Bitcoin faces a retreat after Wall Street opening

Bitcoin (COIN:BTCUSD), with a price of $36,407 in the last 24

hours, experienced a significant drop after the opening of Wall

Street on November 16, repeating past price movement trends. There

was a reduction of over $1,000 in a day, following previous

patterns of lows and sell-offs. Market conditions and weakness in

the US dollar are influencing the outlook, with the US Dollar Index

(DXY) falling to near its lowest levels since September. According

to Fernando Pereira from Bitget, current conditions favor a

continued appreciation of Bitcoin in 2024. “The CPI, one of the

key data related to the dollar’s inflation, showed that a deflation

of the currency is happening. The market viewed this positively,

and a lot of money flowed into the equity market, which pushed some

exchanges worldwide close to their all-time highs. This is

important because it removes the fear that investors had of higher

interest rates. The scenario for Bitcoin to continue rising in

2024, I would say, is one of the best possible within the predicted

conditions,” Pereira said in a message to ADVFN.

Dogecoin prepares for a space journey with Astrobotic

A physical Dogecoin token is scheduled to be sent to the moon by

the company Astrobotic of Pittsburgh, as announced by the Dogecoin

developers (COIN:DOGEUSD). Astrobotic plans to launch Dogecoin into

space aboard the Vulcan Centaur Rocket by ULA, on the Peregrine

Mission One (PM1) mission on December 23, 2023, a project funded by

the Dogecoin community in 2015. In addition to Dogecoin, the

mission will carry a Bitcoin token (COIN:BTCUSD) and a copy of the

Bitcoin Genesis Block, at the request of BitMEX and Bitcoin

Magazine, respectively. This space launch follows a previous SpaceX

mission, entirely funded in DOGE, which was postponed to January

2024.

Jupiter announces airdrop to reward early users

Jupiter, a prominent decentralized exchange aggregator on

Solana, has announced a retrospective airdrop to reward its early

users. This program will distribute four billion Jupiter tokens,

representing 40% of the total in circulation, in four phases. The

first phase, starting next week, will allocate one billion tokens

to users who traded a minimum of $1,000 on the protocol, benefiting

approximately 955,000 wallets. The airdrop will feature different

reward levels based on users’ swap volume and will include new

participants in the future. The Jupiter platform, which

consolidates liquidity from multiple Solana DEXs, recorded a

notable volume of almost $1 billion in October 2021.

BlackRock moves forward with Ethereum ETF to expand cryptocurrency

access

BlackRock (NYSE:BLK), recognized as the world’s largest asset

manager, has filed an S-1 form with the U.S. Securities and

Exchange Commission (SEC) for its iShares Ethereum Trust, an

exchange-traded fund (ETF) based on Ether (COIN:ETHUSD). This

initiative comes after the recent trademark registration and

Nasdaq’s request for approval of a spot Bitcoin ETF. BlackRock’s

moves reflect growing interest in cryptocurrency ETFs, such as the

anticipated spot Bitcoin ETF, and indicate a change in CEO Larry

Fink’s perception of the sector, now expressing support for

cryptocurrencies.

SEC postpones decisions on conversion of Hashdex and Grayscale ETFs

The U.S. Securities and Exchange Commission (SEC) has delayed

its decision on Hashdex’s proposal to convert its bitcoin futures

exchange-traded fund (ETF) into a spot ETF. Simultaneously, the SEC

is also postponing the verdict on Grayscale’s request to launch a

new Ethereum futures-based ETF. Both companies, with Hashdex aiming

to convert its bitcoin futures ETF and Grayscale, a subsidiary of

the Digital Currency Group, proposing an Ethereum futures ETF, face

delays following the extension of the initial decision deadline,

which was November 17, as indicated in recent SEC filings.

Binance inaugurates exclusive exchange in Thailand through

strategic partnership

Binance, the cryptocurrency giant, has announced the launch of a

new exchange in Thailand, initially available by invitation only

and expected to open to the general public next year. This

initiative is a partnership with Gulf Innova, a subsidiary of Gulf

Energy Development Pcl, led by billionaire Sarath Ratanavadi. The

Gulf Binance Co. exchange has received approval from the Securities

and Exchange Commission of Thailand to operate digital asset

exchange and brokerage services. Binance has already contributed to

police actions against cryptocurrency fraud in Thailand,

reinforcing its influence in Asia. This year, in addition to

Thailand, Binance has expanded its presence in Japan and

Kazakhstan.

Korean pension fund registers profit with Coinbase stocks

The National Pension Service (NPS) of South Korea, one of the

world’s largest pension funds, acquired 282,673 shares of Coinbase

(NASDAQ:COIN) in the third quarter of 2023, as revealed in a report

to the U.S. Securities and Exchange Commission (SEC). The

investment, initially worth around $19.9 million, appreciated by

39%, reaching $27.7 million. This purchase marks the first time NPS

has invested in Coinbase, avoiding direct investments in

cryptocurrencies due to their volatility. Despite previous

criticism of crypto investments, NPS emphasized that its

participation is limited to the exchange. Meanwhile, Coinbase

shares have seen significant growth in 2023, despite the legal

challenges faced by the company.

Kyle Davies, co-founder of 3AC, allegedly located in Bali

Kyle Davies, co-founder of the now bankrupt cryptocurrency hedge

fund Three Arrows Capital, has allegedly been spotted in Bali,

evading authorities in Singapore. Reports indicate that Davies,

identified in a local café by his clothing and accessories, appears

to be living comfortably despite facing charges in Singapore. He

and his partner, Su Zhu, are accused of not cooperating with

bankruptcy investigations and face arrest. 3AC, which suffered

massive financial losses, is considered one of the largest

bankruptcies in the cryptocurrency sector. Zhu has already been

arrested, while Davies remains free.

Montenegro court upholds prison sentence for Do Kwon

The Higher Court of Montenegro has confirmed a four-month prison

sentence for Do Kwon, the founder of Terra, denying his appeal

against conviction for document forgery. The decision, which also

involves Han Chang-Joon, a Terra executive, follows a previous

trial in a lower court. Kwon and his associate were arrested in

Montenegro in March following the collapse of Terraform Labs. They

remain in custody, awaiting possible extradition to South Korea or

the United States. The Basic Court of Podgorica justified the

sentence as an appropriate and necessary measure to prevent future

crimes.

Fhenix introduces FHE rollups for confidential smart contracts

After securing $7 million in funding, Fhenix has released its

white paper, presenting the revolutionary blockchain platform with

fully homomorphic encryption (FHE). This system, called “FHE

Rollups,” offers an innovative solution for executing smart

contracts while maintaining confidentiality. By using advanced

encryption, calculations can be performed on encrypted data,

ensuring security and privacy. Integration with Ethereum, without

the need for changes to its base layer, makes FHE Rollups a

significant breakthrough, opening new possibilities for private and

secure blockchain transactions.

G2A launches NFT marketplace for Web3 games

G2A, a prominent digital gaming marketplace, has expanded its

offerings by launching a dedicated marketplace for non-fungible

tokens (NFTs) related to Web3 games on November 15. This new

venture aims to promote Web3 games and NFTs selected by the G2A

team, offering gamers the opportunity to explore the blockchain

gaming universe and buy or sell associated digital assets. G2A CEO

Bartosz Skwarczek highlighted in a statement the growing

familiarity of gamers with the blockchain gaming industry and

involvement in NFT trading. “It has been discovered that gamers

are quite familiar with the blockchain gaming industry, and a

significant portion of them is already playing Web3 games and even

engaging in NFT trading,” he said.

Philippines innovates with tokenized treasury bonds

In a pioneering move, the Department of the Treasury of the

Philippines has announced the issuance of tokenized Treasury bonds,

replacing a previously scheduled traditional auction. This

initiative, aligned with the country’s financial modernization,

aims to offer at least $180 million in one-year bonds to

institutional buyers. Distributed ledger technology (DLT) will be

used for execution, maintaining the official record on the

blockchain system and the Scripless National Register of

Securities. This step highlights the global trend of innovation in

the bond market, following similar experiences in Hong Kong,

Singapore, and elsewhere.

Leadership change at Dubai’s VARA in preparation for expansion in

2023

The Virtual Asset Regulatory Authority (VARA) of Dubai, focused

on regulating cryptocurrencies, has announced a change in its

leadership to drive larger-scale operations in 2023. Henson Orser,

former CEO and former banker at Nomura Holdings, is passing the

reins to Matthew White, a former PwC consultant. Orser, who played

a crucial role in establishing the regulatory framework for the

crypto space, will continue to support VARA as a consultant.

Singapore accelerates plans for CBDC

The Monetary Authority of Singapore (MAS) has announced the

start of pilots to test the use of the Central Bank Digital

Currency (CBDC) in wholesale operations. The initiative includes

three main focuses: expanding CBDC testing in wholesale markets,

infrastructure for Singapore’s digital dollar, and a live pilot of

wholesale CBDC. This plan aims to promote innovation and security

in the use of digital money, with MAS using the Orchid Project for

the necessary technology.

Paxos advances with stablecoin project in Singapore

Paxos, a leading cryptocurrency infrastructure company, has

received preliminary approval from the Monetary Authority of

Singapore (MAS) to create Paxos Digital Singapore Pte. Ltd., a new

entity focused on launching a US dollar-backed stablecoin. This

initial approval allows Paxos to offer digital payment token

services and plan the issuance of a stablecoin following MAS’s

stablecoin guidelines. With full approval, Paxos will seek business

partnerships in Singapore for the issuance of the stablecoin. The

initiative follows MAS’s framework for regulating stablecoins and

comes after Paxos’s experience in launching stablecoins, including

PYUSD for PayPal (COIN:PYUSDUSD).

Turkey plans cryptocurrency regulation to exit FATF gray list

Turkey is formulating regulations for its growing cryptocurrency

market, primarily focusing on licensing and taxation. This

initiative aims to remove the country from the gray list of the

Financial Action Task Force (FATF), where it ranks fourth in the

world in crypto trade volume. According to Bora Erdamar of the

BlockchainIST Center, the new rules will focus on strict licensing

standards to prevent abuses and enhance digital security and

reserve verification.

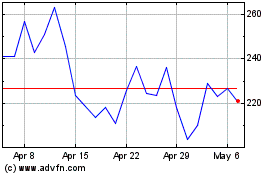

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Jul 2023 to Jul 2024