UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16

or 15d-16 of the Securities Exchange Act of 1934

| For the month of |

September 2023 |

| |

|

| Commission File Number |

001-41460 |

Bruush

Oral Care Inc.

(Translation

of registrant’s name into English)

128

West Hastings Street, Unit 210

Vancouver,

British Columbia V6B 1G8

Canada

(844)

427-8774

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

INFORMATION

CONTAINED IN THIS FORM 6-K REPORT

On

September 14, 2023, Bruush Oral Care Inc. (the “Company”) issued its unaudited condensed financial statements and

the related management discussion and analysis as of and for the six months ended April 30, 2023 and April 30, 2022. The financial statements

and related management discussion and analysis are attached hereto as Exhibit 99.1 and 99.2, respectively, and are incorporated herein

by reference.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

|

|

|

Bruush

Oral Care Inc. |

| |

|

|

|

(Registrant) |

| |

|

|

|

|

| Date: |

September

14, 2023 |

|

By: |

/s/ Aneil

Singh Manhas |

| |

|

|

Name: |

Aneil Singh Manhas |

| |

|

|

Title: |

Chief Executive Officer |

Exhibit

99.1

BRUUSH

ORAL CARE INC.

CONDENSED

INTERIM FINANCIAL STATEMENTS

FOR

THE THREE AND SIX MONTHS ENDED APRIL 30, 2023

(Expressed

in U.S. dollars)

BRUUSH

ORAL CARE INC.

CONDENSED

INTERIM STATEMENTS OF FINANCIAL POSITION

(Unaudited

- Expressed in U.S. dollars)

| As

at | |

Note | | |

April

30, 2023 | | |

October

31, 2022 | |

| | |

| | |

| | |

| |

| ASSETS | |

| | |

| | | |

| | |

| Current | |

| | |

| | | |

| | |

| Cash | |

| | |

$ | 194,321 | | |

$ | 72,921 | |

| Term

deposit | |

| | |

| - | | |

| 18,506 | |

| Accounts

and other receivables | |

3 | | |

| 152,604 | | |

| 175,256 | |

| Inventory | |

4 | | |

| 142,950 | | |

| 241,341 | |

| Prepaid

expenses and deposits | |

5 | | |

| 395,976 | | |

| 677,474 | |

| | |

| | |

| 885,851 | | |

| 1,185,498 | |

| Non-current | |

| | |

| | | |

| | |

| Equipment | |

| | |

| 4,914 | | |

| 5,619 | |

| Total

assets | |

| | |

$ | 890,765 | | |

$ | 1,191,117 | |

| | |

| | |

| | | |

| | |

| LIABILITIES

AND SHAREHOLDERS’ EQUITY | |

| | |

| | | |

| | |

| Current | |

| | |

| | | |

| | |

| Accounts

payable and accrued liabilities | |

6,8 | | |

$ | 2,308,607 | | |

$ | 1,345,288 | |

| Due

to related party | |

8 | | |

| 311,774 | | |

| - | |

| Loan

payable | |

7 | | |

| 2,336,222 | | |

| - | |

| Deferred

revenue | |

| | |

| 2,009 | | |

| 6,045 | |

| Warrant

derivative | |

10 | | |

| 1,107,775 | | |

| 1,242,580 | |

| Total

liabilities | |

| | |

| 6,066,387 | | |

| 2,593,913 | |

| | |

| | |

| | | |

| | |

| SHAREHOLDERS’

EQUITY | |

| | |

| | | |

| | |

| Share

capital | |

9 | | |

| 24,889,414 | | |

| 23,845,704 | |

| Obigation

to issue securities | |

9 | | |

| 283 | | |

| - | |

| Reserves | |

9 | | |

| 1,905,507 | | |

| 1,137,814 | |

| Accumulated

deficit | |

| | |

| (31,970,826 | ) | |

| (26,386,314 | ) |

| Total

shareholders’ equity | |

| | |

| (5,175,622 | ) | |

| (1,402,796 | ) |

| Total

liabilities and shareholders’ deficiency | |

| | |

$ | 890,765 | | |

$ | 1,191,117 | |

Nature

of operations and going concern (Note 1)

Contingencies

(Note 14)

Subsequent

events (Notes 7, 9 and 14)

Approved

and authorized for issue by the Board of Directors on September 13, 2023.

The

accompanying notes are an integral part of these condensed interim financial statements.

BRUUSH

ORAL CARE INC.

CONDENSED

INTERIM STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited

- Expressed in U.S. dollars, except for the number of shares)

| | |

| | |

Three

months ended | | |

Six

months ended | |

| | |

Note | | |

April

30, 2023 | | |

April

30, 2022 | | |

April

30, 2023 | | |

April

30, 2022 | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

| | |

$ | 325,532 | | |

$ | 301,978 | | |

$ | 1,401,624 | | |

$ | 1,111,808 | |

| Cost

of goods sold | |

4 | | |

| 79,336 | | |

| 97,825 | | |

| 436,086 | | |

| 376,088 | |

| Gross

Profit | |

| | |

| 246,196 | | |

| 204,153 | | |

| 965,538 | | |

| 735,720 | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses | |

| | |

| | | |

| | | |

| | | |

| | |

| Advertising

and marketing | |

| | |

| 620,203 | | |

| 425,903 | | |

| 4,483,815 | | |

| 2,567,496 | |

| Amortization

and depreciation expense | |

| | |

| 1,062 | | |

| 2,787 | | |

| 2,110 | | |

| 5,640 | |

| Commission | |

| | |

| 12,899 | | |

| 9,954 | | |

| 62,447 | | |

| 29,841 | |

| Consulting | |

8 | | |

| 273,202 | | |

| 142,384 | | |

| 559,177 | | |

| 482,991 | |

| Interest

and bank charges | |

| | |

| 220,179 | | |

| 231,122 | | |

| 224,344 | | |

| 358,445 | |

| Inventory

management | |

| | |

| 6,549 | | |

| 4,459 | | |

| 18,143 | | |

| 12,896 | |

| Merchant

fees | |

| | |

| 9,221 | | |

| 27,393 | | |

| 47,923 | | |

| 56,460 | |

| Office

and administrative expenses | |

| | |

| 116,982 | | |

| 48,882 | | |

| 260,122 | | |

| 123,782 | |

| Professional

fees | |

8 | | |

| 43,429 | | |

| 27,034 | | |

| 260,802 | | |

| 73,519 | |

| Research

and development | |

| | |

| 1,500 | | |

| - | | |

| 1,680 | | |

| - | |

| Salaries

and wages | |

8 | | |

| 358,465 | | |

| 254,790 | | |

| 757,208 | | |

| 436,575 | |

| Share-based

compensation | |

8,9 | | |

| 202,884 | | |

| - | | |

| 406,154 | | |

| 7,861 | |

| Shipping

and delivery | |

| | |

| 152,205 | | |

| 135,935 | | |

| 450,147 | | |

| 350,096 | |

| Travel

and entertainment | |

| | |

| 38,090 | | |

| 52,853 | | |

| 68,884 | | |

| 127,359 | |

| | |

| | |

| (2,056,870 | ) | |

| (1,363,496 | ) | |

| (7,602,956 | ) | |

| (4,632,961 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Other

items | |

| | |

| | | |

| | | |

| | | |

| | |

| Financing

costs | |

10 | | |

| - | | |

| (1,650,000 | ) | |

| (417,794 | ) | |

| (3,150,000 | ) |

| Foreign

exchange | |

| | |

| 14,179 | | |

| 7,591 | | |

| (31,745 | ) | |

| 19,737 | |

| Gain

on revaluation of warrant derivative | |

10 | | |

| 1,292,230 | | |

| 68,779 | | |

| 1,473,271 | | |

| 181,078 | |

| Other

income | |

11 | | |

| 159,324 | | |

| - | | |

| 159,324 | | |

| - | |

| Write

down of prepaid inventory | |

5 | | |

| (130,150 | ) | |

| - | | |

| (130,150 | ) | |

| - | |

| | |

| | |

| 1,335,583 | | |

| (1,573,630 | ) | |

| 1,052,906 | | |

| (2,949,185 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Net

and comprehensive loss | |

| | |

$ | (475,091 | ) | |

$ | (2,732,973 | ) | |

$ | (5,584,512 | ) | |

$ | (6,846,426 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss

per share - Basic and diluted | |

| | |

$ | (0.95 | ) | |

$ | (17.39 | ) | |

$ | (12.79 | ) | |

$ | (43.56 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted

average number of common shares outstanding - basic and diluted | |

| | |

| 498,721 | | |

| 157,154 | | |

| 436,525 | | |

| 157,154 | |

The

accompanying notes are an integral part of these condensed interim financial statements.

BRUUSH

ORAL CARE INC.

CONDENSED

INTERIM STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

(Unaudited

- Expressed in U.S. dollars, except for the number of shares)

| | |

Common

Stock | | |

Obligation | | |

| | |

| | |

| |

| | |

Number | | |

| | |

to issue | | |

| | |

Accumulated | | |

| |

| | |

of

shares | | |

Amount | | |

securities | | |

Reserves

| | |

Deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance,

October 31, 2021 | |

| 157,154 | | |

$ | 13,276,909 | | |

$ | - | | |

$ | 400,936 | | |

$ | (17,621,043 | ) | |

$ | (3,943,198 | ) |

| Securities

to be issued for financing costs | |

| - | | |

| - | | |

| 3,150,000 | | |

| - | | |

| - | | |

| 3,150,000 | |

| Shares

issued for services | |

| - | | |

| - | | |

| - | | |

| 7,861 | | |

| - | | |

| 7,861 | |

| Net

and comprehensive loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (6,846,426 | ) | |

| (6,846,426 | ) |

| Balance,

April 30, 2022 | |

| 157,154 | | |

$ | 13,276,909 | | |

$ | 3,150,000 | | |

$ | 408,797 | | |

$ | (24,467,469 | ) | |

$ | (7,631,763 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance,

October 31, 2022 | |

| 326,028 | | |

$ | 23,845,704 | | |

$ | - | | |

$ | 1,137,814 | | |

$ | (26,386,314 | ) | |

$ | (1,402,796 | ) |

| Private

placement units | |

| 118,667 | | |

| 973,419 | | |

| - | | |

| - | | |

| - | | |

| 973,419 | |

| Exercise

of warrants | |

| 66,666 | | |

| 637,812 | | |

| 283 | | |

| - | | |

| - | | |

| 638,095 | |

| Shares

issued for services | |

| - | | |

| (361,539 | ) | |

| - | | |

| 361,539 | | |

| - | | |

| - | |

| Financing

costs | |

| - | | |

| (205,982 | ) | |

| - | | |

| - | | |

| - | | |

| (205,982 | ) |

| Share-based

compensation | |

| - | | |

| - | | |

| - | | |

| 406,154 | | |

| - | | |

| 406,154 | |

| Net

and comprehensive loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (5,584,512 | ) | |

| (5,584,512 | ) |

| Balance,

April 30, 2023 | |

| 511,361 | | |

$ | 24,889,414 | | |

$ | 283 | | |

$ | 1,905,507 | | |

$ | (31,970,826 | ) | |

$ | (5,175,622 | ) |

The

accompanying notes are an integral part of these condensed interim financial statements.

BRUUSH

ORAL CARE INC.

CONDENSED

INTERIM STATEMENTS OF CASH FLOWS

(Unaudited

- Expressed in U.S. dollars)

| | |

Six

months ended | | |

Six

months ended | |

| | |

April

30, 2023 | | |

April

30, 2022 | |

| Cash

flows from operating activities | |

| | | |

| | |

| Net

loss | |

$ | (5,584,512 | ) | |

$ | (6,846,426 | ) |

| Items

not affecting cash: | |

| | | |

| | |

| Amortization

and depreciation | |

| 2,110 | | |

| 5,640 | |

| Share-based

compensation | |

| 406,154 | | |

| 7,861 | |

| Gain

on revaluation of warrant derivative | |

| (1,473,271 | ) | |

| (181,078 | ) |

| Write

down of prepaid inventory | |

| 130,150 | | |

| - | |

| Accretion

of promissory note | |

| 206,968 | | |

| 247,261 | |

| Unrealized

foreign exchange | |

| (21 | ) | |

| - | |

| Gain

on write-off of accounts payable | |

| - | | |

| (1,005 | ) |

| Listing

expense | |

| - | | |

| (27 | ) |

| Financing

costs | |

| - | | |

| 3,150,000 | |

| | |

| | | |

| | |

| Changes

in non-cash working capital | |

| | | |

| | |

| Accounts

and other receivables | |

| 22,652 | | |

| 17,961 | |

| Inventory | |

| 98,391 | | |

| 167,057 | |

| Term

deposit | |

| 18,506 | | |

| - | |

| Prepaid

expenses and deposits | |

| 151,348 | | |

| 40,015 | |

| Accounts

payable and accrued liabilities | |

| 1,279,135 | | |

| (192,550 | ) |

| Deferred

revenue | |

| (4,036 | ) | |

| 224,850 | |

| Net

cash flows used in operating activities | |

| (4,746,426 | ) | |

| (3,360,441 | ) |

| | |

| | | |

| | |

| Cash

flows from investing activities | |

| | | |

| | |

| Purchase

of property and equipment | |

| (1,405 | ) | |

| (2,042 | ) |

| Net

cash flows used in investing activities | |

| (1,405 | ) | |

| (2,042 | ) |

| | |

| | | |

| | |

| Cash

flows from financing activities | |

| | | |

| | |

| Proceeds

from private placement warrants | |

| 2,742,069 | | |

| - | |

| Proceeds

from convertible debentures | |

| - | | |

| 3,760,725 | |

| Proceeds

from promissory notes | |

| 1,874,254 | | |

| - | |

| Proceeds

from exercise of warrants | |

| 1,667 | | |

| - | |

| Share

subscriptions received in advance | |

| 283 | | |

| - | |

| Proceeds

from loans | |

| 508,225 | | |

| - | |

| Repayment

of loans | |

| (257,267 | ) | |

| - | |

| Net

cash flows provided by financing activities | |

| 4,869,231 | | |

| 3,760,725 | |

| | |

| | | |

| | |

| Change

in cash | |

$ | 121,400 | | |

$ | 398,242 | |

| | |

| | | |

| | |

| Cash | |

| | | |

| | |

| Beginning

of period | |

$ | 72,921 | | |

$ | 14,530 | |

| End

of period | |

$ | 194,321 | | |

$ | 412,772 | |

| | |

| | | |

| | |

| Supplemental

cash flow disclosure | |

| | | |

| | |

| Interest | |

$ | - | | |

$ | - | |

| Taxes

paid | |

$ | - | | |

$ | - | |

Non-

cash investing and financing activities | |

| | | |

| | |

| Fair

value of warrants exercised | |

$ | 636,160 | | |

$ | - | |

| Broker

warrants | |

$ | 361,539 | | |

$ | - | |

The

accompanying notes are an integral part of these condensed interim financial statements.

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

| 1. |

NATURE

OF OPERATIONS AND GOING CONCERN |

Bruush

Oral Care Inc. (the “Company”) was incorporated in British Columbia under the Business Corporations Act on October 10, 2017.

The Company is in the business of selling electric toothbrushes. The Company is located at 128 West Hastings Street, Unit 210, Vancouver,

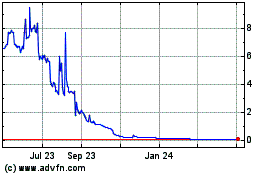

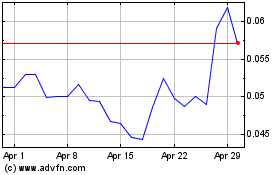

British Columbia V6B 1G8. The Company’s common shares are listed for trading on NASDAQ under the symbol “BRSH”.

As

of April 30, 2023, the Company had a working capital deficit of $5,180,536, an accumulated deficit totaling $31,970,826. The ability

of the Company to carry out its business objectives is dependent on its ability to secure continued financial support from related parties,

to obtain equity financing, or to ultimately attain profitable operations in the future. The Company will need to raise additional capital

during the next twelve months and beyond to support current operations and planned development. Whether and when the Company can attain

profitability and positive cash flows is uncertain. While the Company has been successful in securing financing in the past, there is

no assurance that financing will be available in the future on terms acceptable to the Company.

These

factors form a material uncertainty that may cast significant doubt upon the Company’s ability to continue as a going concern.

These financial statements do not give effect to adjustments to the carrying value and classification of assets and liabilities and related

expense that would be necessary should the Company be unable to continue as a going concern. If the going concern assumption is not appropriate,

material adjustments to the statements could be required.

On

July 7, 2023, the Company completed a 1-for-25 reverse split of its common shares (“the Consolidation”). The Consolidation

is effective as of the close of business on July 31, 2023. Except where otherwise indicated, all historical share numbers and per share

amounts have been adjusted on a retroactive basis to reflect following the Consolidation.

Statement

of compliance

These

unaudited condensed interim financial statements have been prepared in accordance with IAS 34 – Interim Financial Reporting as

issued by the International Accounting Standards Board (“IASB”). Accordingly, certain disclosures included in annual financial

statements prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the IASB have been

condensed or omitted and these unaudited condensed interim consolidated financial statements should be read in conjunction with the Company’s

audited financial statements for the year ended October 31, 2022.

The

Company’s management makes judgments in its process of applying the Company’s accounting policies in the preparation of its

unaudited condensed interim financial statements. In addition, the preparation of the financial data requires that the Company’s

management make assumptions and estimates of the effects of uncertain future events on the carrying amounts of the Company’s assets

and liabilities at the end of the reporting period and the reported amounts of revenues and expenses during the reporting period. Actual

results may differ from those estimates as the estimation process is inherently uncertain. Estimates are reviewed on an ongoing basis

based on historical experience and other factors that are considered to be relevant under the circumstances. Revisions to estimates and

the resulting effects on the carrying amounts of the Company’s assets and liabilities are accounted for prospectively. The critical

judgments and estimates applied in the preparation of the Company’s unaudited condensed interim financial statements are consistent

with those applied and disclosed in the Company’s financial statements for the year ended October 31, 2022. In addition, other

than noted below, the accounting policies applied in these unaudited condensed interim financial statements are consistent with those

applied and disclosed in the Company’s audited financial statements for the year ended October 31, 2022.

These

unaudited condensed interim financial statements were approved by the Board of Directors on September 13, 2023.

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

Basis

of presentation

These

condensed interim financial statements have been prepared on a historical cost basis and presented in U.S. dollars which is the functional

currency of the Company. The financial statements of the Company have been prepared on an accrual basis, except for cash flow information.

The condensed interim financial statements have been prepared on a historical cost basis except for warrants and options, which are measured

at fair value.

| 3. |

ACCOUNTS

AND OTHER RECEIVABLES |

| | |

April

30, 2023 | | |

October

31, 2022 | |

| Trade

receivables | |

$ | 52,879 | | |

$ | 103,471 | |

| Sales

taxes receivable | |

| 99,725 | | |

| 71,785 | |

| | |

$ | 152,604 | | |

$ | 175,256 | |

Inventory

consisted entirely of finished goods.

During

the six months ended April 30, 2023, $434,994 (six months ended April 30, 2022 - $332,657) of inventory was sold and recognized in cost

of goods sold, and $17,473 (six months ended April 30, 2022 - $89,646) of inventory was used for promotional purposes and recognized

in other expense categories, such as selling and marketing and investor relations.

| 5. |

PREPAID

EXPENSES AND DEPOSITS |

| | |

April

30, 2023 | | |

October

31, 2022 | |

| Prepaid

expenses | |

$ | 67,418 | | |

$ | 191,322 | |

| Deposits

on inventory | |

| 317,864 | | |

| 475,458 | |

| Deposits | |

| 10,694 | | |

| 10,694 | |

| | |

$ | 395,976 | | |

$ | 677,474 | |

Deposits

on inventory relate to payment for inventory that is still to be received. During the six months ended April 30, 2023, the Company impaired

deposits on inventory of $130,150 (October 31, 2022 – $Nil).

| 6. |

ACCOUNTS

PAYABLE AND ACCRUED LIABILITIES |

| | |

April

30, 2023 | | |

October

31, 2022 | |

| Accounts

payable | |

$ | 1,661,284 | | |

$ | 909,438 | |

| Accrued

liabilities | |

| 647,323 | | |

| 435,850 | |

| | |

$ | 2,308,607 | | |

$ | 1,345,288 | |

On

March 6, 2023, the Company issued an unsecured promissory note (“the Promissory note”) in a principal amount of $2,749,412.

The Promissory note was issued at discount of 15% with a maturity date of July 18, 2023. The principal amount outstanding shall bear

no interest during the period up until July 18, 2023. The Promissory note will only bear simple interest at the rate of 20% per annum

in the event of default from the date of such non-payment until such amount is paid in full.

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

A

continuity of the Promissory note is shown below:

| Balance

October 31, 2022 | |

$ | - | |

| Additions | |

| 2,749,412 | |

| Discount | |

| (412,412 | ) |

| Transaction

costs | |

| (207,746 | ) |

| Accretion | |

| 206,968 | |

| Balance

April 30, 2023 | |

$ | 2,336,222 | |

Subsequent

to the period ended, the Company and the Promissory note holder (“the Holder”) entered into an agreement in which the Holder

subscribed for convertible notes (Note 14) in lieu of repayment and Promissory note was cancelled in its entirety.

| 8. |

RELATED

PARTY TRANSACTIONS |

Key

Management Compensation

Key

management personnel are those persons having authority and responsibility for planning, directing and controlling the activities of

the Company, directly or indirectly. Key management personnel include the Company’s executive officers and Board of Director members.

All

related party transactions are in the normal course of operations. All amounts either due from or due to related parties other than specifically

disclosed are non-interest bearing, unsecured and have no fixed terms of repayments.

Related

party transactions with key management directors, subsequent and former directors and companies and entities over which they have significant

influence over:

| | |

Three

months ended | | |

Six

months ended | |

| | |

April

30, 2023 | | |

April

30, 2022 | | |

April

30, 2023 | | |

April

30, 2022 | |

| Consulting

fees | |

$ | 11,163 | | |

$ | 35,790 | | |

$ | 11,163 | | |

$ | - | |

| Director

fees | |

| 46,500 | | |

| - | | |

| 93,000 | | |

| 47,905 | |

| Professional

fees | |

| - | | |

| 50,000 | | |

| - | | |

| 50,000 | |

| Salaries | |

| 224,949 | | |

| 70,880 | | |

| 321,234 | | |

| 110,354 | |

| Share-based

compensation | |

| 203,268 | | |

| - | | |

| 405,419 | | |

| - | |

| | |

$ | 485,880 | | |

$ | 156,670 | | |

$ | 830,816 | | |

$ | 208,259 | |

Accounts

payable and accrued liabilities – As of April 30, 2023, $11,163 (October 31, 2022 - $33,918) due to related parties was included

in accounts payable and accrued liabilities.

As

at June 30, 2023, included in loans payable is $311,774 (September 30, 2022 - $Nil) due to the Chief Executive Officer of the Company.

This loan is non-interest bearing, unsecured and payable on demand.

Authorized

share capital

Unlimited

Common Shares without par value.

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

Shares

outstanding

On

July 29, 2022, the Company completed a share reorganization (the “Share Reorganization”) to redesignate all Class B shares

to common shares and to convert the Class A shares to common shares. The Company also effected a share consolidation on the basis of

1 new share for each 3.86 shares outstanding (the “Consolidation”). Prior to the Share Reorganization and Consolidation,

the Company had 6,824,127 Class A and 7,130,223 Class B common shares issued and outstanding. Immediately following the Share Reorganization

and Consolidation, the Company had 3,615,116 common shares outstanding. Except where otherwise indicated, all historical share numbers

and per share amounts have been adjusted on a retroactive basis to reflect the Share Reorganization and Consolidation.

The

Company also completed another Share Reorganization on July 31, 2023 in which 1 new share was issued for each 25 outstanding shares.

Prior to this Share Reorganization, a total of 12,784,209 common shares were outstanding and they were converted into 511,361 common

shares. Except where otherwise indicated, all historical share numbers and per share amounts have been adjusted on a retroactive basis

to also reflect this Share Reorganization.

Six

months ended April 30, 2023:

On

December 9, 2022, the Company closed a private placement pursuant (“the Private placement”) to a securities purchase agreement

with institutional investors. The Company issued 118,667 units (“the units”) and 78,000 pre-funded units (“the pre-funded

units”) at a purchase price of $15 per unit for gross proceeds of $2,948,050. The pre-funded units were sold at a purchase price

of $14.98. Each of the units consists of one share of common stock and one non-tradable warrant (“the unit warrants”) exercisable

for one share of common stock at a price of $15 for a period of 5.5 years from the closing date of the Private placement. The pre-funded

Unit consist of one pre-funded common share purchase warrant of the Company (a “pre-funded warrant”) and one unit warrant.

As at April 30, 2023, $283 had been received in advance as subscriptions for warrants still to be exercised.

In

connection with the Private placement, the Company paid share issuance costs of $623,776 consisting of $295,000 in underwriting fees,

$132,500 in legal fees and $196,276 in other related expenses. Total transaction costs of $623,776 were incurred relating to the Private

placement and $205,982 was allocated to equity.

During

the six months ended April 30, 2023, the Company issued 66,667 common shares as a result of the exercise of 66,667 warrants for total

proceeds of $1,667. The weighted average market price of the Company’s common shares at the period of the exercise was $9.56 per

share.

Six

months ended April 30, 2022:

There

were no share issuances during the six months ended April 30, 2022.

The

Company has established a stock option plan for its directors, officers, employees, and consultants under which the Company may grant

options (each, an “Option”) from time to time to acquire Shares. The exercise price of each Option shall be determined by

the Board of Directors. Options may be granted for a maximum term of five years from the date of grant. Options are non-transferable

and expire immediately upon termination of employment for cause, or within 30 days of termination of employment for cause, or within

30 days of termination of employment or holding office as director or officer of the Company or in the case of death. Unless otherwise

provided in the applicable grant agreement, Options fully vest upon the grant thereof.

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

Six

months ended April 30, 2023:

On

April 3, 2023, the Company granted 40,800 stock options to its directors and officers. Each option is exercisable for one common share

in the capital of the Company at an exercise price of $6.25 per share. These options vest over four years from the date of grant and

expire on April 3, 2028. The fair value of the options was estimated to be $162,384 based on the Black-Scholes Option Pricing Model using

the following assumptions: fair value of the underlying stock – $6.48, exercise price $6.50, expected dividend yield - 0%, expected

volatility - 72%, risk-free interest rate – 2.94% and an expected remaining life – 5 years.

Six

months ended April 30, 2022:

There

were no option grants during the six months ended April 30, 2022.

During

the six months ended April 30, 2023, the Company recognized share-based compensation expense of $6,245 for the vesting of options (six

months ended April 30, 2022 - $7,862).

As

at April 30, 2023, the following options were outstanding and vested, entitling the holders thereof the right to purchase one common

share for each option held as follows:

| Outstanding | | |

Exercise

Price | | |

Expiry

Date | |

Vested | |

| 3,207 | | |

| CAD$172.50 | | |

November

9, 2025 | |

| 3,207 | |

| 40,800 | | |

$ | 6.25 | | |

April

3, 2028 | |

| - | |

| 44,007 | | |

| | | |

| |

| 3,207 | |

During

August 2022, the Company’s volume weighted average stock price was less than the exercise floor of $52 as per the agreements for

the warrants issued as part of the units offered in the Company’s initial public offering (“IPO”) as a result, the

following occurred:

| |

● |

Effective

after the closing of trading on November 3, 2022 (the 90th calendar day immediately following the issuance date of the

Warrants), the exercise price of all IPO warrants was reset from $104 to $52 (“reset price”). The other terms of the

IPO warrants remained unchanged. |

| |

● |

On

November 3, 2022, the Company also issued to an aggregate amount of 266,420 additional warrants (“the additional warrants”)

to purchase 266,420 shares of common stock. The Additional Warrants expire November 3, 2027 and are exercisable at a price of $52. |

Continuity

of the warrants issued and outstanding as follows:

| | |

Number

of warrants | | |

Weighted

average

exercise

price | |

| Outstanding,

October 31, 2021 | |

| 29,210 | | |

$ | 196.75 | |

| Granted | |

| 174,078 | | |

| 105.50 | |

| Outstanding,

October 31, 2022 | |

| 203,288 | | |

$ | 118.75 | |

| Granted | |

| 553,019 | | |

| 5.25 | |

| Exercised | |

| (66,667 | ) | |

| 0.025 | |

| Outstanding,

April 30, 2023 | |

| 689,640 | | |

$ | 46.00 | |

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

The

following table discloses the number of warrants outstanding as at April 30, 2023:

| Number

of warrants | | |

Price | | |

Expiry

date |

| 10,736 | | |

| CAD$86.75 | | |

August

3, 2024 |

| 18,474 | | |

| CAD$260.50 | | |

August

3, 2024 |

| 163,565 | | |

$ | 52 | | |

August

4, 2027 |

| 10,514 | | |

$ | 130 | | |

August

4, 2027 |

| 11,931 | | |

$ | 0.025 | | |

August

4, 2027 |

| 266,420 | | |

$ | 52 | | |

November

3, 2027 |

| 118,667 | | |

$ | 15 | | |

June

9, 2028 |

| 78,000 | | |

$ | 15 | | |

June

9, 2028 |

| 11,333 | | |

$ | 0.025 | | |

No

expiry |

| 689,640 | | |

| | | |

|

As

at April 30, 2023, the weighted average life remaining of warrants outstanding is 4.36 years.

| c) |

Restricted

Share Awards |

On

June 30, 2022, the Company issued 19,689 Restricted Share Awards (“RSU” or “RSU’s”) to directors of the

Company. The RSU’s vest over a period of three years, in three equal tranches on the first, second, and third anniversaries of

the grant date. At October 31, 2022, none of the RSU’s had vested. The Company recognizes the share-based payment expense over

the vesting terms. The share-based compensation costs for the RSU’s are based on the share price at the date of grant at a price

of $71.25 per RSU.

During

the six months ended April 30, 2023, the Company recognized share-based compensation expense of $399,909 for the vesting of RSUs (Six

months ended April 30, 2022 - $nil).

As

at April 30, 2023 and October 31, 2022, 19,689 RSU’s were outstanding.

| 10. |

WARRANT DERIVATIVE LIABILITY |

In

July and August 2020, in connection with a private placement, the Company issued 10,710 warrants with an exercise price of CAD$86.75

($66.50) per warrant with an expiry date of twenty-four months from the time the Company completes a bone-fide public offering of common

shares under a prospectus or registration statement filed with the securities regulatory authorities in Canada or the United States (the

“Liquidity Event”). As the warrants have an exercise price denominated in a currency other than the Company’s functional

currency, they are derivative financial instrument measured at fair value at the end of each reporting period. On July 29, 2022, the

Company amended the exercise price of 3,461 of the warrants to $66.50. As a result, the derivative liability associated with these warrants

at the time of $136,047 was derecognized and recorded to equity. The fair value at the time of derecognition was based on the Black-Scholes

Option Pricing Model using the following assumptions: fair value of the underlying stock - $71.25, expected dividend yield – 0%,

expected volatility – 100%, risk-free interest rate – 2.92% and an expected remaining life – 2.01 years. As at April

30, 2023, the fair value of the remaining 7,248 warrants which were not repriced (and therefore continue to be recognized as derivative

financial instruments) was determined to be $122 based on the Black-Scholes Option Pricing Model using the following assumptions: fair

value of the underlying stock – CAD$8.75, expected dividend yield – 0%, expected volatility – 74%, risk-free interest

rate – 3.72% and an expected remaining life – 1.26 years (2022 - $30,469 based on the Black-Scholes Option Pricing Model

using the following assumptions: fair value of the underlying stock – CAD$37.25, expected dividend yield – 0%, expected volatility

– 72%, risk-free interest rate – 3.90% and an expected remaining life – 1.76 years).

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

In

August and September 2020, in connection with a private placement, the Company issued 15,290 warrants with an exercise price of CAD$260.50

($195) per warrant with an expiry date of twenty-four months from the Liquidity Event. As the warrants have an exercise price denominated

in a currency other than the Company’s functional currency, they are derivative financial instrument measured at fair value at

the end of each reporting period. As at April 30, 2023, the fair value of the warrants was determined to be $3 and was estimated using

the Black-Scholes Options Pricing Model using the following assumptions: fair value of the underlying stock – CAD$8.75, expected

dividend yield – 0%, expected volatility – 74%, risk-free interest rate – 3.72% and an expected remaining life –

1.26 years. (2022 - $8,655 based on the Black-Scholes Option Pricing Model using the following assumptions: fair value of the underlying

stock – CAD$37.25, expected dividend yield – 0%, expected volatility – 72%, risk-free interest rate – 3.90% and

an expected remaining life – 1.76 years).

In

August 2022, in connection with the units issued as part of the Company’s IPO, the Company issued 149,142 warrants with an exercise

price of $104 per warrant with an expiry date of five years from the date of issuance. The warrants contain a cashless exercise provision

which enables the holder to receive common shares equal to the fair value of the warrants based on the number of warrants to be exercise

multiplied by the fair value of the common shares less the exercise price with the difference divided by the fair value of the share.

If a warrant holder exercises this option, there will be variability in the number of shares issued, therefore they are a derivative

financial instrument measured at fair value at the end of each reporting period. On November 3, 2022 ,the exercise price of these warrants

was reset from $104 to $52 the other terms of the IPO warrants remained unchanged (Note 9(b)).

As

at April 30, 2023, the fair value of the warrants was determined to be $152,713 and was estimated using the Black-Scholes Options Pricing

Model using the following assumptions: fair value of the underlying stock – $6.50, expected dividend yield – 0%, expected

volatility – 74%, risk-free interest rate – 3.04% and an expected remaining life – 4.27 years. (2022 – $1,097,323

based on the Black-Scholes Options Pricing Model using the following assumptions: fair value of the underlying stock – $27.25,

expected dividend yield – 0%, expected volatility – 67%, risk-free interest rate – 3.43% and an expected remaining

life – 4.76 years).

Also

in connection with the IPO, on November 3, 2022, the Company issued to an aggregate amount of 266,420 additional warrants to purchase

266,420 shares of common stock (Note 9(b)). The Additional Warrants expire November 3, 2027 and are exercisable at a price of $2.08.

These warrants also contain a cashless exercise provision which enables the holder to receive common shares equal to the fair value of

the warrants based on the number of warrants to be exercise multiplied by the fair value of the common shares less the exercise price

with the difference divided by the fair value of the share. . If a warrant holder exercises this option, there will be variability in

the number of shares issued, therefore they are a derivative financial instrument measured at fair value at the end of each reporting

period. At issuance, the fair value of the warrants was determined to be $2,736,592 and was estimated using the Black-Scholes Options

Pricing Model using the following assumptions: fair value of the underlying stock – $24.50, expected dividend yield – 0%,

expected volatility – 68%, risk-free interest rate – 3.67% and an expected remaining life – 5 years. As at April 30,

2023, the fair value of the warrants was determined to be $291,303 and was estimated using the Black-Scholes Options Pricing Model using

the following assumptions: fair value of the underlying stock – $6.50, expected dividend yield – 0%, expected volatility

– 73%, risk-free interest rate – 3.04% and an expected remaining life – 4.52 years.

In

August 2022, in connection with the units issued as part of its December Senior Secured Promissory Notes, the Company issued 14,423 warrants

with an exercise price of $104 per warrant with an expiry date of five years from the date of issuance. The warrants contain a cashless

exercise provision which enables the holder to receive common shares equal to the fair value of the warrants based on the number of warrants

to be exercise multiplied by the fair value of the common shares less the exercise price with the difference divided by the fair value

of the share. If a warrant holder exercises this option, there will be variability in the number of shares issued, therefore they are

a derivative financial instrument measured at fair value at the end of each reporting period. At issuance, the fair value of the warrants

was determined to be $488,147 and was estimated using the Black-Scholes Options Pricing Model using the following assumptions: fair value

of the underlying stock – $70.25, expected dividend yield – 0%, expected volatility – 66%, risk-free interest rate

– 2.79% and an expected remaining life – 5 years. As at April 30, 2023, the fair value of the warrants was determined to

be $36,917 and was estimated using the Black-Scholes Options Pricing Model using the following assumptions: fair value of the underlying

stock – $6.50, expected dividend yield – 0%, expected volatility – 74%, risk-free interest rate – 3.04% and an

expected remaining life – 4.27 years. (2022 – $106,119 based on the Black-Scholes Options Pricing Model using the following

assumptions: fair value of the underlying stock – $27.25, expected dividend yield – 0%, expected volatility – 67%,

risk-free interest rate – 3.43% and an expected remaining life – 4.76 years).

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

During

December 2022, in connection with the units issued as part of the private placement (Note 9), the Company issued 118,667 unit warrants

with an exercise price of $15 with an expiry date of 5.5 years from the date of issuance. The warrants contain a cashless exercise provision

which enables the holder to receive common shares equal to the fair value of the warrants based on the number of warrants to be exercise

multiplied by the fair value of the common shares less the exercise price with the difference divided by the fair value of the share.

If a warrant holder exercises this option, there will be variability in the number of shares issued, therefore they are a derivative

financial instrument measured at fair value at the end of each reporting period. At issuance, the fair value of the warrants was determined

to be $806,581 and was estimated using the Black-Scholes Options Pricing Model using the following assumptions: fair value of the underlying

stock – $10.25, expected dividend yield – 0%, expected volatility – 67%, risk-free interest rate – 3.07% and

an expected remaining life – 5.5 years. As at April 30, 2023, the fair value of the warrants was determined to be $333,875 and

was estimated using the Black-Scholes Options Pricing Model using the following assumptions: fair value of the underlying stock –

$6.50, expected dividend yield – 0%, expected volatility – 71%, risk-free interest rate – 3.04% and an expected remaining

life – 5.11 years.

Also

in connection with the private placement (Note 9), the Company issued 78,000 pre-funded warrants with an exercise price of $0.025 with

no expiry date and another 78,000 unit warrants with an exercise price of $15 and with an expiry date of 5.5 years from the date of issuance

for total proceeds of $1,168,051. These warrants also contain a cashless exercise provision which enables the holder to receive common

shares equal to the fair value of the warrants based on the number of warrants to be exercise multiplied by the fair value of the common

shares less the exercise price with the difference divided by the fair value of the share. If a warrant holder exercises this option,

there will be variability in the number of shares issued, therefore they are a derivative financial instrument measured at fair value

at the end of each reporting period. At issuance, the fair value of the prefunded warrants and unit warrants was $747,917 and $420,134

respectively, the fair value of the pre-funded warrants was determined with reference to the fair value of the Company’s common

shares and the fair value of the unit warrants was estimated using the Black-Scholes Options Pricing Model using the following assumptions:

fair value of the underlying stock – $12.13, expected dividend yield – 0%, expected volatility – 67%, risk-free interest

rate – 3.07% and an expected remaining life – 5.5 years. As at April 30, 2023 the fair value of the unit warrants was $219,458

respectively and was estimated using the Black-Scholes Options Pricing Model based on the following assumptions: fair value of the underlying

stock – $6.50, expected dividend yield – 0%, expected volatility – 71%, risk-free interest rate – 3.04% and an

expected remaining life – 5.11 years.

During

January 2023, 49,867 pre-funded warrants were exercised (Note 9) and a fair value loss of $39,565 was recognized from the fair valuation

of these pre-funded warrants on the dates of exercise and their total fair value was $517,720.

A

further 16,800 pre- funded warrants were exercised during April 2023 (Note 9) and a fair value gain of $53,340 was recognized from the

fair valuation of these pre-funded warrants on the dates of exercise and their total fair value was $118,440.

As

at April 30, 2023 the fair value of the remaining pre-funded warrants was deterimined to be $73,384 and was estimated using the Black-Scholes

Options Pricing Model using the following assumptions: fair value of the underlying stock – $6.50, expected dividend yield –

0%, expected volatility – 71%, risk-free interest rate – 3.04% and an expected remaining life – 5.11 years.

From

the total transaction costs of $623,776 that were incurred relating to the Private placement (Note 9), $417,794 was allocated to the

derivative liability.

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

The

following is a continuity of the Company’s warrant derivative liability:

| Balance,

October 31, 2021 | |

$ | 1,582,977 | |

| Issued

during the period | |

| 5,535,852 | |

| Change

in fair value of derivative | |

| (5,740,202 | ) |

| Derecognition

of warrant derivative | |

| (136,047 | ) |

| Balance,

October 31, 2022 | |

$ | 1,242,580 | |

| Issued

during the period | |

| 1,974,626 | |

| Change

in fair value of derivative | |

| (1,473,271 | ) |

| Derecognition

of warrant derivative | |

| (636,160 | ) |

| Balance,

April 30, 2023 | |

$ | 1,107,775 | |

During

the year ended October 31, 2022, the Company fell victim to a cyber-scam that resulted in the Company making an inappropriate payment

of $166,150.

During

the six months ended April 30, 2023, the Company has filed an insurance claim and received an indemnity of CAD$217,943 ($159,324) in

relation to the cyber-scam.

| 12. |

FINANCIAL

INSTRUMENT RISK MANAGEMENT |

Classification

of financial instruments

Financial

assets included in the statement of financial position are as follows:

| | |

Level

in fair

value

hierarchy | | |

April

30, 2023 | | |

October

31, 2022 | |

| Amortized

cost: | |

| | | |

| | | |

| | |

| Cash | |

| | | |

$ | 194,321 | | |

$ | 72,921 | |

| Term

deposit | |

| | | |

| - | | |

| 18,506 | |

| Accounts

receivable | |

| | | |

| 152,604 | | |

| 175,256 | |

| | |

| | | |

$ | 346,925 | | |

$ | 266,683 | |

Financial

liabilities included in the statement of financial position are as follows:

| | |

Level

in fair

value

hierarchy | | |

April

30, 2023 | | |

October

31, 2022 | |

| Amortized

cost: | |

| | | |

| | | |

| | |

| Accounts

payable and accrued expenses | |

| | | |

$ | 2,308,607 | | |

$ | 1,345,288 | |

| Loans

payable | |

| | | |

| 2,336,222 | | |

| - | |

| Due

to related party | |

| | | |

| 311,774 | | |

| - | |

| | |

| | | |

| | | |

| | |

| FVTPL: | |

| | | |

| | | |

| | |

| Warrant

derivative liability | |

| Level

3 | | |

| 1,107,775 | | |

| 1,242,580 | |

| | |

| | | |

$ | 6,064,378 | | |

$ | 2,587,868 | |

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

Fair

value

Financial

instruments measured at fair value are classified into one of three levels in the fair value hierarchy according to the relative reliability

of the inputs used to estimate the fair values. The three levels of the fair value hierarchy are:

| ● |

Level

1 – Unadjusted quoted prices in active markets for identical assets or liabilities; |

| ● |

Level

2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and |

| ● |

Level

3 – Inputs that are not based on observable market data. |

The

carrying value of the Company’s cash, term deposits, accounts receivable and accounts payable and accrued liabilities as at approximate

their fair value due to their short terms to maturity.

The

following table shows the valuation techniques used in measuring Level 3 fair values for the derivative liability as well as the significant

unobservable inputs used.

| Type |

|

Valuation

technique |

|

Key

inputs |

|

Inter-relationship

between significant inputs and fair value measurement |

| Warrant

derivative liability |

|

The

fair value of the warrant derivative liability at initial recognition and at period-end has been calculated using the Black Scholes

option pricing model. |

|

Key

observable inputs

●

Share price

●

Risk free interest rate

●

Dividend yield

Key

unobservable inputs

●

Expected volatility

|

|

The

estimated fair value would increase (decrease) if:

●

The share price was higher (lower)

●

The risk-free interest rate was higher (lower)

●

The dividend yield was lower (higher)

●

The expected volatility was higher (lower) |

For

the fair values of the derivative liability, reasonably possible changes to the expected volatility, the most significant unobservable

input would have the following effects:

| Unobservable

Inputs | |

Change | | |

Impact

on comprehensive loss | |

| | |

| | |

Six

months ended

April

30, 2023 | | |

Six

months ended April

30, 2022 | |

| Volatility | |

| 20 | % | |

$ | 435,415 | | |

$ | 261,511 | |

The

Company is exposed in varying degrees to a variety of financial instrument related risks. The Board of Directors approves and monitors

the risk management processes, inclusive of documented investment policies, counterparty limits, and controlling and reporting structures.

Credit

risk

The

Company’s principal financial assets are cash and trade accounts receivable. The Company’s credit risk is primarily concentrated

in its cash which is held with institutions with a high credit worthiness. Credit risk is not concentrated with any particular customer.

The Company’s accounts receivable consists primarily of GST receivable.

The

Company’s maximum credit risk exposure is $152,604.

Liquidity

risk

Liquidity

risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company has a planning and

budgeting process in place to help determine the funds required to support the Company’s normal operating requirements on an ongoing

basis.

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

Historically,

the Company’s primary source of funding has been the issuance of equity securities for cash, primarily through the issuance of

preferred shares. The Company’s access to financing is always uncertain. There can be no assurance of continued access to significant

equity funding.

The

following is an analysis of the contractual maturities of the Company’s financial liabilities as at April 30, 2023:

| | |

Within

one

year | | |

Between

one

and

five years | | |

More

than

five

years | |

| Accounts

payable and accrued expenses | |

$ | 2,308,607 | | |

$ | - | | |

$ | - | |

Foreign

exchange risk

Foreign

currency risk arises from fluctuations in foreign currencies versus the United States dollar that could adversely affect reported balances

and transactions denominated in those currencies. As at April 30, 2023, a portion of the Company’s financial assets are held in

Canadian dollars. The Company’s objective in managing its foreign currency risk is to minimize its net exposure to foreign currency

cash flows by transacting, to the greatest extent possible, with third parties in United States dollars. The Company does not currently

use foreign exchange contracts to hedge its exposure of its foreign currency cash flows as management has determined that this risk is

not significant at this point in time. The Company is not exposed to any material foreign currency risk.

Interest

rate risk

Interest

rate risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market

interest rates. The Company is not exposed to any material interest rate risk.

Capital

Management

In

the management of capital, the Company includes components of shareholders’ equity. The Company aims to manage its capital resources

to ensure financial strength and to maximize its financial flexibility by maintaining strong liquidity and by utilizing alternative sources

of capital including equity, debt and bank loans or lines of credit to fund continued growth. The Company sets the amount of capital

in proportion to risk and based on the availability of funding sources. The Company manages the capital structure and makes adjustments

to it in light of changes in economic conditions and the risk characteristics of the underlying assets. Issuance of equity has been the

primary source of capital to date. Additional debt and/or equity financing may be pursued in future as deemed appropriate to balance

debt and equity. To maintain or adjust the capital structure, the Company may issue new shares, take on additional debt or sell assets

to reduce debt.

| 13. |

SEGMENTED

INFORMATION |

The

Company’s breakdown of sales by geographical region is as follows:

| | |

Six

months ended

April 30, 2023 | | |

Six

months ended

April 30, 2022 | |

| United

States of America | |

$ | 1,319,868 | | |

$ | 1,079,617 | |

| Canada | |

| 81,756 | | |

| 32,191 | |

| | |

$ | 1,401,624 | | |

$ | 1,111,808 | |

| | |

Three

months ended

April 30, 2023 | | |

Three

months ended

April 30, 2022 | |

| United

States of America | |

$ | 295,627 | | |

$ | 289,670 | |

| Canada | |

| 29,905 | | |

| 12,308 | |

| | |

$ | 325,532 | | |

$ | 301,978 | |

BRUUSH

ORAL CARE INC.

NOTES

TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Unaudited

- Expressed in U.S. dollars)

Three

and six months ended April 30, 2023 and 2022

The

Company’s breakdown of sales by product segment is as follows:

| | |

Six

months ended

April 30, 2023 | | |

Six

months ended

April 30, 2022 | |

| Devices | |

$ | 1,088,876 | | |

$ | 665,475 | |

| Consumables | |

| 312,748 | | |

| 446,333 | |

| | |

$ | 1,401,624 | | |

$ | 1,111,808 | |

| | |

Three

months ended

April 30, 2023 | | |

Three

months ended

April 30, 2022 | |

| Devices | |

$ | 280,450 | | |

$ | 62,683 | |

| Consumables | |

| 45,082 | | |

| 238,295 | |

| | |

$ | 325,532 | | |

$ | 1,111,808 | |

Litigation

During

the subsequent period, litigation was brought against the Company by the Toronto Dominion Bank (“TD Bank”) in which TD Bank

made a claim for an amount of $1,721,345 (the “Principal Amount”) relating to a bank overdraft. TD Bank and the Company reached

a settlement agreement in which the Company agreed to repay the Principal Amount plus interest and additional costs. The Settlement was

guaranteed by a letter of credit issued to TD Bank by the Royal Bank of Canada of $2,000,000.

Convertible

debentures

On

June 26, 2023, the Company completed its issuance of an unsecured convertible note with a principal aggregate amount of $3,341,176 (the

“June 2023 Note”) to the Selling Securityholder with a maturity date of June 26, 2024. The conversion price in effect on

any Conversion Date shall be equal to (i) for the first seven months following the date hereof, shall be $0.25, and (ii) following the

seven month anniversary of the date hereof, 90% of the lowest closing price of the Company’s shares for the previous three Trading

Days prior to the conversion date provided, however, that such price shall in no event be less than $0.15. A maximum of 22,274,507 shares

of Common Stock are issuable by the Company upon conversion of the June 2023 note.

In

connection with the issuance of the June 2023 Note, the Company entered into a securities purchase agreement with the Selling Securityholder

and issued a common stock purchase warrant to purchase 10,023,530 shares of Common Stock (the “Purchase Warrant”), with an

Exercise Price of $0.001 or on a cashless basis, to the Selling Securityholder. The Purchase Warrants will be classified as financial

liabilities since the terms allows for a cashless net share settlement at the option of the holder.

Share

capital

On

August 25, 2023, the company offered warrant holders the option to exercise their existing warrants at $3.33 per share, resulting in

633,026 Warrant Shares being issued. Holders were also given new warrants (New Warrants) allowing them to purchase up to 250% of the

exercised Warrant Shares at the same price, with an expiration date of June 9, 2028. The exercise of Existing Warrants led to the issuance

of New Warrants for a total of 1,582,566 New Warrant Shares.

From

August 1 to August 25, 2023, a total of 883,131 shares were issued from warrants being exercised for proceeds of $2,855,979. On August

10 and 14th, the company issued 50,000 and 150,000 common shares as compensation for consulting services.

Exhibit 99.2

BRUUSH

ORAL CARE INC.

MANAGEMENT’s

DISCUSSION AND ANALYSIS OF

FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

September

13, 2023

You

should read the following management’s discussion and analysis of financial condition and results of operations together with our

unaudited condensed interim financial statements as of and for the three and six months ended April 30, 2023 and April 30, 2022, of

Bruush Oral Care Inc. (herein after referred to as “the Company”) which were prepared in accordance with International

Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board, or IASB.

The

statements in this discussion regarding industry outlook, our expectations regarding our future performance, liquidity and capital resources

and other non-historical statements are forward-looking statements. These forward-looking statements are subject to numerous risks and

uncertainties, including the risks and uncertainties described in the section titled “Risk Factors”. Our actual results may

differ materially from those contained in the following discussion and analysis, as well as the section titled “Cautionary Note

Regarding Forward-Looking Statements”.

Basis

of Presentation

Our

unaudited condensed interim financial statements as of and for the three and six months ended April 30, 2023 and April 30, 2022 are presented

in U.S. dollars and have been prepared in accordance with IFRS which may differ in material respects from generally accepted accounting

principles accounting principles in the United States, or U.S. GAAP. Our presentation and functional currency is the U.S. dollar and,

accordingly, all the amounts in this discussion and analysis are in U.S. dollars unless otherwise indicated. See “Results of Operations

– April 30, 2023 compared to April 30, 2022”.

Non-IFRS

Financial Measures

This

discussion may refer to certain non-IFRS measures. These measures are not recognized measures under IFRS, do not have a standardized

meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other companies. Rather, these measures

are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations

from management’s perspective. Accordingly, these measures should not be considered in isolation or as a substitute for analysis

of our financial information reported under IFRS.

Going

Concern

As

of and for the six months ended April 30, 2023, the Company has recurring losses, a working capital deficit of $5,180,536 (October

31, 2022 – working capital deficit of $1,408,415), an accumulated deficit totaling $31,970,826 (October 31, 2022 –

accumulated deficit of $26,386,314) and negative cash flows used in operating activities of $4,746,426 (April 30, 2022 –

negative cash flows used in operating activities of $3,360,441). The ability of the Company to carry out its business objectives is dependent

on its ability to secure continued financial support from related parties, to obtain equity financing or to ultimately attain profitable

operations in the future. The Company will need to raise additional capital during the next twelve months and beyond to support current

operations and planned development. Whether and when the Company can attain profitability and positive cash flows is uncertain. While

the Company has been successful in securing financing in the past, there is no assurance that we will be able to obtain financing in

the future on terms acceptable to us.

Company

Overview

The

Company is on a mission to inspire confidence through brighter smiles and better oral health. Founded in 2018 by Chief Executive Officer

Aneil Manhas, a former investment banker and private equity investor turned entrepreneur, we are an oral care company that is disrupting

the space by reducing the barriers between consumers and access to premium oral care products because it is our belief that high-quality

oral care products should be more accessible. We are an e-commerce business with a product portfolio that currently consists of a sonic-powered

electric toothbrush kit and brush head refills. Through our website, consumers can purchase a Brüush starter kit (the “Brüush

Kit”), which includes: (i) the Brüush electric toothbrush (the “Brüush Toothbrush”); (ii) three brush heads;

(iii) a magnetic charging stand and USB power adapter; and (iv) a travel case. We also sell the brush heads separately which come in

a three-pack (the “Brüush Refill”) and can be purchased on a subscription basis, where the customer will automatically

receive a Brüush Refill every six months (the “Subscription”). We consider a Subscription to be active (an “Active

Subscription”) until it is either cancelled by the customer or terminated due to payment failure (for example, a lost or expired

credit card). In 2024, we plan to expand our portfolio with the launch of several new subscription-based consumable oral care products,

including toothpaste, mouthwash, dental floss, a whitening pen, as well as an electric toothbrush designed for kids.

Financial

Operations Overview

Revenues

Revenues

are comprised of sales of Brüush Kits and of Brüush Refills net of changes in the provision for payment discounts and product

return allowances.

Cost

of goods sold

Cost

of goods sold consists of: (i) the costs of finished goods sold; and (ii) the freight expense of

transporting the finished goods from the manufacturer to our third-party distribution facility in Salt Lake City, Utah.

Operating

expenses

Operating

expenses consist primarily of advertising and marketing expenses, salaries and wages, consulting services, professional fees, interest

charges, and shipping and delivery expense. We offer free regular shipping on all of our

website orders. All of these expenses have increased year-over-year and are expected to keep rising as we continue to scale our brand

building and customer acquisition efforts, as well as expand our operations to facilitate higher revenues.

Results

of Operations – Six months ended April 30, 2023 compared to six months ended April 30, 2022

The

table below sets forth a summary of our results of operations for the six months ended April 30, 2023 and April 30, 2022:

| | |

Six months ended April 30, | | |

| |

| | |

2023 | | |

2022 | | |

| | |

| |

| | |

(unaudited) | | |

(unaudited) | | |

Change | | |

% Change | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 1,401,624 | | |

$ | 1,111,808 | | |

$ | 289,816 | | |

| 26 | % |

| Cost of goods sold | |

| (436,086 | ) | |

| (376,088 | ) | |

| (59,998 | ) | |

| (16 | )% |

| Gross profit | |

$ | 965,538 | | |

$ | 735,720 | | |

$ | 229,818 | | |

| 31 | % |

| Gross margin | |

| 69 | % | |

| 66 | % | |

| | | |

| | |

Revenues

Our

revenues increased 26% for the six months ended April 30, 2023 to $1,401,624 from $1,111,808 for the six months ended April 30, 2022,

due primarily to the results of our expanded marketing and customer acquisition efforts.

Cost

of goods sold

Our

cost of goods sold increased 16% to $436,086 for the six months ended April 30, 2023 from $376,088 for the six months ended April 30,

2022. The increase was mainly due to the increase in goods sold during the six months ended April 30, 2023 compared to six months ended

April 30, 2022 as explained above.

Gross

profit

We

recorded gross profit of $965,538 and $735,720 for the six months ended April 30, 2023 and the six months ended April 30, 2022. Our gross

margin increased to 69% for the six months ended April 30, 2023 from 66% for the six months ended April 30, 2022. The increase in gross

profit is primarily due to the fact that a larger portion of revenue came from Brüush Kits, which have a higher gross margin compared

to Brüush Refills. The split between Brüush Kit and Brüush Refill sales was 78% and 22%, respectively during the six months

ended April 30, 2023, compared to 60% and 40%, respectively during the six months ended April 30, 2022.

Operating

expenses

The

following table sets forth our operating expenses for the six months ended April 30, 2023, and April 30, 2022:

| | |

Six months ended April 30, | | |

| |

| | |

2023 | | |

2022 | | |

| | |

% | |

| | |

(unaudited) | | |

(unaudited) | | |

Change | | |

Change | |

| Advertising and marketing | |

$ | (4,483,815 | ) | |

$ | (2,567,496 | ) | |

$ | (1,916,319 | ) | |

| (75 | )% |

| Depreciation expense | |

| (2,110 | ) | |

| (5,640 | ) | |

| 3,530 | | |

| 63 | % |

| Commission | |

| (62,447 | ) | |

| (29,841 | ) | |

| (32,606 | ) | |

| (109 | )% |

| Consulting | |

| (559,177 | ) | |

| (482,991 | ) | |

| (76,186 | ) | |

| (16 | )% |

| Interest and bank charges | |

| (224,344 | ) | |

| (358,445 | ) | |

| 134,101 | | |

| 37 | % |

| Inventory management | |

| (18,143 | ) | |

| (12,896 | ) | |

| (5,247 | ) | |

| (41 | )% |

| Merchant fees | |

| (47,923 | ) | |

| (56,460 | ) | |

| 8,537 | | |

| 15 | % |

| Office and administrative expenses | |

| (260,122 | ) | |

| (123,782 | ) | |

| (136,340 | ) | |

| (110 | )% |

| Professional fees | |

| (260,802 | ) | |

| (73,519 | ) | |

| (187,283 | ) | |

| (255 | )% |

| Research and development | |

| (1,680 | ) | |

| - | | |

| (1,680 | ) | |

| - | |

| Salaries and benefits | |

| (757,208 | ) | |

| (436,575 | ) | |

| (320,633 | ) | |

| (73 | )% |

| Share-based compensation | |

| (406,154 | ) | |

| (7,861 | ) | |

| (398,293 | ) | |

| (5067 | )% |

| Shipping and delivery | |

| (450,147 | ) | |

| (350,096 | ) | |

| (100,051 | ) | |

| (29 | )% |

| Travel and entertainment | |

| (68,884 | ) | |

| (127,359 | ) | |

| 58,475 | | |

| 46 | % |

| | |

$ | (7,602,956 | ) | |

$ | (4,632,961 | ) | |

$ | (2,969,995 | ) | |

| (64 | )% |

Operating

expenses for the six months ended April 30, 2023 were $7,602,956, compared to $4,632,961, for the six months ended April 30, 2022.

The primary reasons for the increase are: (i) increased advertising and marketing efforts, particularly during the holiday season; (ii)

increased shipping and delivery to facilitate a higher level of sales; (iii) a higher salaries and benefits expense due to expansion

of the team during this period, including the addition of senior team members in operations and sales roles; (iii) a higher office and

administrative expense as we expanded our office in Toronto to support a growing team; (iv) higher professional fees due to an increase

in legal fees related to maintaining the Company’s listing on the Nasdaq Stock Market; and (v) and increased share-based compensation.

Operating

loss before other items

| | |

Six months ended April 30, | | |

| |

| | |

2023 | | |

2022 | | |

| | |

% | |

| | |

(unaudited) | | |

(unaudited) | | |

Change | | |

Change | |

| | |

| | |

| | |

| | |

| |

| Gross profit | |

$ | 965,538 | | |

$ | 735,720 | | |

$ | 229,818 | | |

| 31 | % |

| Operating expenses | |

| (7,602,956 | ) | |

| (4,632,961 | ) | |

| (2,969,995 | ) | |

| (64 | )% |

| Operating loss before other items | |

$ | (6,637,418 | ) | |

$ | (3,897,241 | ) | |

$ | (2,740,177 | ) | |

| (70 | )% |

Our

operating loss before other items was $6,637,418 for the six months ended April 30, 2023 as compared to an operating loss before

other items of $3,897,241 for the six months ended April 30, 2022. The increase of $2,740,177 in operating loss is due to an increase

in overall operating expenses as described above.

Other

items

The

following table sets forth our other income (loss) for the six months ended April 30, 2023, and April 30, 2022:

| | |

Six months ended April 30, | | |

| |

| | |

2023 | | |

2022 | | |

| | |

% | |

| | |

(unaudited) | | |

(unaudited) | | |

Change | | |

Change | |

| | |

| | |

| | |

| | |

| |

| Foreign exchange | |

$ | (31,745 | ) | |

$ | 19,737 | | |

$ | (51,482 | ) | |

| (261 | )% |

| Gain on revaluation of warrant derivative | |

| 1,473,271 | | |