UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 5)*

CF BANKSHARES

INC.

(Name of Issuer)

Common Stock,

par value $0.01 per share

(Title of Class of Securities)

12520L109

(CUSIP Number)

Castle Creek Capital Partners VII, LP

11682 El Camino Real, Suite 320

San Diego, CA 92130

858-756-8300

(Name, Address and

Telephone Number of Person Authorized

to Receive Notices and Communications)

December 12,

2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1

(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

* The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| 1 |

NAME

OF REPORTING PERSONS

Castle Creek Capital Partners VII,

LP |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(See Instructions) |

(a) ¨

(b) ¨ |

| 3 |

SEC

USE ONLY |

| 4 |

SOURCE

OF FUNDS (See Instructions)

WC |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

¨ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

529,197 (1) |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

529,197 (1) |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

529,197 (1) |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

¨ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.9% (1) |

| 14 |

TYPE

OF REPORTING PERSON (See Instructions)

PN (Limited Partnership) |

| |

|

|

|

|

| (1) | The information set forth in Item 5 of this statement on Schedule

13D is incorporated herein by reference. |

| 1 |

NAME

OF REPORTING PERSONS

Castle Creek Capital

VII LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(See Instructions) |

(a) ¨

(b) ¨ |

| 3 |

SEC

USE ONLY |

| 4 |

SOURCE

OF FUNDS (See Instructions)

WC/AF |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

¨ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

529,197 (1) |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

529,197 (1) |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

529,197 (1) |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

¨ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.9% (1) |

| 14 |

TYPE

OF REPORTING PERSON (See Instructions)

OO (Limited Liability

Company), HC (Control Person) |

| |

|

|

|

|

| (1) | The information set forth in Item 5 of this statement on Schedule

13D is incorporated herein by reference. |

This Amendment No. 5 to Schedule 13D (this

“Amendment No. 5”) amends and supplements the Schedule 13D filed on December 24, 2019 (the “Original Schedule

13D”, and as amended by Amendment No. 1 filed on March 31, 2020, Amendment No. 2 filed on June 1, 2020, Amendment

No. 3 filed on November 26, 2024 and Amendment No. 4 filed on December 3, 2024, the “Schedule 13D”) with

the U.S. Securities and Exchange Commission (the “SEC”), relating to the shares of common stock, par value $0.01 per share

(“Voting Common Stock”), of CF Bankshares Inc. (formerly known as Central Federal Corporation) (the “Issuer”

or the “Company”). Unless specifically amended hereby, the disclosures set forth in the Schedule 13D remain unchanged. Capitalized

terms used in this Amendment No. 5 that are not otherwise defined herein have the meanings attributed to them in the Original Schedule

13D.

| Item 3. |

Source and Amount of Funds or Other Consideration |

Item 3 of the Schedule 13D is hereby amended

and supplemented by adding the following:

Between December 2, 2024 and December 10,

2024 (inclusive), Castle Creek Capital Partners VII, LP (“Fund VII”) sold an aggregate of 54,102 shares of Voting Common

Stock for proceeds of $1,542,804.05, which represents an amount net of commissions and fees, in various open-market transactions. Additionally,

on December 6, 2024, Fund VII exchanged all 160 shares of the Company’s non-voting convertible, perpetual Series D preferred

stock, par value $0.01 per share (the “Exchanged Shares”), into 16,000 shares of Voting Common Stock (the “New

Shares”, and such exchange, the “Exchange”). Following the Exchange, Fund VII owns 325,649 shares of Voting

Common Stock, which includes 309,649 shares of Voting Common Stock owned by Fund VII prior to the Exchange.

| Item 4. |

Purpose of Transaction |

The information in Items 3 and 6 is incorporated by reference.

Fund VII entered into the Exchange in the ordinary

course of business because of its belief that the New Shares represented an attractive investment in accordance with its investment strategy.

Subject to the limitations imposed by the Exchange

Agreement and the applicable federal and state securities laws, the Reporting Persons may dispose of the New Shares (as well as the existing

shares of Voting Common Stock owned by the Reporting Persons) from time to time, subject to market conditions and other investment considerations,

and may cause the New Shares to be distributed in kind to investors.

Other than as described in this Item 4 (including

as previously described in the Schedule 13D), each of the Reporting Persons has no present plans or proposals that relate to or would

result in any of the events set forth in Items 4(a) through (j) of Schedule 13D. However, each of the Reporting Persons reserves

the right to change its plans at any time, as it deems appropriate, in light of its ongoing evaluation of (i) its business and liquidity

objectives; (ii) the Company's financial condition, business, operations, competitive position, prospects and/or share price; (iii) industry,

economic and/or securities markets conditions; (iv) alternative investment opportunities; and (v) other relevant factors.

| Item 5. |

Interest in Securities of the Issuer |

Item 5

(a) - (c) of the Schedule 13D is hereby amended and restated in its entirety as follows:

(a) and (b)

| Reporting Person |

|

Amount

Beneficially

Owned (1) |

|

|

Percent of

Class (2) |

|

|

Sole Power to

Vote or Direct

the Vote |

|

|

Shared Power

to Vote or

Direct the Vote |

|

|

Sole Power to

Dispose or to

Direct the

Disposition |

|

|

Shared Power to

Dispose or

Direct the

Disposition |

|

| Castle Creek Capital Partners VII, LP |

|

|

529,197 |

|

|

|

9.9 |

% |

|

|

0 |

|

|

|

529,197 |

|

|

|

0 |

|

|

|

529,197 |

|

| Castle Creek Capital VII LLC (3) |

|

|

529,197 |

|

|

|

9.9 |

% |

|

|

0 |

|

|

|

529,197 |

|

|

|

0 |

|

|

|

529,197 |

|

| (1) | Includes (i) the 325,649 shares of Voting Common Stock held by

Fund VII and (ii) the maximum number of shares (i.e., 203,548 shares) of Voting Common

Stock issuable to Fund VII and its affiliates upon conversion of the Non-Voting Common Stock

held by Fund VII taking into consideration the Ownership Cap. Excludes 980,452 shares of

Non-Voting Common Stock. Since Fund VII does not presently, and will not within the next

60 days, have the right to acquire Voting Common Stock in respect of such Non-Voting Common

Stock (due in part to the Ownership Cap), those underlying shares are not included in the

amount reported herein. |

| (2) | This calculation is based on 5,345,433 shares of Voting Common Stock

of the Company outstanding, which was calculated based on (i) 5,125,885 shares of Voting

Common Stock outstanding as of November 8, 2024, as reported in the Company’s

Quarterly Report on Form 10-Q filed with the SEC on November 13, 2024, and (ii) increased

by (A) the 16,000 New Shares issued in the Exchange and (B) an additional 203,548

shares of Voting Common Stock that would be issued to Fund VII upon conversion of the maximum

number of shares of Non-Voting Common Stock permitted in light of the Ownership Cap. |

| (3) | CCC VII disclaims beneficial ownership of the Voting Common Stock

beneficially owned by Fund VII, except to the extent of its pecuniary interest therein. |

Item 5(c) of the Schedule

13D is hereby amended and supplemented as follows:

Except as previously disclosed in the Schedule 13D,

Fund VII has engaged in the following open market, broker-assisted transactions with respect to the Voting Common Stock during the last

60 days:

(i) 9,687 shares of Voting Common Stock sold

on December 2, 2024 at a weighted average price of $28.42 per share (in multiple open market, broker-assisted transactions ranging

from $28.22 to $28.65, inclusive); (ii) 7,531 shares of Voting Common Stock sold on December 3, 2024 at a weighted average

price of $28.46 per share (in multiple open market, broker-assisted transactions ranging from $28.25 to $28.80, inclusive); (iii) 10,645

shares of Voting Common Stock sold on December 4, 2024 at a weighted average price of $28.33 per share (in multiple open market,

broker-assisted transactions ranging from $28.15 to $28.63, inclusive); (iv) 10,000 shares of Voting Common Stock sold on December 5,

2024 at a weighted average price of $28.33 share (in multiple open market, broker-assisted transactions ranging from $28.10 to $28.43,

inclusive); (v) 8,861 shares of Voting Common Stock sold on December 6, 2024 at a weighted average price of $29.28 per share

(in multiple open market, broker-assisted transactions ranging from $29.00 to $29.53, inclusive); (vi) 2,769 shares of Voting Common

Stock sold on December 9, 2024 at a weighted average price of $28.77 per share (in multiple open market, broker-assisted transactions

ranging from $28.49 to $29.27, inclusive) and (vii) 4,609 shares of Voting Common Stock sold on December 10, 2024 at a weighted

average price of $28.37 per share (in multiple open market, broker-assisted transactions ranging from $28.00 to $29.12, inclusive).

SIGNATURES

After reasonable inquiry and to the best of the

knowledge and belief of the undersigned, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: December 12,

2024

| |

CASTLE CREEK

CAPITAL PARTNERS VII, LP |

| |

|

|

| |

By: |

/s/

Tony Scavuzzo |

| |

Name: |

Tony

Scavuzzo |

| |

Title: |

Managing

Principal |

| |

CASTLE CREEK

CAPITAL VII LLC |

| |

|

|

| |

By: |

/s/

Tony Scavuzzo |

| |

Name: |

Tony

Scavuzzo |

| |

Title: |

Managing Principal |

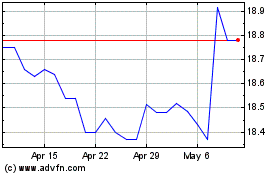

CF Bankshares (NASDAQ:CFBK)

Historical Stock Chart

From Nov 2024 to Dec 2024

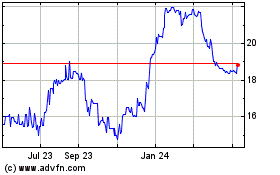

CF Bankshares (NASDAQ:CFBK)

Historical Stock Chart

From Dec 2023 to Dec 2024