SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

______________

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): January

27, 2016

|

|

CIRRUS

LOGIC, INC.

|

|

|

(Exact

name of Registrant as specified in its charter)

|

|

Delaware

|

|

0-17795

|

|

77-0024818

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

800 West 6th Street, Austin, TX

|

|

|

78701

|

|

|

(Address

of Principal Executive Offices)

|

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (512)

851-4000

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

⃞

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

⃞

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

⃞

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On January 27, 2016, the Company issued a press release announcing its

results for its third quarter and first nine months of fiscal year

2016. The full text of the press release is furnished as Exhibit No.

99.1 to this Current Report on Form 8-K.

Item 7.01 Regulation FD.

On January 27, 2016, in addition to issuing a press release, the Company

posted on its website a shareholder letter to investors summarizing the

financial results for its third quarter and first nine months of fiscal

year 2016. The full text of the shareholder letter is furnished as

Exhibit No. 99.2 to this Current Report on Form 8-K.

Use of Non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP

basis, Cirrus has provided certain non-GAAP financial information,

including operating expenses, net income, income from operations,

operating margin and diluted earnings per share. A reconciliation of the

adjustments to GAAP results is included in the tables to the press

release furnished as Exhibit No. 99.1 to this Current Report on Form

8-K. Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and comparative

purposes. In addition, certain non-GAAP financial information is used

internally by management to evaluate and manage the company. As a note,

the non-GAAP financial information used by Cirrus Logic may differ from

that used by other companies. These non-GAAP measures should be

considered in addition to, and not as a substitute for, the results

prepared in accordance with GAAP.

The information contained in Items 2.02, 7.01, and 9.01 in this Current

Report on Form 8-K and the exhibits furnished hereto contain

forward-looking statements regarding the Company and cautionary

statements identifying important factors that could cause actual results

to differ materially from those anticipated. In addition, this

information shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities of that section, nor shall they be

deemed incorporated by reference in any filing under the Securities Act

of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

|

|

(d) Exhibits

|

|

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

|

|

|

Exhibit 99.1

|

|

Cirrus Logic, Inc. press release dated January 27, 2016

|

|

|

Exhibit 99.2

|

|

Cirrus Logic, Inc. shareholder letter dated January 27, 2016

|

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, Registrant has

duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

CIRRUS LOGIC, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

January 27, 2016

|

By:

|

/s/ Thurman K. Case

|

|

|

|

|

|

Name: Thurman K. Case

|

|

|

|

|

|

Title: Chief Financial Officer

|

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

|

|

|

99.1

|

Registrant’s press release dated January 27, 2016

|

|

99.2

|

Cirrus Logic, Inc. shareholder letter dated January 27, 2016

|

Exhibit 99.1

Cirrus

Logic Reports Q3 Revenue of $347.9 Million

Company

Continues to Expect Strong Year-Over-Year Growth in FY16 and FY17

AUSTIN, Texas--(BUSINESS WIRE)--January 27, 2016--Cirrus Logic, Inc.

(Nasdaq: CRUS), a leader in high-precision analog and digital

signal processing products, today posted on its investor relations

website at http://investor.cirrus.com the quarterly Shareholder

Letter that contains the complete financial results for the third

quarter fiscal year 2016, which ended Dec. 26, 2015, as well as the

company’s current business outlook.

“While short term weakness for certain portable audio products drove our

fiscal Q3 results and Q4 outlook lower than anticipated, we are on track

to deliver 27 percent year over year growth for full FY16, based on the

midpoint of Q4 guidance, and we remain confident in our ability to

deliver strong growth in FY17,” said Jason Rhode, president and chief

executive officer. “With a comprehensive roadmap of innovative audio and

voice products targeting the mobile phone, smart accessory and digital

headset markets, the company is focused on execution, diversification

and sustained growth in the coming years.”

Reported Financial Results – Third Quarter FY16

-

Revenue of $347.9 million;

-

GAAP gross margin of 47.4 percent and non-GAAP gross margin of 47.5

percent;

-

GAAP operating expenses of $101 million; non-GAAP operating expenses

of $84.7 million; and

-

GAAP diluted earnings per share of $0.63 and non-GAAP diluted earnings

per share of $0.82.

A reconciliation of the non-GAAP charges is included in the tables

accompanying this press release.

Business Outlook – Fourth Quarter FY16

-

Revenue is expected to range between $210 million and $240 million;

-

GAAP gross margin is expected to be between 47 percent and 49 percent;

and

-

Combined GAAP R&D and SG&A expenses are expected to range between $100

million and $104 million, which includes approximately $8 million in

share-based compensation and $9 million in amortization of acquired

intangibles.

Cirrus Logic will host a live Q&A session at 5 p.m. EST today to answer

questions related to its financial results and business outlook.

Participants may listen to the conference call on the Cirrus Logic

website. Participants who would like to submit a question to be

addressed during the call are requested to email investor.relations@cirrus.com.

A replay of the webcast can be accessed on the Cirrus Logic website

approximately two hours following its completion, or by calling (404)

537-3406, or toll-free at (855) 859-2056 (Access Code: 8524794).

Cirrus Logic, Inc.

Cirrus Logic develops high-precision, analog and mixed-signal integrated

circuits for a broad range of innovative customers. Building on its

diverse analog and signal-processing patent portfolio, Cirrus Logic

delivers highly optimized products for a variety of audio, industrial

and energy-related applications. The company operates from headquarters

in Austin, Texas, with offices in the United States, United Kingdom,

Australia, Japan and Asia. More information about Cirrus Logic is

available at www.cirrus.com.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP

basis, Cirrus has provided non-GAAP financial information, including

gross margins, operating expenses, net income, operating profit and

income, tax expenses and diluted earnings per share. A reconciliation of

the adjustments to GAAP results is included in the tables below.

Non-GAAP financial information is not meant as a substitute for GAAP

results, but is included because management believes such information is

useful to our investors for informational and comparative purposes. In

addition, certain non-GAAP financial information is used internally by

management to evaluate and manage the company. The non-GAAP financial

information used by Cirrus Logic may differ from that used by other

companies. These non-GAAP measures should be considered in

addition to, and not as a substitute for, the results prepared in

accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters set

forth in this news release contain forward-looking statements, including

future growth opportunities and our estimates of fourth quarter fiscal

year 2016 revenue, gross margin, combined research and development and

selling, general and administrative expense levels, share-based

compensation expense and amortization of acquired intangibles. In some

cases, forward-looking statements are identified by words such as

“expect,” “anticipate,” “target,” “project,” “believe,” “goals,”

“opportunity,” “estimates,” “intend,” and variations of these types of

words and similar expressions. In addition, any statements that

refer to our plans, expectations, strategies or other characterizations

of future events or circumstances are forward-looking statements. These

forward-looking statements are based on our current expectations,

estimates and assumptions and are subject to certain risks and

uncertainties that could cause actual results to differ materially.

These risks and uncertainties include, but are not limited to, the

following: the level of orders and shipments during the fourth quarter

of fiscal year 2016, customer cancellations of orders, or the failure to

place orders consistent with forecasts, along with the timing and

success of future product ramps; and the risk factors listed in our Form

10-K for the year ended March 28, 2015, and in our other filings with

the Securities and Exchange Commission, which are available at www.sec.gov.

The foregoing information concerning our business outlook represents our

outlook as of the date of this news release, and we undertake no

obligation to update or revise any forward-looking statements, whether

as a result of new developments or otherwise.

Cirrus Logic and Cirrus are registered trademarks of Cirrus Logic, Inc.

All other company or product names noted herein may be trademarks of

their respective holders.

|

|

|

CIRRUS LOGIC, INC.

|

|

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS

|

|

(unaudited)

|

|

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Nine Months Ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 26,

|

|

|

Sep. 26,

|

|

|

Dec. 27,

|

|

|

|

Dec. 26,

|

|

|

Dec. 27,

|

|

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

Q3'16

|

|

|

Q2'16

|

|

|

Q3'15

|

|

|

|

Q3'16

|

|

|

Q3'15

|

|

Portable audio products

|

|

|

$

|

308,803

|

|

|

|

$

|

257,152

|

|

|

|

$

|

253,355

|

|

|

|

|

$

|

801,821

|

|

|

|

$

|

529,487

|

|

|

Non-portable audio and other products

|

|

|

|

39,060

|

|

|

|

|

49,604

|

|

|

|

|

45,251

|

|

|

|

|

|

135,431

|

|

|

|

|

131,898

|

|

|

Net sales

|

|

|

|

347,863

|

|

|

|

|

306,756

|

|

|

|

|

298,606

|

|

|

|

|

|

937,252

|

|

|

|

|

661,385

|

|

|

Cost of sales

|

|

|

|

182,952

|

|

|

|

|

164,535

|

|

|

|

|

167,775

|

|

|

|

|

|

497,666

|

|

|

|

|

354,612

|

|

|

Gross profit

|

|

|

|

164,911

|

|

|

|

|

142,221

|

|

|

|

|

130,831

|

|

|

|

|

|

439,586

|

|

|

|

|

306,773

|

|

|

Gross margin

|

|

|

|

47.4

|

%

|

|

|

|

46.4

|

%

|

|

|

|

43.8

|

%

|

|

|

|

|

46.9

|

%

|

|

|

|

46.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

|

70,290

|

|

|

|

|

67,258

|

|

|

|

|

55,474

|

|

|

|

|

|

203,383

|

|

|

|

|

139,808

|

|

|

Selling, general and administrative

|

|

|

|

30,632

|

|

|

|

|

30,103

|

|

|

|

|

27,783

|

|

|

|

|

|

89,854

|

|

|

|

|

69,011

|

|

|

Acquisition related costs

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

3,200

|

|

|

|

|

|

-

|

|

|

|

|

18,137

|

|

|

Restructuring and other

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

|

-

|

|

|

|

|

1,455

|

|

|

Patent agreement and other

|

|

|

|

78

|

|

|

|

|

752

|

|

|

|

|

-

|

|

|

|

|

|

(11,670

|

)

|

|

|

|

-

|

|

|

Total operating expenses

|

|

|

|

101,000

|

|

|

|

|

98,113

|

|

|

|

|

86,457

|

|

|

|

|

|

281,567

|

|

|

|

|

228,411

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

|

63,911

|

|

|

|

|

44,108

|

|

|

|

|

44,374

|

|

|

|

|

|

158,019

|

|

|

|

|

78,362

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

|

(591

|

)

|

|

|

|

(601

|

)

|

|

|

|

(1,042

|

)

|

|

|

|

|

(1,830

|

)

|

|

|

|

(4,179

|

)

|

|

Other expense, net

|

|

|

|

(925

|

)

|

|

|

|

(524

|

)

|

|

|

|

(1,071

|

)

|

|

|

|

|

(1,313

|

)

|

|

|

|

(12,564

|

)

|

|

Income before income taxes

|

|

|

|

62,395

|

|

|

|

|

42,983

|

|

|

|

|

42,261

|

|

|

|

|

|

154,876

|

|

|

|

|

61,619

|

|

|

Provision for income taxes

|

|

|

|

21,011

|

|

|

|

|

8,103

|

|

|

|

|

19,532

|

|

|

|

|

|

45,258

|

|

|

|

|

27,790

|

|

|

Net income

|

|

|

$

|

41,384

|

|

|

|

$

|

34,880

|

|

|

|

$

|

22,729

|

|

|

|

|

$

|

109,618

|

|

|

|

$

|

33,829

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share:

|

|

|

$

|

0.65

|

|

|

|

$

|

0.55

|

|

|

|

$

|

0.36

|

|

|

|

|

$

|

1.73

|

|

|

|

$

|

0.54

|

|

|

Diluted earnings per share:

|

|

|

$

|

0.63

|

|

|

|

$

|

0.53

|

|

|

|

$

|

0.35

|

|

|

|

|

$

|

1.66

|

|

|

|

$

|

0.52

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

63,328

|

|

|

|

|

63,346

|

|

|

|

|

62,885

|

|

|

|

|

|

63,316

|

|

|

|

|

62,386

|

|

|

Diluted

|

|

|

|

65,761

|

|

|

|

|

66,329

|

|

|

|

|

65,214

|

|

|

|

|

|

66,184

|

|

|

|

|

65,024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepared in accordance with Generally Accepted Accounting

Principles

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

|

|

(unaudited, in thousands, except per share data)

|

|

(not prepared in accordance with GAAP)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. As a note, the non-GAAP financial information used by

Cirrus Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Certain modifications to prior year non-GAAP presentation has been

made and had no material effect on the results of operations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Nine Months Ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 26,

|

|

|

Sep. 26,

|

|

|

Dec. 27,

|

|

|

|

Dec. 26,

|

|

|

Dec. 27,

|

|

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

|

|

2015

|

|

|

2014

|

|

Net Income Reconciliation

|

|

|

Q3'16

|

|

|

Q2'16

|

|

|

Q3'15

|

|

|

|

Q3'16

|

|

|

Q3'15

|

|

GAAP Net Income

|

|

|

$

|

41,384

|

|

|

|

$

|

34,880

|

|

|

|

$

|

22,729

|

|

|

|

|

$

|

109,618

|

|

|

|

$

|

33,829

|

|

|

Amortization of acquisition intangibles

|

|

|

|

8,634

|

|

|

|

|

8,133

|

|

|

|

|

5,151

|

|

|

|

|

|

23,908

|

|

|

|

|

7,921

|

|

|

Stock based compensation expense

|

|

|

|

7,761

|

|

|

|

|

8,688

|

|

|

|

|

7,815

|

|

|

|

|

|

24,720

|

|

|

|

|

19,933

|

|

|

Patent agreement and other

|

|

|

|

78

|

|

|

|

|

752

|

|

|

|

|

-

|

|

|

|

|

|

(11,670

|

)

|

|

|

|

-

|

|

|

Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

|

-

|

|

|

|

|

1,455

|

|

|

Wolfson acquisition items

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

9,903

|

|

|

|

|

|

-

|

|

|

|

|

43,082

|

|

|

Adjustment to income taxes

|

|

|

|

(3,737

|

)

|

|

|

|

(9,492

|

)

|

|

|

|

17,714

|

|

|

|

|

|

(13,404

|

)

|

|

|

|

24,704

|

|

|

Non-GAAP Net Income

|

|

|

$

|

54,120

|

|

|

|

$

|

42,961

|

|

|

|

$

|

63,312

|

|

|

|

|

$

|

133,172

|

|

|

|

$

|

130,924

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Diluted earnings per share

|

|

|

$

|

0.63

|

|

|

|

$

|

0.53

|

|

|

|

$

|

0.35

|

|

|

|

|

$

|

1.66

|

|

|

|

$

|

0.52

|

|

|

Effect of Amortization of acquisition intangibles

|

|

|

|

0.13

|

|

|

|

|

0.12

|

|

|

|

|

0.08

|

|

|

|

|

|

0.36

|

|

|

|

|

0.12

|

|

|

Effect of Stock based compensation expense

|

|

|

|

0.12

|

|

|

|

|

0.13

|

|

|

|

|

0.12

|

|

|

|

|

|

0.37

|

|

|

|

|

0.31

|

|

|

Effect of Patent agreement and other

|

|

|

|

-

|

|

|

|

|

0.01

|

|

|

|

|

-

|

|

|

|

|

|

(0.18

|

)

|

|

|

|

-

|

|

|

Effect of Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

|

-

|

|

|

|

|

0.02

|

|

|

Effect of Wolfson acquisition items

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

0.15

|

|

|

|

|

|

-

|

|

|

|

|

0.66

|

|

|

Effect of Adjustment to income taxes

|

|

|

|

(0.06

|

)

|

|

|

|

(0.14

|

)

|

|

|

|

0.27

|

|

|

|

|

|

(0.20

|

)

|

|

|

|

0.38

|

|

|

Non-GAAP Diluted earnings per share

|

|

|

$

|

0.82

|

|

|

|

$

|

0.65

|

|

|

|

$

|

0.97

|

|

|

|

|

$

|

2.01

|

|

|

|

$

|

2.01

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Operating Income

|

|

|

$

|

63,911

|

|

|

|

$

|

44,108

|

|

|

|

$

|

44,374

|

|

|

|

|

$

|

158,019

|

|

|

|

$

|

78,362

|

|

|

GAAP Operating Profit

|

|

|

|

18

|

%

|

|

|

|

14

|

%

|

|

|

|

15

|

%

|

|

|

|

|

17

|

%

|

|

|

|

12

|

%

|

|

Amortization of acquisition intangibles

|

|

|

|

8,634

|

|

|

|

|

8,133

|

|

|

|

|

5,151

|

|

|

|

|

|

23,908

|

|

|

|

|

7,921

|

|

|

Stock compensation expense - COGS

|

|

|

|

213

|

|

|

|

|

380

|

|

|

|

|

273

|

|

|

|

|

|

918

|

|

|

|

|

757

|

|

|

Stock compensation expense - R&D

|

|

|

|

4,183

|

|

|

|

|

4,126

|

|

|

|

|

2,904

|

|

|

|

|

|

12,177

|

|

|

|

|

8,228

|

|

|

Stock compensation expense - SG&A

|

|

|

|

3,365

|

|

|

|

|

4,182

|

|

|

|

|

4,638

|

|

|

|

|

|

11,625

|

|

|

|

|

10,948

|

|

|

Patent agreement and other

|

|

|

|

78

|

|

|

|

|

752

|

|

|

|

|

-

|

|

|

|

|

|

(11,670

|

)

|

|

|

|

-

|

|

|

Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

|

-

|

|

|

|

|

1,455

|

|

|

Wolfson acquisition items

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

9,903

|

|

|

|

|

|

-

|

|

|

|

|

28,642

|

|

|

Non-GAAP Operating Income

|

|

|

$

|

80,384

|

|

|

|

$

|

61,681

|

|

|

|

$

|

67,243

|

|

|

|

|

$

|

194,977

|

|

|

|

$

|

136,313

|

|

|

Non-GAAP Operating Profit

|

|

|

|

23

|

%

|

|

|

|

20

|

%

|

|

|

|

23

|

%

|

|

|

|

|

21

|

%

|

|

|

|

21

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expense Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Operating Expenses

|

|

|

$

|

101,000

|

|

|

|

$

|

98,113

|

|

|

|

$

|

86,457

|

|

|

|

|

$

|

281,567

|

|

|

|

$

|

228,411

|

|

|

Amortization of acquisition intangibles

|

|

|

|

(8,634

|

)

|

|

|

|

(8,133

|

)

|

|

|

|

(5,151

|

)

|

|

|

|

|

(23,908

|

)

|

|

|

|

(7,921

|

)

|

|

Stock compensation expense - R&D

|

|

|

|

(4,183

|

)

|

|

|

|

(4,126

|

)

|

|

|

|

(2,904

|

)

|

|

|

|

|

(12,177

|

)

|

|

|

|

(8,228

|

)

|

|

Stock compensation expense - SG&A

|

|

|

|

(3,365

|

)

|

|

|

|

(4,182

|

)

|

|

|

|

(4,638

|

)

|

|

|

|

|

(11,625

|

)

|

|

|

|

(10,948

|

)

|

|

Patent agreement and other

|

|

|

|

(78

|

)

|

|

|

|

(752

|

)

|

|

|

|

-

|

|

|

|

|

|

11,670

|

|

|

|

|

-

|

|

|

Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

|

-

|

|

|

|

|

(1,455

|

)

|

|

Wolfson acquisition items

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

(3,200

|

)

|

|

|

|

|

-

|

|

|

|

|

(20,329

|

)

|

|

Non-GAAP Operating Expenses

|

|

|

$

|

84,740

|

|

|

|

$

|

80,920

|

|

|

|

$

|

70,564

|

|

|

|

|

$

|

245,527

|

|

|

|

$

|

179,530

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin/Profit Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Gross Margin

|

|

|

$

|

164,911

|

|

|

|

$

|

142,221

|

|

|

|

$

|

130,831

|

|

|

|

|

$

|

439,586

|

|

|

|

$

|

306,773

|

|

|

GAAP Gross Profit

|

|

|

|

47.4

|

%

|

|

|

|

46.4

|

%

|

|

|

|

43.8

|

%

|

|

|

|

|

46.9

|

%

|

|

|

|

46.4

|

%

|

|

Wolfson acquisition items

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

6,703

|

|

|

|

|

|

-

|

|

|

|

|

8,313

|

|

|

Stock compensation expense - COGS

|

|

|

|

213

|

|

|

|

|

380

|

|

|

|

|

273

|

|

|

|

|

|

918

|

|

|

|

|

757

|

|

|

Non-GAAP Gross Margin

|

|

|

$

|

165,124

|

|

|

|

$

|

142,601

|

|

|

|

$

|

137,807

|

|

|

|

|

$

|

440,504

|

|

|

|

$

|

315,843

|

|

|

Non-GAAP Gross Profit

|

|

|

|

47.5

|

%

|

|

|

|

46.5

|

%

|

|

|

|

46.2

|

%

|

|

|

|

|

47.0

|

%

|

|

|

|

47.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective Tax Rate Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Tax Expense

|

|

|

$

|

21,011

|

|

|

|

$

|

8,103

|

|

|

|

$

|

19,532

|

|

|

|

|

$

|

45,258

|

|

|

|

$

|

27,790

|

|

|

GAAP Effective Tax Rate

|

|

|

|

33.7

|

%

|

|

|

|

18.9

|

%

|

|

|

|

46.2

|

%

|

|

|

|

|

29.2

|

%

|

|

|

|

45.1

|

%

|

|

Adjustments to income taxes

|

|

|

|

3,737

|

|

|

|

|

9,492

|

|

|

|

|

(17,714

|

)

|

|

|

|

|

13,404

|

|

|

|

|

(24,704

|

)

|

|

Non-GAAP Tax Expense

|

|

|

$

|

24,748

|

|

|

|

$

|

17,595

|

|

|

|

$

|

1,818

|

|

|

|

|

$

|

58,662

|

|

|

|

$

|

3,086

|

|

|

Non-GAAP Effective Tax Rate

|

|

|

|

31.4

|

%

|

|

|

|

29.1

|

%

|

|

|

|

2.8

|

%

|

|

|

|

|

30.6

|

%

|

|

|

|

2.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Impact to EPS Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Tax Expense

|

|

|

$

|

0.32

|

|

|

|

$

|

0.12

|

|

|

|

$

|

0.30

|

|

|

|

|

$

|

0.68

|

|

|

|

$

|

0.43

|

|

|

Adjustments to income taxes

|

|

|

|

0.06

|

|

|

|

|

0.14

|

|

|

|

|

(0.27

|

)

|

|

|

|

|

0.20

|

|

|

|

|

(0.38

|

)

|

|

Non-GAAP Tax Expense

|

|

|

$

|

0.38

|

|

|

|

$

|

0.26

|

|

|

|

$

|

0.03

|

|

|

|

|

$

|

0.88

|

|

|

|

$

|

0.05

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

CONSOLIDATED CONDENSED BALANCE SHEET

|

|

(in thousands)

|

|

|

|

|

|

|

Dec. 26,

|

|

|

Mar. 28,

|

|

|

Dec. 27,

|

|

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

ASSETS

|

|

|

(unaudited)

|

|

|

|

|

|

(unaudited)

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

$

|

159,572

|

|

|

|

$

|

76,401

|

|

|

|

$

|

66,607

|

|

|

Marketable securities

|

|

|

|

67,148

|

|

|

|

|

124,246

|

|

|

|

|

106,061

|

|

|

Accounts receivable, net

|

|

|

|

127,754

|

|

|

|

|

112,608

|

|

|

|

|

148,386

|

|

|

Inventories

|

|

|

|

137,723

|

|

|

|

|

84,196

|

|

|

|

|

73,896

|

|

|

Deferred tax asset

|

|

|

|

19,404

|

|

|

|

|

18,559

|

|

|

|

|

14,143

|

|

|

Other current assets

|

|

|

|

37,982

|

|

|

|

|

35,903

|

|

|

|

|

27,081

|

|

|

Total current Assets

|

|

|

|

549,583

|

|

|

|

|

451,913

|

|

|

|

|

436,174

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term marketable securities

|

|

|

|

22,327

|

|

|

|

|

60,072

|

|

|

|

|

3,404

|

|

|

Property and equipment, net

|

|

|

|

159,149

|

|

|

|

|

144,346

|

|

|

|

|

137,291

|

|

|

Intangibles, net

|

|

|

|

171,664

|

|

|

|

|

175,743

|

|

|

|

|

181,675

|

|

|

Goodwill

|

|

|

|

287,518

|

|

|

|

|

263,115

|

|

|

|

|

264,879

|

|

|

Deferred tax asset

|

|

|

|

27,581

|

|

|

|

|

25,593

|

|

|

|

|

24,991

|

|

|

Other assets

|

|

|

|

18,099

|

|

|

|

|

27,996

|

|

|

|

|

16,654

|

|

|

Total assets

|

|

|

$

|

1,235,921

|

|

|

|

$

|

1,148,778

|

|

|

|

$

|

1,065,068

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

$

|

114,483

|

|

|

|

$

|

112,213

|

|

|

|

$

|

77,195

|

|

|

Accrued salaries and benefits

|

|

|

|

22,438

|

|

|

|

|

24,132

|

|

|

|

|

20,164

|

|

|

Deferred income

|

|

|

|

4,162

|

|

|

|

|

6,105

|

|

|

|

|

5,417

|

|

|

Other accrued liabilities

|

|

|

|

36,301

|

|

|

|

|

34,128

|

|

|

|

|

27,402

|

|

|

Total current liabilities

|

|

|

|

177,384

|

|

|

|

|

176,578

|

|

|

|

|

130,178

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

|

160,439

|

|

|

|

|

180,439

|

|

|

|

|

200,439

|

|

|

Other long-term liabilities

|

|

|

|

38,223

|

|

|

|

|

34,990

|

|

|

|

|

21,073

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

|

Capital stock

|

|

|

|

1,198,547

|

|

|

|

|

1,159,494

|

|

|

|

|

1,135,719

|

|

|

Accumulated deficit

|

|

|

|

(336,653

|

)

|

|

|

|

(400,613

|

)

|

|

|

|

(421,514

|

)

|

|

Accumulated other comprehensive loss

|

|

|

|

(2,019

|

)

|

|

|

|

(2,110

|

)

|

|

|

|

(827

|

)

|

|

Total stockholders' equity

|

|

|

|

859,875

|

|

|

|

|

756,771

|

|

|

|

|

713,378

|

|

|

Total liabilities and stockholders' equity

|

|

|

$

|

1,235,921

|

|

|

|

$

|

1,148,778

|

|

|

|

$

|

1,065,068

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepared in accordance with Generally Accepted Accounting

Principles

|

CONTACT:

Cirrus Logic, Inc.

Thurman K. Case, 512-851-4125

Chief

Financial Officer

Investor.Relations@cirrus.com

1 January 27, 2016 Letter

to Shareholders Q3 FY16 FY13 CIRRUS LOGIC, INC. 800 WEST SIXTH STREET,

AUSTIN, TEXAS 78701

2 January 27, 2016 Dear

Shareholders, Cirrus Logic’s Q3 revenue was $347.9 million, up 13

percent sequentially and 16 percent year over year. On a GAAP basis,

operating profit was 18 percent and EPS was $0.63. Non-GAAP operating

profit and EPS were 23 percent and $0.82, respectively. As previously

announced, our sales for the quarter were below our expectations as we

experienced weaker than anticipated demand for certain portable audio

products. This weakness escalated over the last few weeks of December

and has resulted in a significant reduction in our revenue forecast for

the March quarter. While sales in Q3 and our outlook for Q4 fell short

of expectations, FY16 remains an outstanding year overall as we

anticipate 27 percent year-over-year growth, based on the midpoint of Q4

guidance. We have expanded share and content with existing customers,

ramped 55 nanometer products and increased our served available market

(SAM) considerably with the introduction of digital headset products.

More importantly, we have executed on numerous strategic initiatives,

including several new products that we expect to drive strong growth in

FY17, particularly in the second half of the year. We remain highly

focused on delivering a broad platform of innovative audio and voice

components that target the rapidly growing mobile phone, smart accessory

and digital headset markets. With a compelling portfolio of

sophisticated products including hardware, software and algorithms and a

solid customer base comprised of many industry leaders, we are extremely

optimistic about our future outlook. Figure A: Cirrus Logic Q3 FY16 GAAP

to Non-GAAP Reconciliation GAAP Other Non-GAAP Revenue $347.9 $347.9

Gross Margin Dollars $164.9 $0.2 $165.1 Gross Margin Percent 47.4% 47.5%

Operating Expense $101.0 ($16.3) $84.7 Operating Income $63.9 $16.5

$80.4 Operating Income Percent 18% 23% Other Income / (Expense) ($1.5)

($1.5) Income Tax Benefit / (Expense) ($21.0) ($3.7) ($24.7) Net Income

$41.4 $12.7 $54.1 Diluted EPS $0.63 $0.19 $0.82 *Complete GAAP to

Non-GAAP reconciliations available on page 12 $ millions, except EPS

3 Revenue and Gross Margins

Revenue for the third quarter was $347.9 million, up 13 percent

sequentially and 16 percent year over year, primarily due to growth in

portable audio products. These results reflect lower than anticipated

sales of certain portable audio components as weakness in this product

line escalated in the last few weeks of December. Two customers each

contributed more than 10 percent of total revenue in the December

quarter, representing 76 percent and 11 percent of sales. Our

relationship with our largest customer remains outstanding with design

activity continuing on various products. While we understand there is

intense interest in this customer, in accordance with our policy, we do

not discuss specifics about our business relationship. In the March

quarter, we anticipate revenue will range from $210 million to $240

million, representing a decrease of 35 percent sequentially and 12

percent year over year at the midpoint. This decline is primarily

associated with continued weakness in portable audio. Despite the

near-term challenges, our expectation, based on the midpoint of Q4

guidance, is for 27 percent year over year revenue growth in FY16. As we

look to FY17, we foresee strong growth as we introduce several new

products and expand share with existing and new customers. GAAP and

non-GAAP gross margin for the December quarter were 47.4 percent and

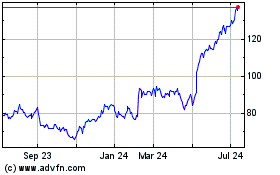

47.5 percent, respectively. In Q3/FY14 Q4/FY14 Q1/FY15 Q2/FY15 Q3/FY15

Q4/FY15 Q1/FY16 Q2/FY16 Q3/FY16 Q4/FY16 $219 $150 $153 $210 $299 255

$283 $307 $348 $225* *Midpoint of guidance as of January 27, 2016 Figure

B: Cirrus Logic Revenue Q3 FY14 to Q4 FY16 (M) $370 $427 $810 $714 $917

$1,162* FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 Figure C: Cirrus Logic

Revenue FY11 to FY16 (M) *Reflects midpoint of Q4 FY16 guidance as of

January 27, 2016

4 the March quarter, gross

margin should range from 47 percent to 49 percent. Operating Profit,

Earnings and Cash Operating margin in the December quarter was

approximately 18 percent GAAP and 23 percent on a non-GAAP basis. GAAP

operating expenses were $101 million and non- GAAP operating expenses

were $84.7 million. GAAP operating expenses include approximately $7.8

million in share-based compensation and $8.6 million in amortization of

acquired intangibles. The sequential increase in operating expense

reflects higher costs associated with additional headcount, contract

labor working to accelerate key R&D projects, employee expenses and

costs related to the write off of certain obsolete IT and Austin

facility assets. Some of the main drivers of the year-over-year increase

were additional headcount, employee expenses, amortization of acquired

intangibles and costs related to the write off of certain obsolete IT

and Austin facility assets. In the March quarter GAAP R&D and SG&A

expenses should range from $100 million to $104 million, including

roughly $8 million in share-based compensation and $9 million in

amortization of acquired intangibles. This guidance reflects an uptick

in R&D, which is being offset by a decline in SG&A. Cirrus Logic’s

business model requires a substantial investment in R&D to effectively

target fast-growing markets and design compelling products. Going

forward, we expect to continue to heavily invest in critical projects,

including broadening our software capabilities and new ventures such as

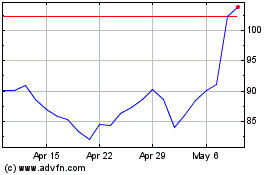

digital headsets Figure D: Cirrus Logic GAAP R&D and SG&A

Expenses/Headcount Q3 FY14 to Q4 FY16 735 751 739 1,099** 1,102 1,104

1,125 1,198 1,248 0 10 20 30 40 50 60 70 80 90 100 Q3/FY14 Q4/FY14

Q1/FY15 Q2/FY15 Q3/FY15 Q4/FY15 Q1/FY16 Q2/FY16 Q3/FY16 Q4/FY16 Expense*

SG&A R&D Headcount $M *Reflects midpoint of combined R&D and SG&A

guidance as of January 27, 2016 **OperaCng expense and headcount

increase reflects 5 weeks of the acquisiCon of Wolfson Microelectronics

($ millions, except headcount)

5 and voice biometrics,

which we believe will fuel future opportunities, while managing SG&A

expenses appropriately. Our total headcount exiting Q3 was 1,248. GAAP

earnings per share for the quarter were $0.63, up $0.10 sequentially and

$0.28 year over year. Non-GAAP earnings per share were $0.82, up $0.17

quarter over quarter and down $0.15 from the prior year. The non-GAAP

earnings per share for the December quarter includes approximately $0.38

of tax-related expense. The non-GAAP tax expense is higher versus the

prior year, as the company had a significant amount of deferred tax

assets and other tax credits in Q3 FY15. Our ending cash balance in the

December quarter was $249 million, up from $165.2 million the prior

quarter. Cash from operations was approximately $116.3 million. The

company’s balance sheet reflects $160.4 million of debt, unchanged from

the September quarter. Interest expense related to this debt is

currently expected to be approximately $1 million per quarter. In the

December quarter we used roughly $20 million to repurchase 687,521

shares of common stock at an average price of $29.08. The company has

approximately $212.5 million remaining in our share repurchase programs.

We will continue to evaluate potential uses of cash including investment

in R&D, acquisitions, the repurchase of shares and repayment of debt.

Taxes Cirrus Logic’s GAAP tax expense for the December quarter was $21

million, resulting in an effective tax rate of 33.7 percent. The

year-to-date GAAP tax expense was $45.3 million or a 29.2 percent

effective tax rate. The non-GAAP tax expense for the quarter and

year-to-date were $24.7 million and $58.7 million, respectively. The

non-GAAP effective tax rates for the quarter and year-to-date were 31.4

percent and 30.6 percent, respectively. Non-GAAP tax expense includes

the tax effect of higher non-GAAP income in various jurisdictions. The

GAAP and non-GAAP tax expense incorporates the permanent reinstatement

of the U.S. Federal R&D credit, which occurred during the quarter. Our

full year FY16 GAAP and non-GAAP effective tax rates are now expected to

range from

6 approximately 31 percent

to 32 percent, compared to our previous estimate of 30 percent. The

increase is due to a higher proportion of pre-tax income being earned in

the U.S. than originally anticipated. As a result, we anticipate our

GAAP and non-GAAP effective tax rates in the March quarter will be

higher than the full FY16 forecast, with GAAP being up significantly

more. Moving forward, we expect a growing portion of our income will be

generated offshore; accordingly, our worldwide effective tax rate in

FY17 should range from 28 percent to 30 percent. Company Strategy CY15

was an exciting year for Cirrus Logic as demand for our high

performance, ultra low power audio and voice products accelerated across

a wide range of customers and form factors. We increased our share with

existing customers, broadened our customer base, ramped new 55 nanometer

products, and significantly expanded the value of our SAM with the

introduction of new smart codecs targeting digital headsets. In this

highly competitive environment, many OEMs increasingly believe the audio

and voice experience plays a key role in differentiating their products.

Interest in features such as always-on voice control and louder sound

output with a consistent user experience is growing rapidly. As the

leading supplier of complete end-to-end audio and voice solutions

including smart codecs, boosted amplifiers and microphones, we expect to

continue to capitalize on this increasing demand. We are confident that

our strategy of focusing on innovative market leading customers in the

fastest growing audio and voice segments and our robust product roadmap,

including scalable platforms with hardware and software solutions that

target various product tiers, will fuel future growth. This success is

expected to be driven by increasing content with existing customers;

broadening our market share in handset OEMs three through ten; and

driving key flagship features into mid-tier mobile devices. As we move

into our next fiscal year, we anticipate strong year-over-year revenue

growth as we introduce several new products and gain traction with these

initiatives. Longer term, the company will leverage the technology

developed for mobile into adjacent markets including wearables and the

smart connected home. Additionally, we believe that our increased level

of investment targeting technology and software capabilities that improve

7 the voice experience,

such as always-on voice, voice biometrics, and various offerings to

improve voice interaction will significantly increase Cirrus Logic’s SAM

over the coming years. Demand for our smart codecs in flagship and more

recently mid-tier smartphones remains strong. We continue to win designs

where key customers choose our audio and voice solutions as an

alternative to the standard audio offerings from SOC vendors. As such,

during the quarter we ramped in several additional smartphones with

another OEM. This reinforces the growing importance that our customers

place on ultra-low power and sophisticated signal processing features

such as always-on voice control and our ability to optimize components

to meet their performance and price requirements. While we anticipate a

rebalance of share at a leading Android customer as they revert to a

dual sourcing strategy on core chipsets, design activity at numerous

OEMs for flagship and midtier products remains robust and as we move

through the coming year we expect to expand our share with both new and

existing customers. Cirrus Logic introduced its first boosted amplifier

in CY12. We have recognized three consecutive years of significant

year-over-year unit growth, shipping over one billion units. During the

quarter, we continued to gain momentum as we ramped new products at an

existing customer and were actively designing with numerous OEMs for

flagship and mid-tier smartphones. We are thrilled with the success of

this business and are excited about our opportunities for the continued

expansion of this product line. There are numerous trends driving a

meaningful increase in demand for high quality boosted amplifiers across

a wide range of OEMs and product tiers. The increase comes from many

leading mobile OEMs and is rooted in the need to deliver louder sound

output from microspeakers without compromising sound quality and the

listening experience. Further, the push for thinner industrial designs

in mobile devices limits the physical space allocated to speaker

systems. These form factor constraints require amplifiers to consume

less board space while providing increased complexity in the hardware

and software algorithms to move sound with less air and ensure the

speaker, battery and overall signal path is protected. Finally, use

cases continue to expand and evolve, and when coupled with the

8 aforementioned push for

thinner industrial designs restricting space for speakers, OEMs are

increasingly looking for alternative solutions to drive even louder high

quality speaker outputs, including utilizing multiple amplifiers.

Although this market remains highly competitive, going forward, we

believe revenue generated by this business will continue to grow

substantially in FY17. While the desire for innovative audio and voice

features in smartphones is immense, the accessories attached to handsets

are being viewed more and more by OEMs as another path for

differentiation. Identifying this emerging market several years ago,

Cirrus Logic leveraged our 55 nanometer transition to develop a number

of ultra low power, high performance products targeting digital

headsets. This technology enables the company to optimize our product

portfolio to address a wide range of specifications and price points. At

the high end, our disruptive headphone smart codec provides

high-fidelity audio playback and advanced features such as adaptive

active noise cancelling (ANC) across all form factors, including

non-sealed earbuds. Our digital headset components designed for

mainstream applications deliver a cost-effective high-fidelity audio

experience. Further, we have solutions and reference designs for digital

headsets and accessories utilizing the Lightning® connector, which are

available through Apple's MFi partner program. Along with the upcoming

broad deployment of USB-C in Android handsets, this positions us to

deliver digital headset solutions and reference designs for the primary

digital connectors found in leading smartphones. A key benefit of more

advanced digital connections between the handset and headset is allowing

power to be drawn from the handset, which provides a meaningful cost

reduction and form factor improvement by eliminating the need for a

battery in an active headset. We are very encouraged with our momentum

this past quarter, as we remained heavily engaged in design activity

across product tiers with numerous smartphone and retail accessory OEMs.

We expect to continue to invest substantially in this new product

category as we build an extensive portfolio of products with the

functionally and price points appropriate for the flagship and mid-tier

categories. While the digital headset market is in the early stages of

development, we are very excited about our opportunities to drive

long-term growth with these products and believe they will contribute

meaningfully to revenue this calendar year.

9 We believe the company is

poised to expand content over the coming years as we continue to

cross-sell smart codecs and amplifiers to existing customers, expand our

market share with mobile OEMs three through ten, build upon our success

in MEMS microphones and gain momentum with our recently introduced smart

codecs for the emerging digital headsets market. With a variety of

vectors for expansion, we are extremely optimistic about our prospects

for sustained revenue growth in the future and our ability to deliver

shareholder value. Summary and Guidance For the March quarter we expect

the following results: • Revenue to range between $210 million and $240

million; • GAAP gross margin to be between 47 percent and 49 percent;

and • Combined GAAP R&D and SG&A expenses to range between $100 million

and $104 million, including approximately $8 million in share-based

compensation expense and $9 million in amortization of acquired

intangibles. In summary, despite the short-term impact to our revenue in

Q3 and Q4, we are pleased with our outlook for FY16 as we are on track

to grow over 20 percent year-overyear. Cirrus Logic is uniquely

positioned to capitalize on the rapidly growing demand for innovative

audio and voice solutions across the mobile phone, smart accessory and

digital headset markets. With an outstanding portfolio of products, an

extensive roadmap and solid relationships with many of the leading

consumer OEMs, the company expects strong growth in FY17. Sincerely,

10 Jason Rhode Thurman Case

President and Chief Executive Officer Chief Financial Officer Conference

Call Q&A Session Cirrus Logic will host a live Q&A session at 5 p.m. EST

today to answer questions related to its financial results and business

outlook. Participants may listen to the conference call on the Cirrus

Logic website. Participants who would like to submit a question to be

addressed during the call are requested to email

investor.relations@cirrus.com. A replay of the webcast can be accessed

on the Cirrus Logic website approximately two hours following its

completion, or by calling (404) 537-3406, or toll-free at (855) 859-

2056 (Access Code: 8524794). Use of Non-GAAP Financial Information To

supplement Cirrus Logic's financial statements presented on a GAAP

basis, Cirrus has provided non- GAAP financial information, including

gross margins, operating expenses, net income, operating profit and

income, tax expenses, effective tax rate and diluted earnings per share.

A reconciliation of the adjustments to GAAP results is included in the

tables below. Non-GAAP financial information is not meant as a

substitute for GAAP results, but is included because management believes

such information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage the

company. The non-GAAP financial information used by Cirrus Logic may

differ from that used by other companies. These non-GAAP measures should

be considered in addition to, and not as a substitute for, the results

prepared in accordance with GAAP. Safe Harbor Statement Except for

historical information contained herein, the matters set forth in this

news release contain forward-looking statements, including expectations

for growth and product ramps in the fourth quarter and 2017 and beyond,

our estimates of effective tax rates, and fourth quarter fiscal year

2016 revenue, gross margin, combined research and development and

selling, general and administrative

11 expense levels,

share-based compensation expense and amortization of acquired

intangibles. In some cases, forward-looking statements are identified by

words such as “expect,” “anticipate,” “forsee,” “target,” “project,”

“believe,” “goals,” “opportunity,” “estimates,” “intend,” and variations

of these types of words and similar expressions. In addition, any

statements that refer to our plans, expectations, strategies or other

characterizations of future events or circumstances are forward-looking

statements. These forward-looking statements are based on our current

expectations, estimates and assumptions and are subject to certain risks

and uncertainties that could cause actual results to differ materially.

These risks and uncertainties include, but are not limited to, the

following: the level of orders and shipments during the fourth quarter

of fiscal year 2016, customer cancellations of orders, or the failure to

place orders consistent with forecasts, along with the timing and

success of future product ramps; and the risk factors listed in our Form

10-K for the year ended March 28, 2015, and in our other filings with

the Securities and Exchange Commission, which are available at

www.sec.gov. The foregoing information concerning our business outlook

represents our outlook as of the date of this news release, and we

undertake no obligation to update or revise any forward-looking

statements, whether as a result of new developments or otherwise.

Summary financial data follows: Dec. 26, Sep. 26, Dec. 27, Dec. 26, Dec.

27, 2015 2015 2014 2015 2014 Q3'16 Q2'16 Q3'15 Q3'16 Q3'15 Portable

audio products $ 308,803 $ 257,152 $ 253,355 $ 8 01,821 $ 529,487

Non-portable audio and other products 39,060 49,604 45,251 1 35,431

131,898 CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED STATEMENT OF

OPERATIONS (unaudited) (in thousands, except per share data) Three

Months Ended Nine Months Ended Net sales 347,863 306,756 298,606 9

37,252 661,385 Cost of sales 182,952 164,535 167,775 4 97,666 354,612

Gross profit 164,911 142,221 130,831 4 39,586 306,773 Gross margin 47.4%

46.4% 43.8% 46.9% 46.4% Research and development 70,290 67,258 55,474 2

03,383 139,808 Selling, general and administrative 30,632 30,103 27,783

89,854 69,011 Acquisition related costs - 3,200 - 18,137 Restructuring

and other - 1,455 Patent agreement and other 78 752 - (11,670) - Total

operating expenses 101,000 98,113 86,457 2 81,567 228,411 Income from

operations 63,911 44,108 44,374 1 58,019 78,362 Interest expense, net

(591) (601) (1,042) (1,830) (4,179) Other expense, net (925) (524)

(1,071) (1,313) ( 12,564) Income before income taxes 62,395 42,983

42,261 1 54,876 61,619 Provision for income taxes 21,011 8,103 19,532

45,258 27,790 Net income $ 41,384 $ 34,880 $ 22,729 $ 1 09,618 $ 33,829

Basic earnings per share: $ 0.65 $ 0.55 $ 0.36 $ 1.73 $ 0.54 Diluted

earnings per share: $ 0.63 $ 0.53 $ 0.35 $ 1.66 $ 0.52 Weighted average

number of shares: Basic 63,328 63,346 62,885 63,316 62,386 Diluted

65,761 66,329 65,214 66,184 65,024 Prepared in accordance with Generally

Accepted Accounting Principles

12 Dec. 26, Sep. 26, Dec.

27, Dec. 26, Dec. 27, 2015 2015 2014 2015 2014 Net Income Reconciliation

Q3'16 Q2'16 Q3'15 Q3'16 Q3'15 GAAP Net Income $ 41,384 $ 34,880 $ 22,729

$ 1 09,618 $ 33,829 Amortization of acquisition intangibles 8,634 8,133

5,151 23,908 7,921 Stock based compensation expense 7,761 8,688 7,815

24,720 19,933 (not prepared in accordance with GAAP) CIRRUS LOGIC, INC.

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

(unaudited, in thousands, except per share data) Non-GAAP financial

information is not meant as a substitute for GAAP results, but is

included because management believes such information is useful to our

investors for informational and comparative purposes. In addition,

certain non-GAAP financial information is used internally by management

to evaluate and manage the company. As a note, the non-GAAP financial

information used by Cirrus Logic may differ from that used by other

companies. These non-GAAP measures should be considered in addition to,

and not as a substitute for, the results prepared in accordance with

GAAP. Certain modifications to prior year non-GAAP presentation has been

made and had no material effect on the results of operations. Three

Months Ended Nine Months Ended Patent agreement and other 78 752 -

(11,670) - Restructuring and other costs, net - 1,455 Wolfson