China SXT Pharmaceuticals,

Inc. (the “Company” or “we”) is offering an unsecured convertible promissory note in the original

principal amount of $2,804,848 (the “Note”), convertible into ordinary shares, $0.004 par value per share, of the Company

(the “Ordinary Shares”), for $2,636,557 in gross proceeds.

On March 14, 2022, the aggregate

market value of our Ordinary Shares held by non-affiliates was approximately $20,714,542.98, based on 40,627,868 Ordinary Shares outstanding,

38,502,868 of which are held by non-affiliates, and a per Ordinary Share price of $0.54 based on the closing sale price of our Ordinary

Shares on Nasdaq on January 14, 2021. Pursuant to General Instruction I.B.5 of Form F-3, in no event will we sell the securities covered

hereby in a public primary offering with a value exceeding more than one-third of the aggregate market value of our ordinary shares in

any 12-month period so long as the aggregate market value of our outstanding Ordinary Shares held by non-affiliates remains below $75,000,000.

During the 12 calendar months prior to and including the date of this prospectus, we have sold a total of 22,777,774 Ordinary Shares for

an aggregate price of $4,099,999.32 pursuant to General Instruction I.B.5 of Form F-3.

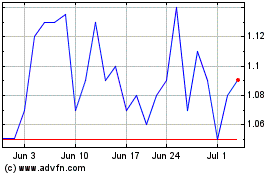

Our Ordinary Shares are listed

on The Nasdaq Capital Market, or Nasdaq, under the symbol “SXTC”. On March 11, 2022, the last reported price of our Ordinary

Share on Nasdaq was $0.19 per Ordinary Share. There is no established trading market for the Note, and we do not intend to apply for listing

of the Note on any securities exchange or for inclusion of the Note in any automated quotation system.

We are an offshore holding

company incorporated in British Virgin Islands, conducting all of our business through our subsidiaries and variable interests entity,

Jiangsu Taizhou Suxuantang Pharmaceutical Co., Ltd. (“Taizhou Suxuantang” or the “VIE”) in China. Neither we nor

our subsidiaries own any share in Taizhou Suxuantang. Instead, Instead, our wholly-owned subsidiary, Taizhou Suxantang Biotechnology Co.

Ltd. (the “WFOE”), Taizhou Suxuantang, and Taizhou Suxuantang’s shareholders entered into a series of contractual arrangements,

or the “VIE Agreements”, include (i) certain power of attorney agreements and equity interest pledge agreement, which provide

WFOE effective control over Taizhou Suxuantang; (ii) an exclusive technical consulting and service agreement which allows WFOE to receive

substantially all of the economic benefits from Taizhou Suxuantang; and (iii) certain exclusive equity interest purchase agreements which

provide WFOE with an exclusive option to purchase all or part of the equity interests in and/or assets of Taizhou Suxuantang when and

to the extent permitted by PRC laws. Through the VIE Agreements among WFOE, Taizhou Suxuantang and Taizhou Suxuantang’s shareholders,

we are regarded as the primary beneficiary of Taizhou Suxuantang for accounting purpose, and, therefore, we are able to consolidate the

financial results of Taizhou Suxuantang in our consolidated financial statements in accordance with U.S. GAAP. However, the VIE structure

cannot completely replicate a foreign investment in China-based companies, as the investors will not and may never directly hold equity

interests in the Chinese operating entities. Instead, the VIE structure provides contractual exposure to foreign investment in us. Although

we took every precaution available to effectively enforce the contractual and corporate relationship above, these VIE Agreements may still

be less effective than direct ownership and that we may incur substantial costs to enforce the terms of the arrangements. Because we do

not directly hold equity interests in Taizhou Suxuantang, we are subject to risks due to uncertainty of the interpretation and the application

of the PRC laws and regulations, including but not limited to limitation on foreign ownership of internet technology companies, regulatory

review of oversea listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the VIE Agreements.

We are also subject to the risks of uncertainty about any future actions of the PRC government in this regard that could disallow the

VIE structure, which would likely result in a material change in our operations and the value of Ordinary Shares may depreciate significantly

or become worthless.

We are subject to certain

legal and operational risks associated with being based in China. PRC laws and regulations governing our current business operations are

sometimes vague and uncertain, and as a result these risks may result in material changes in the operations of our subsidiaries, significant

depreciation of the value of our Ordinary Shares, or a complete hindrance of our ability to offer or continue to offer our securities

to investors. Recently, the PRC government adopted a series of regulatory actions and issued statements to regulate business operations

in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed

overseas using variable interest entity structures, adopting new measures to extend the scope of cybersecurity reviews, and expanding

the efforts in anti-monopoly enforcement. As of the date of this prospectus supplement, we, our subsidiaries, and Taizhou Suxuantang and

its subsidiaries, have not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor

has any of them received any inquiry, notice or sanction. As of the date of this prospectus supplement, there are currently no relevant

laws or regulations in the PRC that prohibit companies whose entity interests are within the PRC from listing on overseas stock exchanges.

However, since these statements and regulatory actions are newly published, official guidance and related implementation rules have

not been issued. It is highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business

operation, the ability to accept foreign investments and our ability to continue our listing on an U.S. exchange.

We intend to keep any future

earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future.

As of the date of this prospectus, no cash transfer or transfer of other assets have occurred among our Company, its subsidiaries, and

the VIE. PRC regulations restricts how cash can be transferred within our organization. For details about how dividends can be paid to

our investors and how cash is transferred within our organization, please see “Prospectus Summary - Dividend Distributions or Assets

Transfer among the Holding Company, its Subsidiaries and the Consolidated VIE”

The date of this prospectus supplement is March

14, 2022.

CAUTIONARY NOTE ON FORWARD LOOKING STATEMENTS

Certain statements contained

or incorporated by reference in this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference

herein and therein, including the statements of our management referring to or summarizing the contents of this prospectus supplement,

include “forward-looking statements”. We have based these forward-looking statements on our current expectations and projections

about future events. Our actual results may differ materially or perhaps significantly from those discussed herein, or implied by, these

forward-looking statements. Forward-looking statements are identified by words such as “believe,” “expect,” “anticipate,”

“intend,” “estimate,” “plan,” “project” and other similar expressions. In addition, any

statements that refer to expectations or other characterizations of future events or circumstances are forward-looking statements. Forward-looking

statements included or incorporated by reference in this prospectus or our other filings with the SEC include, but are not necessarily

limited to, those relating to:

| |

● |

risks and uncertainties associated with the integration of the assets and operations we have acquired and may acquire in the future; |

| |

|

|

| |

● |

our possible inability to raise or generate additional funds that will be necessary to continue and expand our operations; |

| |

|

|

| |

● |

our potential lack of revenue growth; |

| |

|

|

| |

● |

our potential inability to add new products and services that will be necessary to generate increased sales; |

| |

|

|

| |

● |

our potential lack of cash flows; |

| |

|

|

| |

● |

our potential loss of key personnel; |

| |

|

|

| |

● |

the availability of qualified personnel; |

| |

|

|

| |

● |

international, national regional and local economic political changes; |

| |

|

|

| |

● |

general economic and market conditions; |

| |

|

|

| |

● |

increases in operating expenses associated with the growth of our operations; |

| |

|

|

| |

● |

the potential for increased competition; |

| |

|

|

| |

● |

risks related to health epidemics and other outbreaks, which could significantly disrupt our operations and could have a material adverse impact on us, such as the outbreak of the coronavirus disease 2019 (COVID-19), and other events or factors, many of which are beyond our control, including those resulting from such events, or the prospect of such events, including war, terrorism and other international conflicts, public health issues and natural disasters such as fire, hurricanes, earthquakes, tornados or other adverse weather and climate conditions, whether occurring in the People’s Republic of China or elsewhere; and |

| |

|

|

| |

● |

other unanticipated factors. |

The foregoing does not represent

an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced

with that may cause our actual results to differ from those anticipate in our forward-looking statements. Please see “Risk Factors”

in our reports filed with the SEC, including in this prospectus supplement, the accompanying base prospectus, and the documents incorporated

by reference herein and therein, including our Annual Report on Form 20-F for the fiscal year ended March 31, 2021, for additional

risks which could adversely impact our business and financial performance.

Moreover, new risks regularly

emerge and it is not possible for our management to predict or articulate all risks we face, nor can we assess the impact of all risks

on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any

forward-looking statements. All forward-looking statements included in this prospectus supplement are based on information available to

us on the date of this prospectus supplement. Except to the extent required by applicable laws or rules, we undertake no obligation to

publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent

written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety

by the cautionary statements contained above and throughout (or incorporated by reference in) this prospectus supplement.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights selected information

contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus. This summary does

not contain all of the information you should consider before investing in our securities. Before making an investment decision,

you should read the entire prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein

and therein carefully, including the risk factors sections, the financial statements and the notes to the financial statements

incorporated herein and therein by reference.

In this prospectus supplement, unless otherwise

indicated, the terms “China SXT,” the “Company,” “we,” “us,” and “our” refer

and relate to China SXT Pharmaceuticals, Inc and its consolidated subsidiaries.

Our Company

We are an offshore holding

company incorporated in British Virgin Islands, conducting all of our business through our subsidiaries and variable interests entity,

Jiangsu Taizhou Suxantang Pharmaceutical Co., Ltd. (“Taizhou Suxuantang” or the “VIE”) in China. Neither we nor

our subsidiaries own any share in Taizhou Suxuantang. Instead, we control and receive the economic benefits of Taizhou Suxuantang’s

business operation through a series of contractual arrangements, also known as VIE Agreements. The VIE Agreements by and among our wholly-owned

subsidiary, Taizhou Suxantang Biotechnology Co. Ltd. (the “WFOE”), Taizhou Suxuantang, and Taizhou Suxuantang’s shareholders

include (i) certain power of attorney agreements and equity interest pledge agreement, which provide WFOE effective control over Taizhou

Suxuantang; (ii) an exclusive technical consulting and service agreement which allows WFOE to receive substantially all of the economic

benefits from Taizhou Suxuantang; and (iii) certain exclusive equity interest purchase agreements which provide WFOE with an exclusive

option to purchase all or part of the equity interests in and/or assets of Taizhou Suxuantang when and to the extent permitted by PRC

laws. Through the VIE Agreements among WFOE, Taizhou Suxuantang and Taizhou Suxuantang’s shareholders, we are regarded as the primary

beneficiary of Taizhou Suxuantang for accounting purpose, and, therefore, we are able to consolidate the financial results of Taizhou

Suxuantang in our consolidated financial statements in accordance with U.S. GAAP. However, the VIE structure cannot completely replicate

a foreign investment in China-based companies, as the investors will not and may never directly hold equity interests in the Chinese operating

entities. Instead, the VIE structure provides contractual exposure to foreign investment in us. Because we do not directly hold equity

interests in the VIE, we are subject to risks due to uncertainty of the interpretation and the application of the PRC laws and regulations,

including but not limited to limitation on foreign ownership of internet technology companies, regulatory review of oversea listing of

PRC companies through a special purpose vehicle, and the validity and enforcement of the VIE Agreements. We are also subject to the risks

of uncertainty about any future actions of the PRC government in this regard that could disallow the VIE structure, which would likely

result in a material change in our operations and the value of Ordinary Shares may depreciate significantly or become worthless.

Our VIE Agreements may not

be effective in providing control over Taizhou Suxuantang. We may also subject to sanctions imposed by PRC regulatory agencies including

Chinese Securities Regulatory Commission, or CSRC, if we fail to comply with their rules and regulations.

Through Taizhou Suxuantang

and its subsidiaries, we are an innovative pharmaceutical company based in China that focuses on the research, development, manufacture,

marketing and sales of traditional Chinese medicine and pharmacology (“TCMP”). TCMP is a type of traditional Chinese medicine

(“TCM”) products that has been widely accepted by Chinese people for thousands of years. Throughout the decades of years,

TCMP products’ origin, identification, preparation process, quality standard, indication, dosage and administration, precautions,

and storage have been well documented, listed and specified in “China Pharmacopoeia” a state-governmental issued guidance

on manufacturing TCMP. In recent years, the TCMP industry enjoyed more rapid growth than any other segments of the pharmaceutical industry

primarily due to the favorable government policies for the TCMP industry. Because of the favorable government policies, TCMP products

do not have to go through rigorous clinical trials before commercialization. We currently sell three types of TCMP products: Advanced

TCMP, Fine TCMP and Regular TCMP. Although all of our TCMP products are generic TCMP drugs and we did not change the medical effects of

these products in any significant way, these products are innovative in terms of their unconventional administration. The complexity of

the manufacturing process is what differentiates our products. Advanced TCMP typically has the highest quality because it requires specialized

equipment and preparation processes to manufacture, and has to go through more manufacturing steps to produce than Fine TCMP and Regular

TCMP. Fine TCMP is manufactured with more refined ingredients than Regular TCMP.

Our Corporate Structure

China SXT Pharmaceutical Inc.

is a British Virgin Islands corporation which holds 100% Ordinary Shares of its wholly owned Hong Kong subsidiary, China SXT Group Limited.

China SXT Group Limited holds all of the share capital of Taizhou Suxuantang Biotechnology Co. Ltd., a wholly foreign-owned enterprise.

Taizhou Suxuantang Biotechnology Co. Ltd., through a series of contractual arrangements, controls our operating entity, Jiangsu Taizhou

Suxuantang Pharmaceutical Col. Ltd.

The following diagram illustrates

our corporate structure as of the date of this prospectus supplement:

Permission Required from the PRC Authorities

for The VIE’s Operation and This Offering

On December 24, 2021, the

China Securities Regulatory Commission, or the CSRC, issued Provisions of the State Council on the Administration of Overseas Securities

Offering and Listing by Domestic Companies (Draft for Comments) (the “Administration Provisions”), and the Provisions of the

State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Measures”),

which are now open for public comments. The Administration Provisions and Measures for overseas listings lay out specific requirements

for filing documents and include unified regulation management, strengthening regulatory coordination, and cross-border regulatory cooperation.

Domestic companies seeking to list abroad must carry out relevant security screening procedures if their businesses involve such supervision.

Companies endangering national security are among those off-limits for overseas listings. According to Relevant Officials of the CSRC

Answered Reporter Questions (“CSRC Answers”), after the Administration Provisions and Measures are implemented upon completion

of public consultation and due legislative procedures, the CSRC will formulate and issue guidance for filing procedures to further specify

the details of filing administration and ensure that market entities could refer to clear guidelines for filing, which means it still

takes time to make the Administration Provisions and Measures into effect. As the Administration Provisions and Measures have not yet

come into effect, we are currently unaffected. However, according to CSRC Answers, new initial public offerings and refinancing by existent

overseas listed Chinese companies will be required to go through the filing process; other existent overseas listed companies will be

allowed sufficient transition period to complete their filing procedure, which means we will certainly go through the filing process in

the future.

Based on our understanding

of the current PRC laws and regulations and the proposed drafts of the Administration Provisions and the Measures, we are currently not

required to obtain permission from any of the PRC authorities to operate and issue our Ordinary Shares to foreign investors. In addition,

we, our subsidiaries, or VIE are not required to obtain permission or approval from the PRC authorities including CSRC or CAC for the

VIE’s operation, nor have we, our subsidiaries, or VIE received any denial for the VIE’s operation. However, recently, the

General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the

“Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the Opinions, which was made available

to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities, and

the need to strengthen the supervision over overseas listings by Chinese companies. Effective measures, such as promoting the construction

of relevant regulatory systems will be taken to deal with the risks and incidents of China-concept overseas listed companies, and cybersecurity

and data privacy protection requirements and similar matters. The Opinions and any related implementing rules to be enacted may subject

us to compliance requirement in the future. Given the current regulatory environment in the PRC, we are still subject to the uncertainty

of different interpretation and enforcement of the rules and regulations in the PRC adverse to us, which may take place quickly with little

advance notice.

Dividend Distributions or Assets Transfer among the Holding Company,

its Subsidiaries and the Consolidated VIE

We rely principally on dividends

and other distributions on equity from Taizhou Suxuantang and its subsidiaries for our cash requirements, including for services of any

debt we may incur. Taizhou Suxuantang and its subsidiaries’ ability to distribute dividends is based upon their distributable earnings.

Current PRC regulations permit Taizhou Suxuantang and its subsidiaries to pay dividends to their respective shareholders only out of their

accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of Taizhou Suxuantang

and its subsidiaries are required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until

such reserve reaches 50% of each of their registered capitals. These reserves are not distributable as cash dividends. If our PRC subsidiaries

incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other

payments to us. Any limitation on the ability of Taizhou Suxuantang and its subsidiaries to distribute dividends or other payments to

their respective shareholders could materially and adversely limit our ability to grow, make investments or acquisitions that could be

beneficial to our businesses, pay dividends or otherwise fund and conduct our business.

To address the persistent

capital outflow and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China

and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the subsequent months,

including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments

and shareholder loan repayments. For instance, the Circular on Promoting the Reform of Foreign Exchange Management and Improving Authenticity

and Compliance Review, or the SAFE Circular 3, issued on January 26, 2017, provides that the banks shall, when dealing with dividend remittance

transactions from domestic enterprise to its offshore shareholders of more than US$50,000, review the relevant board resolutions, original

tax filing form and audited financial statements of such domestic enterprise based on the principal of genuine transaction. The PRC government

may continue to strengthen its capital controls and Taizhou Suxuantang and its subsidiaries’ dividends and other distributions may

be subject to tightened scrutiny in the future. Any limitation on the ability of Taizhou Suxuantang and its subsidiaries to pay dividends

or make other distributions to us could materially and adversely limit our ability to grow, make investments or acquisitions that could

be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

In addition, the Enterprise

Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable to dividends payable by

Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central government and

governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the tax agreement between

Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the payment of dividends by a PRC

enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10% if the Hong Kong enterprise (i) directly holds at

least 25% of the PRC enterprise, (ii) is a tax resident in Hong Kong and (iii) could be recognized as a beneficial owner of the dividend

from PRC tax perspective. Under administrative guidance, a Hong Kong resident enterprise must meet the following conditions, among others,

in order to apply the reduced withholding tax rate: (i) it must be a company; (ii) it must directly own the required percentage of equity

interests and voting rights in the PRC resident enterprise; and (iii) it must have directly owned such required percentage in the PRC

resident enterprise throughout the 12 months prior to receiving the dividends. Nonresident enterprises are not required to obtain pre-approval

from the relevant tax authority in order to enjoy the reduced withholding tax. Instead, nonresident enterprises and their withholding

agents may, by self-assessment and on confirmation that the prescribed criteria to enjoy the tax treaty benefits are met, directly apply

the reduced withholding tax rate, and file necessary forms and supporting documents when performing tax filings, which will be subject

to post-tax filing examinations by the relevant tax authorities. Accordingly, our wholly owned subsidiary China SXT Group Limited (“SXT

HK”) incorporated in Hong Kong may be able to benefit from the 5% withholding tax rate for the dividends it receives from our PRC

subsidiaries, if it satisfies the conditions prescribed under Guoshuihan [2009] 81 and other relevant tax rules and regulations. However,

if the relevant tax authorities consider the transactions or arrangements we have are for the primary purpose of enjoying a favorable

tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance

that the reduced 5% will apply to dividends received by SXT HK from Taizhou Suxuantang and its subsidiaries. This withholding tax will

reduce the amount of dividends we may receive from Taizhou Suxuantang and its subsidiaries.

As of the date of this prospectus

supplement, we, our subsidiaries, and the VIE have not distributed any earnings or settled any amounts owed under the VIE Agreements,

nor do they have any plan to distribute earnings or settle amounts owed under the VIE Agreements in the foreseeable future. As of the

date of this prospectus supplement, none of our subsidiaries or VIE have made any dividends or distributions to us and we has not made

any dividends or distributions to our shareholders.

In December 2018, we

reconstructed and assembled a facility and received a “Food Manufacturing Certificate” issued by the local Food and Drug Administration,

which granted the Company permission to produce TCM Homologous Supplements (“TCMHS”), a classification of health-supporting

food used traditionally in China as TCM but which are also consumed as food. The scope of production includes “Substitute Teas,”

made of TCMHS plants, and “Solid Beverages,” a kind of granule produced through extraction of TCMHS materials.

We have successfully developed

four (4) solid beverage products which were commercially launched in April 2019.

We have developed nineteen

(19) Advanced TCMPs, seventeen (17) of which have been produced and marketed, ten (10) Fine TCMPs, two hundred thirty-five (235) Regular

TCMPs and four (4) TCMHS solid beverages. Advanced TCMP has gradually become our principal product due to its quality and greater market

potential. For the six months ended September 30, 2021, Advanced TCMP brought in 28% of the total revenue, whereas Fine TCMP and Regular

TCMP each brought in 16% and 47% of the total revenue respectively. For the fiscal year ended March 31, 2021, Advanced TCMP brought in

37% of the total revenue, whereas Fine TCMP and Regular TCMP each brought in 12% and 30% of the total revenue respectively. For the fiscal

year ended March 31, 2020, Advanced TCMP brought in 30.6% of the total revenue, whereas Fine TCMP and Regular TCMP each brought in 20.0%

and 44.2% of the total revenue respectively. For the fiscal year ended March 31, 2019, Advanced TCMP brought in 51.8% of the total revenue,

whereas Fine TCMP and Regular TCMP each brought in 7.5% and 40.7% of the total revenue respectively. Our Advanced TCMP includes nineteen

products, which can be further divided into seven Directly-Oral TCMP products, and ten After-Soaking-Oral TCMP products. Directly-Oral

TCMP, as the name suggests, has the advantage of being taken orally. Following the principle of Directly-Oral-TCMP, we have established

a new scientific and technological strategy and methods for the research and development of the direct-oral pharmaceutical TCMP products.

We believe our Directly-Oral TCMP products comply with the regulations of the National Medical Products Administration (NMPA) and provincial

MPA, as well as keep the principles of TCM. The After-Soak-Oral TCMP comes as a small, porous, sealed bag that can be immersed in boiling

water to make an infusion. Our major Directly-Oral-TCMP are SanQiFen, CuYanHuSuo, XiaTianWu and LuXueJing; our major After-Soaking-Oral-TCMP

are ChenXiang, SuMu, ChaoSuanZaoRen, and JiangXiang. For each principal product’s indications and year of commercialization, see

“Business – Our Products” in our annual report on the Form 20-F.

Taizhou Suxuantang, the VIE

entity, was founded in 2005 and has grown significantly in recent years. Our net revenues decreased from $3,860,501 for the six months

ended September 30, 2020 to $1,027,674 for the six months ended September 30, 2021, representing a decrease of 73%. Our net income decreased

from $1,381,258 for the six months ended September 30, 2020 to a net loss of $3,091,824 for the six months ended September 30, 2021, representing

a decrease of 324% of net income during this period. Our net revenues decreased from $5,162,268 in fiscal year ended March 31, 2020 to

$4,777,573 in fiscal year ended March 31, 2021, representing a decrease of 7%. Our net loss decreased from $10,287,872 in fiscal year

ended March 31, 2020 to $2,748,183 in fiscal year ended March 31, 2021, representing a decrease of 73% of net loss during this period.

Our net revenues decreased from $7,012,026 in fiscal year ended March 31, 2019 to $5,162,268 in fiscal year ended March 31, 2020, representing

a decrease of 26%. Our net income decreased from $1,539,227 in fiscal year ended March 31, 2019 to a net loss of $10,287,872 in fiscal

year ended March 31, 2020, representing a decrease of 768% during this period.

We own fourteen (14) Chinese

registered trademarks related to our brand “Suxuantang.” Our TCMP products received the prestigious award of Jiangsu Taizhou

Famous Product, and Well-known Brand Trademark in December 2016, and 2017, respectively. The awards were granted by the Government of

Taizhou City, Jiangsu, China. In the near future, we plan to increase our efforts in cooperating with universities, research institutes,

and R&D agents on joint R&D projects involving TCMP processing methods and quality standard, as well as the training of our researchers.

We have been focusing on the

research and development of new Advanced TCMP products. We submitted eight invention patent applications regarding Advanced TCMP to the

State Intellectual Property Office of the PRC in the Spring of 2017. We also submitted five additional invention patent applications to

the State Intellectual Property Office of PRC afterwards, one of which was rejected as of the date of this prospectus supplement. All

of these patents have been under the substantive examination stages, which do not involve new products.

Our major customers are hospitals,

especially TCM hospitals, primarily in the Jiangsu province in China. Another substantial part of our sales are made to pharmaceutical

distributors, which then sell our products to hospitals and other healthcare distributors. As of July 31, 2021, our end-customer base

includes seventy (70) pharmaceutical companies, twelve (12) chain pharmacies and fifty-nine (59) hospitals in ten (10) provinces

and municipalities in China including Jiangsu, Hubei, Shandong, Hebei, Jiangxi, Guangdong, Anhui, Henan, Liaoning, and Fujian.

Corporate Information

Our principal executive offices

are located at 178 Taidong Rd North, Taizhou, Jiangsu, China. Our telephone number at this address is +86- 523-86298290. Our Ordinary

Shares are traded on Nasdaq under the symbol “SXTC.”

Our Internet website, www.sxtchina.com,

provides a variety of information about our Company. We do not incorporate by reference into this prospectus supplement or the accompanying

base prospectus any of the information on, or accessible through, our website, and you should not consider it as part of this prospectus

supplement or accompanying base prospectus. Our annual reports on Form 20-F and current reports on Form 6-K filed and furnished

with the SEC are available, as soon as practicable after filing, at the investors’ page on our corporate website, or by a direct

link to its filings on the SEC’s free website.

THE OFFERING

| Issuer |

|

China SXT Pharmaceuticals, Inc. |

| |

|

|

| Note |

|

An unsecured convertible promissory note, in the original principal amount of $2,804,848, which includes an original issue discount of $168,291.00 (“OID”). The Note bears interest at a rate of 6% per annum compounding daily. All outstanding principal and accrued interest on the Note will become due and payable twelve (12) months after the purchase price of the Note is delivered by the Investor to the Company (the “Purchase Price Date”). For a more detailed description of the Note, see the section entitled “Description of Our Securities We Are Offering” beginning on page S-20. |

| |

|

|

| Original Principal Amount |

|

$2,804,848 |

| |

|

|

| Redemption |

|

At any point after 90 days following the closing date, Investor can redeem the Note in whole or in part, subject to the Maximum Monthly Redemption Amount of $600,000 per calendar month (the “Maximum Monthly Redemption Amount”) |

| |

|

|

| Conversion Rights |

|

At any point after 90 days following the closing, Investor may convert the Note into our Ordinary Shares, at a fixed price of $0.30 per share, subject to adjustments as set forth in the Note. |

| |

|

|

| Sales Limitation |

|

The Investor agreed that in any given calendar week (being from Sunday to Saturday of that week), the number of Ordinary Shares sold by it in the open market will not be more than fifteen percent (15%) of the weekly trading volume for the Ordinary Shares during any such week. |

| |

|

|

| Prepayment at our option |

|

We may prepay the Note at an amount equal to 120% of the outstanding principal and the accrued and unpaid interest. |

| |

|

|

| Event of Default |

|

If an event of default on the Note occurs, interest shall accrue at a rate of 15% annually until paid. The Investor shall the right to increase the balance of the Note by 15% for major defaults and 5% for minor defaults. |

| |

|

|

| Use of proceeds |

|

We intend to use the net proceeds from this offering for working capital And general business purposes. See “Use of Proceeds” on page S-18 of this prospectus supplement. |

| |

|

|

| Risk factors |

|

Investing in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our securities, see the information contained in or incorporated by reference under the heading “Risk Factors” beginning on page S-7 of this prospectus supplement, on page 5 of the accompanying base prospectus, in our Annual Report on Form 20-F for the fiscal year ended March 31, 2021 and in the other documents incorporated by reference into this prospectus supplement and accompanying base prospectus. |

RISK FACTORS

Before you make a decision to invest in our

securities, you should consider carefully the risks described below, together with other information in this prospectus supplement, the

accompanying base prospectus and the information incorporated by reference herein and therein, including our Annual Report on Form 20-F

for the fiscal year ended March 31, 2021. If any of the following events actually occur, our business, operating results, prospects or

financial condition could be materially and adversely affected. This could cause the trading price of our Ordinary Shares to decline and

you may lose all or part of your investment. The risks described below are not the only ones that we face. Additional risks not presently

known to us or that we currently deem immaterial may also significantly impair our business operations and could result in a complete

loss of your investment.

Risks Related to Our Corporate Structure

If the PRC government deems that the contractual

arrangements in relation to Taizhou Suxuantang, the consolidated variable interest entity, do not comply with PRC regulatory restrictions

on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the

future, we could be subject to severe penalties or be forced to relinquish our interests in those operations.

We are a holding company incorporated

under the laws of British Virgin Islands. As a holding company with no material operations of our own, we conduct all of our operations

through our subsidiaries established in PRC and the VIE. We control and receive the economic benefits of the VIE’s business operations

through certain contractual arrangements. Our Ordinary Shares and Pre-funded Warrants offered in this offering are securities of our offshore

holding company instead of those of the VIE in China.

The VIE contributed 100% of

the Company’s consolidated results of operations and cash flows for the years ended March 31, 2021 and 2020, respectively. As of

September 30, 2021, the VIE accounted for approximately 91% of the consolidated total assets and 94% of total liabilities of the Company,

respectively. The VIE contributed 100% of the Company’s consolidated results of operations and cash flows for the years ended March

31, 2021 and 2020, respectively. As of March 31, 2021, the VIE accounted for approximately 79% of the consolidated total assets and 92%

of total liabilities of the Company, respectively.

We rely on and expect to continue

to rely on the VIE Agreements. These VIE Agreements may not be as effective in providing us with control over Taizhou Suxuantang as ownership

of controlling equity interests would be in providing us with control over, or enabling us to derive economic benefits from the operations

of Taizhou Suxuantang. Under the current VIE Agreements, as a legal matter, if Taizhou Suxuantang or any of its shareholders executing

the VIE Agreements fails to perform its, his or her respective obligations under these VIE Agreements, we may have to incur substantial

costs and resources to enforce such arrangements, and rely on legal remedies available under PRC laws, including seeking specific performance

or injunctive relief, and claiming damages, which we cannot assure you will be effective. For example, if shareholders of the VIE were

to refuse to transfer their equity interests in the VIE to us or our designated persons when we exercise the purchase option pursuant

to these VIE Agreements, we may have to take a legal action to compel them to fulfill their contractual obligations.

If (i) the applicable PRC

authorities invalidate these VIE Agreements for violation of PRC laws, rules and regulations, (ii) the VIE or its shareholders terminate

the VIE Agreements (iii) the VIE or its shareholders fail to perform its/his/her obligations under these VIE Agreements, or (iv) if these

regulations change or are interpreted differently in the future, our business operations in China would be materially and adversely affected,

and the value of your shares would substantially decrease or even become worthless. Further, if we fail to renew these VIE Agreements

upon their expiration, we would not be able to continue our business operations unless the then current PRC law allows us to directly

operate businesses in China.

In addition, if the VIE or

all or part of its assets become subject to liens or rights of third-party creditors, we may be unable to continue some or all of our

business activities, which could materially and adversely affect our business, financial condition and results of operations. If the VIE

undergoes a voluntary or involuntary liquidation proceeding, its shareholders or unrelated third-party creditors may claim rights to some

or all of its assets, thereby hindering our ability to operate our business, which could materially and adversely affect our business

and our ability to generate revenues.

All of these VIE Agreements

are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. The legal environment in the PRC is

not as developed as in some other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could limit

our ability to enforce these VIE Agreements. In the event we are unable to enforce these VIE Agreements, we may not be able to exert effective

control over our operating entities and we may be precluded from operating our business, which would have a material adverse effect on

our financial condition and results of operations.

These VIE Agreements may not

be as effective as direct ownership in providing us with control over the VIE. For example, the VIE and its shareholders could breach

their VIE Agreements with us by, among other things, failing to conduct their operations in an acceptable manner or taking other actions

that are detrimental to our interests. If we had direct ownership of the VIE, we would be able to exercise our rights as a shareholder

to effect changes in the board of directors of the VIE, which in turn could implement changes, subject to any applicable fiduciary obligations,

at the management and operational level. However, under the current VIE Agreements, we rely on the performance by the VIE and its shareholders

of their obligations under the contracts to exercise control over the VIE. The shareholders of our consolidated VIE may not act in the

best interests of our company or may not perform their obligations under these contracts. Such risks exist throughout the period in which

we intend to operate certain portions of our business through the VIE Agreements with the VIE.

If the VIE or its shareholders

fail to perform their respective obligations under the VIE Agreements, we may have to incur substantial costs and expend additional resources

to enforce such arrangements. For example, if the shareholders of the VIE refuse to transfer their equity interest in the VIE to us or

our designee if we exercise the purchase option pursuant to these VIE Agreements, or if they otherwise act in bad faith toward us, then

we may have to take legal actions to compel them to perform their contractual obligations. In addition, if any third parties claim any

interest in such shareholders’ equity interests in the VIE, our ability to exercise shareholders’ rights or foreclose the

share pledge according to the VIE Agreements may be impaired. If these or other disputes between the shareholders of the VIE and third

parties were to impair our control over the VIE, our ability to consolidate the financial results of the VIE would be affected, which

would in turn result in a material adverse effect on our business, operations and financial condition.

In the opinion of our PRC

legal counsel, each of the VIE Agreements among our WFOE, the VIE and its shareholders governed by PRC laws are valid, binding and enforceable,

and will not result in any violation of PRC laws or regulations currently in effect. However, our PRC legal counsel has also advised us

that there are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and

rules. Accordingly, the PRC regulatory authorities may ultimately take a view that is contrary to the opinion of our PRC legal counsel.

In addition, it is uncertain whether any new PRC laws or regulations relating to variable interest entity structures will be adopted or

if adopted, what they would provide. PRC government authorities may deem that foreign ownership is directly or indirectly involved in

the VIE’s shareholding structure. If our corporate structure and VIE Agreements are deemed by the Ministry of Industry and Information

Technology, or MIIT, or the Ministry of Commerce, or MOFCOM, or other regulators having competent authority to be illegal, either in whole

or in part, we may lose control of our consolidated VIE and have to modify such structure to comply with regulatory requirements. However,

there can be no assurance that we can achieve this without material disruption to our business. Furthermore, if we or the VIE is found

to be in violation of any existing or future PRC laws or regulations, or fail to obtain or maintain any of the required permits or approvals,

the relevant PRC regulatory authorities would have broad discretion to take action in dealing with such violations or failures, including,

without limitation:

| |

● |

revoking the business license and/or operating licenses of our WFOE or the VIE; |

| |

● |

discontinuing or placing restrictions or onerous conditions on our operations through any transactions among our WFOE and the VIE; |

| |

● |

imposing fines, confiscating the income from our WFOE, the VIE or its subsidiaries, or imposing other requirements with which we or the VIE may not be able to comply; |

| |

● |

placing restrictions on our right to collect revenues; |

| |

● |

requiring us to restructure our ownership structure or operations, including terminating the VIE Agreements with the VIE and deregistering the equity pledges of the VIE, which in turn would affect our ability to consolidate, derive economic interests from, or exert effective control over the VIE; or |

| |

● |

restricting or prohibiting our use of the proceeds of this offering to finance our business and operations in China. |

| |

● |

taking other regulatory or enforcement actions against us that could be harmful to our business. |

The imposition of any of these

penalties would result in a material and adverse effect on our ability to conduct our business. In addition, it is unclear what impact

the PRC government actions would have on us and on our ability to consolidate the financial results of the VIE in our consolidated financial

statements, if the PRC government authorities were to find our corporate structure and VIE Agreements to be in violation of PRC laws and

regulations. If the imposition of any of these government actions causes us to lose our right to direct the activities of the VIE or our

right to receive substantially all the economic benefits and residual returns from the VIE and we are not able to restructure our ownership

structure and operations in a satisfactory manner, we would no longer be able to consolidate the financial results of the VIE in our consolidated

financial statements. Either of these results, or any other significant penalties that might be imposed on us in this event, would have

a material adverse effect on our financial condition and results of operations.

We may not be able to consolidate the financial

results of some of our affiliated companies or such consolidation could materially and adversely affect our operating results and financial

condition.

Our business is conducted

through Taizhou Suxuantang, which is considered a VIE for accounting purposes, and we are considered the primary beneficiary, thus enabling

us to consolidate our financial results in our consolidated financial statements. In the event that in the future a company we hold as

a VIE no longer meets the definition of a VIE under applicable accounting rules, or we are deemed not to be the primary beneficiary, we

would not be able to consolidate line by line that entity’s financial results in our consolidated financial statements for reporting

purposes. Also, if in the future an affiliate company becomes a VIE and we become the primary beneficiary, we would be required to consolidate

that entity’s financial results in our consolidated financial statements for accounting purposes. If such entity’s financial

results were negative, this would have a corresponding negative impact on our operating results for reporting purposes.

Because we rely on the VIE Agreements for

our revenue, the termination of these agreements would severely and detrimentally affect our continuing business viability under our current

corporate structure.

We are a holding company and

all of our business operations are conducted through the VIE Agreements. Although Taizhou Suxuantang does not have termination rights

pursuant to the VIE Agreements, it could terminate, or refuse to perform under, the VIE Agreements. Because neither we, nor our subsidiaries,

own equity interests of Taizhou Suxuantang, the termination or non-performance of the VIE Agreements would sever our ability to receive

payments from Taizhou Suxuantang under our current holding company structure. While we are currently not aware of any event or reason

that may cause the VIE Agreements to terminate, we cannot assure you that such an event or reason will not occur in the future. In the

event that the VIE Agreements are terminated, this would have a severe and detrimental effect on our continuing business viability under

our current corporate structure, which, in turn, would affect the value of your investment.

Our current corporate structure and business operations may be

affected by the newly enacted Foreign Investment Law.

On March 15, 2019, the National

People’s Congress approved the Foreign Investment Law, which took effect on January 1, 2020. Since it is relatively new, uncertainties

exist in relation to its interpretation and its implementation rules that are yet to be issued. The Foreign Investment Law does not explicitly

classify whether variable interest entities that are controlled through VIE Agreements would be deemed as foreign-invested enterprises

if they are ultimately “controlled” by foreign investors. However, it has a catch-all provision under definition of “foreign

investment” that includes investments made by foreign investors in China through other means as provided by laws, administrative

regulations or the State Council of the PRC, or the State Council. Therefore, it still leaves leeway for future laws, administrative regulations

or provisions of the State Council to provide for VIE Agreements as a form of foreign investment. Therefore, there can be no assurance

that our control over the VIE through VIE Agreements will not be deemed as foreign investment in the future.

The Foreign Investment Law

grants national treatment to foreign-invested entities, except for those foreign-invested entities that operate in industries specified

as either “restricted” or “prohibited” from foreign investment in a “negative list”. The Foreign Investment

Law provides that foreign-invested entities operating in “restricted” or “prohibited” industries will require

market entry clearance and other approvals from relevant PRC government authorities. If our control over the VIE through VIE Agreements

are deemed as foreign investment in the future, and any business of the VIE is “restricted” or “prohibited” from

foreign investment under the “negative list” effective at the time, we may be deemed to be in violation of the Foreign Investment

Law, the VIE Agreements that allow us to have control over the VIE may be deemed as invalid and illegal, and we may be required to unwind

such VIE Agreements and/or restructure our business operations, any of which may have a material adverse effect on our business operations.

In addition, as the Chinese government has been updating the Negative List in recent years and reducing the sectors prohibited or restricted

for foreign investment, it is probable in the future that, even if the VIE is identified as a FIE, it is still allowed to acquire or hold

equity of enterprises in sectors currently prohibited or restricted for foreign investment.

Furthermore, the PRC Foreign

Investment Law provides that foreign invested enterprises established according to the existing laws regulating foreign investment may

maintain their structure and corporate governance within five years after the implementing of the PRC Foreign Investment Law.

In addition, the PRC Foreign

Investment Law also provides several protective rules and principles for foreign investors and their investments in the PRC, including,

among others, that a foreign investor may freely transfer into or out of China, in Renminbi or a foreign currency, its contributions,

profits, capital gains, income from disposition of assets, royalties of intellectual property rights, indemnity or compensation lawfully

acquired, and income from liquidation, among others, within China; local governments shall abide by their commitments to the foreign investors;

governments at all levels and their departments shall enact local normative documents concerning foreign investment in compliance with

laws and regulations and shall not impair legitimate rights and interests, impose additional obligations onto FIEs, set market access

restrictions and exit conditions, or intervene with the normal production and operation activities of FIEs; except for special circumstances,

in which case statutory procedures shall be followed and fair and reasonable compensation shall be made in a timely manner, expropriation

or requisition of the investment of foreign investors is prohibited; and mandatory technology transfer is prohibited.

Notwithstanding the above,

the PRC Foreign Investment Law stipulates that foreign investment includes “foreign investors invest through any other methods under

laws, administrative regulations or provisions prescribed by the State Council”. Therefore, there are possibilities that future

laws, administrative regulations or provisions prescribed by the State Council may regard VIE Agreements as a form of foreign investment,

and then whether our contractual arrangement will be recognized as foreign investment, whether our contractual arrangement will be deemed

to be in violation of the foreign investment access requirements and how the above-mentioned contractual arrangement will be handled are

uncertain.

The Chinese government may exercise significant

oversight influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval

from Chinese authorities to list on U.S. exchanges, however, if the VIE or the holding company were required to obtain approval in the

future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S.

exchange, which would materially affect the interest of the investors.

The Chinese government has

exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state

ownership. Our ability to operate through the VIE in China may be harmed by changes in its laws and regulations, including those relating

to taxation, environmental regulations, land use rights, property and other matters. The central or local governments of these jurisdictions

may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts

on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including

any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local

variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions

thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

For example, the Chinese cybersecurity

regulator announced on July 2021 that it had begun an investigation of Didi Global Inc. (NYSE: DIDI) and two days later ordered that the

company’s app was removed from smartphone app stores. On July 24, 2021, the General Office of the Communist Party of China Central

Committee and the General Office of the State Council jointly released the Guidelines for Further Easing the Burden of Excessive Homework

and Off-campus Tutoring for Students at the Stage of Compulsory Education, pursuant to which foreign investment in such firms via mergers

and acquisitions, franchise development, and variable interest entities are banned from this sector.

We believe that our operations

in China are in material compliance with all applicable legal and regulatory requirements. However, the Company’s business segments

may be subject to various government and regulatory interference in the provinces in which they operate. The Company could be subject

to regulation by various political and regulatory entities, including various local and municipal agencies and government sub-divisions.

The Company may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure

to comply, and such compliance or any associated inquiries or investigations or any other government actions may:

| |

● |

delay or impede our development; |

| |

● |

result in negative publicity or increase the Company’s operating costs; |

| |

● |

require significant management time and attention; and |

| |

● |

subject the VIE to remedies, administrative penalties and even criminal liabilities that may harm our business, including fines assessed for our current or historical operations, or demands or orders that we modify or even cease our business practices. |

Furthermore, it is uncertain

when and whether the Company will be required to obtain permission from the PRC government to list on U.S. exchanges in the future, and

even when such permission is obtained, whether it will be denied or rescinded. Although the Company is currently not required to obtain

permission from any of the PRC federal or local government to obtain such permission and has not received any denial to list on the U.S.

exchange, our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its

business or industry, which could result in a material adverse change in the value of our securities, potentially rendering it worthless.

As a result, both you and us face uncertainty about future actions by the PRC government that could significantly affect our ability to

offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless.

Risks Related to Our Business Operations and Doing Business in China

The Chinese government exerts substantial

influence over the manner in which we may conduct our business activities, and if we are unable to substantially comply with any PRC rules and

regulations that negatively impact our business operations, our financial condition and results of operations may be materially adversely

affected.

The Chinese government has

exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state

ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation,

environmental regulations, land use rights, property and other matters. The central or local governments of these jurisdictions may impose

new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part

to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision

not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in

the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof,

and could require us to divest ourselves of any interest we then hold in Chinese properties.

As such, our business operations

of and the industries we operate in may be subject to various government and regulatory interference in the provinces in which they operate.

We could be subject to regulation by various political and regulatory entities, including various local and municipal agencies and government

sub-divisions. We may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for

any failure to comply. In the event that we are not able to substantially comply with any existing or newly adopted laws and regulations,

our business operations may be materially adversely affected and the value of our Ordinary Shares may significantly decrease.

Furthermore, the PRC government

authorities may strengthen oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers

like us. Such actions taken by the PRC government authorities may intervene or influence our operations at any time, which are beyond

our control. Therefore, any such action may adversely affect our operations and significantly limit or hinder our ability to offer or

continue to offer securities to you and reduce the value of such securities.

We may be liable for improper use or appropriation

of personal information provided by our customers and any failure to comply with PRC laws and regulations over data security could result

in materially adverse impact on our business, results of operations, our continued listing on Nasdaq, and this offering.

Our business involves collecting

and retaining certain internal and external data and information including that of our customers and supplies. The integrity and protection

of such information and data are crucial to us and our business. Owners of such data and information expect that we will adequately protect

their personal information. We are required by applicable laws to keep strictly confidential the personal information that we collect,

and to take adequate security measures to safeguard such information.

The PRC Criminal Law, as amended

by its Amendment 7 (effective on February 28, 2009) and Amendment 9 (effective on November 1, 2015), prohibits institutions,

companies and their employees from selling or otherwise illegally disclosing a citizen’s personal information obtained in performing

duties or providing services or obtaining such information through theft or other illegal ways. On November 7, 2016, the Standing

Committee of the PRC National People’s Congress issued the Cyber Security Law of the PRC, or Cyber Security Law, which became effective

on June 1, 2017. Pursuant to the Cyber Security Law, network operators must not, without users’ consent, collect their personal

information, and may only collect users’ personal information necessary to provide their services. Providers are also obliged to

provide security maintenance for their products and services and shall comply with provisions regarding the protection of personal information

as stipulated under the relevant laws and regulations.

The Civil Code of the PRC

(issued by the PRC National People’s Congress on May 28, 2020 and effective from January 1, 2021) provides legal basis

for privacy and personal information infringement claims under the Chinese civil laws. PRC regulators, including the Cyberspace Administration

of China, the Ministry of Industry and Information Technology, and the Ministry of Public Security, have been increasingly focused on

regulation in data security and data protection.

The PRC regulatory requirements

regarding cybersecurity are evolving. For instance, various regulatory bodies in China, including the Cyberspace Administration of China,

the Ministry of Public Security and the State Administration for Market Regulation, have enforced data privacy and protection laws and

regulations with varying and evolving standards and interpretations. In April 2020, the Chinese government promulgated Cybersecurity

Review Measures, which came into effect on June 1, 2020. According to the Cybersecurity Review Measures, operators of critical information

infrastructure must pass a cybersecurity review when purchasing network products and services which do or may affect national security.

In July 2021, the Cyberspace

Administration of China and other related authorities released the draft amendment to the Cybersecurity Review Measures for public comments

through July 25, 2021. The draft amendment proposes the following key changes:

| |

● |

companies who are engaged in data processing are also subject to the regulatory scope; |

| |

|

|

| |

● |

the CSRC is included as one of the regulatory authorities for purposes of jointly establishing the state cybersecurity review working mechanism; |

| |

|

|

| |

● |

the operators (including both operators of critical information infrastructure and relevant parties who are engaged in data processing) holding more than one million users/users’ (which to be further specified) individual information and seeking a listing outside China shall file for cybersecurity review with the Cybersecurity Review Office; and |

| |

|

|

| |

● |

the risks of core data, material data or large amounts of personal information being stolen, leaked, destroyed, damaged, illegally used or transmitted to overseas parties and the risks of critical information infrastructure, core data, material data or large amounts of personal information being influenced, controlled or used maliciously shall be collectively taken into consideration during the cybersecurity review process. |

Currently, the draft amendment

has been released for public comment only, and its implementation provisions and anticipated adoption or effective date remains substantially

uncertain and may be subject to change. If the draft amendment is adopted into law in the future, we may become subject to enhanced cybersecurity

review. Certain internet platforms in China have been reportedly subject to heightened regulatory scrutiny in relation to cybersecurity

matters. As of the date of this prospectus supplement, as a company engaged in e-commerce business through the VIE and their subsidiaries

in China, we have not been included within the definition of “operator of critical information infrastructure” by competent

authority, nor have we been informed by any PRC governmental authority of any requirement that we file for a cybersecurity review. However,

if we are deemed to be a critical information infrastructure operator or a company that is engaged in data processing and holds personal

information of more than one million users, we could be subject to PRC cybersecurity review.

As there remains significant

uncertainty in the interpretation and enforcement of relevant PRC cybersecurity laws and regulations, we could be subject to cybersecurity

review, and if so, we may not be able to pass such review. In addition, we could become subject to enhanced cybersecurity review or investigations

launched by PRC regulators in the future. Any failure or delay in the completion of the cybersecurity review procedures or any other non-compliance

with the related laws and regulations may result in fines or other penalties, including suspension of business, website closure, removal

of our app from the relevant app stores, and revocation of prerequisite licenses, as well as reputational damage or legal proceedings

or actions against us, which may have material adverse effect on our business, financial condition or results of operations. As of the

date of this prospectus supplement, we have not been involved in any investigations on cybersecurity review initiated by the Cyber Administration

of China or related governmental regulatory authorities, and we have not received any inquiry, notice, warning, or sanction in such respect.

We believe that we are in compliance with the aforementioned regulations and policies that have been issued by the Cyber Administration

of China.

On June 10, 2021, the

Standing Committee of the National People’s Congress of China, or the SCNPC, promulgated the PRC Data Security Law, which will take

effect in September 2021. The PRC Data Security Law imposes data security and privacy obligations on entities and individuals carrying

out data activities, and introduces a data classification and hierarchical protection system based on the importance of data in economic

and social development, and the degree of harm it will cause to national security, public interests, or legitimate rights and interests

of individuals or organizations when such data is tampered with, destroyed, leaked, illegally acquired or used. The PRC Data Security

Law also provides for a national security review procedure for data activities that may affect national security and imposes export restrictions

on certain data an information.

As of the date of this prospectus

supplement, we do not expect that the current PRC laws on cybersecurity or data security would have a material adverse impact on our business

operations. However, as uncertainties remain regarding the interpretation and implementation of these laws and regulations, we cannot

assure you that we will comply with such regulations in all respects and we may be ordered to rectify or terminate any actions that are

deemed illegal by regulatory authorities. We may also become subject to fines and/or other sanctions which may have material adverse effect

on our business, operations and financial condition.

Although the audit report included in this

prospectus is prepared by U.S. auditors who are currently inspected by the Public Company Accounting Oversight Board (the “PCAOB”),

there is no guarantee that future audit reports will be prepared by auditors inspected by the PCAOB and, as such, in the future investors

may be deprived of the benefits of such inspection. Furthermore, trading in our securities may be prohibited under the Holding Foreign

Companies Accountable Act (the “HFCA Act”) if the SEC subsequently determines our audit work is performed by auditors that

the PCAOB is unable to inspect or investigate completely, and as a result, U.S. national securities exchanges, such as the Nasdaq, may

determine to delist our securities. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable

Act, which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S.

stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.

As an auditor of companies

that are registered with the SEC and publicly traded in the United States and a firm registered with the PCAOB, our auditor is required

under the laws of the United States to undergo regular inspections by the PCAOB to assess their compliance with the laws of the United

States and professional standards. The PCAOB is currently unable to conduct inspections without the approval of the Chinese government

authorities. Currently, our U.S. auditor is currently inspected by the PCAOB.

Inspections of other auditors

conducted by the PCAOB outside mainland China have at times identified deficiencies in those auditors’ audit procedures and quality

control procedures, which may be addressed as part of the inspection process to improve future audit quality. The lack of PCAOB inspections

of audit work undertaken in mainland China prevents the PCAOB from regularly evaluating auditors’ audits and their quality control

procedures. As a result, if there is any component of our auditor’s work papers become located in mainland China in the future,

such work papers will not be subject to inspection by the PCAOB. As a result, investors would be deprived of such PCAOB inspections, which

could result in limitations or restrictions to our access of the U.S. capital markets.

As part of a continued regulatory

focus in the United States on access to audit and other information currently protected by national law, in particular mainland China’s,

in June 2019, a bipartisan group of lawmakers introduced bills in both houses of the U.S. Congress which, if passed, would require the

SEC to maintain a list of issuers for which PCAOB is not able to inspect or investigate the audit work performed by a foreign public accounting

firm completely. The proposed Ensuring Quality Information and Transparency for Abroad-Based Listings on our Exchanges (“EQUITABLE”)

Act prescribes increased disclosure requirements for these issuers and, beginning in 2025, the delisting from U.S. national securities

exchanges such as the Nasdaq of issuers included on the SEC’s list for three consecutive years. It is unclear if this proposed legislation

will be enacted. Furthermore, there have been recent deliberations within the U.S. government regarding potentially limiting or restricting

China-based companies from accessing U.S. capital markets. On May 20, 2020, the U.S. Senate passed the Holding Foreign Companies Accountable

Act (the “HFCA Act”), which includes requirements for the SEC to identify issuers whose audit work is performed by auditors

that the PCAOB is unable to inspect or investigate completely because of a restriction imposed by a non-U.S. authority in the auditor’s

local jurisdiction. The U.S. House of Representatives passed the HFCA Act on December 2, 2020, and the HFCA Act was signed into law on

December 18, 2020. Additionally, in July 2020, the U.S. President’s Working Group on Financial Markets issued recommendations for

actions that can be taken by the executive branch, the SEC, the PCAOB or other federal agencies and department with respect to Chinese

companies listed on U.S. stock exchanges and their audit firms, in an effort to protect investors in the United States. In response, on

November 23, 2020, the SEC issued guidance highlighting certain risks (and their implications to U.S. investors) associated with investments

in China-based issuers and summarizing enhanced disclosures the SEC recommends China-based issuers make regarding such risks. On March

24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the

HFCA Act. We will be required to comply with these rules if the SEC identifies us as having a “non-inspection” year (as defined