Total Sales for the nine-weeks ending December 31, 2022 of

$171.9 million, in line with expectations

Q4 2022 EPS expected to be in the range of $0.78 to $0.86;

EPS for the second half of Fiscal 2022 expected to be in the range

of $3.80 to $3.88, or $1.02 to $1.10 as adjusted*, compared to

$0.73 in the second half of Fiscal 2019, or $0.77 as

adjusted*

Year-end cash balance now expected to be approximately $95

million to $105 million

Reaffirms all other components of second half Fiscal 2022

guidance

Citi Trends, Inc. (NASDAQ: CTRN), a leading specialty value

retailer of apparel, accessories and home trends for way less spend

primarily for African American and Latinx families in the United

States, today announced results for its holiday selling period.

Total sales for the nine-week period ending December 31, 2022 of

$171.9 million compared to $204.8 million in the same period in

2021 and $170.5 million in the same period in 2019, a decrease of

16.1% and an increase of 0.8%, respectively. Comparable store sales

for the nine-week period ending December 31, 2022 decreased 17.5%

versus the same period in 2021.

David Makuen, Chief Executive Officer, said, “We are pleased

with our holiday season performance, particularly in light of the

continued inflationary pressure our customers experienced. Our

sales were in line with our expectations thanks to our curated,

on-trend gift assortment and amazing values, which resonated with

our customers. In addition, we continued to deliver strong gross

margin, driven by well managed inventory levels.”

Mr. Makuen continued, “I would like to thank the entire Citi

Trends team across our Buy, Move, Sell and Support functions for

their exceptional and nimble execution, especially our store teams

who amazed our customers up until the very last minute delivering

on our Gift Big and Spend Less holiday promise. We look forward to

building on our strong foundation as we kick off Fiscal 2023.”

Guidance

The Company now expects year-end cash balance of approximately

$95 million to $105 million. The Company is reaffirming all other

components of the guidance it previously provided for the second

half of Fiscal 2022. That guidance, which included the impact of

the sale-leaseback of the Roland distribution center, is detailed

below. In addition, the Company now expects EPS for the fourth

quarter of Fiscal 2022 to be in the range of $0.78 to $0.86. EPS

for the second half of Fiscal 2022 is expected to be in the range

of $3.80 to $3.88, or $1.02 to $1.10 as adjusted*, compared to

$0.73 in the second half of Fiscal 2019, or $0.77 as adjusted*. At

the midpoint, this guidance represents an EPS increase of

approximately 425% compared to the second half of Fiscal 2019, or

38% on an adjusted* basis.

- Expects low single digit increase in second half total sales

compared to first half total sales

- Expects gross margin to remain in the high 30s to low 40s range

for the second half

- Expects significantly less SG&A expense deleverage in the

second half vs. the same period in the prior year as a result of

swift expense reduction actions net of incremental lease expense

from the sale-leaseback transactions

- Expects second half operating income to be approximately in

line with the second half of 2019

*Non-GAAP Financial

Measures

Reconciliations of each of the non-GAAP financial measures to

the most directly comparable GAAP measure are at the end of this

press release.

About Citi Trends

Citi Trends, Inc. is a leading specialty value retailer of

apparel, accessories and home trends for way less spend primarily

for African American and Latinx families in the United States. The

Company operates 612 stores located in 33 states. For more

information, visit cititrends.com or your local store.

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding the Company’s future

financial results and position, business policy and plans,

objectives and expectations of management for future operations and

capital allocation expectations, are forward-looking statements

that are subject to material risks and uncertainties. The words

"believe," "may," "could," "plans," "estimate," “expects,”

"continue," "anticipate," "intend," "expect," “upcoming,” “trend”

and similar expressions, as they relate to the Company, are

intended to identify forward-looking statements, although not all

forward-looking statements contain such language. Statements with

respect to earnings, sales or new store guidance are

forward-looking statements. Investors are cautioned that any such

forward-looking statements are subject to the finalization of the

Company’s quarter-end financial and accounting procedures, are not

guarantees of future performance or results, and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Actual results or developments may differ

materially from those included in the forward-looking statements as

a result of various factors which are discussed in our Annual

Reports and Quarterly Reports on Forms 10-K and 10-Q, respectively,

and any amendments thereto, filed with the Securities and Exchange

Commission. These risks and uncertainties include, but are not

limited to, uncertainties relating to general economic conditions,

including inflation, energy and fuel costs, unemployment levels,

and any deterioration whether caused by acts of war, terrorism,

political or social unrest (including any resulting store closures,

damage or loss of inventory) or other factors; changes in market

interest rates and market levels of wages; natural disasters such

as hurricanes; public health emergencies such as the ongoing

COVID-19 pandemic and associated containment and remediation

efforts, the potential negative impacts of COVID-19 on the global

economy and foreign sourcing; the impacts of COVID-19 on the

Company's financial condition, business operations and liquidity,

including the re-closure of any or all of the Company’s retail

stores and distribution centers; transportation and distribution

delays or interruptions; changes in freight rates; the Company’s

ability to attract and retain workers; the Company’s ability to

negotiate effectively the cost and purchase of merchandise

inventory risks due to shifts in market demand; the Company’s

ability to gauge fashion trends and changing consumer preferences;

consumer confidence and changes in consumer spending patterns;

competition within the industry; competition in our markets; the

duration and extent of any economic stimulus programs; changes in

product mix; interruptions in suppliers’ businesses; temporary

changes in demand due to weather patterns; seasonality of the

Company’s business; changes in market interest rates and market

levels of wages; the results of pending or threatened litigation;

delays associated with building, remodeling, opening and operating

new stores; and delays associated with building and opening or

expanding new or existing distribution centers. Any forward-looking

statements by the Company, with respect to guidance, the repurchase

of shares pursuant to a share repurchase program, or otherwise, are

intended to speak only as of the date such statements are made.

Except as required by applicable law, including the securities laws

of the United States and the rules and regulations of the

Securities and Exchange Commission, the Company does not undertake

to publicly update any forward-looking statements in this news

release or with respect to matters described herein, whether as a

result of any new information, future events or otherwise.

CITI TRENDS, INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

(unaudited)

The Company makes reference in

this release to adjusted earnings per diluted share. The Company

believes this supplemental measure reflects operating results that

are more indicative of the Company's ongoing operating performance

while improving comparability to prior and future periods, and as

such, may provide investors with an enhanced understanding of the

Company's past financial performance and prospects for the future.

This information is not intended to be considered in isolation or

as a substitute for net income or earnings per diluted share

prepared in accordance with generally accepted accounting

principles (GAAP).

Guidance - Fiscal 2022

Reconciliation of Diluted EPS

Guidance

Fourth Quarter

Second Half

Diluted EPS guidance

$0.78 - $0.86

$3.80 - $3.88

Gain on sale-leaseback

–

$(3.58)

Tax impact of gain on

sale-leaseback

–

$0.80

Adjusted diluted EPS guidance

$0.78 - $0.86

$1.02 - $1.10

Fiscal 2019

Reconciliation of Diluted

EPS

Fourth Quarter

Second Half

Diluted EPS

$0.84

$0.73

Interim CEO related expenses

$0.05

$0.05

Tax impact of interim CEO related

expenses

$(0.01)

$(0.01)

Adjusted diluted EPS

$0.88

$0.77

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230109005252/en/

Tom Filandro / Rachel Schacter ICR, Inc.

CitiTrendsIR@icrinc.com

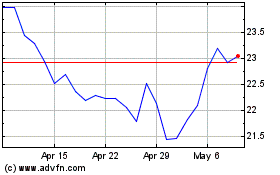

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Sep 2023 to Sep 2024