The Ordinary Shares trade

on The Nasdaq Capital Market, or Nasdaq, under the symbol “SXTC”. On January 19, 2022, the last reported price of the Ordinary

Shares on Nasdaq was $0.20 per Ordinary Share. There is no established trading market for the Pre-funded Warrants and we do not intend

to list the Pre-funded Warrants on any securities exchange or nationally recognized trading system.

We have granted the underwriter

an option for a period ending 45 days after the closing of this offering to purchase up to an additional Ordinary Shares and the shares

underlying the Pre-funded Warrants sold in this offering at the public offering price, less the underwriting discount, solely to cover

over-allotments, if any. If the underwriter exercises the option in full, the total underwriting discount will be $278,934.90, and the

total proceeds to us, before expenses, will be $3,705,749.42, assuming no exercise of the Pre-funded Warrants.

CAUTIONARY

NOTE ON FORWARD LOOKING STATEMENTS

Certain

statements contained or incorporated by reference in this prospectus supplement, the accompanying base prospectus and the documents incorporated

by reference herein and therein, including the statements of our management referring to or summarizing the contents of this prospectus

supplement, include “forward-looking statements”. We have based these forward-looking statements on our current expectations

and projections about future events. Our actual results may differ materially or perhaps significantly from those discussed herein, or

implied by, these forward-looking statements. Forward-looking statements are identified by words such as “believe,” “expect,”

“anticipate,” “intend,” “estimate,” “plan,” “project” and other similar expressions.

In addition, any statements that refer to expectations or other characterizations of future events or circumstances are forward-looking

statements. Forward-looking statements included or incorporated by reference in this prospectus or our other filings with the SEC include,

but are not necessarily limited to, those relating to:

|

|

●

|

risks

and uncertainties associated with the integration of the assets and operations we have acquired and may acquire in the future;

|

|

|

|

|

|

|

●

|

our

possible inability to raise or generate additional funds that will be necessary to continue and expand our operations;

|

|

|

|

|

|

|

●

|

our potential lack of revenue growth;

|

|

|

|

|

|

|

●

|

our

potential inability to add new products and services that will be necessary to generate increased sales;

|

|

|

|

|

|

|

●

|

our potential lack of cash flows;

|

|

|

|

|

|

|

●

|

our potential loss of key personnel;

|

|

|

|

|

|

|

●

|

the availability of qualified personnel;

|

|

|

|

|

|

|

●

|

international, national regional and local economic

political changes;

|

|

|

|

|

|

|

●

|

general economic and market conditions;

|

|

|

|

|

|

|

●

|

increases in operating expenses associated with the

growth of our operations;

|

|

|

|

|

|

|

●

|

the potential for increased competition;

|

|

|

|

|

|

|

●

|

risks

related to health epidemics and other outbreaks, which could significantly disrupt our operations and could have a material adverse

impact on us, such as the outbreak of the coronavirus disease 2019 (COVID-19), and other events or factors, many of which are

beyond our control, including those resulting from such events, or the prospect of such events, including war, terrorism and

other international conflicts, public health issues and natural disasters such as fire, hurricanes, earthquakes, tornados or

other adverse weather and climate conditions, whether occurring in the People’s Republic of China or elsewhere; and

|

|

|

|

|

|

|

●

|

other unanticipated factors.

|

The

foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or

risk factors that we are faced with that may cause our actual results to differ from those anticipate in our forward-looking statements.

Please see “Risk Factors” in our reports filed with the SEC, including in this prospectus supplement, the accompanying base

prospectus, and the documents incorporated by reference herein and therein, including our Annual Report on Form 20-F for the fiscal

year ended March 31, 2021, for additional risks which could adversely impact our business and financial performance.

Moreover,

new risks regularly emerge and it is not possible for our management to predict or articulate all risks we face, nor can we assess the

impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from

those contained in any forward-looking statements. All forward-looking statements included in this prospectus supplement are based on

information available to us on the date of this prospectus supplement. Except to the extent required by applicable laws or rules, we

undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events

or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly

qualified in their entirety by the cautionary statements contained above and throughout (or incorporated by reference in) this prospectus

supplement.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights selected information contained or incorporated by reference in this prospectus supplement and

the accompanying base prospectus. This summary does not contain all of the information you should consider before investing

in our securities. Before making an investment decision, you should read the entire prospectus supplement, the accompanying

base prospectus and the documents incorporated by reference herein and therein carefully, including the risk factors sections,

the financial statements and the notes to the financial statements incorporated herein and therein by reference.

In

this prospectus supplement, unless otherwise indicated, the terms “China SXT,” the “Company,” “we,”

“us,” and “our” refer and relate to China SXT Pharmaceuticals, Inc and its consolidated subsidiaries.

Our

Company

We

are an offshore holding company incorporated in British Virgin Islands, conducting all of our business through our subsidiaries and variable

interests entity, Jiangsu Taizhou Suxantang Pharmaceutical Co., Ltd. (“Taizhou Suxuantang” or the “VIE”) in China.

Neither we nor our subsidiaries own any share in Taizhou Suxuantang. Instead, we control and receive the economic benefits of Taizhou

Suxuantang’s business operation through a series of contractual arrangements, also known as VIE Agreements. The VIE Agreements

by and among our wholly-owned subsidiary, Taizhou Suxantang Biotechnology Co. Ltd. (the “WFOE”), Taizhou Suxuantang, and

Taizhou Suxuantang’s shareholders include (i) certain power of attorney agreements and equity interest pledge agreement, which

provide WFOE effective control over Taizhou Suxuantang; (ii) an exclusive technical consulting and service agreement which allows WFOE

to receive substantially all of the economic benefits from Taizhou Suxuantang; and (iii) certain exclusive equity interest purchase agreements

which provide WFOE with an exclusive option to purchase all or part of the equity interests in and/or assets of Taizhou Suxuantang when

and to the extent permitted by PRC laws. Through the VIE Agreements among WFOE, Taizhou Suxuantang and Taizhou Suxuantang’s shareholders,

we are regarded as the primary beneficiary of Taizhou Suxuantang for accounting purpose, and, therefore, we are able to consolidate the

financial results of Taizhou Suxuantang in our consolidated financial statements in accordance with U.S. GAAP. However, the VIE structure

cannot completely replicate a foreign investment in China-based companies, as the investors will not and may never directly hold equity

interests in the Chinese operating entities. Instead, the VIE structure provides contractual exposure to foreign investment in us. Because

we do not directly hold equity interests in the VIE, we are subject to risks due to uncertainty of the interpretation and the application

of the PRC laws and regulations, including but not limited to limitation on foreign ownership of internet technology companies, regulatory

review of oversea listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the VIE Agreements.

We are also subject to the risks of uncertainty about any future actions of the PRC government in this regard that could disallow the

VIE structure, which would likely result in a material change in our operations and the value of Ordinary Shares may depreciate significantly

or become worthless.

Our

VIE Agreements may not be effective in providing control over Taizhou Suxuantang. We may also subject to sanctions imposed by PRC regulatory

agencies including Chinese Securities Regulatory Commission, or CSRC, if we fail to comply with their rules and regulations.

Through

Taizhou Suxuantang and its subsidiaries, we are an innovative pharmaceutical company based in China that focuses on the research, development,

manufacture, marketing and sales of traditional Chinese medicine and pharmacology (“TCMP”). TCMP is a type of traditional

Chinese medicine (“TCM”) products that has been widely accepted by Chinese people for thousands of years. Throughout the

decades of years, TCMP products’ origin, identification, preparation process, quality standard, indication, dosage and administration,

precautions, and storage have been well documented, listed and specified in “China Pharmacopoeia” a state-governmental issued

guidance on manufacturing TCMP. In recent years, the TCMP industry enjoyed more rapid growth than any other segments of the pharmaceutical

industry primarily due to the favorable government policies for the TCMP industry. Because of the favorable government policies, TCMP

products do not have to go through rigorous clinical trials before commercialization. We currently sell three types of TCMP products:

Advanced TCMP, Fine TCMP and Regular TCMP. Although all of our TCMP products are generic TCMP drugs and we did not change the medical

effects of these products in any significant way, these products are innovative in terms of their unconventional administration. The

complexity of the manufacturing process is what differentiates our products. Advanced TCMP typically has the highest quality because

it requires specialized equipment and preparation processes to manufacture, and has to go through more manufacturing steps to produce

than Fine TCMP and Regular TCMP. Fine TCMP is manufactured with more refined ingredients than Regular TCMP.

Our Corporate

Structure

China

SXT Pharmaceutical Inc. is a British Virgin Islands corporation which holds 100% Ordinary Shares of its wholly owned Hong Kong subsidiary,

China SXT Group Limited. China SXT Group Limited holds all of the share capital of Taizhou Suxuantang Biotechnology Co. Ltd., a wholly

foreign-owned enterprise. Taizhou Suxuantang Biotechnology Co. Ltd., through a series of contractual arrangements, controls our operating

entity, Jiangsu Taizhou Suxuantang Pharmaceutical Col. Ltd.

The

following diagram illustrates our corporate structure as of the date of this prospectus supplement:

Permission

Required from the PRC Authorities for The VIE’s Operation and This Offering

On

December 24, 2021, the China Securities Regulatory Commission, or the CSRC, issued Provisions of the State Council on the Administration

of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Administration Provisions”),

and the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft

for Comments) (the “Measures”), which are now open for public comments. The Administration Provisions and Measures for overseas

listings lay out specific requirements for filing documents and include unified regulation management, strengthening regulatory coordination,

and cross-border regulatory cooperation. Domestic companies seeking to list abroad must carry out relevant security screening procedures

if their businesses involve such supervision. Companies endangering national security are among those off-limits for overseas listings.

According to Relevant Officials of the CSRC Answered Reporter Questions (“CSRC Answers”), after the Administration Provisions

and Measures are implemented upon completion of public consultation and due legislative procedures, the CSRC will formulate and issue

guidance for filing procedures to further specify the details of filing administration and ensure that market entities could refer to

clear guidelines for filing, which means it still takes time to make the Administration Provisions and Measures into effect. As the Administration

Provisions and Measures have not yet come into effect, we are currently unaffected. However, according to CSRC Answers, new initial public

offerings and refinancing by existent overseas listed Chinese companies will be required to go through the filing process; other existent

overseas listed companies will be allowed sufficient transition period to complete their filing procedure, which means we will certainly

go through the filing process in the future.

Based

on our understanding of the current PRC laws and regulations and the proposed drafts of the Administration Provisions and the Measures,

we are currently not required to obtain permission from any of the PRC authorities to operate and issue our Ordinary Shares to foreign

investors. In addition, we, our subsidiaries, or VIE are not required to obtain permission or approval from the PRC authorities including

CSRC or CAC for the VIE’s operation, nor have we, our subsidiaries, or VIE received any denial for the VIE’s operation. However,

recently, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly

issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the Opinions, which

was made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities

activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Effective measures, such as promoting

the construction of relevant regulatory systems will be taken to deal with the risks and incidents of China-concept overseas listed companies,

and cybersecurity and data privacy protection requirements and similar matters. The Opinions and any related implementing rules to be

enacted may subject us to compliance requirement in the future. Given the current regulatory environment in the PRC, we are still subject

to the uncertainty of different interpretation and enforcement of the rules and regulations in the PRC adverse to us, which may take

place quickly with little advance notice.

Dividend

Distributions or Assets Transfer among the Holding Company, its Subsidiaries and the Consolidated VIE

We

rely principally on dividends and other distributions on equity from Taizhou Suxuantang and its subsidiaries for our cash requirements,

including for services of any debt we may incur. Taizhou Suxuantang and its subsidiaries’ ability to distribute dividends is based

upon their distributable earnings. Current PRC regulations permit Taizhou Suxuantang and its subsidiaries to pay dividends to their respective

shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In

addition, each of Taizhou Suxuantang and its subsidiaries are required to set aside at least 10% of its after-tax profits each year,

if any, to fund a statutory reserve until such reserve reaches 50% of each of their registered capitals. These reserves are not distributable

as cash dividends. If our PRC subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict

their ability to pay dividends or make other payments to us. Any limitation on the ability of Taizhou Suxuantang and its subsidiaries

to distribute dividends or other payments to their respective shareholders could materially and adversely limit our ability to grow,

make investments or acquisitions that could be beneficial to our businesses, pay dividends or otherwise fund and conduct our business.

To

address the persistent capital outflow and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s

Bank of China and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the

subsequent months, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions,

dividend payments and shareholder loan repayments. For instance, the Circular on Promoting the Reform of Foreign Exchange Management

and Improving Authenticity and Compliance Review, or the SAFE Circular 3, issued on January 26, 2017, provides that the banks shall,

when dealing with dividend remittance transactions from domestic enterprise to its offshore shareholders of more than US$50,000, review

the relevant board resolutions, original tax filing form and audited financial statements of such domestic enterprise based on the principal

of genuine transaction. The PRC government may continue to strengthen its capital controls and Taizhou Suxuantang and its subsidiaries’

dividends and other distributions may be subject to tightened scrutiny in the future. Any limitation on the ability of Taizhou Suxuantang

and its subsidiaries to pay dividends or make other distributions to us could materially and adversely limit our ability to grow, make

investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

In

addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable

to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC

central government and governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to

the tax agreement between Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the

payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10% if the Hong Kong

enterprise (i) directly holds at least 25% of the PRC enterprise, (ii) is a tax resident in Hong Kong and (iii) could be recognized as

a beneficial owner of the dividend from PRC tax perspective. Under administrative guidance, a Hong Kong resident enterprise must meet

the following conditions, among others, in order to apply the reduced withholding tax rate: (i) it must be a company; (ii) it must directly

own the required percentage of equity interests and voting rights in the PRC resident enterprise; and (iii) it must have directly owned

such required percentage in the PRC resident enterprise throughout the 12 months prior to receiving the dividends. Nonresident enterprises

are not required to obtain pre-approval from the relevant tax authority in order to enjoy the reduced withholding tax. Instead, nonresident

enterprises and their withholding agents may, by self-assessment and on confirmation that the prescribed criteria to enjoy the tax treaty

benefits are met, directly apply the reduced withholding tax rate, and file necessary forms and supporting documents when performing

tax filings, which will be subject to post-tax filing examinations by the relevant tax authorities. Accordingly, our wholly owned subsidiary

China SXT Group Limited (“SXT HK”) incorporated in Hong Kong may be able to benefit from the 5% withholding tax rate for

the dividends it receives from our PRC subsidiaries, if it satisfies the conditions prescribed under Guoshuihan [2009] 81 and other relevant

tax rules and regulations. However, if the relevant tax authorities consider the transactions or arrangements we have are for the primary

purpose of enjoying a favorable tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly,

there is no assurance that the reduced 5% will apply to dividends received by SXT HK from Taizhou Suxuantang and its subsidiaries. This

withholding tax will reduce the amount of dividends we may receive from Taizhou Suxuantang and its subsidiaries.

As

of the date of this prospectus supplement, we, our subsidiaries, and the VIE have not distributed any earnings or settled any amounts

owed under the VIE Agreements, nor do they have any plan to distribute earnings or settle amounts owed under the VIE Agreements in the

foreseeable future. As of the date of this prospectus supplement, none of our subsidiaries or VIE have made any dividends or distributions

to us and we has not made any dividends or distributions to our shareholders.

In

December 2018, we reconstructed and assembled a facility and received a “Food Manufacturing Certificate”

issued by the local Food and Drug Administration, which granted the Company permission to produce TCM Homologous Supplements (“TCMHS”),

a classification of health-supporting food used traditionally in China as TCM but which are also consumed as food. The scope of production

includes “Substitute Teas,” made of TCMHS plants, and “Solid Beverages,” a kind of granule produced through extraction

of TCMHS materials.

We

have successfully developed four (4) solid beverage products which were commercially launched in April 2019.

We

have developed nineteen (19) Advanced TCMPs, seventeen (17) of which have been produced and marketed, ten (10) Fine TCMPs, two hundred

thirty-five (235) Regular TCMPs and four (4) TCMHS solid beverages. Advanced TCMP has gradually become our principal product due to its

quality and greater market potential. For the six months ended September 30, 2021, Advanced TCMP brought in 28% of the total revenue,

whereas Fine TCMP and Regular TCMP each brought in 16% and 47% of the total revenue respectively. For the fiscal year ended March 31,

2021, Advanced TCMP brought in 37% of the total revenue, whereas Fine TCMP and Regular TCMP each brought in 12% and 30% of the total

revenue respectively. For the fiscal year ended March 31, 2020, Advanced TCMP brought in 30.6% of the total revenue, whereas Fine TCMP

and Regular TCMP each brought in 20.0% and 44.2% of the total revenue respectively. For the fiscal year ended March 31, 2019, Advanced

TCMP brought in 51.8% of the total revenue, whereas Fine TCMP and Regular TCMP each brought in 7.5% and 40.7% of the total revenue respectively.

Our Advanced TCMP includes nineteen products, which can be further divided into seven Directly-Oral TCMP products, and ten After-Soaking-Oral

TCMP products. Directly-Oral TCMP, as the name suggests, has the advantage of being taken orally. Following the principle of Directly-Oral-TCMP,

we have established a new scientific and technological strategy and methods for the research and development of the direct-oral pharmaceutical

TCMP products. We believe our Directly-Oral TCMP products comply with the regulations of the National Medical Products Administration

(NMPA) and provincial MPA, as well as keep the principles of TCM. The After-Soak-Oral TCMP comes as a small, porous, sealed bag that

can be immersed in boiling water to make an infusion. Our major Directly-Oral-TCMP are SanQiFen, CuYanHuSuo, XiaTianWu and LuXueJing;

our major After-Soaking-Oral-TCMP are ChenXiang, SuMu, ChaoSuanZaoRen, and JiangXiang. For each principal product’s indications

and year of commercialization, see “Business – Our Products” in our annual report on the Form 20-F.

Taizhou

Suxuantang, the VIE entity, was founded in 2005 and has grown significantly in recent years. Our net revenues decreased from $3,860,501

for the six months ended September 30, 2020 to $1,027,674 for the six months ended September 30, 2021, representing a decrease of 73%.

Our net income decreased from $1,381,258 for the six months ended September 30, 2020 to a net loss of $3,091,824 for the six months ended

September 30, 2021, representing a decrease of 324% of net income during this period. Our net revenues decreased from $5,162,268 in fiscal

year ended March 31, 2020 to $4,777,573 in fiscal year ended March 31, 2021, representing a decrease of 7%. Our net loss decreased from

$10,287,872 in fiscal year ended March 31, 2020 to $2,748,183 in fiscal year ended March 31, 2021, representing a decrease of 73% of

net loss during this period. Our net revenues decreased from $7,012,026 in fiscal year ended March 31, 2019 to $5,162,268 in fiscal year

ended March 31, 2020, representing a decrease of 26%. Our net income decreased from $1,539,227 in fiscal year ended March 31, 2019 to

a net loss of $10,287,872 in fiscal year ended March 31, 2020, representing a decrease of 768% during this period.

We

own fourteen (14) Chinese registered trademarks related to our brand “Suxuantang.” Our TCMP products received the prestigious

award of Jiangsu Taizhou Famous Product, and Well-known Brand Trademark in December 2016, and 2017, respectively. The awards were granted

by the Government of Taizhou City, Jiangsu, China. In the near future, we plan to increase our efforts in cooperating with universities,

research institutes, and R&D agents on joint R&D projects involving TCMP processing methods and quality standard, as well as

the training of our researchers.

We

have been focusing on the research and development of new Advanced TCMP products. We submitted eight invention patent applications regarding

Advanced TCMP to the State Intellectual Property Office of the PRC in the Spring of 2017. We also submitted five additional invention

patent applications to the State Intellectual Property Office of PRC afterwards, one of which was rejected as of the date of this prospectus

supplement. All of these patents have been under the substantive examination stages, which do not involve new products.

Our

major customers are hospitals, especially TCM hospitals, primarily in the Jiangsu province in China. Another substantial part of our

sales are made to pharmaceutical distributors, which then sell our products to hospitals and other healthcare distributors. As of July

31, 2021, our end-customer base includes seventy (70) pharmaceutical companies, twelve (12) chain pharmacies and fifty-nine (59) hospitals

in ten (10) provinces and municipalities in China including Jiangsu, Hubei, Shandong, Hebei, Jiangxi, Guangdong, Anhui, Henan, Liaoning,

and Fujian.

Corporate

Information

Our

principal executive offices are located at 178 Taidong Rd North, Taizhou, Jiangsu, China. Our telephone number at this address is +86-

523-86298290. Our Ordinary Shares are traded on Nasdaq under the symbol “SXTC.”

Our

Internet website, www.sxtchina.com, provides a variety of information about our Company. We do not incorporate by reference into this

prospectus supplement or the accompanying base prospectus any of the information on, or accessible through, our website, and you should

not consider it as part of this prospectus supplement or accompanying base prospectus. Our annual reports on Form 20-F and current

reports on Form 6-K filed and furnished with the SEC are available, as soon as practicable after filing, at the investors’

page on our corporate website, or by a direct link to its filings on the SEC’s free website.

THE

OFFERING

|

Ordinary

Shares offered

by

us pursuant to this

prospectus

supplement

|

|

8,285,260 Ordinary

Shares (or 11,256,274 Ordinary Shares if the underwriter exercises its option to purchase additional Ordinary Shares

from us in full) and 11,521,500 Pre-funded Warrants to purchase up to 11,521,500 Ordinary Shares. The Pre-funded Warrants will have

an exercise price of $0.01 per share, will be exercisable immediately and may be exercised at any time until all of the Pre-funded

Warrants are exercised in full. We are also offering ordinary shares issuable upon exercise of the Pre-funded Warrants.

|

|

|

|

|

|

Public Offering Price of Ordinary Shares

|

|

$ 0.18 per Ordinary

Share

|

|

|

|

|

|

Public Offering Price of Pre-Funded Warrant

|

|

$ 0.17 per Pre-funded

Warrant

|

|

|

|

|

|

Ordinary Shares to be outstanding before this offering

|

|

17,850,094 Ordinary Shares

|

|

|

|

|

|

Ordinary Shares outstanding immediately after this

offering

|

|

26,135,354 Ordinary

Shares (or 29,106,368 Ordinary Shares if the underwriter exercise its option to purchase additional Ordinary Shares from us

in full), assuming none of the Pre-funded Warrants in this offering are exercised.

|

|

|

|

|

|

Pre-funded Warrants outstanding immediately after

this offering

|

|

Pre-funded Warrants, assuming none of the Pre-funded

Warrants are exercised.

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net

proceeds from this offering for working capital And general business purposes. See “Use of Proceeds” on page S-19

of this prospectus supplement.

|

|

|

|

|

|

Risk factors

|

|

Investing in our securities

involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our securities,

see the information contained in or incorporated by reference under the heading “Risk Factors” beginning on page S-7

of this prospectus supplement, on page 5 of the accompanying base prospectus, in our Annual Report on Form 20-F for the

fiscal year ended March 31, 2021 and in the other documents incorporated by reference into this prospectus supplement and accompanying

base prospectus.

|

|

|

|

|

|

Listing

|

|

The

Ordinary Shares are traded on Nasdaq under the symbol “SXTC.”

Our

Pre-funded Warrants are not and will not be listed on any stock exchange.

|

Unless

otherwise indicated, the number of shares outstanding prior to and after this offering is based on 17,850,094 Ordinary Shares issued

and outstanding as of January 14, 2022 and no exercise of the Pre-funded Warrants. The number of outstanding shares does not include

399,167 ordinary shares underlying the 399,167 warrants outstanding as of January 14, 2022.

Unless

otherwise indicated, all information in this prospectus supplement assumes no exercise of the underwriter’s over-allotment option.

RISK

FACTORS

Before

you make a decision to invest in our securities, you should consider carefully the risks described below, together with other information

in this prospectus supplement, the accompanying base prospectus and the information incorporated by reference herein and therein, including

our Annual Report on Form 20-F for the fiscal year ended March 31, 2021. If any of the following events actually occur, our business,

operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of

our Ordinary Shares to decline and you may lose all or part of your investment. The risks described below are not the only ones that

we face. Additional risks not presently known to us or that we currently deem immaterial may also significantly impair our business operations

and could result in a complete loss of your investment.

Risks

Related to Our Corporate Structure

If

the PRC government deems that the contractual arrangements in relation to Taizhou Suxuantang, the consolidated variable interest entity,

do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation

of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those

operations.

We

are a holding company incorporated under the laws of British Virgin Islands. As a holding company with no material operations of our

own, we conduct all of our operations through our subsidiaries established in PRC and the VIE. We control and receive the economic benefits

of the VIE’s business operations through certain contractual arrangements. Our Ordinary Shares and Pre-funded Warrants offered

in this offering are securities of our offshore holding company instead of those of the VIE in China.

The

VIE contributed 100% of the Company’s consolidated results of operations and cash flows for the years ended March 31, 2021 and

2020, respectively. As of September 30, 2021, the VIE accounted for approximately 91% of the consolidated total assets and 94% of total

liabilities of the Company, respectively. The VIE contributed 100% of the Company’s consolidated results of operations and cash

flows for the years ended March 31, 2021 and 2020, respectively. As of March 31, 2021, the VIE accounted for approximately 79% of the

consolidated total assets and 92% of total liabilities of the Company, respectively.

We

rely on and expect to continue to rely on the VIE Agreements. These VIE Agreements may not be as effective in providing us with control

over Taizhou Suxuantang as ownership of controlling equity interests would be in providing us with control over, or enabling us to derive

economic benefits from the operations of Taizhou Suxuantang. Under the current VIE Agreements, as a legal matter, if Taizhou Suxuantang

or any of its shareholders executing the VIE Agreements fails to perform its, his or her respective obligations under these VIE Agreements,

we may have to incur substantial costs and resources to enforce such arrangements, and rely on legal remedies available under PRC laws,

including seeking specific performance or injunctive relief, and claiming damages, which we cannot assure you will be effective. For

example, if shareholders of the VIE were to refuse to transfer their equity interests in the VIE to us or our designated persons when

we exercise the purchase option pursuant to these VIE Agreements, we may have to take a legal action to compel them to fulfill their

contractual obligations.

If

(i) the applicable PRC authorities invalidate these VIE Agreements for violation of PRC laws, rules and regulations, (ii) the VIE or

its shareholders terminate the VIE Agreements (iii) the VIE or its shareholders fail to perform its/his/her obligations under these VIE

Agreements, or (iv) if these regulations change or are interpreted differently in the future, our business operations in China would

be materially and adversely affected, and the value of your shares would substantially decrease or even become worthless. Further, if

we fail to renew these VIE Agreements upon their expiration, we would not be able to continue our business operations unless the then

current PRC law allows us to directly operate businesses in China.

In

addition, if the VIE or all or part of its assets become subject to liens or rights of third-party creditors, we may be unable to continue

some or all of our business activities, which could materially and adversely affect our business, financial condition and results of

operations. If the VIE undergoes a voluntary or involuntary liquidation proceeding, its shareholders or unrelated third-party creditors

may claim rights to some or all of its assets, thereby hindering our ability to operate our business, which could materially and adversely

affect our business and our ability to generate revenues.

All

of these VIE Agreements are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. The legal

environment in the PRC is not as developed as in some other jurisdictions, such as the United States. As a result, uncertainties in the

PRC legal system could limit our ability to enforce these VIE Agreements. In the event we are unable to enforce these VIE Agreements,

we may not be able to exert effective control over our operating entities and we may be precluded from operating our business, which

would have a material adverse effect on our financial condition and results of operations.

These

VIE Agreements may not be as effective as direct ownership in providing us with control over the VIE. For example, the VIE and its shareholders

could breach their VIE Agreements with us by, among other things, failing to conduct their operations in an acceptable manner or taking

other actions that are detrimental to our interests. If we had direct ownership of the VIE, we would be able to exercise our rights as

a shareholder to effect changes in the board of directors of the VIE, which in turn could implement changes, subject to any applicable

fiduciary obligations, at the management and operational level. However, under the current VIE Agreements, we rely on the performance

by the VIE and its shareholders of their obligations under the contracts to exercise control over the VIE. The shareholders of our consolidated

VIE may not act in the best interests of our company or may not perform their obligations under these contracts. Such risks exist throughout

the period in which we intend to operate certain portions of our business through the VIE Agreements with the VIE.

If

the VIE or its shareholders fail to perform their respective obligations under the VIE Agreements, we may have to incur substantial costs

and expend additional resources to enforce such arrangements. For example, if the shareholders of the VIE refuse to transfer their equity

interest in the VIE to us or our designee if we exercise the purchase option pursuant to these VIE Agreements, or if they otherwise act

in bad faith toward us, then we may have to take legal actions to compel them to perform their contractual obligations. In addition,

if any third parties claim any interest in such shareholders’ equity interests in the VIE, our ability to exercise shareholders’

rights or foreclose the share pledge according to the VIE Agreements may be impaired. If these or other disputes between the shareholders

of the VIE and third parties were to impair our control over the VIE, our ability to consolidate the financial results of the VIE would

be affected, which would in turn result in a material adverse effect on our business, operations and financial condition.

In

the opinion of our PRC legal counsel, each of the VIE Agreements among our WFOE, the VIE and its shareholders governed by PRC laws are

valid, binding and enforceable, and will not result in any violation of PRC laws or regulations currently in effect. However, our PRC

legal counsel has also advised us that there are substantial uncertainties regarding the interpretation and application of current and

future PRC laws, regulations and rules. Accordingly, the PRC regulatory authorities may ultimately take a view that is contrary to the

opinion of our PRC legal counsel. In addition, it is uncertain whether any new PRC laws or regulations relating to variable interest

entity structures will be adopted or if adopted, what they would provide. PRC government authorities may deem that foreign ownership

is directly or indirectly involved in the VIE’s shareholding structure. If our corporate structure and VIE Agreements are deemed

by the Ministry of Industry and Information Technology, or MIIT, or the Ministry of Commerce, or MOFCOM, or other regulators having competent

authority to be illegal, either in whole or in part, we may lose control of our consolidated VIE and have to modify such structure to

comply with regulatory requirements. However, there can be no assurance that we can achieve this without material disruption to our business.

Furthermore, if we or the VIE is found to be in violation of any existing or future PRC laws or regulations, or fail to obtain or maintain

any of the required permits or approvals, the relevant PRC regulatory authorities would have broad discretion to take action in dealing

with such violations or failures, including, without limitation:

|

|

●

|

revoking

the business license and/or operating licenses of our WFOE or the VIE;

|

|

|

●

|

discontinuing

or placing restrictions or onerous conditions on our operations through any transactions

among our WFOE and the VIE;

|

|

|

●

|

imposing

fines, confiscating the income from our WFOE, the VIE or its subsidiaries, or imposing other

requirements with which we or the VIE may not be able to comply;

|

|

|

|

|

|

|

●

|

placing

restrictions on our right to collect revenues;

|

|

|

●

|

requiring

us to restructure our ownership structure or operations, including terminating the VIE Agreements

with the VIE and deregistering the equity pledges of the VIE, which in turn would affect

our ability to consolidate, derive economic interests from, or exert effective control over

the VIE; or

|

|

|

●

|

restricting

or prohibiting our use of the proceeds of this offering to finance our business and operations

in China.

|

|

|

●

|

taking

other regulatory or enforcement actions against us that could be harmful to our business.

|

The

imposition of any of these penalties would result in a material and adverse effect on our ability to conduct our business. In addition,

it is unclear what impact the PRC government actions would have on us and on our ability to consolidate the financial results of the

VIE in our consolidated financial statements, if the PRC government authorities were to find our corporate structure and VIE Agreements

to be in violation of PRC laws and regulations. If the imposition of any of these government actions causes us to lose our right to direct

the activities of the VIE or our right to receive substantially all the economic benefits and residual returns from the VIE and we are

not able to restructure our ownership structure and operations in a satisfactory manner, we would no longer be able to consolidate the

financial results of the VIE in our consolidated financial statements. Either of these results, or any other significant penalties that

might be imposed on us in this event, would have a material adverse effect on our financial condition and results of operations.

We

may not be able to consolidate the financial results of some of our affiliated companies or such consolidation could materially and adversely

affect our operating results and financial condition.

Our

business is conducted through Taizhou Suxuantang, which is considered a VIE for accounting purposes, and we are considered the primary

beneficiary, thus enabling us to consolidate our financial results in our consolidated financial statements. In the event that in the

future a company we hold as a VIE no longer meets the definition of a VIE under applicable accounting rules, or we are deemed not to

be the primary beneficiary, we would not be able to consolidate line by line that entity’s financial results in our consolidated

financial statements for reporting purposes. Also, if in the future an affiliate company becomes a VIE and we become the primary beneficiary,

we would be required to consolidate that entity’s financial results in our consolidated financial statements for accounting purposes.

If such entity’s financial results were negative, this would have a corresponding negative impact on our operating results for

reporting purposes.

Because

we rely on the VIE Agreements for our revenue, the termination of these agreements would severely and detrimentally affect our continuing

business viability under our current corporate structure.

We

are a holding company and all of our business operations are conducted through the VIE Agreements. Although Taizhou Suxuantang does not

have termination rights pursuant to the VIE Agreements, it could terminate, or refuse to perform under, the VIE Agreements. Because neither

we, nor our subsidiaries, own equity interests of Taizhou Suxuantang, the termination or non-performance of the VIE Agreements would

sever our ability to receive payments from Taizhou Suxuantang under our current holding company structure. While we are currently not

aware of any event or reason that may cause the VIE Agreements to terminate, we cannot assure you that such an event or reason will not

occur in the future. In the event that the VIE Agreements are terminated, this would have a severe and detrimental effect on our continuing

business viability under our current corporate structure, which, in turn, would affect the value of your investment.

Our

current corporate structure and business operations may be affected by the newly enacted Foreign Investment Law.

On

March 15, 2019, the National People’s Congress approved the Foreign Investment Law, which took effect on January 1, 2020. Since

it is relatively new, uncertainties exist in relation to its interpretation and its implementation rules that are yet to be issued. The

Foreign Investment Law does not explicitly classify whether variable interest entities that are controlled through VIE Agreements would

be deemed as foreign-invested enterprises if they are ultimately “controlled” by foreign investors. However, it has a catch-all

provision under definition of “foreign investment” that includes investments made by foreign investors in China through other

means as provided by laws, administrative regulations or the State Council of the PRC, or the State Council. Therefore, it still leaves

leeway for future laws, administrative regulations or provisions of the State Council to provide for VIE Agreements as a form of foreign

investment. Therefore, there can be no assurance that our control over the VIE through VIE Agreements will not be deemed as foreign investment

in the future.

The

Foreign Investment Law grants national treatment to foreign-invested entities, except for those foreign-invested entities that operate

in industries specified as either “restricted” or “prohibited” from foreign investment in a “negative list”.

The Foreign Investment Law provides that foreign-invested entities operating in “restricted” or “prohibited”

industries will require market entry clearance and other approvals from relevant PRC government authorities. If our control over the

VIE through VIE Agreements are deemed as foreign investment in the future, and any business of the VIE is “restricted” or

“prohibited” from foreign investment under the “negative list” effective at the time, we may be deemed to be

in violation of the Foreign Investment Law, the VIE Agreements that allow us to have control over the VIE may be deemed as invalid and

illegal, and we may be required to unwind such VIE Agreements and/or restructure our business operations, any of which may have a material

adverse effect on our business operations. In addition, as the Chinese government has been updating the Negative List in recent years

and reducing the sectors prohibited or restricted for foreign investment, it is probable in the future that, even if the VIE is identified

as a FIE, it is still allowed to acquire or hold equity of enterprises in sectors currently prohibited or restricted for foreign investment.

Furthermore,

the PRC Foreign Investment Law provides that foreign invested enterprises established according to the existing laws regulating foreign

investment may maintain their structure and corporate governance within five years after the implementing of the PRC Foreign Investment

Law.

In

addition, the PRC Foreign Investment Law also provides several protective rules and principles for foreign investors and their investments

in the PRC, including, among others, that a foreign investor may freely transfer into or out of China, in Renminbi or a foreign currency,

its contributions, profits, capital gains, income from disposition of assets, royalties of intellectual property rights, indemnity or

compensation lawfully acquired, and income from liquidation, among others, within China; local governments shall abide by their commitments

to the foreign investors; governments at all levels and their departments shall enact local normative documents concerning foreign investment

in compliance with laws and regulations and shall not impair legitimate rights and interests, impose additional obligations onto FIEs,

set market access restrictions and exit conditions, or intervene with the normal production and operation activities of FIEs; except

for special circumstances, in which case statutory procedures shall be followed and fair and reasonable compensation shall be made in

a timely manner, expropriation or requisition of the investment of foreign investors is prohibited; and mandatory technology transfer

is prohibited.

Notwithstanding

the above, the PRC Foreign Investment Law stipulates that foreign investment includes “foreign investors invest through any other

methods under laws, administrative regulations or provisions prescribed by the State Council”. Therefore, there are possibilities

that future laws, administrative regulations or provisions prescribed by the State Council may regard VIE Agreements as a form of foreign

investment, and then whether our contractual arrangement will be recognized as foreign investment, whether our contractual arrangement

will be deemed to be in violation of the foreign investment access requirements and how the above-mentioned contractual arrangement will

be handled are uncertain.

The

Chinese government may exercise significant oversight influence over the manner in which we must conduct our business activities. We

are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges, however, if the VIE or the holding

company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges,

we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors.

The

Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through

regulation and state ownership. Our ability to operate through the VIE in China may be harmed by changes in its laws and regulations,

including those relating to taxation, environmental regulations, land use rights, property and other matters. The central or local governments

of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional

expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions

in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy

or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in

China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

For

example, the Chinese cybersecurity regulator announced on July 2021 that it had begun an investigation of Didi Global Inc. (NYSE: DIDI)

and two days later ordered that the company’s app was removed from smartphone app stores. On July 24, 2021, the General Office

of the Communist Party of China Central Committee and the General Office of the State Council jointly released the Guidelines for Further

Easing the Burden of Excessive Homework and Off-campus Tutoring for Students at the Stage of Compulsory Education, pursuant to which

foreign investment in such firms via mergers and acquisitions, franchise development, and variable interest entities are banned from

this sector.

We

believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the Company’s

business segments may be subject to various government and regulatory interference in the provinces in which they operate. The Company

could be subject to regulation by various political and regulatory entities, including various local and municipal agencies and government

sub-divisions. The Company may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties

for any failure to comply, and such compliance or any associated inquiries or investigations or any other government actions may:

|

|

●

|

delay

or impede our development;

|

|

|

●

|

result

in negative publicity or increase the Company’s operating costs;

|

|

|

●

|

require

significant management time and attention; and

|

|

|

●

|

subject

the VIE to remedies, administrative penalties and even criminal liabilities that

may harm our business, including fines assessed for our current or historical operations,

or demands or orders that we modify or even cease our business practices.

|

Furthermore,

it is uncertain when and whether the Company will be required to obtain permission from the PRC government to list on U.S. exchanges

in the future, and even when such permission is obtained, whether it will be denied or rescinded. Although the Company is currently not

required to obtain permission from any of the PRC federal or local government to obtain such permission and has not received any denial

to list on the U.S. exchange, our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations

relating to its business or industry, which could result in a material adverse change in the value of our securities, potentially rendering

it worthless. As a result, both you and us face uncertainty about future actions by the PRC government that could significantly affect

our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be

worthless.

Risks

Related to Our Business Operations and Doing Business in China

The

Chinese government exerts substantial influence over the manner in which we may conduct our business activities, and if we are unable

to substantially comply with any PRC rules and regulations that negatively impact our business operations, our financial condition

and results of operations may be materially adversely affected.

The

Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through

regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those

relating to taxation, environmental regulations, land use rights, property and other matters. The central or local governments of these

jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures

and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future,

including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional

or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular

regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

As

such, our business operations of and the industries we operate in may be subject to various government and regulatory interference in

the provinces in which they operate. We could be subject to regulation by various political and regulatory entities, including various

local and municipal agencies and government sub-divisions. We may incur increased costs necessary to comply with existing and newly adopted

laws and regulations or penalties for any failure to comply. In the event that we are not able to substantially comply with any existing

or newly adopted laws and regulations, our business operations may be materially adversely affected and the value of our Ordinary Shares

may significantly decrease.

Furthermore,

the PRC government authorities may strengthen oversight and control over offerings that are conducted overseas and/or foreign investment

in China-based issuers like us. Such actions taken by the PRC government authorities may intervene or influence our operations at any

time, which are beyond our control. Therefore, any such action may adversely affect our operations and significantly limit or hinder

our ability to offer or continue to offer securities to you and reduce the value of such securities.

We

may be liable for improper use or appropriation of personal information provided by our customers and any failure to comply with PRC

laws and regulations over data security could result in materially adverse impact on our business, results of operations, our continued

listing on Nasdaq, and this offering.

Our

business involves collecting and retaining certain internal and external data and information including that of our customers and supplies.

The integrity and protection of such information and data are crucial to us and our business. Owners of such data and information expect

that we will adequately protect their personal information. We are required by applicable laws to keep strictly confidential the personal

information that we collect, and to take adequate security measures to safeguard such information.

The

PRC Criminal Law, as amended by its Amendment 7 (effective on February 28, 2009) and Amendment 9 (effective on November 1,

2015), prohibits institutions, companies and their employees from selling or otherwise illegally disclosing a citizen’s personal

information obtained in performing duties or providing services or obtaining such information through theft or other illegal ways. On

November 7, 2016, the Standing Committee of the PRC National People’s Congress issued the Cyber Security Law of the PRC, or

Cyber Security Law, which became effective on June 1, 2017. Pursuant to the Cyber Security Law, network operators must not, without

users’ consent, collect their personal information, and may only collect users’ personal information necessary to provide

their services. Providers are also obliged to provide security maintenance for their products and services and shall comply with provisions

regarding the protection of personal information as stipulated under the relevant laws and regulations.

The

Civil Code of the PRC (issued by the PRC National People’s Congress on May 28, 2020 and effective from January 1, 2021)

provides legal basis for privacy and personal information infringement claims under the Chinese civil laws. PRC regulators, including

the Cyberspace Administration of China, the Ministry of Industry and Information Technology, and the Ministry of Public Security, have

been increasingly focused on regulation in data security and data protection.

The

PRC regulatory requirements regarding cybersecurity are evolving. For instance, various regulatory bodies in China, including the Cyberspace

Administration of China, the Ministry of Public Security and the State Administration for Market Regulation, have enforced data privacy

and protection laws and regulations with varying and evolving standards and interpretations. In April 2020, the Chinese government

promulgated Cybersecurity Review Measures, which came into effect on June 1, 2020. According to the Cybersecurity Review Measures,

operators of critical information infrastructure must pass a cybersecurity review when purchasing network products and services which

do or may affect national security.

In

July 2021, the Cyberspace Administration of China and other related authorities released the draft amendment to the Cybersecurity

Review Measures for public comments through July 25, 2021. The draft amendment proposes the following key changes:

|

|

●

|

companies who are engaged

in data processing are also subject to the regulatory scope;

|

|

|

|

|

|

|

●

|

the

CSRC is included as one of the regulatory authorities for purposes of jointly establishing the state cybersecurity review working

mechanism;

|

|

|

|

|

|

|

●

|

the

operators (including both operators of critical information infrastructure and relevant parties who are engaged in data processing)

holding more than one million users/users’ (which to be further specified) individual information and seeking a listing outside

China shall file for cybersecurity review with the Cybersecurity Review Office; and

|

|

|

|

|

|

|

●

|

the

risks of core data, material data or large amounts of personal information being stolen, leaked, destroyed, damaged, illegally used

or transmitted to overseas parties and the risks of critical information infrastructure, core data, material data or large amounts

of personal information being influenced, controlled or used maliciously shall be collectively taken into consideration during the

cybersecurity review process.

|

Currently,

the draft amendment has been released for public comment only, and its implementation provisions and anticipated adoption or effective

date remains substantially uncertain and may be subject to change. If the draft amendment is adopted into law in the future, we may become

subject to enhanced cybersecurity review. Certain internet platforms in China have been reportedly subject to heightened regulatory scrutiny

in relation to cybersecurity matters. As of the date of this prospectus supplement, as a company engaged in e-commerce business through

the VIE and their subsidiaries in China, we have not been included within the definition of “operator of critical information infrastructure”

by competent authority, nor have we been informed by any PRC governmental authority of any requirement that we file for a cybersecurity

review. However, if we are deemed to be a critical information infrastructure operator or a company that is engaged in data processing

and holds personal information of more than one million users, we could be subject to PRC cybersecurity review.

As

there remains significant uncertainty in the interpretation and enforcement of relevant PRC cybersecurity laws and regulations, we could

be subject to cybersecurity review, and if so, we may not be able to pass such review. In addition, we could become subject to enhanced

cybersecurity review or investigations launched by PRC regulators in the future. Any failure or delay in the completion of the cybersecurity

review procedures or any other non-compliance with the related laws and regulations may result in fines or other penalties, including

suspension of business, website closure, removal of our app from the relevant app stores, and revocation of prerequisite licenses, as

well as reputational damage or legal proceedings or actions against us, which may have material adverse effect on our business, financial

condition or results of operations. As of the date of this prospectus supplement, we have not been involved in any investigations on

cybersecurity review initiated by the Cyber Administration of China or related governmental regulatory authorities, and we have not received

any inquiry, notice, warning, or sanction in such respect. We believe that we are in compliance with the aforementioned regulations and

policies that have been issued by the Cyber Administration of China.

On

June 10, 2021, the Standing Committee of the National People’s Congress of China, or the SCNPC, promulgated the PRC Data Security

Law, which will take effect in September 2021. The PRC Data Security Law imposes data security and privacy obligations on entities

and individuals carrying out data activities, and introduces a data classification and hierarchical protection system based on the importance

of data in economic and social development, and the degree of harm it will cause to national security, public interests, or legitimate

rights and interests of individuals or organizations when such data is tampered with, destroyed, leaked, illegally acquired or used.

The PRC Data Security Law also provides for a national security review procedure for data activities that may affect national security

and imposes export restrictions on certain data an information.

As

of the date of this prospectus supplement, we do not expect that the current PRC laws on cybersecurity or data security would have a

material adverse impact on our business operations. However, as uncertainties remain regarding the interpretation and implementation

of these laws and regulations, we cannot assure you that we will comply with such regulations in all respects and we may be ordered to

rectify or terminate any actions that are deemed illegal by regulatory authorities. We may also become subject to fines and/or other

sanctions which may have material adverse effect on our business, operations and financial condition.

Although

the audit report included in this prospectus is prepared by U.S. auditors who are currently inspected by the Public Company Accounting

Oversight Board (the “PCAOB”), there is no guarantee that future audit reports will be prepared by auditors inspected by

the PCAOB and, as such, in the future investors may be deprived of the benefits of such inspection. Furthermore, trading in our securities

may be prohibited under the Holding Foreign Companies Accountable Act (the “HFCA Act”) if the SEC subsequently determines

our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely, and as a result, U.S. national

securities exchanges, such as the Nasdaq, may determine to delist our securities. Furthermore, on June 22, 2021, the U.S. Senate passed

the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCA Act and require the SEC to prohibit

an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive

years instead of three.

As

an auditor of companies that are registered with the SEC and publicly traded in the United States and a firm registered with the PCAOB,

our auditor is required under the laws of the United States to undergo regular inspections by the PCAOB to assess their compliance with

the laws of the United States and professional standards. The PCAOB is currently unable to conduct inspections without the approval of

the Chinese government authorities. Currently, our U.S. auditor is currently inspected by the PCAOB.

Inspections

of other auditors conducted by the PCAOB outside mainland China have at times identified deficiencies in those auditors’ audit

procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality.

The lack of PCAOB inspections of audit work undertaken in mainland China prevents the PCAOB from regularly evaluating auditors’

audits and their quality control procedures. As a result, if there is any component of our auditor’s work papers become located

in mainland China in the future, such work papers will not be subject to inspection by the PCAOB. As a result, investors would be deprived

of such PCAOB inspections, which could result in limitations or restrictions to our access of the U.S. capital markets.

As

part of a continued regulatory focus in the United States on access to audit and other information currently protected by national law,

in particular mainland China’s, in June 2019, a bipartisan group of lawmakers introduced bills in both houses of the U.S. Congress

which, if passed, would require the SEC to maintain a list of issuers for which PCAOB is not able to inspect or investigate the audit

work performed by a foreign public accounting firm completely. The proposed Ensuring Quality Information and Transparency for Abroad-Based

Listings on our Exchanges (“EQUITABLE”) Act prescribes increased disclosure requirements for these issuers and, beginning

in 2025, the delisting from U.S. national securities exchanges such as the Nasdaq of issuers included on the SEC’s list for three

consecutive years. It is unclear if this proposed legislation will be enacted. Furthermore, there have been recent deliberations within

the U.S. government regarding potentially limiting or restricting China-based companies from accessing U.S. capital markets. On May 20,

2020, the U.S. Senate passed the Holding Foreign Companies Accountable Act (the “HFCA Act”), which includes requirements

for the SEC to identify issuers whose audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely

because of a restriction imposed by a non-U.S. authority in the auditor’s local jurisdiction. The U.S. House of Representatives

passed the HFCA Act on December 2, 2020, and the HFCA Act was signed into law on December 18, 2020. Additionally, in July 2020, the U.S.

President’s Working Group on Financial Markets issued recommendations for actions that can be taken by the executive branch, the

SEC, the PCAOB or other federal agencies and department with respect to Chinese companies listed on U.S. stock exchanges and their audit

firms, in an effort to protect investors in the United States. In response, on November 23, 2020, the SEC issued guidance highlighting

certain risks (and their implications to U.S. investors) associated with investments in China-based issuers and summarizing enhanced

disclosures the SEC recommends China-based issuers make regarding such risks. On March 24, 2021, the SEC adopted interim final rules

relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. We will be required to comply with

these rules if the SEC identifies us as having a “non-inspection” year (as defined in the interim final rules) under a process

to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA Act, including the listing

and trading prohibition requirements described above. Under the HFCA Act, our securities may be prohibited from trading on the Nasdaq

or other U.S. stock exchanges if our auditor is not inspected by the PCAOB for three consecutive years, and this ultimately could result

in our Ordinary Shares being delisted. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies

Accountable Act (“HFCAA”), which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s

securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead

of three. On September 22, 2021, the PCAOB adopted a final rule implementing the HFCAA, which provides a framework for the PCAOB to use

when determining, as contemplated under the HFCAA, whether the Board is unable to inspect or investigate completely registered public

accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. On November

5, 2021, the SEC approved the PCAOB’s Rule 6100, Board Determinations Under the Holding Foreign Companies Accountable Act. Rule

6100 provides a framework for the PCAOB to use when determining, as contemplated under the HFCAA, whether it is unable to inspect or

investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more

authorities in that jurisdiction. On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure

requirements in the HFCAA The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report

issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate

completely because of a position taken by an authority in foreign jurisdictions. The Public Company Accounting Oversight Board (the “PCAOB”)

issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered

public accounting firms headquartered in: (1) mainland China of the PRC, and (2) Hong Kong. In addition, the PCAOB’s report identified

the specific registered public accounting firms which are subject to these determinations. Our auditor, ZH CPA, LLC, is headquartered

in Denver, Colorado, not mainland China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determination.

Our auditor is currently subject to PCAOB inspections.

The

SEC is assessing how to implement other requirements of the HFCAA, including the listing and trading prohibition requirements described

above. Future developments in respect of increasing U.S. regulatory access to audit information are uncertain, as the legislative developments

are subject to the legislative process and the regulatory developments are subject to the rule-making process and other administrative

procedures.

While

we understand that there has been dialogue among the China Securities Regulatory Commission (the “CSRC”), the SEC and the

PCAOB regarding the inspection of PCAOB-registered accounting firms in mainland China, there can be no assurance that we will be able

to comply with requirements imposed by U.S. regulators if there is significant change to current political arrangements between mainland

China and Hong Kong, or if any component of our auditor’s work papers become located in mainland China in the future. Delisting

of our Ordinary Shares would force holders of our Ordinary Shares to sell their Ordinary Shares. The market price of our Ordinary Shares

could be adversely affected as a result of anticipated negative impacts of these executive or legislative actions upon, regardless of

whether these executive or legislative actions are implemented and regardless of our actual operating performance.

Risks

Related to this Offering and our Ordinary Shares

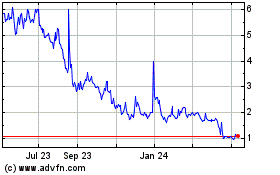

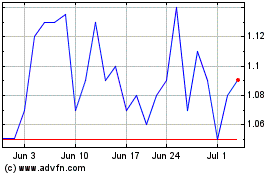

Our

share price may be volatile and could decline substantially.

The

market price of our Ordinary Shares may be volatile, both because of actual and perceived changes in the company’s financial results

and prospects, and because of general volatility in the stock market. The factors that could cause fluctuations in our share price may