China SXT Pharmaceuticals, Inc. Announces Successful Closing of $4.1 Million Follow-on Underwritten Offering of Ordinary Shares and Pre-Funded Warrants With Simultaneous Exercise of the Over-Allotment

January 20 2022 - 10:45AM

China SXT Pharmaceuticals, Inc. ("SXTC" or the "Company"), (NASDAQ:

SXTC), a specialty pharmaceutical company focusing on the research,

development, manufacturing, marketing, and sales of Traditional

Chinese Medicine Pieces ("TCMPs"), including Advanced TCMPs

(Directly-Oral TCMP and After-Soaking-Oral TCMP), fine TCMPs,

regular TCMPs, and TCM Homologous Supplements ("TCMHS"), today

announced the closing of an underwritten public offering (the

“Offering”) of its ordinary shares and prefunded warrants to

purchase ordinary shares, and the simultaneous closing of the

overallotment option, with gross proceeds to the Company to be

approximately $4.1 million, assuming the pre-funded warrants will

be fully exercised and before deducting underwriting discounts and

commissions and other estimated expenses payable by the Company.

The Offering equates to 22,777,774 of the Company's ordinary

shares. The ordinary shares are offered at a price of $0.18 per

share and the pre-funded warrants are offered at the same price per

share as the ordinary shares, less the $0.01 per share exercise

price of each pre-funded warrant. The Company intends to use the

net proceeds from this Offering for general corporate purposes,

including, but not limited to, working capital and other business

opportunities.

Aegis Capital Corp. acted as the sole

book-running manager for the Offering.

This Offering is being made pursuant to an

effective shelf registration statement on Form F-3 (No. 333-252664)

previously filed with the U.S. Securities and Exchange Commission

(the “SEC”) and declared effective by the SEC on February 10, 2021.

A final prospectus supplement relating to, and describing the terms

of, the Offering has been filed with the SEC and is available on

the SEC's website at www.sec.gov. Electronic copies of the

preliminary prospectus supplement and the accompanying prospectus

may be obtained, when available, by contacting Aegis Capital Corp.,

Attention: Syndicate Department, 810 7th Avenue, 18th floor, New

York, NY 10019, by email at syndicate@aegiscap.com, or by telephone

at (212) 813-1010. Before investing in this Offering, interested

parties should read in their entirety the prospectus supplement and

the accompanying prospectus and the other documents that the

Company has filed with the SEC that are incorporated by reference

in such prospectus supplement and the accompanying prospectus,

which provide more information about the Company and such

Offering.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About China SXT Pharmaceuticals,

Inc.

Founded in 2005 and headquartered in Taizhou

City, Jiangsu Province, China, China SXT Pharmaceuticals, Inc. is

an innovative pharmaceutical company focusing on the research,

development, manufacture, marketing and sales of traditional

Chinese medicine pieces, which is a type of Traditional Chinese

Medicine that has been processed to be ready for use. For more

information, please visit www.sxtchina.com.

Safe Harbor Statement

This press release contains forward-looking

statements as defined by the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements

concerning plans, objectives, goals, strategies, future events or

performance, and underlying assumptions and other statements that

are other than statements of historical facts. When the Company

uses words such as "may, "will, "intend," "should," "believe,"

"expect," "anticipate," "project," "estimate" or similar

expressions that do not relate solely to historical matters, it is

making forward-looking statements. Specifically, the Company's

statements regarding the closing of the proposed private placement

are forward-looking statements. Forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties that may cause the actual results to differ

materially from the Company's expectations discussed in the

forward-looking statements. These statements are subject to

uncertainties and risks including, but not limited to, the

following: the Company's goals and strategies; the Company's future

business development; product and service demand and acceptance;

changes in technology; the growth of the pharmaceutical market,

particularly the Traditional Chinese Medicine Pieces ("TCMPs")

market, in China; reputation and brand; the impact of competition

and pricing; government regulations; fluctuations in general

economic and business conditions in China and the international

markets the Company serves and assumptions underlying or related to

any of the foregoing and other risks contained in reports filed by

the Company with the Securities and Exchange Commission. For these

reasons, among others, investors are cautioned not to place undue

reliance upon any forward-looking statements in this press release.

Additional factors are discussed in the Company's filings with the

U.S. Securities and Exchange Commission, which are available for

review at www.sec.gov. The Company undertakes no obligation to

publicly revise these forward – looking statements to reflect

events or circumstances that arise after the date hereof.

CONTACT:

Name: Feng Zhou

Email: fzhou@sxtchina.com

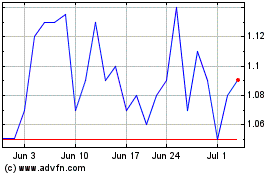

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Feb 2024 to Feb 2025