UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under § 240.14a-12

|

BIO-key International, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☐

|

Fee paid previously with preliminary materials

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

BIO-KEY INTERNATIONAL, INC.

101 Crawfords Corner Road, Suite 4116

Holmdel, NJ 07733

November 24, 2023

Dear Stockholder:

You are cordially invited to attend a special meeting of stockholders of BIO-key International, Inc. (the “Company”) on December 14, 2023, at 10:00 a.m., local time, at our offices at 101 Crawfords Corner Road, Suite 4116, Holmdel, NJ 07733.

The Notice of Special Meeting of Stockholders and Proxy Statement on the following pages describe the matters to be presented at the meeting and should be read in their entirety.

The first purpose of the meeting is for our stockholders to consider and approve a proposed amendment to our Certificate of Incorporation, as amended, to effect a reverse split of our issued and outstanding common stock at a ratio between 1-for-6 and 1-for-20, with the final decision of whether to proceed with the reverse stock split and the exact ratio and timing of the reverse split to be determined by our board of directors, in its discretion, following stockholder approval (if obtained), but no later than December 22, 2023 (the “Reverse Stock Split”).

The Reverse Stock Split should, among other things, assist the Company in our effort to regain compliance with Nasdaq Listing Rule 5550(a)(2), which requires that we maintain a minimum bid price of $1.00 per share.

THE REVERSE STOCK SPLIT WILL AFFECT ALL HOLDERS OF COMMON STOCK UNIFORMLY AND NO STOCKHOLDER’S INTEREST IN THE COMPANY WILL BE DILUTED AS EACH STOCKHOLDER WILL HOLD THE SAME PERCENTAGE OF COMMON STOCK OUTSTANDING IMMEDIATELY FOLLOWING THE REVERSE STOCK SPLIT AS THAT STOCKHOLDER HELD IMMEDIATELY PRIOR TO THE REVERSE STOCK SPLIT, EXCEPT FOR IMMATERIAL ADJUSTMENTS THAT MAY RESULT FROM THE TREATMENT OF FRACTIONAL SHARES AS DESCRIBED BELOW.

The second purpose of the meeting is for our stockholders to approve the BIO-key International, Inc. 2023 Stock Incentive Plan.

It is important that your shares be represented at the meeting. We hope that you will have your shares represented by signing, dating and returning your proxy as soon as possible. Your shares will be voted in accordance with the instructions you have given in your proxy. Whether or not you plan to attend the meeting, we urge you to complete, date and sign the enclosed proxy card and return it at your earliest convenience in the enclosed envelope.

We look forward to seeing you at the meeting. Thank you for your continued support.

| |

Sincerely yours,

|

|

| |

|

|

| |

/s/ Michael W. DePasquale

|

|

| |

Michael W. DePasquale

|

|

| |

Chairman and Chief Executive Officer

|

|

BIO-KEY INTERNATIONAL, INC.

101 Crawfords Corner Road, Suite 4116

Holmdel, NJ 07733

Notice of Special Meeting of Stockholders

You are hereby notified that a special meeting of stockholders of BIO-key International, Inc. (the “Company”) will be held on December 14, 2023, at 10:00 a.m., local time, at our offices at 101 Crawfords Corner Road, Suite 4116, Holmdel, NJ 07733, for the following purposes:

1. To consider and approve a proposed amendment to our Certificate of Incorporation, as amended, to effect a reverse split of our issued and outstanding common stock at a ratio between 1-for-6 and 1-for-20, with the final decision of whether to proceed with the reverse stock split and the exact ratio and timing of the reverse split to be determined by our board of directors, in its discretion, following stockholder approval (if obtained), but no later than December 22, 2023 (the “Reverse Stock Split”); and

2. To approve the BIO-key International, Inc. 2023 Stock Incentive Plan.

Only holders of record of our common stock as of the close of business on October 31, 2023 are entitled to notice of and to vote at the meeting, or any adjournment thereof.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, WE URGE YOU TO COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE. THE PROMPT RETURN OF PROXIES WILL ENSURE A QUORUM AND SAVE US THE EXPENSE OF FURTHER SOLICITATION. EACH PROXY GRANTED MAY BE REVOKED BY THE STOCKHOLDER APPOINTING SUCH PROXY AT ANY TIME BEFORE IT IS VOTED.

| |

By order of the board of directors,

|

|

| |

|

|

| |

|

|

| |

/s/ Michael W. DePasquale

|

|

| |

Michael W. DePasquale

|

|

| |

Chairman and Chief Executive Officer

|

|

BIO-KEY INTERNATIONAL, INC.

101 Crawfords Corner Road, Suite 4116

Holmdel, NJ 07733

PROXY STATEMENT

This proxy statement contains information related to the special meeting of stockholders of BIO-key International, Inc. (the “Company,” “we” or “us”) to be held on December 14, 2023, at 10:00 a.m. local time, at our offices at 101 Crawfords Corner Road, Suite 4116, Holmdel, NJ 07733, and at any postponements or adjournments thereof (the “Special Meeting”), for the purpose set forth in the attached Notice of Special Meeting of Stockholders. This proxy statement and the enclosed proxy card are first being mailed to our stockholders on or about November 27, 2023.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER 14, 2023. THIS PROXY STATEMENT AND THE ACCOMPANYING FORM OF PROXY CARD ARE AVAILABLE AT WWW.PROXYVOTE.COM. In accordance with rules issued by the Securities and Exchange Commission (“SEC”), we are providing access to our proxy materials both by sending you this full set of proxy materials and by notifying you of the availability of our proxy materials on the Internet.

VOTING AT THE SPECIAL MEETING

Who Can Vote

Only stockholders of record at the close of business on October 31, 2023, the record date, are entitled to notice of and to vote at the meeting, and at any postponement(s) or adjournment(s) thereof. As of October 31, 2023, 13,668,894 shares of our common stock, par value $0.0001 per share, were issued and outstanding. Holders of our common stock are entitled to one vote per share for each proposal presented at the meeting.

How to Vote; How Proxies Work

Our board of directors is asking for your proxy. Whether or not you plan to attend the meeting, we urge you to vote by proxy. Please complete, date and sign the enclosed proxy card and return it at your earliest convenience. We will bear the costs incidental to the solicitation and obtaining of proxies, including the costs of reimbursing banks, brokers and other nominees for forwarding proxy materials to beneficial owners of our common stock. Proxies may be solicited by our officers and employees, without extra compensation, by mail, telephone, telefax, personal interviews and other methods of communication. We may engage the services of a proxy solicitation firm to assist in the solicitation of proxies which we anticipate would cost approximately $20,000.

If you are a registered stockholder, you may vote your shares or submit a proxy to have your shares voted by one of the following methods:

| |

●

|

By Internet. You may submit a proxy electronically via the internet by following the instructions provided on the proxy card. Please have your proxy card in hand when you access the website. Internet voting facilities will close at 11:59 p.m., Eastern Time, on December 14, 2023.

|

| |

●

|

By Telephone. You may submit a proxy by telephone using the toll-free number listed on the proxy card. Please have the proxy card in hand when you call. Telephone voting facilities will close at 11:59 p.m., Eastern Time, on December 14, 2023.

|

| |

●

|

By Mail. You may submit a proxy by signing, dating and returning your proxy card in the provided pre-addressed envelope in accordance with the enclosed instructions. We encourage you to sign and return the proxy or voter instruction card even if you plan to attend the Special Meeting so that your shares will be voted even if you are unable to attend.

|

| |

●

|

In Person. If you plan to attend the Special Meeting and vote in person, we will provide you with a ballot at the Special Meeting. You may vote in person at the Special Meeting by completing a ballot; however, attending the Special Meeting without completing a ballot will not count as a vote.

|

At the meeting, and at any adjournment(s) or postponement(s) thereof, all shares entitled to vote and represented by properly executed proxies received prior to the meeting and not revoked will be voted as instructed on those proxies. If no instructions are indicated on a properly executed proxy, the shares represented by the proxies will be voted:

(i) FOR an amendment to our Certificate of Incorporation, as amended, to effect a reverse stock split of our issued and outstanding common stock at a ratio between 1-for 6 and 1-for-20, with the final decision of whether to proceed with the reverse stock split and the exact ratio and timing of the reverse split to be determined by our board of directors, in its discretion, following stockholder approval (if obtained), but no later than December 22, 2023, or to determine not to proceed with the Reverse Stock Split (“Proposal 1”);

(ii) FOR approval of the BIO-key International, Inc. 2023 Stock Incentive Plan (“Proposal 2”); and

(iii) in the discretion of the person named in the enclosed form of proxy, on any other proposals which may properly come before the meeting or any adjournment(s) thereof.

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record on how to vote your shares. You must follow the instructions of your broker or other nominee in order for your shares to be voted. If your shares are not registered in your name and you plan to vote your shares in person at the meeting, you must obtain and bring with you to the meeting a “legal proxy” from the broker or other nominee holding your shares that confirms your beneficial ownership of the shares and gives you the right to vote your shares at the meeting.

If you receive more than one proxy card because your shares are registered in different names or addresses, each such proxy card should be signed and returned to assure that all of your shares will be voted.

What Constitutes a Quorum

The presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast at the meeting will constitute a quorum for the transaction of business.

What Vote is Required

In accordance with Delaware law, approval and adoption of Proposal 1 requires the affirmative vote of at least a majority of votes cast at the Special Meeting. Approval of Proposal 2 requires the affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote on the proposal at the Special Meeting.

How Abstentions and Broker Non-Votes Are Treated

Abstentions will be counted as shares that are present for purposes of determining a quorum. Abstentions will have no effect on Proposal 1. For Proposal 2, abstentions will have the practical effect of a vote against the proposal.

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker, bank or other nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the nominee holding the shares. If the beneficial owner does not provide voting instructions, the nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to matters that are considered to be “non-routine.” The Reverse Stock Split is a “routine” matter and may be voted upon by your broker if you do not submit voting instructions. As a result, we do not anticipate any broker non-votes with respect to Proposal 1. The adoption of the BIO-key International, Inc. 2023 Stock Incentive Plan is not a “routine” matter and may not be voted upon by your broker if you do not submit voting instructions. We encourage you to provide instructions to your broker regarding the voting of your shares.

Broker non-votes will be counted as shares that are present for purposes of determining a quorum. Broker non-votes will have no effect on either Proposal 1 or Proposal 2.

Voting of Proxies

Our board of directors recommends a vote “FOR” the Reverse Stock Split and “FOR” the adoption of the BIO-key International, Inc. 2023 Stock Incentive Plan. Your shares of common stock will be voted in accordance with the instructions contained in your signed proxy card. If you return a signed proxy card without giving specific voting instructions, proxies will be voted in favor of the board of directors’ recommendations with respect to such proposal as set forth in this proxy statement.

How to Revoke

Any stockholder who has submitted a proxy may revoke it at any time before it is voted, by written notice addressed to and received by our chief financial officer, by submitting a duly executed proxy bearing a later date, or by electing to vote in person at the meeting. The mere presence at the meeting of the person appointing a proxy does not, however, revoke the appointment. If you are a stockholder whose shares are not registered in your own name, you will need additional documentation from your record holder to vote personally at the meeting.

No Dissenters or Appraisal Rights

Under the General Corporation Law of the State of Delaware, our Certificate of Incorporation and our bylaws, the holders of common stock will not be entitled to dissenter’s rights or appraisal rights in connection with the proposals set forth herein.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of October 31, 2023, information with respect to the securities holdings of all persons that we, pursuant to filings with the SEC and our stock transfer records, have reason to believe may be deemed the beneficial owner of more than 5% of our common stock. The following table also sets forth, as of such date, the beneficial ownership of our common stock by all of our current executive officers and directors, both individually and as a group.

The beneficial owners and amount of securities beneficially owned have been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934 (the “Exchange Act”), as awarded, and, in accordance therewith, include all shares of our common stock that may be acquired by such beneficial owners within 60 days of October 31, 2023 upon the exercise or conversion of any options, warrants or other convertible securities. This table has been prepared based on 13,668,894 shares of common stock outstanding on October 31, 2023.

|

Name and Address of Beneficial Owner (1)

|

|

Amount and Nature

of

Beneficial

Ownership

|

|

|

Percent of

Class

|

|

| |

|

|

|

|

|

|

|

|

|

Directors and Executive Officers

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Michael W. DePasquale

|

|

|

505,827 |

(2) |

|

|

3.6 |

%

|

|

Cecilia C. Welch

|

|

|

99,375 |

(3) |

|

|

* |

|

|

Mira K. LaCous

|

|

|

52,501 |

(4) |

|

|

* |

|

|

James D. Sullivan

|

|

|

618,000 |

(5) |

|

|

4.4 |

%

|

|

Robert J. Michel

|

|

|

38,991 |

(6) |

|

|

* |

|

|

Emmanuel Alia

|

|

|

31,772 |

(7) |

|

|

* |

|

|

Wong Kwok Fong (Kelvin)

|

|

|

589,464 |

(8) |

|

|

4.3 |

%

|

|

Cameron E. Williams

|

|

|

6,231 |

|

|

|

* |

|

|

All officers and directors as a group (eight (8) persons)

|

|

|

1,942,161 |

|

|

|

13.7 |

%

|

| |

|

|

|

|

|

|

|

|

|

Beneficial Owners

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Lind Global Micro Fund, LP

|

|

|

833,125 |

(9) |

|

|

5.7 |

%

|

|

AJB Capital Investments LLC

|

|

|

900,000 |

(10) |

|

|

6.5 |

%

|

|

(1)

|

Unless otherwise indicated, the address of each person listed below is c/o BIO-key International, Inc., 101 Crawfords Corner Road, Suite 4116, Holmdel, NJ 07733

|

|

(2)

|

Includes 39,584 shares issuable on exercise of options, 74,125 shares of restricted stock of which 59,709 remain subject to vesting, and 165,000 shares issuable upon exercise of warrants.

|

|

(3)

|

Includes 22,500 of shares issuable upon exercise of options and 64,125 shares of restricted stock of which 51,375 remain subject to vesting.

|

|

(4)

|

Includes 15,626 of shares issuable upon exercise of options and 21,625 shares of restricted stock of which 16,375 remain subject to vesting.

|

|

(5)

|

Includes 18,750 of shares issuable on exercise of options, 64,125 shares of restricted stock of which 51,375 remain subject to vesting, and 228,000 shares issuable upon exercise of warrants.

|

|

(6)

|

Includes 1,960 of shares issuable on exercise of options and 5,000 shares of restricted stock of which 3,334 remain subject to vesting. Does not include 104 shares issuable upon exercise of options subject to vesting.

|

|

(7)

|

Includes 209 of shares issuable on exercise of options and 5,000 shares of restricted stock of which 3,334 remain subject to vesting. Does not include 104 shares issuable upon exercise of options subject to vesting.

|

|

(8)

|

Includes 27,084 shares issuable on exercise of options and 9,125 shares of restricted stock of which 4,709 remain subject to vesting. The address of Kelvin is Flat C, 27/F, Block 5, Grand Pacific Views, Siu Lam, Hong Kong N7.

|

|

(9)

|

Consists of shares issuable upon exercise of warrants. The address of Lind Global Capital Micro Fund, LP is 444 Madison Ave, Floor 41, New York, NY 10022.

|

|

(10)

|

Includes 200,000 shares issuable upon exercise of warrants. The address of AJB Capital Investments LLC is 4700 Sheridan Street, Suite J, Hollywood, FL 33021.

|

PROPOSAL 1

APPROVAL OF AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

General

The Board has unanimously approved, and recommended that our stockholders approve, an amendment to our Certificate of Incorporation, as amended, in substantially the form attached hereto as Appendix A (the “Certificate of Amendment”), to effect the Reverse Stock Split at a ratio of between 1-for-6 and 1-for-20, with the final decision of whether to proceed with the Reverse Stock Split and the exact ratio of the Reverse Stock Split to be determined by our board of directors, in its discretion. If the stockholders approve the Reverse Stock Split, and the Board decides to implement it, the Reverse Stock Split will become effective upon the filing of the Certificate of Amendment with the Delaware Secretary of State.

The Reverse Stock Split will be realized simultaneously for all outstanding common stock. The Reverse Stock Split will affect all holders of common stock uniformly and no stockholder’s interest in the Company will be diluted as each stockholder will hold the same percentage of common stock outstanding immediately following the Reverse Stock Split as that stockholder held immediately prior to the Reverse Stock Split, except for immaterial adjustments that may result from the treatment of fractional shares as described below. The Certificate of Amendment will not reduce the number of authorized shares of common stock (which will remain at 170,000,000) and will not change the par value of the common stock (which will remain at $0.0001 per share).

Reasons for the Reverse Stock Split

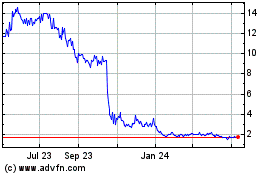

On January 12, 2023, we received a letter from the staff of The Nasdaq Stock Market LLC (“Nasdaq”) stating that the Company did not satisfy the continued listing requirement to maintain a minimum bid price of $1.00 per share, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”), as the Company’s closing bid price was less than $1.00 per share for the 30 consecutive business days prior to the date of the Nasdaq letter. On July 12, 2023, we received a letter from Nasdaq (the “Letter”) stating that although the Company had not regained compliance with the Minimum Bid Price Requirement, Nasdaq determined that the Company was eligible for an additional 180-day period, or until January 8, 2024, to regain compliance with the Minimum Bid Price Requirement. In the Letter, Nasdaq stated that its determination was based on (i) the Company meeting the continued listing requirement for market value of its publicly held shares and all other applicable requirements for initial listing on the Nasdaq Capital Market with the exception of the Minimum Bid Price Requirement, and (ii) the Company’s written notice to Nasdaq of its intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary. Our board of directors has unanimously approved and declared advisable an amendment to the Company’s Certificate of Incorporation, as amended, to effect a reverse stock split of all issued and outstanding shares of our Common Stock, in a ratio between 1-for-6 and 1-for-20, in order to, among other things, assist the Company in our effort to regain compliance with the Minimum Bid Price Requirement.

The precise ratio of the proposed Reverse Stock Split shall be a whole number within this range, determined in the sole discretion of our board of directors. It is expected that such determination, if any, shall occur at some time on or prior to December 22, 2023. By approving this proposal, stockholders will give our board of directors authority, but not the obligation, to effect the Reverse Stock Split and full discretion to approve the ratio at which shares of Common Stock will be automatically reclassified up to and including a ratio between 1-for-6 and 1-for-20. Our board of directors believes that providing our board of directors with this grant of authority with respect to setting the reverse split ratio, rather than approval of a pre-determined reverse stock split ratio, will give our board of directors the flexibility to set the ratio in accordance with current market conditions and, therefore, allow our board of directors to act in the best interests of the Company and our stockholders.

In determining the ratio following the receipt of stockholder approval, our board of directors may consider, among other things, factors such as:

● the historical trading price and trading volume of our common stock;

● the then-prevailing trading price and trading volume of our common stock and the anticipated impact of the Reverse Stock Split on the trading market for our common stock;

● the number of shares of our common stock then outstanding, and the number of shares of common stock issuable upon exercise of options and warrants then outstanding;

● the anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs;

● prevailing general market and economic conditions;

● any threshold prices of brokerage houses or institutional investors that could impact their ability to invest or recommend investments in our common stock; and

● compliance with the Minimum Bid Price Requirement.

If our stockholders approve this proposal and our board of directors does not otherwise abandon the amendment contemplating the Reverse Stock Split, we will file a Certificate of Amendment to the Company’s Certificate of Incorporation with the Secretary of State of the State of Delaware (the “Delaware Secretary of State”) to effect the proposed Reverse Stock Split, in the form attached to this proxy statement as Appendix A. Our board of directors has approved and declared advisable the proposed amendment to the Company’s Certificate of Incorporation as set forth in the Certificate of Amendment, in the form attached to this proxy statement as Appendix A. If the proposed Reverse Stock Split is effected, then the number of issued and outstanding shares of our common stock would be reduced. Our board of directors has reserved the right to abandon the amendment at any time before the effectiveness of the filing of the Certificate of Amendment with the Delaware Secretary of State, even if the adoption of the amendment is approved by the stockholders. Thus, the board of directors, at its discretion, may cause the filing of the Certificate of Amendment (following stockholder approval) to effect the Reverse Stock Split or abandon the amendment and not effect the Reverse Stock Split if it determines that any such action is or is not in the best interests of our Company and stockholders.

Prior to filing the amendment to the Certificate of Amendment reflecting the Reverse Stock Split, we must first notify Nasdaq of the anticipated record date of the Reverse Stock Split.

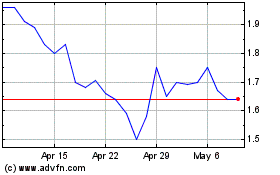

Purpose of Proposed Reverse Stock Split

Nasdaq Listing Rule 5550(a)(2) requires that we maintain a minimum bid price of $1.00 per share to maintain our listing on the Nasdaq Capital Market. On November 22, 2023, the sale price of our common stock on the Nasdaq was $0.15 per share. A decrease in the number of issued and outstanding shares of our common stock resulting from the Reverse Stock Split should, absent other factors, cause the per share market price of our common stock to trade above the required price. However, we cannot provide any assurance that (i) we will regain compliance with Nasdaq Listing Rule 5550(a)(2), or other listing requirements, in effect the Nasdaq Capital Market or (ii) even if we do, that our minimum bid price would remain over the minimum bid price requirement of the Nasdaq Capital Market following the Reverse Stock Split.

Our board of directors believes that the Reverse Split and any resulting increase in the per share price of our common stock will enhance the acceptability and marketability of our common stock to the financial community and investing public. Some investors prefer to invest in stocks that trade at a per share price range more typical of companies listed on Nasdaq. Also, some brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in stocks priced below a certain level (for example, $5.00 per share) or tend to discourage individual brokers from recommending lower-priced stocks to their customers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were higher. The Company believes that the Reverse Stock Split will make our common stock a more attractive and cost effective investment for many investors, which in turn would enhance the liquidity of the holders of our common stock.

Reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share trading price of our common stock. However, other factors, such as our financial results and financial outlook and investor perception of our future prospects, as well as general market and economic conditions, among many factors, may positively or negatively affect the trading price of our common stock. Therefore, even if the Reverse Stock Split is effected, the trading price of our common stock may not increase to a level we may have expected following the Reverse Stock Split or, if it does, the trading price of our common stock may decrease in the future. Additionally, the trading price per share of our common stock after the Reverse Stock Split may not increase in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

We believe increasing the trading price of our common stock will assist in meeting the continued listing criteria of The Nasdaq Capital Market and is our best option to meet the bid price criteria to comply with the continued listing requirements. Accordingly, we believe that the Reverse Stock Split is in our stockholders’ best interests.

In addition, an increase in the per share trading value of our common stock would be beneficial to us to the extent that it would:

● improve the perception of our common stock as an investment security;

● reset our stock price to more normalized trading levels in the face of potentially extended market dislocation;

● appeal to a broader range of investors to generate greater investor interest in us; and

● reduce stockholder transaction costs because investors would pay lower commission to trade a fixed dollar amount of our stock if our stock price were higher than they would if our stock price were lower.

Future Issuances

In addition to the foregoing, the Reverse Stock Split will provide us with the ability to support our present capital needs and future anticipated growth. As discussed below under the caption “Effect on Authorized but Unissued Shares,” the Reverse Stock Split will have the effect of increasing the number of shares of common stock that we are authorized to issue. We have historically met our capital needs primarily through the sale of our debt and equity securities. The availability of additional shares of common stock would provide us with the flexibility to consider and respond to future business opportunities and needs as they arise, including public or private financings, subscription rights offerings, mergers, acquisitions, stock dividends, stock splits and the granting of equity incentive awards. The Reverse Stock Split would permit us to undertake certain of the foregoing actions without the delay and expense associated with holding a meeting of stockholders to obtain stockholder approval each time such an opportunity arises that would require the issuance of shares of our common stock.

We have no specific plans, arrangements or understandings, whether written or oral, to issue any additional shares.

We do not intend to use the Reverse Stock Split as a part of or a first step in a “going private” transaction within the meaning of Rule 13e-3 of the Exchange Act. There is no plan or contemplated plan by us to take ourselves private at the date of this proxy statement.

Consequences of Not Obtaining Stockholder Approval of the Reverse Stock Split

If we do not obtain stockholder approval of the Reverse Stock Split and we are unable to satisfy the listing requirements for the Nasdaq Capital Market, we may be delisted from the exchange. In addition, if we need additional capital to fund operations and at such time do not have a sufficient number of authorized and unissued shares of common stock to raise such additional capital, our business would be materially and adversely affected.

If stockholder approval for the Reverse Stock Split is not obtained, the number of shares of our common stock that are issued and outstanding will not change and the anticipated benefits of the Reverse Stock Split described above under “Reasons for the Reverse Stock Split” will not be achieved.

Principal Effects of the Reverse Stock Split

A reverse stock split refers to a reduction in the number of outstanding shares of a class of a corporation’s capital stock, which may be accomplished, as in this case, by reclassifying and combining all of our outstanding shares of common stock into a proportionately smaller number of shares. For example, a stockholder holding 100,000 shares of common stock before the reverse stock split would instead hold 12,500 shares of common stock immediately after the reverse stock split if the ratio at which the board of directors determines the ratio to be 1-for-8. Each stockholder’s proportionate ownership of outstanding shares of common stock would remain the same, subject to immaterial adjustments due to the issuance of an additional share in lieu of a fractional share. All shares of common stock will remain validly issued, fully paid and non-assessable.

After the effective date of the Reverse Stock Split, our common stock will have a new committee on uniform securities identification procedures number, also known as a CUSIP number, which is a number used to identify our common stock. Our common stock is currently registered under Section 12(b) of the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The proposed Reverse Stock Split will not affect the registration of our common stock under the Exchange Act.

Effect on Authorized but Unissued Shares

The Reverse Stock Split will have the effect of increasing the number of authorized but unissued shares of common stock available for issuance. The number of shares of common stock that we are authorized to issue will not be decreased and will remain at 170,000,000.

The table below provides examples of reverse stock splits at various ratios between 1-for-6 and 1-for-20, without giving effect to the treatment of fractional shares. The actual number of shares outstanding after giving effect to the Reverse Stock Split, if effected, will depend on the actual ratio that is determined by our board of directors.

|

Shares outstanding at

October 31, 2023

|

|

Reverse Stock Split Ratio

|

|

Shares outstanding

after Reverse Stock Split

|

|

|

Reduction in

Shares

Outstanding

|

|

| 13,668,894 |

|

1-for-6

|

|

|

2,278,149 |

|

|

|

83.3 |

%

|

| 13,668,894 |

|

1-for-12

|

|

|

1,139,075 |

|

|

|

91.7 |

%

|

| 13,668,894 |

|

1-for-20

|

|

|

683,445 |

|

|

|

5.0 |

%

|

The resulting decrease in the number of shares of our common stock outstanding could potentially adversely affect the liquidity of our common stock, especially in the case of larger block trades.

Certain Risks Associated with the Reverse Stock Split

A reverse stock split could result in a significant devaluation of our market capitalization and the trading price of our common stock.

We cannot assure you that the Reverse Stock Split, if implemented, will increase the market price of our common stock in proportion to the reduction in the number of issued and outstanding shares of common stock or result in a permanent increase in the market price. Accordingly, the total market capitalization of our common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split and, in the future, the market price of our common stock following the Reverse Stock Split may not exceed or remain higher than the market price prior to the Reverse Stock Split.

The effect the Reverse Stock Split may have upon the market price of our common stock cannot be predicted with any certainty, and the history of similar reverse stock splits for companies in similar circumstances to ours is varied. The market price of our common stock is dependent on many factors, including our business and financial performance, general market conditions, prospects for future success and other factors detailed from time to time in the reports we file with the SEC. If the Reverse Stock Split is implemented and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split.

The Reverse Stock Split may result in some stockholders owning “odd lots” that may be more difficult to sell or require greater transaction costs per share to sell.

The Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of common stock on a post-split basis. These odd lots may be more difficult to sell, or require greater transaction costs per share to sell, than shares in “round lots” of even multiples of 100 shares.

The reduced number of shares of common stock resulting from a reverse stock split could adversely affect the liquidity of our common stock.

Although the Board believes that the decrease in the number of shares of common stock outstanding as a consequence of the Reverse Stock Split and the anticipated increase in the market price of common stock could encourage interest in our common stock and possibly promote greater liquidity for our stockholders, such liquidity could also be adversely affected by the reduced number of shares outstanding after the reverse stock split.

Anti-Takeover and Dilutive Effects

The purpose of maintaining our authorized common stock at 170,000,000 after the Reverse Stock Split is to facilitate our ability to issue additional shares of common stock to execute our business plan, not to establish any barriers to a change of control or acquisition of the Company. Shares of common stock that are authorized but unissued provide the Board with flexibility to effect, among other transactions, public or private financings, subscription rights offerings, mergers, acquisitions, stock dividends, stock splits and the granting of equity incentive awards. However, the increase in the number of shares of common stock authorized for issuance could, under certain circumstances, be construed as having an anti-takeover effect. For example, in the event a person seeks to effect a change in the composition of our board of directors or contemplates a tender offer or other transaction involving the combination of our Company with another company, it may be possible for us to impede the attempt by issuing additional shares of common stock, thereby diluting the voting power of the other outstanding shares and increasing the potential cost to acquire control of our Company. By potentially discouraging initiation of any such unsolicited takeover attempt, our Certificate of Incorporation may limit the opportunity for our stockholders to dispose of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal. The proposed Reverse Stock Split may also have the effect of permitting our current management, including our Board, to retain its position indefinitely and place it in a better position to resist changes that our stockholders may wish to make if they are dissatisfied with the conduct of our business.

Our board of directors did not propose this Reverse Stock Split in response to any effort known to the Board to accumulate common stock or to obtain control of our Company by means of a merger, tender offer or solicitation in opposition to management. In addition, this proposal is not part of any plan by management to recommend a series of similar amendments to our stockholders. Finally, except as described in this proxy statement, our board of directors does not currently contemplate recommending the adoption of any other amendments to our Certificate of Incorporation that could be construed as affecting the ability of third parties to take over or change the control of our Company.

In addition, the issuance of additional shares of common stock for any of the corporate purposes listed above could have a dilutive effect on earnings per share and the book or market value of our outstanding common stock, depending on the circumstances, and would likely dilute a stockholder’s percentage voting power in the Company. Holders of common stock are not entitled to preemptive rights or other protections against dilution.

Effect on Fractional Stockholders

No fractional shares of common stock will be issued in connection with the Reverse Stock Split. In lieu of issuing fractional shares, we intend to round fractional shares up to the next whole share.

Effect on Beneficial Stockholders

If you hold shares of common stock in “street name” through an intermediary, we will treat your common stock in the same manner as stockholders whose shares are registered in their own names. Intermediaries will be instructed to effect the Reverse Stock Split for their customers holding common stock in street name. However, these intermediaries may have different procedures for processing a reverse stock split. If you hold shares of common stock in street name, we encourage you to contact your intermediaries.

Registered “Book-Entry” Holders of Common Stock

If you hold shares of common stock electronically in book-entry form with our transfer agent, you do not currently have and will not be issued stock certificates evidencing your ownership after the reverse stock split, and you do not need to take action to receive post-reverse stock split shares. If you are entitled to post-reverse stock split shares, a transaction statement will automatically be sent to you indicating the number of shares of common stock held following the reverse stock split.

Effect on Registered Stockholders Holding Certificates

As soon as practicable after the Reverse Stock Split, our transfer agent will mail transmittal letters to each stockholder holding shares of common stock in certificated form. The letter of transmittal will contain instructions on how a stockholder should surrender his or her certificate(s) representing shares of common stock (the “Old Certificates”) to the transfer agent in exchange for certificates representing the appropriate number of whole shares of post-reverse stock split common stock (the “New Certificates”). No New Certificates will be issued to a stockholder until such stockholder has surrendered all Old Certificates, together with a properly completed and executed letter of transmittal, to the transfer agent. No stockholder will be required to pay a transfer or other fee to exchange his or her Old Certificates. Stockholders will then receive a New Certificate(s) representing the number of whole shares of common stock that they are entitled as a result of the reverse stock split. Until surrendered, we will deem outstanding Old Certificates held by stockholders to be cancelled and to represent only the number of whole shares of post-reverse stock split common stock to which these stockholders are entitled. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock, will automatically be exchanged for New Certificates.

Effect on Outstanding Options and Warrants

Upon a reverse stock split, all outstanding options, warrants and future or contingent rights to acquire common stock will be adjusted to reflect the Reverse Stock Split. With respect to all outstanding options and warrants to purchase common stock, the number of shares of common stock that such holders may purchase upon exercise of such options or warrants will decrease, and the exercise prices of such options or warrants will increase, in proportion to the fraction by which the number of shares of common stock underlying such options and warrants are reduced as a result of the Reverse Stock Split. Also, the number of shares reserved for issuance under our existing equity incentive plans would be reduced proportionally based on the ratio of the Reverse Stock Split.

Procedure for Effecting the Reverse Stock Split

If our stockholders approve this proposal, and the board of directors elects to effect the Reverse Stock Split, we will effect the Reverse Stock Split by filing the Certificate of Amendment with the Secretary of State of the State of Delaware. The Reverse Stock Split will become effective, and the combination of, and reduction in, the number of our outstanding shares as a result of the Reverse Stock Split will occur automatically, at the time of the filing of the Certificate of Amendment (referred to as the “effective time”), without any action on the part of our stockholders and without regard to the date that stock certificates representing any certificated shares prior to the Reverse Stock Split are physically surrendered for new stock certificates. Beginning at the effective time, each certificate representing pre-Reverse Stock Split shares will be deemed for all corporate purposes to evidence ownership of post-Reverse Stock Split shares. The text of the Certificate of Amendment is subject to modification to include such changes as may be required by the office of the Secretary of State of the State of Delaware and as the Board deems necessary and advisable to effect the Reverse Stock Split.

The board of directors reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior to filing the Certificate of Amendment, the Board, in its sole discretion, determines that it is no longer in the best interests of the Company and its stockholders to proceed with the Reverse Stock Split. By voting in favor of the Reverse Stock Split, you are also expressly authorizing the Board to delay or abandon the Reverse Stock split.

Stockholders should not destroy any stock certificate(s) and should not submit any certificate(s) until they receive a letter of transmittal from our transfer agent.

Certain Material U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a summary of certain material United States federal income tax consequences of the Reverse Stock Split to our stockholders. This summary does not purport to be a complete discussion of all of the possible federal income tax consequences of the Reverse Stock Split and is included for general information only. Further, it does not address any state, local or foreign income or other tax consequences. Also, it does not address the tax consequences to stockholders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, foreign entities, nonresident alien individuals, broker-dealers and tax-exempt entities. Other stockholders may also be subject to special tax rules, including but not limited to: stockholders that received common stock as compensation for services or pursuant to the exercise of an employee stock option, or stockholders who have held, or will hold, stock as part of a straddle, hedging or conversion transaction for federal income tax purposes. This summary also assumes that you are a United States holder (defined below) who has held, and will hold, shares of common stock as a “capital asset,” as defined in the Internal Revenue Code of 1986, as amended (the “Code”), i.e., generally, property held for investment. Finally, the following discussion does not address the tax consequences of transactions occurring prior to or after the reverse stock split (whether or not such transactions are in connection with the Reverse Stock Split), including, without limitation, the exercise of options or rights to purchase common stock in anticipation of the Reverse Stock Split.

The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. You should consult with your own tax advisor with respect to the tax consequences of the Reverse Stock Split. As used herein, the term United States holder means a stockholder that is, for federal income tax purposes: a citizen or resident of the United States; a corporation or other entity taxed as a corporation created or organized in or under the laws of the United States or any state, including the District of Columbia; an estate the income of which is subject to federal income tax regardless of its source; or a trust that (i) is subject to the primary supervision of a U.S. court and the control of one of more U.S. persons or (ii) has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

The following discussion is based on the Code, applicable Treasury Regulations, judicial authority and administrative rulings and practice, all as of the date hereof. The Internal Revenue Service could adopt a contrary position. In addition, future legislative, judicial or administrative changes or interpretations could adversely affect the accuracy of the statements and conclusions set forth herein. Any such changes or interpretations could be applied retroactively and could affect the tax consequences described herein. No ruling from the Internal Revenue Service or opinion of counsel has been obtained in connection with the Reverse Stock Split.

No gain or loss should be recognized by a stockholder upon such stockholder’s exchange of pre-Reverse Stock Split shares of common stock for post-Reverse Stock Split shares of common stock pursuant to the Reverse Stock Split. The aggregate tax basis of the post-Reverse Stock Split shares received in the Reverse Stock Split (including any whole share received in exchange for a fractional share) will be the same as the stockholder’s aggregate tax basis in the pre-Reverse Stock Split shares exchanged therefore. The stockholder’s holding period for the post-Reverse Stock Split shares will include the period during which the stockholder held the pre-Reverse Stock Split shares surrendered in the Reverse Stock Split.

THE PRECEDING DISCUSSION IS INTENDED ONLY AS A SUMMARY OF CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT AND DOES NOT PURPORT TO BE A COMPLETE ANALYSIS OR DISCUSSION OF ALL POTENTIAL TAX EFFECTS RELEVANT THERETO. YOU SHOULD CONSULT YOUR OWN TAX ADVISORS AS TO THE PARTICULAR FEDERAL, STATE, LOCAL, FOREIGN AND OTHER TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT IN LIGHT OF YOUR SPECIFIC CIRCUMSTANCES.

Accounting Matters

The par value of the common stock will remain unchanged at $0.0001 per share after the Reverse Stock Split. As a result, our stated capital, which consists of the par value per share of the common stock multiplied by the aggregate number of shares of the common stock issued and outstanding, will be reduced proportionately at the effective time of the Reverse Stock Split. Correspondingly, our additional paid-in capital, which consists of the difference between our stated capital and the aggregate amount paid to us upon the issuance of all currently outstanding shares of common stock, will be increased by a number equal to the decrease in stated capital. Further, net loss per share, book value per share and other per share amounts will be increased as a result of the Reverse Stock Split because there will be fewer shares of common stock outstanding.

Required Vote

In accordance with Delaware law, approval of Proposal 1 requires the affirmative vote of at least a majority of votes cast at the Special Meeting. Abstentions and broker non-votes will have no effect on Proposal 1. Shares represented by valid proxies and not revoked will be voted at the meeting in accordance with the instructions given. If no voting instructions are given, such shares will be voted “FOR” this proposal.

Board Recommendation

After careful consideration, our board of directors has determined that the reverse stock split is advisable and in the best interests of the Company and its stockholders and recommends that you vote “FOR” the approval of the Reverse Stock Split.

PROPOSAL 2

APPROVAL OF THE BIO-KEY INTERNATIONAL, INC. 2023 STOCK INCENTIVE PLAN

Background

The board of directors, upon recommendation of the compensation committee, approved the BIO-key International, Inc. 2023 Stock Incentive Plan (referred to in this section as the “2023 plan” or the “plan”), subject to approval by our stockholders at the Special Meeting. The purpose of the 2023 plan is to advance the interests of the Company and our stockholders by enabling us to attract and retain qualified individuals to perform services, provide incentive compensation for such individuals in a form that is linked to the growth and profitability of our company and increases in stockholder value, and provide opportunities for equity participation that align the interests of recipients with those of our stockholders.

Subject to adjustment, the maximum number of shares of our common stock to be authorized for issuance under the 2023 plan is 6,000,000 shares. All share numbers included in the following discussion regarding Proposal 2 are pre-split.

The board of directors is asking our stockholders to approve the 2023 plan in order to qualify stock options for treatment as incentive stock options for purposes of Section 422 of the Internal Revenue Code of 1986, as amended. In addition, the Listing Rules of the Nasdaq Stock Market require stockholder approval of the 2023 plan.

The 2023 plan allows us to award eligible recipients the following awards:

| |

●

|

options to purchase shares of our common stock that qualify as “incentive stock options” within the meaning of Section 422 of the Code (referred to as “incentive options”);

|

| |

●

|

options to purchase shares of our common stock that do not qualify as incentive options (referred to as “non-statutory options”);

|

| |

●

|

rights to receive a payment from us, in the form of shares of our common stock, cash or a combination of both, equal to the difference between the fair market value of one or more shares of our common stock and a specified exercise price of such shares (referred to as “stock appreciation rights” or “SARs”);

|

| |

●

|

shares of our common stock that are subject to certain forfeiture and transferability restrictions (referred to as “restricted stock awards”);

|

| |

●

|

rights to receive shares of common stock (or the equivalent value in cash or other property) at a future time (referred to as “deferred stock units” or “DSUs”);

|

| |

●

|

rights to receive the fair market value of one or more shares of our common stock, payable in cash, shares of our common stock, or a combination of both, the payment, issuance, retention and/or vesting of which is subject to the satisfaction of specified conditions, which may include achievement of specified objectives (referred to as “restricted stock unit awards” or “RSUs”);

|

| |

●

|

rights to receive an amount of cash, a number of shares of our common stock, or a combination of both, contingent upon achievement of specified objectives during a specified period (referred to as “performance awards”); and

|

| |

●

|

other stock-based awards.

|

In the following discussion, we refer to both incentive options and non-statutory options as “options,” and to options, stock appreciation rights, restricted stock awards, deferred stock units, restricted stock units, performance awards and other stock based awards as “incentive awards.”

Reasons Why You Should Vote in Favor of the 2023 Plan

The board of directors recommends a vote “FOR” the approval of the 2023 plan because the board of directors believes the proposed 2023 plan is in the best interests of the Company and its stockholders for the following reasons:

| |

●

|

Retain the ability to provide equity based compensation to our employees. As of November 22, 2023, there were only 61,975 shares of common stock available for issuance under the 2015 plan. Unless stockholders approve the 2023 plan, we will have very limited ability to issue any form of equity based compensation to our employees.

|

| |

●

|

Aligns directors, employee and stockholder interests. We currently provide long-term incentives in the form of stock option grants and restricted stock to our non-employee directors, executive officers and other key employees. We believe that our stock-based compensation program helps align the interests of our directors, executive officers and other key employees with our stockholders. We believe that our long-term stock-based incentives help promote long-term retention of our employees and encourage ownership of our common stock. If the 2023 plan is approved, we will be able to maintain our means of aligning the interests of our directors, executive officers and other key employees with the interests of our stockholders.

|

| |

●

|

Attracts and retains talent. Talented, motivated and effective directors, executives and employees are essential to executing our business strategies. Stock-based and annual cash incentive compensation has been an important component of total compensation at the Company for many years because such compensation enables us to effectively recruit executives and other employees while encouraging them to act and think like owners of the Company. If the 2023 plan is approved, we believe we will maintain our ability to offer competitive compensation packages to both retain our best performers and attract new talent.

|

| |

●

|

Supports our pay-for-performance philosophy. We believe that stock-based compensation, by its very nature, is performance-based compensation. We use incentive compensation to help reinforce desired financial and other business results to our executives and to motivate them to make decisions to produce those results.

|

| |

●

|

Protects stockholder interests and embraces sound stock-based compensation practices. As described in more detail below under “Summary of Sound Governance Features of the 2023 Plan,” the 2023 plan includes a number of features that are consistent with the interests of our stockholders and sound corporate governance practices.

|

Summary of Sound Governance Features of the 2023 Plan

The board of directors and compensation committee believe that the 2023 plan contains several features that are consistent with the interests of our stockholders and sound corporate governance practices, including the following:

| ✔ |

No automatic share replenishment or “evergreen” provision

|

✔ |

Members of the committee administering the plan are non-employee and independent directors

|

| ✔ |

Will not be excessively dilutive to our stockholders

|

✔ |

Stockholder approval is required for material revisions to the 2023 plan

|

| ✔ |

Limit on number of “full value” awards

|

✔ |

No “tax gross-ups”

|

| ✔ |

No liberal share counting or “recycling” of shares from exercised stock options, SARs or other stock-based awards

|

✔ |

Options, SARs and unvested performance awards are not entitled to dividend equivalent rights and no dividends will be paid on unvested awards

|

| ✔ |

No reload stock options or SARs

|

✔ |

Limits on non-employee director compensation

|

| ✔ |

No re-pricing of “underwater” stock options or SARs without stockholder approval

|

✔ |

Stock option and SAR exercise prices will not be lower than the fair market value on the grant date

|

| ✔ |

“Clawback” provisions

|

|

|

Background for Shares Authorized for Issuance

If the 2023 plan is approved, the maximum number of shares of common stock available for issuance under the 2023 plan will be 6,000,000 shares. As of November 22, 2023, 578,263 shares of common stock were subject to outstanding awards under the 2015 plan, and 61,975 shares of common stock remained available for issuance under the 2015 plan.

In determining the number of shares of common stock available under the 2023 plan, the board of directors and compensation committee considered a number of factors, which are discussed further below, including:

| |

●

|

Shares currently available under the 2015 plan and total outstanding equity-based awards and how long the shares available are expected to last;

|

| |

●

|

Historical equity award granting practices, including our three-year average share usage rate (commonly referred to as “burn rate”);

|

| |

●

|

The number of outstanding shares of common stock and outstanding pre-funded warrants to purchase shares of common exercisable at par value, or $0.0001 per share; and

|

Shares Available and Outstanding Equity Awards

While the use of long-term incentives, in the form of equity awards, is an important part of our compensation program, we are mindful of our responsibility to our stockholders to exercise judgment in the granting of equity awards. In setting the number of shares of common stock available for issuance under the 2023 plan, the board of directors and compensation committee also considered shares currently available under the 2015 plan and total outstanding equity awards and how long the shares available under the 2015 plan are expected to last. To facilitate approval of the 2023 plan, set forth below is certain information about our shares of common stock that may be issued under our equity compensation plans as of October 31, 2023.

As of October 31, 2023,

| |

●

|

we had 13,668,894 shares of common stock issued and outstanding. The market value of one share of common stock on November 22, 2023, as determined by reference to the closing price as reported on the Nasdaq Capital Market, was $0.15;

|

| |

●

|

17,200,000 shares were subject to outstanding pre-funded warrants exercisable at a par value, or $0.0001 per share;

|

| |

●

|

60,296 shares were subject to outstanding stock options under the 2015 plan and 517,967 shares underlying restricted stock awards were outstanding under the 2015 plan; and

|

| |

●

|

61,975 shares remained available for issuance under the 2015 plan.

|

Historical Equity Award Granting Practices

In setting the number of shares of common stock authorized for issuance under the 2023 plan, the board of directors and compensation committee also considered the historical number of equity awards granted under the 2015 plan in each of the last three years. The following table sets forth information regarding awards granted and earned and the annual burn rate for each of the last three years. The only equity awards granted during the last three fiscal years were stock options and restricted stock awards.

| |

|

2023

|

|

|

2022

|

|

|

2021

|

|

|

Stock options granted

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

Restricted stock awards granted

|

|

|

242,775 |

|

|

|

267,750 |

|

|

|

13,125 |

|

|

Weighted average basic common shares outstanding during fiscal year

|

|

|

9,047,527 |

|

|

|

8,100,000 |

|

|

|

7,791,741 |

|

|

Burn rate

|

|

|

2.68 |

% |

|

|

3.30 |

% |

|

|

.17 |

% |

The board of directors and compensation committee also considered our three-year average burn rate (2021 to 2023) of approximately 2.05%, which is lower than the industry thresholds established by certain major proxy advisory firms.

Based on historical and anticipated granting practices and the recent trading price of our common stock, we expect the additional shares authorized for issuance by the 2023 plan to cover awards for approximately five years. However, we cannot predict our future equity grant practices, the future price of our shares, or future hiring activity with any degree of certainty at this time, and the shares available for issuance under the 2023 plan could last for a shorter or longer time.

Potential Dilution

In setting the number of shares of common stock authorized for issuance under the 2023 plan, the board of directors and compensation committee also considered the potential dilution (often referred to as overhang) that would result by approval of the 2023 plan, including the policies of certain institutional investors and major proxy advisory firms. Potential dilution, or overhang, is as set forth in the table below, as of October 31, 2023, assuming approval of the 2023 plan. The 6,000,000 shares that would be available under the 2023 plan would represent 19.5% of our outstanding shares of common stock and pre-funded warrants assuming the 2023 plan is approved, as described in the table below.

| |

|

Assuming Approval of

2023 Plan

|

|

|

Options Outstanding as of October 31, 2023

|

|

|

60,296 |

|

|

Weighted Average Exercise Price of Options Outstanding

|

|

$ |

10.62 |

|

|

Weighted Average Remaining Term of Options Outstanding (in years)

|

|

2.44

|

|

|

Shares Underlying Restricted Stock Awards as of October 31, 2023

|

|

|

517,967 |

|

|

Total Equity Awards Outstanding(1)

|

|

|

578,263 |

|

|

Common Stock Outstanding as of October 31, 2023 plus outstanding pre-funded warrants(2)

|

|

|

30,868,894 |

|

|

Current Dilution as of October 31, 2023(3)

|

|

|

1.87 |

% |

|

Shares Available for Grant under the 2015 Plan

|

|

|

61,975 |

|

|

Current Potential Dilution, or Overhang, Under the 2015 Plan, as a Percentage of Common Stock Outstanding as of October 31, 2023 plus outstanding pre-funded warrants (4)

|

|

|

2.07 |

% |

|

Shares Available for Future Grant Under the 2023 Plan

|

|

|

6,000,000 |

|

|

Potential Dilution, or Overhang, Under the 2023 Plan, as a Percentage of Common Stock Outstanding as of October 31, 2023 plus outstanding pre-funded warrants (5)

|

|

|

19.63 |

% |

|

(1)

|

The only equity awards outstanding are stock options and restricted stock awards. No restricted stock units, performance stock units or other equity awards are outstanding.

|

|

(2)

|

On October 31, 2023, we completed a public offering of units which included 17,200,000 pre-funded warrants exercisable at par value, or $0.0001 per share.

|

|

(3)

|

Dilution consists of the number of shares subject to equity awards outstanding as of October 31, 2023 divided by the number of shares of common stock outstanding as of October 31, 2023 plus outstanding pre-funded warrants.

|

|

(4)

|

Current potential dilution, or overhang, under the 2015 plan consists of the number of shares subject to equity awards outstanding as of October 31, 2023 and the number of shares available for future grant under the 2015 plan divided by the number of shares of common stock outstanding as of October 31, 2023 plus outstanding pre-funded warrants.

|

|

(5)

|

Current potential dilution, or overhang, under the 2023 plan consists of the number of shares subject to equity awards outstanding as of October 31, 2023, the number of shares available for future grant under the 2015 plan, and the number of shares available for future grant under the 2023 plan divided by the number of shares of common stock outstanding as of October 31, 2023 plus outstanding pre-funded warrants.

|

Summary of the 2023 Plan Features

The major features of the 2023 plan are summarized below. The summary is qualified in its entirety by reference to the full text of the 2023 plan, a copy of which may be obtained from us. A copy of the 2023 plan also has been filed electronically with the Securities and Exchange Commission, or SEC, as Appendix B to this proxy statement, and is available through the SEC’s website at www.sec.gov.

Purpose. The purpose of the 2023 plan is to advance the interests of the Company and our stockholders by enabling us to attract and retain qualified individuals through opportunities for equity participation in the Company and to reward those individuals who contribute to the achievement of our economic objectives.

Eligibility. All employees (including officers and directors who are also employees), non-employee directors, consultants, advisors and independent contractors of the Company or any subsidiary will be eligible to receive incentive awards under the 2023 plan.

Shares Available for Issuance. The maximum number of shares of our common stock available for issuance under the 2023 plan will be 6,000,000 shares.

Shares of our common stock that are issued under the 2023 plan or that are potentially issuable pursuant to outstanding incentive awards reduce the number of shares remaining available. All shares so subtracted from the amount available under the plan with respect to an incentive award that lapses, expires, is forfeited or for any reason is terminated, unexercised or unvested and any shares of our common stock that are subject to an incentive award that is settled or paid in cash or any other form other than shares of our common stock will automatically again become available for issuance under the 2023 plan. However, any shares not issued due to the exercise of an option by a “net exercise” or the tender or attestation as to ownership of previously acquired shares (as described below), as well as shares covered by a stock-settled stock appreciation right and shares withheld by us to satisfy any tax withholding obligations will not again become available for issuance under the 2023 plan. Any shares of our common stock that we repurchase on the open market using the proceeds from the exercise of an award under the 2023 plan will not increase the number of shares available for future grants of awards under the 2023 plan.

Non-Employee Director Compensation Limit. The 2023 plan provides that the sum of any cash compensation, or other compensation, and the value (determined as of the grant date in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, or any successor thereto) of awards granted to a non-employee director as compensation for services as a non-employee director during any fiscal year of the Company may not exceed $200,000 (increased to $300,000 with respect to any non-employee director serving as chair of the board of directors or lead independent director or in the fiscal year of a non-employee director’s initial service as a non-employee director). Any compensation that is deferred will count towards this limit for the year in which the compensation is first earned, and not a later year of settlement.

Grant Limits. Under the terms of the 2023 plan:

| |

●

|

no more than 6,000,000 shares of our common stock may be issued pursuant to the exercise of incentive stock options; and

|

| |

●

|

no more than 5,000,000 shares of our common stock may be issued or issuable in connection with full-value awards.

|

All of the share limitations in the 2023 plan may be adjusted to reflect changes in our corporate structure or shares, as described below. In addition, the number of shares that may be issued as incentive options or other incentive awards will not apply to certain incentive awards granted upon our assumption or substitution of like awards in any acquisition, merger or consolidation.

Adjustments. In the event of any reorganization, merger, consolidation, recapitalization, liquidation, reclassification, stock dividend, stock split, combination of shares, rights offering, divestiture or extraordinary dividend (including a spin-off) or any other similar change in our corporate structure or shares of common stock, we must adjust or substitute:

| |

●

|

the number and kind of securities available for issuance under the 2023 plan, including the sub-limits described above; and

|

| |

●

|

in order to prevent dilution or enlargement of the rights of participants, the number, kind and, where applicable, the exercise price of securities subject to outstanding incentive awards.

|

Administration. The 2023 plan is administered by our board of directors or by a committee of the Board. Any such committee will consist of at least two members of the Board, all of whom are “non-employee directors” within the meaning of Rule 16b-3 under the Exchange Act, and all of whom are “independent” as required by the listing standards of the Nasdaq Stock Market. We expect both the board of directors and the compensation committee of the board of directors to administer the 2023 plan. The board of directors or the committee administering the 2023 plan is referred to as the “committee.” The committee may delegate its duties, power and authority under the 2023 plan to any of our officers to the extent consistent with applicable Delaware corporate law, except with respect to participants subject to Section 16 of the Exchange Act.

The committee has the authority to determine all provisions of incentive awards consistent with terms of the 2023 plan, including, the eligible recipients who will be granted one or more incentive awards under the 2023 plan, the nature, extent and terms of the incentive awards to be made to each participant and the form of an incentive award agreement, the time or times when incentive awards will be granted, the duration of each incentive award, and the restrictions and other conditions to which the payment or vesting of incentive awards may be subject. The committee has the authority to pay the economic value of any incentive award or settle any incentive award in the form of cash, our common stock or any combination of both, construe and interpret the 2023 plan and incentive awards, determine fair market value of our common stock, determine whether incentive awards will be adjusted for dividend equivalents and may amend or modify the terms of outstanding incentive awards (except for any prohibited “re-pricing” of options, discussed below) so long as the amended or modified terms are permitted under the 2023 plan and any adversely affected participant has consented to the amendment or modification.