First Quarter 2021

Highlights

- Net sales increased 10 percent to $625.6 million, compared

to first quarter 2020.

- Operating income of $70.5 million, or 11.3 percent of net

sales, compared to first quarter 2020 operating loss of $2.0

million, or (0.3) percent of net sales.

- Diluted earnings per share of $0.84, compared to break even

diluted earnings per share in first quarter 2020.

- Exited the quarter with $874.6 million in cash and

short-term investments and no borrowings.

- The Company repurchased $11.2 million of common stock during

the quarter.

- On April 23, 2021, the Board of Directors approved a regular

quarterly dividend of $0.26 per share.

Full Year 2021 Financial

Outlook

The following forward-looking statements reflect our

expectations as of April 29, 2021 and are subject to significant

risks and business uncertainties, including those factors described

under “Forward-Looking Statements” below. Additional disclosures

and financial outlook details can be found in the Full Year 2021

Financial Outlook section below and the CFO Commentary and

Financial Review presentation.

- Net sales of $3.04 to $3.08 billion, representing net sales

growth of 21.5 to 23.0 percent compared to 2020.

- Operating income of $347 to $369 million, representing

operating margin of 11.4 to 12.0 percent.

- Diluted earnings per share of $4.05 to $4.30.

Columbia Sportswear Company (NASDAQ: COLM, the "Company"), a

leading innovator in outdoor, active and everyday lifestyle

apparel, footwear, accessories and equipment products, today

announced first quarter 2021 financial results for the period ended

March 31, 2021.

Chairman, President and Chief Executive Officer Tim Boyle

commented, "I’m pleased to report the pace of fundamental recovery

exceeded our expectations in the first quarter, resulting in a

return to net sales growth and financial results that were stronger

than we anticipated. Business momentum was led by our

direct-to-consumer e-commerce business which grew 35 percent

year-over-year, reaching 20 percent of our total net sales mix. In

our wholesale business, we experienced a strong finish to the Fall

2020 sales season as well as excellent early season sell-through of

our Spring 2021 assortment. Consumer demand is high and retail

inventories are lean, resulting in a favorable full price selling

environment. I’d like to thank our operations and distribution

center teams that did an amazing job mitigating industry-wide

supply chain disruptions and enabling us to deliver these results

today.

“Based on first quarter results and visibility provided by early

Spring 2021 sell-through, our Fall 2021 order book and business

fundamentals, we are increasing our full year financial outlook.

I’m encouraged by the strong start to the year, but mindful that we

must continue to carefully navigate operational challenges and

quickly adapt to changing business conditions and ongoing pandemic

related disruptions.

“Our fortress balance sheet remains strong, with cash and

short-term investments totaling $875 million with no bank

borrowings at quarter end. We are committed to driving sustainable

and profitable long-term growth and investing in our strategic

priorities to:

- drive brand awareness and sales growth through increased,

focused demand creation investments;

- enhance consumer experience and digital capabilities in all our

channels and geographies;

- expand and improve global direct-to-consumer operations with

supporting processes and systems; and

- invest in our people and optimize our organization across our

portfolio of brands."

CFO's Commentary and Financial Review

Presentation Available Online

For a detailed review of the Company's first quarter 2021

financial results and additional updates relating to the COVID-19

pandemic, please refer to the CFO Commentary and Financial Review

presentation furnished to the Securities and Exchange Commission

(the "SEC") on a Current Report on Form 8-K and published on the

Investor Relations section of the Company's website at http://investor.columbia.com/results.cfm at

approximately 4:15 p.m. ET today. Analysts and investors are

encouraged to review this commentary prior to participating in our

conference call.

COVID-19 Update

The Company's top priority throughout this pandemic remains to

protect the health and safety of our employees, their families, our

customers and our communities. While there were isolated temporary

store closures resulting from local regulations or safety concerns,

the majority of the Company's owned stores remained open throughout

first quarter 2021. Overall brick & mortar store traffic trends

vary by region but remain below prior year levels. First quarter

2021 results include the impact of port congestion and logistics

constraints that resulted in later timing of Spring 2021 inventory

receipts and deliveries. Please refer to the CFO Commentary and

Financial Review presentation for a detailed review of COVID-19

pandemic related issues and our responses.

First Quarter 2021 Financial

Results

(All comparisons are between first quarter 2021 and first

quarter 2020, unless otherwise noted.)

Net sales increased 10 percent to $625.6 million from

$568.2 million for the comparable period in 2020. Business momentum

was led by direct-to-consumer ("DTC") e-commerce net sales growth

as well as better than planned sequential improvement in DTC brick

& mortar trends.

Gross margin expanded 360 basis points to 51.4 percent of

net sales from 47.8 percent of net sales for the comparable period

in 2020. Gross margin expansion was primarily driven by decreased

reserve provisions related to less excess inventory, lower DTC

promotional levels and favorable channel and region sales mix.

SG&A expenses decreased 8 percent to $254.4 million,

or 40.7 percent of net sales, from $276.8 million, or 48.7 percent

of net sales, for the comparable period in 2020. The decrease in

SG&A expenses primarily reflects a reduction in bad debt

expense driven by a healthier wholesale customer base, partially

offset by higher incentive and personnel expenses. The reduction in

bad debt expense was driven by incremental COVID-related bad debt

reserve provisions in first quarter 2020, compared to a reduction

of bad debt reserves in first quarter 2021.

Operating income of $70.5 million, or 11.3 percent of net

sales, compared to an operating loss of $2.0 million, or (0.3)

percent of net sales, for the comparable period in 2020.

Net income of $55.9 million, or $0.84 per diluted share,

compared to net income of $0.2 million, or break even diluted

earnings per share, for the comparable period in 2020.

Balance Sheet as of March 31,

2021

Cash, cash equivalents and short-term investments totaled $874.6

million, compared to $706.9 million at March 31, 2020.

The Company had no borrowings, compared to short-term borrowings

of $174.4 million at March 31, 2020.

Inventories decreased 9 percent to $525.7 million, compared to

$577.1 million at March 31, 2020. The reduction in inventory was

primarily driven by lower Spring 2021 inventory purchases, a

reduction of excess inventory and delayed receipts of Spring 2021

inventory. Inventory at quarter-end primarily consisted of current

and future season product. Aged inventories represent a manageable

portion of our total inventory mix.

Cash Flow for the Three Months Ended

March 31, 2021

Net cash flow from operating activities was $110.9 million,

compared to net cash flow from operating activities of $12.8

million for the same period in 2020.

Capital expenditures totaled $3.9 million, compared to $9.5

million for the same period in 2020.

Share Repurchases for the Three Months

Ended March 31, 2021

In first quarter 2021, the Company repurchased 108,987 shares of

common stock for an aggregate of $11.2 million, or an average price

per share of $102.98.

At March 31, 2021, $471.0 million remained available under our

current stock repurchase authorization, which does not obligate the

Company to acquire any specific number of shares or to acquire

shares over any specified period of time.

Quarterly Cash Dividend

The Board of Directors approved a regular quarterly cash

dividend of $0.26 per share, payable on May 27, 2021 to

shareholders of record on May 13, 2021.

Full Year 2021 Financial

Outlook

(Additional financial outlook details can be found in the CFO

Commentary and Financial Review presentation.)

The Company's 2021 Financial Outlook is forward-looking in

nature, and the following forward-looking statements reflect our

expectations as of April 29, 2021 and are subject to significant

risks and business uncertainties, including those factors described

under “Forward-Looking Statements” below. These risks and

uncertainties limit our ability to accurately forecast results.

This outlook reflects our estimates as of April 29, 2021 regarding

the impact on our operations of the COVID-19 pandemic, economic

conditions, supply chain and logistics capacity constraints, and

changes in consumer behavior and confidence, as well as

geopolitical tensions. This outlook assumes a sequential recovery

in brick & mortar retail traffic and sales throughout 2021.

However, it is not possible to determine the ultimate impact on our

operations for 2021, or whether other currently unanticipated

direct or indirect consequences of the pandemic are reasonably

likely to materially affect our operations. Projections are

predicated on normal seasonal weather globally.

Net sales are expected to increase 21.5 to 23.0 percent

(prior 18 to 20 percent) to $3.04 to $3.08 billion (prior $2.95 to

$3.00 billion) from $2.50 billion in 2020.

Gross margin is expected to improve 110 to 130 basis

points to 50.0 to 50.2 percent of net sales (prior approximately 50

percent) from 48.9 percent of net sales in 2020.

SG&A expenses are expected to increase at a slower

rate than net sales growth. SG&A expenses as a percent of net

sales is expected to be 38.7 to 39.1 percent (prior 39.2 to 39.7

percent), compared to SG&A expenses as a percent of net sales

of 43.9 percent in 2020. Demand creation as a percent of net sales

is anticipated to be 6.0 percent in 2021, compared to 5.7 percent

in 2020.

Operating income is expected to be $347 to $369 million

(prior $320 to $346 million), resulting in operating margin of 11.4

to 12.0 percent (prior 10.8 to 11.5 percent) compared to operating

margin of 5.5 percent in 2020.

Effective income tax rate is expected to be approximately

22 percent. The effective income tax rate may be affected by

unanticipated impacts from changes in international, federal or

state tax policies, changes in the Company's geographic mix of

pre-tax income, other discrete events, as well as differences from

our estimate of the tax benefits associated with employee equity

awards and our estimate of the tax impact of various tax

initiatives.

Net income is expected to be $271 to $288 million (prior

$250 to $270 million), resulting in diluted earnings per share of

$4.05 to $4.30 (prior $3.75 to $4.05).

Foreign Currency

Foreign currency translation is anticipated to increase 2021 net

sales growth by approximately 130 basis points.

Foreign currency is expected to have essentially no impact on

earnings as favorable foreign currency translation impacts are

anticipated to be offset by foreign currency transactional effects

from hedging of production.

Balance Sheet and Cash Flows

Operating cash flow is expected to be $250 to $270

million (prior $300 to $320 million). The lower operating cash flow

forecast for 2021 is primarily driven by changes to projected

year-end inventory. This change in outlook is based on the

expectation of receiving Spring 2022 inventory earlier than

previously projected.

Capital expenditures are planned to be $60 to $80

million.

First Half 2021 Commentary

Our annual net sales are weighted more heavily toward the

Fall/Winter season, while operating expenses are more equally

distributed throughout the year, resulting in a highly seasonal net

sales and profitability pattern weighted toward the second half of

the year.

Based on first quarter 2021 results, advance wholesale orders

for the Spring 2021 season and plans for growth in our global DTC

businesses as we anniversary prior year temporary store closures,

we believe mid to high-20 percent first half year-over-year net

sales growth is achievable (prior high-teens percent to low-20

percent). In second quarter 2021, year-over-year net sales growth

by channel will be impacted by the anniversary of prior year

temporary brick & mortar store closures as well as elevated DTC

e-commerce net sales penetration levels as demand shifted online

when consumers were unable shop in store.

Please note the second quarter is typically our lowest volume

sales quarter and small changes in the timing of product shipments

and expenses can have a material impact on reported results.

Historically, second quarter profitability has been challenging

given our fixed cost structure, resulting in the Company reporting

a second quarter earnings loss in most years.

Conference Call

The Company will hold its first quarter 2021 conference call at

5:00 p.m. ET today. Dial (877) 407-9205 to participate. The call

will also be webcast live on the Investor Relations section of the

Company's website at http://investor.columbia.com.

Second Quarter 2021 Reporting

Date

Columbia Sportswear Company plans to report second quarter 2021

financial results on Monday, August 2, 2021 at approximately 4:00

p.m. ET.

Supplemental Financial

Information

Since Columbia Sportswear Company is a global company, the

comparability of its operating results reported in United States

dollars is affected by foreign currency exchange rate fluctuations

because the underlying currencies in which it transacts change in

value over time compared to the United States dollar. To supplement

financial information reported in accordance with GAAP, the Company

discloses constant-currency net sales information, which is a

non-GAAP financial measure, to provide a framework to assess how

the business performed excluding the effects of changes in the

exchange rates used to translate net sales generated in foreign

currencies into United States dollars. The Company calculates

constant-currency net sales by translating net sales in foreign

currencies for the current period into United States dollars at the

average exchange rates that were in effect during the comparable

period of the prior year. Management believes that this non-GAAP

financial measure reflects an additional and useful way of viewing

an aspect of our operations that, when viewed in conjunction with

our GAAP results, provides a more comprehensive understanding of

our business and operations. In particular, investors may find the

non-GAAP financial measure useful by reviewing our net sales

results without the volatility in foreign currency exchange rates.

This non-GAAP financial measure also facilitates management's

internal comparisons to our historical net sales results and

comparisons to competitors' net sales results.

The non-GAAP financial measures should be viewed in addition to,

and not in lieu of or superior to, our financial measures

calculated in accordance with GAAP. The Company provides a

reconciliation of non-GAAP measures to the most directly comparable

financial measure calculated in accordance with GAAP. See the

"Reconciliation of GAAP to Non-GAAP Financial Measures" table

included herein. The non-GAAP financial measures presented may not

be comparable to similarly titled measures reported by other

companies.

Forward-Looking

Statements

This document contains forward-looking statements within the

meaning of the federal securities laws, including statements

regarding the Company’s expectations, anticipations or beliefs

about full year 2021 net sales, gross margin, SG&A expense,

demand creation spend, operating income, effective income tax rate,

net income, diluted earnings per share, foreign currency

translation, inventory, cash flows, and capital expenditures, as

well as growth of its global DTC businesses, and first half 2021

net sales growth. Forward-looking statements often use words such

as "will," "anticipate," "estimate," "expect," "should," "may" and

other words and terms of similar meaning or reference future dates.

The Company's expectations, beliefs and projections are expressed

in good faith and are believed to have a reasonable basis; however,

each forward-looking statement involves a number of risks and

uncertainties, including those set forth in this document, those

described in the Company's Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q under the heading "Risk Factors," and those

that have been or may be described in other reports filed by the

Company, including reports on Form 8-K. Potential risks and

uncertainties include those relating to the impact of the COVID-19

pandemic on our operations, which is highly dependent on numerous

factors that we may not be able to predict or control, including:

the duration and scope of the COVID-19 pandemic, including any

recurrence due to variants; actions that may be taken to contain

the pandemic or to treat its impact, including lock-downs and the

speed of the vaccination roll-out; economic slowdowns that have and

may continue to result from the pandemic; workforce staffing and

productivity; our ability to continue operations in affected areas;

supply chain and logistics capacity constraints; and consumer

demand and spending patterns, as well as the effects on suppliers,

creditors, and wholesale customers, all of which are uncertain. The

Company cautions that forward-looking statements are inherently

less reliable than historical information. The Company does not

undertake any duty to update any of the forward-looking statements

after the date of this document to conform them to actual results

or to reflect changes in events, circumstances or its expectations.

New factors emerge from time to time and it is not possible for the

Company to predict or assess the effects of all such factors or the

extent to which any factor, or combination of factors, may cause

results to differ materially from those contained in any

forward-looking statement.

About Columbia Sportswear

Company

Columbia Sportswear Company connects active people with their

passions through its portfolio of well-known brands, making it a

global leader in outdoor, active and everyday lifestyle apparel,

footwear, accessories, and equipment products. Founded in 1938 in

Portland, Oregon, the Company's brands are sold in approximately 90

countries. In addition to the Columbia® brand, Columbia Sportswear

Company also owns the Mountain Hard Wear®, SOREL® and prAna®

brands. To learn more, please visit the Company's websites at

www.columbia.com, www.mountainhardwear.com, www.sorel.com, and www.prana.com.

COLUMBIA SPORTSWEAR

COMPANY

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

March 31,

(in thousands)

2021

2020

ASSETS

Current Assets:

Cash and cash equivalents

$

873,641

$

671,108

Short-term investments

920

35,828

Accounts receivable, net

338,787

312,951

Inventories, net

525,704

577,124

Prepaid expenses and other current

assets

66,173

113,726

Total current assets

1,805,225

1,710,737

Property, plant, and equipment, net

300,063

332,997

Operating lease right-of-use assets

363,652

387,984

Intangible assets, net

103,146

122,850

Goodwill

68,594

68,594

Deferred income taxes

86,825

73,827

Other non-current assets

66,401

54,498

Total assets

$

2,793,906

$

2,751,487

LIABILITIES AND EQUITY

Current Liabilities:

Short-term borrowings

$

—

$

174,443

Accounts payable

165,555

150,971

Accrued liabilities

224,674

214,044

Operating lease liabilities

81,308

64,456

Income taxes payable

3,431

6,441

Total current liabilities

474,968

610,355

Non-current operating lease

liabilities

356,766

364,300

Income taxes payable

50,285

48,320

Deferred income taxes

4,406

8,944

Other long-term liabilities

38,671

22,977

Total liabilities

925,096

1,054,896

Shareholders' equity

1,868,810

1,696,591

Total liabilities and shareholders'

equity

$

2,793,906

$

2,751,487

COLUMBIA SPORTSWEAR

COMPANY

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended March

31,

(In thousands, except per share

amounts)

2021

2020

Net sales

$

625,606

$

568,228

Cost of sales

304,204

296,514

Gross profit

321,402

271,714

51.4

%

47.8

%

Selling, general and administrative

expenses

254,389

276,820

Net licensing income

3,467

3,119

Income (loss) from operations

70,480

(1,987

)

Interest income, net

278

1,813

Other non-operating income (expense),

net

(304

)

1,738

Income before income tax

70,454

1,564

Income tax expense

(14,554

)

(1,351

)

Net income

$

55,900

$

213

Earnings per share:

Basic

$

0.84

$

0.00

Diluted

$

0.84

$

0.00

Weighted average shares outstanding:

Basic

66,363

66,970

Diluted

66,885

67,412

COLUMBIA SPORTSWEAR

COMPANY

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended March

31,

(In thousands)

2021

2020

Cash flows from operating

activities:

Net income

55,900

213

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, amortization and non-cash

lease expense

30,459

32,994

Provision for uncollectible accounts

receivable

(7,849

)

19,229

Loss on disposal or impairment of

property, plant and equipment

131

2,138

Deferred income taxes

4,577

3,802

Stock-based compensation

4,874

3,675

Changes in operating assets and

liabilities:

Accounts receivable

117,818

150,687

Inventories

25,117

23,510

Prepaid expenses and other current

assets

(11,150

)

(11,922

)

Other assets

51

(5,873

)

Accounts payable

(41,194

)

(100,402

)

Accrued liabilities

(27,253

)

(77,861

)

Income taxes payable

(19,291

)

(9,429

)

Operating lease assets and liabilities

(21,273

)

(16,807

)

Other liabilities

(18

)

(1,200

)

Net cash provided by operating

activities

110,899

12,754

Cash flows from investing

activities:

Purchases of short-term investments

—

(35,044

)

Sales and maturities of short-term

investments

1,054

1,631

Capital expenditures

(3,896

)

(9,452

)

Net cash used in investing activities

(2,842

)

(42,865

)

Cash flows from financing

activities:

Proceeds from credit facilities

7,753

175,719

Repayments on credit facilities

(7,532

)

(1,054

)

Proceeds from issuance of common stock

related to stock-based compensation

13,772

1,096

Tax payments related to stock-based

compensation

(5,358

)

(4,207

)

Repurchase of common stock

(11,223

)

(132,889

)

Cash dividends paid

(17,285

)

(17,195

)

Net cash provided by (used in) financing

activities

(19,873

)

21,470

Net effect of exchange rate changes on

cash

(5,268

)

(6,260

)

Net increase (decrease) in cash and

cash equivalents

82,916

(14,901

)

Cash and cash equivalents, beginning of

period

790,725

686,009

Cash and cash equivalents, end of

period

$

873,641

$

671,108

Supplemental disclosures of non-cash

investing and financing activities:

Property, plant and equipment acquired

through increase in liabilities

$

2,832

$

2,503

COLUMBIA SPORTSWEAR

COMPANY

Reconciliation of GAAP to

Non-GAAP Financial Measures

Net Sales Growth -

Constant-currency Basis

(Unaudited)

Three Months Ended March

31,

Reported Net Sales

Adjust for Foreign

Currency

Constant-currency Net

Sales

Reported Net Sales

Reported Net Sales

Constant-currency Net

Sales

(In millions, except percentage

changes)

2021

Translation

2021(1)

2020

% Change

% Change(1)

Geographical Net Sales:

United States

$

408.6

$

—

$

408.6

$

375.9

9

%

9

%

Latin America and Asia Pacific

112.0

(6.3

)

105.7

102.6

9

%

3

%

Europe, Middle East and Africa

70.8

(5.1

)

65.7

55.8

27

%

18

%

Canada

34.2

(1.4

)

32.8

33.9

1

%

(3

)%

Total

$

625.6

$

(12.8

)

$

612.8

$

568.2

10

%

8

%

Brand Net Sales:

Columbia

$

527.4

$

(11.9

)

$

515.5

$

471.7

12

%

9

%

SOREL

46.3

(0.6

)

45.7

38.7

20

%

18

%

prAna

31.5

—

31.5

36.5

(14

)%

(14

)%

Mountain Hardwear

20.4

(0.3

)

20.1

21.3

(4

)%

(6

)%

Total

$

625.6

$

(12.8

)

$

612.8

$

568.2

10

%

8

%

Product Category Net Sales:

Apparel, Accessories and Equipment

$

468.9

$

(8.7

)

$

460.2

$

452.2

4

%

2

%

Footwear

156.7

(4.1

)

152.6

116.0

35

%

32

%

Total

$

625.6

$

(12.8

)

$

612.8

$

568.2

10

%

8

%

Channel Net Sales:

Wholesale

$

335.4

$

(7.8

)

$

327.6

$

325.9

3

%

1

%

DTC

290.2

(5.0

)

285.2

242.3

20

%

18

%

Total

$

625.6

$

(12.8

)

$

612.8

$

568.2

10

%

8

%

(1) Constant-currency net sales information is a non-GAAP

financial measure that excludes the effect of changes in foreign

currency exchange rates against the United States dollar between

comparable reporting periods. The Company calculates

constant-currency net sales by translating net sales in foreign

currencies for the current period into United States dollars at the

average exchange rates that were in effect during the comparable

period of the prior year.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210429005978/en/

Andrew Burns, CFA Director of Investor Relations and Competitive

Intelligence Columbia Sportswear Company (503) 985-4112

aburns@columbia.com

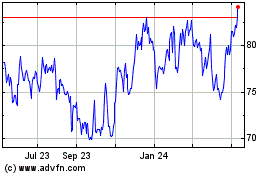

Columbia Sportswear (NASDAQ:COLM)

Historical Stock Chart

From Nov 2024 to Dec 2024

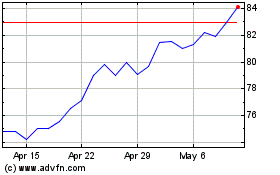

Columbia Sportswear (NASDAQ:COLM)

Historical Stock Chart

From Dec 2023 to Dec 2024