports required by Section 16(a) of the Exchange Act during the year ended December 31, 2021, except for a late filing by Susan Snow of a Form 3 due to technical difficulties in obtaining edgar filing codes from the SEC.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The following includes a summary of transactions since January 1, 2020 to which we have been a party in which the amount involved exceeded or will exceed the lesser of $120,000 or 1% of the average of our total assets as of December 31, 2021 and 2020, and in which any of our directors, executive officers or, to our knowledge, beneficial owners of more than 5% of our capital stock or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest.

Management Reimbursement Agreement

On November 17, 2017, we entered into a Management Reimbursement Agreement with CMH, a related party whose directors and executive officers include our executive officers and former directors. Pursuant to this agreement, during 2019 and 2020, and until September 16, 2021, we reimbursed CMH an aggregate of $45,000 per month for the services of management and consultants employed by CMH (including our Chief Executive Officer and Chief Financial Officer, and our former directors Dr. Patel and Dr. Ichim). The agreement provided that at the option of CMH, the reimbursable amounts may be paid from time to time in shares of common stock of the Company at a price equal to a 30% discount to the lowest closing price during the 20 trading days prior to time the notice is given. The Agreement may be terminated by either party upon 30 days’ prior written notice. This agreement was terminated effective September 15, 2021. At December 31, 2020, we owed CMH $18,782 under this agreement, and at December 31, 2021, no amounts were owed CMH under this agreement.

Debt Settlement Agreement

On January 12, 2018, we entered into a Debt Settlement Agreement with Timothy Warbington, our Chief Executive Officer, under which we issued 3,000,000 shares of super-voting Series A Preferred Stock to Mr. Warbington in exchange for the cancellation of $150,000 of debt owed by us to CMH, which CMH in turn was obligated to pay Mr. Warbington. The Series A Preferred Stock previously provided Mr. Warbington with substantial control over all matters subject to a vote of our shareholders. Mr. Warbington surrendered the Series A Preferred Stock to us in December 2021 immediately prior to the closing of our public offering in exchange for $150,000 plus 8% interest on such amount from January 2018 until the date of surrender.

Jadi Cell License Agreement

On December 28, 2020, we entered into a patent license agreement with Jadi Cell, LLC, a company owned and controlled by Dr. Amit Patel, a former director of ours. The agreement provides us with an exclusive license to U.S. Patent No. 9,803,176 “Methods and compositions for the clinical derivation of an allogenic cell and therapeutic uses” and the proprietary process of expanding the master cell bank of Jadi Cell LLC, in the field of enhancing autologous cells. The agreement includes the following terms:

| | · | We were required to pay an initial license fee of $250,000 either in cash or shares of our common stock at a discount of 25% of the closing price of our common stock on the date of the agreement. |

| | · | Within thirty (30) days of the end of each calendar quarter, we are required to pay Jadi Cell five percent (5%) of the net income we generate from ImmCelz™ during such calendar quarter. |

| | · | If we sell or dispose of the ImmCelz™ business, we will be required to pay Jadi Cell ten percent of the proceeds of the sale. |

| | · | The agreement may only be terminated by Jadi Cell if we are in material breach of the agreement, in the event of our bankruptcy, if we cease to engage in the ImmCelz™ business or if we challenge the validity of the patent rights granted to us under the agreement. |

To date, we have not made any payments to Jadi Cell under this agreement, other than the $250,000 initial license fee, which was paid by the issuance of 180,180 shares of common stock to Jadi Cell in February 2022.

StemSpine Patent Purchase

We acquired U.S. Patent No. 9,598,673 covering the use of various stem cells for the treatment of lower back pain from our affiliate CMH pursuant to a Patent Purchase Agreement dated May 17, 2017, which was amended in November 2017. The inventors of the patent were Thomas Ichim, PhD and Amit Patel, MD, former directors of ours, and Annette Marleau, PhD. As amended, the Patent Purchase Agreement includes the following terms:

| | · | We were required to pay CMH $100,000 within 30 days of demand as an initial payment. |

| | · | Upon the determination to pursue the technology via use of autologous cells, we were required to pay CMH: |

| | o | $100,000 upon the signing agreement with a university for the initiation of an IRB clinical trial. |

| | o | $200,000, upon completion of the IRB clinical trial. |

| | o | $300,000 in the event we commercialize the technology via use of autologous cells by a physician without a clinical trial. |

| · | In the event we determine to pursue the technology via use of allogenic cells, we are required to pay CMH: |

| | o | $100,000 upon filing an IND with the FDA. |

| | o | $200,000 upon dosing of the first patient in a Phase 1-2 clinical trial. |

| o | $400,000 upon dosing the first patient in a Phase 3 clinical trial. |

| | · | Each payment may be made in cash or shares of our common at a discount of 30% to the recent trading price. |

| | · | In the event our shares of common stock trade below $0.01 per share for two or more consecutive trading days, the number of any shares issuable as payment doubles. |

| | · | For a period of five years from the date of the first sale of any product derived from the patent, we are required to make royalty payments of 5% from gross sales of products, and 50% of sale price or ongoing payments from third parties for licenses granted under the patent to third parties. |

We paid CMH the $100,000 obligation of the initial payment due under this agreement, by a $50,000 cash payment and the issuance of 6,667 shares of common stock on December 12, 2019. On December 31, 2019, following our announcement with respect to the clinical commercialization of the StemSpine technology, we paid CMH $50,000 of the $300,000 obligation due under this agreement through the issuance of 133 shares of common stock. On September 30, 2020 we paid CMH an additional $40,000 of the $300,000 obligation due under this agreement through the issuance of 84,656 shares of common stock, and in January 2021 we paid CMH an additional $50,000 of the $300,000 obligation due under this agreement through the issuance of 89,286 shares of common stock. The remaining portion of the $300,000 obligation has been paid in cash.

Related-Person Transactions Policy And Procedures

We have a written Related-Person Transactions Policy that sets forth the Company’s policies and procedures regarding the identification, review, consideration and approval or ratification of “related-persons transactions.” For purposes of our policy only, a “related-person transaction” is a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which the Company and any “related person” are participants involving an amount that exceeds $25,000. Transactions involving compensation for services provided to the Company as an employee, director, consultant or similar capacity by a related person are not covered by this policy. A related person is any executive officer, director, or more than 5% stockholder of the Company, including any of their immediate family members, and any entity owned or controlled by such persons.

Under the policy, where a transaction has been identified as a related-person transaction, management must present information regarding the proposed related-person transaction to the Audit Committee (or, where Audit Committee approval would be inappropriate, to another independent body of the Board) for consideration and approval or ratification. The presentation must include a description of, among other things, the material facts, the interests, direct and indirect, of the related persons, the benefits to the Company of the transaction and whether any alternative transactions were available. To identify related-person transactions in advance, the Company relies on information supplied by its executive officers and directors. In considering related-person transactions, the Committee takes into account the relevant available facts and circumstances including, but not limited to (a) the risks, costs and benefits to the Company, (b) the impact on a director’s independence in the event the related person is a director, immediate family member of a director or an entity with which a director is affiliated, (c) the terms of the transaction, (d) the availability of other sources for comparable services or products, and (e) the terms available to or from, as the case may be, unrelated third parties or to or from employees generally. In the event a director has an interest in the proposed transaction, the director must recuse himself or herself form the deliberations and approval. The policy requires that, in determining whether to approve, ratify or reject a related-person transaction, the Committee look at, in light of known circumstances, whether the transaction is in, or is not inconsistent with, the best interests of the Company and its stockholders, as the Committee determines in the good faith exercise of its discretion.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our Common Stock as of October 1, 2022, based on 14,070,279 shares of Common Stock outstanding as of such date, by:

| | · | each person, or group of affiliated persons, who we know to beneficially own more than 5% of our Common Stock; |

| | | |

| | · | each of our named executive officers; |

| | | |

| | · | each of our directors and director nominees; and |

| | | |

| | · | all of our executive officers and directors as a group. |

Information with respect to beneficial ownership has been furnished by each director, officer or beneficial owner of more than 5% of our Common Stock. We have determined beneficial ownership in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities. In addition, the rules include shares of our Common Stock issuable pursuant to the exercise of warrants. These shares are deemed to be outstanding and beneficially owned by the person holding those warrants for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

| Names and Address of Individual or Identity of Group(1) | | | Number of Shares Beneficially Owned | | | Beneficial Ownership (%) | |

| Officers and Directors | | | | | | | |

| Timothy Warbington | | | | 328,680 | (2) | | | 2.3 | % |

| Donald Dickerson | | | | 43,326 | (3) | | * | |

| Michael H. Finger | | | | 18,502 | | | * | |

| Susan Snow | | | -0- | | | * | |

| Bruce S. Urdang | | | -0- | | | * | |

| All Directors and Executive Officers as a Group (5 Persons) | | | | 390,508 | (4) | | | 2.8 | % |

5% Holders

N/A

| * | Less than one percent. |

| | |

| (1) | Unless otherwise indicated, the business address of each officer and director of the Company is c/o Creative Medical Technology Holdings, Inc., 211 E. Osborn Road, Phoenix, AZ 85012. |

| (2) | Includes 226,948 shares beneficially owned by Creative Medical Health, Inc., of which Mr. Warbington serves as President and Chief Executive Officer, and currently exercisable options to purchase 14,645 shares of Common Stock. |

| (3) | Includes currently exercisable warrants to purchase 30,000 shares of Common Stock and currently exercisable options to purchase 13,309 shares of Common Stock. |

| (4) | Includes 30,000 shares that may be issued under currently exercisable warrants, and 27,954 shares that may be issued under currently exercisable options. |

COMMUNICATIONS WITH OUR BOARD OF DIRECTORS

Interested parties who wish to communicate with our Board of Directors or any specified individual director, including our non-employee directors, may send their communications in writing to the Corporate Secretary at Creative Medical Technology Holdings, Inc., 211 E Osborn Road, Phoenix, AZ 85012, Attn: Corporate Secretary. The Corporate Secretary shall review all incoming communications (except for mass mailings, job inquiries, business solicitations and patently offensive or otherwise inappropriate material) and, if appropriate, route such communications to the appropriate member(s) of the Board of Directors or, if none is specified, to the Chair of the Board.

The Corporate Secretary may decide in the exercise of his or her judgment whether a response to any communication is necessary and shall provide a report to the corporate governance and nominating committee on a quarterly basis of any communications received for which the Corporate Secretary has either responded or determined no response is necessary.

This procedure for communications with the non-management directors is administered by the Company’s corporate governance and nominating committee. This procedure does not apply to (a) communications to non-employee directors from officers or directors of the Company who are stockholders, or (b) stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act.

PROPOSAL ONE: ELECTION OF DIRECTORS

Our Board of Directors has nominated five candidates for election as director for a term expiring at the next annual meeting of stockholders. All of the nominees are currently members of our Board. Directors are elected to serve for their respective terms of one year or until their successors have been duly elected or appointed and qualified. The Board has no reason to believe that any of the nominees named below will be unavailable, or if elected, will decline to serve.

Pursuant to our Bylaws, generally the number of directors is fixed and may be increased or decreased from time to time by resolution of our Board. The Board has fixed the number of directors at five members. Proxies cannot be voted for a greater number of persons than the number of nominees named. In the event one or more of the named nominees is unable to serve, the persons designated as proxies may cast votes for other persons as substitute nominees.

Nominees

Our corporate governance and nominating committee of the Board of Directors recommended, and the Board of Directors approved, Timothy Warbington, Donald Dickerson, Michael H. Finger, Susan Snow and Bruce S. Urdang as nominees for re-election to the Board of Directors at the Annual Meeting.

Please see “Directors, Executive Officers and Corporate Governance” in this Proxy Statement for information concerning the nominees.

Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR Timothy Warbington, Donald Dickerson, Michael H. Finger, Susan Snow and Bruce S. Urdang. If a nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for another nominee designated by the Board of Directors. We are not aware of any reason that a nominee would be unable or unwilling to serve as a director.

Required Vote

Each director is elected by a plurality of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the vote.

The Board of Directors unanimously recommends that stockholders vote “for” the re-election of each of Timothy Warbington, Donald Dickerson, Michael H. Finger, Susan Snow and Bruce S. Urdang to the Board of Directors.

PROPOSAL TWO: ADVISORY VOTE ON EXECUTIVE COMPENSATION

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), our stockholders are entitled to vote to approve, on an advisory, non-binding basis, the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with the SEC’s rules. Please read the “Executive Compensation” section of this Proxy Statement for additional details about our executive compensation program.

We are asking our stockholders to indicate their support for our named executive officer compensation as described in this Proxy Statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this Proxy Statement. Accordingly, we will ask our stockholders to vote “FOR” the following resolution at the Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s proxy statement for the 2022 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission.”

We believe that our compensation policies and procedures are intended to be aligned with the long-term interests of our stockholders. The say-on-pay vote is advisory, and therefore not binding on the Company, the compensation committee or the Board. However, the Board and compensation committee value the opinions of our stockholders, we will consider our stockholders’ concerns, and the compensation committee will consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

Required Vote

Assuming that a quorum is present at the Meeting, approval of this proposal requires the affirmative vote of holders of a majority of the shares present and entitled to vote thereon either in person or represented by proxy at the Meeting.

The Board of Directors unanimously recommends that stockholders vote “for” the approval, on a nonbinding advisory basis, of the compensation of our named executive officers.

PROPOSAL THREE: ADVISORY VOTE ON THE FREQUENCY OF THE ADVISORY, NON-BINDING VOTE ON EXECUTIVE COMPENSATION

Pursuant to the Dodd-Frank Act and Section 14A of the Exchange Act, as amended, our stockholders are entitled at least once every six years to cast an advisory, non-binding vote to indicate their preference regarding how frequently we should seek an advisory, non-binding vote on the compensation of our named executive officers as disclosed in our proxy statements. Accordingly, the Company is asking its stockholders to indicate whether they would prefer an advisory, non-binding vote on named executive officer compensation once every year, every two years or every three years. Alternatively, stockholders may abstain from casting a vote on this proposal. For the reasons described below, our Board recommends that the stockholders select a frequency of every year.

After consideration, our Board has determined that holding a non-binding, advisory vote on executive compensation every year is the most appropriate alternative for the Company at this time, and therefore recommends that stockholders vote for future advisory votes on executive compensation to occur every year. While our executive compensation program is intended to promote a long-term connection between pay and performance, the Board recognizes that executive compensation disclosures are made annually. The Board considered that an annual advisory vote on executive compensation will allow our stockholders to evaluate our executive compensation program in relation to our compensation policies and practices as disclosed in the proxy statement every year. However, stockholders should note that because the advisory vote on executive compensation occurs well into the compensation year, and because the different elements of our executive compensation program are designed to operate as part of an integrated program, it may not be appropriate or feasible to modify our executive compensation program in consideration of any one year’s advisory vote on executive compensation by the time of the following year’s annual meeting of stockholders.

While the Board believes that its recommendation is appropriate at this time, the stockholders are not voting to approve or disapprove that recommendation, but are instead asked to indicate their preferences, on an advisory basis, as to whether the non-binding advisory vote on the approval of our executive officer compensation practices should be held every year, every two years or every three years. The option among those choices that receives the highest number of votes from the holders of shares present in person or represented by proxy and entitled to vote at the annual meeting will be deemed to be the frequency preferred by the stockholders.

The Board and the compensation committee will consider the outcome of the vote when making future decisions regarding the frequency of advisory votes on executive compensation. However, because this vote is advisory and not binding, the Board may decide that it is in the best interests of the Company and our stockholders that we hold an advisory vote on executive compensation more or less frequently than the alternative preferred by our stockholders.

The Board of Directors recommends that stockholders vote “for” “every year” as the frequency with which stockholders are provided an advisory vote on executive compensation.

PROPOSAL FOUR: RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTANTS

Our audit committee of the Board of Directors has appointed Haynie & Company as our independent registered public accountants for the year ending December 31, 2022, and the Board recommends that stockholders vote for ratification of such appointment.

Notwithstanding its selection or voting results, the audit committee in its discretion may appoint new independent registered public accountants at any time during the year if the audit committee believes that such a change would be in the best interests of the Company and its stockholders. If our stockholders do not ratify the appointment, the audit committee may reconsider whether it should appoint another independent registered public accounting firm.

Haynie & Company served as our independent registered public accounting firm for the year ended December 31, 2021. We currently do not expect that a representative of Haynie & Company will be present at the Annual Meeting.

Principal Accounting Fees and Services

The following table sets forth all fees accrued or paid to Haynie & Company for the years ended December 31, 2021 and 2020:

| | | Year Ended December 31, | |

| | | 2021 | | | 2020 | |

| Audit Fees (1) | | $ | 84,750 | | | $ | 63,250 | |

| Audit-Related Fees (2) | | $ | 27,500 | | | | - | |

| Tax Fees | | | - | | | | - | |

| All Other Fees | | | - | | | | - | |

| Total | | $ | 112,250 | | | $ | 63,250 | |

| (1) | Audit Fees consist of professional services rendered in connection with the audit of our annual consolidated financial statements, including audited financial statements presented in our Annual Report on Form 10-K and services that are normally provided by the independent registered public accountants in connection with statutory and regulatory filings or engagements for those fiscal years. |

| | |

| (2) | Audit-Related Fees consist of professional services rendered in connection with our 2021 public offering transaction and the related Registration Statement on Forms S-1. |

Pre-approval Policy. Under our audit committee’s policy governing our use of the services of our independent registered public accountants, the audit committee is required to pre-approve all audit and permitted non-audit services performed by our independent registered public accountants in order to ensure that the provision of such services does not impair the public accountants’ independence. However, out audit committee was not formed until just prior to our public offering in December 2021, and as a result, did not approve any of the fees identified above.

Required Vote

Assuming that a quorum is present at the Meeting, approval of this proposal requires the affirmative vote of holders of a majority of the shares present and entitled to vote thereon either in person or represented by proxy at the Meeting.

The Board of Directors unanimously recommends that stockholders vote “for” the ratification of the selection of Haynie & Company as the Company’s independent registered public accountants for the year ending December 31, 2022.

AUDIT COMMITTEE REPORT

The following is the report of the audit committee of our Board of Directors. The audit committee has reviewed and discussed our audited financial statements for the fiscal year ended December 31, 2021 with our management. In addition, the audit committee has discussed with Haynie & Company, our independent registered public accountants, the matters required to be discussed by standards promulgated by the American Institute of Certified Public Accountants (“AICPA”) and Public Company Accounting Oversight Board (the “PCAOB”), including PCAOB Auditing Standard No. 16 “Communications with Audit Committees.” The audit committee also has received the written disclosures and the letter from Haynie & Company as required by the applicable requirements of the PCAOB regarding the independent accountant’s communications with the audit committee concerning independence, and the audit committee has discussed with Haynie & Company the independence of Haynie & Company.

Based on the audit committee’s review of the matters noted above and its discussions with our independent accountants and our management, the audit committee recommended to the Board of Directors that the financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Respectfully submitted by the members of the audit committee of the Board of Directors:

Susan Snow (Chair)

Michael H. Finger

Bruce S. Urdang

ANNUAL REPORTS

The Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (our “Annual Report”) (which is not a part of our proxy soliciting materials), is being mailed with this Proxy Statement to those stockholders that request to receive a copy of the proxy materials in the mail. Stockholders that received the Notice of Internet Availability of Proxy Materials can access this Proxy Statement and our Annual Report at www.proxyvote.com. Requests for copies of our Annual Report may also be directed to the Corporate Secretary at Creative Medical Technology Holdings, Inc., 211 E Osborn Road, Phoenix, AZ 85012, Attn: Corporate Secretary.

We filed our Annual Report with the SEC on March 30, 2022. It is available free of charge at the SEC’s web site at www.sec.gov. Upon written request by a stockholder, we will mail without charge a copy of our Annual Report, including the financial statements and financial statement schedules, but excluding exhibits to our Annual Report. Exhibits to our Annual Report are available upon payment of a reasonable fee, which is limited to our expenses in furnishing the requested exhibit(s). All requests should be directed to the Corporate Secretary at Creative Medical Technology Holdings, Inc., 211 E Osborn Road, Phoenix, AZ 85012, Attn: Corporate Secretary.

OTHER MATTERS

The Board of Directors does not know of any other matters to be presented at the Annual Meeting. If any additional matters are properly presented or otherwise allowed to be considered at the Annual Meeting, the persons named in the enclosed proxy will have discretion to vote shares they represent in accordance with their own judgment on such matters.

It is important that your shares be represented at the meeting, regardless of the number of shares that you hold. You are, therefore, urged to submit your proxy or voting instructions at your earliest convenience.

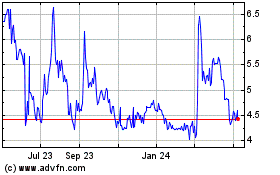

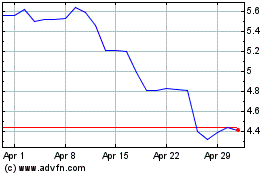

Creative Medical Technol... (NASDAQ:CELZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Creative Medical Technol... (NASDAQ:CELZ)

Historical Stock Chart

From Apr 2023 to Apr 2024