Current Report Filing (8-k)

August 11 2022 - 7:03AM

Edgar (US Regulatory)

0001862150

false

0001862150

2022-08-09

2022-08-09

0001862150

CING:CommonStockParValue0.0001PerShareMember

2022-08-09

2022-08-09

0001862150

CING:WarrantsExercisableForOneShareOfCommonStockMember

2022-08-09

2022-08-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

August

9, 2022

CINGULATE

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40874 |

|

86-3825535 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

1901

W. 47th Place

Kansas

City, KS 66205

(Address

of principal executive offices) (Zip Code)

(913)

942-2300

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

CING |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

| Warrants,

exercisable for one share of common stock |

|

CINGW |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

1.01. |

Entry

into a Material Definitive Agreement. |

On

August 9, 2022, Cingulate Therapeutics, LLC (“CTx”), a wholly owned subsidiary of Cingulate Inc. (the “Company”),

executed a $5 million promissory note (the “Note”) in favor of Werth Family Investment Associates LLC (“WFIA”).

WFIA owns 871,731 shares of the Company’s common stock and Peter J. Werth, a member of the Company’s Board of Directors (the

“Board”) and the manager of WFIA, owns 21,849 shares of the Company’s common stock.

The

Audit Committee and Board reviewed the terms of the Note pursuant to the Company’s Policy and Procedures for Related Person Transactions

and determined that the Note is in the best interests of the Company and its stockholders. Due to the issuance of the Note, the Board

determined that Mr. Werth is no longer an independent director.

CTx

received the principal amount of the Note from WFIA on August 10, 2022. Outstanding principal and all accrued and unpaid interest is

due and payable on August 8, 2025 unless accelerated due to an event of default. Beginning April 1, 2023, WFIA has the right during the

first five business days

of each calendar quarter to demand payment of all outstanding principal and interest 120 days following notice to CTx. CTx may prepay

the Note, in whole or in part, without premium or penalty; provided, that no amount repaid may be reborrowed.

The

foregoing description of the Note does not purport to be complete and is qualified in its entirety by reference to the full text of the

Note, which has been filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

| Item

2.02. |

Results

of Operations and Financial Condition. |

On

August 11, 2022, the Company issued a press release announcing its financial results for the second quarter of 2022 and providing a clinical

and business update. A copy of the press release is furnished as Exhibit 99.1 and incorporated by reference.

| Item

2.03. |

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The

information set forth in Item 1.01 is incorporated by reference into this Item 2.03.

| Item

5.02. |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangments of Certain Officers. |

On

August 9, 2022, the Board, upon the recommendation of the Nominating and Corporate Governance Committee, expanded the size of the Board

to eight directors and appointed Scott Applebaum as a Class III director to serve until the Company’s 2024 annual meeting of stockholders.

The Board also appointed Mr. Applebaum to serve on the Audit Committee.

Mr.

Applebaum will receive the standard compensation for non-employee directors, as described in the section entitled “2022 Director

Compensation Program” in the Company’s proxy statement filed with the Securities and Exchange Commission (the “SEC”)

on April 22, 2022, including a prorated cash retainer and grant of 12,000 non-qualified stock options. In addition, the Company intends

to enter into an indemnification agreement with Mr. Applebaum in substantially the form filed as Exhibit 10.10 to the Company’s

Registration Statement on Form S-1 filed with the SEC on September 9, 2021.

There

is no arrangement or understanding between Mr. Applebaum and any other person pursuant to which he was appointed as a director of the

Company and there are no familial relationships between Mr. Applebaum and any of the Company’s directors or executive officers.

There are no transactions to which the Company is a party and in which Mr. Applebaum has a direct or indirect material interest that

would be required to be disclosed under Item 404(a) of Regulation S-K. The Board has affirmatively determined that Mr. Applebaum qualifies

as an “independent director” under the Nasdaq listing requirements.

| Item

7.01. |

Regulation

FD Disclosure. |

A

copy of the press release announcing Mr. Applebaum’s appointment is furnished as Exhibit 99.1 and incorporated by reference.

| Item

9.01. |

Financial

Statements and Exhibits. |

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CINGULATE

INC. |

| |

|

|

| Dated:

August 11, 2022 |

By: |

/s/

Louis G. Van Horn |

| |

Name: |

Louis

G. Van Horn |

| |

Title: |

Chief

Financial Officer |

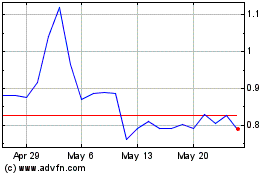

Cingulate (NASDAQ:CING)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cingulate (NASDAQ:CING)

Historical Stock Chart

From Jul 2023 to Jul 2024