Bionano Reports Third Quarter 2024 Results and Highlights Recent Business Progress

November 13 2024 - 4:01PM

Bionano Genomics, Inc. (Nasdaq: BNGO) today reported financial

results for the third quarter ended September 30, 2024.

Our results in the third quarter reflect

improving momentum for OGM utilization and sales of flowcells,

despite overall revenues coming in below our expectations, again

driven by a small number of system orders taking longer than

expected to come through. Importantly, cash burn for the quarter

was significantly lower than the prior year period, which has been

a consistent trend now for several quarters due to our

reorganization plan to decrease expenses and is a key element in

our shift toward securing revenue and growth from our installed

base of customers using OGM and VIA software and away from

aggressively growing the installed base, which proved to be costly

in the constrained environment for capital expenditures in the

market. As a result of the restructuring, we have taken a

number of charges, which elevated operating expense, but a

substantial amount of that comprises one-time non-cash charges we

don’t expect to see to the same degree going forward,”

commented Erik Holmlin, PhD, president and chief executive

officer of Bionano. “Indeed, our disciplined and systematic

approach to mitigating operational expenses and cash burn has been

painful at times, but we believe it is necessary. I am proud of the

team’s execution to reduce the overall cash needs of the business

as we prepare for new opportunities in the future."

Q3 2024 Company Highlights

- CPT code implementation and

pricing announcement on schedule following the category 1 CPT code

approval by the American Medical Association (AMA) in May

2024. The new CPT Code is for the use of OGM in

cytogenomic genome-wide analysis to detect structural and copy

number variations related to hematological malignancies. The final

Clinical Lab Fee Schedule (CLFS) for 2025 is expected to publish

before year end.

- Announced a registered

direct offering and concurrent private placement of clinical

milestone-linked Series A and Series B warrants:

- Upfront gross proceeds to

the Company of approximately $10.0

million, before deducting the placement agent’s fees and

other offering expenses payable by the Company; funds will be used

for general corporate purposes.

- Potential additional gross

proceeds of up to $20.0 million upon the cash exercise (at an

exercise price of $0.571 per share and subject to stockholder

approval) in full of the Series A and Series B warrants to

purchase an aggregate of 35,026,272 shares.

- Adjournment of Special

Shareholder Meeting due to lack of Quorum

- The Special Meeting will reconvene

at 10 a.m. (PT) on November 27, 2024 in hopes of reaching the

quorum requirements for a meeting. As of October 30th,

approximately 2.2 million additional votes were needed to reach a

quorum.

- Announced Publication of

First Multi-Site Study to Analyze the Utility of OGM in Multiple

Myeloma

- The study conducted by researchers

at University of Texas MD Anderson Cancer Center and The Johns

Hopkins Hospital, researchers concurrently analyzed 45 PCN samples

using karyotype (KT), fluorescence in situ hybridization

(FISH), OGM and next-generation sequencing (NGS).

- OGM uniquely identified complex

genomic rearrangements that are associated with cancer

proliferation and progression, resulting in a change in

prognostication beyond that indicated by traditional cytogenetic

analysis in 18% of cases. In at least five cases (11%), OGM’s

unique findings provided precise information to predict response to

target therapies like BCMA monoclonal antibody, CAR-T, or GPRC5D

targeted therapies, which may have therapeutic implications.

- The study results highlight OGM’s

ability to provide researchers with a highly sensitive, accurate

genome-wide analysis that can lead to a more comprehensive

understanding of genetic subtypes in PCN when compared with FISH

and KT.

- Installed base of OGM

systems totaled 368 at the end of the third quarter of

2024, which represents a 22% increase over the 301

installed systems reported at the end of the third quarter of

2023.

- 7,835 nanochannel array

flowcells sold during the third quarter of 2024, which

represents a 27% increase over the 6,176 flowcells sold during the

third quarter of 2023.

Q3 2024 Financial Results

- Total revenue for the third

quarter of 2024 was $6.1 million, a decrease of 35%

compared to the third quarter of 2023. Revenues included $6.6

million in sales of core products and software offset by a $0.5

million write-down of aged receivables from Bionano Laboratories

clinical service offerings, which were discontinued in March of

2024. The write-down was treated as a reversal of revenue.

- GAAP gross margin for the

third quarter of 2024 was (139)%, compared to 30% for the

third quarter of 2023. Third quarter 2024 non-GAAP gross margin was

26%, compared to 32% for the third quarter of 2023. Third quarter

2024 non-GAAP gross margin excludes $82,000 in stock-based

compensation, $139,000 of restructuring expense, and $9.8 million

of impairment and disposal of reagent rentals and inventory. Third

quarter 2023 GAAP to non-GAAP reconciliation can be found in the

reconciliation table accompanying this press release.

- Third quarter 2024 GAAP

operating expense was $35.5 million, and $16.1

million on a non-GAAP basis, which is a decrease of 69%

and 49%, respectively, from the third quarter of 2023. Non-GAAP

operating expense in the third quarter of 2024 excludes

restructuring costs, stock-based compensation, and other

adjustments as detailed in the reconciliation table accompanying

this press release. Third quarter 2023 GAAP to non-GAAP

reconciliation can be found in the same table in this release.

- Cash, cash equivalents,

available-for-sale securities, and restricted cash were $23.4

million as of September 30, 2024. As of September 30,

2024, $11.4 million was subject to certain restrictions.

- As of September 30, 2024, the

aggregate principal amount of senior secured convertible debentures

outstanding was $17.0 million.

- Bionano raised net proceeds of

approximately $0.1million from ATM sales during the third quarter.

An additional $1.2 million was raised in net proceeds from ATM

sales subsequent to the end of the third quarter 2024.

Recent Highlights

- Announced closing of an

additional $3.0 million registered direct offering

- Upfront gross proceeds to

the Company of approximately $3.0 million, before

deducting the placement agent’s fees and other offering expenses

payable by the Company; funds will be used for general corporate

purposes.

- Potential additional gross proceeds

of up to $6.0 million upon the cash exercise (at an exercise price

of $0.3039 per share and subject to stockholder approval) in full

of the Series C and Series D warrants to purchase an aggregate of

19,762,226 shares.

- Recent Peer-reviewed

highlighted applications of OGM in blood cancers

- Publication in Blood Cancer

Journal by a group of researchers at the Korea College of

Medicine in South Korea showing that optical genome

mapping (OGM) can resolve rearrangements in the MYC gene

in multiple myeloma (MM), which represent highly actionable

biomarkers in cancer.

- Data demonstrated the potential for

wider adoption and use of OGM across all blood cancers as an

alternative to traditional methods like KT and FISH.

Conference Call & Webcast

Details

|

Date: |

Wednesday, November 13th, 2024 |

|

Time: |

4:30 p.m. ET |

|

Participant Link: |

Registration - Click Here |

|

Webcast Link: |

https://edge.media-server.com/mmc/p/dmabxin9 |

Participants may access a live webcast of the

call on the Investors page of the Bionano website. A replay of the

conference call and webcast will be archived on Bionano’s investor

relations website at https://ir.bionano.com/ for at least 30

days.

About Bionano

Bionano is a provider of genome analysis

solutions that can enable researchers and clinicians to reveal

answers to challenging questions in biology and medicine. The

Company’s mission is to transform the way the world sees the genome

through optical genome mapping (OGM) solutions, diagnostic services

and software. The Company offers OGM solutions for applications

across basic, translational and clinical research. The Company also

offers an industry-leading, platform-agnostic genome analysis

software solution, and nucleic acid extraction and purification

solutions using proprietary isotachophoresis (ITP) technology.

Through its Lineagen, Inc. d/b/a Bionano Laboratories business, the

Company also offers OGM-based diagnostic testing services. For more

information, visit www.bionano.com

and www.bionanolaboratories.com.

Unless specifically noted otherwise, Bionano’s

OGM products are for research use only and not for use in

diagnostic procedures.

Non-GAAP Financial Measures

To supplement Bionano’s financial results

reported in accordance with U.S. generally accepted accounting

principles (GAAP), the Company has provided non-GAAP gross margin

and non-GAAP operating expense in this press release, which are

non-GAAP financial measures. Non-GAAP operating expense excludes

from GAAP reported operating expense the following components as

detailed in the reconciliation table accompanying this press

release: costs directly attributable to the company restructuring,

stock-based compensation, amortization of intangibles, change in

fair value of contingent consideration and certain deal-related

costs. Non-GAAP gross margin excludes from GAAP reported gross

margin stock-based compensation and certain restructuring expense

as detailed in the reconciliation table accompanying this press

release.

Bionano believes that non-GAAP gross margin and

non-GAAP operating expense are useful to investors and analysts as

a supplement to its financial information prepared in accordance

with GAAP for analyzing operating performance and identifying

operating trends in its business. Bionano uses non-GAAP gross

margin and non-GAAP operating expense internally to facilitate

period-to-period comparisons and analysis of its operating

performance in order to understand, manage and evaluate its

business and to make operating decisions. Accordingly, Bionano

believes these measures allow for greater transparency with respect

to key financial metrics it uses in assessing its own operating

performance and making operating decisions.

These non-GAAP financial measures are not meant

to be considered in isolation or as a substitute for comparable

GAAP measures; should be read in conjunction with the Company’s

consolidated financial statements prepared in accordance with GAAP;

have no standardized meaning prescribed by GAAP; and are not

prepared under any comprehensive set of accounting rules or

principles. In addition, from time to time in the future, there may

be other items that the Company may exclude for purposes of its

non-GAAP financial measures; and the Company may in the future

cease to exclude items that it has historically excluded for

purposes of its non-GAAP financial measures. Likewise, the Company

may determine to modify the nature of its adjustments to arrive at

its non-GAAP financial measures. Because of the non-standardized

definitions of non-GAAP financial measures, the non-GAAP financial

measures as used by Bionano in this press release and the

accompanying reconciliation table have limits in its usefulness to

investors and may be calculated differently from, and therefore may

not be directly comparable to, similarly titled measures used by

other companies.

For a reconciliation of non-GAAP gross margin

and non-GAAP operating expense to gross margin and operating

expense reported in accordance with GAAP, please refer to the

financial tables accompanying this release.

Forward-Looking Statements of Bionano

Genomics

This press release and accompanying conference

call contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Words such as

“believe,” “estimate,” “expect,” “may,” “plan,” “will” and similar

expressions (as well as other words or expressions referencing

future events, conditions or circumstances) convey uncertainty of

future events or outcomes and are intended to identify these

forward-looking statements. Forward-looking statements include

statements regarding our intentions, beliefs, projections, outlook,

analyses or current expectations concerning, among other things:

our expectations regarding product uptake, revenue growth, market

development and OGM adoption, including through publications

highlighting the utility and applications of OGM; our growth

prospects and future financial and operating results; the growth of

our installed OGM system base; the sales of our flowcell

consumables and the other expectations related thereto; our

commercial expectations; the anticipated benefits and success of

our collaboration efforts; continued research, presentations and

publications involving OGM and its utility compared to traditional

cytogenetics and our technologies; our ability to drive adoption of

OGM and our technology solutions; any potential proceeds from the

exercise of the Series A, Series B, Series C and Series D warrants;

our plans to hold a special meeting of stockholders; our cost

savings and strategic productivity initiatives; our expectation of

a reduction in non-cash charges in the future; and efforts to

extend our cash runway. Each of these forward-looking statements

involves risks and uncertainties. Actual results or developments

may differ materially from those projected or implied in these

forward-looking statements. Factors that may cause such a

difference include the risks and uncertainties associated with: the

timing and amount of revenue we are able to recognize in a given

fiscal period; the impact of adverse geopolitical and macroeconomic

events, such as recent and potential future bank failures and the

ongoing conflicts between Ukraine and Russia and in the Middle

East, on our business and the global economy; general market

conditions, including inflation and supply chain disruptions;

challenges inherent in developing, manufacturing and

commercializing our products; our ability to further deploy new

products and applications and expand the market for our technology

platforms; our expectations and beliefs regarding future growth of

the business and the markets in which we operate; changes in our

strategic and commercial plans; our ability to continue as a “going

concern” which requires us to manage costs and obtain significant

additional financing to fund our strategic plans and

commercialization efforts; our ability to cure any deficiencies in

compliance with Nasdaq Listing Rules that could adversely affect

our ability to raise capital and our financial condition and

business; our ability to consummate any strategic alternatives; the

risk that if we fail to obtain additional financing we may seek

relief under applicable insolvency laws; the ability of medical and

research institutions to obtain funding to support adoption or

continued use of our technologies; study results that differ or

contradict the results mentioned in this press release; our ability

to obtain stockholder approval for the exercise of the Series A,

Series B, Series C and Series D warrants; and the risks and

uncertainties associated with our business and financial condition

in general, including the risks and uncertainties described in our

filings with the Securities and Exchange Commission, including,

without limitation, our Annual Report on Form 10-K for the year

ended December 31, 2023 and in other filings subsequently made by

us with the Securities and Exchange Commission. All forward-looking

statements contained in this press release speak only as of the

date on which they were made and are based on management’s

assumptions and estimates as of such date. We do not undertake any

obligation to publicly update any forward-looking statements,

whether as a result of the receipt of new information, the

occurrence of future events or otherwise.

CONTACTS

Company Contact:Erik Holmlin,

CEOBionano Genomics, Inc.+1 (858) 888-7610eholmlin@bionano.com

Investor Relations:David

HolmesGilmartin Group+1 (858) 888-7625IR@bionano.com

|

|

|

BIONANO GENOMICS, INC |

|

Condensed Consolidated Balance Sheet

(Unaudited) |

| |

(Unaudited) |

|

|

| |

September 30,2024 |

|

December 31,2023 |

|

Assets |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

8,794,000 |

|

|

$ |

17,948,000 |

|

|

Investments |

|

3,160,000 |

|

|

|

48,823,000 |

|

|

Accounts receivable, net |

|

5,316,000 |

|

|

|

9,319,000 |

|

|

Inventory |

|

14,323,000 |

|

|

|

22,892,000 |

|

|

Prepaid expenses and other current assets |

|

4,387,000 |

|

|

|

6,019,000 |

|

|

Restricted investments |

|

11,000,000 |

|

|

|

35,117,000 |

|

| Total current

assets |

|

46,980,000 |

|

|

|

140,118,000 |

|

|

Restricted cash, net of current portion |

|

400,000 |

|

|

|

400,000 |

|

|

Property and equipment, net |

|

19,995,000 |

|

|

|

23,345,000 |

|

|

Operating lease right-of-use asset |

|

2,833,000 |

|

|

|

5,633,000 |

|

|

Financing lease right-of-use asset |

|

3,351,000 |

|

|

|

3,503,000 |

|

|

Intangible assets, net |

|

11,045,000 |

|

|

|

33,974,000 |

|

|

Other long-term assets |

|

2,758,000 |

|

|

|

7,431,000 |

|

| Total assets |

$ |

87,362,000 |

|

|

$ |

214,404,000 |

|

| |

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

$ |

8,700,000 |

|

|

$ |

10,384,000 |

|

|

Accrued expenses |

|

5,883,000 |

|

|

|

8,089,000 |

|

|

Contract liabilities |

|

1,195,000 |

|

|

|

783,000 |

|

|

Operating lease liability |

|

1,956,000 |

|

|

|

2,163,000 |

|

|

Finance lease liability |

|

263,000 |

|

|

|

272,000 |

|

|

Purchase option liability (at fair value) |

|

— |

|

|

|

8,534,000 |

|

|

Convertible debentures and High Trail notes payable (at fair

value) |

|

14,953,000 |

|

|

|

69,803,000 |

|

| Total current

liabilities |

|

32,950,000 |

|

|

|

100,028,000 |

|

|

Operating lease liability, net of current portion |

|

1,730,000 |

|

|

|

3,590,000 |

|

|

Finance lease liability, net of current portion |

|

3,551,000 |

|

|

|

3,585,000 |

|

|

Contingent consideration |

|

— |

|

|

|

10,890,000 |

|

|

Long-term contract liabilities |

|

263,000 |

|

|

|

154,000 |

|

| Total

liabilities |

|

38,494,000 |

|

|

|

118,247,000 |

|

| Stockholders’

equity: |

|

|

|

|

Common stock |

|

9,000 |

|

|

|

5,000 |

|

|

Preferred Stock |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

720,425,000 |

|

|

|

677,337,000 |

|

|

Accumulated deficit |

|

(673,100,000 |

) |

|

|

(581,208,000 |

) |

|

Accumulated other comprehensive income (loss) |

|

1,534,000 |

|

|

|

23,000 |

|

| Total

stockholders’ equity |

|

48,868,000 |

|

|

|

96,157,000 |

|

| Total liabilities

and stockholders’ equity |

$ |

87,362,000 |

|

|

$ |

214,404,000 |

|

| |

|

|

|

| |

|

|

|

|

|

|

|

Bionano Genomics, Inc. |

|

Condensed Consolidated Statement of Operations

(Unaudited) |

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

Product revenue |

$ |

6,021,000 |

|

|

$ |

6,456,000 |

|

|

$ |

19,359,000 |

|

|

$ |

18,512,000 |

|

|

Service and other revenue |

|

52,000 |

|

|

|

2,862,000 |

|

|

|

3,254,000 |

|

|

|

6,883,000 |

|

|

Total revenue |

|

6,073,000 |

|

|

|

9,318,000 |

|

|

|

22,613,000 |

|

|

|

25,395,000 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

Cost of product revenue |

|

14,251,000 |

|

|

|

5,105,000 |

|

|

|

23,858,000 |

|

|

|

13,714,000 |

|

|

Cost of service and other revenue |

|

268,000 |

|

|

|

1,464,000 |

|

|

|

1,792,000 |

|

|

|

4,553,000 |

|

|

Total cost of revenue |

|

14,519,000 |

|

|

|

6,569,000 |

|

|

|

25,650,000 |

|

|

|

18,267,000 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

4,717,000 |

|

|

|

13,785,000 |

|

|

|

21,329,000 |

|

|

|

42,331,000 |

|

|

Selling, general and administrative |

|

9,464,000 |

|

|

|

24,896,000 |

|

|

|

40,109,000 |

|

|

|

77,809,000 |

|

|

Goodwill impairment |

|

— |

|

|

|

77,280,000 |

|

|

|

— |

|

|

|

77,280,000 |

|

|

Intangible assets and other long-lived assets impairment |

|

19,504,000 |

|

|

|

— |

|

|

|

19,951,000 |

|

|

|

— |

|

|

Restructuring costs |

|

1,770,000 |

|

|

|

— |

|

|

|

7,616,000 |

|

|

|

— |

|

|

Total operating expenses |

|

35,455,000 |

|

|

|

115,961,000 |

|

|

|

89,005,000 |

|

|

|

197,420,000 |

|

| Loss from operations |

|

(43,901,000 |

) |

|

|

(113,212,000 |

) |

|

|

(92,042,000 |

) |

|

|

(190,292,000 |

) |

| Other income (expenses): |

|

|

|

|

|

|

|

|

Interest income |

|

376,000 |

|

|

|

730,000 |

|

|

|

1,876,000 |

|

|

|

2,122,000 |

|

|

Other income (expense) |

|

(697,000 |

) |

|

|

(45,000 |

) |

|

|

(1,694,000 |

) |

|

|

(334,000 |

) |

|

Total other income (expense) |

|

(321,000 |

) |

|

|

685,000 |

|

|

|

182,000 |

|

|

|

1,788,000 |

|

| Loss before income taxes |

|

(44,222,000 |

) |

|

|

(112,527,000 |

) |

|

|

(91,860,000 |

) |

|

|

(188,504,000 |

) |

| Provision for income

taxes |

|

(24,000 |

) |

|

|

(39,000 |

) |

|

|

(32,000 |

) |

|

|

(98,000 |

) |

| Net loss |

$ |

(44,246,000 |

) |

|

$ |

(112,566,000 |

) |

|

$ |

(91,892,000 |

) |

|

$ |

(188,602,000 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bionano Genomics, Inc. |

|

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited) |

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| GAAP gross margin: |

|

|

|

|

|

|

|

|

GAAP revenue |

$ |

6,073,000 |

|

|

$ |

9,318,000 |

|

|

$ |

22,613,000 |

|

|

$ |

25,395,000 |

|

| GAAP cost of revenue |

|

14,519,000 |

|

|

|

6,569,000 |

|

|

|

25,650,000 |

|

|

|

18,267,000 |

|

|

GAAP gross profit |

|

(8,446,000 |

) |

|

|

2,749,000 |

|

|

|

(3,037,000 |

) |

|

|

7,128,000 |

|

|

GAAP gross margin % |

|

(139 |

)% |

|

|

30 |

% |

|

|

(13 |

)% |

|

|

28 |

% |

| |

|

|

|

|

|

|

|

| Adjusted non-GAAP gross

margin: |

|

|

|

|

|

|

|

| GAAP revenue |

$ |

6,073,000 |

|

|

$ |

9,318,000 |

|

|

$ |

22,613,000 |

|

|

$ |

25,395,000 |

|

| GAAP cost of revenue |

|

14,519,000 |

|

|

|

6,569,000 |

|

|

|

25,650,000 |

|

|

|

18,267,000 |

|

|

Stock-based compensation expense |

|

(82,000 |

) |

|

|

(187,000 |

) |

|

|

(338,000 |

) |

|

|

(531,000 |

) |

|

COGS restructuring |

|

(139,000 |

) |

|

|

— |

|

|

|

(157,000 |

) |

|

|

— |

|

|

Impairment and disposal of reagent rentals and inventory |

|

(9,822,494 |

) |

|

|

— |

|

|

|

(9,822,494 |

) |

|

|

— |

|

|

Adjusted non-GAAP cost of revenue |

|

4,475,506 |

|

|

|

6,382,000 |

|

|

|

15,332,506 |

|

|

|

17,736,000 |

|

|

Adjusted non-GAAP gross profit |

|

1,597,494 |

|

|

|

2,936,000 |

|

|

|

7,280,494 |

|

|

|

7,659,000 |

|

|

Adjusted non-GAAP gross margin % |

|

26 |

% |

|

|

32 |

% |

|

|

32 |

% |

|

|

30 |

% |

| |

|

|

|

|

|

|

|

| GAAP operating expense |

|

|

|

|

|

|

|

|

GAAP selling, general and administrative expense |

$ |

9,464,000 |

|

|

$ |

24,896,000 |

|

|

$ |

40,109,000 |

|

|

$ |

77,809,000 |

|

|

Stock-based compensation expense |

|

(1,675,000 |

) |

|

|

(2,556,000 |

) |

|

|

(5,732,000 |

) |

|

|

(7,368,000 |

) |

|

Intangible asset amortization |

|

(1,713,000 |

) |

|

|

(1,792,000 |

) |

|

|

(5,219,000 |

) |

|

|

(5,377,000 |

) |

|

Change in fair value of contingent consideration |

|

5,774,000 |

|

|

|

(310,000 |

) |

|

|

10,890,000 |

|

|

|

(2,528,000 |

) |

|

Transaction related expenses |

|

— |

|

|

|

(929,000 |

) |

|

|

— |

|

|

|

(929,000 |

) |

|

Adjusted non-GAAP selling, general and administrative expense |

|

11,850,000 |

|

|

|

19,309,000 |

|

|

|

40,048,000 |

|

|

|

61,607,000 |

|

|

GAAP research and development expense |

$ |

4,717,000 |

|

|

$ |

13,785,000 |

|

|

$ |

21,329,000 |

|

|

$ |

42,331,000 |

|

|

Stock-based compensation expense |

|

(445,000 |

) |

|

|

(1,249,000 |

) |

|

|

(1,730,000 |

) |

|

|

(3,907,000 |

) |

|

Adjusted non-GAAP R & D expense |

|

4,272,000 |

|

|

|

12,536,000 |

|

|

|

19,599,000 |

|

|

|

38,424,000 |

|

|

GAAP goodwill impairment |

$ |

— |

|

|

$ |

77,280,000 |

|

|

$ |

— |

|

|

$ |

77,280,000 |

|

|

Goodwill impairment |

|

— |

|

|

|

(77,280,000 |

) |

|

|

— |

|

|

|

(77,280,000 |

) |

|

Adjusted non-GAAP goodwill impairment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

GAAP intangible assets and other long-lived assets impairment |

$ |

19,504,000 |

|

|

$ |

— |

|

|

$ |

19,951,000 |

|

|

$ |

— |

|

|

Intangible assets, and other long-lived assets impairment |

|

(19,504,000 |

) |

|

|

— |

|

|

|

(19,951,000 |

) |

|

|

— |

|

|

Adjusted non-GAAP intangible assets and other long-lived assets

impairment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

GAAP restructuring costs |

$ |

1,769,000 |

|

|

$ |

— |

|

|

$ |

7,616,000 |

|

|

$ |

— |

|

|

Restructuring costs |

|

(1,769,000 |

) |

|

|

— |

|

|

|

(7,616,000 |

) |

|

|

— |

|

|

Adjusted non-GAAP restructuring costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total adjusted non-GAAP

operating expense |

$ |

16,122,000 |

|

|

$ |

31,845,000 |

|

|

$ |

59,647,000 |

|

|

$ |

100,031,000 |

|

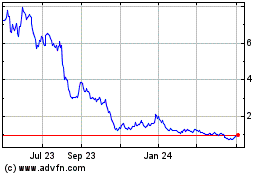

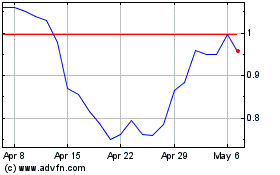

Bionano Genomics (NASDAQ:BNGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bionano Genomics (NASDAQ:BNGO)

Historical Stock Chart

From Dec 2023 to Dec 2024