false

--12-31

2024

Q2

0001643918

0001643918

2024-01-01

2024-06-30

0001643918

2023-01-01

2023-06-30

0001643918

2024-06-30

0001643918

2023-12-31

0001643918

2022-12-31

0001643918

2023-06-30

0001643918

BDRX:ShareCapitalMember

2023-12-31

0001643918

ifrs-full:SharePremiumMember

2023-12-31

0001643918

ifrs-full:MergerReserveMember

2023-12-31

0001643918

ifrs-full:WarrantReserveMember

2023-12-31

0001643918

ifrs-full:RetainedEarningsMember

2023-12-31

0001643918

BDRX:ShareCapitalMember

2022-12-31

0001643918

ifrs-full:SharePremiumMember

2022-12-31

0001643918

ifrs-full:MergerReserveMember

2022-12-31

0001643918

ifrs-full:WarrantReserveMember

2022-12-31

0001643918

ifrs-full:RetainedEarningsMember

2022-12-31

0001643918

BDRX:ShareCapitalMember

2024-01-01

2024-06-30

0001643918

ifrs-full:SharePremiumMember

2024-01-01

2024-06-30

0001643918

ifrs-full:MergerReserveMember

2024-01-01

2024-06-30

0001643918

ifrs-full:WarrantReserveMember

2024-01-01

2024-06-30

0001643918

ifrs-full:RetainedEarningsMember

2024-01-01

2024-06-30

0001643918

BDRX:ShareCapitalMember

2023-01-01

2023-06-30

0001643918

ifrs-full:SharePremiumMember

2023-01-01

2023-06-30

0001643918

ifrs-full:MergerReserveMember

2023-01-01

2023-06-30

0001643918

ifrs-full:WarrantReserveMember

2023-01-01

2023-06-30

0001643918

ifrs-full:RetainedEarningsMember

2023-01-01

2023-06-30

0001643918

BDRX:ShareCapitalMember

2024-06-30

0001643918

ifrs-full:SharePremiumMember

2024-06-30

0001643918

ifrs-full:MergerReserveMember

2024-06-30

0001643918

ifrs-full:WarrantReserveMember

2024-06-30

0001643918

ifrs-full:RetainedEarningsMember

2024-06-30

0001643918

BDRX:ShareCapitalMember

2023-06-30

0001643918

ifrs-full:SharePremiumMember

2023-06-30

0001643918

ifrs-full:MergerReserveMember

2023-06-30

0001643918

ifrs-full:WarrantReserveMember

2023-06-30

0001643918

ifrs-full:RetainedEarningsMember

2023-06-30

0001643918

ifrs-full:IntangibleAssetsUnderDevelopmentMember

BDRX:GrossGrossGrossCarryingAmountMember

2022-12-31

0001643918

ifrs-full:GoodwillMember

BDRX:GrossGrossGrossCarryingAmountMember

2022-12-31

0001643918

BDRX:ITAndWebsiteCostsMember

BDRX:GrossGrossGrossCarryingAmountMember

2022-12-31

0001643918

BDRX:GrossGrossGrossCarryingAmountMember

2022-12-31

0001643918

ifrs-full:IntangibleAssetsUnderDevelopmentMember

BDRX:GrossGrossGrossCarryingAmountMember

2023-01-01

2023-12-31

0001643918

ifrs-full:GoodwillMember

BDRX:GrossGrossGrossCarryingAmountMember

2023-01-01

2023-12-31

0001643918

BDRX:ITAndWebsiteCostsMember

BDRX:GrossGrossGrossCarryingAmountMember

2023-01-01

2023-12-31

0001643918

BDRX:GrossGrossGrossCarryingAmountMember

2023-01-01

2023-12-31

0001643918

ifrs-full:IntangibleAssetsUnderDevelopmentMember

BDRX:GrossGrossGrossCarryingAmountMember

2023-12-31

0001643918

ifrs-full:GoodwillMember

BDRX:GrossGrossGrossCarryingAmountMember

2023-12-31

0001643918

BDRX:ITAndWebsiteCostsMember

BDRX:GrossGrossGrossCarryingAmountMember

2023-12-31

0001643918

BDRX:GrossGrossGrossCarryingAmountMember

2023-12-31

0001643918

ifrs-full:IntangibleAssetsUnderDevelopmentMember

BDRX:GrossGrossGrossCarryingAmountMember

2024-01-01

2024-06-30

0001643918

ifrs-full:GoodwillMember

BDRX:GrossGrossGrossCarryingAmountMember

2024-01-01

2024-06-30

0001643918

BDRX:ITAndWebsiteCostsMember

BDRX:GrossGrossGrossCarryingAmountMember

2024-01-01

2024-06-30

0001643918

BDRX:GrossGrossGrossCarryingAmountMember

2024-01-01

2024-06-30

0001643918

ifrs-full:IntangibleAssetsUnderDevelopmentMember

BDRX:GrossGrossGrossCarryingAmountMember

2024-06-30

0001643918

ifrs-full:GoodwillMember

BDRX:GrossGrossGrossCarryingAmountMember

2024-06-30

0001643918

BDRX:ITAndWebsiteCostsMember

BDRX:GrossGrossGrossCarryingAmountMember

2024-06-30

0001643918

BDRX:GrossGrossGrossCarryingAmountMember

2024-06-30

0001643918

ifrs-full:IntangibleAssetsUnderDevelopmentMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2022-12-31

0001643918

ifrs-full:GoodwillMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2022-12-31

0001643918

BDRX:ITAndWebsiteCostsMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2022-12-31

0001643918

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2022-12-31

0001643918

ifrs-full:IntangibleAssetsUnderDevelopmentMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2023-01-01

2023-12-31

0001643918

ifrs-full:GoodwillMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2023-01-01

2023-12-31

0001643918

BDRX:ITAndWebsiteCostsMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2023-01-01

2023-12-31

0001643918

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2023-01-01

2023-12-31

0001643918

ifrs-full:IntangibleAssetsUnderDevelopmentMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2023-12-31

0001643918

ifrs-full:GoodwillMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2023-12-31

0001643918

BDRX:ITAndWebsiteCostsMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2023-12-31

0001643918

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2023-12-31

0001643918

ifrs-full:IntangibleAssetsUnderDevelopmentMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2024-01-01

2024-06-30

0001643918

ifrs-full:GoodwillMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2024-01-01

2024-06-30

0001643918

BDRX:ITAndWebsiteCostsMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2024-01-01

2024-06-30

0001643918

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2024-01-01

2024-06-30

0001643918

ifrs-full:IntangibleAssetsUnderDevelopmentMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2024-06-30

0001643918

ifrs-full:GoodwillMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2024-06-30

0001643918

BDRX:ITAndWebsiteCostsMember

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2024-06-30

0001643918

ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember

2024-06-30

0001643918

BDRX:MTX228TolimidoneAcquiredIPRDMember

2024-06-30

0001643918

BDRX:MTX228TolimidoneAcquiredIPRDMember

2023-12-31

0001643918

BDRX:MTX230eRapaAcquiredIPRDMember

2024-06-30

0001643918

BDRX:MTX230eRapaAcquiredIPRDMember

2023-12-31

0001643918

2024-04-01

2024-04-25

0001643918

BDRX:EmtoraMember

2024-04-01

2024-04-25

0001643918

2024-04-25

0001643918

BDRX:EmtoraMember

2024-01-01

2024-06-30

0001643918

2023-01-01

2023-12-31

0001643918

BDRX:SeriesGADSWarrantsMember

2024-05-01

2024-05-31

0001643918

BDRX:SeriesHADSWarrantsMember

2024-05-01

2024-05-31

0001643918

2024-05-31

0001643918

BDRX:SeriesEADSWarrantsMember

2023-12-01

2023-12-31

0001643918

BDRX:SeriesFADSWarrantsMember

2023-12-01

2023-12-31

0001643918

BDRX:SeriesDADSWarrantsMember

2023-06-01

2023-06-30

0001643918

BDRX:SeriesDADSWarrantsMember

2023-06-30

0001643918

BDRX:SeriesGADSWarrantsMember

2020-05-01

2020-05-31

0001643918

BDRX:SeriesGADSWarrantsMember

2019-10-01

2019-10-31

0001643918

BDRX:SeriesEWarrantsMember

2024-01-01

2024-06-30

0001643918

BDRX:SeriesFWarrantsMember

2024-01-01

2024-06-30

0001643918

BDRX:May2024GrantMember

2022-12-31

0001643918

BDRX:May2024GrantMember

2023-01-01

2023-12-31

0001643918

BDRX:May2024GrantMember

2023-12-31

0001643918

BDRX:May2024GrantMember

2024-01-01

2024-06-30

0001643918

BDRX:May2024GrantMember

2024-06-30

0001643918

BDRX:December2023GrantMember

2022-12-31

0001643918

BDRX:December2023GrantMember

2023-01-01

2023-12-31

0001643918

BDRX:December2023GrantMember

2023-12-31

0001643918

BDRX:December2023GrantMember

2024-01-01

2024-06-30

0001643918

BDRX:December2023GrantMember

2024-06-30

0001643918

BDRX:May2023GrantMember

2022-12-31

0001643918

BDRX:May2023GrantMember

2023-01-01

2023-12-31

0001643918

BDRX:May2023GrantMember

2023-12-31

0001643918

BDRX:May2023GrantMember

2024-01-01

2024-06-30

0001643918

BDRX:May2023GrantMember

2024-06-30

0001643918

BDRX:May2020GrantMember

2022-12-31

0001643918

BDRX:May2020GrantMember

2023-01-01

2023-12-31

0001643918

BDRX:May2020GrantMember

2023-12-31

0001643918

BDRX:May2020GrantMember

2024-01-01

2024-06-30

0001643918

BDRX:May2020GrantMember

2024-06-30

0001643918

BDRX:October19GrantMember

2022-12-31

0001643918

BDRX:October19GrantMember

2023-01-01

2023-12-31

0001643918

BDRX:October19GrantMember

2023-12-31

0001643918

BDRX:October19GrantMember

2024-01-01

2024-06-30

0001643918

BDRX:October19GrantMember

2024-06-30

0001643918

BDRX:DARAOptionsMember

2022-12-31

0001643918

BDRX:DARAOptionsMember

2023-01-01

2023-12-31

0001643918

BDRX:DARAOptionsMember

2023-12-31

0001643918

BDRX:DARAOptionsMember

2024-01-01

2024-06-30

0001643918

BDRX:DARAOptionsMember

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesHWarrantsMember

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesHWarrantsMember

2023-12-31

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesHWarrantsMember

2024-01-01

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesGWarrantsMember

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesGWarrantsMember

2023-12-31

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesGWarrantsMember

2024-01-01

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesFWarrantsMember

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesFWarrantsMember

2023-12-31

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesFWarrantsMember

2024-01-01

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesEWarrantsMember

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesEWarrantsMember

2023-12-31

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesEWarrantsMember

2024-01-01

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesDWarrantsMember

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesDWarrantsMember

2023-12-31

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:SeriesDWarrantsMember

2024-01-01

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:May2020WarrantsMember

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:May2020WarrantsMember

2023-12-31

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:May2020WarrantsMember

2024-01-01

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:October2019WarrantsMember

2024-06-30

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:October2019WarrantsMember

2023-12-31

0001643918

ifrs-full:Level3OfFairValueHierarchyMember

BDRX:October2019WarrantsMember

2024-01-01

2024-06-30

0001643918

ifrs-full:OrdinarySharesMember

2024-06-30

0001643918

ifrs-full:OrdinarySharesMember

2023-12-31

0001643918

BDRX:ADeferredSharesMember

2024-06-30

0001643918

BDRX:ADeferredSharesMember

2023-12-31

0001643918

BDRX:BDeferredSharesMember

2024-06-30

0001643918

BDRX:BDeferredSharesMember

2023-12-31

0001643918

BDRX:PreFundedWarrantsMember

2023-01-01

2023-12-31

0001643918

BDRX:SeriesAWarrantsMember

2023-01-01

2023-12-31

0001643918

BDRX:SeriesBWarrantsMember

2023-01-01

2023-12-31

0001643918

BDRX:SeriesCWarrantsMember

2023-01-01

2023-12-31

0001643918

BDRX:PreFundedWarrantsMember

2022-12-31

0001643918

BDRX:AbeyanceSharesMember

2022-12-31

0001643918

BDRX:SeriesAWarrantsMember

2022-12-31

0001643918

BDRX:SeriesBWarrantsMember

2022-12-31

0001643918

BDRX:SeriesCWarrantsMember

2022-12-31

0001643918

BDRX:AbeyanceSharesMember

2023-01-01

2023-12-31

0001643918

BDRX:PreFundedWarrantsMember

2023-12-31

0001643918

BDRX:AbeyanceSharesMember

2023-12-31

0001643918

BDRX:SeriesAWarrantsMember

2023-12-31

0001643918

BDRX:SeriesBWarrantsMember

2023-12-31

0001643918

BDRX:SeriesCWarrantsMember

2023-12-31

0001643918

BDRX:PreFundedWarrantsMember

2024-01-01

2024-06-30

0001643918

BDRX:AbeyanceSharesMember

2024-01-01

2024-06-30

0001643918

BDRX:SeriesAWarrantsMember

2024-01-01

2024-06-30

0001643918

BDRX:SeriesBWarrantsMember

2024-01-01

2024-06-30

0001643918

BDRX:SeriesCWarrantsMember

2024-01-01

2024-06-30

0001643918

BDRX:PreFundedWarrantsMember

2024-06-30

0001643918

BDRX:AbeyanceSharesMember

2024-06-30

0001643918

BDRX:SeriesAWarrantsMember

2024-06-30

0001643918

BDRX:SeriesBWarrantsMember

2024-06-30

0001643918

BDRX:SeriesCWarrantsMember

2024-06-30

0001643918

ifrs-full:OrdinarySharesMember

2024-01-01

2024-06-30

0001643918

BDRX:ADeferredSharesMember

2024-01-01

2024-06-30

0001643918

BDRX:BDeferredSharesMember

2024-01-01

2024-06-30

0001643918

srt:MinimumMember

2024-01-01

2024-06-30

0001643918

srt:MaximumMember

2024-01-01

2024-06-30

0001643918

ifrs-full:OrdinarySharesMember

2022-12-31

0001643918

BDRX:ADeferredSharesMember

2022-12-31

0001643918

BDRX:BDeferredSharesMember

2022-12-31

0001643918

ifrs-full:OrdinarySharesMember

2023-01-01

2023-12-31

0001643918

BDRX:ADeferredSharesMember

2023-01-01

2023-12-31

0001643918

BDRX:BDeferredSharesMember

2023-01-01

2023-12-31

0001643918

2022-12-18

0001643918

2023-01-23

0001643918

2024-07-01

2024-07-22

0001643918

BDRX:PreFundedWarrantsMember

2024-07-01

2024-07-22

0001643918

2024-07-22

0001643918

BDRX:SeriesJWarrantsMember

2024-07-01

2024-07-22

0001643918

BDRX:SeriesKWarrantsMember

2024-07-01

2024-07-22

iso4217:GBP

xbrli:shares

iso4217:GBP

xbrli:shares

iso4217:USD

iso4217:USD

xbrli:shares

BDRX:Integer

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

June 30,2024

For the month of September 2024

Commission File Number 001-37652

Biodexa Pharmaceuticals PLC

(Translation of registrant’s name into English)

1 Caspian Point,

Caspian Way

Cardiff, CF10 4DQ, United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form

40-F o

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): o

The information included in this report on Form 6-K shall be deemed to be incorporated by reference into the registration statements

on Form S-8 (File Number 333-209365) and Form F-3 (File Number 333-267932) of the Company (including any prospectuses forming a

part of such registration statements) and to be a part thereof from the date on which this report is filed, to the extent not superseded

by documents or reports subsequently filed or furnished.

SUBMITTED HEREWITH

Attached to the Registrant’s Form 6-K filing for the month of

September 2024 is:

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release, dated September 26, 2024, entitled “Interim results for the sixth months ended 30 June 2024”. |

| 101.INS |

|

XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 101.SCH |

|

INLINE XBRL Taxonomy Extension Schema Document. |

| 101.DEF |

|

INLINE XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.LAB |

|

INLINE XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE |

|

INLINE XBRL Taxonomy Extension Presentation Linkbase Document. |

| 104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Biodexa Pharmaceuticals PLC |

| |

|

|

| Date: September 26, 2024 |

By: |

/s/ Stephen Stamp |

| |

|

Stephen Stamp |

| |

|

Chief Executive Officer and Chief Financial Officer |

Exhibit 99.1

September 26, 2024

Biodexa Pharmaceuticals

PLC

(“Biodexa”

or the “Company”)

Interim results

for the six months ended June 30, 2024

Biodexa Pharmaceuticals

PLC (Nasdaq: BDRX), an acquisition-focused clinical stage biopharmaceutical company developing a pipeline of innovative products for the

treatment of diseases with unmet medical needs, today announces its unaudited interim results for the six months ended June 30, 2024 which

will also be made available on the Company’s website at www.biodexapharma.com

OPERATIONAL

HIGHLIGHTS

The Company announced

the following in the six months ended June 30, 2024:

| · | Exclusive worldwide licensing of eRapa™,

a Phase 3 ready asset with a lead indication of Familial Adenomatous Polyposis (“FAP”) together with access to a $17 million

grant. |

| · | Six month data of eRapa in FAP showing an 83%

non-progression rate and a statistically significant reduction on overall polyp burden, announced at the Digestive Disease Week scientific

meeting in Washington D.C. |

| · | 12 month data of eRapa in FAP showing a 75% non-progression

rate and median overall decrease in polyp burden of 17%, presented at the bi-annual InSIGHT scientific meeting in Barcelona. |

| · | 12 month overall survival of patient #1 in the

Company’s MAGIC-G1 Phase 1 study of MTX110 in recurrent Glioblastoma (“rGBM”). |

| · | 16.5 months overall survival of patients in a

Phase 1 study of MTX110 in Diffuse Midline Glioma, subsequently presented at the International Symposium on Pediatric Neuro-oncology (ISPNO

2024). |

| · | Allowance by the US Patent and Trademark Office

of Family 13 (“Prevention of Pancreatic Cell Degeneration”), a key component of tolimidone exclusivity. |

Post period end:

| · | Approval by Health Canada to proceed with a Phase

2a dose confirmation study of tolimidone in Type 1 diabetes to be conducted by the University of Alberta Diabetes Institute. |

| · | An update on the status of cohort A in the MAGIC-G1

study: patients #1 and #2 have deceased with overall survival (OS) since start of treatment of 12 months and 13 months, respectively.

Patients #3 and #4 remain alive with progression free survival (PFS) since the start of treatment of 6 and 9 months, respectively and

OS thus far of 12 and 11 months respectively. |

FINANCIAL HIGHLIGHTS

| · | Receipt of $6.05 million in gross proceeds from

the exercise of certain Series E and Series F warrants to purchase 4.4 million ADSs. The warrant inducement included a reduction in exercise

price and issuance of replacement Series G and Series H warrants. |

| · | R&D costs decreased to £2.19 million

in 1H24 (1H23: £2.25 million) reflecting a reduction in spend on the MAGIC-G1 study in rGBM, termination of legacy drug delivery

projects and lower personnel costs offset by the addition of MTD228 (tolimidone) and MTX230 (eRapa) preclinical and study initiation costs.

|

| · | Administrative costs decreased to £2.03

million (1H23: £2.29 million) as a result of a positive reversal in foreign exchange and a reduction in professional fees offset

by increases in share-based payment charge and sundry other costs. |

| · | Net cash used in operating activities (after

changes in working capital) in 1H24 was £4.81 million (1H23: £3.88million). |

| · | The Company’s cash balance at June 30,

2024 was £5.06 million. The cash balance at August 31, 2024 was £5.71 million. |

Post period end:

| · | Receipt of $5.0 million in gross proceeds from

a Registered Direct Offering of 5.1m ADSs and 0.3m Pre-funded warrants together with a private placement of Series J and Series K warrants. |

| · | Payment of the final match, enabling access to

the remainder of the $17 million grant from the Cancer Prevention and Research Institute of Texas (“CPRIT”), which will be

used to fund the upcoming Phase 3 registrational study of eRapa in the orphan indication of FAP. |

Commenting, Stephen

Stamp, CEO and CFO, said “It was a busy first half for Biodexa. Licensing in eRapa, a Phase 3 ready asset with access to $17

million of non-dilutive grant funding, is an enormous step forward. The second half will be about executing on our lead programs. We already

have approval from Health Canada for the IIT Phase 2a study of tolimidone in Type 1 diabetes and we are working diligently to set up a

global Phase 3 registrational study of eRapa in FAP so we can begin recruiting early next year.”

For more information,

please contact:

Biodexa Pharmaceuticals

PLC

Stephen Stamp, CEO, CFO

Tel: +44 (0)29 2048 0180

www.biodexapharma.com

About Biodexa

Biodexa Pharmaceuticals

PLC (listed on NASDAQ: BDRX) is a clinical stage biopharmaceutical company developing a pipeline of innovative products for the treatment

of diseases with unmet medical needs. The Company’s lead development programs include eRapa, under development for Familial Adenomatous

Polyposis and Non-Muscle Invasive Blader Cancer; tolimidone, under development for the treatment of type 1 diabetes; and MTX110, which

is being studied in aggressive rare/orphan brain cancer indications.

eRapa is a proprietary

oral formulation of rapamycin, also known as sirolimus. Rapamycin is an mTOR (mammalian Target Of Rapamycin) inhibitor. mTOR has been

shown to have a significant role in the signalling pathway that regulates cellular metabolism, growth and proliferation and is activated

during tumorgenesis.

Tolimidone is an

orally delivered, potent and selective activator of Lyn kinase. Lyn is a member of the Src family of protein tyrosine kinases, which is

mainly expressed in hematopoietic cells, in neural tissues, liver, and adipose tissue. Tolimidone demonstrates glycemic control via insulin

sensitization in animal models of diabetes and has the potential to become a first in class blood glucose modulating agent.

MTX110 is a solubilised

formulation of the histone deacetylase (HDAC) inhibitor, panobinostat. This proprietary formulation enables delivery of the product via

convection-enhanced delivery (CED) at chemotherapeutic doses directly to the site of the tumor, by-passing the blood-brain barrier and

potentially avoiding systemic toxicity.

Biodexa is supported

by three proprietary drug delivery technologies focused on improving the bio-delivery and bio-distribution of medicines. Biodexa’s

headquarters and R&D facility is in Cardiff, UK. For more information visit www.biodexapharma.com.

Forward-Looking

Statements

Certain statements

in this announcement may constitute “forward-looking statements” within the meaning of legislation in the United Kingdom and/or

United States. Such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995

and are based on management’s belief or interpretation. All statements contained in this announcement that do not relate to matters

of historical fact should be considered forward-looking statements. In certain cases, forward-looking statements can be identified by

the use of words such as “plans”, “expects” or “does not anticipate”, or “believes”, or

variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”,

“might” or “will be taken”, “occur” or “be achieved.” Forward-looking statements and information

are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict,

that may cause their actual results, performance or achievements to be materially different from those expressed or implied thereby, and

are developed based on assumptions about such risks, uncertainties and other factors set out herein.

Reference should

be made to those documents that Biodexa shall file from time to time or announcements that may be made by Biodexa in accordance with the

rules and regulations promulgated by the SEC, which contain and identify other important factors that could cause actual results to differ

materially from those contained in any projections or forward-looking statements. These forward-looking statements speak only as of the

date of this announcement. All subsequent written and oral forward-looking statements by or concerning Biodexa are expressly qualified

in their entirety by the cautionary statements above. Except as may be required under relevant laws in the United States, Biodexa does

not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or

events otherwise arising.

CHIEF EXECUTIVE’S

REVIEW

Our primary focus

in the first half of 2024 was on assimilating tolimidone, licensed in December 2023, into our portfolio and searching for additional clinical-stage

assets to diversify and advance our pipeline which ultimately led to the licensing of eRapa in May 2024.

eRapa License

In line with our strategy

to build a sustainable therapeutics company in rare/orphan diseases, we continue to search for opportunities to broaden and diversify

our development pipeline. On April 25, 2024, we entered into a License and Collaboration Agreement (“LCA”) with Rapamycin

Holdings, Inc. (d/b/a Emtora Biosciences), relating to the license of eRapa, an oral formulation of rapamycin (also known as sirolimus)

for use in all diseases, states or conditions in humans. Under the LCA, we obtained an exclusive, worldwide, sublicensable right to develop,

manufacture, commercialize, or otherwise exploit products containing rapamycin. Pursuant to the terms of the LCA, the Company and Emtora

established a joint development committee to monitor and progress the development of eRapa.

Emtora has conducted

a Phase 1 study of eRapa in prostate cancer, a Phase 2 study in FAP and has an ongoing Phase 2 study in Non-muscle Invasive Bladder Cancer.

Preparations are under way for a registrational Phase 3 study of eRapa in FAP.

In consideration for

the license, we made an upfront payment of 378,163 ADSs (equal to five percent of our then outstanding Ordinary Shares, calculated on

a fully-diluted basis). In addition, we are also responsible for up to an aggregate $31.5 million in sales milestones within the first

six months of commercial sale of a first-approved indication of eRapa in certain markets, with decreasing milestones for subsequent approvals

for additional indications. There is also a one-time $10.0 million milestone payable upon cumulative net sales of $1.0 billion. Further,

we are also obligated to pay Emtora single digit tiered royalties on net sales of eRapa, in addition to honouring Emtora’s legacy

royalty obligations and paying Emtora fees related to income derived from sublicensing and partnering of eRapa. In addition, a promissory

note previously issued by Emtora in favour of the Company in the amount of $0.25 million was forgiven. We also made an additional $0.5

million payment which was used for a match to an advance from the CPRIT. Emtora had secured a grant of $17.0 million from CPRIT to support

the Phase 3 study of eRapa in FAP. The grant requires a 1 for 2 match and Biodexa was expected to fund the match of up to $7.5 million,

being 50% of the remaining CPRIT grant, which was completed in September 2024. Grant funding is available once the match payment has been

certified and CPRIT has approved eligible trial expenses. In certain instances, CPRIT may advance payments before eligible trial expenses

have been incurred.

Upon a change of control

of the Company, we will issue Emtora a warrant exercisable for 1,604,328 ADSs. The LCA also provides us with the exclusive option to acquire

all of the capital stock of Emtora on commercially reasonable terms in the 90 days after acceptance of the filing of an NDA by the U.S.

Food and Drug Administration (the “FDA”).

R&D update

Following the in-licensing

of eRapa, our development pipeline has not only advanced in terms of clinical stage but expanded to six programmes overall, four of which

are orphan indications:

eRapa

eRapa is a proprietary

oral formulation of rapamycin, also known as sirolimus. Rapamycin is an mTOR (mammalian Target Of Rapamycin)

inhibitor. mTOR has been shown to have a significant role in the signalling pathway that regulates cellular metabolism, growth and proliferation

and is activated during tumorgenesis1. Rapamycin is approved in the US for organ rejection in renal transplantation as Rapamune®(Pfizer).

Through the use of nanotechnology and pH sensitive polymers, eRapa is designed to address the poor bioavailability, variable pharmacokinetics

and toxicity generally associated with the currently available forms of rapamycin. eRapa is protected by a number of issued patents which

extend through 2035, with other pending applications potentially providing further protection beyond 2035.

Familial

Adenomatous Polyposis (“FAP”)

FAP is an orphan

indication characterized by a proliferation of polyps in the colon and/or rectum, usually occurring in mid-teens. There is no approved

therapeutic option for treating FAP patients, for whom active surveillance and surgical resection of the colon and/or rectum remain the

standard of care. If untreated, FAP typically leads to cancer of the colon and/or rectum. There is a significant hereditary component

to FAP with a reported incidence of one in 5,000 to 10,000 in the US1 and one in 11,300 to 37,600 in Europe2. eRapa

has received Orphan Designation in the US with plans to seek such designation in Europe. Importantly, mTOR has been shown to be over-expressed

in FAP polyps – thereby underscoring the rationale for using a potent and safe mTOR inhibitor like eRapa to treat FAP.

An open-label

Phase 2 study (NCT04230499) was conducted by Emtora in seven U.S. centres of excellence in 30 adult patients. Patients were sequentially

enrolled into three dosing cohorts of 10 patients each for a 12-month treatment period: 0.5mg every other day (Cohort 1), 0.5mg daily

every other week (Cohort 2), and 0.5mg daily (Cohort 3). Upper and lower endoscopic surveillance occurred at baseline and after six months.

Primary endpoints were safety and tolerability of eRapa and percentage change from baseline in polyp burden, as measured by the aggregate

of all polyp diameters.

In May

2024, results of the Phase 2 study at six months were presented at the prestigious 2024 Digestive Disease Week annual meeting in Washington

D.C. by Carol Burke, MD, the Principal Investigator. In summary, at six months, eRapa appeared safe and well-tolerated with a significant

24% reduction in the total polyp burden at six months compared with baseline (p=0.04) and an overall 83% non-progression rate.

In June

2024, results of the Phase 2 study at 12 months were presented at the bi-annual InSIGHT meeting in Barcelona by Dr Burke. Overall, 21

of 28 (75%) patients were deemed to be non-progressors at 12 months with a median reduction in polyp burden of 17%. In Cohort 2, the likely

dosage regimen for Phase 3, eight of nine (89)% of patients were deemed non-progressors at 12 months with a median reduction in polyp

burden of 29%. Over the course of 12 months, there were four related Grade 3 or higher and one related Serious Adverse Event reported

during the trial and 95% compliance rate at 12 months. One patient was removed from the trial due to non-compliance.

The Phase

3 registrational study is planned to be a double-blind placebo-controlled design recruiting approximately 150 high risk patients diagnosed

with germline or phenotypic FAP. The primary clinical endpoint is expected to be the first progression free survival event which will

comprise composite endpoints including major surgery. A ‘Type C’ meeting with the FDA is planned for 4Q24 to finalise the

protocol and related matters. A $17 million grant from CPRIT will support this study.

Non-muscle

Invasive Bladder Cancer (“NMIBC”)

NMIBC refers

to tumors found in the tissue that lines the inner surface of the bladder. The most common treatment is transurethral resection of the

bladder tumor followed by intravesical Bacillus Calmette-Guerin (“BCG”) with chemotherapy depending upon assessment of risk

of recurrence. NMIBC is the fourth most common cancer in men with an incidence of 10.1 per 100,000 and 2.5 per 100,000 in women3.

Our ongoing

multi-centre, double-blind, placebo-controlled Phase 2 study in NMIBC is expected to enrol up to 166 patients with primary endpoints of

safety/tolerability and relapse free survival after 12 months of treatment. The Phase 2 study, which is supported by a $3.0 million non-dilutive

grant from the National Cancer Institute, part of the National Institutes of Health, is expected to read out in mid-2025.

MTD228 –

Tolimidone

Tolimidone was originally

discovered by Pfizer and was developed through Phase 2 for the treatment of gastric ulcers. Pfizer undertook a broad pre-clinical program

to characterize the pharmacology, pharmacokinetics, metabolism and toxicology of tolimidone. Pfizer discontinued development of the drug

due to lack of efficacy for that indication in a Phase II clinical trial.

Tolimidone is a selective

activator of the enzyme Lyn kinase which increases phosphorylation of insulin substrate-1, thereby amplifying the signalling cascade initiated

by the binding of insulin to its receptor.

Type

1 Diabetes (“T1D”)

Tolimidone’s

potential utility in T1D has been demonstrated by several ground-breaking preclinical studies conducted by the University of Alberta,

where Lyn kinase was identified as a key factor for beta cell survival and proliferation in in vitro and in vivo models.

Most importantly, tolimidone was able to induce proliferation in beta cells isolated from human cadavers. From a mechanism of action perspective,

tolimidone has been shown to both prevent beta cell degradation and to stimulate beta cell proliferation. In a meta analysis of 1,202

articles and 193 studies, the incidence of T1D was shown to be 15 per 100,000 with a prevalence of 9.5 per 10,000 of the population4.

As a first

step in the continued clinical development of tolimidone, a Phase 2a Investigator Initiated Trial (IIT) at the University of Alberta Diabetes

Institute is designed to establish the minimum effective dose of tolimidone in patients with T1D. The study, which was approved by Health

Canada in July 2024 is expected to recruit 12 patients initially across three dose groups. The study will measure C-peptide levels (a

marker for insulin) and HbA1c (a marker for blood glucose) after three months compared with baseline and the number of hyperglycemic events.

MTX110

MTX110

is a solubilised formulation of the histone deacetylase (HDAC) inhibitor, panobinostat. This proprietary formulation enables delivery

of the product via convection-enhanced delivery (CED) at chemotherapeutic doses directly to the site of the brain tumor, by-passing

the blood-brain barrier and potentially avoiding systemic toxicity. All three types of brain cancer being studied are orphan.

Recurrent

Glioblastoma (“rGBM”)

Our Phase

1 MAGIC-G1 study (NCT05324501) of MTX110 in rGBM completed the dose escalation part of the study with the recruitment of the fourth patient

in Cohort A. In February 2024 we announced Patient #1, who had received sub-optimal infusions of 60µM of MTX110 had survived for12

months from the start of treatment (OS=12). GBM universally recurs and once it does median overall survival according to a retrospective

analysis of 299 patients reported in the Journal of Neuro-Oncology is 6.5 months. Post period end, we provided an update on the status

of cohort A in the MAGIC-G1 study: patients #1 and #2 have deceased with overall survival (OS) since start of treatment of 12 months and

13 months, respectively. Patients #3 and #4 remain alive with progression free survival (PFS) since the start of treatment of 6 and 9

months, respectively and OS thus far of 12 and 11 months respectively. GBM virtually always recurs with median Progression Free Survival

of 1.5–6.0 months and median Overall Survival of 2.0–9.0 months5.

Diffuse

Midline Glioma (“DMG”)

In February

2024 we announced headline data from a Phase 1 IIT study conducted by Columbia University in newly diagnosed patients with DMG. As this

was the first ever study of repeated infusions to the pons via an implanted CED catheter, the primary objective of the study was safety

and tolerability and, accordingly, the number of infusions was limited to two, each of 48 hours, 7 days apart in nine patients. One patient

suffered a severe adverse event assessed by the investigators as not related to the study drug. Although not powered to reliably demonstrate

efficacy, median overall survival (OS) of patients in the study was 16.5 months compared with median survival rate in a cohort of 316

cases of 10.0 months (Jansen et al, 2015. Neuro-Oncology 17(1):160-166).

Study investigators

subsequently presented the results of the trial at the 21st International Symposium on Pediatric Neuro-Oncology (ISPNO 2024) in Philadelphia.

Medulloblastoma

An IIT

Phase I study of MTX110 in medulloblastoma remains ongoing at the University of Texas.

Financing

As a pre-revenue biotech company, securing adequate finance to fund

operations to an out-licensing and/or partnering event is a constant focus. On the back of the eRapa in-licensing and the subsequent announcement

of positive 6-month and 12-month data of eRapa in FAP, we accomplished two financings; the first in May 2024 and the second post period

end in July 2024.

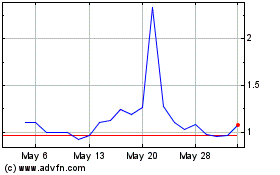

May 2024 Warrant

Exercises

On May 22, 2024, we raised

$6.05 million of gross proceeds from the exercise of previously issued warrants following an agreement between the Company and several

accredited investors to exercise existing Series E warrants and Series F warrants to purchase up to an aggregate of 4,358,322 ADSs. The

warrant holders agreed to exercise the Series E and/or Series F warrants at an exercise price of $1.50 (reduced from $2.20) per ADS.

In consideration for

the immediate exercise of the Series E and/or Series F warrants for cash, we issued one replacement warrant for each Series E warrant

exercised in the form of a Series G warrant, and one replacement warrant for each Series F warrant exercised in the form of a Series H

warrant. The Series G and Series H warrants are exercisable for five years and one year, respectively, at $2.50 each.

July 2024 Registered

Direct Offering and Private Placement

On July 22, 2024, we utilised our capacity under

our Registration Statement on Form F-3 to raise $5.0 million in gross proceeds in a Registered Direct Offering with certain institutional

investors for the sale of an aggregate of 5,050,808 ADSs and 278,975 pre-funded warrants at a price of $0.94 per ADS. In a concurrent

Private Placement, we issued and sold to the Investors (i) Series J warrants exercisable for 5,329,783 ADSs, and (ii) Series K Warrants

to purchase an aggregate of 5,329,783 ADSs. The Series J and Series K warrants are exercisable for five years and one year, respectively,

at $1.00 per ADS each.

| 1. | https://rarediseases.org/rare-diseases/familial-adenomatous-polyposis/ |

| 2. | https://www.orpha.net/en/disease/detail/733#:~:text=FAP%20has%20a%20birth%20incidence,colorectal%20cancer%20(CRC)%20cases. |

| 3. | Cassell et al., World J Oncol. 2019

Jun; 10(3): 123–131. |

| 4. | National Library of Medicine, Mobasseri et al., published

online 2020 Mar 30. doi: 10.34172/hpp.2020.18 |

| 5. | Birzu et al. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7794906 |

1H24 FINANCIAL

REVIEW

The unaudited results

for the six months ended June 30, 2024 are discussed below:

Key performance

indicators (KPIs):

| | |

1H 2024 | | |

1H 2023 | | |

Change | |

| | |

| | |

| | |

| |

| R&D costs | |

£ | 2.19 | m | |

£ | 2.25 | m | |

| (3 | )% |

| R&D as % of operating costs | |

| 52 | % | |

| 50 | % | |

| 5 | % |

| Net cash (outflow)/inflow for the period | |

£ | (0.92 | )m | |

£ | 2.39 | m | |

| N/M | |

Biodexa’s

KPIs focus on the key areas of operating results, R&D spend and cash management. These measures provide information on the core R&D

operations. Additional financial and non-financial KPIs may be adopted in due course.

Revenues

Total revenue for

the six months to June 30, 2024 was £Nil compared to £0.30 million in the first six months of 2023. The R&D collaboration

with Janssen, which represented the entire revenue in 1H23, concluded in September 2023.

Research and

Development

R&D costs in

1H24 reduced by £0.06 million, or 3%, to £2.19 million compared with £2.25 million in 1H23. The percentage of R&D

costs as a percentage of total operating costs increased to 52% in the period from 50%. The reduction in R&D costs in 1H24 reflects

a reduction in spend of £0.54 million on the MAGIC-G1 study in rGBM, the termination of legacy drug delivery projects and lower

personnel costs offset by the addition of MTD228 (tolimidone) and MTX230 (eRapa) for a combined expenditure of £0.65 million in

1H24.

Administrative

Costs

Administrative

costs in 1H24 decreased by £0.26 million, or 11% to £2.03 million from £2.29 million in 1H23. The decrease in administrative

costs in 1H24 is a result of a positive reversal in foreign exchange of £0.23 million and a reduction in professional fees of £0.14

million offset by increases in share-based payment charge of £0.12 million and sundry other costs.

Finance Income

and Expense

Finance income

in 1H24 and 1H23 included gains in respect of an equity settled derivative financial liability of £0.75 million (1H23: £0.39

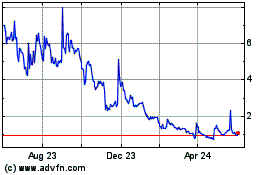

million). The gains arose as a result of the fall in the Biodexa share price. In addition, the Company earned interest on cash deposits.

Finance expense

in the period related to lease liabilities and discounted interest on deferred consideration.

Cash Flows

Cash outflows from

operating activities in 1H24 were £4.81 million compared to £3.88 million in 1H23, driven by a net loss of £3.31 million

(1H23: £3.57 million) and after negative working capital of £0.87 million (1H23: positive £0.21 million) and other negative

non-cash items totalling £0.63 million (1H23: negative £0.52 million).

Net cash used in

investing activities in 1H24 of £0.75 million in 1H24 resulted from the purchase of eRapa licence for total consideration of £3.07

million including cash consideration of £0.85 million (1H23: £Nil) offset by £0.10 million of interest received (1H23:

£0.02 million).

Net cash generated

in financing activities in 1H24 was £4.65 million (1H23: inflow £6.25 million), which was driven by receipts from share issuances,

including warrants, net of costs of £4.74 million offset by payments on lease liabilities of £0.09 million.

Overall, cash decreased

by £0.92 million in 1H24 compared to an increase of £2.39 million in 1H23. This resulted in a cash balance at June 30, 2024

of £5.06 million compared with £5.23 million at June 30, 2023 and £5.97 million at December 31, 2023.

Going concern

Biodexa has experienced

net losses and significant cash outflows from cash used in operating activities over the past years as it develops its portfolio. For

the six months to June 30, 2024, the Group incurred a consolidated loss from operations of £3.31 million (1H23: £3.57 million)

and negative cash flows from operating activities of £4.81 million (1H23: £3.88 million). As of June 30, 2024, the Group had

accumulated deficit of £147.88 million.

The Group’s

future viability is dependent on its ability to raise cash from financing activities to finance its development plans until commercialisation,

generate cash from operating activities and to successfully obtain regulatory approval to allow marketing of its development products.

The Group’s failure to raise capital as and when needed could have a negative impact on its financial condition and ability to pursue

its business strategies.

The Group's consolidated

interim financial information has been presented on a going concern basis, which contemplates the realization of assets and the satisfaction

of liabilities in the normal course of business.

As at June 30,

2024, the Group had cash and cash equivalents of £5.06 million. The Directors forecast that the Group currently has enough cash

to fund its planned operations into the first quarter of 2025. If the Company does not secure additional funding before the first quarter

of 2025, it will no longer be a going concern and would likely be placed in Administration.

The Directors have

prepared cash flow forecasts and considered the cash flow requirement for the Group for the next three years including the period 12 months

from the date of approval of this interim financial information. These forecasts show that further financing will be required before the

first quarter of 2025 assuming, inter alia, that certain development programs and other operating activities continue as currently planned.

If we raise additional funds through the issuance of debt securities or additional equity securities, it could result in dilution to our

existing shareholders, increased fixed payment obligations and these securities may have rights senior to those of our ordinary shares

(including the ADSs) and could contain covenants that would restrict our operations and potentially impair our competitiveness, such as

limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights

and other operating restrictions that could adversely impact our ability to conduct our business. Any of these events could significantly

harm our business, financial condition and prospects.

On August 27, 2024,

the Company received notification from the Listing Qualifications Department of The Nasdaq Stock Market LLC advising that the Company

was not in compliance with the minimum bid requirement set forth in NASDAQ’s rules for continued listing of its securities. The

Company has requested a Hearing Panel which has paused any suspension or delisting action pending the hearing. If the Company's ADSs are

delisted, it could be more difficult to buy or sell the Company's ADSs or to obtain accurate quotations, and the price of the Company's

ADSs could suffer a material decline. Delisting may impair the Company's ability to raise capital.

In the Directors’

opinion, the environment for financing of small and micro-cap biotech companies continues to be challenging. While this may present acquisition

and/or merger opportunities with other companies with limited or no access to financing, as noted above, any attendant financings by Biodexa

are likely to be dilutive. The Directors continue to evaluate financing options, including those connected to acquisitions and/or mergers,

potentially available to the Group. Any alternatives considered are contingent upon the agreement of counterparties and accordingly, there

can be no assurance that any of alternative courses of action to finance the Group would be successful. This requirement for additional

financing in the short term represents a material uncertainty that may cast significant doubt upon the Group’s ability to continue

as a going concern. Should it become evident in the future that there are no realistic financing options available to the Group which

are actionable before its cash resources run out then the Group will no longer be a going concern. In such circumstances, we would no

longer be able to prepare financial statements under paragraph 25 of IAS 1. Instead, the financial statements would be prepared on a liquidation

basis and assets would be stated at net realizable value and all liabilities would be accelerated to current liabilities.

The Directors believe

there are adequate options and time available to secure additional financing for the Group and after considering the uncertainties, the

Directors consider it is appropriate to continue to adopt the going concern basis in preparing these financial statements.

Our forecast of

the period of time through which our financial resources will be adequate to support our operations is a forward-looking statement and

involves risks and uncertainties, and actual results could vary as a result of a number of factors, including the timing of clinical trials.

We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than

we currently expect. If we lack sufficient capital to expand our operations or otherwise capitalize on our business opportunities, our

business, financial condition and results of operations could be materially adversely affected.

Stephen Stamp

Chief Executive

Officer and Chief Financial Officer

Consolidated

Statements of Comprehensive Income

For the year

six month period ended June 30

| | |

| |

| | |

| |

| | |

Note | |

2024 unaudited £’000 | | |

2023 unaudited £’000 | |

| Revenue | |

| |

| - | | |

| 298 | |

| Research and development costs | |

| |

| (2,189 | ) | |

| (2,251 | ) |

| Administrative costs | |

| |

| (2,034 | ) | |

| (2,291 | ) |

| Loss from operations | |

| |

| (4,223 | ) | |

| (4,244 | ) |

| Finance income | |

3 | |

| 839 | | |

| 410 | |

| Finance expense | |

3 | |

| (49 | ) | |

| (22 | ) |

| Loss before tax | |

| |

| (3,433 | ) | |

| (3,856 | ) |

| Taxation | |

4 | |

| 125 | | |

| 288 | |

| Loss for the period attributable to the owners of the parent | |

| |

| (3,308 | ) | |

| (3,568 | ) |

| Total comprehensive loss attributable to the owners of the parent | |

| |

| (3,308 | ) | |

| (3,568 | ) |

| Loss per share | |

| |

| | | |

| | |

| Basic and diluted loss per ordinary share – pence | |

5 | |

| (0.1 | p) | |

| (3.6 | )p |

The accompanying notes

form part of these financial statements

Consolidated

Statements of Financial Position

| | |

| |

| | |

| |

| | |

Note | |

As at June 30, 2024

unaudited £’000 | | |

As at December 31,

2023 £’000 | |

| Assets | |

| |

| | |

| |

| Non-current assets | |

| |

| | |

| |

| Property, plant and equipment | |

| |

| 436 | | |

| 571 | |

| Intangible assets | |

6 | |

| 6,008 | | |

| 2,941 | |

| Total Non-Current Assets | |

| |

| 6,444 | | |

| 3,512 | |

| Current assets | |

| |

| | | |

| | |

| Trade and other receivables | |

| |

| 1,922 | | |

| 637 | |

| Taxation | |

| |

| 547 | | |

| 422 | |

| Cash and cash equivalents | |

| |

| 5,055 | | |

| 5,971 | |

| Total Current Assets | |

| |

| 7,524 | | |

| 7,030 | |

| Total assets | |

| |

| 13,968 | | |

| 10,542 | |

| Liabilities | |

| |

| | | |

| | |

| Non-current liabilities | |

| |

| | | |

| | |

| Deferred consideration | |

7 | |

| 1,552 | | |

| - | |

| Borrowings | |

| |

| 208 | | |

| 295 | |

| Total Non-Current Liabilities | |

| |

| 1,760 | | |

| 295 | |

| Current liabilities | |

| |

| | | |

| | |

| Trade and other payables | |

| |

| 1,689 | | |

| 1,240 | |

| Deferred consideration | |

7 | |

| 459 | | |

| - | |

| Borrowings | |

| |

| 174 | | |

| 169 | |

| Derivative financial liability | |

8 | |

| 1,159 | | |

| 4,160 | |

| Total current Liabilities | |

| |

| 3,481 | | |

| 5,569 | |

| Total liabilities | |

| |

| 5,241 | | |

| 5,864 | |

| Issued capital and reserves attributable to owners of the parent | |

| |

| | | |

| | |

| Share capital | |

9 | |

| 8,689 | | |

| 6,253 | |

| Share premium | |

| |

| 91,242 | | |

| 86,732 | |

| Merger reserve | |

| |

| 53,003 | | |

| 53,003 | |

| Warrant reserve | |

| |

| 3,674 | | |

| 3,457 | |

| Accumulated deficit | |

| |

| (147,881 | ) | |

| (144,767 | ) |

| Total equity | |

| |

| 8,727 | | |

| 4,678 | |

| Total equity and liabilities | |

| |

| 13,968 | | |

| 10,542 | |

The accompanying notes

form part of these financial statements

Consolidated

Statements of Cash Flows

For the six

month period ended June 30

| | |

| |

| | | |

| | |

| | |

Note | |

2024 unaudited £’000 | | |

2023 unaudited £’000 | |

| Cash flows from operating activities | |

| |

| | |

| |

| Loss for the period | |

| |

| (3,308 | ) | |

| (3,568 | ) |

| Adjustments for: | |

| |

| | | |

| | |

| Depreciation of property, plant and equipment | |

| |

| 67 | | |

| 72 | |

| Depreciation of right of use asset | |

| |

| 68 | | |

| 70 | |

| Amortisation of intangible fixed asset | |

| |

| 1 | | |

| 1 | |

| Finance income | |

3 | |

| (839 | ) | |

| (410 | ) |

| Finance expense | |

3 | |

| 49 | | |

| 22 | |

| Share-based payment expense | |

| |

| 150 | | |

| 15 | |

| Taxation | |

4 | |

| (125 | ) | |

| (288 | ) |

| Foreign exchange losses | |

| |

| 2 | | |

| - | |

| Cash flows from operating activities before changes in working capital | |

| |

| (3,935 | ) | |

| (4,086 | ) |

| (Increase)/Decrease in trade and other receivables | |

| |

| (1,298 | ) | |

| 103 | |

| Increase in trade and other payables | |

| |

| 426 | | |

| 309 | |

| Decrease in provisions | |

| |

| - | | |

| (207 | ) |

| Cash used in operations | |

| |

| (4,807 | ) | |

| (3,881 | ) |

| Taxes payments | |

| |

| - | | |

| - | |

| Net cash used in operating activities | |

| |

| (4,807 | ) | |

| (3,881 | ) |

Consolidated

Statements of Cash Flows (continued)

For the six

month period ended June 30

| | |

Note | |

2024 unaudited £’000 | | |

2023 unaudited £’000 | |

| Investing activities | |

| |

| | |

| |

| Purchases of property, plant and equipment | |

| |

| - | | |

| (4 | ) |

| Proceeds from disposal of fixed assets | |

| |

| - | | |

| - | |

| Purchase intangible asset | |

| |

| (852 | ) | |

| - | |

| Interest received | |

| |

| 98 | | |

| 24 | |

| Net cash generated from/(used in) investing activities | |

| |

| (754 | ) | |

| 20 | |

| Financing activities | |

| |

| | | |

| | |

| Interest paid | |

| |

| - | | |

| (7 | ) |

| Amounts paid on lease liabilities | |

| |

| (93 | ) | |

| (95 | ) |

| Share issues including warrants, net of costs | |

9 | |

| 4,738 | | |

| 6,354 | |

| Net cash generated from/(used in) financing activities | |

| |

| 4,645 | | |

| 6,252 | |

| Net increase/(decrease) in cash and cash equivalents | |

| |

| (916 | ) | |

| 2,391 | |

| Cash and cash equivalents at beginning of period | |

| |

| 5,971 | | |

| 2,836 | |

| Cash and cash equivalents at end of period | |

| |

| 5,055 | | |

| 5,227 | |

The accompanying notes

form part of these financial statements

Consolidated

Statements of Changes in Equity (unaudited)

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Note | | |

Share capital £’000 | | |

Share premium £’000 | | |

Merger

reserve £’000 | | |

Warrant

reserve

£’000 | | |

Accumulated deficit £’000 | | |

Total equity £’000 | |

| At January 1, 2024 | |

| | |

| 6,253 | | |

| 86,732 | | |

| 53,003 | | |

| 3,457 | | |

| (144,767 | ) | |

| 4,678 | |

| Loss for the period | |

| | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,308 | ) | |

| (3,308 | ) |

| Total comprehensive loss | |

| | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,308 | ) | |

| (3,308 | ) |

| Transactions with owners: | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued on May 22, 2024 | |

9 | | |

| 1,242 | | |

| 3,730 | | |

| - | | |

| 1,690 | | |

| - | | |

| 6,662 | |

| Costs associated with share issue on May 22, 2024 | |

| | |

| - | | |

| (369 | ) | |

| - | | |

| (125 | ) | |

| - | | |

| (494 | ) |

| Exercise of warrants during period | |

9 | | |

| 1,043 | | |

| 1,081 | | |

| - | | |

| (1,348 | ) | |

| - | | |

| 776 | |

| Issue of shares to purchase intangible asset | |

9 | | |

| 151 | | |

| 68 | | |

| - | | |

| - | | |

| - | | |

| 219 | |

| Share-based payment charge | |

| | |

| - | | |

| - | | |

| - | | |

| - | | |

| 195 | | |

| 195 | |

| Total contribution by and distributions to owners | |

| | |

| 2,436 | | |

| 4,510 | | |

| - | | |

| 217 | | |

| 195 | | |

| 7,357 | |

| At June 30, 2024 | |

| | |

| 8,689 | | |

| 91,242 | | |

| 53,003 | | |

| 3,674 | | |

| (147,881 | ) | |

| 8,727 | |

| | |

Note | | |

Share capital £’000 | | |

Share premium £’000 | | |

Merger

reserve £’000 | | |

Warrant

reserve

£’000 | | |

Accumulated deficit £’000 | | |

Total equity £’000 | |

| At January 1, 2023 | |

| | |

| 1,108 | | |

| 83,667 | | |

| 53,003 | | |

| 720 | | |

| (135,336 | ) | |

| 3,162 | |

| Loss for the period | |

| | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,568 | ) | |

| (3,568 | ) |

| Total comprehensive loss | |

| | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,568 | ) | |

| (3,568 | ) |

| Transactions with owners: | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued on February 15, 2023 | |

9 | | |

| 1,956 | | |

| 3,013 | | |

| - | | |

| - | | |

| - | | |

| 4,969 | |

| Costs associated with share issue on February 15, 2023 | |

| | |

| - | | |

| (903 | ) | |

| - | | |

| - | | |

| - | | |

| (903 | ) |

| Shares issued on May 26, 2023 | |

9 | | |

| 2,277 | | |

| - | | |

| - | | |

| 103 | | |

| (355 | ) | |

| 2,025 | |

| Costs associated with share issue on May 26, 2023 | |

| | |

| - | | |

| - | | |

| - | | |

| - | | |

| (527 | ) | |

| (527 | ) |

| Share-based payment charge | |

| | |

| - | | |

| - | | |

| - | | |

| - | | |

| 141 | | |

| 141 | |

| Total contribution by and distributions to owners | |

| | |

| 4,233 | | |

| 2,110 | | |

| - | | |

| 103 | | |

| (741 | ) | |

| 5,705 | |

| At June 30, 2023 | |

| | |

| 5,341 | | |

| 85,777 | | |

| 53,003 | | |

| 823 | | |

| (139,645 | ) | |

| 5,299 | |

The accompanying notes

form part of these financial statements

Notes Forming

Part of The Consolidated Unaudited Interim Financial Information

For the six

month period ended June 30, 2024

The unaudited interim

consolidated financial information for the six months ended June 30, 2024 has been prepared following the recognition and measurement

principles of the International Financial Reporting Standards, International Accounting Standards and Interpretations (collectively IFRS)

issued by the International Accounting Standards Board (IASB), and as adopted by the UK and in accordance with International Accounting

Standard 34 Interim Financial Reporting (‘IAS 34’). The interim consolidated financial information does not include all the

information and disclosures required in the annual financial information and should be read in conjunction with the audited financial

statements for the year ended December 31, 2023.

The accounting

policies adopted are consistent with those of the previous financial year and corresponding interim reporting periods.

Book values approximate

to fair value at 30 June 2024, 30 June 2023 and 31 December 2023.

The condensed interim

financial information contained in this interim statement does not constitute statutory financial statements as defined by section 434(3)

of the Companies Act 2006. The condensed interim financial information has not been audited. The comparative financial information for

the six months ended June 30, 2023 and the year ended December 31, 2023 in this interim financial information does not constitute statutory

financial statements for that period or year. The statutory financial statements for December 31, 2023 have been delivered to the UK Registrar

of Companies. The auditor’s report on those accounts was unqualified and did not contain a statement under section 498(2) or 498(3)

of the Companies Act 2006. The auditor’s report did draw attention to a material uncertainty related to going concern and the requirement,

as of the date of the report, for additional funding to be raised by the Company by the fourth quarter of 2024.

Biodexa Pharmaceutical’s

annual reports may be downloaded from the Company’s website at https://biodexapharma.com/investors/financial-reports-and-presentations/#financial-reports

or a copy may be obtained from 1 Caspian Point, Caspian Way, Cardiff CF10 4DQ.

Going Concern

– material uncertainty

Biodexa has experienced

net losses and significant cash outflows from cash used in operating activities over the past years as it develops its portfolio. For

the six months to June 30, 2024, the Group incurred a consolidated loss from operations of £3.31 million (1H23: loss £3.56

million) and negative cash flows from operating activities of £4.81 million (1H23 £3.88 million). As of June 30, 2024, the

Group had accumulated deficit of £147.88 million.

The Group’s

future viability is dependent on its ability to raise cash from financing activities to finance its development plans until commercialisation,

generate cash from operating activities and to successfully obtain regulatory approval to allow marketing of its development products.

The Group’s failure to raise capital as and when needed could have a negative impact on its financial condition and ability to pursue

its business strategies.

The Group's consolidated

financial statements have been presented on a going concern basis, which contemplates the realization of assets and the satisfaction of

liabilities in the normal course of business.

As at June 30,

2024, the Group had cash and cash equivalents of £5.06 million. The Directors forecast that the Group currently has enough cash

to fund its planned operations into the first quarter of 2025. If the Company does not secure additional funding before the first quarter

of 2025, it will no longer be a going concern and would likely be placed in Administration.

The Directors have

prepared cash flow forecasts and considered the cash flow requirement for the Group for the next three years including the period 12 months

from the date of approval of this interim financial information. These forecasts show that further financing will be required before the

first quarter of 2025 assuming, inter alia, that certain development programs and other operating activities continue as currently planned.

If we raise additional funds through the issuance of debt securities or additional equity securities, it could result in dilution to our

existing shareholders, increased fixed payment obligations and these securities may have rights senior to those of our ordinary shares

(including the ADSs) and could contain covenants that would restrict our operations and potentially impair our competitiveness, such as

limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights

and other operating restrictions that could adversely impact our ability to conduct our business. Any of these events could significantly

harm our business, financial condition and prospects.

On August 27, 2024,

the Company received notification from the Listing Qualifications Department of The Nasdaq Stock Market LLC advising that the Company

was not in compliance with the minimum bid requirement set forth in NASDAQ’s rules for continued listing of its securities. The

Company has requested a Hearing Panel which has paused any suspension or delisting action pending the hearing. If the Company's ADSs are

delisted, it could be more difficult to buy or sell the Company's ADSs or to obtain accurate quotations, and the price of the Company's

ADSs could suffer a material decline. Delisting may impair the Company's ability to raise capital.

In the Directors’

opinion, the environment for financing of small and micro-cap biotech companies continues to be challenging. While this may present acquisition

and/or merger opportunities with other companies with limited or no access to financing, as noted above, any attendant financings by Biodexa

are likely to be dilutive. The Directors continue to evaluate financing options, including those connected to acquisitions and/or mergers,

potentially available to the Group. Any alternatives considered are contingent upon the agreement of counterparties and accordingly, there

can be no assurance that any of alternative courses of action to finance the Group would be successful. This requirement for additional

financing in the short term represents a material uncertainty that may cast significant doubt upon the Group’s ability to continue

as a going concern. Should it become evident in the future that there are no realistic financing options available to the Group which

are actionable before its cash resources run out then the Group will no longer be a going concern. In such circumstances, we would no

longer be able to prepare financial statements under paragraph 25 of IAS 1. Instead, the financial statements would be prepared on a liquidation

basis and assets would be stated at net realizable value and all liabilities would be accelerated to current liabilities.

The Directors believe

there are adequate options and time available to secure additional financing for the Group and after considering the uncertainties, the

Directors consider it is appropriate to continue to adopt the going concern basis in preparing these financial statements.

Our forecast of

the period of time through which our financial resources will be adequate to support our operations is a forward-looking statement and

involves risks and uncertainties, and actual results could vary as a result of a number of factors, including the timing of clinical trials.

We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than

we currently expect. If we lack sufficient capital to expand our operations or otherwise capitalize on our business opportunities, our

business, financial condition and results of operations could be materially adversely affected.

| 2. | Accounting for eRapa and CPRIT grant |

The LCA entered

into with Emtora meets the definition of a Joint Arrangement under IFRS 11, specifically related to the FAP program.

A jointly controlled escrow account was established

on completion of the LCA. All FAP program transactions are processed through the escrow account, including the Company’s deposits

of matching funds, as set out in the agreement, the receipt of grant funding from CPRIT and the payment of eligible R&D expenses.

Although the CPRIT grant and R&D supplier contracts are with Emtora, the joint arrangement nature of the LCA results in Emtora being

deemed to be acting as the Company’s agent. Accordingly, the Company recognises 100% of the grant and 100% of the R&D expenditure.

The CPRIT grant recognized is on a 1 for 2 match. In accordance with the Company’s accounting policy, the grant, as it is the re-imbursement

of directly related costs, is credited to R&D costs in the same period in The Statements of Comprehensive Income. The escrow account

is recognised within prepayments, CPRIT grant received in advance is recognised within deferred revenue and any grant not yet received

is recognised in accrued income.

In 1H24 the company

recognised R&D costs of £0.2 million on the FAP project, this was made up of expenditure of £0.5 million netted against

CPRIT grant of £0.3 million.

The balances as

at June 30, 2024 were as follows in relation to the FAP project:

| Schedule of relation the FAP |

|

| Prepayments |

£1.2 million |

| Deferred revenue |

£0.1 million |

| 3. | Finance income and expense |

The gain on the

equity settled derivative financial liability in 1H24 and 1H23 arose as a result of the fall in the Biodexa share price.

| | |

Six months

ended June

30, 2024 unaudited £’000 | | |

Six months

ended June

30, 2023 unaudited £’000 | |

| Finance expense | |

| | | |

| | |

| Interest expense on lease liabilities | |

| 11 | | |

| 15 | |

| Interest expense on deferred consideration | |

| 38 | | |

| - | |

| Other loans | |

| - | | |

| 7 | |

| Total finance expense | |

| 49 | | |

| 22 | |

Income tax is recognised

or provided at amounts expected to be recovered or to be paid using the tax rates and tax laws that have been enacted or substantively

enacted at the Group Statement of Financial Position date. Research and development tax credits are recognised on an accruals basis and

are included as an income tax credit under current assets. The research and development tax credit recognised is based on management’s

estimate of the expected tax claim for the period and is recorded within taxation under the Small and Medium-sized Enterprise Scheme.

Basic loss per

share amounts are calculated by dividing the net loss for the period from continuing operations, attributable to ordinary equity holders

of the parent company, by the weighted average number of ordinary shares outstanding during the period. As the Group made a loss for the

period the diluted loss per share is equal to the basic loss per share.

The Company has