Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

January 10 2024 - 4:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨

Definitive Proxy Statement

¨

Definitive Additional Materials

x

Soliciting Material Pursuant to Rule 14a-12

Consolidated

Communications Holdings, Inc.

(Name of Registrant

as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| x | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a6(i)(1) and 0-11. |

| Transaction with Searchlight is

the Best Strategic Alternative Available to Shareholders

Consolidated Communications Holdings, Inc.

January 10, 2024 |

| 2

Legal Disclosure

Forward-Looking Statements

Certain statements in this communication are forward-looking statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect, among other things, the

Company’s current expectations, plans, strategies and anticipated financial results.

There are a number of risks, uncertainties and conditions that may cause the Company’s actual results to differ materially from those expressed or implied by these forward-looking statements, including: (i) the risk that the Proposed Transaction may not be

completed in a timely manner or at all; (ii) the failure to receive, on a timely basis or otherwise, the required approvals of the Proposed Transaction by the Company’s stockholders; (iii) the possibility that any or all of the various conditions to the

consummation of the Proposed Transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals);

(iv) the possibility that competing offers or acquisition proposals for the Company will be made; (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to the

Proposed Transaction, including in circumstances which would require the Company to pay a termination fee; (vi) the effect of the announcement or pendency of the Proposed Transaction on the Company’s ability to attract, motivate or retain key executives

and employees, its ability to maintain relationships with its customers, suppliers and other business counterparties, or its operating results and business generally; (vii) risks related to the Proposed Transaction diverting management’s attention from the

Company’s ongoing business operations; (viii) the amount of costs, fees and expenses related to the Proposed Transaction; (ix) the risk that the Company’s stock price may decline significantly if the Proposed Transaction is not consummated; (x) the risk of

shareholder litigation in connection with the Proposed Transaction, including resulting expense or delay; and (xi) (A) the risk factors described in Part I, Item 1A of Risk Factors in the Company’s Annual Report on Form 10-K for the year ended December 31,

2022 and (B) the other risk factors identified from time to time in the Company’s other filings with the SEC. Filings with the SEC are available on the SEC’s website at http://www.sec.gov.

Many of these circumstances are beyond the Company’s ability to control or predict. These forward-looking statements necessarily involve assumptions on the Company’s part. These forward-looking statements generally are identified by the words

“believe,” “expect,” “anticipate,” “intend,” “plan,” “should,” “may,” “will,” “would” or similar expressions. All forward-looking statements attributable to the Company or persons acting on the Company’s behalf are expressly qualified in their entirety by the

cautionary statements that appear throughout this communication. Furthermore, undue reliance should not be placed on forward-looking statements, which are based on the information currently available to the Company and speak only as of the date they

are made. The Company disclaims any intention or obligation to update or revise publicly any forward-looking statements.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the Proposed Transaction. The Special Meeting will be held on January 31, 2024 at 9:00 A.M. Central Time, at which meeting the stockholders of the Company will be asked to

consider and vote on a proposal to adopt the merger agreement and approve the Proposed Transaction. In connection with the Proposed Transaction, the Company filed relevant materials with the SEC, including the Proxy Statement. The Company

commenced mailing the Proxy Statement and a proxy card to each stockholder of the Company entitled to vote at the Special Meeting on December 18, 2023. In addition, the Company and certain affiliates of the Company jointly filed an amended

transaction statement on Schedule 13e-3 (the “Schedule 13e-3”). INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT AND

THE SCHEDULE 13E-3, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, SEARCHLIGHT AND BCI AND THE PROPOSED TRANSACTION. Investors and stockholders of the Company are able to obtain these

documents free of charge from the SEC's website at www.sec.gov, or free of charge from the Company by directing a request to the Company at 2116 South 17th Street, Mattoon, IL 61938, Attention: Investor Relations or at tel: +1 (844) 909-2675. |

| 3

Executive Summary

Transaction Offers a

Compelling

Valuation, and

Shifts Execution,

Liquidity and Market

Risk to Buyers

1 ✓ All-cash offer at a 70% premium to unaffected1 price is significantly higher than public and take-private precedent transactions,

and exceeds analysts’ price targets

✓ Implied 9.6x LTM EBITDA multiple is higher than any Local Exchange Carrier (LEC) precedent transaction in at least a decade

✓ Provides shareholders with a substantial premium despite material sector-wide decline since initial non-binding offer was made

✓ Eliminates ongoing uncertainty from strategic plan’s liquidity, funding and execution risks, transferring those risks to the buyers

✓ Extensive special committee process – including 35+ meetings over a 6-month span

̶ Examined multiple strategic alternatives, and effects of core constraints on strategic flexibility

̶ Successfully negotiated a 17.5% increase2

in price amid a decline in peer shares

Standalone Plan

Carries More

Downside Risk than

Upside

2 ✓ No longer has the liquidity to fund its prior standalone growth plans, and sufficient external financing is not readily available

̶ Asset sale proceeds are exhausted and asset securitization on commercially acceptable terms is not a viable option in the near-term

̶ Leverage ratio is already close to covenant maximum, and the Company’s revolver will be maxed out in the near-term

̶ Revolver’s “springing covenant,” which reduces amount of capital available in revolver if ratio is exceeded, puts remaining capital at

heightened risk from execution headwinds / cost increases

✓ Liquidity constraints add serious risk to Consolidated’s capital-intensive fiber transformation – a requirement to remain competitive and

deliver growth – leaving little margin for error

✓ Time to market is imperative – those who are first to market with fiber offerings will be best-positioned to take and hold significant share –

delays to Consolidated’s fiber build due to liquidity constraints cedes its incumbency advantage, presenting potential franchise risk by

making investments in less economical target markets

Following Wildcat’s

Lead Would be

Disastrous for

Shareholders

3 ✓ Wildcat may dismiss the strategic urgency of our liquidity constraints – but if this deal is not approved the market will not

̶ Consolidated’s closest peers (Lumen and Frontier) have traded down approximately (26%) and (22%)3

, respectively4

, underscoring

the market’s concern about the challenges Consolidated and its peers face

✓ Wildcat’s analysis fails to account for both the cost and dilutive impact of additional capital needed to execute the plan and the

significant execution risks that fiber conversion presents

✓ Wildcat’s core argument – that Frontier’s valuation demonstrates Consolidated is worth more – is a mirage: at Frontier’s valuation multiple,

Consolidated would have negative equity value

✓ Shareholders are not leaving value on the table: no other bidders emerged during the well-publicized process or post-announcement,

underscoring that this is the best deal available to the Company

Source: FactSet (as of December 29, 2023 and October 16, 2023)

Notes:

1. Unaffected date is April 12, 2023, the last trading day prior to public announcement of the non-binding proposal

2. Percentage increase based on (offer price of $4.70 / initial offer price submitted by Searchlight & BCI of $4.00) - 1

3. Frontier share price return calculated from April 12, 2023 through October 16, 2023 (the day before Jana Partners publicly advocated for a

sale of Frontier)

4. Share price returns calculated from April 12, 2023 (the unaffected date) through December 29, 2023 |

| 4

Transaction Offers a Compelling Valuation,

and Shifts Execution, Liquidity and Market Risk to Buyers |

| (80%)

(60%)

(40%)

(20%)

-

20%

40%

Apr-22 Oct-23

5

Sources: FactSet (as of October 13, 2023), company filings

Notes:

1. Peers include Frontier Communications Parent, Inc., Lumen Technologies, Inc., Cable One, Inc., Shenandoah Telecommunications Company, ATN International, Inc., WideOpenWest, Inc., Altice USA, Inc. and Charter Communications, Inc.

2. Unaffected date is April 12, 2023, the last trading day prior to public announcement of the non-binding proposal

3. Calendar day VWAPs as of April 12, 2023

Transaction

announced

Monday

Oct 16,

2023

Transaction Offers Shareholders a Compelling and De-Risked Valuation

$4.70 / share takeout price

Premium to:

Unaffected Price2

($2.76) 70%

Initial Offer ($4.00) 18%

1-month VWAP3

($2.49) 89%

2-month VWAP3

($2.86) 64%

6-month VWAP3

($3.54) 33%

Offer easily exceeds recent

trading history – even after

initial bid was made public

Initial offer of

$4.00/share

publicly

disclosed

Key risks shift entirely to buyers:

▪ Execution risk with little margin for error

▪ Constrained liquidity and access to capital

▪ Competitive pressures from large, well-capitalized national competitors (Spectrum,

Comcast, AT&T, etc.)

Consolidated Communications

Peer Average1

Takeout Price

(Indexed to CNSL starting price)

Share Price Return Since April 12, 2022 |

| (22%)

(Unaffected2

)

+13%

(26%) +16%

(62%)

(30%)

(Unaffected3

)

6

Special Committee Won a 70% Price Premium Even As Peers Were Falling

Share Price Returns1 since Special Committee Process Began (April 12, 2023 – December 29, 2023)

Sources: FactSet (as of December 29, 2023, December 8, 2023 and October 16, 2023), various news outlets

Notes:

1. Share price returns calculated from April 12, 2023 (the unaffected date) through December 29, 2023

2. Frontier share price return calculated from April 12, 2023 through October 16, 2023 (the day before Jana Partners publicly advocated for a sale of Frontier)

3. Altice share price return calculated from April 12, 2023 through December 8, 2023 (around the time when major news outlets reported interest from potential buyers for Altice Portugal)

Multi-Regional Peers National Peers

(4%)

(15%) |

| 34%

51%

63%

80%

25th

percentile

Median Mean 75th

percentile

21%

32%

45%

53%

25th

percentile

Median Mean 75th

percentile

7

Premium is Meaningfully Higher than Precedent Transactions

Sources: company filings, Refinitiv, FactSet (as of October 13, 2023)

Notes:

1. Includes all-cash going-private transactions of U.S. companies with enterprise values of greater than $250m led by shareholders with ownership between 15% and 50% since January 1, 2013

2. Includes all-cash acquisitions of U.S. companies by third parties with enterprise values of $1.0 – 5.0bn since January 1, 2013; premium to one day prior to announcement date or date transaction publicly rumored

3. Premium based on unaffected date of April 12, 2023, the last trading day prior to public announcement of the non-binding proposal

Offer price easily exceeds what precedent all-cash transactions would have implied

Implied CNSL takeout price at precedent premium:

Better/(Worse) than Searchlight offer:

$3.34

$(1.36)

$3.64

$(1.06)

$3.99

$(0.71)

$4.23

$(0.47)

Implied CNSL takeout price at precedent premium:

Better/(Worse) than Searchlight offer:

$3.71

$(0.99)

$4.18

$(0.52)

$4.50

$(0.20)

$4.97

$ 0.27

25th percentile Median Mean 75th percentile 25th percentile Median Mean 75th percentile

Going-Private Transactions1 Public Acquisition Transactions2

CNSL premium3 CNSL premium3

: 70% : 70% |

| 9.6x

5.5x

5.0x

7.6x

6.4x

5.0x

6.1x

9.4x

6.0x

7.3x

6.7x

4.8x

Target

Acquiror

EV ($bn) $3.1 $7.5 $0.3 $3.1 $0.2 $1.4 $0.7 $0.9 $1.6 $0.3 $10.5 $2.0

Date Oct-23 Aug-21 Jan-21 Mar-20 Dec-19 May-19 Jul-17 Feb-17 Dec-16 Jun-14 Jan-14 Dec-13

8

…While Multiple is Higher than Any Relevant Public LEC Precedent in a Decade1

Sources: public filings, press releases

Notes:

1. Transaction multiples recognized on an LTM EBITDA basis as of announcement date unless otherwise noted

2. Pro forma for the previously disclosed sales of certain non-core operations, including the expected sale of Washington assets

3. Sale of ILEC business including consumer, SMB, wholesale and mostly copper-served enterprise customers and assets in 20 states; multiple as-disclosed by Lumen based on 2020E EBITDA

4. Sale of operations and associated assets in Washington, Oregon, Idaho and Montana

5. Sale of wireline operations in California, Texas and Florida based on total consideration and segment EBITDA from investor presentation February 5, 2015 and 8-K filed June 2, 2015, respectively

6. Acquisition of wireline operations in Connecticut; 2014 PF Day 1 EBITDA from company investor presentation issued December 17, 2013

(CA, TX, FL

assets)5

(CT assets) (WA, OR, ID, 6

MT assets)4

(ILEC assets)3

2

The transaction

on which

Wildcat bases

its argument

had a multiple

>4 turns lower

than CNSL

achieved

The most relevant

precedent fell short of

CNSL on multiple

2 |

| 14%

(1%)

(60%)

(40%)

(20%)

-

20%

40%

Dec-22 Feb-23 Apr-23 Jun-23 Aug-23 Oct-23 Dec-23

2

2024E EBITDA $354

(x) Multiple 6.4x

Implied EV $2,250

(-) Net Debt (1,922)

(-) Other Adjustments (592)

Implied Eq. Value ($264)

Implied CNSL Equity Value Assuming CNSL

Trades at 6.4x EV / '24E EBITDA ($m) 6.4x

FYBR

…yet its 1-year stock return is significantly below CNSL’s…

9

Comparison to Frontier Demonstrates How Compelling This Offer is

Frontier’s qualitative advantages should yield a better valuation…

… and its ’24E EBITDA multiple, if applied to CNSL, would yield a negative equity value

As compared to CNSL, Frontier Communications:

▪ Is a larger company

▪ Maintains more liquidity, with securitization in place

▪ Is further along in the fiber conversion process

October 16, 2023, the day before

Jana Partners began advocating

for Frontier to sell itself

CNSL

FYBR

Sources: company filings, FactSet (as of December 29, 2023 and October 16, 2023)

Notes:

1. Implied 2024E multiple for Frontier as of October 16, 2023 (the day before Jana Partners publicly advocated for a sale of Frontier)

2. Consolidated’s 2024E EBITDA includes pro forma impact of WA divestiture per CNSL Management

3. Based on the company’s Q2 2023 filings unless otherwise stated, the latest available data prior to the Frontier unaffected date

4. Includes NPV of WA sale proceeds and interim cash flows treated as cash-like items

5. Includes net, tax-effected PBO and OPEB per 2022 10-K (assuming tax rate of 26%), NCI, investments and preferred stock (at liquidation

preference)

1

1

3,4

3,5 |

| 10

Special Committee Conducted an Exhaustive Review of Alternatives

Conclusion: Standalone Plan has Significantly More Downside Risk than Upside

Execute on

Standalone Plan

▪ Requires a further delay of build, as necessary, to

preserve capital / re-accelerate build when financing

markets improve and/or market dynamics improve

▪ Potentially allows the Company to realize higher

valuation if fiber conversion is completed in a

competitively timely manner

▪ Share price likely to lose deal premium and trade well below $4.70 (and

probably below the unaffected price of $2.76)

▪ Fiber build cadence falls materially behind prior plan / public guidance

▪ Potentially lose first mover advantage in target markets, increasing risk over

the longer-term

▪ Significant liquidity risk on even slight EBITDA underperformance; small

missteps likely create large risk

▪ Substantially limits degrees of freedom

Raise Capital

(if Possible) to

Execute a More

Aggressive Build

Plan

▪ Enables Consolidated to return to prior build

cadence (i.e., execute on original plan), potentially

avoiding competitive risk of losing first-mover

advantage

▪ Requires $450m – $500m of new capital1

(140%+ unaffected equity value2

)

by 2026 without any feasible funding source

▪ Already highly levered (6.1x3

); 7.7x3

including preferred stock

▪ New equity would be issued at a material discount, heavily diluting current

shareholders

▪ May require shareholder and regulatory approval

▪ Redirects resources to smaller footprint

▪ Proceeds, though limited, could slightly offset

potential dilution from future capital raises needed to

fund build

Execute

Additional Sale of

Select Assets or

Regional

Operations

▪ Negative impact on EBITDA and leverage

▪ Proceeds may not be available for > 9 – 18 months, likely too late to solve

current liquidity challenges

▪ Limited proceeds unlikely to impact business

▪ Valuation may be dilutive to current multiple and negatively impact liquidity;

Washington assets sold for ~5.1x4

▪ Lack of credible interest from buyers at attractive valuations or on

acceptable terms

Potential Benefits Likely Risks

Sources: Company filings, Illustrative Buyer Plan (Including Pre-Closing Capital)

Notes:

1. Based on Illustrative Buyer Plan (Including Pre-Closing Capital)

2. Required capital of $450m / unaffected market cap of $327m

3. As of Q3 2023; preferred stock is included at liquidation preference

4. Assumes gross proceeds (EV) of $73m and LTM EBITDA of $14.2m (LTM calculated as July 1, 2022 through June 30, 2023)

Possible Alternatives |

| 11

Special Committee Conducted an Exhaustive Review of Alternatives

Conclusion: No Third-party Alternative is Available or Viable

Sell to Another

Financial Buyer

▪ Potentially facilitates greater valuation so long as the

Company is able to find a buyer willing to write a

bigger equity check and the Company is able to

absorb higher interest rates

▪ Would require a refinancing of Consolidated’s debt on less attractive terms

▪ Searchlight has publicly stated that it would not vote in favor of any

alternative sale, merger or similar transaction

▪ Even assuming sufficient shareholder support, this option would require

significantly more equity capital given a financial buyer could not finance the

transaction at Consolidated’s current leverage level and would need to take

out Searchlight common and preferred stock; likely has higher debt service

costs going forward

▪ Would require a 12 - 18 month debt financing commitment, which is unlikely

in current debt market

▪ No inbound interest received over 6-month+ process

Sell to / Merge

with a Strategic

▪ Consolidated shareholders could expect to partially

share synergy value

▪ Equity consideration could bridge valuation gap

▪ Shareholders would retain upside potential if there is

a stock-for-stock deal

▪ Most strategics undergoing deployment strategies similar to those of

Consolidated have constrained balance sheets, which may limit their

interest or ability to enter into a transaction

▪ Searchlight has publicly stated that it would not vote in favor of any

alternative sale, merger or similar transaction

▪ No inbound interest received over 6-month+ process

Potential Benefits Likely Risks Possible Alternatives |

| 12

Special Committee Conducted an Exhaustive Review of Alternatives

Conclusion: Sale of Entire Company is Most Compelling Strategy Involving Searchlight

Sell Entire

Company to

Searchlight / BCI

▪ All-cash proposal at a significant premium

▪ Transfers all execution, liquidity and financing risk to

buyers

▪ Limited diligence requirements given familiarity with

business and management

▪ Shareholders forgo potential long-term upside from fiber deployment

Offer Searchlight

the Opportunity to

Acquire >51%

Through a Tender

Offer

▪ Provides some optionality for other shareholders to

continue or exit investment

▪ Does not address near-term funding needs

▪ Unclear whether any control premium would be available, or what other exit

opportunities would be available in the future

▪ Raise capital through sale of additional preferred

stock or other securities

Offer Searchlight

an Opportunity to

Provide Additional

Capital

▪ Expensive capital that dilutes returns to common equity over the long-term

▪ Likely to provide de facto / actual control to Searchlight without a control

premium

▪ Provides no liquidity option for current shareholders

▪ Unlikely to provide sufficient new capital to fund the build plan

Potential Benefits Likely Risks Possible Alternatives |

| $2.76

$4.00

$4.20 $4.35 $4.50 $4.55 $4.65 $4.70

$6.00

$5.25

$5.05

$4.80 $4.70

April 12,

2023

Initial

Offer

Revised

offer #1

SC

Counteroffer

#1

Revised

offer #2

SC

Counteroffer

#2

Revised

offer #3

SC

Counteroffer

#3

Revised

offer #4

SC

Counteroffer

#4

Revised

offer #5

SC

Counteroffer

#5

Agreed

Price

Chart Title

13

Thorough Process Delivered the Highest Value Available

Note:

1. Unaffected date is April 12, 2023, the last trading day prior to public announcement of the Searchlight Group’s non-binding proposal

Six Month Process

Premium to

unaffected

price1

44.9% 52.2% 57.6% 63.0% 64.9% 68.5% 70.3%

35+ Special

Committee

(“SC”)

meetings 0

Alternative bidders

expressed interest,

despite long and public 6 process

Price increases totaling

a 17.5% improvement in

valuation 70%Premium to

unaffected

price1 |

| Prior to April Offer

Price Target $4.50 $2.50 $4.00

Mar 1, 2023 Mar 1, 2023 Mar 1, 2023

Methodology DCF1 DCF2

/ OIBDA2 DCF

Transaction Premium3 +4% +88% +18%

After April Offer Announced

Price Target $4.50 $3.50 $4.00

Apr 13, 2023 Apr 13, 2023 Apr 13, 2023

Methodology DCF1 Offer4

/ Other4 DCF

Transaction Premium3 +4% +34% +18%

“…we view Searchlight's take-private bid and fully funded

FTTH build plan as the cleanest strategy.”

- August 8, 2023

14

Third-Party Analysts Endorse Both the Valuation and the Sale Strategy

Sources: Wall Street research (permission to use quotes neither sought nor obtained)

Notes:

1. DCF based on SOTP exit multiple

2. Methodology based on simple average (rounded to nearest 50 cents) of DCF and EV/OIBDA multiple

3. Transaction premium calculated as (offer price of $4.70 / respective price target) - 1

4. Methodology based on scenario weighted valuation (rounded to nearest 50 cents) with a 75% probability of a $4 value (based on the initial offer price of Searchlight) and 25% probability based on fundamental value assessment of $2.70 per share; fundamental value is based on

simple average of DCF and EV/OIBDA multiple

“Net-net, we view the outcome

positively for CNSL

shareholders, especially in the

context of a weakening near-term operating position.”

- October 16, 2023

“We do not expect resistance

given CNSL’s 2024/2025 capital

needs, operational challenges

(providing downside guidance

the past two years), the

challenging capital markets,

and a healthy take-out multiple.

We believe an overbid would be

difficult…”

- April 13, 2023

Offer price exceeds standalone valuations from equity analysts |

| 15

Standalone Plan Carries More Downside Risk than Upside |

| Significant Investment Required to Reposition and Transition Both the Residential and Commercial Businesses to Return to Growth

16

Maintaining Competitiveness Requires a Complex Technology Transformation

Residential / Consumer Commercial / Carrier

2023E Revenue1

/

3-year Historical CAGR

~$450m

’20 – ’23E CAGR: (4%)

~$530m

’20 – ’23E CAGR: (3%)

Business Challenges

▪ CNSL’s legacy DSL network not competitive in today’s

broadband market

̶ Average sold copper / DSL speeds of 25Mbps

▪ By comparison, primary competitors (Charter and

Comcast) offer up to 1-Gig

▪ CNSL’s legacy network not competitive in today’s

market

▪ Transitioning to fiber-based services quickly

Business Strategy

▪ Upgrade at least 1.8m2 or ~71% of 2.5m2 household

footprint to fiber

̶ $2.3bn cumulative capital investment project5

▪ Extend network in current markets

▪ Improve penetration

▪ Reposition and simplify service offerings

What We Do

▪ Provide business internet services over owned network

▪ Provide data transmission for regional, national and

wireless carriers

▪ Provide home internet and voice services over owned

network across a service territory that passes 2.5m2

households

̶ 66% of passings3

in Northern New England

(Maine, New Hampshire, Vermont)

̶ 34% of passings3 spread across 18 states4

Sources: Company filings, August Standalone Plan

Notes:

1. Per August Standalone Plan; excludes other and CAF/RDOF revenue

2. Excludes SMB passings

3. As of September 30, 2023

4. 18 states include Washington assets as the transaction has not yet closed

5. Calculated from 2021E through 2031E; additional capital investment may be required beyond 2031E; excludes commercial and carrier

capital investments; includes build / growth and success-based CapEx |

| 4.0x

4.5x

3.9x

4.2x

4.8x

5.5x 5.7x

6.2x

1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23

17

CapEx and EBITDA Underperformance Has Led to Higher Leverage

▪ Consolidated has spent a significant amount of capital on fiber investments but has not generated sufficient EBITDA

̶ 10 consecutive quarters of EBITDA decline; 4Q23 expected to be ~30% below 1Q22 level

▪ Bank net debt balance increased from ~$1.9bn in 1Q22 to ~$2.1bn expected at YE2023 while EBITDA missed target

̶ Revolver will be maxed out in the short-term

̶ Business plan developed to remain below 6.35x leverage cap leaves little margin for error in forecasting or execution

Bank Net Leverage Position1,2 (x) since 1Q22

Multiple Factors Are Driving Historically High Leverage…

Pre-amendment Covenant Threshold: 5.85x to 6.35x

Source: August Standalone Plan

Notes:

1. Based on bank net leverage ratio; debt balance for calculating leverage includes deferred debt issuance costs and excludes finance leases

2. Expected cost savings programs have been included for the LTM period ending 9/30/23 and 12/31/2023

Bank net

debt1

($m)

LTM adj.

EBITDA2

($m)

$1,944 $2,063 $1,646 $1,692 $1,772 $1,905 $2,024 $2,099

$484 $459 $425 $398 $370 $345 $357 $341 |

| $630

$231

$89

$11 $26

2022A 2023E 2024E 2025E 2026E

18

…Resulting in Significant Near-Term Liquidity Constraints

▪ The Company expects to operate with a narrow cash balance and limited liquidity through 2026 and beyond, fully utilizing its available cash

balance and drawing on its revolver to fund its growth plan

̶ Standalone plan is further complicated by strategic risks of cutting back on build plan and losing competitiveness in key markets

▪ Springing covenant on revolver, which reduces amount of capital available in revolver if leverage ratio is exceeded, will immediately restrict

access to a large portion of current liquidity if leverage ratio exceeds 6.35x (reflects pre-amendment level; 7.75x following October amendment)

̶ Revolver amendment will fall away and first lien leverage ratio will return to pre-amendment levels if $300m in new cash proceeds from

equity contributions are not received by August 1, 2025

▪ Cash on hand, including asset sale proceeds, has been fully depleted leaving a <$15m balance from 2023 through 2029 for a $3bn+ business

̶ Proceeds from historical asset sales (~$620m; ~$690m incl. WA) were reinvested in the business; asset sales lowered EBITDA by ~16%

Projected liquidity ($m)1

…Leaving Company with Minimal Access to Capital

Source: August Standalone Plan

Note:

1. Projected liquidity position assuming continued execution of fiber build-out; liquidity based on cash on hand and revolver availability |

| Liquidity

Incremental Fiber Passings

19

…Which Forced the Business into Liquidity Preservation Mode

Sources: August Standalone Plan, Illustrative Buyer Plan (Including Pre-Closing Capital)

Note:

1. Reflects Illustrative Buyer Plan (Including Pre-Closing Capital)

Illustrative Buyer Plan1

August Standalone Plan

Forced Revision of Build Plan Projected Liquidity – Illustrative Buyer Plan vs. Current Build Plan ($m)

▪ Company unable to build at competitively

desirable pace, as shown in the

‘Illustrative Buyer Plan’, due to capital

constraints

̶ Approximately 470k reduction in fiber

HP across 2024 – 2026

̶ Assumes Company is fully drawing

on, and in compliance with, its

revolver’s springing covenant

̶ Company’s liquidity concerns were

exacerbated by a deteriorating

financing and operating environment

that is substantially different from

when the plan was originally

developed

▪ Slowing the build cadence was the only

viable option for the Company to survive

as a standalone entity

$107

($209)

($405) ($467)

249 225 225 201

Total Liquidity

$231

$89 $11 $26

222 75 45 60

Total Liquidity

2023 2024 2025 2026 |

| 403

222

75

45

60

Historical average:

300k+ HP per year

2022A 2023E 2024E 2025E 2026E

1.2 1.3 1.4 1.4

1.5

1.7

1.9

0.3

0.6

1.0

1.3

1.5

1.7

1.9 1.9 1.9 1.9

2020A

2021A

2022A

2023E

2024E

2025E

2026E

2027E

2028E

2029E

20

…And Resulted in Irreversible Delays in Fiber Build Plan

Sources: August Standalone Plan, Illustrative Buyer Plan (Including Pre-Closing Capital)

Notes:

1. 29% calculated as 0.5m HP / 1.6m HP; 1.6m HP reflects CNSL’s multi-year fiber build plan launched in Q1 2021

2. Reflects Illustrative Buyer Plan (Including Pre-Closing Capital)

3. Reflects August Standalone Plan

▪ Target date for build completion pushed from 2026 to 2029

▪ Historical build rate of ~220 – ~400k homes per year reduced to 45

– 75k in the next three years (2024E through 2026E)

̶ Historical average (2021 through 2023) of ~320k

▪ 470k fewer homes built in 2024 – 2026 timeframe – more than 29%

of aggregate Company build plan delayed1

Incremental Fiber Passings2

(nearest 000s)

Illustrative vs. Revised Fiber Build Plan (in millions)

Illustrative Buyer Plan2

Revised Fiber Build Plan3 |

| 21

… Putting Long-Term Viability at Risk in a Highly Competitive Market

Announced Network Upgrades Underscore Strategic Urgency of Build Plan Competitive Risks for Consolidated

▪ Broadband sector evolving into a “three-player” market in

many parts of the country

̶ Fiber-equivalent speeds required to compete

effectively

̶ TelCo vs. CableCo vs. greenfield fiber provider

(“New Entrants”)

▪ Speed to market is imperative – those who are first with

fiber are best-positioned to obtain significant market

share; late entrants will be playing “catch-up”

̶ Late entrants have greater difficulty achieving

required penetration to make fiber investments

economical

▪ Consolidated’s business risk increases with liquidity

constraint

̶ Incumbency advantage lost by slowed build, given

long cycle from upfront fiber investment to cash flow

realization

̶ Creates greater risk to achieve projected penetration

levels at projected revenue per customer targets

30m+ Passings

By YE 2025

1.2m Passings

By YE 2026

10m Passings

By YE 2025

8-10m Passings

In the Next 4+ Years

~1.9m Passings1

By YE 20291

Extensive universe of

New Entrants with

purpose-built fiber

networks (i.e., greenfield

fiber providers) racing to

establish and build

share in markets served

by traditional TelCo’s

and CableCo’s

(~6m homes passed in

Actively the aggregate)

launching

DOCSIS 4.0

50m+ Homes &

Businesses

With multi-gig

speeds by 2025

6.5m+ Homes

Passed

By YE 2025

85% of Footprint

55m+ Homes

With 5Gpbs+ speeds

by YE 2025

3m+ Passings

In the Next 5 years

Traditional TelCo’s CableCo’s New Entrants

Cable is upgrading to multi-gig; once there, CNSL

will face greater challenges in winning customers

(as cable will have more competitive speeds)

Sources: company filings, New Street Research, Wall Street research, press releases, August Standalone Plan

Note:

1. Based on August Standalone Plan |

| $597 $589 $576 $542 $532 $516

2019A 2020A 2021A 2022A 2023E 2024E

Chart Title

$208 $212 $209

$185

$161 $140

2019A 2020A 2021A 2022A 2023E 2024E

Chart Title

$181 $171 $161 $143 $127 $120

2019A 2020A 2021A 2022A 2023E 2024E

Chart Title

Legacy Consumer DSL Business Quickly Unwinding ($m)

22

Declining Legacy Business Underscores Urgency of Transformation

Sources: Company filings, August Standalone Plan

Note:

1. Normalized for the sale of Kansas City and Ohio Assets

CAGR: (8%)

CAGR: (3%)

Legacy Consumer Voice Declines Continuing at Rapid Pace ($m)

Commercial & Carrier Revenue Turnaround Yet to Materialize ($m)

CAGR: (8%)

1 1

1 |

| 13%

20%

14%

24%

1-year Mark

Q3 22 Cohort

2-year Mark

Q3 21 Cohort

Chart Title

23

…Exacerbated by Challenges Fiber Conversion Continues to Face

Source: August Standalone Plan

Notes:

1. Cohort ready for sale (RFS) excludes certain multi-dwelling units (MDU’s) and multi-tenant units (MTU’s). In aggregate, across all of the

Company's fiber passings of 1,187,076, this exclusion is approximately 15%. Fiber penetrations by cohort represents all fiber connections

(consumer and business) as a percentage of RFS. 1-year mark (Q322 cohort) and 2-year mark (Q321 cohort) are cumulative. These

estimates are based upon the information available at this time and are subject to updates as additional information becomes available.

2. Cost / passing, net of CWIP and inventory

3. Cost to connect includes CPE, labor and drop

4. Reflects midpoint of full year 2023 guidance (as of February 28, 2023)

5. Reflects 2023E CapEx estimate per August Standalone Plan

▪ Significant increases to build costs given inflationary environment

▪ Need to accelerate new market penetration to meet target levels

▪ Increasing competition and limited capital requires difficult capital

allocation decisions

▪ Potential inability to pursue government subsidy opportunities (i.e.,

BEAD, state grants, etc.)

Fiber Penetration (%) Has Been Slower Than Expected

Fiber Build Costs ($) Have Been Increasing

~$435m 2023E CapEx

Guidance ~$495m

@ 2/28/20234 Current5

Actual vs. Targeted Fiber Broadband Penetration on Fiber

Passings by Cohort1

(%)

Cohort Penetration

Targets

Cost / Passing ~$695 2 ~$800

2021A 2023E

+7%

CAGR

+14%

% change

Cost to Connect ~$700 3 ~$850

@ Q4 2021 2023E

+10%

CAGR |

| $132

$10

$2

$36

$128

33% 3% 1% 8% 24%

2022A 2023E 2024E 2025E 2026E

24

The Result is an Optimistic Strategic Plan with Little Margin for Error

Source: August Standalone Plan

Note:

1. Illustrative EBITDA miss in respective period that would breach springing leverage covenant on revolver and immediately limit the amount that can be drawn on revolver

Covenant Headroom Very Tight Revolver is the Only Source of Incremental Near-Term Liquidity

EBITDA Miss1

($m) Limits Access to Revolver

% of Projected EBITDA1

▪ Asset sales proceeds have bee exhausted; the Company’s latest

asset sale (Washington) will not generate cash until 2024

▪ Asset securitization not yet available to Consolidated

▪ Lead time on capital commitments reduce operating flexibility if

EBITDA underperforms

Slight Variance of CapEx May Result in No Liquidity

% CapEx variance that results in $0 liquidity

2024E 2025E 2026E

25% 4% 9% |

| 40%

36%

50% 50.5%

32%

45%

25

Standalone Strategy Has Significant Downside Risk

Sources: August Standalone Plan, FactSet (as of December 29, 2023), Wall Street research

Notes:

1. Based on range of 2023E EBITDA margin estimates of Wall Street research analysts; includes Shenandoah Telecommunications

Company, Altice USA, Inc., Charter Communications, Inc., WideOpenWest, Inc. and Cable One, Inc.

2. Based on range of furthest reported period EBITDA margin estimates of Wall Street research analysts; Frontier Communications Parent,

Inc. margin range based on selected data points between 2029 through 2031; Lumen Technologies, Inc. margin range based on selected

data points between 2027 through 2030

3. Based on 2031E EBITDA margin of the August Standalone Plan

4. Per August Standalone Plan

5. Sensitivity analyses vs. August Standalone Plan

6. Valuation date as of June 30, 2023; enterprise value to equity value bridge based on balance sheet as of June 30, 2023 per CNSL

Management; FDSO of 118.5m as of October 11, 2023 per CNSL Management

7. Based on nine total values at PGR of 1.5% to 2.5% and WACC of 9.5% to 10.5%

Modest Misses to Management’s Plan Results in Expected Value Well Below $4.70 per Share and, in Many Cases, No Equity Value at All

Select Broadband Terminal Margin Comparables (%) Illustrative Terminal EBITDA Margin Sensitivity5,6

CableCo Avg.1

50.0% $5.29 44% 0%

45.0% $1.01 100% 33%

40.0% $0.00 100% 100%

% of DCF

data points7

below $0.00

Midpoint

DCF

Share price

% of DCF

data points7

below $4.70

2 2 3

EBITDA margin range:

High

Low

CNSL

2023E:

29%4

If CNSL can only achieve “Cable-like” margins (40%),

intrinsic value of equity likely to be worth $0.00

32% |

| 26

Following Wildcat’s Lead Would Be Disastrous For Shareholders |

| 27

▪ Wildcat’s wildly unrealistic demand for $14.00/share is, in reality, a demand for a 407% premium over the

unaffected stock price

̶ Wildcat’s implied calculation of $10.70 suffers from the same fatal errors and represents a similarly

unrealistic estimate of risk-adjusted value

▪ Wildcat’s call to further slow the fiber build would ease liquidity, but at a significant strategic cost

▪ Wildcat may dismiss the urgency of our liquidity constraints and inability to finance our build plan, but if this deal

is not approved, the market will not

̶ Consolidated’s ILEC and broadband peers (Lumen and Frontier) have traded down approximately (26%)

and (22%1

), respectively, since the initial offer was made on April 13, 20232

, underscoring the market’s

concern about the challenges Consolidated and its peers face

̶ Without the certainty of this $4.70 all-cash proposal, Consolidated’s share price would likely collapse below

the $2.76 unaffected price, destroying significant value for shareholders and jeopardizing the Company’s

prospects as a standalone business

▪ Wildcat’s core argument – that Frontier’s valuation demonstrates Consolidated is worth more – is a mirage: at

Frontier’s valuation multiple, Consolidated would have negative equity value

Sources: Wildcat Capital public statement, FactSet (as of December 29, 2023)

Notes:

1. Frontier share price return calculated from April 12, 2023 through October 16, 2023 (the day before Jana Partners publicly advocated for a sale of Frontier)

2. Share price returns calculated from April 12, 2023 (the unaffected date) through December 29, 2023

We Appreciate Wildcat’s Endorsement of Our Longer-Term Vision But

It Cannot Be Accomplished Without Capital We Do Not Have

Following Wildcat’s Lead Would Be Disastrous For Shareholders |

| 28

Sources: Wildcat Capital public statement, FactSet (as of December 29, 2023), company filings

Notes:

1. Assumes balance sheet as of June 30, 2023 as per CNSL Management; FDSO of 118.5m as of October 11, 2023 per

CNSL Management

2. Unaffected date is April 12, 2023, the last trading day prior to public announcement of the non-binding proposal

3. PF for divestures of Ohio and Kansas City operations and wireless partnerships; LTM Jun-23 financials adjusted for PF impact of WA divestiture per

CNSL Management

4. Includes all-cash going-private transactions of U.S. companies with enterprise values of greater than $250m led by shareholders with ownership

between 15% and 50% since January 1, 2013

5. Share price return calculated from April 12, 2023 (the unaffected date) through December 29, 2023

Wildcat Cherry Picks Data Points to Misdirect Shareholders

Wildcat’s

Misleading Claims What the Facts Show

Wildcat’s valuation of $14.00 per share ($4.2bn implied EV1

) is unrealistically high, obscuring the real issues

▪ Offer price of $4.70 is an attractive and compelling price for CNSL shareholders given the Company’s near-term

liquidity constraints – the risk-adjusted price shifts massive risk to Searchlight and BCI

▪ Wildcat’s valuation would reflect a 407% stock price premium to the unaffected price2 or 13.1x LTM3 EBITDA while

the highest quartile of comparable benchmarks is closer to an 80% premium for take-private transactions4

▪ 13.1x LTM3 EBITDA multiple would reflect more than twice the average multiple of historical LEC transactions

▪ CNSL’s offer price reflects a massive stock price premium +70% over its peers and competitors, with the next

closest peer / competitor stock return at +8%5

(Shentel) / +13%5

(Charter)

▪ Wildcat’s valuation analysis is predicated on simplistic, high-level extrapolation from Consolidated’s and other

companies’ expected performance and other unwarranted assumptions – none of which has been proven today

Intrinsic Enterprise

Value is Nearly

30% Above

Proposed

Transaction Value

Myth #1:

Voting Down this Deal Would Be Disastrous For Shareholders |

| Wildcat’s

Misleading Claims

Sources: Wildcat Capital public statement, company filings 29

Wildcat’s Analysis of Build Cost Financing is Misinformed

What the Facts Show

CNSL does not have any material cash remaining, forcing it to trade fiber development priorities against

funding constraints in a revised plan that offers minimal cash cushion

▪ Standalone CNSL has neither sufficient capital nor access to commercially agreeable alternative sources of capital

to fund its fiber build at its original target build pace

̶ Net proceeds from the Washington asset sale are nominal compared to the CapEx needs of the business

▪ CNSL’s cash burn has also contributed to a growing net debt balance and increased risk of breaching its revolver

covenant

̶ Underperformance vs. the August Standalone Plan creates significant credit risk in the business

▪ Government-subsidized BEAD program has yet to allocate capital amongst operators within the industry

̶ Cost to pass for BEAD opportunities is expected to be high while funding likely requires a letter of credit or

other security, as well as matching funds (a recently anticipated use of cash)

▪ Without sufficient capital, CNSL cannot meaningfully expand its network at the rate required to remain competitive

▪ Forced to slow its build, CNSL is still years away from a mature fiber-based network that achieves its targeted

coverage of ~71% and in which existing investments have had the 5+ years necessary to ramp up to a targeted

penetration of 40%

̶ Until Consolidated reaches this operating state (now expected to be 2029 or later), the cash flow from its

existing network upgrades will continue to underperform against the Company’s previous expectations

̶ If the Company’s conversion timeline is further extended, the risk of competition in existing markets will

increase while churn on copper passings (loss of existing copper customers) may also increase

CNSL has Liquidity

Available to

Accelerate its Build

Plan

Myth #2:

Voting Down this Deal Would Be Disastrous For Shareholders (cont’d) |

| 30

Sources: Wildcat Capital public statement, company filings, Fitch

Note:

1. Fiber Gig+ Capable (on fiber passings) consumer broadband penetration % as of Q3 2023

2. Per August Standalone Plan

Wildcat Misleadingly Compares a Specific, Mature Market in Frontier’s Network to CNSL’s Entire Network

What the Facts Show

Recent securitization financing of Frontier is not relevant to Consolidated’s valuation

▪ Frontier’s securitized assets in its greater Dallas market are not comparable to CNSL

̶ The assets securitized by Frontier represent only a fraction of the company’s asset base / business and are

not comparable to Consolidated’s business

̶ Frontier’s securitized market is a mature fiber-based market that has reached full penetration economics – it is

46% penetrated (vs. CNSL’s current penetration of 15%1

), has an EBITDA margin in the range of ~60% (vs.

CNSL’s estimated 2023E EBITDA of 29%2

) and has had ARPU growth of 3% or better in last 5 years

̶ The network also has a higher fiber coverage percentage of ~78% vs. CNSL’s target of ~71%

▪ Securitizing assets may be possible for CNSL in the future, but is unlikely to materially impact the risk-adjusted

valuation

̶ CNSL’s fiber-based network is less than 3 years old and is in the early innings of achieving its long-term

targets

̶ The process is lengthy, costly and complex as the Company will need to track customer-level revenue; it will

also require significant attention from the management team to execute on, which may add an additional layer

of stress on business performance

̶ Select markets may go through the process and may not be able to be securitized

̶ Even if securitization was a guaranteed alternative, it will not provide CNSL with incremental capital in 2024

and likely will not provide the capital necessary for the Company in 2025 either, the most critical build years for

the business going forward

Recent Financing

Market

Developments

Support Higher

Enterprise Value

Myth #3:

Voting Down this Deal Would Be Disastrous For Shareholders (cont’d)

Wildcat’s

Misleading Claims |

| 31

Shareholders Should Vote to Approve the Sale to Searchlight

✓The offer is compelling:

o All-cash consideration at a 70% premium to the unaffected price

o Significantly higher than public and take-private precedent transactions

o Exceeds analysts’ price targets prior to unaffected date

✓The process was thorough:

o Special Committee met 35+ times over a six-month period

o Examined multiple strategic alternatives before settling on this transaction

o Successfully negotiated a 17.5% increase in price as peer shares declined

✓The transaction transfers all liquidity, financing and execution risk to the buyers

Consolidated’s Board of Directors recommends shareholders

✓Vote “FOR” the Transaction

Shareholders with questions or who require assistance voting their shares should contact Consolidated’s proxy solicitor:

Morrow Sodali LLC

430 Park Avenue, 14th Floor

New York, NY 10022

Shareholders may call toll-free: (800) 662-5200 or +1 (203) 658-9400 (international)

Email: CNSL@info.morrowsodali.com |

| 32

Appendix |

| 33

Special Committee has Extensive Sector Knowledge and M&A Experience

Robert J. Currey

Chairman, Independent Director

▪ Former Director, CEO and President of

Consolidated Communications

▪ Former Vice Chairman of RCN Corporation

▪ Former President and CEO of 21st Century

Telecom Group

▪ Former Director and Group President of

Telecommunications Services of McLeodUSA

Thomas A. Gerke

Independent Director

▪ Board Member of MGP Ingredients, Inc.

▪ Former General Counsel and Chief

Administrative Officer of H&R Block

▪ Former Executive Vice President, General

Counsel and Secretary of YRC Worldwide

▪ Former Executive Vice Chairman of CenturyLink

▪ Former President and CEO of Embarq

Roger H. Moore

Independent Director

▪ Board Member of Verisign, Inc.

▪ Former President and CEO of Illuminet

Holdings, Inc., a provider of network, database

and billings services to the communications

industry

▪ Former President, CEO and Board Member of

VINA Technologies, Inc., a telecommunications

equipment company

Maribeth S. Rahe

Independent Director

▪ President and CEO of Fort Washington

Investment Advisors, Inc.

▪ Board Member of First Financial Bancorp and

First Financial Bank

▪ Former President, Board Member and Vice

Chair of U.S. Trust Company of New York

Source: Company website |

| 34

Several Key Factors Constrain Consolidated’s Strategic Flexibility

▪ Searchlight has certain consent rights over debt incurrence and equity issuances; the Special Committee, when considering

the alternatives, believed that Searchlight would be unlikely to approve investments (such as a capital raise or capital infusion)

that would dilute their equity stake without a substantial and guaranteed premium to its investment

▪ Searchlight publicly stated it would not vote in favor of any alternative sale, merger or similar transaction involving the

Company

Searchlight Consent

Rights / Position on

Alternative

Transactions

▪ New equity would be at a material discount and highly dilutive to current shareholders

▪ Challenging interest rate environment and leverage position

̶ Raising additional debt will likely risk access to undrawn revolver

̶ Company has increased debt carrying costs in light of higher interest rates

Cost of New Capital

▪ Debt financing environment limits lenders’ willingness to commit capital at attractive rates

̶ Often complex and expensive options that are treated as a “last resort” to avoid bankruptcy

Market Availability

of Debt Financing

▪ Highly levered capital structure limits opportunity to pursue more aggressive growth strategy and ability to raise additional

debt financing

▪ Searchlight will be able to retain the Company’s existing capital structure; which other buyers cannot, creating a large cost /

quantum of debt advantage for Searchlight

▪ Current leverage has minimal cushion; if covenant is exceeded, Company loses access to portion of undrawn revolver

Capital Structure

Special Committee Considered These Key Structural Factors in Their Review of Feasible Strategic Alternatives |

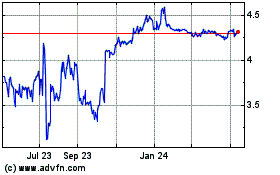

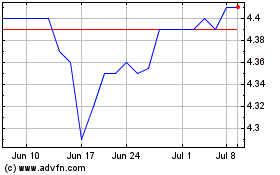

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Apr 2024 to May 2024

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From May 2023 to May 2024