As

filed with the Securities and Exchange Commission on October 31, 2023.

Registration

No. 333-275156

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment No.1

to

FORM

F-1

REGISTRATION

STATEMENT UNDER SECURITIES ACT OF 1933

Bruush

Oral Care Inc.

(Exact

name of Registrant as specified in its charter)

| British

Columbia, Canada |

|

3843 |

|

N/A |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

No.) |

128

West Hastings Street, Unit 210

Vancouver,

British Columbia V6B 1G8

Canada

(844)

427-8774

(Address,

including zip code, and telephone number, including

area

code, of Registrant’s principal executive offices)

Cogency

Global Inc.

122

East 42nd Street, 18th Floor

New

York, NY 10168

(800)

221-0102

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

Copies

of all communications, including communications sent to agent for service, should be sent to:

Joseph

M. Lucosky, Esq.

Lahdan S. Rahmati, Esq.

Lucosky

Brookman LLP

101

Wood Avenue South, 5th Floor

Woodbridge,

NJ 08830

(732)

395-4496

jlucosky@lucbro.com

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an

offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED [●], 2023 |

28,591,268

Common Shares

This

prospectus relates to the offer and sale, from time to time, by the Selling Securityholders named herein (the “Selling Securityholders”)

of an aggregate of up to 28,591,268 common shares without par value (“Common Shares”) of Bruush Oral Care Inc. (the

“Company”), consisting of (i) in respect of Generating Alpha Ltd., (a) 79,724 Common Shares, (b) 7,181,146 Common Shares

issuable upon exercise of the Prefunded Warrant (as defined herein), and (c) 8,350,000 Common Shares issuable upon exercise of the Warrant

(as defined herein), (ii) in respect of Yaletown Bros. Ventures Ltd., 9,980,398 Common Shares, and (iii) in respect of Alchemy Advisors

LLC, 3,000,000 Common Shares issuable upon exercise of the Alchemy Warrants (as defined herein).

The

Selling Securityholders may sell Common Shares at market prices prevailing at the times of sale, prices related to the prevailing market

prices or negotiated prices. The Selling Securityholders may offer Common Shares to or through underwriters, dealers or other agents,

directly to investors or through any other manner permitted by law, on a continued or delayed basis. We will bear all costs, expenses

and fees in connection with the registration of the securities offered by this prospectus, and the Selling Securityholders will bear

all incremental selling expenses, including commissions and discounts, brokerage fees and other similar selling expenses they incur in

sale of the securities. See “Plan of Distribution”.

We

are not selling any securities in this offering, and we will not receive any proceeds from the sale of any securities by the Selling

Securityholders. The registration of the securities covered by this prospectus does not necessarily mean that any of these securities

will be offered or sold by the Selling Securityholders. The timing and amount of any sale is within the Selling Securityholders’

sole discretion, subject to certain restrictions. To the extent that any of the Selling Securityholders sell any securities, such

holder may be required to provide you with this prospectus identifying and containing specific information about the Selling Securityholders

and the terms of the securities being offered. We may receive proceeds up to (i) $1,553 in the event of the exercise in full of the

Prefunded Warrant for cash, and (ii) $3,000 in the event of the exercise in full of the Alchemy Warrants.

The

Selling Securityholders and intermediaries through whom the securities are sold may be deemed “underwriters” within the meaning

of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the securities offered hereby, and any

profits realized or commissions received may be deemed underwriting compensation.

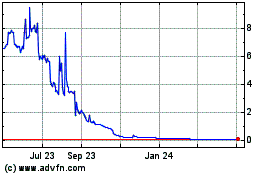

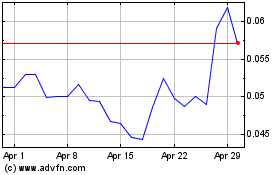

Our Common Shares and warrants are quoted on The

Nasdaq Stock Market (“Nasdaq”) under the trading symbols “BRSH” and “BRSHW”, respectively. On October

23, 2023, the closing price of our Common Shares on Nasdaq was $0.37 per share, and the closing price of our warrants

on Nasdaq was $0.02 per warrant.

On September 21, 2023, the Nasdaq Hearings Panel (the “Panel”) held on a hearing

to consider our appeal of Nasdaq’s determination that we were not in compliance with the minimum stockholders’ equity requirement

for continued listing and its determination to delist our securities. At the hearing, we presented our plan for regaining and sustaining

compliance with Nasdaq’s continued listing requirements. On October 2, 2023, the Company received a letter from the Nasdaq notifying

the Company that the Panel has granted an exception to the Company for continued listing on the Nasdaq, subject to the Company demonstrating

compliance with the minimum stockholders’ equity rule on or before December 31, 2023. The Panel reserves the right to reconsider

the terms of this exception based on any event, condition or circumstance that exists or develops that would, in the opinion of the Panel,

make continued listing of the Company’s securities on Nasdaq inadvisable or unwarranted.

Unless otherwise noted, the share and per share

information in this prospectus reflects a 1-for-25 reverse stock split of our outstanding Common Shares effective as of August 1, 2023.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire

prospectus and any amendments or supplements carefully before you make your investment decision.

Investing

in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of material

risks of investing in the Common Shares and our Company. See “Risk Factors” incorporated by reference

into this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

We

are a “foreign private issuer” and an “emerging growth company” each as defined under the federal securities

laws, and, as such, we are subject to reduced public company reporting requirements. See the section entitled “Prospectus

Summary—Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is [●], 2023

TABLE

OF CONTENTS

About

This Prospectus

Neither

we nor the Selling Securityholders have authorized anyone to provide information different from or additional to that contained

in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus prepared by us or on our behalf.

The Selling Securityholders named in this prospectus may, from time to time, sell the securities

described in this prospectus in one or more offerings. Neither we nor the Selling Securityholders take any responsibility

for, and can provide no assurance as to the reliability of, any information other than the information in this prospectus, any amendment

or supplement to this prospectus, and any free writing prospectus prepared by us or on our behalf. Neither the delivery of this prospectus

nor the sale of our securities in this offering means that information contained in this prospectus is correct after the date of this

prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy these shares in any circumstances under which

such offer or solicitation is unlawful.

Our

financial statements included or incorporated by reference into this prospectus have been prepared in accordance with International Financial

Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB. None

of the financial statements included herein were prepared in accordance with generally accepted accounting principles in the United States,

or US GAAP. IFRS differs from US GAAP in certain material respects and thus may not be comparable to financial information presented

by U.S. companies.

The

Selling Securityholders are offering to sell the Common Shares, and seeking offers to buy Common Shares, only in jurisdictions

where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless

of the time of delivery of this prospectus or any sale of the securities.

For

investors outside of the United States: Neither we nor the Selling Securityholders have done anything that would permit this offering

or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United

States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions

relating to this offering and the distribution of this prospectus outside of the United States.

Throughout

this prospectus, unless otherwise designated or the context requires otherwise, the terms “we”, “us”, the “Company”,

and “our” refer to Bruush Oral Care Inc. Unless the context requires otherwise, all references to our financial statements

mean the financial statements of our Company included herein.

Enforcement

of Civil Liabilities

We

are a company incorporated under the law of British Columbia, Canada. Some of our directors and officers, and some of the experts named

in this prospectus, are residents of Canada or

otherwise reside outside of the United States, and all or a substantial portion of their assets, and all or a substantial portion of

our assets, are located outside of the United States. We have appointed an agent for service of process in the United States, but it

may be difficult for shareholders who reside in the United States to effect service within the United States upon those directors, officers

and experts who are not residents of the United States. It may also be difficult for shareholders who reside in the United States to

realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability

of our directors, officers and experts under the United States federal securities laws. There can be no assurance that U.S. investors

will be able to enforce against us, directors, officers or certain experts named herein who are residents of Canada or

other countries outside the United States, any judgments in civil and commercial matters, including judgments under the federal securities

laws.

Cautionary

Note Regarding Forward-Looking Statements

We

discuss in this prospectus our business strategy, market opportunity, capital requirements, product introductions and development plans

and the adequacy of our funding. These statements, and other statements contained in this prospectus, which are not historical facts,

are also forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,”

“will,” “could,” “should,” “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates” or similar

expressions that predict or indicate future events or trends or that are not statements of historical matters.

Forward-looking

statements include, without limitation, our expectations concerning the outlook for our business, productivity, plans and goals for future

operational improvements and capital investments, operational performance, future market conditions or economic performance and developments

in the capital and credit markets and expected future financial performance, as well as any information concerning possible or assumed

future results of operations of the Company.

We

caution investors against placing undue reliance on forward-looking statements presented in this prospectus, or that we may make orally

or in writing from time to time, which are based on the beliefs of, assumptions made by, and information currently available to, us.

These forward-looking statements are based on assumptions, and the actual outcome will be affected by known and unknown risks, trends,

uncertainties and factors that are beyond our control or ability to predict. Although we believe that our assumptions are reasonable,

they are not a guarantee of future performance, and some will inevitably prove to be incorrect. As a result, our actual future results

can be expected to differ from our expectations, and those differences may be material. Accordingly, investors should use caution in

relying on forward-looking statements, which are based only on known results and trends at the time they are made, to anticipate future

results or trends. Certain risks are discussed in this prospectus and also from time to time in our other filings with the U.S. Securities

and Exchange Commission (“SEC”). For additional information regarding risk factors that could affect the Company’s

projections, see the “Risk Factors” section in our Annual Report on Form 20-F for the year ended October 31, 2022 incorporated

by reference herein, and as may be included from time-to-time in our reports filed with the SEC which will be accessible at www.sec.gov,

and which you are advised to consult.

This

prospectus and all subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly

qualified in their entirety by the cautionary statements contained or referred to in this section. The forward-looking statements speak

only as of the time of such statements and we do not undertake or plan to update or revise such forward-looking statements as more information

becomes available or to reflect changes in expectations, assumptions or results, except as and to the extent required by applicable securities

laws. We can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of, or any

material adverse change in, one or more of the risk factors or risks and uncertainties referred to in our Annual Report on Form 20-F

for the year ended October 31, 2022 incorporated by reference in this prospectus, could materially and adversely affect our results of

operations, financial condition, liquidity, and our future performance.

Industry

Data and Forecasts

This

prospectus contains data related to the oral healthcare products industry in Canada and the United States. This industry data includes

projections that are based on a number of assumptions which have been derived from industry and government sources which we believe to

be reasonable. The oral healthcare products industry may not grow at the rate projected by industry data, or at all. The failure of the

industry to grow as anticipated is likely to have a material adverse effect on our business and the market price of our Common Shares.

In addition, the rapidly changing nature of the oral healthcare products industry and consumer preferences subjects any projections or

estimates relating to the growth prospects or future condition of our industries to significant uncertainties. Furthermore, if any one

or more of the assumptions underlying the industry data turns out to be incorrect, actual results may, and are likely to, differ from

the projections based on these assumptions.

INCORPORATION

OF DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” information we have previously filed with it into our registration statement

of which this prospectus is a part, which means that we can disclose important information to you by referring you to other documents.

The information incorporated by reference is considered to be part of this prospectus. We incorporate by reference into this prospectus

the documents listed below and any additional documents that we file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the

Exchange Act on or after the date we file this prospectus, except for information “furnished” to the SEC which is not deemed

filed and not incorporated in this prospectus until the termination of the offering of securities described herein.

We

hereby incorporate by reference the following documents and information:

| |

● |

our

Annual Report on Form 20-F for the year ended October 31, 2022, filed on March 10, 2023; |

| |

|

|

| |

● |

our

Reports of Foreign Issuer on Form 6-K furnished to the SEC on March

21, 2023, March

21, 2023, March

22, 2023, May

12, 2023, June

23, 2023, July

31, 2023, August

23, 2023, September

7, 2023, September

14, 2023, October

5, 2023, October

6, 2023 and October 24, 2023. |

The

information relating to us contained in this prospectus does not purport to be comprehensive and should be read together with the information

contained in the documents incorporated or deemed to be incorporated by reference into this prospectus.

As

you read the above documents, you may find inconsistencies in information from one document to another. If you find inconsistencies between

the documents and this prospectus, you should rely on the statements made in the most recent document. All information appearing in this

prospectus is qualified in its entirety by the information and financial statements, including the notes thereto, contained in the documents

incorporated by reference herein.

Potential

investors, including any beneficial owner, may obtain a copy of any of the documents summarized herein (subject to certain restrictions

because of the confidential nature of the subject matter) or any of our SEC filings incorporated by reference herein without charge by

written or oral request directed to:

Bruush

Oral Care Inc.

Attention:

Aneil Manhas

128

West Hastings Street, Unit 210

Vancouver,

British Columbia V6B 1G8

Canada

(844)

427-8774

You

should rely only on the information contained or incorporated by reference in this prospectus or a prospectus supplement. We have not

authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus,

or such earlier date, that is indicated in this prospectus. Our business, financial condition, results of operations and prospects may

have changed since that date.

Prospectus

Summary

The

following summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain

all the information you should consider before investing in our securities. You should carefully read this prospectus in its entirety

before investing in our securities, including the sections entitled “Risk Factors”, “Business” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes incorporated

by reference in our Annual Report on Form 20-F for the year ended October 31, 2022 and our Reports of Foreign Issuer on Form 6-K

furnished to the SEC on September 14, 2023 for the six months ended April 30, 2023.

Unless

otherwise noted, the share and per share information in this prospectus reflects a 1-for-25 reverse stock split of our outstanding Common

Shares effective as of August 1, 2023.

This

summary highlights certain information contained elsewhere in this prospectus. You should read this entire prospectus carefully, including

the “Risk Factors” and the financial statements and related notes incorporated by reference herein. This prospectus includes

forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements.”

References to “we,” “our,” “Bruush,” and the “Company” refer to Bruush Oral Care Inc.

Our

Company

Overview

The

Company, incorporated under the Business Corporations Act of British Columbia on October 10, 2017 under the name “Bruush Oral Care

Inc.”, is on a mission to inspire confidence through brighter smiles and better oral health. Founded by Chief Executive Officer,

Aneil Manhas, a former investment banker and private equity investor turned entrepreneur, we are an oral care company that is disrupting

the space by reducing the barriers between consumers and access to premium oral care products because it is our belief that high-quality

oral care products should be more accessible. We are an e-commerce business with a product portfolio that currently consists of a sonic-powered

electric toothbrush kit and brush head refills. Through our website, consumers can purchase a Brüush starter kit (the “Brüush

Kit”), which includes: (i) the Brüush electric toothbrush (the “Brüush Toothbrush”); (ii) three brush heads;

(iii) a magnetic charging stand and USB power adapter; and (iv) a travel case. We also sell the brush heads separately which come in

a three-pack (the “Brüush Refill”) and can be purchased on a subscription basis, where the customer will automatically

receive a Brüush Refill every six months (the “Subscription”). We consider a Subscription to be active (an “Active

Subscription”) until it is either cancelled by the customer or terminated due to payment failure (for example, a lost or expired

credit card). Currently, we have almost 40,000 Active Subscriptions in our program. Next year, we plan to expand our portfolio

with the launch of several new subscription-based consumable oral care products, including toothpaste, mouthwash, dental floss, a whitening

pen, as well as an electric toothbrush designed for kids.

Recent

Developments

Consulting Agreement

On October

23, 2023, the Company entered into a consulting agreement (the “Alchemy Consulting Agreement”) with Alchemy Advisors LLC

(the “Consultant”), whereby the Consultant was engaged by the Company as a business consultant. In return for services

rendered by the Consultant, the Company issued to the Consultant 3,000,000 prefunded warrants of the Company (the “Alchemy Warrants”)

to purchase 3,000,000 Common Shares. The Alchemy Warrants are exercisable for five years, and the exercise price is $0.001 per share.

The exercise of Alchemy Warrants is subject to the beneficial ownership limitation. The Alchemy Warrants also permit for cashless exercise

and have piggyback registration rights.

October 2023 Private Placement

On October 2, 2023, the Company entered into a private

placement transaction (the “October 2023 Private Placement”), pursuant to a Securities Purchase Agreement (the “Agreement”)

and a Registration Rights Agreement (the “Registration Rights Agreement”) with Generating Alpha Ltd. (the “Purchaser”)

for aggregate gross proceeds of $5,010,000, before deducting fees to the placement agent and other expenses payable by the Company in

connection with the October 2023 Private Placement. EF Hutton, division of Benchmark Investments, LLC acted as the exclusive placement

agent for the October 2023 Private Placement, which closed on October 2, 2023.

As part of the October 2023 Private Placement, the

Company issued to the Purchaser 79,724 Common Shares, a prefunded common share purchase warrant (the “Prefunded Warrant”)

to purchase 7,181,146 Common Shares, and a common share purchase warrant (the “Warrant” and together with the Prefunded Warrant,

the “Warrants”) to purchase 8,350,000 Common Shares. The Warrants have a term of five years from the date of issuance and

an exercise price of $0.0001 per share.

To secure performance of the Company’s obligations

pursuant to the Agreement, the Company executed a Confession of Judgment (the “Confession of Judgment”), whereby the Company

confessed judgment in favor of the Purchaser in an amount equal to the fair market value of the common shares of the Company that the

Purchaser submitted an exercise notice under either the Pre-Funded Warrant or the Warrant.

In connection with the October 2023 Private Placement, the Company entered

into a Waiver and Notice Letter with Target Capital 14, LLC (“Target Capital”) (the “Waiver and Notice Letter”),

whereby the Company requested that Target Capital waive certain provisions of the securities purchase agreement between the Company and

Target Capital, dated June 26, 2023 and the related convertible note in the initial principal amount of $3,341,176 in exchange for the

Company issuing to Target Capital a prefunded warrant to purchase 1,000,000 Common Shares (the “Waiver Warrant”).

The descriptions of the Agreement, Registration Rights Agreement, Pre-Funded

Warrant, Warrant, Confession of Judgment and Waiver set forth above are qualified in their entirety by reference to the full text of those

documents.

Credit Support Share Agreement

On August

25, 2023, the Company entered into a credit support fee agreement (the “Credit Support Agreement”) with one of the

Company’s shareholders, Yaletown Bros Ventures Ltd. (“YBV”), pursuant to which YBV agreed to provide for the Company

an irrevocable standby letter of credit in the face amount of $2 million (the “Credit Support”). In consideration of the

Credit Support, the Company agreed to issue to YBV Common Shares to be delivered as follows: (i) on September

25, 2023, a number of Common Shares equal to the initial amount of the Credit Support divided by the closing price of the Common Shares

on September 22, 2023, and (ii) if the provision of Credit Support is ongoing as of September 25, 2023, for every succeeding week, an

amount equal to 20% of the initial amount of the Credit Support divided by the closing price of the Shares on the last trading day prior

to delivery of such Common Shares on each of October 3, 2023, October 10, 2023, October 17, 2023, and October 24, 2023.

Additionally,

the Company has agreed to file a registration statement with the SEC coving the resale of any Common Shares issued under the Credit

Support Agreement as soon as reasonably practicable following the date of any issuance of shares thereunder, but in no event

prior to (i) 60 days following such issuance if such 60th day is following the date of certain inducement letter

entered into by the Company on August 22, 2023 (the “Inducement Effective Date”), or (ii) if such 60th day

is not following Inducement Effective Date, on the earliest SEC filing date following the Inducement Effective Date.

On October 23, 2023, the Company and YBV entered

into an amendment to the Credit Support Agreement (the “Amendment to Credit Support Agreement”). Pursuant to the Amendment to Credit Support Agreement,

if the Credit Support has been drawn as of October 24, 2023, the Company shall cause to be issued to YBV additional Shares in an amount

equal to 100% of the Drawn Credit Amount (as defined below), divided by the closing price of the Shares on the last trading day prior to

October 24, 2023. Further, following the sale by YBV of all of such Shares as YBV shall have received in respect of this Agreement (the

“YBV Share Sale”), if the proceeds of the YBV Share Sale shall be less than the amount of the Credit Support drawn by the

creditor (the “Drawn Credit Amount”), the Company shall pay to YBV cash in an amount equal to the difference between Drawn

Credit Amount and the proceeds of the YBV Share Sale.

Reverse

Stock Split

On

August 1, 2023, the Company effected a 1-for-25 reverse stock split (the “Reverse Stock Split”) to comply with the Nasdaq’s

minimum bid price requirement. As a result of the Reverse Stock Split, every 25 Common Shares issued and outstanding were exchanged for

one Common Share. Immediately after the Reverse Stock Split became effective, the Company had approximately 511,368 Common Shares issued

and outstanding.

Inducement

Letter

As

previously reported on December 20, 2022, the Company entered into a $3 million private placement transaction, pursuant to which the

Company issued to certain investors (the “Holders”) Common Share purchase warrants (the “Existing Warrants”),

each warrant exercisable for one share of Common Share. On August 22, 2023, the Company issued an offer letter to the Holders (the “Inducement

Letter”), providing the Holders the opportunity to exercise for cash all or some of the Existing Warrants at an exercise price

of $3.33 per Common Share in consideration for the issuance to each exercising Holder of a new Common Share purchase warrant (the “New

Warrant”) exercisable at an exercise price of $3.33 per share for a number of Common Shares equal to 250% of the number of Common

Shares issued in connection with the Inducement Letter. The New Warrants are exercisable up to 5:00 P.M., New York City time, on June

9, 2028. In connection with the Inducement Letter, the Holders elected to exercise Existing Warrants for 633,026 Common Shares. As a

result of such exercise, New Warrants exercisable for an aggregate 1,582,566 Common Shares were issued. On September 14, 2023, the

Company filed a registration statement on Form F-1 with the SEC to register the shares issuable upon exercise of the New Warrants for

resale, which was declared effective on October 19, 2023.

June

2023 Private Placement

On

June 26, 2023, the Company completed a private placement (the “June 2023 Private Placement”) of an unsecured convertible

note with a principal aggregate amount of $3,341,176 (the “June 2023 Note”) to Target Capital.

The June 2023 Note will mature on June 26, 2024 and, if any Event of Default occurs an interest rate equal to 20% per annum shall

immediately accrue which shall be paid in cash monthly to Target Capital until the Event of Default is cured. The conversion price

in effect on any Conversion Date shall be equal to (i) for the first nine (9) months following the date hereof, shall be $0.25, or $6.25

after giving effect to the Reverse Stock Split, which amount may adjusted by mutual agreement by the parties; and (ii) following the

nine (9) month anniversary of the date hereof, 90% of the lowest closing price of the Company’s shares for the previous three (3)

Trading Days prior to the conversion date (the “Conversion Price”); provided, however, that such price shall in no event

be less than $0.15, or $3.75 after giving effect to the Reverse Stock Split. Consequently, a maximum of 890,980 Common Shares are issuable by the Company upon conversion

of the June 2023 Note. The June 2023 Note contains customary and standard representations and warranties, and covenants.

In

connection with the issuance of the June 2023 Note, the Company entered into a securities purchase agreement and a registration rights

agreement with Target Capital and issued to Target Capital a common share purchase warrant to purchase 400,941 Common Shares

(the “Purchase Warrant”), with an Exercise Price of $0.001 or on a cashless basis. Pursuant

to the Registration Rights Agreement, the Company must file a registration statement covering the resale of such number of shares equal

to 200% of the number of Common Shares issuable upon conversion of the June 2023 Note and the exercise of the Purchase Warrant, or a

total of 2,583,842 Common Shares.

On

June 26, 2023, the Company filed a registration statement on Form F-1 with the SEC to register the shares issuable pursuant to the

June 2023 Private Placement and shares issuable upon exercise of the June 2023 Note and Purchase Warrants for resale,

which was declared effective on October 19, 2023.

As stated

above, in connection with the October 2023 Private Placement, the Company entered into the Waiver and Notice Letter with Target Capital

whereby the Company requested that Target Capital waive certain provisions of the securities purchase agreement between the Company and

Target Capital, dated June 26, 2023 and the related convertible note in the initial principal amount of $3,341,176 in exchange for the

Company issuing to Target Capital a prefunded warrant to purchase 1,000,000 Common Shares.

March

2023 Promissory Note

On

March 20, 2023, the Company closed its issuance of an unsecured promissory note in the principal amount of $2,749,412 (the “Note”)

to Target Capital (the “March 2023 Note”). The March 2023 Note was issued at an original issue discount of 15% and

set to mature on July 18, 2023. On June 26, 2023, the Company and Target Capital entered into the June 2023 Note and cancelled

the March 23 Promissory Note in its entirety. As a result, the Company has no obligations pursuant to the March 2023 Note.

December

2022 Private Placement

On

December 9, 2022, the Company closed a private placement of 2,966,667 units not reflecting the Reverse Stock Split and 1,950,001 pre-funded

units not reflecting the Reverse Stock Split (the units and pre-funded units together, the “Units”) at a purchase price of

$0.60 per Unit not reflecting the Reverse Stock Split (the “December Private Placement”) for aggregate gross proceeds of

approximately $3 million, before deducting fees to the placement agent and other expenses payable by the Company.

Each

Unit is comprised of one Common Share (or pre-funded funded warrant) and one non-tradable warrant (each, a “December

Warrant,” and collectively, the “December Warrants”) exercisable for one Common Share at a price of $0.60

(not reflecting the Reverse Stock Split) subject to adjustment. The December Warrants are exercisable for five and one-half (5.5)

years from the date of issuance. Each pre-funded warrant is exercisable by the holder for one Common Share at an exercise price of $0.001

per share.

The

Company used the net proceeds from the December Private Placement for working capital, growth capital and other general corporate

purposes.

On

December 7, 2022, the Company entered into a Securities Purchase Agreement and Registration Rights Agreement with institutional investors

and into a Placement Agent Agreement with Aegis Capital Corp. (“Aegis”) as the exclusive placement agent in connection with

the December Private Placement. Pursuant to the Placement Agent Agreement, Aegis was paid a commission equal to 10% for the placement

of the securities sold at closing and 10% of the proceeds from the exercise of Warrants, and a non-accountable expense allowance equal

to 3% of the amount of securities sold at closing.

Pursuant

to the Registration Rights Agreement, the Company filed a registration statement on Form F-1 with the SEC to register the shares issuable

upon exercise of the Warrants for resale. The registration statement was declared effective on January 17, 2023.

Nasdaq

Notice

Minimum

Bid Price Requirement

On

January 20, 2023, the Company received written notice (the “January 2023 Notice”) from the Nasdaq Stock Market, LLC (“Nasdaq”)

that, based on the closing bid price of the Common Shares for the last 30 consecutive trading days, the Company no longer complied

with the minimum bid price requirement for continued listing on the Nasdaq Capital Market. Nasdaq Listing Rule 5450(a)(1) requires

listed securities to maintain a minimum bid price of $1.00 per share (the “Minimum Bid Price Requirement”), and Nasdaq Listing

Rule 5810(c)(3)(A) provides that a failure to meet the Minimum Bid Price Requirement exists if the deficiency continues for a period

of 30 consecutive trading days.

On

July 20, 2023, Nasdaq notified the Company that Nasdaq has determined that the Company’s securities will be delisted from Nasdaq

in accordance with Listing Rules Listing Rule 5450(a)(1), 5810(c)(3)(A) and 5550(b)(1) unless the Company appeals the delisting determination.

On July 27, 2023, the Company appealed such determination and requested a hearing. The hearing was scheduled for September 21,

2023. To regain compliance, the closing bid price of the Company’s common shares must meet or exceed $1.00 per share for a minimum

of ten consecutive trading days during this period.

On

August 1, 2023, the Company effected the Reverse Stock Split to comply with the Nasdaq’s minimum bid price requirement. As a result

of the Reverse Stock Split, every 25 Common Shares issued and outstanding were exchanged for one Common Share. Immediately after the

Reverse Stock Split became effective, the Company had approximately 511,368 Common Shares issued and outstanding. The Reverse Stock Split

was primarily intended for the Company to regain compliance with the Minimum Bid Requirement.

The

Company regained compliance with the Minimum Bid Price Requirement on August 15, 2023, by effecting the Reverse Stock Split on August

1, 2023 and the closing price per share of the Company’s common shares being at least $1.00 for 10 consecutive business days thereafter.

Minimum

Stockholders’ Equity Requirement

On

March 16, 2023, the Company received written notice (the “March 2023 Notice”) from the Listing Qualifications Department

of the Nasdaq notifying the Company that, based on the Company’s stockholders’ equity as reported in the Company’s

Annual Report on Form 20-F for the fiscal year ended October 31, 2022 filed with the Securities and Exchange Commission on March 10,

2023, the Company did not meet the minimum stockholders’ equity requirement (“Minimum Stockholders’ Equity Requirement”),

or the alternatives of market value of listed securities or net income from continuing operations for continued listing of its securities

on the Nasdaq Capital Market under Nasdaq Listing Rule 5550(b)(1) (the “Rule”).

The

March 2023 Notice has no immediate effect on the listing of the Company’s Common Shares or listing warrants on the Nasdaq

Capital Market. As provided in the Rule and in the March 2023 Notice, the Company had 45 calendar days to submit a plan to regain

compliance with the continued listing requirements under the Rule, and if the plan is accepted, Nasdaq can grant an extension of up to

180 days to evidence compliance. If the plan is not accepted, the Company would then be entitled to appeal to the Nasdaq Listing

Qualifications Panel and request a hearing.

To

regain compliance, the Company must meet one of the following alternatives: a minimum stockholders’ equity of $2.5 million, a minimum

of $35 million in the market value of listed securities or a minimum net income from continuing operations of $500,000, and the Company

must otherwise satisfy The Nasdaq Capital Market’s requirements for listing. The Company will consider various options available

to regain compliance and maintain the listing of its securities on Nasdaq. There can be no assurance that the Company will be

able to regain compliance with the Nasdaq Capital Market’s continued listing requirements or that Nasdaq will grant the Company

a further extension of time to regain compliance, if applicable.

The

Company submitted a plan (the “Submission”) to regain compliance with the Minimum Stockholders’ Equity Requirement

on May 24, 2023, as supplemented with additional materials on June 9, 2023. Based on the Submission, Nasdaq informed the Company on June

14, 2023 (the “Notice”) that it had granted the Company an extension of time to regain compliance with the Rule. Under the

terms of the extension, on or before September 12, 2023, the Company must complete certain proposed financing transactions and opt for

one of the two alternatives provided by Nasdaq to evidence compliance with the Rule. If the Company fails to evidence compliance upon

filing its periodic report for the period ended October 31, 2023 with the SEC and the Nasdaq, the Company may be subject to delisting.

In the event the Company does not satisfy the terms set forth in the Notice, Nasdaq will provide written notification to the Company

that its securities will be delisted. At such time, the Company may appeal such determination to the Panel.

On

August 31, 2023, the Company received written notice from Nasdaq notifying the Company that, following the July 2023 Notice and in accordance

with Nasdaq Listing Rule 5810(c)(2)(A), Nasdaq is no longer permitted to consider the Company’s Plan to regain compliance with

the Minimum Stockholders’ Equity Requirement and that the Panel, at a hearing scheduled

for September 21, 2023, will consider the Company’s appeal of the determination by Nasdaq to delist the Company’s securities.

On

September 21, 2023, the Panel held on a hearing to consider our appeal of Nasdaq’s determination that we were not in compliance

with the minimum stockholders’ equity requirement for continued listing and its determination to delisting our securities. At the

hearing, we presented our plan for regaining and sustaining compliance Nasdaq’s continued listing requirements. On October 2, 2023,

the Company received a letter from the Nasdaq notifying the Company that the Panel has granted an exception to the Company for continued

listing on the Nasdaq, subject to the Company demonstrating compliance with the Rule on or before December 31, 2023. The Panel reserves

the right to reconsider the terms of this exception based on any event, condition or circumstance that exists or develops that would,

in the opinion of the Panel, make continued listing of the Company’s securities on the Nasdaq inadvisable or unwarranted.

Audit

Committee Requirement

On

May 8, 2023, the Company received written notice (the “May 2023 Notice”) from the Listing Qualifications Department of Nasdaq

notifying the Company that, as a result of the resignation of Brett Yormark from our board of directors and from the Audit Committee

of our board of directors, the Company is not in compliance with Nasdaq Listing Rule 5605, including Rule 5605(c)(2), which requires

the Audit Committee of our board of directors of a listed company to consist of at least three members, each of whom is an independent

director under the Nasdaq Listing Rules and who meets heightened independence standards for Audit Committee members. The Audit Committee

currently consists of two independent directors.

The

May 2023 Notice has no immediate effect on the listing of the Common Shares on Nasdaq. The May 2023 Notice states that, consistent with

Nasdaq Listing Rule 5605(c)(4), the Company is afforded a cure period to regain compliance until the earlier of (a) the

Company’s next annual shareholders’ meeting or April 12, 2024 and (b) October 9, 2023, if the next annual shareholders’

meeting is held before such date. The Company has not yet scheduled its annual shareholders’ meeting.

Implications

of Being an Emerging Growth Company and a Foreign Private Issuer

We

qualify as an “emerging growth company”, as defined in the US federal securities laws. An emerging growth company may take

advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. Upon the

effectiveness of the registration statement of which this prospectus forms a part, we will report under the Securities Exchange Act of

1934, as amended, or the Exchange Act, as a non-U.S. company with foreign private issuer status under the Exchange Act, and we will be

exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies. In addition, we will not be

required to file annual reports and financial statements with the SEC as promptly as U.S. domestic companies whose securities are registered

under the Exchange Act, and are not required to comply with Regulation FD, which restricts the selective disclosure of material information.

See “Risk Factors – We are an emerging growth company within the meaning of the Securities Act, and if we take advantage

of certain exemptions from disclosure requirements available to emerging growth companies, this could make it more difficult to compare

our performance with other public companies”.

Both

foreign private issuers and emerging growth companies are also exempt from certain executive compensation disclosure rules under the

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Even if we no longer qualify as an emerging growth company, so long

as we remain a foreign private issuer, we will continue to be exempt from certain executive compensation

disclosures required of companies that are neither an emerging growth company nor a foreign private issuer. See “Risk Factors

– We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses”.

Corporate

Information

The

Company’s principal office is located at 128 West Hastings Street, Unit 210, Vancouver, British Columbia V6B 1G8. Our telephone

number is (844) 427-8774. The SEC maintains an Internet site (http://www.sec.gov) that makes available

reports and other information regarding issuers that file electronically with the SEC. The Company’s website address is

www.bruush.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus. Investors

should not rely on any such information in deciding whether to purchase our securities.

The

Offering

This

prospectus relates to the offer and sale from time to time of up to an aggregate of 28,591,268 Common Shares by the Selling Securityholders.

| Securities

being offered |

|

The

Selling Securityholders are offering up to 28,591,268 Common Shares. |

| |

|

|

| Common

Shares outstanding prior to this offering |

|

1,594,492 Common Shares. (1)(2) |

| |

|

|

| Common

Shares outstanding after this offering |

|

35,352,168

Common Shares. (3)(4) |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of Common Shares by the Selling Securityholders. We may receive proceeds up to (i)

$1,553 in the event of the exercise in full of the Prefunded Warrant for cash, and (ii) $3,000 in the event of the exercise in full

of the Alchemy Warrants. Please refer to the sections entitled “Selling Securityholders” and “Plan

of Distribution”. We have agreed to bear the expenses relating to the registration of the Common Shares for the Selling Securityholders. |

| |

|

|

| Risk

factors |

|

Investing

in our securities is highly speculative and involves a high degree of risk.

You

should carefully consider the information set forth in the “Risk Factors” section in our Annual Report on Form 20-F for

the year ended October 31, 2022 incorporated by reference herein before deciding to invest in our securities. |

| |

|

|

| Dividends |

|

We

do not anticipate paying dividends on our Common Shares for the foreseeable future. |

| (1) |

Based

on 1,594,492 Common Shares outstanding as of October 23, 2023. |

| (2) |

Excludes a certain number of Common Shares held by Yaletown Bros. Ventures Ltd. that are being registered pursuant to this registration statement

and a certain number of Common Shares recently issued and registered on Registration Statement

File No. 333-272942 and Registration Statement File No. 333-274518. Assumes no exercise of any other outstanding warrants

or options. |

| (3) |

Includes

3,583,842 Common Shares registered on a registration statement on Form F-1 filed with the SEC, File No. 333-272942 (“Registration

Statement File No. 333-272942”) for resale by the selling securityholder named therein. |

| (4) |

Includes 1,582,566 Common Shares registered on a registration

statement on Form F-1 filed with the SEC, File No. 333-274518 (“Registration Statement File No. 333-274518”), for resale

by the selling securityholders named therein. |

Capitalization

The

following table sets forth our cash and capitalization as of April 30, 2023.

You

should read the following table in conjunction with “Use of Proceeds” in this prospectus and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, each as incorporated

by reference into this prospectus.

| | |

As of April 30, 2023 | |

| Cash | |

$ | 194,321 | |

| Loan payable | |

$ | 2,336,222 | |

| Warrant derivative | |

| 1,107,775 | |

| | |

| | |

| Share capital | |

| 24,889,414 | |

| Obligation to issue securities | |

| 283 | |

| Reserves | |

| 1,905,507 | |

| Accumulated deficit | |

| (31,970,826 | ) |

| Total stockholders’ equity | |

| (5,175,622 | ) |

| Total capitalization | |

$ | (1,731,625 | ) |

Outstanding

warrants are classified as financial liabilities in the table above and are included in the warrant derivative line on the Company’s

financial statements.

Dividend

Policy

Since

inception, we have not declared or paid any dividends on our Common Shares. We do not have any current plans to pay any such dividends

in the foreseeable future. We intend to retain most, if not all, of our available funds and any future earnings to operate and expand

our business. Because we do not anticipate paying any cash dividends on Common Shares in the foreseeable future, capital appreciation,

if any, will be your sole source of gains and you may never receive a return on your investment.

The

determination to pay dividends will be made at the discretion of our board of directors and may be based on a number of factors, including

our future operations and earnings, capital requirements and surplus, general financial condition, contractual and legal restrictions

and other factors that the board of directors may deem relevant.

Use

of Proceeds

The

Company will not receive any proceeds from the sale of Common Shares by the Selling Securityholders. We may receive proceeds up to

(i) $1,553 in the event of the exercise in full of the Prefunded Warrant for cash, and (ii) $3,000 in the event of the exercise in full

of the Alchemy Warrants. All proceeds from the sale of such Common Shares will be paid directly to the Selling Securityholders.

SELLING

SECURITYHOLDERS

The 28,591,268

Common Shares being offered by the Selling Securityholders consist of (i) in respect of Generating Alpha Ltd., (a) 79,724 Common

Shares, (b) 7,181,146 Common Shares issuable upon exercise of the Prefunded Warrant, and (c) 8,350,000 Common Shares issuable

upon exercise of the Warrant, (ii) in respect of Yaletown Bros. Ventures Ltd., 9,980,398 Common Shares, and (iii)

in respect of Alchemy Advisors LLC, 3,000,000 Common Shares issuable upon exercise of the Alchemy Warrants. For additional

information regarding the issuance of the Common Shares, see “Prospectus Summary – Recent Developments – October

2023 Private Placement” and “Prospectus Summary – Recent Developments – Credit Support Share

Agreement”. We are registering our Common Shares in order to permit the Selling Securityholders to offer the Common Shares

for resale from time to time. Except as otherwise described in the footnotes to the table below and for the ownership of the

registered shares issued pursuant to the Security Purchase Agreements, neither the Selling Securityholders nor any of the persons

that control any of them has had any material relationships with us or our affiliates within the past three (3) years.

The

table below lists the Selling Securityholders and other information regarding the beneficial ownership (as determined under Section 13(d)

of the Exchange Act (and the rules and regulations thereunder) of Common Shares offered hereby.

The

second column lists the number of Common Shares beneficially owned by each of the Selling Securityholders before this offering (including

shares which the Selling Securityholders have the right to acquire within 60 days, including upon conversion of any convertible securities).

The

third column lists the Common Shares that may be offered by the Selling Securityholders pursuant to this prospectus.

The

fourth and fifth columns list the number of Common shares beneficially owned by each Selling Securityholder and its percentage ownership

after the offering (including shares which the Selling Securityholders have the right to acquire within 60 days, including upon conversion

of any convertible securities), assuming the sale of all of the shares offered by each Selling Securityholder pursuant to this prospectus.

The

amounts and information set forth below are based upon information provided to us by the Selling Securityholders as of October 24,

2023, except as otherwise noted below. The Selling Securityholders may sell all or some of the Common Shares it is offering, and

may sell, unless indicated otherwise in the footnotes below, Common Shares otherwise than pursuant to this prospectus. The tables below

assume the Selling Securityholders sells all of the shares offered by them in offerings pursuant to this prospectus, and do not acquire

any additional shares. We are unable to determine the exact number of shares that will actually be sold or when or if these sales will

occur.

| Selling Securityholder |

|

Number of Shares Owned

Before Offering |

|

|

Shares Offered Hereby |

|

|

Number of Shares Owned

After Offering (1) |

|

|

Percentage of Shares

Beneficially Owned After Offering (1) |

|

| Generating Alpha Ltd. (2) |

|

|

15,610,870 |

|

|

|

15,610,870 |

|

|

|

0 |

|

|

|

- |

% |

| Yaletown Bros Ventures Ltd. (3) |

|

|

9,980,398 |

|

|

|

9,980,398 |

|

|

|

0 |

|

|

|

- |

% |

| Alchemy Advisors LLC (4) |

|

|

3,000,000 |

|

|

|

3,000,000 |

|

|

|

0 |

|

|

|

- |

% |

| TOTAL |

|

|

28,591,268 |

|

|

|

28,591,268 |

|

|

|

0 |

|

|

|

- |

% |

| |

(1) |

Assumes that

all Common Shares will be sold. |

| |

(2) |

Includes

79,724 Common Shares, 7,181,146 Common Shares issuable upon exercise of the Prefunded Warrant, and 8,350,000 Common

Shares issuable upon exercise of the Warrant. The securities are directly held by Generating Alpha Ltd., a company

organized under the law of St. Kitts and Nevis, and may be deemed to be beneficially owned by Maria Cano. The

warrants are subject to a beneficial ownership limitation of 4.99%, which such limitation restricts the Selling Stockholder from

exercising that portion of the warrants that would result in the Selling Stockholder and its affiliates owning, after exercise, a

number of Common Shares in excess of the beneficial ownership limitation. The address of Generating Alpha Ltd. is Hunkins

Waterfront Plaza, Suite 556, Main Street, Charlestown, Nevis. |

| |

(3) |

Yaletown Bros Ventures Ltd. is jointly owned by Matthew Friesen and

Bradley Friesen. The registered address of Yaletown Bros Ventures Ltd. is 1900 - 1040 West Georgia Street, Vancouver, British Columbia,

Canada. |

| |

(4) |

Includes 3,000,000 Common Shares issuable upon exercise

of the Alchemy Warrants. The address for Alchemy Advisors

LLC is 13600 Carr 968, Apt 64, Rio Grande, PR 00745. The controlling person of Alchemy Advisors LLC is Dmitriy Shapiro. As of October 23, 2023, Dmitriy Shapiro shall also be deemed as the beneficial

owner of 3,583,842 Common Shares, which includes Common Shares that Dmitriy Shapiro has the right to acquire within 60 days, including

upon conversion of any convertible securities in accordance with Rule 13(d)-3 under the Exchange Act, subject to the 4.99% beneficial

ownership limitation. |

Description

of COMMON SHARES

Common

Shares

The

following is a description of our Common Shares. You should read the material provisions of our Memorandum and Articles of Association

as incorporated by reference to Item 10B of our Annual Report on Form 20-F into this prospectus.

All

of our issued and outstanding Common Shares are fully paid and non-assessable. Our Common Shares are issuable in registered form and

are issued when registered in our register of members. Holders of Common Shares are entitled to one vote in respect of each share held.

The holders of Common Shares are entitled, out of any or all profits or surplus available for dividends, to receive, when, as and if

declared by the directors, those dividends as may be declared from time to time in respect of Common Shares. Common Shares are not redeemable

or retractable unless the board of directors determine otherwise, each holder of Common Shares will not receive a certificate evidencing

such shares. Holders of Common Shares may freely hold and vote their shares.

We

are authorized to issue an unlimited amount of Common Shares with no par value per share. Subject to the provisions of the Business Corporations

Act (British Columbia) (“Business Corporations Act”) and our articles regarding redemption and purchase of the shares, the

directors have general and unconditional authority to allot (with or without confirming rights of renunciation), grant options over or

otherwise deal with any unissued shares to such persons, at such times and on such terms and conditions as they may decide. Such authority

could be exercised by the directors to allot shares which carry rights and privileges that are preferential to the rights attaching to

common shares. No share may be issued at a discount except in accordance with the provisions of the Business Corporations Act and the

Nasdaq. The directors may refuse to accept any application for shares and may accept any application in whole or in part, for any reason

or for no reason.

On

August 1, 2023, the Company effected the Reverse Stock Split at a ratio of 1-for-25 to comply with the Nasdaq’s minimum bid price

requirement. As a result of the Reverse Stock Split, every 25 Common Shares issued and outstanding were exchanged for one Common Share.

If any fractional common shares are created as a result of the Consolidation, any fractional Common Share less than 0.50 will be cancelled

and any fractional Common Share greater than 0.50 will be rounded up to the nearest whole Common Share. Immediately after the Reverse

Stock Split became effective, the Company had approximately 511,368 Common Shares issued and outstanding.

Transfer

Agent and Registrar

Our

transfer agent and registrar is Endeavor Trust Corporation located at 702-777 Hornby Street, Vancouver, BC, V6Z 1S4. Their phone number

is (604) 559-8880.

Certain

Material Tax Considerations

The

following summary contains a description of some of the material Canadian and U.S. federal income tax consequences of the acquisition,

ownership and disposition of our Common Shares.

Certain

U.S. Federal Income Tax Considerations

The

following is a summary of the material U.S. federal income tax consequences to U.S. Holders (as defined below) of purchasing, owing and

disposing of our Common Shares. This discussion is included for general informational purposes only, does not purport to consider all

aspects of U.S. federal income taxation that might be relevant to a U.S. Holder, and does not constitute, and is not, a tax opinion for

or tax advice to any particular U.S. Holder. The summary does not address any U.S. tax matters other than those specifically discussed.

The summary is based on the provisions of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), existing Treasury

Regulations (including temporary regulations) issued thereunder, judicial decisions and administrative rulings and pronouncements and

other legal authorities, all as of the date hereof and all of which are subject to change, possibly with retroactive effect. Any such

change could alter the tax consequences described herein.

The

discussion below applies only to U.S Holders holding shares of our Common Shares as capital assets within the meaning of Section 1221

of the Code (generally, property held for investment), and does not address the tax consequences that may be relevant to U.S. Holders

who, in light of their particular circumstances, may be subject to special tax rules, including without limitation:

| |

● |

insurance

companies, tax-exempt organizations, regulated investment companies, real estate investment trusts, brokers or dealers in securities

or foreign currencies, banks and other financial institutions, mutual funds, retirement plans, traders in securities that elect to

mark-to-market, certain former U.S. citizens or long-term residents; |

| |

● |

U.S.

Holders that are classified for U.S. federal income tax purposes as partnerships and other pass-through entities and investors therein; |

| |

● |

U.S.

Holders who hold shares as part of a hedge, straddle, constructive sale, conversion, or other integrated or risk-reduction transaction,

as “qualified small business stock,” within the meaning of Section 1202 of the Code or as Section 1244 stock for purposes

of the Code; |

| |

● |

U.S.

Holders who hold shares through individual retirement or other tax-deferred accounts; |

| |

● |

U.S.

Holders that have a functional currency other than the U.S. dollar; |

| |

● |

U.S.

Holders who are subject to the alternative minimum tax provisions of the Code or the tax imposed by Section 1411 of the Code; |

| |

● |

U.S.

Holders who acquire shares pursuant to any employee share option or otherwise as compensation; |

| |

● |

U.S.

Holders required to accelerate the recognition of any item of gross income with respect to their holding of shares as a result of

such income being recognized on an applicable financial statement; or |

| |

● |

U.S.

Holders who hold or held, directly or indirectly, or are treated as holding or having held under applicable constructive attribution

rules, 10% or more of our shares, measured by voting power or value. |

Any

such U.S. Holders should consult their own tax advisors.

For

purposes of this discussion, a “U.S. Holder” means a holder of Common Shares that is or is treated, for U.S. federal income

tax purposes, as (i) an individual citizen or resident of the United States, (ii) a corporation (or other entity taxable as a corporation

for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any State thereof or the District

of Columbia or any entity treated as such for U.S. federal income tax purposes, (iii) an estate the income of which is subject to U.S.

federal income taxation regardless of its source, or (iv) a trust (A) the administration over which a U.S. court exercises primary supervision

and all of the substantial decisions of which one or more U.S. persons have the authority to control, or (B) that has a valid election

in effect under the applicable Treasury Regulations to be treated as a U.S. person under the Code.

If

a partnership or other pass-through entity (including any entity or arrangement treated as such for purposes of U.S. federal income tax

law) holds our shares, the tax treatment of a partner of such partnership or member of such entity will generally depend upon the status

of the partner and the activities of the partnership. Partnerships and other pass-through entities holding our shares, and any person

who is a partner or member of such entities should consult their own tax advisors regarding the tax consequences of purchasing, owning

and disposing of the shares.

Passive

Foreign Investment Company Considerations

A

non-U.S. corporation will be classified as a passive foreign investment company, or PFIC, for U.S. federal income tax purposes, if, in

the case of any particular taxable year, either (i) 75% or more of its gross income for such taxable year consists of certain types of

“passive” income or (ii) 50% or more of the value of its assets (based on an average of the quarterly values of the assets)

during such taxable year is attributable to assets that produce or are held for the production of passive income. For this purpose, a

foreign corporation will be treated as owning its proportionate share of the assets and earning its proportionate share of the income

of any other non-U.S. corporation in which it owns, directly or indirectly, more than 25% (by value) of the stock. In the PFIC analysis,

cash is categorized as a passive asset, and the company’s un-booked intangibles associated with active business activities may

generally be classified as active assets. Passive income generally includes, among other things, dividends, interest, rents, royalties,

and gains from the disposition of passive assets.

Based

upon our current income and assets and projections as to the value of our Common Shares, we do not presently expect that we will be classified

as a PFIC for the 2023 taxable year or the foreseeable future. The determination of whether we will be or become a PFIC will depend upon

the composition of our income (which may differ from our historical results and current projections) and assets and the value of its

assets from time to time, including, in particular the value of its goodwill and other unbooked intangibles (which may depend upon the

market value of our Common Shares from time to time and may be volatile). It is also possible that the IRS may challenge the classification

or valuation of our assets, including goodwill and other unbooked intangibles, or the classification of certain amounts received by us,

including interest earnings, which may result in our being, or becoming classified as, a PFIC for the 2023 taxable year, or future taxable

years.

The

determination of whether we will be or become a PFIC may also depend, in part, on how, and how quickly, we use liquid assets and the

cash proceeds of this offering or otherwise. If we were to retain significant amounts of liquid assets, including cash, the risk of being

classified as a PFIC may substantially increase. Because there are uncertainties in the application of the relevant rules and PFIC status

is a factual determination made annually after the close of each taxable year, there can be no assurance that we will not be a PFIC for

the 2023 taxable year or any future taxable year, and no opinion of counsel has or will be provided regarding our classification as a

PFIC. If we were classified as a PFIC for any year during which a holder held Common Shares, we generally would continue to be treated

as a PFIC for all succeeding years during which such holder held our shares. The discussion below under “—Dividends Paid

on Shares of Common Shares” and “—Sale or Other Disposition of Shares” is written on the basis that we

will not be classified as a PFIC for U.S. federal income tax purposes.

Dividends

Paid on Shares of Common Shares

We

have never paid dividends with respect to our Common Shares and we have no plan to do so in the foreseeable future. In the event our

dividend policy were to change, the following discussion addresses the U.S. tax consequences of any dividends we might distribute. Subject

to the PFIC rules described below, any cash distributions (including constructive distributions) paid with respect to the shares of

our Common Shares out of our current or accumulated earnings and profits, as determined under U.S. federal income tax principles,

will generally be includible in the gross income of a U.S. Holder as dividend income on the day actually or constructively received by

the U.S. Holder. Because we do not intend to determine our earnings and profits on the basis of U.S. federal income tax principles, any

distribution will generally be treated as a “dividend” for U.S. federal income tax purposes. Under current law, a non-corporate

recipient of a dividend from a “qualified foreign corporation” will generally be subject to tax on the dividend income at

the lower applicable net capital gains rate rather than the marginal tax rates generally applicable to ordinary income, provided certain

holding period and other requirements are met.

A

non-U.S. corporation (other than a corporation that is classified as a PFIC for the taxable year in which the dividend is paid or the

preceding taxable year) will generally be considered to be a qualified foreign corporation (i) if it is eligible for the benefits of

a comprehensive tax treaty with the United States which the Secretary of Treasury of the United States determines is satisfactory for

purposes of this provision and which includes an exchange of information program, or (ii) with respect to any dividend it pays on stock,

which is readily tradable on an established securities market in the United States. We believe we are eligible for the benefits of the

Convention Between the United States of America and Canada with Respect to Taxes on Income and Capital (or the United States-Canada income

tax treaty), which the Secretary of the Treasury of the United States has determined is satisfactory for this purpose and includes an

exchange of information program, in which case we would be treated as a qualified foreign corporation with respect to dividends paid

in respect of our Common Shares. U.S. Holders are urged to consult their tax advisors regarding the availability of the reduced tax rate

on dividends in their particular circumstances. Dividends received in respect of our Common Shares will not be eligible for the dividends

received deduction allowed to corporations.

Sale

or Other Disposition of Shares

Subject

to the PFIC rules discussed below, a U.S. Holder of our Common Shares will generally recognize capital gain or loss, if any, upon

the sale or other disposition of Common Shares and warrants in an amount equal to the difference between the amount realized upon

such sale or other disposition and the U.S. Holder’s adjusted tax basis in such shares. Any capital gain or loss will be long-term

capital gain or loss if the shares have been held for more than one year and will generally be United States source capital gain or loss

for United States foreign tax credit purposes. Long-term capital gains of non-corporate taxpayers are currently eligible for reduced

rates of taxation.

Disposition

of Foreign Currency

U.S.

Holders are urged to consult their tax advisors regarding the tax consequences of receiving, converting or disposing of any non-U.S.

currency received as dividends on our Common Shares.

Tax

on Net Investment Income

U.S.

Holders may be subject to an additional 3.8% Medicare tax on some or all of such U.S. Holder’s “net investment income”

as defined in Section 1411 of the Code. Net investment income generally includes income from the shares unless such income is derived

in the ordinary course of the conduct of a trade or business (other than a trade or business that consists of certain passive or trading

activities). You should consult your tax advisors regarding the effect this tax may have, if any, on your acquisition, ownership or disposition

of Common Shares.

Passive

Foreign Investment Company Rules

If

we are classified as a PFIC for any taxable year during which a U.S. Holder holds shares of our Common Shares, unless the holder

makes a mark-to-market election (as described below), the holder will, except as discussed below, be subject to special tax rules that

have a penalizing effect, regardless of whether we remain a PFIC, on (i) any “excess distribution” that we make to the holder

(which generally means any distribution paid during a taxable year to a holder that is greater than 125% of the average annual distributions

paid in the three preceding taxable years or, if shorter, the holder’s holding period for the shares), and (ii) any gain realized

on the sale or other disposition, including, under certain circumstances, a pledge, of our Common Shares.

Under

the PFIC rules:

| |

● |

The

excess distribution and/or gain will be allocated ratably over the U.S. Holder’s holding period for the Common Shares; |

| |

|

|