BigCommerce Holdings, Inc. (“BigCommerce” or the “Company”)

(NASDAQ: BIGC) today announced that on July 31, 2024, it entered

into a privately negotiated exchange agreement (the “Exchange

Agreement”) with a holder of its 0.25% convertible senior notes due

2026 (the “Existing Convertible Notes”). Pursuant to the Exchange

Agreement, BigCommerce will exchange (the “Exchange Transaction”)

approximately $161.2 million in aggregate principal amount of the

Existing Convertible Notes for $150.0 million in aggregate

principal amount of new 7.5% convertible senior notes due 2028 (the

“New Convertible Notes”) and approximately $0.1 million in cash,

with such cash payment representing the accrued and unpaid interest

on such Existing Convertible Notes. In addition, on July 31, 2024,

BigCommerce has also entered into separate, privately negotiated

repurchase agreements with a limited number of holders of its

Existing Convertible Notes to repurchase (the “Repurchase

Transactions” and collectively with the Exchange Transaction, the

“Transactions”) approximately $120.6 million aggregate principal

amount of the Existing Convertible Notes for aggregate cash

consideration of approximately $108.7 million, including accrued

but unpaid interest on such Existing Convertible Notes. The

Exchange Transaction is expected to settle on or about August 7,

2024 and the Repurchase Transactions are expected to settle on or

about August 8, 2024, subject, in each case, to customary closing

conditions.

Upon completion of the Transactions, the

aggregate principal amount of the Existing Convertible Notes

outstanding will be approximately $63.1 million, and the aggregate

principal amount of the New Convertible Notes outstanding will be

$150.0 million. BigCommerce will not receive any cash proceeds from

the issuance of the New Convertible Notes pursuant to the Exchange

Transaction.

The New Convertible Notes will be senior,

initially unsecured obligations of BigCommerce and will accrue

interest at a rate of 7.5% per annum, payable semi-annually in

arrears on April 1 and October 1 of each year, beginning on October

1, 2024. The New Convertible Notes will mature on October 1, 2028,

unless earlier converted, redeemed or repurchased by BigCommerce.

Before July 3, 2028, noteholders will have the right to convert

their New Convertible Notes only upon the occurrence of certain

events. From and after July 3, 2028, noteholders may convert their

New Convertible Notes at any time at their election until the close

of business on the second scheduled trading day immediately before

the maturity date. BigCommerce will settle conversions by paying or

delivering, as applicable, cash, shares of its common stock (the

“common stock”) or a combination of cash and shares of its common

stock, at BigCommerce’s election. The initial conversion rate is

62.5000 shares of common stock per $1,000 principal amount of New

Convertible Notes, which represents an initial conversion price of

$16.00 per share of common stock. The conversion rate and

conversion price will be subject to adjustment upon the occurrence

of certain events.

The New Convertible Notes will not be redeemable

at BigCommerce’s election before October 7, 2026. The New

Convertible Notes will be redeemable, in whole or in part (subject

to certain limitations), for cash at BigCommerce’s option at any

time, and from time to time, on or after October 7, 2026 and on or

before the 25th scheduled trading day immediately before the

maturity date, but only if the last reported sale price per share

of BigCommerce’s common stock exceeds 130% of the conversion price

for a specified period of time and certain other conditions are

satisfied. The redemption price will be equal to the principal

amount of the New Convertible Notes to be redeemed, plus accrued

and unpaid interest, if any, to, but excluding, the redemption

date.

If a “fundamental change” (as defined in the

indenture for the New Convertible Notes) occurs, then, subject to a

limited exception, noteholders may require BigCommerce to

repurchase their New Convertible Notes for cash. The repurchase

price will be equal to the principal amount of the New Convertible

Notes to be repurchased, plus accrued and unpaid interest, if any,

to, but excluding, the applicable repurchase date.

The indenture for the New Convertible Notes will

contain a number of restrictive covenants and limitations,

including restrictions on the Company’s ability to incur certain

indebtedness, as further described in the indenture for the New

Convertible Notes. In addition, to the extent BigCommerce incurs

subordinated indebtedness pursuant to the terms of the Indenture,

it will be required to secure the New Convertible Notes, subject

only to prior security interests in favor of lenders under any

senior secured revolving credit facility, if then outstanding.

The Exchange Transaction and any common stock

issuable upon conversion of the New Convertible Notes have not

been, and will not be, registered under the Securities Act of 1933,

as amended (the “Securities Act”) or any other securities laws, and

the New Convertible Notes and any such common stock cannot be

offered or sold except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and any other applicable securities laws. This press

release does not constitute an offer to sell, or the solicitation

of an offer to buy, the Existing Convertible Notes, the New

Convertible Notes or any common stock issuable upon conversion of

the New Convertible Notes, nor will there be any sale of the New

Convertible Notes or any such common stock, in any state or other

jurisdiction in which such offer, sale or solicitation would be

unlawful.

About BigCommerce

BigCommerce (Nasdaq: BIGC) is a leading open

SaaS and composable ecommerce platform that empowers brands and

retailers of all sizes to build, innovate and grow their businesses

online. BigCommerce provides its customers sophisticated

enterprise-grade functionality, customization and performance with

simplicity and ease-of-use. Tens of thousands of B2C and B2B

companies across 150 countries and numerous industries rely on

BigCommerce, including Burrow, Coldwater Creek, Francesca’s, Harvey

Nichols, King Arthur Baking Co., MKM Building Supplies, United Aqua

Group and Uplift Desk.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements generally relate to

future events or BigCommerce’s future financial or operating

performance. For example, statements regarding the completion of

the Exchange Transaction and the Repurchase Transactions are

forward-looking statements. In some cases, you can identify

forward-looking statements by terms such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “outlook,” “may,”

“might,” “plan,” “project,” “will,” “would,” “should,” “could,”

“can,” “predict,” “potential,” “strategy, “target,” “goal,”

“explore,” “continue,” or the negative of these terms, and similar

expressions intended to identify forward-looking statements.

However, not all forward-looking statements contain these

identifying words. These statements may relate to market

conditions, the satisfaction of the closing conditions related to

the Exchange Transaction and the Repurchase Transactions and risks

relating to BigCommerce’s business, that could cause actual

results, performance or achievement to differ materially and

adversely from those anticipated or implied in the forward-looking

statements. By their nature, these statements are subject to

numerous uncertainties and risks, including factors beyond our

control that could cause actual results, performance or achievement

to differ materially and adversely from those anticipated or

implied in the forward-looking statements. Other unknown or

unpredictable factors also could have material adverse effects on

the Company’s future results. Additional risks and uncertainties

that could cause actual outcomes and results to differ materially

from those contemplated by the forward-looking statements are

included under the caption “Risk Factors” and elsewhere in our

filings with the Securities and Exchange Commission (the “SEC”),

including our Annual Report on Form 10-K for the year ended

December 31, 2023 filed with the SEC on February 29, 2024 and the

quarterly and current reports that we file with the SEC.

Forward-looking statements speak only as of the date the statements

are made and are based on information available to BigCommerce at

the time those statements are made and/or management's good faith

belief as of that time with respect to future events. BigCommerce

assumes no obligation to update forward-looking statements to

reflect events or circumstances after the date they were made,

except as required by law.

|

Media Relations ContactBrad

HemPR@BigCommerce.com |

Investor Relations ContactTyler

DuncanInvestorRelations@BigCommerce.com |

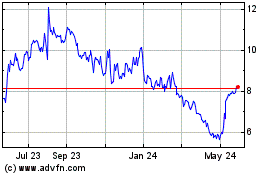

BigCommerce (NASDAQ:BIGC)

Historical Stock Chart

From Oct 2024 to Nov 2024

BigCommerce (NASDAQ:BIGC)

Historical Stock Chart

From Nov 2023 to Nov 2024