Citizens First Financial Corp. Announces Dividend and Third Quarter

Results BLOOMINGTON, Ill., Oct. 31 /PRNewswire-FirstCall/ --

Citizens First Financial Corp. (the "Company"), the parent company

of Citizens Savings Bank (the "Bank"), announced that its Board of

Directors has declared that a dividend of $0.10 per share will be

paid on November 24, 2003 to stockholders of record as of November

10, 2003. "This will be the 17th consecutive quarter of paying a

dividend to our shareholders," said C. William Landefeld, President

and Chief Executive Officer. In addition, the Company announced net

income for the nine months ended September 30, 2003 of $1,960,000,

compared to net income of $1,776,000 for the nine months ended

September 30, 2002, an increase of $184,000 or 10.4%. The Company

had basic and diluted earnings per share of $1.33 and $1.22,

respectively for the nine months ended September 30, 2003 compared

to basic and diluted earnings per share of $1.21 and $1.12,

respectively, for the nine months ended September 30, 2002. The

Company had net income for the three months ended September 30,

2003 of $497,000, compared to $379,000 for the three months ended

September 30, 2002, an increase of $118,000 or 31.1%. The Company

had basic and diluted earnings per share of $0.33 and $0.31,

respectively, for the three months ended September 30, 2003,

compared to basic and diluted earnings per share of $0.26 and

$0.24, respectively, for the three months ended September 30, 2002.

"The Company and the Bank continue to perform well in 2003 due to

the record low interest rate environment and our strong, vibrant

local economy," said Landefeld. Net interest income decreased from

$8,209,000 for the nine months ended September 30, 2002 to

$7,980,000 for the nine months ended September 30, 2003, a decrease

of $229,000 or 2.8%. Interest income decreased to $14,704,000 for

the nine months ended September 30, 2003 from $16,867,000 for the

nine months ended September 30, 2002, a decrease of $2,163,000 or

12.8%. The decrease was attributable to a decrease in the average

yield on loans and investments of 71 basis points and 47 basis

points, respectively and a decrease in the average balance of loans

of $13.3 million, offset by an increase of $9.6 million in the

average balance of investments and interest-earning deposits.

Interest expense decreased to $6,724,000 for the nine months ended

September 30, 2003 from $8,658,000 for the nine months ended

September 30, 2002, a decrease of $1,934,000 or 22.3%. The decrease

was primarily due to a decrease in the average cost of deposits and

borrowings of 89 basis points and 50 basis points, respectively.

The provision for loan losses increased to $867,000 for the nine

months ended September 30, 2003 from $725,000 for the nine months

ended September 30, 2002. Noninterest income increased from

$1,264,000 for the nine months ended September 30, 2002 to

$2,596,000, an increase of $1,332,000, for the nine months ended

September 30, 2003. The increase was primarily due to an increase

of $586,000 in net gains on loan sales, $131,000 in gains on sale

of land in a real estate joint venture and a recovery of $123,000

of previously impaired mortgage servicing rights in 2003 and a

$323,000 charge for mortgage servicing rights impairment and

$71,000 loss on sale of available for sale securities in 2002.

Noninterest expense increased from $5,845,000 for the nine months

ended September 30, 2002 to $6,548,000 for the nine months ended

September 30, 2003, an increase of $703,000, primarily because of

increases of $778,000 in loss on sale of real estate owned, $70,000

in the minority interest in the net income of a real estate joint

venture and $78,000 in legal fees, offset by a $395,000 decrease in

salaries and employee benefits expense due to the ESOP shares being

fully allocated during 2002. The Bank currently has five offices in

central Illinois. CITIZENS FIRST FINANCIAL CORP. SELECTED FINANCIAL

INFORMATION (In thousands except for per share data) 09/30/03

12/31/02 09/30/02 (Unaudited) (Unaudited) Balance Sheet Data Total

assets $351,463 $357,056 $352,169 Cash and cash equivalents $17,584

$33,583 $19,498 Investment securities $22,302 $20,712 $22,565 FHLB

stock $14,983 $4,697 $4,639 Loans held for sale $4,332 $6,098

$6,240 Loans $275,934 $282,591 $287,494 Allowance for loan losses

$1,788 $3,753 $2,621 Deposits $246,621 $249,163 $243,310 Borrowings

$68,800 $72,825 $73,400 Equity capital $33,160 $31,894 $31,978 Book

value per common share $22.18 $21.91 $21.65 Quarter ended Nine

months ended (Unaudited) (Unaudited) 09/30/03 09/30/02 09/30/03

09/30/02 Summary of Operations Interest income $4,883 $5,544

$14,704 $16,867 Interest expense 2,138 2,775 6,724 8,658 Net

interest income 2,745 2,769 7,980 8,209 Provision for loan losses

476 495 867 725 Noninterest income 1,013 355 2,596 1,264

Noninterest expense 2,501 2,009 6,548 5,845 Income before income

tax 781 620 3,161 2,903 Income tax expense 284 241 1,201 1,127 Net

income $497 $379 $ 1,960 $ 1,776 Earnings per share: Basic $0.33 $

0.26 $1.33 $1.21 Diluted $0.31 $ 0.24 $1.22 $1.12 Ratios Based on

Net Income Return on average stockholders' equity 6.00% 4.74% 8.03%

7.53% Return on average assets 0.57% 0.43% 0.74% 0.68% Net interest

yield on average earning assets 3.40% 3.32% 3.25% 3.29% DATASOURCE:

Citizens First Financial Corp. CONTACT: C. William Landefeld,

President & Chief Executive Officer, Citizens First Financial

Corp., +1-309-661-8700

Copyright

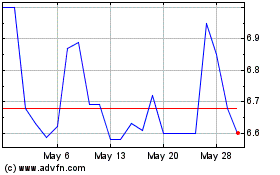

CFSB Bancorp (NASDAQ:CFSB)

Historical Stock Chart

From Nov 2024 to Dec 2024

CFSB Bancorp (NASDAQ:CFSB)

Historical Stock Chart

From Dec 2023 to Dec 2024