Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

March 29 2022 - 4:09PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-248279

AMENDMENT NO. 1 DATED MARCH 29, 2022

to Prospectus Supplement dated September 3, 2020

(to Prospectus dated September 3, 2020)

Up to $5,000,000

Common Stock

This Amendment No. 1

to Prospectus Supplement, or this Amendment, amends our prospectus supplement dated September 3, 2020 (File No. 333-248279), or the

Prospectus Supplement. This Amendment should be read in conjunction with the Prospectus Supplement and

the accompanying prospectus dated September 3, 2020, or the Prospectus, and is qualified by reference thereto, except to the extent

that the information herein amends or supersedes the information contained in the Prospectus Supplement and the Prospectus. This Amendment

is not complete without, and may only be delivered or utilized in connection with, the Prospectus Supplement and Prospectus, and any future

amendments or supplements thereto.

We have previously entered

into an At-the-Market Sales Agreement, or the Sales Agreement, with Virtu Americas LLC, or Virtu, relating to shares of our common stock,

par value $0.001 per share, offered by the Prospectus Supplement and Prospectus. In accordance with the terms of the Sales Agreement,

from time to time we may offer and sell shares of our common stock having an aggregate offering price of up to $15,477,192 through Virtu,

acting as sales agent. As of March 28, 2022, we have sold 2,299,993 shares of our common stock for gross proceeds of $3,187,070 under

the Sales Agreement, all of which shares were sold under General Instruction I.B.1 of Form S-3.

Our common stock is traded

on the Nasdaq Capital Market under the symbol “CWBR.”

Sales of our common stock,

if any, under this Prospectus Supplement may be made in sales deemed to be an “at the market offering” as defined in Rule

415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act. Subject to the terms of the Sales Agreement,

Virtu is not required to sell any specific number or dollar amounts of securities but will act as our sales agent using commercially reasonable

efforts consistent with its normal trading and sales practices, on mutually agreed terms between Virtu and us. There is no arrangement

for funds to be received in any escrow, trust or similar arrangement.

The

compensation to Virtu for sales of common stock sold pursuant to the Sales Agreement will be at a fixed commission rate of up to 3.0%

of the gross proceeds of any shares of common stock sold under the Sales Agreement. In connection with the sale of the common stock on

our behalf, Virtu will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Virtu

will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to Virtu against

certain civil liabilities, including liabilities under the Securities Act.

We are filing this Amendment

to amend the Prospectus Supplement to update the amount of shares we are eligible to sell under General Instruction I.B.6 of Form S-3

and pursuant to the Sales Agreement. As of March 28, 2022, the aggregate market value of our outstanding common stock held by non-affiliates,

or the public float, was $30,430,822, which was calculated based on 84,530,060 shares of our outstanding common stock held by non-affiliates

as of March 28, 2022, and at a price of $0.36 per share, the closing price of our common stock on February 1, 2022. Pursuant to General

Instruction I.B.6 of Form S-3, in no event will we sell shares pursuant to the Prospectus Supplement and Prospectus, as amended by this

Amendment, with a value of more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month

period, so long as the aggregate market value of our common stock held by non-affiliates is less than $75 million. During the 12 calendar

months prior to, and including, the date of this Amendment, we have not sold any securities pursuant to General Instruction I.B.6 of Form

S-3.

As a result of these limitations

and the current public float of our common stock, and in accordance with the terms of the Sales Agreement, we may offer and sell shares

of our common stock having an aggregate offering price of up to $5,000,000 from time to time through Virtu. If our public float increases

such that we may sell additional amounts under the Sales Agreement, the Prospectus Supplement and the Prospectus, we will file another

amendment to the Prospectus Supplement prior to making additional sales.

Investing in our common

stock involves a high degree of risk. Please read the information contained in and incorporated by reference under the heading “Risk

Factors” beginning on page S-3 of the Prospectus Supplement, under the heading “Risk Factors” beginning on page 3 of

the accompanying Prospectus, and the risk factors described in the documents that are incorporated by reference into the Prospectus Supplement

and the accompanying Prospectus, as they may be amended, updated or modified periodically in our reports filed with the Securities and

Exchange Commission.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus

Supplement or the accompanying Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Amendment

No. 1 to Prospectus Supplement is March 29, 2022.

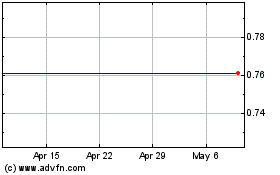

CohBar (NASDAQ:CWBR)

Historical Stock Chart

From Jun 2024 to Jul 2024

CohBar (NASDAQ:CWBR)

Historical Stock Chart

From Jul 2023 to Jul 2024