Current Report Filing (8-k)

December 17 2021 - 5:01PM

Edgar (US Regulatory)

false000181391400018139142021-12-132021-12-130001813914us-gaap:WarrantMember2021-12-132021-12-130001813914us-gaap:CommonClassAMember2021-12-132021-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 13, 2021

CareMax, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-39391

|

|

85-0992224

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

1000 NW 57 Court, Suite 400

Miami, FL 33126

|

|

(Address of principal executive offices, including zip code)

|

(786) 360-4768

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbols

|

|

Name of each exchange on

which registered

|

|

Class A common stock, par value $0.0001 per share

|

|

CMAX

|

|

The Nasdaq Stock Market LLC

|

|

Warrants, each whole warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share

|

|

CMAXW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 13, 2021, CareMax, Inc., a Delaware corporation (the “Company”), through Managed Healthcare Partners, L.L.C., a Florida limited liability company and wholly-owned subsidiary of the Company, entered into employment agreements (the “Employment Agreements”) with each of Carlos A. de Solo, the Company’s Chief Executive Officer and a Director, Alberto de Solo, the Company’s Chief Operating Officer, and Kevin Wirges, the Company’s Chief Financial Officer (collectively, the “Executives”). The Employment Agreements with each of Messrs. Carlos de Solo, Alberto de Solo and Wirges provide for base salaries of $650,000, $450,000 and $350,000, respectively, in each case subject to annual review by the Board of Directors of the Company (the “Board”). Each Employment Agreement provides that the respective Executive may receive an annual bonus as determined by the Compensation Committee of the Board, with the bonus target to be not less than 100% of each Executive’s base salary, including a pro-rated bonus for the period from June 8, 2021 through December 31, 2021. Additionally, each Employment Agreement provides that the respective Executive will be eligible to receive annual equity grants, as determined in the sole discretion of the Board, and will be eligible to participate in retirement and welfare or other benefit programs offered to employees and executives generally.

Each Employment Agreement further provides that upon a termination of employment without “Cause” or for “Good Reason” (as such terms are defined in the Employment Agreements), the respective Executive will receive cash severance, the target bonus for the year in which such termination occurs and certain healthcare benefits, with the cash severance being equal to 24 months of base salary for Mr. Carlos de Solo and 12 months of base salary for each other Executive; provided that upon a termination of employment without “Cause” or for “Good Reason” within 12 months following a “change in control” (as defined in the Company’s 2021 Long-Term Incentive Plan), each of Messrs. Alberto de Solo and Wirges will receive cash severance equal to 18 months of base salary. Severance and termination benefits payable pursuant to each Employment Agreement are subject to the respective Executive’s execution of a release of claims and compliance with restrictive covenants, including non-competition and non-solicitation and non-disparagement covenants.

The foregoing description of the Employment Agreements with each of Messrs. Carlos de Solo, Alberto de Solo, and Wirges does not purport to be complete and is qualified in its entirety by the full text of Employment Agreements, which are attached hereto as Exhibits 10.1, 10.2 and 10.3, respectively, and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

Exhibit Index

|

|

Exhibit No.

|

Description

|

|

10.1

|

Executive Employment Agreement, dated December 13, 2021, by and between Managed Healthcare Partners, L.L.C. and Carlos A. de Solo.

|

|

10.2

|

Executive Employment Agreement, dated December 13, 2021, by and between Managed Healthcare Partners, L.L.C. and Alberto de Solo.

|

|

10.3

|

Executive Employment Agreement, dated December 13, 2021, by and between Managed Healthcare Partners, L.L.C. and Kevin Wirges.

|

|

104

|

Cover Page Interactive Data File (the cover page tags are embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 17, 2021

CareMax, Inc.

By: /s/ Kevin Wirges

Name: Kevin Wirges

Title: Executive Vice President, Chief Financial Officer and Treasurer

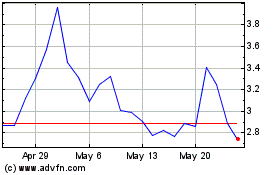

CareMax (NASDAQ:CMAX)

Historical Stock Chart

From Dec 2024 to Jan 2025

CareMax (NASDAQ:CMAX)

Historical Stock Chart

From Jan 2024 to Jan 2025