SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

______________

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): October

29, 2014

|

|

CIRRUS

LOGIC, INC.

|

|

|

(Exact

name of Registrant as specified in its charter)

|

|

Delaware

|

|

0-17795

|

|

77-0024818

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

800 West 6th Street, Austin, TX

|

|

|

78701

|

|

|

(Address

of Principal Executive Offices)

|

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (512)

851-4000

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

⃞

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

⃞

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

⃞

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On October 29, 2014, the Company issued a press release announcing its

results for its second quarter and first six months of fiscal year

2015. The full text of the press release is furnished as Exhibit No.

99.1 to this Current Report on Form 8-K.

Item 7.01 Regulation FD.

On October 29, 2014, in addition to issuing a press release, the Company

posted on its website a shareholder letter to investors summarizing the

financial results for its second quarter and first six months of fiscal

year 2015. The full text of the shareholder letter is furnished as

Exhibit No. 99.2 to this Current Report on Form 8-K.

Use of Non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP

basis, Cirrus has provided certain non-GAAP financial information,

including gross margin, operating expenses, net income, income from

operations, operating margin and diluted earnings per share. A

reconciliation of the adjustments to GAAP results is included in the

tables to the press release furnished as Exhibit No. 99.1 to this

Current Report on Form 8-K. Non-GAAP financial information is not meant

as a substitute for GAAP results, but is included because management

believes such information is useful to our investors for informational

and comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage the

company. As a note, the non-GAAP financial information used by Cirrus

Logic may differ from that used by other companies. These non-GAAP

measures should be considered in addition to, and not as a substitute

for, the results prepared in accordance with GAAP.

The information contained in Items 2.02, 7.01, and 9.01 in this Current

Report on Form 8-K and the exhibits furnished hereto contain

forward-looking statements regarding the Company and cautionary

statements identifying important factors that could cause actual results

to differ materially from those anticipated. In addition, this

information shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities of that section, nor shall they be

deemed incorporated by reference in any filing under the Securities Act

of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Description

Exhibit 99.1 Cirrus Logic, Inc. press release dated

October 29, 2014

Exhibit 99.2 Cirrus Logic, Inc.

shareholder letter dated October 29, 2014

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, Registrant has

duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

CIRRUS LOGIC, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

October 29, 2014

|

By:

|

/s/ Thurman K. Case

|

|

|

|

|

|

Name: Thurman K. Case

|

|

|

|

|

|

Title: Chief Financial Officer

|

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

|

|

|

99.1

|

Registrant’s press release dated October 29, 2014

|

|

99.2

|

Cirrus Logic, Inc. shareholder letter dated October 29, 2014

|

Exhibit 99.1

Cirrus

Logic Reports Revenue of $210.2 Million

Strong

Demand for Portable Audio Drives September Quarter Revenue Growth

AUSTIN, Texas--(BUSINESS WIRE)--October 29, 2014--Cirrus Logic, Inc.

(Nasdaq: CRUS), a leader in high-precision analog and digital

signal processing components, today posted on its investor relations

website at http://investor.cirrus.com the quarterly Shareholder

Letter that contains the complete financial results for the second

quarter fiscal year 2015, which ended Sept. 27, 2014, as well as the

company’s current business outlook.

“Q2 was an outstanding quarter for Cirrus Logic, as strong demand for

portable audio products drove revenue above expectations. In addition,

we were pleased to have closed the acquisition of Wolfson

Microelectronics on Aug. 21,” said Jason Rhode, president and chief

executive officer. “The acquisition further strengthens Cirrus Logic’s

position as a market leader and helps accelerate critical R&D programs

we believe will fuel revenue growth in the future.”

Reported Financial Results – Second Quarter FY15

-

Revenue of $210.2 million, including $197.2 million from Cirrus Logic

and $13 million from five weeks of Wolfson Microelectronics;

-

GAAP gross margin of 47.8 percent and non-GAAP gross margin of 48.7

percent;

-

GAAP operating expenses of $82.5 million and non-GAAP operating

expenses of $57.3 million. GAAP operating expense includes $18.7

million in acquisition costs and $6.5 million of share-based

compensation and amortization of acquired intangibles; and

-

GAAP diluted earnings per share of $0.01 and non-GAAP diluted earnings

per share of $0.68.

A reconciliation of the non-GAAP charges is included in the tables

accompanying this press release.

Business Outlook – Third Quarter FY15

-

Revenue is expected to range between $265 million and $285 million;

-

GAAP gross margin is expected to be between 42 percent and 44 percent,

which includes roughly 200 basis points of costs associated with the

fair value write up of acquired inventory; and

-

Combined R&D and SG&A expenses are expected to range between $86

million and $90 million, which includes approximately $9 million in

share-based compensation and $7 million in amortization of acquired

intangibles.

Cirrus Logic will host a live Q&A session at 5 p.m. EDT today to answer

questions related to its financial results and business outlook.

Participants may listen to the conference call on the Cirrus Logic

website. Participants who would like to submit a question to be

addressed during the call are requested to email investor.relations@cirrus.com.

A replay of the webcast can be accessed on the Cirrus Logic website

approximately two hours following its completion, or by calling (404)

537-3406, or toll-free at (855) 859-2056 (Access Code: 13896797).

Cirrus Logic, Inc.

Cirrus Logic develops high-precision, analog and mixed-signal integrated

circuits for a broad range of innovative customers. Building on its

diverse analog and signal-processing patent portfolio, Cirrus Logic

delivers highly optimized products for a variety of audio, industrial

and energy-related applications. The company operates from headquarters

in Austin, Texas, with offices in the United States, United Kingdom,

Europe, Japan and Asia. More information about Cirrus Logic is available

at www.cirrus.com.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP

basis, Cirrus has provided non-GAAP financial information, including

gross margins, operating expenses, net income, operating profit and

diluted earnings per share. A reconciliation of the adjustments to GAAP

results is included in the tables below. Non-GAAP financial information

is not meant as a substitute for GAAP results, but is included because

management believes such information is useful to our investors for

informational and comparative purposes. In addition, certain non-GAAP

financial information is used internally by management to evaluate and

manage the company. The non-GAAP financial information used by Cirrus

Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters set

forth in this news release contain forward-looking statements, including

our estimates of third quarter fiscal year 2015 revenue, gross margin,

combined research and development and selling, general and

administrative expense levels, share-based compensation expense,

amortization of acquired intangibles and acquisition related costs

associated with the fair value write up of acquired inventory. In some

cases, forward-looking statements are identified by words such as

“expect,” “anticipate,” “target,” “project,” “believe,” “goals,”

“opportunity,” “estimates,” “intend,” and variations of these types of

words and similar expressions. In addition, any statements that

refer to our plans, expectations, strategies or other characterizations

of future events or circumstances are forward-looking statements. These

forward-looking statements are based on our current expectations,

estimates and assumptions and are subject to certain risks and

uncertainties that could cause actual results to differ materially.

These risks and uncertainties include, but are not limited to, the

following: the level of orders and shipments during the third quarter of

fiscal year 2015, as well as customer cancellations of orders, or the

failure to place orders consistent with forecasts; and the risk factors

listed in our Form 10-K for the year ended March 29, 2014, and in our

other filings with the Securities and Exchange Commission, which are

available at www.sec.gov. The foregoing information concerning

our business outlook represents our outlook as of the date of this news

release, and we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new developments or

otherwise.

Cirrus Logic, Cirrus and Wolfson are registered trademarks of Cirrus

Logic, Inc. or its subsidiaries. All other company or product names

noted herein may be trademarks of their respective holders.

Summary financial data follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS

|

|

(unaudited)

|

|

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sep. 27,

|

|

|

Jun. 28,

|

|

|

Sep. 28,

|

|

|

Sep. 27,

|

|

|

Sep. 28,

|

|

|

|

|

2014

|

|

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

|

|

|

Q2'15

|

|

|

Q1'15

|

|

|

Q2'14

|

|

|

Q2'15

|

|

|

Q2'14

|

|

Portable audio products

|

|

|

$

|

163,563

|

|

|

|

$

|

112,570

|

|

|

|

$

|

150,949

|

|

|

|

$

|

276,132

|

|

|

|

$

|

267,556

|

|

|

Non-portable audio and other products

|

|

|

|

46,651

|

|

|

|

|

39,995

|

|

|

|

|

39,722

|

|

|

|

|

86,647

|

|

|

|

|

78,240

|

|

|

Net sales

|

|

|

|

210,214

|

|

|

|

|

152,565

|

|

|

|

|

190,671

|

|

|

|

|

362,779

|

|

|

|

|

345,796

|

|

|

Cost of sales

|

|

|

|

109,647

|

|

|

|

|

77,190

|

|

|

|

|

91,223

|

|

|

|

|

186,837

|

|

|

|

|

166,850

|

|

|

Gross profit

|

|

|

|

100,567

|

|

|

|

|

75,375

|

|

|

|

|

99,448

|

|

|

|

|

175,942

|

|

|

|

|

178,946

|

|

|

Gross margin

|

|

|

|

47.8

|

%

|

|

|

|

49.4

|

%

|

|

|

|

52.2

|

%

|

|

|

|

48.5

|

%

|

|

|

|

51.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

|

44,557

|

|

|

|

|

39,777

|

|

|

|

|

29,722

|

|

|

|

|

84,334

|

|

|

|

|

58,252

|

|

|

Selling, general and administrative

|

|

|

|

21,545

|

|

|

|

|

19,683

|

|

|

|

|

19,215

|

|

|

|

|

41,228

|

|

|

|

|

38,413

|

|

|

Restructuring and other

|

|

|

|

1,455

|

|

|

|

|

-

|

|

|

|

|

(154

|

)

|

|

|

|

1,455

|

|

|

|

|

(584

|

)

|

|

Acquisition related costs

|

|

|

|

14,937

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

14,937

|

|

|

|

|

-

|

|

|

Patent infringement settlements, net

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

695

|

|

|

Total operating expenses

|

|

|

|

82,494

|

|

|

|

|

59,460

|

|

|

|

|

48,783

|

|

|

|

|

141,954

|

|

|

|

|

96,776

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

|

18,073

|

|

|

|

|

15,915

|

|

|

|

|

50,665

|

|

|

|

|

33,988

|

|

|

|

|

82,170

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net

|

|

|

|

(2,670

|

)

|

|

|

|

(467

|

)

|

|

|

|

201

|

|

|

|

|

(3,137

|

)

|

|

|

|

359

|

|

|

Other income (expense), net

|

|

|

|

(11,994

|

)

|

|

|

|

501

|

|

|

|

|

(38

|

)

|

|

|

|

(11,493

|

)

|

|

|

|

(55

|

)

|

|

Income before income taxes

|

|

|

|

3,409

|

|

|

|

|

15,949

|

|

|

|

|

50,828

|

|

|

|

|

19,358

|

|

|

|

|

82,474

|

|

|

Provision for income taxes

|

|

|

|

2,557

|

|

|

|

|

5,701

|

|

|

|

|

17,461

|

|

|

|

|

8,258

|

|

|

|

|

28,465

|

|

|

Net income

|

|

|

$

|

852

|

|

|

|

$

|

10,248

|

|

|

|

$

|

33,367

|

|

|

|

$

|

11,100

|

|

|

|

$

|

54,009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share:

|

|

|

$

|

0.01

|

|

|

|

$

|

0.17

|

|

|

|

$

|

0.53

|

|

|

|

$

|

0.18

|

|

|

|

$

|

0.85

|

|

|

Diluted earnings per share:

|

|

|

$

|

0.01

|

|

|

|

$

|

0.16

|

|

|

|

$

|

0.50

|

|

|

|

$

|

0.17

|

|

|

|

$

|

0.82

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

62,241

|

|

|

|

|

62,032

|

|

|

|

|

63,217

|

|

|

|

|

62,137

|

|

|

|

|

63,329

|

|

|

Diluted

|

|

|

|

65,085

|

|

|

|

|

64,688

|

|

|

|

|

66,125

|

|

|

|

|

64,892

|

|

|

|

|

66,203

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepared in accordance with Generally Accepted Accounting

Principles

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

|

|

(unaudited, in thousands, except per share data)

|

|

(not prepared in accordance with GAAP)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. As a note, the non-GAAP financial information used by

Cirrus Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sep. 27,

|

|

|

Jun. 28,

|

|

|

Sep. 28,

|

|

|

Sep. 27,

|

|

|

Sep. 28,

|

|

|

|

|

2014

|

|

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

Net Income Reconciliation

|

|

|

Q2'15

|

|

|

Q1'15

|

|

|

Q2'14

|

|

|

Q2'15

|

|

|

Q2'14

|

|

GAAP Net Income

|

|

|

$

|

852

|

|

|

|

$

|

10,248

|

|

|

|

$

|

33,367

|

|

|

|

$

|

11,100

|

|

|

|

$

|

54,009

|

|

|

Amortization of acquisition intangibles

|

|

|

|

2,524

|

|

|

|

|

246

|

|

|

|

|

-

|

|

|

|

|

2,770

|

|

|

|

|

-

|

|

|

Stock based compensation expense

|

|

|

|

6,496

|

|

|

|

|

5,622

|

|

|

|

|

5,739

|

|

|

|

|

12,118

|

|

|

|

|

11,513

|

|

|

Provision for litigation expenses and settlements

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

695

|

|

|

Restructuring and other costs, net

|

|

|

|

1,455

|

|

|

|

|

-

|

|

|

|

|

(154

|

)

|

|

|

|

1,455

|

|

|

|

|

(584

|

)

|

|

Wolfson acquisition items

|

|

|

|

30,875

|

|

|

|

|

2,304

|

|

|

|

|

-

|

|

|

|

|

33,179

|

|

|

|

|

-

|

|

|

Provision for income taxes

|

|

|

|

1,764

|

|

|

|

|

5,226

|

|

|

|

|

16,378

|

|

|

|

|

6,990

|

|

|

|

|

26,539

|

|

|

Non-GAAP Net Income

|

|

|

$

|

43,966

|

|

|

|

$

|

23,646

|

|

|

|

$

|

55,330

|

|

|

|

$

|

67,612

|

|

|

|

$

|

92,172

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Diluted earnings per share

|

|

|

$

|

0.01

|

|

|

|

$

|

0.16

|

|

|

|

$

|

0.50

|

|

|

|

$

|

0.17

|

|

|

|

$

|

0.82

|

|

|

Effect of Amortization of acquisition intangibles

|

|

|

|

0.04

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

0.04

|

|

|

|

|

-

|

|

|

Effect of Stock based compensation expense

|

|

|

|

0.10

|

|

|

|

|

0.09

|

|

|

|

|

0.09

|

|

|

|

|

0.19

|

|

|

|

|

0.17

|

|

|

Effect of Provision for litigation expenses and settlements

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

0.01

|

|

|

Effect of Restructuring and other costs, net

|

|

|

|

0.03

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

0.02

|

|

|

|

|

(0.01

|

)

|

|

Effect of Wolfson acquisition items

|

|

|

|

0.47

|

|

|

|

|

0.04

|

|

|

|

|

-

|

|

|

|

|

0.51

|

|

|

|

|

-

|

|

|

Effect of Provision for income taxes

|

|

|

|

0.03

|

|

|

|

|

0.08

|

|

|

|

|

0.25

|

|

|

|

|

0.11

|

|

|

|

|

0.40

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Diluted earnings per share

|

|

|

$

|

0.68

|

|

|

|

$

|

0.37

|

|

|

|

$

|

0.84

|

|

|

|

$

|

1.04

|

|

|

|

$

|

1.39

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Operating Income

|

|

|

$

|

18,073

|

|

|

|

$

|

15,915

|

|

|

|

$

|

50,665

|

|

|

|

$

|

33,988

|

|

|

|

$

|

82,170

|

|

|

GAAP Operating Profit

|

|

|

|

9

|

%

|

|

|

|

10

|

%

|

|

|

|

27

|

%

|

|

|

|

9

|

%

|

|

|

|

24

|

%

|

|

Amortization of acquisition intangibles

|

|

|

|

2,524

|

|

|

|

|

246

|

|

|

|

|

-

|

|

|

|

|

2,770

|

|

|

|

|

-

|

|

|

Stock compensation expense - COGS

|

|

|

|

253

|

|

|

|

|

231

|

|

|

|

|

239

|

|

|

|

|

484

|

|

|

|

|

245

|

|

|

Stock compensation expense - R&D

|

|

|

|

2,781

|

|

|

|

|

2,543

|

|

|

|

|

2,158

|

|

|

|

|

5,324

|

|

|

|

|

5,012

|

|

|

Stock compensation expense - SG&A

|

|

|

|

3,462

|

|

|

|

|

2,848

|

|

|

|

|

3,342

|

|

|

|

|

6,310

|

|

|

|

|

6,256

|

|

|

Provision for litigation expenses and settlements

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

695

|

|

|

Restructuring and other costs, net

|

|

|

|

1,455

|

|

|

|

|

-

|

|

|

|

|

(154

|

)

|

|

|

|

1,455

|

|

|

|

|

(584

|

)

|

|

Wolfson acquisition items

|

|

|

|

16,547

|

|

|

|

|

2,192

|

|

|

|

|

-

|

|

|

|

|

18,739

|

|

|

|

|

-

|

|

|

Non-GAAP Operating Income

|

|

|

$

|

45,095

|

|

|

|

$

|

23,975

|

|

|

|

$

|

56,250

|

|

|

|

$

|

69,070

|

|

|

|

$

|

93,794

|

|

|

Non-GAAP Operating Profit

|

|

|

|

21

|

%

|

|

|

|

16

|

%

|

|

|

|

30

|

%

|

|

|

|

19

|

%

|

|

|

|

27

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expense Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Operating Expenses

|

|

|

$

|

82,494

|

|

|

|

$

|

59,460

|

|

|

|

$

|

48,783

|

|

|

|

$

|

141,954

|

|

|

|

$

|

96,776

|

|

|

Amortization of acquisition intangibles

|

|

|

|

(2,524

|

)

|

|

|

|

(246

|

)

|

|

|

|

-

|

|

|

|

|

(2,770

|

)

|

|

|

|

-

|

|

|

Stock compensation expense - R&D

|

|

|

|

(2,781

|

)

|

|

|

|

(2,543

|

)

|

|

|

|

(2,158

|

)

|

|

|

|

(5,324

|

)

|

|

|

|

(5,012

|

)

|

|

Stock compensation expense - SG&A

|

|

|

|

(3,462

|

)

|

|

|

|

(2,848

|

)

|

|

|

|

(3,342

|

)

|

|

|

|

(6,310

|

)

|

|

|

|

(6,256

|

)

|

|

Provision for litigation expenses and settlements

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

(695

|

)

|

|

Restructuring and other costs, net

|

|

|

|

(1,455

|

)

|

|

|

|

-

|

|

|

|

|

154

|

|

|

|

|

(1,455

|

)

|

|

|

|

584

|

|

|

Wolfson acquisition items

|

|

|

|

(14,937

|

)

|

|

|

|

(2,192

|

)

|

|

|

|

-

|

|

|

|

|

(17,129

|

)

|

|

|

|

-

|

|

|

Non-GAAP Operating Expenses

|

|

|

$

|

57,335

|

|

|

|

$

|

51,631

|

|

|

|

$

|

43,437

|

|

|

|

$

|

108,966

|

|

|

|

$

|

85,397

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin/Profit Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Gross Margin

|

|

|

$

|

100,567

|

|

|

|

$

|

75,375

|

|

|

|

$

|

99,448

|

|

|

|

$

|

175,942

|

|

|

|

$

|

178,946

|

|

|

GAAP Gross Profit

|

|

|

|

47.8

|

%

|

|

|

|

49.4

|

%

|

|

|

|

52.2

|

%

|

|

|

|

48.5

|

%

|

|

|

|

51.7

|

%

|

|

Wolfson acquisition items

|

|

|

|

1,610

|

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

1,610

|

|

|

|

|

-

|

|

|

Stock compensation expense - COGS

|

|

|

|

253

|

|

|

|

|

231

|

|

|

|

|

239

|

|

|

|

|

484

|

|

|

|

|

245

|

|

|

Non-GAAP Gross Margin

|

|

|

$

|

102,430

|

|

|

|

$

|

75,606

|

|

|

|

$

|

99,687

|

|

|

|

$

|

178,036

|

|

|

|

$

|

179,191

|

|

|

Non-GAAP Gross Profit

|

|

|

|

48.7

|

%

|

|

|

|

49.6

|

%

|

|

|

|

52.3

|

%

|

|

|

|

49.1

|

%

|

|

|

|

51.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

|

CONSOLIDATED CONDENSED BALANCE SHEET

|

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

Sep. 27,

|

|

Mar. 29,

|

|

Sep. 28,

|

|

|

|

|

|

|

|

|

2014

|

|

2014

|

|

2013

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

|

(unaudited)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

$

|

48,214

|

|

|

$

|

31,850

|

|

|

$

|

68,886

|

|

|

|

Marketable securities

|

|

|

|

|

|

85,796

|

|

|

|

263,417

|

|

|

|

199,423

|

|

|

|

Accounts receivable, net

|

|

|

|

|

126,161

|

|

|

|

63,220

|

|

|

|

97,640

|

|

|

|

Inventories

|

|

|

|

|

|

121,169

|

|

|

|

69,743

|

|

|

|

91,247

|

|

|

|

Deferred tax assets

|

|

|

|

|

|

16,435

|

|

|

|

22,024

|

|

|

|

38,398

|

|

|

|

Other current assets

|

|

|

|

|

|

29,089

|

|

|

|

25,079

|

|

|

|

23,978

|

|

|

|

Total current assets

|

|

|

|

|

|

426,864

|

|

|

|

475,333

|

|

|

|

519,572

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term marketable securities

|

|

|

|

9,228

|

|

|

|

89,243

|

|

|

|

40,254

|

|

|

|

Property and equipment, net

|

|

|

|

133,458

|

|

|

|

103,650

|

|

|

|

101,885

|

|

|

|

Intangibles, net

|

|

|

|

|

|

187,030

|

|

|

|

11,999

|

|

|

|

4,734

|

|

|

|

Goodwill

|

|

|

|

|

|

|

265,410

|

|

|

|

16,367

|

|

|

|

6,027

|

|

|

|

Deferred tax assets

|

|

|

|

|

|

24,998

|

|

|

|

25,065

|

|

|

|

16,638

|

|

|

|

Other assets

|

|

|

|

|

|

17,658

|

|

|

|

3,087

|

|

|

|

10,051

|

|

|

|

Total assets

|

|

|

|

|

$

|

1,064,646

|

|

|

$

|

724,744

|

|

|

$

|

699,161

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

|

|

$

|

81,549

|

|

|

$

|

51,932

|

|

|

$

|

56,868

|

|

|

|

Accrued salaries and benefits

|

|

|

|

17,706

|

|

|

|

13,388

|

|

|

|

16,894

|

|

|

|

Other accrued liabilities

|

|

|

|

|

34,946

|

|

|

|

11,572

|

|

|

|

6,313

|

|

|

|

Deferred income

|

|

|

|

|

|

5,218

|

|

|

|

5,631

|

|

|

|

4,858

|

|

|

|

Total current liabilities

|

|

|

|

|

139,419

|

|

|

|

82,523

|

|

|

|

84,933

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other long-term liabilities

|

|

|

|

|

25,376

|

|

|

|

4,863

|

|

|

|

11,231

|

|

|

|

Long-term debt

|

|

|

|

|

|

226,439

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

|

|

Capital stock

|

|

|

|

|

|

1,104,379

|

|

|

|

1,078,878

|

|

|

|

1,055,256

|

|

|

|

Accumulated deficit

|

|

|

|

|

|

(430,144

|

)

|

|

|

(440,634

|

)

|

|

|

(451,532

|

)

|

|

|

Accumulated other comprehensive loss

|

|

|

|

(823

|

)

|

|

|

(886

|

)

|

|

|

(727

|

)

|

|

|

Total stockholders' equity

|

|

|

|

673,412

|

|

|

|

637,358

|

|

|

|

602,997

|

|

|

|

Total liabilities and stockholders' equity

|

|

|

$

|

1,064,646

|

|

|

$

|

724,744

|

|

|

$

|

699,161

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepared in accordance with Generally Accepted Accounting

Principles

|

CONTACT:

Cirrus Logic, Inc.

Investor Contact:

Thurman K.

Case, 512-851-4125

Chief Financial Officer

Investor.Relations@cirrus.com

October 29, 2014 Letter to

Shareholders Q2 FY15 CIRRUS LOGIC, INC. FY13 800 WEST SIXTH STREET,

AUSTIN, TEXAS 78701

October 29, 2014 Dear

Shareholders, Q2 was an outstanding quarter for Cirrus Logic as we

delivered revenue of $210.2 million, which included approximately five

weeks of contribution from Wolfson Microelectronics. On a standalone

basis, Cirrus Logic’s revenue exceeded expectations, increasing 29

percent quarter over quarter and three percent year over year to $197.2

million, as strong demand for portable audio products was fueled by

shipments ramping in several new flagship smartphones. The September

quarter was very productive as we broadened both our custom and

general-market product portfolios with both the US and UK teams taping

out several new devices in advanced geometries targeting the audio and

voice markets. We were pleased to close the Wolfson Microelectronics

transaction on Aug. 21. The strategic rationale for the acquisition was

primarily driven by the fundamental value of Wolfson’s technology,

skilled engineering teams, and the potential for the combined company to

capitalize on additional opportunities. The acquisition accelerates

Cirrus Logic’s strategic roadmap; further strengthens our technology

portfolio with the addition

of MEMS microphones,

advanced DSP technology, and extensive software capabilities,

particularly in the Android ecosystem; and expands our development

capacity and customer base. As a premier supplier of IC solutions that

span the complete audio signal chain from capture to playback, Cirrus

Logic is now well positioned as a market leader with a broad portfolio

of custom-and general-market products shipping in many tier-one flagship

devices today, including five of the top ten global smartphone OEMs. We

believe as the value placed on audio and voice technology continues to

increase there is an opportunity to drive revenue growth over the next

several years through the addition of new customers and expanding

content with existing customers. Revenue and Gross Margins Revenue for

the second quarter was $210.2 million, including $13 million from the

acquisition of Wolfson. On a standalone basis, Cirrus Logic’s revenue

increased 29 percent sequentially and three percent year over year to

$197.2 million, as we experienced strong demand for our custom portable

audio products. As anticipated, the previously mentioned year-over-year

revenue headwinds associated with the change in our portable audio

pricing structure are largely behind us as we have transitioned to a

different product mix. While revenue from the Wolfson acquisition only

contributed five weeks of sales to the combined results in Q2, for the

full quarter they generated total revenue of $28.8 million. Our largest

customer contributed approximately 73 percent of total revenue in Q2.

Our relationship with this customer remains outstanding with design

activity continuing on various products. While we understand there is

intense interest in this

customer, in accordance

with our policy, we do not discuss specifics about our business

relationship. As a combined company, we derive the vast majority of our

revenue from the audio market; therefore, going forward we are adjusting

how we identify revenue to better reflect our sales by product lines.

Beginning this quarter, revenue will be designated as Portable Audio

Products, which includes devices selling into such end applications as

tablets and smartphones. The remainder of the revenue will be defined as

Non-Portable Audio and Other Products, which target high-end home

entertainment, automotive, energy, industrial and various general

markets. In the September quarter, revenue generated by the combined

company consisted of approximately 78 percent of Portable Audio Products

and 22 percent of Non-Portable Audio and Other Products. In the December

quarter we expect revenue to range from $265 million to $285 million,

representing growth on both a quarter-over-quarter and a year-over-year

basis. This guidance reflects reduced revenue expectations for

general-market portable products selling into high-end Android

applications. Sales into this application have been negatively impacted

by a variety of market factors over the past several quarters, and as a

result, we have lowered our outlook for Wolfson revenue in Q3. However,

on a standalone basis, Cirrus Logic’s revenue outlook is exceeding prior

expectations and contributing to year over year revenue growth for FY15.

GAAP gross margins for the September quarter, including Wolfson, were

47.8 percent and non-GAAP gross margins were 48.7 percent. GAAP gross

margins reflect a seasonally higher mix of portable products and costs

related to the accounting requirements associated with the fair value

write up of acquired inventory. We expect these charges to also affect

Q3, but to be largely behind us by the end of the quarter. In the

December quarter, we expect GAAP gross margin to range from 42 percent

to 44 percent, which includes an impact of approximately 200 basis

points due to acquired inventory

accounting charges. Gross

margin guidance also reflects a product mix more in-line with our

long-term model in the mid-40 percent range. Operating Profit and Cash

Operating profit in the September quarter, including the contribution

from the acquisition of Wolfson, was nine percent GAAP and 21 percent

non-GAAP. Operating expenses on a GAAP basis were $82.5 million and

$57.3 million non-GAAP. GAAP operating expenses include approximately

$6.5 million in share-based compensation and roughly $18.7 million in

costs associated with the acquisition of Wolfson. In the December

quarter R&D and SG&A expenses should range from $86 million to $90

million, including $9 million in share-based compensation and $7 million

in amortization of acquired intangibles. Our total headcount exiting Q2

was 1,099, which includes the addition of 381 Wolfson employees. A key

consideration in the acquisition of Wolfson was the ability of the

combined company to aggressively target a significant number of

meaningful opportunities in the audio and voice market that we believe

will fuel future revenue growth and diversification. Since the

acquisition closed in August, our engineering and technical marketing

teams have diligently evaluated and aligned our strategic roadmaps.

Consequently, we are increasing investment in several critical projects

being developed by our UK teams, including next

generation smart codecs,

which we believe will enable the company to deliver innovative solutions

across a broader range of key customers and markets. Operating expense

guidance for the December quarter includes costs associated with design

tools and contract resources needed to expedite these projects. As a

result of our decision to accelerate R&D investment and our adjusted

expectations for sales of general market portable products, we do not

anticipate the Wolfson acquisition to be accretive in the December

quarter. However, longer-term, we continue to expect to see improvements

in operating efficiencies and profitability as these product lines

benefit from Cirrus Logic’s supply chain and engineering processes.

Furthermore, we remain on track to meet our ongoing annual savings goal

for the acquisition. The ending cash balance in the September quarter

was $143 million, down from the prior quarter as a portion of our cash

was utilized to finance the acquisition of Wolfson. As of Q2, the

company’s balance sheet reflects $226 million in debt associated with

funding the acquisition. Interest expense related to this debt is

expected to range from $1 million to $1.5 million per quarter for FY15.

Taxes Our GAAP tax expense during the quarter was $2.6 million, which

included $1.8 million of non-cash charges associated with our deferred

tax asset and other tax credits. At this time, we anticipate our

effective quarterly cash tax rate to be less than four percent for the

remainder of the fiscal year. Our U.S. deferred tax assets and other tax

credits should be largely depleted by the end of FY15. We anticipate

paying an annual worldwide tax rate of approximately 30 percent in FY16,

with the rate being higher in the first half of the fiscal year. Moving

forward, we expect a growing portion of our revenue and income will be

generated offshore, accordingly, our worldwide effective tax rate has

the potential to be further reduced in FY17 and beyond.

We are excited to have

closed the acquisition of Wolfson during the quarter. This acquisition

accelerates Cirrus Logic’s strategic roadmap and strengthens our

technology portfolio with the addition of MEMS microphones, extensive

software infrastructure and proven smart codec technology. The combined

company is leveraging our unparalleled expertise in analog and

mixed-signal technology, comprehensive software capabilities and

world-class engineering teams to drive continued innovation in the

rapidly changing audio market. With a broad portfolio of products,

including amplifiers, codecs, DSPs and MEMS microphones, Cirrus Logic is

currently the only IC company with a solution that encompasses the

complete audio signal chain from capture to playback. Cirrus Logic and

Wolfson’s product development approach and our vision of the audio

market are very complementary. On a standalone basis, Cirrus Logic has

historically dedicated a large portion of our engineering resources to

the rapid development of custom silicon products, while Wolfson has

largely focused on general market products for Android platforms where

they can provide added differentiation via embedded software algorithms.

Both companies have been successful engaging tier-one customers but have

been limited by engineering resource constraints and scale in efforts to

meaningfully address additional opportunities. As a combined company, we

are maximizing our engineering experience and resources to target

initiatives we view as critical for future growth. We have a robust

product roadmap that spans the complete audio signal chain and would

like to highlight three of our key investment areas: smart codecs, MEMS

microphones and software. Smart codecs integrate the functionality of

several discrete audio components, including codecs, audio and voice

DSP's, and class-D amplifiers, into one component with complex digital

signal processing capabilities and programmable DSP. This integration

greatly reduces the amount of board space required for the audio

subsystem and lowers the total bill of materials for customers. As a

result of these benefits combined with the

processing capabilities,

enable the company to command higher ASPs for smart codecs compared to

individual components. The company is shipping smart codecs in flagship

devices today and we are heavily investing in next generation products

with increased performance and functionality that target both high-end

and mid-tier devices across numerous applications. Through the

acquisition of Wolfson, we gained MEMS microphone technology, which is

an integral component of our strategic roadmap and significantly

broadens our served available market as two to three microphones are

typically connected to a codec in each device. While we are shipping

microphones today in several devices, we expect to target additional

opportunities going forward where our microphones are designed in tandem

with our smart codecs to enable the chipset to deliver enhanced

performance and features. We are also ramping our investment in

software, as we believe it is essential to deliver a complete,

best-in-class hardware and software solution to our customers. The

combination offers flexible solutions that provide compelling features

to consumers across a variety of use cases. We have seen a notable

transformation in mobile devices over the past few years as they have

transitioned from a tool used for basic communications to a

sophisticated device used for creating, sharing and consuming multimedia

content. As this market evolves and new product categories emerge, OEMs

are increasingly looking to differentiate their products with features

and functions that enable a compelling and consistent audio and voice

user experience. This interest is fueling demand for ultra low power,

smaller, smarter and more complex analog and mixed signal processing

products, which aligns well with Cirrus Logic’s core competencies. Still

in the early stages of development, the proliferation of voice is

expanding beyond mobile devices and gaining traction across many product

categories including wearables, headphones and accessories. While there

has been concern about slowing sales in high-end smartphones, we believe

audio and voice will continue to drive growth as more manufacturers push

penetration of these features into mid and lower tier devices.

Additionally, we believe these same features and technologies will be

increasingly appealing in other markets such as automotive and

wearables. At this time we do not expect wearables to contribute

meaningfully to near-term revenue. However, longer

term we believe our ability

to provide comprehensive hardware and software solutions across the

audio signal chain gives Cirrus Logic a significant advantage. We are

extremely pleased to be recognized in Fortune magazine, for the fourth

year in a row, by the Great Places to Work® Institute as one of the top

10 employers on the 2014 50 Best Small and Medium Workplaces in America.

Cirrus Logic has focused on developing a corporate culture that

encourages innovation, creativity and timely execution, while fostering

an environment of integrity, trust and camaraderie. We believe this

unique culture is a critical element in to retaining motivated employees

and attracting talented engineers, who will strengthen our workforce,

deliver best-in-class audio solutions and contribute to the company’s

long-term success. Summary and Guidance For the December quarter we

expect the following results: • Revenue to range between $265 million

and $285 million; • GAAP gross margin to be between 42 percent and 44

percent, which includes roughly 200 basis points of costs associated

with the fair value write up of acquired inventory; and • Combined R&D

and SG&A expenses to range between $86 million and $90 million,

including approximately $9 million in share-based compensation expense

and $ 7 million in amortization of acquired intangibles. In summary, Q2

was a great quarter for Cirrus Logic as we delivered strong sequential

revenue growth and closed the acquisition of Wolfson. With a broad range

of solutions spanning the audio signal chain from capture to playback,

an innovative strategic

roadmap and a commitment to

accelerating R&D investment in compelling programs we believe we are

well positioned to drive future growth opportunities. Sincerely, Jason

Rhode Thurman Case President and Chief Executive Officer Chief Financial

Officer Conference Call Q&A Session Cirrus Logic will host a live Q&A

session at 5 p.m. EDT today to answer questions related to its financial

results and business outlook. Participants may listen to the conference

call on the Cirrus Logic website. Participants who would like to submit

a question to be addressed during the call are requested to email

investor.relations@cirrus.com. A replay of the webcast can be accessed

on the Cirrus Logic website approximately two hours following its

completion, or by calling (404) 537-3406, or toll-free at (855) 859-

2056 (Access Code: 13896797). Use of Non-GAAP Financial Information This

shareholder letter and its attachments include references to non-GAAP

financial information, including gross margins, operating expenses, net

income, operating profit and diluted earnings per share. A

reconciliation of the adjustments to GAAP results is included in the

tables below. Non-GAAP financial information is not meant as a

substitute for GAAP results, but is included because management believes

such information is useful

to

our

investors

for

informational

and

comparative

purposes.

In

addition,

certain

non--‐

GAAP

financial

information

is

used

internally

by

management

to

evaluate

and

manage

the

company.

As

a

note,

the

non--‐GAAP

financial

information

used

by

Cirrus

Logic

may

differ

from

that

used

by

other

companies.

These

non--‐GAAP

measures

should

be

considered

in

addition

to,

and

not

as

a

substitute

for,

the

results

prepared

in

accordance

with

GAAP.

Safe Harbor Statement Except

for

historical

information

contained

herein,

the

matters

set

forth

in

this

news

release

contain

forward--‐looking

statements,

including

our

future

growth

expectations

and

our

estimates

of

third

quarter

fiscal

year

2015

revenue,

gross

margin,

combined

research

and

development

and

selling,

general

and

administrative

expense

levels,

share--‐based

compensation

expense,

amortization

of

acquired

intangibles

and

acquisition

related

costs

associated

with

the

fair

value

write

up

of

acquired

inventory.

In

some

cases,

forward--‐looking

statements

are

identified

by

words

such

as

“expect,”

“anticipate,”

“target,”

“project,”

“believe,”

“goals,”

“opportunity,”

“estimates,”

“intend,”

and

variations

of

these

types

of

words

and

similar

expressions.

In

addition,

any

statements

that

refer

to

our

plans,

expectations,

strategies

or

other

characterizations

of

future

events

or

circumstances

are

forward--‐looking

statements.

These

forward--‐looking

statements

are

based

on

our

current

expectations,

estimates

and

assumptions

and

are

subject

to

certain

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially.

These

risks

and

uncertainties

include,

but

are

not

limited

to,

the

level

of

orders

and

shipments

during

the

third

quarter

fiscal

year

2015,

as

well

as

customer

cancellations

of

orders,

or

the

failure

to

place

orders

consistent

with

forecasts;

and

the

risk

factors

listed

in

our

Form

10--‐K

for

the

year

ended

March

29,

2014,

and

in

our

other

filings

with

the

Securities

and

Exchange

Commission,

which

are

available

at

www.sec.gov.

The

foregoing

information

concerning

our

business

outlook

represents

our

outlook

as

of

the

date

of

this

news

release,

and

we

undertake

no

obligation

to

update

or

revise

any

forward--‐looking

statements,

whether

as

a

result

of

new

developments

or

otherwise.

Cirrus Logic, Cirrus and Wolfson are registered trademarks of Cirrus

Logic, Inc. or its subsidiaries. All other company or product names

noted herein may be trademarks of their respective holders. Summary

financial data follows:

CIRRUS LOGIC, INC.

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS (unaudited) (in

thousands, except per share data) Three Months Ended Six Months Ended

Net sales 210,214 152,565 190,671 362,779 345,796 Cost of sales 109,647

77,190 91,223 186,837 166,850 Gross profit 100,567 75,375 99,448

175,942 178,946 Gross margin 47.8% 49.4% 52.2% 48.5% 51.7% Research

and development 44,557 39,777 29,722 84,334 58,252 Selling, general and

administrative 21,545 19,683 19,215 41,228 38,413 Restructuring and

other 1,455 - (154) 1,455 (584) Acquisition related costs 14,937 - -

14,937 - Patent infringement settlements, net - - - - 695 Total

operating expenses 82,494 59,460 48,783 141,954 96,776 Operating income

18,073 15,915 50,665 33,988 82,170 Interest income (expense), net

(2,670) (467) 201 (3,137) 359 Other income (expense), net (11,994) 501

(38) (11,493) (55) Income before income taxes 3,409 15,949 50,828 19,358

82,474 Provision for income taxes 2,557 5,701 17,461 8,258 28,465 Net

income $ 852 $ 10,248 $ 33,367 $ 11,100 $ 54,009 Basic earnings per

share: $ 0.01 $ 0.17 $ 0.53 $ 0.18 $ 0.85 Diluted earnings per share: $

0.01 $ 0.16 $ 0.50 $ 0.17 $ 0.82 Weighted average common shares

outstanding: Basic 62,241 62,032 63,217 62,137 63,329 Diluted 65,085

64,688 66,125 64,892 66,203 Prepared in accordance with Generally

Accepted Accounting Principles

CIRRUS LOGIC, INC.

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

(unaudited, in thousands, except per share data) Non-GAAP financial

information is not meant as a substitute for GAAP results, but is

included because management believes such information is useful to our

investors for informational and comparative purposes. In addition,

certain non-GAAP financial information is used internally by management

to evaluate and manage the company. As a note, the non-GAAP financial

information used by Cirrus Logic may differ from that used by other

companies. These non-GAAP measures should be considered in addition to,

and not as a substitute for, the results prepared in accordance with

GAAP. Three Months Ended Six Months Ended Provision for litigation

expenses and settlements - - - - 695 Restructuring and other costs, net

1,455 - (154) 1,455 (584) Wolfson acquisition items 30,875 2,304 -

33,179 - Provision for income taxes 1,764 5,226 16,378 6,990 26,539

Non-GAAP Net Income $ 43,966 $ 23,646 $ 55,330 $ 67,612 $ 92,172

Earnings Per Share Reconciliation GAAP Diluted earnings per share $ 0.01

$ 0.16 $ 0.50 $ 0.17 $ 0.82 Effect of Amortization of acquisition

intangibles 0.04 - - 0.04 - Effect of Stock based compensation expense

0.10 0.09 0.09 0.18 0.17 Effect of Provision for litigation expenses and

settlements - - - - 0.01 Effect of Restructuring and other costs, net

0.03 - - 0.02 (0.01) Effect of Wolfson acquisition items 0.47 0.04 -

0.50 - Effect of Provision for income taxes 0.03 0.08 0.25 0.11 0.40

Non-GAAP Diluted earnings per share $ 0.68 $ 0.37 $ 0.84 $ 1.02 $ 1.39

Operating Income Reconciliation GAAP Operating Income $ 18,073 $ 15,915

$ 50,665 $ 33,988 $ 82,170 GAAP Operating Profit 9% 10% 27% 9% 24%

Amortization of acquisition intangibles 2,524 246 - 2,770 - Stock

compensation expense - COGS 253 231 239 484 245 Stock compensation

expense - R&D 2,781 2,543 2,158 5,324 5,012 Stock compensation expense -

SG&A 3,462 2,848 3,342 6,310 6,256 Provision for litigation expenses and

settlements - - - - 695 Restructuring and other costs, net 1,455 - (154)

1,455 (584) Wolfson acquisition items 16,547 2,192 - 18,739 - Non-GAAP

Operating Income $ 45,095 $ 23,975 $ 56,250 $ 69,070 $ 93,794 Non-GAAP

Operating Profit 21% 16% 30% 19% 27% Operating Expense Reconciliation

GAAP Operating Expenses $ 82,494 $ 59,460 $ 48,783 $ 141,954 $ 96,776

Amortization of acquisition intangibles (2,524) (246) - (2,770) - Stock

compensation expense - R&D (2,781) (2,543) (2,158) (5,324) (5,012) Stock

compensation expense - SG&A (3,462) (2,848) (3,342) (6,310) (6,256)

Provision for litigation expenses and settlements - - - - (695)

Restructuring and other costs, net (1,455) - 154 (1,455) 584 Wolfson

acquisition items (14,937) (2,192) - (17,129) - Non-GAAP Operating

Expenses $ 57,335 $ 51,631 $ 43,437 $ 108,966 $ 85,397 Gross

Margin/Profit Reconciliation GAAP Gross Margin $ 100,567 $ 75,375 $

99,448 $ 175,942 $ 178,946 GAAP Gross Profit 47.8% 49.4% 52.2% 48.5%

51.7% Wolfson acquisition items 1,610 - - 1,610 - Stock compensation

expense - COGS 253 231 239 484 245 Non-GAAP Gross Margin $ 102,430 $

75,606 $ 99,687 $ 178,036 $ 179,191 Non-GAAP Gross Profit 48.7% 49.6%

52.3% 49.1% 51.8%

CIRRUS LOGIC, INC.

CONSOLIDATED CONDENSED BALANCE SHEET Sep. 27, Mar. 29, Sep. 28, 2014

2014 2013 (unaudited) (unaudited) ASSETS Current assets Cash and cash

equivalents $ 48,214 $ 31,850 $ 68,886 (in thousands) Marketable

securities 85,796 263,417 199,423 Accounts receivable, net 126,161

63,220 97,640 Inventories 121,169 69,743 91,247 Deferred tax assets

16,435 22,024 38,398 Other current assets 29,089 25,079 23,978 Total

current assets 426,864 475,333 519,572 Long-term marketable securities

9,228 89,243 40,254 Property and equipment, net 133,458 103,650 101,885

Intangibles, net 187,030 11,999 4,734 Goodwill 265,410 16,367 6,027

Deferred tax assets 24,998 25,065 16,638 Other assets 17,658 3,087

10,051 Total assets $ 1,064,646 $ 724,744 $ 699,161 LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities Accounts payable $ 81,549 $

51,932 $ 56,868 Accrued salaries and benefits 17,706 13,388 16,894 Other

accrued liabilities 34,946 11,572 6,313 Deferred income 5,218 5,631

4,858 Total current liabilities 139,419 82,523 84,933 Other long-term

liabilities 25,376 4,863 11,231 Long-term debt 226,439 - - Stockholders'

equity: Capital stock 1,104,379 1,078,878 1,055,256 Accumulated deficit

(430,144) (440,634) (451,532) Accumulated other comprehensive loss (823)

(886) (727) Total stockholders' equity 673,412 637,358 602,997 Total

liabilities and stockholders' equity $ 1,064,646 $ 724,744 $ 699,161

Prepared in accordance with Generally Accepted Accounting Principles

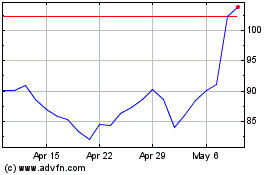

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

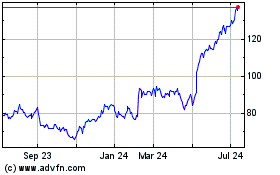

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024