Cirrus Logic, Inc. (Nasdaq: CRUS), a leader in high-precision

analog and digital signal processing components, today posted on

its investor relations website at http://investor.cirrus.com the

quarterly Shareholder Letter that contains the complete financial

results for the fourth quarter and fiscal year 2012, which ended

March 31, 2012, as well as the company’s current business

outlook.

“We expect revenue to grow substantially in FY ’13 as new audio

and energy products hit full production later this year,” said

Jason Rhode, president and chief executive officer. “Our product

development team has done an excellent job developing innovative

new components and our supply chain team now has the task of

supporting what we expect to be a significant ramp of a wide range

of products. Combined with our strong balance sheet, the new credit

facility gives us additional flexibility as we transition to a

significantly higher run rate for our business. We are very excited

about our outlook for FY ’13.”

Reported Financial Results

Fourth Quarter FY2012

- Revenue of $110.6 million

- Gross margin of 56 percent

- GAAP operating expenses of $41.5

million

- Non-GAAP operating expenses of $37.5

million

Due to recent financial performance, as well as further

improvements to its business outlook, the company revalued the

deferred tax asset to the full value it expects to use, which

resulted in a non-cash, net tax benefit of approximately $30

million in Q4, or $0.45 per share, based on 67.9 million diluted

shares.

A reconciliation of the non-GAAP adjustments is included in the

tables accompanying this press release.

While the company expects to grow revenue substantially during

FY ’13, year-over-year revenue in Q1 is currently forecasted to

grow approximately 10 percent. Due to the timing of various product

introductions later this year, the company expects to transition to

a sharply higher level of revenue beginning in the September

quarter. In connection with this transition, the company also

announced that it has entered into an unsecured, one-year $100

million revolving credit agreement that provides access to

additional working capital the company may need in order to support

the production ramps of multiple new products this fall. Wells

Fargo Bank, N.A., is serving as the Administrative Agent. Wells

Fargo Securities, LLC and Barclays Capital served as Joint Lead

Arrangers and Joint Bookrunners for this transaction.

Business Outlook

First Quarter FY2013

- Revenue is expected to range between

$96 million and $106 million;

- Gross margin is expected to be between

53 percent and 55 percent;

- Combined R&D and SG&A expenses

are expected to range between $43 million and $45 million, which

includes approximately $4 million in share-based compensation and

amortization of acquisition-related intangibles expenses; and

- Ending inventory is expected to roughly

double.

Cirrus Logic management will host a live Q&A session at 5:00

p.m. EDT on Wednesday, April 25, 2012, to answer questions related

to its financial results and business outlook. Shareholders who

would like to submit a question to be addressed during the call are

requested to email investor.relations@cirrus.com.

A live webcast of the Q&A session can be accessed on the

Cirrus Logic website, and a replay will be available approximately

one hour following its completion, or by calling (303) 590-3030, or

toll-free at (800) 406-7325 (Access Code: 4531962).

Cirrus Logic, Inc.

Cirrus Logic develops high-precision, analog and mixed-signal

integrated circuits for a broad range of innovative customers.

Building on its diverse analog and signal-processing patent

portfolio, Cirrus Logic delivers highly optimized products for a

variety of audio and energy-related applications. The company

operates from headquarters in Austin, Texas, with offices in

Tucson, Ariz., Europe, Japan and Asia. More information about

Cirrus Logic is available at www.cirrus.com.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a

GAAP basis, Cirrus has provided non-GAAP financial information,

including operating expenses, net income, operating margin and

diluted earnings per share. A reconciliation of the adjustments to

GAAP results is included in the tables below. Non-GAAP financial

information is not meant as a substitute for GAAP results, but is

included because management believes such information is useful to

our investors for informational and comparative purposes. In

addition, certain non-GAAP financial information is used internally

by management to evaluate and manage the company. The non-GAAP

financial information used by Cirrus Logic may differ from that

used by other companies. These non-GAAP measures should be

considered in addition to, and not as a substitute for, the results

prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters

set forth in this news release contain forward-looking statements,

including our estimates of first quarter fiscal year 2013 revenue,

gross margin, combined research and development and selling,

general and administrative expense levels, share-based compensation

expense, amortization of acquired intangible expenses, and ending

inventory, as well as estimates for fiscal year 2013 annual revenue

growth rate, operating expenses, and inventory increases. In some

cases, forward-looking statements are identified by words such as

“expect,” “anticipate,” “target,” “project,” “believe,” “goals,”

“opportunity,” “estimates,” “intend,” and variations of these types

of words and similar expressions. In addition, any statements that

refer to our plans, expectations, strategies or other

characterizations of future events or circumstances are

forward-looking statements. These forward-looking statements are

based on our current expectations, estimates and assumptions and

are subject to certain risks and uncertainties that could cause

actual results to differ materially. These risks and uncertainties

include, but are not limited to, the following: the level of orders

and shipments during the first quarter and complete fiscal year

2013, as well as customer cancellations of orders, or the failure

to place orders consistent with forecasts; our ability to introduce

and ramp production of new products in a timely manner; and the

risk factors listed in our Form 10-K for the year ended March 26,

2011, and in our other filings with the Securities and Exchange

Commission, which are available at www.sec.gov. The foregoing

information concerning our business outlook represents our outlook

as of the date of this news release, and we undertake no obligation

to update or revise any forward-looking statements, whether as a

result of new developments or otherwise.

Cirrus Logic and Cirrus are trademarks of Cirrus Logic Inc.

CRUS-F

Summary financial data follows:

CIRRUS LOGIC, INC.

CONSOLIDATED CONDENSED STATEMENTS OF INCOME (unaudited;

in thousands, except per share data) Three Months

Ended Fiscal Year Ended Mar. 31, Dec.

31, Mar. 26, Mar. 31, Mar. 26, 2012

2011 2011 2012 2011 Q4'12

Q3'12 Q4'11 Q4'12 Q4'11 Audio products

$ 90,522 $ 105,418 $ 66,965 $ 350,742 $ 264,840 Energy products

20,109 16,950 24,468

76,101 104,731

Net revenue

110,631 122,368

91,433 426,843

369,571 Cost of sales 48,284

56,338 45,415 196,402

167,576

Gross Profit 62,347 66,030

46,018 230,441 201,995 Research and

development 24,105 23,143 17,044 85,697 63,934 Selling, general and

administrative 17,254 16,488 15,252 65,108 58,066 Other expenses

(proceeds) * 100

-

57 100 (3,332 ) Total

operating expenses 41,459 39,631

32,353 150,905 118,668

Operating income 20,888 26,399 13,665

79,536 83,327 Interest income, net 139 112 187

517 860 Other income (expense), net 45 (71 )

40 (70 ) 27

Income before

income taxes 21,072 26,440 13,892

79,983 84,214 Provision (benefit) for income taxes

(29,755 ) 9,709 (116,514 )

(8,000 ) (119,289 )

Net income $ 50,827

$ 16,731 $ 130,406

$ 87,983 $ 203,503

Basic income per share: $ 0.79 $ 0.26 $ 1.91 $ 1.35 $ 3.00 Diluted

income per share: $ 0.75 $ 0.25 $ 1.80 $ 1.29 $ 2.82

Weighted average number of shares: Basic 64,213 63,957 68,164

64,934 67,857 Diluted 67,913 66,989 72,344 68,064 72,103 *

Other expenses (proceeds) contains certain litigation expenses

settled during the applicable time period as well as proceeds from

a patent agreement and an impairment of non-marketable securities

during fiscal year 2011. Prepared in accordance with

Generally Accepted Accounting Principles

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED BALANCE

SHEETS

(unaudited; in thousands)

Mar. 31, Dec. 31, Mar. 26, 2012

2011 2011 ASSETS Current assets Cash and cash

equivalents $ 65,997 $ 38,010 $ 37,039 Restricted investments -

2,898 5,786 Marketable securities 115,877 99,342 159,528 Accounts

receivable, net 44,153 54,512 39,098 Inventories 55,915 58,079

40,497 Deferred tax asset 53,137 30,798 30,797 Other current assets

16,508 16,116 6,725 Total

Current Assets 351,587 299,755 319,470 Long-term marketable

securities 2,914 20,092 12,702 Property and equipment, net 66,978

57,263 34,563 Intangibles, net 18,241 18,596 20,125 Goodwill 6,027

6,027 6,027 Deferred tax asset 89,071 82,071 102,136 Other assets

9,644 10,813 1,598 Total

Assets $ 544,462 $ 494,617 $ 496,621

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts

payable $ 38,108 $ 45,104 $ 27,639 Accrued salaries and benefits

13,634 11,539 12,402 Other accrued liabilities 14,015 14,259 5,169

Deferred income on shipments to distributors 7,228

8,511 6,844 Total Current Liabilities

72,985 79,413 52,054 Long-term restructuring accrual - - 113

Other long-term obligations 5,620 6,494 6,075 Stockholders'

equity: Capital stock 1,008,228 1,001,967 991,947 Accumulated

deficit (541,609 ) (592,436 ) (552,814 ) Accumulated other

comprehensive loss (762 ) (821 ) (754 ) Total

Stockholders' Equity 465,857 408,710

438,379 Total Liabilities and Stockholders' Equity $

544,462 $ 494,617 $ 496,621 Prepared in

accordance with Generally Accepted Accounting Principles

CIRRUS LOGIC, INC.

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL

INFORMATION

(unaudited; in thousands, except per

share data)

(not prepared in accordance with GAAP)

Non-GAAP financial information is not

meant as a substitute for GAAP results, but is included because

management believes such information is useful to our investors for

informational and comparative purposes. In addition, certain

non-GAAP financial information is used internally by management to

evaluate and manage the company. The non-GAAP financial information

used by Cirrus Logic may differ from that used by other companies.

These non-GAAP measures should be considered in addition to, and

not as a substitute for, the results prepared in accordance with

GAAP.

Three Months Ended Fiscal Year Ended

Mar. 31, Dec. 31, Mar. 26, Mar. 31,

Mar. 26, 2012 2011 2011 2012

2011 Q4'12 Q3'12 Q4'11 Q4'12

Q4'11 Net Income Reconciliation

GAAP Net Income

$ 50,827 $ 16,731 $

130,406 $ 87,983 $ 203,503

Amortization of acquisition intangibles 353 353 353 1,412 1,429

Stock-based compensation expense 3,451 2,769 2,294 12,179 8,142

Other adjustments ** 263 - 57 885 (2,638 ) Provision (benefit) for

income taxes (30,310 ) 8,992 (117,078 )

(10,171 ) (121,154 )

Non-GAAP Net Income

$ 24,584 $ 28,845

$ 16,032 $ 92,288

$ 89,282 Earnings Per Share

Reconciliation

GAAP Diluted income per share $

0.75 $ 0.25 $ 1.80 $

1.29 $ 2.82 Effect of Amortization of

acquisition intangibles 0.01 0.01 - 0.02 0.02 Effect of Stock-based

compensation expense 0.05 0.04 0.03 0.18 0.11 Effect of Other

adjustments ** - - - 0.01 (0.03 ) Effect of Provision (benefit) for

income taxes (0.45 ) 0.13 (1.61 )

(0.14 ) (1.68 )

Non-GAAP Diluted income per

share $ 0.36 $ 0.43

$ 0.22 $ 1.36 $

1.24 Operating Income Reconciliation

GAAP

Operating Income $ 20,888 $ 26,399

$ 13,665 $ 79,536 $

83,327 Amortization of acquisition intangibles 353 353 353

1,412 1,429 Stock compensation expense - COGS 113 92 78 398 243

Stock compensation expense - R&D 1,753 1,613 924 5,590 2,641

Stock compensation expense - SG&A 1,585 1,064 1,292 6,191 5,258

Other adjustments ** 263 - 57

885 (2,638 )

Non-GAAP Operating

Income $ 24,955 $ 29,521

$ 16,369 $ 94,012

$ 90,260 Operating Expense

Reconciliation

GAAP Operating Expenses $

41,459 $ 39,631 $ 32,353

$ 150,905 $ 118,668 Amortization of

acquisition intangibles (353 ) (353 ) (353 ) (1,412 ) (1,429 )

Stock compensation expense - R&D (1,753 ) (1,613 ) (924 )

(5,590 ) (2,641 ) Stock compensation expense - SG&A (1,585 )

(1,064 ) (1,292 ) (6,191 ) (5,258 ) Other adjustments **

(263 ) - (57 ) (885 ) 2,638

Non-GAAP Operating Expenses $ 37,505

$ 36,601 $ 29,727

$ 136,827 $ 111,978

** Other adjustments may include certain litigation

expenses, facility charges, patent agreements, international sales

reorganizations, or other.

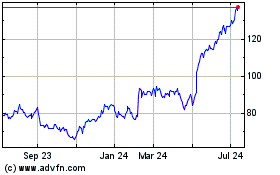

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

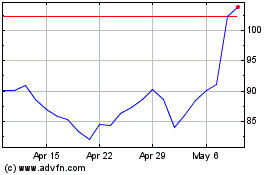

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024