Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend]

February 14 2024 - 8:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13G/A

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 2)*

Celcuity Inc.

(Name of Issuer)

Common Stock, $0.001 par value

(Title of Class of Securities)

15102K100

(CUSIP Number)

December 31, 2023

(Date of Event Which Requires Filing of This

Statement)

Check the appropriate box to designate the rule pursuant to which this

Schedule is filed:

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. |

The information required in the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 15102K100 |

Page 2 of 14 |

| |

|

|

|

|

| 1. |

|

Name of reporting persons

Venrock Healthcare Capital Partners III, L.P. |

| 2. |

|

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) x1 (b) ¨

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

2,476,9802 |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

2,476,9802 |

| 9. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,476,9802 |

| 10. |

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See

Instructions) ¨

|

| 11. |

|

Percent of Class Represented by Amount in Row (9)

9.99%3 |

| 12. |

|

Type of Reporting Person (See Instructions)

PN |

| |

|

|

|

|

|

| 1 | Venrock Healthcare Capital Partners

III, L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P., VHCP Management III, LLC, VHCP Management

EG, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13G/A. |

| 2 | Consists of (i) 651,198 shares

held by Venrock Healthcare Capital Partners III, L.P.; (ii) 65,147 shares held by VHCP Co-Investment Holdings III, LLC; and (iii) 1,760,635

shares held by Venrock Healthcare Capital Partners EG, L.P. The share numbers in the preceding sentence represent the maximum number

of shares of common stock that may be held by the Reporting Persons as a result of the beneficial ownership provision described in the

following sentence. Under the terms of the Securities Purchase Agreement dated May 15, 2022, the number of shares of common stock purchased

by the Reporting Persons at the closing shall not, when aggregated with all other shares of common stock owned by such Reporting Persons

at such time, result in such Reporting Persons beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act)

in excess of 9.99% of the Common Stock issued and outstanding immediately prior to the closing. Without giving effect to this beneficial

ownership limitation, the Reporting Persons would beneficially own approximately 20.8% of the Issuer’s common stock. |

| 3 | This percentage is calculated based upon

(i) 24,203,156 shares outstanding as of November 6, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with

the Securities and Exchange Commission on December 13, 2023, plus (ii) the 591,442 shares described in Footnote 2 above. |

| CUSIP No. 15102K100 |

Page 3 of 14 |

| |

|

|

|

|

| 1.

|

|

Name

of reporting persons

VHCP

Co-Investment Holdings III, LLC |

| 2. |

|

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

x1 (b) ¨

|

| 3. |

|

SEC

USE ONLY

|

| 4. |

|

Citizenship

or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With: |

5.

|

Sole

Voting Power

0 |

| 6. |

Shared

Voting Power

2,476,9802 |

| 7. |

Sole

Dispositive Power

0 |

| 8. |

Shared

Dispositive Power

2,476,9802 |

| 9. |

|

Aggregate

Amount Beneficially Owned by Each Reporting Person

2,476,9802 |

| 10. |

|

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) ¨

|

| 11. |

|

Percent

of Class Represented by Amount in Row (9)

9.99%3 |

| 12. |

|

Type

of Reporting Person (See Instructions)

OO |

| |

|

|

|

|

|

| 1 | Venrock Healthcare Capital Partners

III, L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P., VHCP Management III, LLC, VHCP Management

EG, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13G/A. |

| 2 | Consists of (i) 651,198 shares held

by Venrock Healthcare Capital Partners III, L.P.; (ii) 65,147 shares held by VHCP Co-Investment Holdings III, LLC; and (iii) 1,760,635

shares held by Venrock Healthcare Capital Partners EG, L.P. The share numbers in the preceding sentence represent the maximum number

of shares of common stock that may be held by the Reporting Persons as a result of the beneficial ownership provision described in the

following sentence. Under the terms of the Securities Purchase Agreement dated May 15, 2022, the number of shares of common stock purchased

by the Reporting Persons at the closing shall not, when aggregated with all other shares of common stock owned by such Reporting Persons

at such time, result in such Reporting Persons beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act)

in excess of 9.99% of the Common Stock issued and outstanding immediately prior to the closing. Without giving effect to this beneficial

ownership limitation, the Reporting Persons would beneficially own approximately 20.8% of the Issuer’s common stock. |

| 3 | This percentage is calculated based upon

(i) 24,203,156 shares outstanding as of November 6, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with

the Securities and Exchange Commission on December 13, 2023, plus (ii) the 591,442 shares described in Footnote 2 above. |

| CUSIP No. 15102K100 |

Page 4 of 14 |

| |

|

|

|

|

| 1.

|

|

Name

of reporting persons

Venrock Healthcare Capital Partners EG, L.P. |

| 2. |

|

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a)

x1 (b) ¨

|

| 3. |

|

SEC

USE ONLY

|

| 4. |

|

Citizenship

or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With: |

5.

|

Sole

Voting Power

0 |

| 6. |

Shared

Voting Power

2,476,9802 |

| 7. |

Sole

Dispositive Power

0 |

| 8. |

Shared

Dispositive Power

2,476,9802 |

| 9. |

|

Aggregate

Amount Beneficially Owned by Each Reporting Person

2,476,9802 |

| 10. |

|

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) ¨

|

| 11. |

|

Percent

of Class Represented by Amount in Row (9)

9.99%3 |

| 12. |

|

Type

of Reporting Person (See Instructions)

PN |

| |

|

|

|

|

|

| 1 | Venrock Healthcare Capital Partners

III, L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P., VHCP Management III, LLC, VHCP Management

EG, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13G/A. |

| 2 | Consists of (i) 651,198 shares held

by Venrock Healthcare Capital Partners III, L.P.; (ii) 65,147 shares held by VHCP Co-Investment Holdings III, LLC; and (iii) 1,760,635

shares held by Venrock Healthcare Capital Partners EG, L.P. The share numbers in the preceding sentence represent the maximum number

of shares of common stock that may be held by the Reporting Persons as a result of the beneficial ownership provision described in the

following sentence. Under the terms of the Securities Purchase Agreement dated May 15, 2022, the number of shares of common stock purchased

by the Reporting Persons at the closing shall not, when aggregated with all other shares of common stock owned by such Reporting Persons

at such time, result in such Reporting Persons beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act)

in excess of 9.99% of the Common Stock issued and outstanding immediately prior to the closing. Without giving effect to this beneficial

ownership limitation, the Reporting Persons would beneficially own approximately 20.8% of the Issuer’s common stock. |

| 3 | This percentage is calculated based upon

(i) 24,203,156 shares outstanding as of November 6, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with

the Securities and Exchange Commission on December 13, 2023, plus (ii) the 591,442 shares described in Footnote 2 above. |

| CUSIP No. 15102K100 |

Page 5 of 14 |

| |

|

|

|

|

| 1. |

|

Name of reporting persons

VHCP Management III, LLC |

| 2. |

|

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) x1

(b) ¨

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

2,476,9802 |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

2,476,9802 |

| 9. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,476,9802 |

| 10. |

|

Check if the

Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) ¨

|

| 11. |

|

Percent of Class Represented by Amount in Row (9)

9.99%3 |

| 12. |

|

Type of Reporting Person (See Instructions)

OO |

| |

|

|

|

|

|

| 1 | Venrock Healthcare

Capital Partners III, L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P., VHCP Management III,

LLC, VHCP Management EG, LLC, Nimish Shah and Bong Koh are members of a group for the purposes of this Schedule 13G/A. |

| 2 | Consists of (i) 651,198 shares held by Venrock Healthcare Capital

Partners III, L.P.; (ii) 65,147 shares held by VHCP Co-Investment Holdings III, LLC; and (iii) 1,760,635 shares held by Venrock Healthcare

Capital Partners EG, L.P. The share numbers in the preceding sentence represent the maximum number of shares of common stock that may

be held by the Reporting Persons as a result of the beneficial ownership provision described in the following sentence. Under the terms

of the Securities Purchase Agreement dated May 15, 2022, the number of shares of common stock purchased by the Reporting Persons at the

closing shall not, when aggregated with all other shares of common stock owned by such Reporting Persons at such time, result in such

Reporting Persons beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act) in excess of 9.99% of the

Common Stock issued and outstanding immediately prior to the closing. Without giving effect to this beneficial ownership limitation,

the Reporting Persons would beneficially own approximately 20.8% of the Issuer’s common stock. |

| 3 | This percentage is calculated based upon (i) 24,203,156 shares

outstanding as of November 6, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange

Commission on December 13, 2023, plus (ii) the 591,442 shares described in Footnote 2 above. |

| CUSIP No. 15102K100 |

Page 6 of 14 |

| |

|

|

|

|

| 1. |

|

Name of reporting persons

VHCP Management EG, LLC |

| 2. |

|

Check the Appropriate Box if

a Member of a Group (See Instructions)

(a) x1

(b) ¨

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

2,476,9802 |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

2,476,9802 |

| 9. |

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

2,476,9802 |

| 10. |

|

Check if the Aggregate Amount

in Row (9) Excludes Certain Shares (See Instructions) ¨

|

| 11. |

|

Percent of Class Represented

by Amount in Row (9)

9.99%3 |

| 12. |

|

Type of Reporting Person (See

Instructions)

OO |

| |

|

|

|

|

|

| 1 | Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment

Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P., VHCP Management III, LLC, VHCP Management EG, LLC, Nimish Shah and Bong

Koh are members of a group for the purposes of this Schedule 13G/A. |

| 2 | Consists of (i) 651,198 shares held by Venrock Healthcare Capital

Partners III, L.P.; (ii) 65,147 shares held by VHCP Co-Investment Holdings III, LLC; and (iii) 1,760,635 shares held by Venrock Healthcare

Capital Partners EG, L.P. The share numbers in the preceding sentence represent the maximum number of shares of common stock that may

be held by the Reporting Persons as a result of the beneficial ownership provision described in the following sentence. Under the terms

of the Securities Purchase Agreement dated May 15, 2022, the number of shares of common stock purchased by the Reporting Persons at the

closing shall not, when aggregated with all other shares of common stock owned by such Reporting Persons at such time, result in such

Reporting Persons beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act) in excess of 9.99% of the

Common Stock issued and outstanding immediately prior to the closing. Without giving effect to this beneficial ownership limitation,

the Reporting Persons would beneficially own approximately 20.8% of the Issuer’s common stock. |

| 3 | This percentage is calculated based upon (i) 24,203,156 shares

outstanding as of November 6, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange

Commission on December 13, 2023, plus (ii) the 591,442 shares described in Footnote 2 above. |

| CUSIP No. 15102K100 |

Page 7 of 14 |

| |

|

|

|

|

| 1. |

|

Name of Reporting Persons

Shah, Nimish |

| 2. |

|

Check the Appropriate Box if

a Member of a Group (See Instructions)

(a) x1

(b) ¨

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

Citizenship or Place of Organization

United States |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

2,476,9802 |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

2,476,9802 |

| 9. |

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

2,476,9802 |

| 10. |

|

Check if the Aggregate Amount

in Row (9) Excludes Certain Shares (See Instructions) ¨

|

| 11. |

|

Percent of Class Represented

by Amount in Row (9)

9.99%3 |

| 12. |

|

Type of Reporting Person (See

Instructions)

IN |

| 1 | Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment

Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P., VHCP Management III, LLC, VHCP Management EG, LLC, Nimish Shah and Bong

Koh are members of a group for the purposes of this Schedule 13G/A. |

| 2 | Consists of (i) 651,198 shares held by Venrock Healthcare Capital

Partners III, L.P.; (ii) 65,147 shares held by VHCP Co-Investment Holdings III, LLC; and (iii) 1,760,635 shares held by Venrock Healthcare

Capital Partners EG, L.P. The share numbers in the preceding sentence represent the maximum number of shares of common stock that may

be held by the Reporting Persons as a result of the beneficial ownership provision described in the following sentence. Under the terms

of the Securities Purchase Agreement dated May 15, 2022, the number of shares of common stock purchased by the Reporting Persons at the

closing shall not, when aggregated with all other shares of common stock owned by such Reporting Persons at such time, result in such

Reporting Persons beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act) in excess of 9.99% of the

Common Stock issued and outstanding immediately prior to the closing. Without giving effect to this beneficial ownership limitation,

the Reporting Persons would beneficially own approximately 20.8% of the Issuer’s common stock. |

| 3 | This percentage is calculated based upon (i) 24,203,156 shares

outstanding as of November 6, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange

Commission on December 13, 2023, plus (ii) the 591,442 shares described in Footnote 2 above. |

| CUSIP No. 15102K100 |

Page 8 of 14 |

| |

|

|

|

|

| 1. |

|

Name of Reporting Persons

Koh, Bong |

| 2. |

|

Check the Appropriate Box if

a Member of a Group (See Instructions)

(a) x1

(b) ¨

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

Citizenship or Place of Organization

United States |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

2,476,9802 |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

2,476,9802 |

| 9. |

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

2,476,9802 |

| 10. |

|

Check if the Aggregate Amount

in Row (9) Excludes Certain Shares (See Instructions) ¨

|

| 11. |

|

Percent of Class Represented

by Amount in Row (9)

9.99%3 |

| 12. |

|

Type of Reporting Person (See

Instructions)

IN |

| 1 | Venrock Healthcare Capital Partners III, L.P., VHCP Co-Investment

Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P., VHCP Management III, LLC, VHCP Management EG, LLC, Nimish Shah and Bong

Koh are members of a group for the purposes of this Schedule 13G/A. |

| 2 | Consists of (i) 651,198 shares held by Venrock Healthcare Capital

Partners III, L.P.; (ii) 65,147 shares held by VHCP Co-Investment Holdings III, LLC; and (iii) 1,760,635 shares held by Venrock Healthcare

Capital Partners EG, L.P. The share numbers in the preceding sentence represent the maximum number of shares of common stock that may

be held by the Reporting Persons as a result of the beneficial ownership provision described in the following sentence. Under the terms

of the Securities Purchase Agreement dated May 15, 2022, the number of shares of common stock purchased by the Reporting Persons at the

closing shall not, when aggregated with all other shares of common stock owned by such Reporting Persons at such time, result in such

Reporting Persons beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act) in excess of 9.99% of the

Common Stock issued and outstanding immediately prior to the closing. Without giving effect to this beneficial ownership limitation,

the Reporting Persons would beneficially own approximately 20.8% of the Issuer’s common stock. |

| 3 | This percentage is calculated based upon (i) 24,203,156 shares

outstanding as of November 6, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange

Commission on December 13, 2023, plus (ii) the 591,442 shares described in Footnote 2 above. |

| CUSIP No. 15102K100 |

Page 9 of 14 |

Introductory Note: This Schedule 13G/A is filed on behalf of Venrock

Healthcare Capital Partners III, L.P., a limited partnership organized under the laws of the State of Delaware (“VHCP III LP”),

VHCP Co-Investment Holdings III, LLC, a limited liability company organized under the laws of the State of Delaware (“VHCP Co-Investment

III”), Venrock Healthcare Capital Partners EG, L.P., a limited partnership organized under the laws of the State of Delaware (“VHCP

EG”), VHCP Management III, LLC, a limited liability company organized under the laws of the State of Delaware (“VHCP Management

III”), VHCP Management EG, LLC, a limited liability company organized under the laws of the State of Delaware (“VHCP Management

EG” and collectively with VHCP III LP, VHCP Co-Investment III, VHCP EG and VHCP Management III, the “Venrock Entities”),

Nimish Shah (“Shah”) and Bong Koh (“Koh”) in respect of Common Stock of Celcuity Inc.

Item 1.

Celcuity Inc.

| |

(b) |

Address of Issuer’s Principal Executive Offices |

16305 36th Avenue North, Suite 100

Minneapolis, Minnesota 55446

Item 2.

| |

(a) |

Name of Person Filing |

Venrock Healthcare Capital Partners III, L.P.

VHCP Co-Investment Holdings III, LLC

Venrock Healthcare Capital Partners EG, L.P.

VHCP Management III, LLC

VHCP Management EG, LLC

Nimish Shah

Bong Koh

| |

(b) |

Address of Principal Business Office or, if none, Residence |

| |

New York Office: |

Palo Alto Office: |

| |

|

|

| |

7 Bryant Park |

3340 Hillview Avenue |

| |

23rd Floor |

Palo Alto, CA 94304 |

| |

New York, NY 10018 |

|

All of the Venrock Entities were organized in Delaware. The individuals

are both United States citizens.

| |

(d) |

Title of Class of Securities |

Common Stock, par value $0.001 per share

15102K100

| Item

3. |

If this statement is filed pursuant to §§240.13d-1(b), or 240.13d-2(b) or (c), check whether the person filing is a: |

Not applicable

| |

(a) |

Amount Beneficially Owned as of December 31, 2023: |

| Venrock Healthcare Capital Partners III, L.P. | |

| 2,476,980 | (1) |

| VHCP Co-Investment Holdings III, LLC | |

| 2,476,980 | (1) |

| Venrock Healthcare Capital Partners EG, L.P. | |

| 2,476,980 | (1) |

| VHCP Management III, LLC | |

| 2,476,980 | (1) |

| VHCP Management EG, LLC | |

| 2,476,980 | (1) |

| Nimish Shah | |

| 2,476,980 | (1) |

| Bong Koh | |

| 2,476,980 | (1) |

| |

(b) |

Percent of Class as of December 31, 2023: |

| Venrock Healthcare Capital Partners III, L.P. | |

| 9.99 | % |

| VHCP Co-Investment Holdings III, LLC | |

| 9.99 | % |

| Venrock Healthcare Capital Partners EG, L.P. | |

| 9.99 | % |

| VHCP Management III, LLC | |

| 9.99 | % |

| VHCP Management EG, LLC | |

| 9.99 | % |

| Nimish Shah | |

| 9.99 | % |

| Bong Koh | |

| 9.99 | % |

| |

(c) |

Number of shares as to which the person has, as of December 31, 2023: |

| |

(i) |

Sole power to vote or to direct the vote |

| Venrock Healthcare Capital Partners III, L.P. | |

| 0 | |

| VHCP Co-Investment Holdings III, LLC | |

| 0 | |

| Venrock Healthcare Capital Partners EG, L.P. | |

| 0 | |

| VHCP Management III, LLC | |

| 0 | |

| VHCP Management EG, LLC | |

| 0 | |

| Nimish Shah | |

| 0 | |

| Bong Koh | |

| 0 | |

| |

(ii) |

Shared power to vote or to direct the vote |

| |

|

|

|

|

|

|

|

| Venrock Healthcare Capital Partners III, L.P. | |

| 2,476,980 | (1) |

| VHCP Co-Investment Holdings III, LLC | |

| 2,476,980 | (1) |

| Venrock Healthcare Capital Partners EG, L.P. | |

| 2,476,980 | (1) |

| VHCP Management III, LLC | |

| 2,476,980 | (1) |

| VHCP Management EG, LLC | |

| 2,476,980 | (1) |

| Nimish Shah | |

| 2,476,980 | (1) |

| Bong Koh | |

| 2,476,980 | (1) |

| |

(iii) |

Sole power to dispose or to direct the disposition of |

| Venrock Healthcare Capital Partners III, L.P. | |

| 0 | |

| VHCP Co-Investment Holdings III, LLC | |

| 0 | |

| Venrock Healthcare Capital Partners EG, L.P. | |

| 0 | |

| VHCP Management III, LLC | |

| 0 | |

| VHCP Management EG, LLC | |

| 0 | |

| Nimish Shah | |

| 0 | |

| Bong Koh | |

| 0 | |

| |

(iv) |

Shared power to dispose or to direct the disposition of |

| Venrock Healthcare Capital Partners III, L.P. | |

| 2,476,980 | (1) |

| VHCP Co-Investment Holdings III, LLC | |

| 2,476,980 | (1) |

| Venrock Healthcare Capital Partners EG, L.P. | |

| 2,476,980 | (1) |

| VHCP Management III, LLC | |

| 2,476,980 | (1) |

| VHCP Management EG, LLC | |

| 2,476,980 | (1) |

| Nimish Shah | |

| 2,476,980 | (1) |

| Bong Koh | |

| 2,476,980 | (1) |

| 1 | Consists of (i) 651,198 shares held by Venrock Healthcare Capital

Partners III, L.P.; (ii) 65,147 shares held by VHCP Co-Investment Holdings III, LLC; and (iii) 1,760,635 shares held by Venrock Healthcare

Capital Partners EG, L.P. The share numbers in the preceding sentence represent the maximum number of shares of common stock that may

be held by the Reporting Persons as a result of the beneficial ownership provision described in the following sentence. Under the terms

of the Securities Purchase Agreement dated May 15, 2022, the number of shares of common stock purchased by the Reporting Persons at the

closing shall not, when aggregated with all other shares of common stock owned by such Reporting Persons at such time, result in such

Reporting Persons beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act) in excess of 9.99% of the

Common Stock issued and outstanding immediately prior to the closing. Without giving effect to this beneficial ownership limitation,

the Reporting Persons would beneficially own approximately 20.8% of the Issuer’s common stock. |

VHCP Management III, LLC is the general

partner of Venrock Healthcare Capital Partners III, L.P. and the manager of VHCP Co-Investment Holdings III, LLC. VHCP Management EG,

LLC is the general partner of Venrock Healthcare Capital Partners EG, L.P. Messrs. Shah and Koh are the voting members of VHCP Management

III, LLC and VHCP Management EG, LLC.

| Item 5. |

Ownership of Five Percent or Less of a Class |

If this statement

is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five

percent of the class of securities, check the following ¨.

| Item 6. |

Ownership of More than Five Percent on Behalf of Another Person |

Not Applicable

| Item 7. |

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company or Control Person. |

Not Applicable

| Item 8. |

Identification and Classification of Members of the Group |

Not Applicable

| Item 9. |

Notice of Dissolution of a Group |

Not Applicable

By signing below I certify that, to the best of my knowledge and belief,

the securities referred to above were not acquired and are not held for the purpose of or with the effect of changing or influencing the

control of the issuer of the securities and were not acquired and are not held in connection with or as a participant in any transaction

having that purpose or effect, other than activities solely in connection with a nomination under § 240.14a-11.

| CUSIP No. 15102K100 |

Page 13 of 14 |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

Dated: February 14, 2024

| Venrock Healthcare Capital Partners III, L.P. |

|

Venrock Healthcare Capital Partners EG, L.P. |

| |

|

|

By: |

VHCP

Management III, LLC |

|

By: |

VHCP Management EG, LLC |

| Its: |

General Partner |

|

Its: |

General Partner |

| |

|

|

|

|

| By: |

/s/ Sherman G. Souther |

|

By: |

/s/ Sherman G. Souther |

| |

Name: Sherman G. Souther |

|

|

Name: Sherman G. Souther |

| |

Its: Authorized Signatory |

|

|

Its: Authorized Signatory |

| VHCP Co-Investment Holdings III, LLC |

|

|

| |

|

|

| By: VHCP Management III, LLC |

|

|

| Its: Manager |

|

|

| |

|

|

| By: |

/s/ Sherman G. Souther |

|

|

| |

Name: Sherman G. Souther |

|

|

| |

Its: Authorized Signatory |

|

|

| VHCP Management III, LLC |

|

VHCP Management EG, LLC |

| |

|

|

| By: |

/s/ Sherman G. Souther |

|

By: |

/s/ Sherman G. Souther |

| |

Name: Sherman G. Souther |

|

|

Name: Sherman G. Souther |

| |

Its: Authorized Signatory |

|

|

Its: Authorized Signatory |

| Nimish Shah |

|

|

| |

|

|

| /s/ Sherman G. Souther |

|

|

| Sherman G. Souther, Attorney-in-fact |

|

|

| Bong Koh |

|

|

| |

|

|

| /s/ Sherman G. Souther |

|

|

| Sherman G. Souther, Attorney-in-fact |

|

|

| CUSIP No. 15102K100 |

Page 14 of 14 |

EXHIBITS

EXHIBIT A

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k) under the Securities

Exchange Act of 1934, as amended, the undersigned agree to the joint filing on behalf of each of them of a statement on Schedule 13G (including

amendments thereto) with respect to the Common Stock of Celcuity Inc. and further agree that this agreement be included as an exhibit

to such filing. Each party to the agreement expressly authorizes each other party to file on its behalf any and all amendments to such

statement. Each party to this agreement agrees that this joint filing agreement may be signed in counterparts.

In evidence whereof, the undersigned have caused

this Agreement to be executed on their behalf this 14th day of February, 2024.

| Venrock Healthcare Capital Partners III, L.P. |

|

Venrock Healthcare Capital Partners EG, L.P. |

| |

|

|

By: |

VHCP

Management III, LLC |

|

By: |

VHCP Management EG, LLC |

| Its: |

General Partner |

|

Its: |

General Partner |

| |

|

|

|

|

| By: |

/s/ Sherman G. Souther |

|

By: |

/s/ Sherman G. Souther |

| |

Name: Sherman G. Souther |

|

|

Name: Sherman G. Souther |

| |

Its: Authorized Signatory |

|

|

Its: Authorized Signatory |

| VHCP Co-Investment Holdings III, LLC |

|

|

| |

|

|

| By: VHCP Management III, LLC |

|

|

| Its: Manager |

|

|

| |

|

|

| By: |

/s/ Sherman G. Souther |

|

|

| |

Name: Sherman G. Souther |

|

|

| |

Its: Authorized Signatory |

|

|

| VHCP Management III, LLC |

|

VHCP Management EG, LLC |

| |

|

|

| By: |

/s/ Sherman G. Souther |

|

By: |

/s/ Sherman G. Souther |

| |

Name: Sherman G. Souther |

|

|

Name: Sherman G. Souther |

| |

Its: Authorized Signatory |

|

|

Its: Authorized Signatory |

| Nimish Shah |

|

|

| |

|

|

| /s/ Sherman G. Souther |

|

|

| Sherman G. Souther, Attorney-in-fact |

|

|

| Bong Koh |

|

|

| |

|

|

| /s/ Sherman G. Souther |

|

|

| Sherman G. Souther, Attorney-in-fact |

|

|

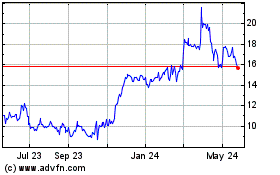

Celcuity (NASDAQ:CELC)

Historical Stock Chart

From Dec 2024 to Jan 2025

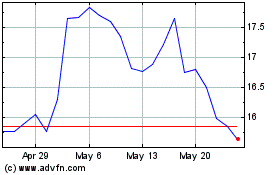

Celcuity (NASDAQ:CELC)

Historical Stock Chart

From Jan 2024 to Jan 2025