Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 15 2023 - 12:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January and February 2023

Commission File Number: 001-41606

BRERA HOLDING PLC

(Exact name of registrant as specified in its charter)

Connaught House, 5th Floor

One Burlington Road

Dublin 4

D04 C5Y6

Ireland

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry into a Letter

of Intent

On February 13, 2023, Brera

Holdings PLC, a public company limited by shares incorporated in the Republic of Ireland (the “Company”), entered into a binding

letter of intent (the “Letter of Intent”) with Fudbalski Klub Akademija Pandev, an entity organized under the laws of North

Macedonia (“FKAP”), and its sole equity holder, Goran Pandev (the “FKAP Owner”), relating to the acquisition of

FKAP by the Company or Brera Milano srl, an Italian limited liability company (società a responsabilità limitata) and wholly-owned

subsidiary of the Company (“Brera Milano”).

Pursuant to the Letter of

Intent, the Company, FKAP and the FKAP Owner will enter into a securities purchase agreement and other documents or agreements (the “Definitive

Agreements”) that will be consistent with the Letter of Intent and will describe the terms upon which the Company will acquire from

the FKAP Owner a number of shares of the issued and outstanding capital stock or other equity interests of FKAP constituting 90% of the

outstanding equity of FKAP after such acquisition. The Company will pay the FKAP Owner €600,000 on the date that the parties enter

into the Definitive Agreements. Additionally, for a period of ten years beginning with December 31, 2023, and following each year thereafter

until December 31, 2033, the Company shall issue to the FKAP Owner a number of restricted Class B Ordinary Shares, nominal value $0.005

per share (the “Class B Ordinary Shares”), of the Company equal to the quotient of the Applicable Net Income Amount (as defined

below) divided by the VWAP Per Share (as defined below). For purposes of the Letter of Intent, the “Applicable Net Income Amount”

shall be equal to the sum of (i) 15% of the net income actually received by FKAP from players’ transfer market fees received during

the applicable year; plus (ii) 15% of the net income actually received by FKAP from Union of European Football Associations prize money

paid for access to European qualifying rounds (not including group stages, and only including such rounds) during the applicable year;

and “VWAP Per Share” means the average of the daily Volume-Weighted Average Price per share of the Class B Ordinary Shares

for each of the ten consecutive trading days beginning on the trading day immediately prior to the measurement date.

The Letter of Intent will

automatically terminate, and be of no further force and effect except as provided, upon the earlier of (i) execution of the Definitive

Agreements, (ii) mutual agreement between the Company and the FKAP Owner, or (iii) at least ten days’ written notice of termination

from one party to the other which may occur no sooner than March 31, 2023.

The Letter of Intent

contains customary covenants including as to due diligence, exclusivity, and expenses.

The Letter of Intent is filed as Exhibit 1.1 to

this report on Form 6-K, and this description of the Letter of Intent is qualified in its entirety by reference to such exhibit.

Other Events

On January 27, 2023,

the Company issued a press release announcing that its shares commenced trading on The Nasdaq Stock Market LLC (“Nasdaq”).

On February 8, 2023, the Company issued a press release announcing that it will ring the closing bell of Nasdaq on February 9, 2023, to

commemorate the Company’s recent initial public offering. On February 13, 2023, the Company issued a press release announcing the

Nasdaq closing bell ceremony on February 9, 2023. On February 15, 2023, the Company issued a press release announcing the Letter of Intent.

Copies of these press releases are attached hereto as Exhibits 99.1, 99.2, 99.3, and 99.4 respectively.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: February 15, 2023 |

BRERA HOLDINGS PLC |

| |

|

|

| |

By: |

/s/ Sergio Carlo Scalpelli |

| |

|

Sergio Carlo Scalpelli |

| |

|

Chief Executive Officer |

2

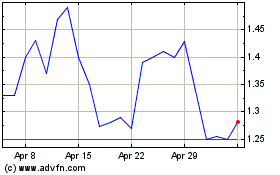

Brera (NASDAQ:BREA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brera (NASDAQ:BREA)

Historical Stock Chart

From Nov 2023 to Nov 2024