UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16

or 15d-16 of the Securities Exchange Act of 1934

| For the month of |

October 2023 |

| |

|

| Commission File Number |

001-41460 |

Bruush

Oral Care Inc.

(Translation

of registrant’s name into English)

128

West Hastings Street, Unit 210

Vancouver,

British Columbia V6B 1G8

Canada

(844)

427-8774

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

INFORMATION

CONTAINED IN THIS FORM 6-K REPORT

Amendment

to Credit Support Agreement

On

August 25, 2023, Bruush Oral Care Inc. (the “Company”) entered into a credit support fee agreement (the “Credit Support

Agreement”) with one of the Company’s shareholders, Yaletown Bros Ventures Ltd. (“YBV”), pursuant to which YBV

agreed to provide for the Company an irrevocable standby letter of credit in the face amount of $2 million (the “Credit Support”).

In consideration of the Credit Support, the Company agreed to issue to YBV Common Shares (the “Shares”), to be delivered

as follows: (i) on September 25, 2023, a number of Shares equal to the initial amount of the Credit Support divided by the closing price

of the Shares on September 22, 2023, and (ii) if the provision of Credit Support is ongoing as of September 25, 2023, for every succeeding

week, an amount equal to 25% of the initial amount of the Credit Support divided by the closing price of the Shares on the last

trading day prior to delivery of such Common Shares on each of October 3, 2023, October 10, 2023, October 17, 2023, and October 24, 2023.

On

October 23, 2023, the Company and YBV entered into an amendment to Credit Support Agreement (the “Amendment to Credit Support Agreement”).

Pursuant to the Amendment to Credit Support Agreement, if the Credit Support has been drawn as of October 24, 2023, the Company shall

cause to be issued to YBV additional Shares in an amount equal to 100% of the Drawn Credit Amount (as defined below), divided

by the closing price of the Shares on the last trading day prior to October 24, 2023. Further, following the sale by YBV of all of such

Shares as YBV shall have received in respect of this Agreement (the “YBV Share Sale”), if the proceeds of the YBV Share Sale

shall be less than the amount of the Credit Support drawn by the creditor (the “Drawn Credit Amount”), the Company shall

pay to YBV cash in an amount equal to the difference between Drawn Credit Amount and the proceeds of the YBV Share Sale.

The

description of the Amendment to Credit Support Agreement set forth above is qualified in its entirety by reference to the full text of

Amendment to Credit Support Agreement, which is attached hereto as Exhibit 10.1.

Consulting

Agreement

On

October 23, 2023, the Company entered into a consulting agreement (the “Alchemy Consulting Agreement”) with Alchemy Advisors

LLC (the “Consultant”), whereby the Consultant was engaged by the Company as a business consultant. In return for the services

rendered by the Consultant, the Company issued to the Consultant 3,000,000 prefunded warrants of the Company (the “Warrants”)

to purchase 3,000,000 Shares of the Company. The Warrants are exercisable for five years, and the exercise price is $0.001

per share. The exercise of Warrants is subject to the beneficial ownership limitation. The Warrants also permit for cashless exercise

and have piggyback registration rights.

The

description of the Alchemy Consulting Agreement set forth above is qualified in its entirety by reference to the full text of Alchemy

Consulting Agreement, which is attached hereto as Exhibit 10.2.

Exhibits:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

|

|

Bruush

Oral Care Inc. |

| |

|

|

(Registrant) |

| |

|

|

|

|

| Date: |

October

24, 2023 |

|

By: |

/s/ Aneil

Singh Manhas |

| |

|

|

Name: |

Aneil Singh Manhas |

| |

|

|

Title: |

Chief Executive Officer |

Exhibit 10.1

AMENDMENT

TO

CREDIT

SUPPORT SHARE AGREEMENT

THIS

AMENDMENT TO CREDIT SUPPORT SHARE AGREEMENT (this “Amendment”) is dated effective as of October 23, 2023 (the

“Amendment Effective Date”), by and among BRUUSH ORAL CARE INC., a British Columbia company having its principal place

of business at 128 West Hastings Street, Unit 210, Vancouver, British Columbia (“Company”), and YALETOWN BROS VENTURES

LTD., a British Columbia company having a registered office at 1900 - 1040 West Georgia Street, Vancouver, British Columbia (“YBV”,

and together with Company, the “Parties”, and each, a “Party”).

WHEREAS,

the Company and Holders previously entered into that certain Credit Support Share, dated and effective as of August 25, 2023 (the “Agreement”);

and

WHEREAS,

the Parties have agreed to amend the Agreement in the manner and under the terms set forth in this Amendment;

NOW

THEREFORE, in consideration of the premises and the mutual covenants of the parties hereinafter expressed and other good and valuable

consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto, each intending to be legally bound, agree

as follows:

1.

Recitals. The recitations set forth in the preamble of this Amendment are true and correct and incorporated herein by this reference.

2.

Capitalized Terms. All capitalized terms used in this Amendment shall have the same meaning ascribed to them in the Agreement,

except as otherwise specifically set forth herein.

3.

Conflicts. In the event of any conflict or ambiguity by and between the terms and provisions of this Amendment and the terms and

provisions of the Agreement, the terms and provisions of this Amendment shall control, but only to the extent of any such conflict or

ambiguity.

4.

Amendments. Section 3 of the Agreement is hereby deleted in its entirety and replaced as follows:

3.

Repayment of the Credit Support. If as of October 24, 2023, TD shall have drawn on the Credit Support, the Company shall cause

to be issued to YBV, additional Shares in an amount equal to 100% of the Drawn Credit Amount, divided by the closing price of

the Shares on the last trading day prior to October 24, 2023. Further, following the sale by YBV of all of such Shares as YBV shall have

received in respect of this Agreement (the “YBV Share Sale”), if the proceeds of the YBV Share Sale shall be less

than the amount of the Credit Support drawn by TD (the “Drawn Credit Amount”), the Company shall pay to YBV cash in

an amount equal to the difference between Drawn Credit Amount and the proceeds of the YBV Share Sale.

5.

No Other Amendment. All other terms and conditions of the Agreement shall remain in full force and effect and the Agreement shall

be read and construed as if the terms of this Amendment were included therein by way of addition or substitution, as the case may be.

6.

Governing Law. This Amendment shall be construed and interpreted in accordance with governing law provisions of the Agreement.

7.

Amendment Effective Date. All references in the Agreement to the Agreement on and after the date hereof shall be deemed to refer

to the Agreement as amended hereby, and the parties hereto agree that on and after the Amendment Effective Date, the Agreement, as amended

hereby, is in full force and effect.

8.

Effect on Agreement. Except as expressly amended by this Amendment, all of the terms and provisions of the Agreement shall remain

and continue in full force and effect after the execution of this Amendment, are hereby ratified and confirmed, and incorporated herein

by this reference.

9.

Execution. This Amendment may be executed in one or more counterparts, all of which taken together shall be deemed and considered

one and the same Amendment. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf”

format file or other similar format file, such signature shall be deemed an original for all purposes and shall create a valid and binding

obligation of the party executing same with the same force and effect as if such facsimile or “.pdf” signature page was an

original thereof.

[Signatures

on the following page]

IN

WITNESS WHEREOF, the parties have executed this Amendment as of the date first above written.

BRUUSH

ORAL CARE INC.

| By: |

/s/ Aneil Manhas |

|

| Name: |

Aneil Manhas |

|

| Title: |

CEO |

|

| |

|

| YALETOWN BROS

VENTURES LTD. |

|

| |

|

| By: |

/s/ Matthew Friesen |

|

| Name: |

Matthew Friesen |

|

| Title: |

Director |

|

Exhibit 10.2

CONSULTING

AGREEMENT

This

Consulting Agreement (the “Agreement”) is entered into as of this 23rd day of October, 2023 (the “Effective

Date”), by and between Alchemy Advisory LLC (the “Consultant”), and Bruush Oral Care Inc. (the “Company”)

having its principal place of business at 128 West Hastings Street, Unit 210, Vancouver, British Columbia V6B 1G8 Canada. The Company

and Consultant are collectively referred to herein as the “Parties”.

WHEREAS,

Consultant is operating as a financial and business consultant;

WHEREAS,

the Company desires to retain Consultant, and Consultant desire to be retained by the Company;

NOW,

THEREFORE, in consideration of the premises and promises, warranties and representations herein contained, it is agreed as follows:

1.

DUTIES.

(a) The

Company hereby engages the Consultant, and the Consultant hereby accepts engagement as a strategy business consultant of the Company.

It is understood and agreed, and it is the express intention of the Parties to this Agreement, that the Consultant is an independent

contractor, and not an employee or agent of the Company for any purpose whatsoever. Consultant shall perform all duties and obligations

as described in this Section and agrees to be available at such times as may be scheduled by the Company. It is understood, however,

that the Consultant will maintain Consultant’s own business in addition to providing services to the Company. The Consultant agrees

to promptly perform all services required of the Consultant hereunder in an efficient, professional, trustworthy and business-like manner.

In such capacity, Consultant will utilize only materials, reports, financial information or other documentation that is approved in writing

in advance by the Company.

(b) Description

of Consulting Services. The Consultant agrees, to the extent reasonably required in the conduct of its business with the Company, to

place at the disposal of the Company its judgment and experience and to provide financial and business advice to the Company including,

but not limited, to (a) help drafting a public company competitive overview, (b) help preparing and/or reviewing a valuation analysis,

(c) help drafting marketing materials and presentations, (d) reviewing the Company’s business requirements and discuss financing

and businesses opportunities, (e) investor marketing, (f) investor relations introductions, (g) legal counsel introductions, (h) auditor

introductions, (i) investment banking and research introductions, (j) m&a canvassing and ways to grow the business organically, (k)

stand by capital markets advisory services as needed, and (v) anything else the Company may reasonably require from the Consultant.

2. TERM.

The Term of this contract is for 6 months, at which point the contract can be extended for another 6 months, with the consent of both

Parties in writing.

3. COMPENSATION.

For services rendered hereunder, the Company shall issue to the Consultant 3,000,000 Prefunded Warrants of the Company (the “Warrants”).

Warrants will have a 5 year Maturity and an Exercise Price of $0.001 and will also permit for Cashless Exercise.

(a)

Cashless Exercise. This Warrant may be exercised, in whole or in part, at any time by means of a “cashless exercise”

in which the Holder shall be entitled to receive a number of Warrant Shares equal to the quotient obtained by dividing [(A-B) (X)] by

(A), where:

| ● | (A)

= as applicable: (i) the VWAP on the Trading Day immediately preceding the date of the applicable

Notice of Exercise if such Notice of Exercise is (1) both executed and delivered pursuant

to Section 2(a) hereof on a day that is not a Trading Day or (2) both executed and delivered

pursuant to Section 2(a) hereof on a Trading Day prior to the opening of “regular trading

hours” (as defined in Rule 600(b)(64) of Regulation NMS promulgated under the federal

securities laws) on such Trading Day, (ii) at the option of the Holder, either (y) the VWAP

on the Trading Day immediately preceding the date of the applicable Notice of Exercise or

(z) the Bid Price of the Common Stock on the principal Trading Market as reported by Bloomberg

L.P. as of the time of the Holder’s execution of the applicable Notice of Exercise

if such Notice of Exercise is executed during “regular trading hours” on a Trading

Day and is delivered within two (2) hours thereafter (including until two (2) hours after

the close of “regular trading hours” on a Trading Day) pursuant to Section 2(a)

hereof or (iii) the VWAP on the date of the applicable Notice of Exercise if the date of

such Notice of Exercise is a Trading Day and such Notice of Exercise is both executed and

delivered pursuant to Section 2(a) hereof after the close of “regular trading hours”

on such Trading Day; |

| ● | (B)

= the Exercise Price of this Warrant, as adjusted hereunder; and |

| ● | (X)

= the number of Warrant Shares that would be issuable upon exercise of this Warrant in accordance

with the terms of this Warrant if such exercise were by means of a cash exercise rather than

a cashless exercise. |

| ● | If

Warrant Shares are issued in such a cashless exercise, the parties acknowledge and agree

that in accordance with Section 3(a)(9) of the Securities Act, the Warrant Shares shall take

on the characteristics of the Warrants being exercised. The Company agrees not to take any

position contrary to this Section 2(c). |

(b) Holder’s

Exercise Limitations. The Company shall not effect any exercise of this Warrant, and a Holder shall not have the right to exercise

any portion of this Warrant, pursuant to Section 2 or otherwise, to the extent that after giving effect to such issuance after exercise

as set forth on the applicable Notice of Exercise, the Holder (together with the Holder’s Affiliates, and any other Persons acting

as a group together with the Holder or any of the Holder’s Affiliates (such Persons, “Attribution Parties”)), would

beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For purposes of the foregoing sentence, the number

of shares of Common Stock beneficially owned by the Holder and its Affiliates and Attribution Parties shall include the number of shares

of Common Stock issuable upon exercise of this Warrant with respect to which such determination is being made, but shall exclude the

number of shares of Common Stock which would be issuable upon (i) exercise of the remaining, nonexercised portion of this Warrant beneficially

owned by the Holder or any of its Affiliates or Attribution Parties and (ii) exercise or conversion of the unexercised or nonconverted

portion of any other securities of the Company (including, without limitation, any other Common Stock Equivalents) subject to a limitation

on conversion or exercise analogous to the limitation contained herein beneficially owned by the Holder or any of its Affiliates or Attribution

Parties. Except as set forth in the preceding sentence, for purposes of this Section 2(e), beneficial ownership shall be calculated in

accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder, it being acknowledged by the

Holder that the Company is not representing to the Holder that such calculation is in compliance with Section 13(d) of the Exchange Act

and the Holder is solely responsible for any schedules required to be filed in accordance therewith. To the extent that the limitation

contained in this Section 2(e) applies, the determination of whether this Warrant is exercisable (in relation to other securities owned

by the Holder together with any Affiliates and Attribution Parties) and of which portion of this Warrant is exercisable shall be in the

sole discretion of the Holder, and the submission of a Notice of Exercise shall be deemed to be the Holder’s determination of whether

this Warrant is exercisable (in relation to other securities owned by the Holder together with any Affiliates and Attribution Parties)

and of which portion of this Warrant is exercisable, in each case subject to the Beneficial Ownership Limitation, and the Company shall

have no obligation to verify or confirm the accuracy of such determination. In addition, a determination as to any group status as contemplated

above shall be determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder.

For purposes of this Section 2(e), in determining the number of outstanding shares of Common Stock, a Holder may rely on the number of

outstanding shares of Common Stock as reflected in (A) the Company’s most recent periodic or annual report filed with the Commission,

as the case may be, (B) a more recent public announcement by the Company or (C) a more recent written notice by the Company or the Transfer

Agent setting forth the number of shares of Common Stock outstanding. Upon the written or oral request of a Holder, the Company shall

within one Trading Day confirm orally and in writing to the Holder the number of shares of Common Stock then outstanding. In any case,

the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities

of the Company, including this Warrant, by the Holder or its Affiliates or Attribution Parties since the date as of which such number

of outstanding shares of Common Stock was reported. The “Beneficial Ownership Limitation” shall be 9.99% of the number of

shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock issuable upon exercise

of this Warrant. The Holder, upon notice to the Company, may increase or decrease the Beneficial Ownership Limitation provisions of this

Section 2(e), provided that the Beneficial Ownership Limitation in no event exceeds 9.99% of the number of shares of the Common Stock

outstanding immediately after giving effect to the issuance of shares of Common Stock upon exercise of this Warrant held by the Holder

and the provisions of this Section 2(e) shall continue to apply. Any increase in the Beneficial Ownership Limitation will not be effective

until the 61st day after such notice is delivered to the Company. The provisions of this paragraph shall be construed and implemented

in a manner otherwise than in strict conformity with the terms of this Section 2(e) to correct this paragraph (or any portion hereof)

which may be defective or inconsistent with the intended Beneficial Ownership Limitation herein contained or to make changes or supplements

necessary or desirable to properly give effect to such limitation. The limitations contained in this paragraph shall apply to a successor

holder of this Warrant.

4. EXPENSES.

The Company agrees to reimburse the Consultant from time to time, for reasonable and pre-approved in writing, including via email, out-of-pocket

expenses incurred by Consultant in connection with its activities under this Agreement.

5.

INVESTOR REPRESENTATIONS. The Consultant represents and warrants to the Company that:

(a) The

Consultant represents that it is an “accredited investor” as such term is defined in Rule 501(a) of Regulation D under the

Securities Act of 1933, as amended (the “Securities Act”), and acknowledges that the sale contemplated hereby is being

made in reliance, among other things, on a private placement exemption to “accredited investors” under the Securities Act

and similar exemptions under state law.

(b)

The Consultant is acquiring the Warrants solely for investment purposes, for the Consultant’s own account (and/or for the account

or benefit of its members or affiliates, as permitted, and not with a view to the distribution thereof and the Consultant has no present

arrangement to sell the Warrants to or through any person or entity.

(c)

The Consultant acknowledges and understands the Warrants are being transferred to it by the Company in a transaction not involving a

public offering in the United States within the meaning of the Securities Act. The Warrants have not been registered under the Securities

Act and, if in the future the Consultant decides to offer, resell, pledge or otherwise transfer the Warrants, such Warrants may be offered,

resold, pledged or otherwise transferred only (A) pursuant to an effective registration statement filed under the Securities Act, (B)

pursuant to an exemption from registration under Rule 144 promulgated under the Securities Act, if available, or (C) pursuant to any

other available exemption from the registration requirements of the Securities Act, and in each case in accordance with any applicable

Warrants laws of any state or any other jurisdiction. Consultant agrees that if any transfer of its Warrants or any interest therein

is proposed to be made, as a condition precedent to any such transfer, the Consultant may be required to deliver to the Company an opinion

of counsel satisfactory to the Company with respect to such transfer. Absent registration or another available exemption from registration,

the Consultant agrees it will not resell the Warrants.

(d)

The Consultant is sophisticated in financial matters and is able to evaluate the risks and benefits of the investment in the Warrants.

(e)

The Consultant is aware that an investment in the Warrants is highly speculative and subject to substantial risks because, among other

things, the Warrants are subject to transfer restrictions and have not been registered under the Securities Act and therefore cannot

be sold unless subsequently registered under the Securities Act or an exemption from such registration is available. The Consultant is

able to bear the economic risk of its investment in the Warrants for an indefinite period of time.

(f)

The Consultant, in making the decision to acquire the Warrants, has relied upon an independent investigation of the Company and has not

relied upon any information or representations made by any third parties or upon any oral or written representations or assurances from

the Company, its officers, directors or employees or any other representatives or agents of the Company. The Consultant is familiar with

the business, operations and financial condition of the Company and has had an opportunity to ask questions of, and receive answers from

the Company’s officers and directors concerning the Company has had full access to such other information concerning the Company

as the Consultant has requested.

6. PIGGYBACK

REGISTRATION RIGHTS. If the Company shall determine to register for sale for cash any of its securities, for its own account

or for the account of others (other than the Consultant), other than (i) a registration relating solely to employee benefit plans or

securities issued or issuable to employees, consultants (to the extent the securities owned or to be owned by such consultants could

be registered on Form F-8) (ii) a registration relating solely to a Securities Act Rule 145 transaction or a registration on Form F-4

in connection with a merger, acquisition, divestiture, reorganization or similar event, or (iii) in connection with any offering involving

an underwriting of securities to be issued by the Company, the managing underwriter shall prohibit the inclusion of securities by selling

holders in such registration statement or shall impose a limitation on the number of securities which may be included in any such registration

statement because, in its judgment, such limitation is necessary to effect an orderly public distribution, and such limitation is imposed

pro rata with respect to all securities whose holders have a contractual, incidental (piggyback) right to include such securities in

the registration statement and as to which inclusion has been requested pursuant to such right and there is first excluded from such

registration statement all securities sought to be included therein by (A) any holder thereof not having any such contractual, incidental

registration rights, and (B) any holder thereof having contractual, incidental registration rights subordinate and junior to the Consultant’s

Registrable Securities, the Company shall then be obligated to include in such registration statement only such limited portion (which

may be none) of the Consultant’s Registrable Securities with respect to which such holder has requested inclusion hereunder. The

Company shall promptly give to the Consultant written notice thereof (and in no event shall such notice be given less than ten (10) calendar

days prior to the filing of such registration statement), and shall include as a Piggyback Registration all of the Warrants specified

in a written request delivered by the Consultant thereof within five (5) calendar days after receipt of such written notice from the

Company. However, the Company may, without the consent of the Consultant, withdraw such registration statement prior to it becoming effective

if the Company or such other stockholders have elected to abandon the proposal to register the securities proposed to be registered thereby.

7. CONFIDENTIALITY.

All knowledge and information of a proprietary and confidential nature relating to the Company which the Consultant obtains during

the Consulting period, from the Company or the Company’s employees, agents or Consultants shall be for all purposes regarded and

treated as strictly confidential for so long as such information remains proprietary and confidential and shall be held in trust by the

Consultant solely for the Company’s benefit and use and shall not be directly or indirectly disclosed by the Consultant to any

person without the prior written consent of the Company, which consent may be withheld by the Company in its sole discretion.

8. INDEPENDENT

CONTRACTOR STATUS. Consultant understands that since the Consultant is not an employee of the Company, the Company will not withhold

income taxes or pay any employee taxes on its behalf, nor will it receive any fringe benefits. The Consultant shall not have any authority

to assume or create any obligations, express or implied, on behalf of the Company and shall have no authority to represent the Company

as an agent, employee or in any other capacity that as herein provided.

9. TERMINATION.

This Agreement may be terminated by mutual consent of both Parties at any time, provided, however, that a termination shall not relieve

the Company from paying the compensation already accrued.

10. NO

THIRD-PARTY RIGHTS. The Parties warrant and represent that they are authorized to enter into this Agreement and that no third

parties, other than the Parties hereto, have any interest in any of the services contemplated hereby.

11. ABSENCE

OF WARRANTIES AND REPRESENTATIONS. Each party hereto acknowledges that they have signed this Agreement without having

relied upon or being induced by any agreement, warranty or representation of fact or opinion of any person not expressly set forth

herein. All representations and warranties of either Party contained herein shall survive its signing and delivery.

12. GOVERNING

LAW. This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

13. ATTORNEY

FEES. In the event of any controversy, claim or dispute between the Parties hereto, arising out of or in any manner relating

to this Agreement or its fruition, including of an attempt to rescind or set aside this Agreement; it is hereby agreed that the prevailing

Party in any such action brought shall be entitled to recover its reasonable attorney’s fees and costs, irrespective of the merits

of the suit, so long as the expense and the costs were incurred in connection and as a direct result of such controversy, claim, or dispute

pertaining to this Agreement.

14. VALIDITY.

If any paragraph, sentence, term or provision hereof shall be held to be invalid or unenforceable for any reason; such invalidity or

unenforceability shall not affect the validity enforceability of any other paragraph, sentence, term and provision contained herein.

To the extent required, any paragraph, sentence, term or provision of this Agreement may be modified by the Parties hereto by a written

amendment to preserve its validity and enforceability.

15. NON-DISCLOSURE

OF TERMS. The terms of this Agreement shall be kept confidential, and no Party, its representative, associate, attorney or family

member shall reveal its contents to any third party, except as may be required by the law or as shall be necessary to comply with the

applicable laws or Parties pre-existing contractual commitments.

16. ENTIRE

AGREEMENT. This Agreement contains the entire understanding of the Parties and cannot be altered or amended except by an

amendment duly executed by all Parties hereto, in writing. This Agreement supersedes and replaces any and all previous

agreements between the Parties, and any negotiations thereof. This Agreement shall be binding upon and inure to the benefit of the

successors, assigns and personal representatives of the Parties.

IN

WITNESS WHEREOF, the Parties hereto have executed this Agreement effective as of the date first written above.

| The Company |

|

The Consultant |

| |

|

|

| Bruush Oral

Care Inc. |

|

Alchemy Advisory

LLC |

| |

|

|

| By: |

/s/ Aneil Manhas |

|

By: |

/s/ Dmitriy Shapiro |

| Name: |

Aneil Manhas |

|

Name: |

Dmitriy Shapiro |

| Title: |

Chief Executive Officer |

|

Title: |

|

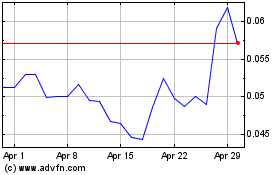

Bruush Oral Care (NASDAQ:BRSH)

Historical Stock Chart

From Apr 2024 to May 2024

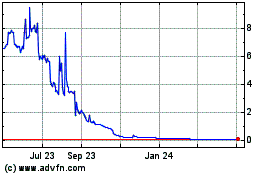

Bruush Oral Care (NASDAQ:BRSH)

Historical Stock Chart

From May 2023 to May 2024