false0001109354BRUKER CORP00011093542023-12-262023-12-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 26, 2023

BRUKER CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware |

000-30833 |

04-3110160 |

(State or other jurisdiction of |

(Commission |

(I.R.S. Employer |

incorporation) |

File number) |

Identification No.) |

40 Manning Road

Billerica, MA 01821

(Address of principal executive offices) (Zip Code)

(978) 663-3660

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

Common Stock, $0.01 par value per share |

|

BRKR |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 - Registrant's Business and Operations

1.01 Entry into a Material Definitive Agreement.

The following material definitive agreements have been, or may be, entered into by Bruker Invest AG, a Swiss stock corporation (“Buyer”), and a subsidiary of Bruker Corporation (the “Company”).

A Put Option Letter dated December 23, 2023 (the “Put Option Letter”), from Buyer to Tecfin S.à r.l., a controlled affiliate of PAI Partners (the “Beneficiary”) acting for itself and on behalf of the shareholders (collectively, the “Sellers”) owning directly or indirectly 100% of the issued and outstanding securities of TecInvest S.à r.l, which does business as ELITechGroup (“Target”). Target’s subsidiaries (collectively, “EliTech”) are active in the molecular diagnostics, microbiology and biomedical testing equipment fields. Under the terms of the Put Option Letter, Buyer has irrevocably and unconditionally agreed to sign the form of (i) Share Purchase Agreement attached to the Put Option Letter as Annex I (the “SPA”) and (ii) Warranty Agreement attached to the Put Option Letter as Annex II containing customary representations and warranties of the Sellers for transactions of this type (the “Warranty Agreement”), both pertaining to the acquisition of all issued and outstanding securities of Target on the terms and conditions set forth therein (the “Acquisition”), subject to the sending by the Beneficiary, on or prior to the Expiry Time (as defined below), of a notice of Sellers’ decision to sell all of Target’s securities to Buyer in accordance with the terms and conditions of the SPA (the “Put Option”). Concomitantly with the execution of the Put Option Letter, (i) the Company delivered to the Sellers a customary equity commitment letter covering all amounts payable by Buyer under the SPA (and which the Beneficiary relied upon in entering into the Put Option Letter) and (ii) Buyer secured an insurance policy to cover (as sole recourse) any and all claims for breach of the representations and warranties of the Sellers contained in the Warranty Agreement (the “W&I Insurance”).

Under the Put Option Letter, before the Beneficiary can decide whether to exercise the Put Option and enter into the SPA, (i) the social and economic committee (the “French Works’ Council”) of Elitech economic and social unit must be informed and consulted on the contemplated Acquisition and the French Works’ Council must have delivered a final opinion (whether positive or negative) on the Acquisition and (ii) the Dutch works council at the level of Elitech Group B.V. (the “Dutch Works’ Council”) must be informed and requested for advice on the carve out of Target’s clinical chemistry systems business, which will not be acquired by Buyer in the Acquisition ((i) and (ii) herein, the “Consultation Process”).

The Put Option Letter contains a 12-month exclusivity period. The Put Option Letter terminates on the earlier of (the “Expiry Time”): (i) 11:59 p.m. (CET) on the 10th business day after the Consultation Process has been completed; and (ii) 11:59 p.m. (CET) on the first business day four months after December 23, 2023.

Under the terms of the SPA, Buyer will agree to acquire (directly or indirectly) the Target and its subsidiaries for a cash purchase price derived from an Enterprise Value of €870 million, subject to certain adjustments. The purchase price will be paid by Buyer with cash on hand. The SPA provides that closing of the Acquisition is subject to the satisfaction or waiver of certain conditions, notably certain regulatory approvals and notices and the carve out referred to above. The SPA will be accompanied by the Warranty Agreement.

The description of the Put Option Letter and the SPA and the transactions contemplated thereby, including the Acquisition, contained in this Item 1.01 is not complete and is subject to, and qualified by, the full text of the Put Option Letter and the SPA which will be filed as exhibits to the Company’s Annual Report on Form 10-K for its fiscal year ended December 31, 2023.

7.01 Regulation FD Disclosure

Subject to the conditions in the Put Option Letter, and, assuming the parties enter into the SPA, the conditions to closing in the SPA, the Acquisition is currently expected to close in the second quarter of 2024. Based on information provided to Buyer by Target, the acquired business of the Target is on track to deliver €150 million in revenue in

FY2023, the majority of which is recurring revenue. If the Acquisition closes in the second quarter of 2024, Buyer expects the Acquisition to be accretive to non-GAAP EPS in FY2024.

The information furnished in this Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Cautions Concerning Forward-Looking Statements

Any statements contained in this Current Report on Form 8-K that do not describe historical facts may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including with respect to the Company’s plans to acquire the Target, anticipated timing for closing, assuming exercise of the Put Option and entry into the SPA, Target’s financial performance, and other statements about the Acquisition and the Company’s future expectations, prospects, estimates and other matters that are dependent upon future events or developments. Any forward-looking statements contained herein are based on current expectations, but are subject to risks and uncertainties that could cause actual results to differ materially from those indicated, including, but not limited to, risks and uncertainties relating to the completion of the Consultation Process and the Sellers’ execution of the SPA; the ability to successfully complete the Acquisition on a timely basis, including receipt of required regulatory approvals; the occurrence of any event, change or other circumstance that could give rise to the termination of the Acquisition; the outcome of any legal proceedings that may be instituted against the parties and others related to the Acquisition; the satisfaction of certain conditions to the completion of the Acquisition, and if the Acquisition is completed, the ability to retain the customers and employees of the acquired business, the ability to successfully integrate the acquired business into the Company’s operations, and the ability to achieve the expected financial and business synergies; competitive pressures in the Company’s various lines of business; the risk of non-renewal or a default under one or more key customer or supplier arrangements or changes to the terms of or level of purchases under those arrangements; uncertainties with respect to tax or trade laws; the effects of any investigation or action by any regulatory authority; the length and severity of any recession and the impact on global economic conditions, continued volatility in the capital markets, effects from inflation; and changes in foreign currency rates and the cost of commodities. These and other factors are identified and described in more detail in our filings with the SEC, including, without limitation, our annual report on Form 10-K for the year ended December 31, 2022 and our subsequent quarterly reports on Forms 10-Q. We expressly disclaim any intent or obligation to update these forward-looking statements other than as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

BRUKER CORPORATION

(Registrant) |

|

|

Date: December 26, 2023 |

By: |

/s/ GERALD N. HERMAN |

|

|

Gerald N. Herman |

|

|

Executive Vice President and Chief Financial Officer |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

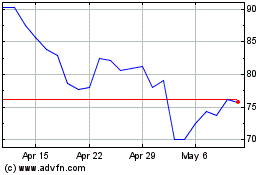

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

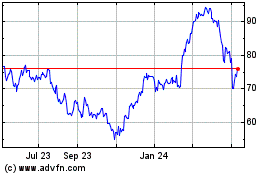

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Apr 2023 to Apr 2024